The following sections will delve deeper into the specific components of a comparative financial report, offering practical guidance on interpretation and analysis. Examples of real-world applications and best practices will further illustrate the value of this powerful tool for businesses of all sizes.

1. Comparative Analysis

Comparative analysis forms the core utility of a two-year income statement template. By juxtaposing financial data from two consecutive reporting periods, this analysis illuminates trends and variances crucial for evaluating financial performance. Cause-and-effect relationships between strategic decisions and financial outcomes become clearer. For instance, a marketing campaign launched in year one can be directly correlated with revenue growth observed in year two. Similarly, cost-cutting measures implemented in one period can be assessed against subsequent expense reductions.

The importance of comparative analysis within this framework lies in its ability to provide context. A single year’s financial results offer a limited perspective. However, when compared with the previous year, the same data points gain significance. A 10% increase in revenue might seem positive in isolation, but if the previous year saw a 20% increase, it signals a potential slowdown requiring investigation. This comparative lens enables stakeholders to understand not only what changed, but also the magnitude and direction of that change, facilitating more informed decision-making.

Understanding the symbiotic relationship between comparative analysis and a two-year income statement template is essential for effective financial management. While the template provides the structured format, comparative analysis unlocks the insights hidden within the data. This understanding empowers stakeholders to move beyond simply observing numbers to actively interpreting trends, diagnosing issues, and ultimately, driving strategic decisions that enhance financial performance and long-term sustainability.

2. Trend Identification

Trend identification relies heavily on the comparative nature of a two-year income statement template. Examining changes in key financial figures over two reporting periods reveals patterns indicative of underlying business dynamics. For instance, consistent growth in revenue coupled with stable cost of goods sold suggests increasing profitability driven by operational efficiency. Conversely, declining revenue alongside rising operating expenses may indicate market saturation or escalating overhead costs. This cause-and-effect relationship between observed trends and underlying business realities empowers stakeholders to take proactive measures. Identifying a negative trend, such as declining gross profit margin, allows for timely intervention, whether through pricing adjustments, cost reduction initiatives, or product diversification strategies.

The importance of trend identification within this framework extends beyond simple observation. It serves as a crucial component for forecasting future performance and informing strategic planning. A consistent upward trend in customer acquisition cost, for example, might necessitate revisiting marketing strategies or exploring alternative customer segments. Similarly, a downward trend in research and development expenditure could signal a potential decline in innovation, prompting a reassessment of resource allocation in that area. Real-world examples, such as a retailer identifying declining sales in a specific product category or a manufacturer observing increasing raw material costs, illustrate the practical significance of this analysis. These insights enable data-driven decisions, allowing businesses to adapt to changing market conditions and maintain a competitive edge.

Effective trend identification within a two-year income statement template requires a discerning approach. While observing changes is essential, understanding the context surrounding those changes is equally critical. Factors such as industry benchmarks, economic conditions, and competitive landscape must be considered. Furthermore, isolated trends might not always tell the full story. A comprehensive analysis requires evaluating multiple interconnected trends to develop a holistic understanding of financial performance. This multifaceted approach, combined with the structured data provided by the template, empowers stakeholders to extract actionable insights, address potential challenges, and ultimately, steer the business toward sustained growth and profitability.

3. Performance Evaluation

Performance evaluation hinges critically on the comparative data afforded by a two-year income statement template. Analyzing financial results across two reporting periods provides a robust framework for assessing operational efficiency, profitability, and overall financial health. This temporal perspective allows for a more nuanced understanding of performance trends, moving beyond static snapshots to dynamic assessments of progress and areas requiring attention. The following facets highlight the integral connection between performance evaluation and this comparative financial tool.

- Revenue Growth AnalysisRevenue growth serves as a key performance indicator, reflecting market demand and sales effectiveness. A two-year income statement template allows for analyzing not only the absolute revenue change but also its trajectory. Consistent growth indicates positive momentum, while deceleration or decline warrants further investigation into potential market shifts or competitive pressures. For example, a software company might observe strong initial revenue growth followed by a slowdown, signaling potential market saturation requiring strategic product diversification.

- Profitability AssessmentProfitability, measured through metrics like gross profit margin and net income, provides crucial insights into operational efficiency and cost management. Comparing these metrics across two years reveals trends in pricing strategies, production costs, and overhead expenses. A manufacturing firm, for instance, might identify declining gross profit margins despite stable revenue, suggesting increasing raw material costs or production inefficiencies requiring immediate attention.

