Forecasting finances in this manner allows businesses to anticipate potential shortfalls, identify periods of surplus capital, and make informed decisions regarding investments, borrowing, and operational expenses. This proactive approach facilitates better financial management, contributing to increased stability and growth potential. It also serves as a crucial tool for securing funding from lenders and attracting potential investors, demonstrating financial viability and planning proficiency.

Further exploration of this topic will cover key components, creation methods, and practical applications for various business scenarios.

1. Forecasting

Forecasting forms the foundation of a robust twelve-month cash flow statement. Accurate projections of future cash inflows and outflows are essential for informed decision-making and effective financial management. This process involves anticipating future financial performance based on historical data, market trends, and strategic plans.

- Sales ProjectionsPredicting future sales revenue is a crucial first step. This involves analyzing historical sales data, considering market conditions, and incorporating planned marketing and sales strategies. Accurate sales projections directly impact the anticipated cash inflows, influencing all subsequent elements of the statement. For example, a seasonal business might anticipate higher sales during specific months, impacting its cash flow projections accordingly.

- Expense BudgetingForecasting operating expenses, such as salaries, rent, and utilities, is equally important. This requires a detailed understanding of cost structures and potential fluctuations. Accurate expense budgeting allows organizations to anticipate periods of higher cash outflows and plan accordingly. A manufacturing company, for instance, might forecast increased raw material costs due to anticipated supply chain disruptions.

- Capital Expenditure PlanningInvestments in fixed assets, such as equipment or property, represent significant cash outflows. Forecasting these expenditures allows organizations to assess their impact on long-term cash flow and plan for appropriate financing. A rapidly expanding technology company, for example, might anticipate significant capital expenditures related to new server infrastructure.

- Financing ActivitiesForecasting financing activities, such as debt repayment or equity financing, is vital for understanding the overall impact on cash flow. This includes projecting interest payments, loan principal repayments, and potential equity injections. A real estate developer, for example, might project loan drawdowns and repayments based on the construction timeline of a project.

By accurately forecasting these elements, organizations can develop a comprehensive twelve-month cash flow statement that provides a realistic view of their future financial position. This enables informed decision-making regarding resource allocation, investment strategies, and financing options, contributing to long-term financial stability and growth.

2. Budgeting

Budgeting and a twelve-month cash flow statement are intrinsically linked. The statement serves as a dynamic tool for budget creation and ongoing monitoring. A well-defined budget relies on projected cash inflows and outflows, information derived directly from the statement. This interconnectedness allows organizations to allocate resources effectively, anticipate potential shortfalls, and ensure financial stability. Cause and effect relationships between budgetary decisions and cash flow outcomes become readily apparent within the statement framework. For example, a reduction in marketing spend will impact projected sales and, consequently, cash inflows. Conversely, securing a new loan will increase cash inflows but also impact future cash outflows due to interest and principal repayments. This dynamic interplay highlights the statement’s importance as a budgeting tool.

Budgeting, as a component of a twelve-month cash flow statement, provides a structured approach to financial planning. Organizations can allocate resources across departments, projects, and operational needs based on anticipated cash flow. This structured approach promotes financial discipline, ensuring resources are aligned with strategic goals. Practical applications vary depending on the organization’s specific needs. A retail business, for instance, might allocate a larger portion of its budget to inventory purchases during peak seasons, anticipating increased sales and corresponding cash inflows. A non-profit organization, on the other hand, might prioritize fundraising activities during specific periods to ensure sufficient cash flow for ongoing operational expenses.

Understanding the relationship between budgeting and a twelve-month cash flow statement is crucial for sound financial management. It provides organizations with the foresight to anticipate financial challenges, make informed decisions, and adapt to changing circumstances. While creating accurate projections can be challenging, particularly in volatile economic environments, the insights gained from this process contribute significantly to long-term financial health and sustainability. Regularly reviewing and adjusting the statement and associated budgets based on actual performance enhances their accuracy and effectiveness as management tools.

3. Financial Control

Maintaining robust financial control is paramount for organizational success. A twelve-month cash flow statement template provides a critical framework for monitoring, analyzing, and managing cash flow, enabling proactive identification and mitigation of potential financial risks. This structured approach facilitates informed decision-making and promotes financial stability. Analyzing actual cash flow against projected figures allows for timely corrective action and optimized resource allocation.