- Expense Management EvaluationEffective expense management is crucial for long-term financial health. Analyzing operating expenses across two years allows for identifying areas of potential cost optimization or escalating expenditures. A retail business, for example, might observe consistently rising administrative expenses, prompting a review of staffing levels, office space utilization, or other overhead costs.

- Return on Investment (ROI) ScrutinyEvaluating ROI on key investments, such as marketing campaigns or capital expenditures, requires assessing their impact on financial performance over time. A two-year income statement template facilitates this analysis by providing a comparative view of revenue generation and profitability before and after the investment. For instance, a company investing in new equipment can track its impact on production efficiency and cost of goods sold over two years to determine the actual ROI achieved.

These interconnected facets demonstrate how a two-year income statement template provides the necessary data framework for comprehensive performance evaluation. By analyzing trends, identifying areas for improvement, and tracking the impact of strategic decisions, businesses gain valuable insights for optimizing operations, enhancing profitability, and ensuring long-term financial sustainability. This data-driven approach to performance management empowers stakeholders to move beyond reactive responses to proactive planning and execution, fostering a culture of continuous improvement and informed decision-making.

4. Financial Health

Financial health represents a comprehensive assessment of a company’s overall financial stability and sustainability. A two-year income statement template provides a crucial framework for evaluating this health by offering a comparative view of key financial indicators over time. This temporal perspective allows stakeholders to identify trends, assess risks, and make informed decisions to ensure long-term financial viability. Cause-and-effect relationships between operational decisions and financial outcomes become clearer, enabling proactive management of resources and strategic planning for future growth.

Several key aspects of financial health benefit directly from analysis using a two-year income statement template. Liquidity, the ability to meet short-term obligations, can be assessed by observing trends in current assets and liabilities. Solvency, the capacity to meet long-term debt obligations, becomes clearer through analysis of debt-to-equity ratios and interest coverage. Profitability trends, as reflected in gross profit margins and net income, offer insights into pricing strategies, cost management, and overall operational efficiency. Real-world examples, such as a retailer experiencing declining inventory turnover or a manufacturer facing increasing debt levels, highlight the practical implications of these assessments. Early identification of such trends allows for timely intervention, mitigating potential financial distress and preserving long-term stability.

The practical significance of understanding financial health through this comparative lens lies in its ability to empower proactive decision-making. A company observing declining profitability despite increasing revenue, for instance, can investigate underlying causes such as rising cost of goods sold or escalating operating expenses. This understanding allows for targeted interventions, whether through pricing adjustments, cost optimization strategies, or operational restructuring. Moreover, a two-year income statement template facilitates scenario planning and forecasting. By projecting current trends, businesses can anticipate potential challenges and proactively adjust strategies to mitigate risks and capitalize on opportunities. This forward-looking perspective is crucial for maintaining financial health and navigating the complexities of the modern business environment.

5. Data-Driven Decisions

Data-driven decisions represent a cornerstone of effective financial management, relying on objective data analysis rather than intuition or speculation. A two-year income statement template provides the structured data necessary for informed decision-making, enabling businesses to identify trends, assess performance, and develop strategies grounded in empirical evidence. This analytical framework fosters a proactive approach to financial management, allowing organizations to anticipate challenges, capitalize on opportunities, and navigate the complexities of the business landscape with greater confidence.

The cause-and-effect relationship between data analysis and strategic decisions becomes evident when utilizing a two-year income statement template. Observing declining profit margins over two consecutive years, for instance, prompts investigation into underlying factors such as rising production costs or ineffective pricing strategies. This data-driven diagnosis then informs corrective actions, whether through cost optimization initiatives, pricing adjustments, or product diversification efforts. Real-world examples abound, such as a retailer using sales data to optimize inventory management or a manufacturer analyzing production costs to identify efficiency improvements. The practical significance of this approach lies in its ability to transform raw data into actionable insights, leading to more effective resource allocation, improved operational efficiency, and enhanced profitability.

Leveraging a two-year income statement template for data-driven decisions requires a structured approach. Key performance indicators (KPIs) must be identified and tracked consistently across both reporting periods. Trends and variances in these KPIs then serve as the basis for analysis, leading to the identification of root causes and the formulation of targeted solutions. This analytical process empowers stakeholders to move beyond reactive responses to proactive planning, anticipating potential challenges and implementing preemptive measures to mitigate risks and capitalize on emerging opportunities. Furthermore, continuous monitoring and evaluation of outcomes ensure that decisions remain aligned with strategic objectives and contribute to long-term financial health and sustainability.