- Variance AnalysisComparing actual cash flow against projected figures reveals variances that can indicate underlying operational or financial issues. Significant deviations warrant investigation and corrective action. For example, consistently lower-than-projected sales might indicate a need to reassess marketing strategies or product pricing. Conversely, higher-than-expected operating expenses could signal inefficiencies requiring attention. Variance analysis provides valuable insights into organizational performance.

- Early Warning SystemMonitoring cash flow projections allows for early detection of potential cash shortages or surpluses. This proactive approach provides time to implement corrective measures, such as securing additional financing or adjusting operational expenditures. A construction company, for instance, might identify a potential cash shortfall due to project delays and proactively secure a short-term loan to cover operating expenses. Early identification of potential issues is crucial for mitigating financial risks.

- Performance EvaluationA twelve-month cash flow statement serves as a valuable tool for evaluating financial performance against established budgets and strategic objectives. This allows organizations to assess the effectiveness of financial strategies and make necessary adjustments. A software company, for example, might analyze its cash flow statement to determine the profitability of a new product launch and adjust its marketing strategy accordingly. Performance evaluation based on cash flow data facilitates continuous improvement.

- Resource AllocationUnderstanding projected cash inflows and outflows allows organizations to optimize resource allocation across various departments and projects. This ensures that funds are directed towards activities that generate the highest returns and contribute most effectively to strategic objectives. A research and development company, for example, might allocate more resources to a promising project based on projected positive cash flow outcomes. Strategic resource allocation enhances overall financial performance.

By integrating a twelve-month cash flow statement into financial control processes, organizations gain valuable insights into their financial health, facilitating proactive risk management, informed decision-making, and optimized resource allocation. This proactive approach contributes significantly to long-term financial stability and sustainable growth. Regular review and analysis of the statement are essential for maximizing its effectiveness as a financial control tool.

4. Investment Decisions

Prudent investment decisions rely heavily on a clear understanding of projected cash flow. A twelve-month cash flow statement template provides this crucial insight, enabling organizations to assess the financial viability of potential investments and align them with overall strategic objectives. Analyzing projected cash inflows and outflows allows for informed evaluation of investment opportunities and their potential impact on long-term financial health. This structured approach minimizes financial risks and maximizes the potential for return on investment.

- Capital BudgetingEvaluating potential capital investments, such as new equipment or facility expansions, requires careful consideration of associated cash flows. A twelve-month cash flow statement allows organizations to project the impact of these investments on future cash inflows and outflows, enabling informed decisions regarding project feasibility and prioritization. For example, a manufacturing company considering investing in new machinery can use the statement to project the increased production capacity and resulting revenue, weighed against the cost of the equipment and ongoing maintenance expenses. This analysis informs the decision of whether the investment aligns with the company’s overall financial goals.

- Return on Investment AnalysisAssessing the potential return on investment (ROI) is crucial for any investment decision. A twelve-month cash flow statement facilitates ROI analysis by providing projected cash inflows and outflows associated with the investment. This allows for a more accurate calculation of potential returns and comparison across different investment opportunities. A technology company considering two different software development projects can use the statement to project the revenue generated by each project, compared to the development costs, providing a clear picture of the potential ROI for each option.

- Risk AssessmentEvery investment carries inherent risks. A twelve-month cash flow statement allows organizations to assess the potential financial risks associated with different investment opportunities. By projecting cash flows under various scenarios, organizations can identify potential downsides and develop mitigation strategies. A real estate developer considering a new property acquisition can use the statement to project cash flows under different market conditions, such as rising interest rates or a potential economic downturn. This analysis informs the decision of whether the potential risks outweigh the potential rewards.

- Strategic AlignmentInvestment decisions should align with the organization’s overall strategic objectives. A twelve-month cash flow statement ensures that investment opportunities are evaluated in the context of the organization’s long-term financial goals. This alignment maximizes the strategic impact of investments and contributes to sustainable growth. A retail company expanding into online sales can use the statement to project the costs associated with website development, marketing, and logistics, compared to the projected increase in sales revenue. This analysis ensures that the investment aligns with the company’s overall growth strategy and contributes to long-term financial health.

By integrating a twelve-month cash flow statement into the investment decision-making process, organizations can make informed choices that align with their strategic objectives, maximize potential returns, and minimize financial risks. The insights derived from this structured approach contribute significantly to long-term financial health and sustainable growth. Regular review and adjustment of the statement based on actual performance and changing market conditions further enhance its effectiveness as a tool for sound investment decision-making.

5. Funding Requests

Securing external funding often hinges on demonstrating financial viability and a clear plan for utilizing invested capital. A twelve-month cash flow statement template plays a crucial role in funding requests, serving as a tangible representation of an organization’s financial health and projected performance. This detailed projection of anticipated cash inflows and outflows provides potential lenders and investors with the necessary information to assess risk and make informed decisions. The statement’s ability to showcase financial stability and growth potential directly influences the success of funding applications. For example, a startup seeking venture capital can utilize a well-structured statement to demonstrate its ability to generate revenue and manage expenses, increasing its likelihood of securing funding. Established businesses seeking bank loans can leverage the statement to showcase consistent positive cash flow and the capacity to repay borrowed funds. This clear demonstration of financial responsibility increases the likelihood of loan approval and potentially secures more favorable terms.

Creating a compelling narrative within the statement is essential for successful funding requests. Accurately projecting revenue growth, demonstrating cost control measures, and highlighting key financial assumptions builds confidence among potential funders. A clear understanding of the target audience’s priorities and tailoring the statement to address their specific concerns enhances its effectiveness. A technology company seeking funding for research and development might emphasize projected revenue growth from new product innovation, while a manufacturing company might highlight cost savings achieved through process optimization. This targeted approach demonstrates a clear understanding of the funding landscape and increases the likelihood of a successful outcome.

A well-crafted twelve-month cash flow statement provides a crucial foundation for successful funding requests. It demonstrates financial viability, planning proficiency, and the ability to manage resources effectively. This transparency instills confidence in potential lenders and investors, increasing the likelihood of securing necessary capital for growth and expansion. While projections inherently involve uncertainty, a robust statement incorporates sensitivity analysis, acknowledging potential variations and demonstrating preparedness for different economic scenarios. This realistic approach further strengthens the funding request and positions the organization for long-term financial success. The statement serves not merely as a reporting document but as a strategic tool for securing capital and achieving financial objectives.

Key Components of a 12-Month Cash Flow Statement Template

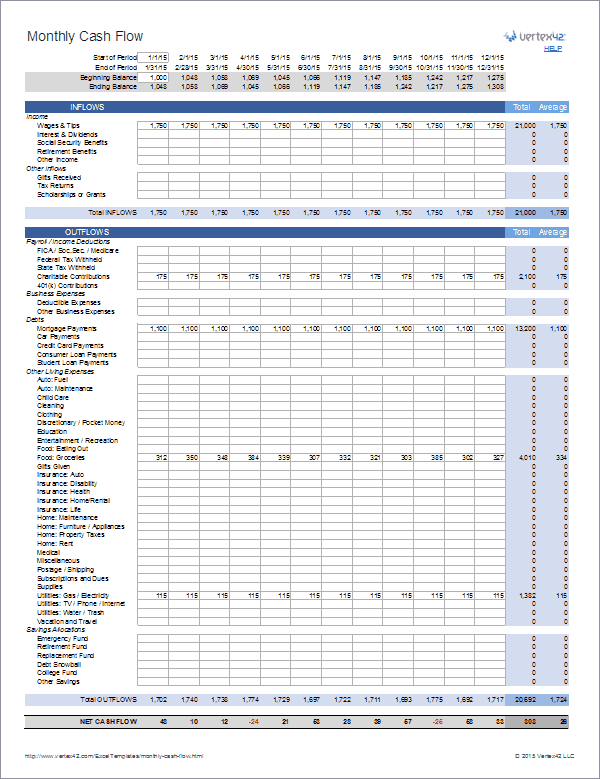

A comprehensive 12-month cash flow statement template provides a structured framework for projecting and analyzing cash inflows and outflows over a year. Understanding its key components is essential for accurate forecasting and effective financial management.

1. Operating Activities: This section details cash flows generated from core business operations. It includes cash received from customers, payments to suppliers, salary disbursements, and other operating expenses. Accurate projections in this section are crucial for understanding the business’s ability to generate cash from its primary activities.