6. Standardized Format

A standardized format is fundamental to the utility of a two-year income statement template. Consistency in presentation across reporting periods ensures comparability, enabling accurate trend analysis and performance evaluation. This standardized structure facilitates clear identification of year-over-year changes in key financial figures, such as revenue, cost of goods sold, and net income. Without a consistent format, comparing financial data across two years becomes challenging, potentially obscuring meaningful trends and hindering effective decision-making. A standardized template eliminates this ambiguity, providing a reliable framework for analysis. For instance, consistent categorization of operating expenses allows for accurate tracking of trends in specific cost areas, such as marketing or research and development, facilitating informed resource allocation decisions.

The importance of a standardized format extends beyond simple comparability. It promotes transparency and facilitates communication among stakeholders. A consistent presentation of financial data ensures that all parties, including investors, lenders, and management, interpret information uniformly. This shared understanding fosters trust and enables more effective collaboration in strategic planning and decision-making. Real-world examples, such as a company seeking funding from investors or a management team evaluating departmental performance, underscore the practical significance of a standardized format. Clear, consistent financial reporting enhances credibility and facilitates informed assessments of financial health and performance.

A standardized two-year income statement template, therefore, provides a crucial foundation for effective financial analysis and management. By ensuring comparability, promoting transparency, and facilitating communication, this structured approach empowers stakeholders to extract meaningful insights from financial data, identify trends, evaluate performance, and ultimately, make data-driven decisions that contribute to long-term financial health and sustainability. Navigating the complexities of the modern business environment requires a clear and consistent understanding of financial performance, and a standardized two-year income statement template provides precisely that framework.

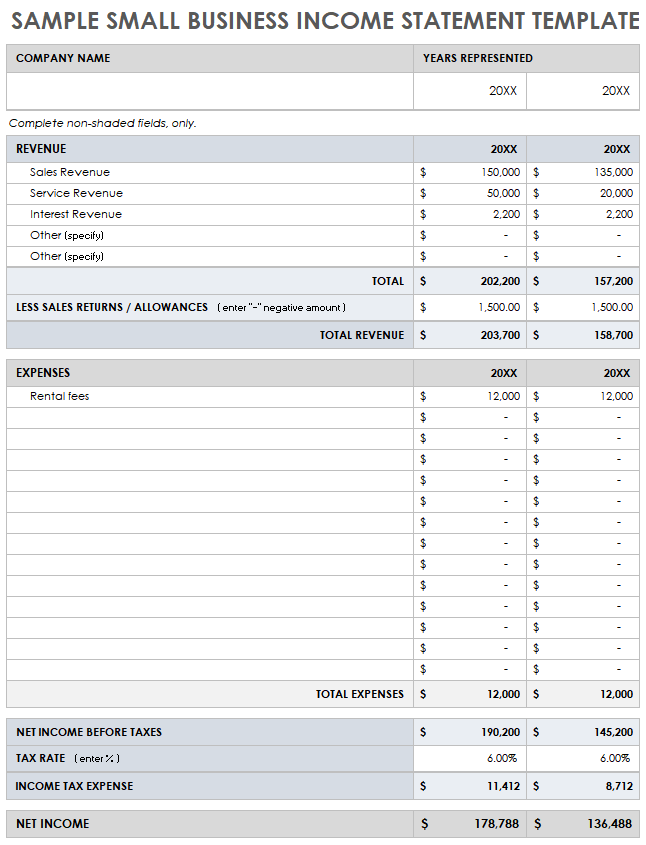

Key Components of a Two-Year Income Statement Template

A two-year income statement template provides a comparative view of a company’s financial performance over two consecutive reporting periods. Understanding its key components is crucial for effective analysis and informed decision-making. The following elements constitute the core structure of this essential financial tool.

1. Revenue: Revenue represents the total income generated from sales of goods or services during each reporting period. Comparing revenue figures across two years reveals growth trends, market demand fluctuations, and the effectiveness of sales strategies. Significant variances warrant further investigation into underlying causes, such as pricing changes, market shifts, or competitive pressures.

2. Cost of Goods Sold (COGS): COGS encompasses all direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. Analyzing COGS across two years reveals trends in production efficiency, raw material costs, and manufacturing processes. Increasing COGS alongside stagnant or declining revenue signals potential profitability challenges requiring immediate attention.

3. Gross Profit: Gross profit, calculated as revenue minus COGS, represents the profit generated directly from sales before accounting for operating expenses. Comparing gross profit across two years provides insights into pricing strategies, production efficiency, and overall profitability trends. Declining gross profit margins warrant further investigation into cost structures and pricing models.

4. Operating Expenses: Operating expenses encompass all costs associated with running the business, including salaries, rent, marketing, and administrative expenses. Analyzing operating expenses across two years reveals trends in overhead costs, staffing levels, and marketing effectiveness. Consistently rising operating expenses can erode profitability and require cost optimization strategies.

5. Operating Income: Operating income, calculated as gross profit minus operating expenses, represents the profit generated from core business operations. Comparing operating income across two years provides insights into operational efficiency, cost management, and overall profitability trends. Declining operating income despite increasing revenue signals potential issues with cost control or operational effectiveness.

6. Other Income/Expenses: This category captures income or expenses not directly related to core business operations, such as interest income, investment gains, or losses. Analyzing these items across two years provides insights into non-operational financial activities and their impact on overall profitability. Significant fluctuations warrant further investigation into underlying causes.

7. Net Income: Net income represents the final profit after accounting for all revenues, expenses, and other income/expenses. Comparing net income across two years provides a comprehensive view of overall profitability trends and financial performance. Consistent growth in net income demonstrates financial health and effective management.

These components, presented in a standardized format across two reporting periods, offer a comprehensive overview of a company’s financial performance and trends. Analyzing these elements collectively allows stakeholders to gain a deeper understanding of financial health, identify areas for improvement, and make informed decisions to drive sustainable growth and profitability.

How to Create a Two-Year Income Statement Template

Creating a two-year income statement template involves structuring key financial data in a comparative format. This process facilitates trend analysis, performance evaluation, and informed decision-making. The following steps outline the creation of a comprehensive template.

1: Define Reporting Periods: Clearly specify the two consecutive fiscal years or reporting periods for comparison. Consistent reporting periods ensure accurate trend analysis. For example, calendar years (January 1st to December 31st) or fiscal years aligned with business operations.

2: Gather Financial Data: Collect all necessary financial data for both reporting periods, including revenue figures, cost of goods sold (COGS), operating expenses, and other income/expenses. Ensure data accuracy and completeness.

3: Structure the Template: Create a table or spreadsheet with columns for each reporting period and rows for each financial element. Maintain a consistent structure to facilitate direct comparison. Include clear labels for each row and column.

4: Input Revenue Data: Enter revenue figures for each period, clearly differentiating between various revenue streams if applicable (e.g., product sales, service revenue). Calculate year-over-year percentage change to highlight growth trends.

5: Input COGS Data: Enter COGS figures for each period, breaking down costs into relevant categories (e.g., raw materials, direct labor). Calculate COGS as a percentage of revenue to assess production efficiency trends.

6: Calculate and Input Gross Profit: Calculate gross profit by subtracting COGS from revenue for each period. Calculate gross profit margin to assess pricing strategy effectiveness.

7: Input Operating Expense Data: Enter operating expenses for each period, categorizing expenses into relevant areas (e.g., salaries, rent, marketing). Analyze trends in individual expense categories to identify potential cost optimization areas.

8: Calculate and Input Operating Income: Calculate operating income by subtracting operating expenses from gross profit for each period. Analyze operating income trends to assess operational efficiency and profitability.

9: Input Other Income/Expenses: Enter any non-operational income or expenses, such as interest income or investment gains/losses, for each period.

10: Calculate and Input Net Income: Calculate net income by adding other income/expenses to operating income for each period. This final figure represents the overall profitability for each year.

11: Calculate Key Ratios and Metrics: Calculate relevant financial ratios, such as gross profit margin, operating profit margin, and net profit margin, for both periods. These ratios provide deeper insights into profitability trends and financial performance.

A well-structured template provides a clear, comparative view of financial performance, enabling effective trend analysis, performance evaluation, and informed strategic decision-making. This structured approach fosters proactive financial management and contributes to long-term financial health and sustainability.

Analysis using a two-year income statement template provides invaluable insights into financial performance trends, enabling informed decision-making and proactive financial management. Comparative analysis across two reporting periods illuminates key areas of strength and weakness, facilitating data-driven strategies for optimizing profitability, managing expenses, and ensuring long-term financial health. Understanding key components, such as revenue streams, cost of goods sold, operating expenses, and net income, within this comparative framework empowers stakeholders to identify areas for improvement, track the impact of strategic initiatives, and navigate the complexities of the business landscape with greater confidence.

Effective utilization of this financial tool requires a commitment to data accuracy, consistent reporting periods, and a structured analytical approach. By embracing data-driven insights and incorporating comparative analysis into financial planning processes, organizations can enhance operational efficiency, mitigate risks, and position themselves for sustained growth and profitability in the evolving economic landscape. The ability to interpret and act upon the trends revealed within a two-year income statement template represents a critical competency for achieving long-term financial success.