2. Investing Activities: This component captures cash flows related to investments in long-term assets. It includes purchases and sales of property, plant, and equipment (PP&E), investments in other companies, and acquisitions. Analyzing these cash flows provides insights into the business’s long-term investment strategy and its potential impact on future cash flow.

3. Financing Activities: This section details cash flows related to financing the business. It includes proceeds from debt or equity financing, loan repayments, dividend payments, and stock repurchases. Understanding these cash flows is crucial for assessing the business’s capital structure and its ability to meet its financing obligations.

4. Beginning Cash Balance: The starting cash balance for each month is essential for accurate cash flow projections. This figure represents the cash available at the beginning of the period and serves as the foundation for calculating subsequent monthly cash balances.

5. Net Cash Flow: This represents the difference between total cash inflows and total cash outflows for each month. A positive net cash flow indicates a surplus, while a negative net cash flow indicates a deficit. Monitoring net cash flow is crucial for identifying potential liquidity issues.

6. Ending Cash Balance: This figure represents the cash available at the end of each month. It is calculated by adding the net cash flow to the beginning cash balance. Tracking the ending cash balance is essential for assessing short-term liquidity and ensuring sufficient funds to meet operational needs.

7. Assumptions and Notes: This section provides context for the projected figures. It includes key assumptions used in the forecasting process, such as sales growth rates, expense projections, and financing assumptions. Clearly documenting these assumptions enhances the transparency and credibility of the statement.

Careful consideration of these components enables the creation of a robust and informative 12-month cash flow statement. This, in turn, empowers informed decision-making, effective financial management, and proactive mitigation of potential financial risks. Accurate and detailed projections within each component contribute to a comprehensive understanding of the organization’s financial health and future prospects.

How to Create a 12-Month Cash Flow Statement Template

Developing a robust 12-month cash flow statement requires a structured approach and careful consideration of key financial elements. The following steps outline the process of creating this essential financial planning tool.

1. Establish a Timeline: Define the 12-month period for the projection. This provides the timeframe for all subsequent calculations and projections.

2. Determine Starting Cash Balance: Establish the initial cash balance. This figure represents the cash available at the beginning of the projection period.

3. Project Operating Cash Flows: Forecast cash inflows from sales and cash outflows for operating expenses. This includes projecting revenue based on sales forecasts and anticipating expenses related to production, marketing, administration, and other operational activities.

4. Project Investing Cash Flows: Estimate cash flows related to capital expenditures, acquisitions, and divestitures. This involves projecting investments in fixed assets, such as property, plant, and equipment, as well as investments in other businesses.

5. Project Financing Cash Flows: Forecast cash flows related to debt, equity, and other financing activities. This includes projecting proceeds from loans or equity investments, as well as loan repayments, dividend payments, and other financing-related cash outflows.

6. Calculate Net Cash Flow: Determine the net cash flow for each month by subtracting total cash outflows from total cash inflows. This calculation provides a clear picture of the overall cash position for each period.

7. Calculate Ending Cash Balance: Calculate the ending cash balance for each month by adding the net cash flow to the beginning cash balance. This figure represents the cash available at the end of each period and serves as the beginning balance for the subsequent month.

8. Review and Refine: Regularly review and refine the statement based on actual performance, changing market conditions, and updated financial information. This iterative process ensures accuracy and relevance for informed decision-making.

A meticulously constructed statement provides a comprehensive view of anticipated financial performance, enabling proactive financial management, informed decision-making regarding investments and financing, and effective communication with stakeholders. Its dynamic nature allows for adjustments based on actual results and evolving circumstances, promoting financial stability and long-term growth.

A twelve-month cash flow statement template provides a critical framework for understanding, projecting, and managing an organization’s financial health. From forecasting and budgeting to financial control and investment decisions, the statement serves as a dynamic tool for informed decision-making. Its value extends to securing funding, providing potential investors and lenders with clear visibility into projected financial performance. By meticulously constructing and regularly reviewing this statement, organizations gain valuable insights into their short-term liquidity and long-term financial viability.

Effective utilization of this financial tool empowers organizations to navigate complex financial landscapes, anticipate potential challenges, and capitalize on opportunities for growth. The insights derived from a well-crafted twelve-month cash flow statement contribute significantly to long-term financial stability and sustainable success. Regularly revisiting and adapting projections based on actual performance and changing market dynamics ensures its ongoing relevance and value as a strategic management tool.