Utilizing this concise format allows for quicker identification of trends, potential issues, and areas for improvement. The focused timeframe facilitates more agile decision-making and adjustments to operational strategies, leading to enhanced financial control and improved outcomes. This approach also simplifies the process of securing funding or attracting potential investors by offering a clear and readily digestible picture of recent financial activity.

The subsequent sections delve further into creating, interpreting, and utilizing these valuable financial tools. Topics covered include key components, practical applications, and best practices for maximizing their effectiveness in diverse business contexts.

1. Revenue Streams

Revenue streams represent the various inflows of income generated within a business over a specific period. Within the context of a condensed financial statement covering three months, analyzing revenue streams offers crucial insights into the financial health and performance of an organization. This detailed breakdown illuminates the primary sources of income, revealing which areas contribute most significantly to overall profitability. Understanding this composition is essential for strategic decision-making, resource allocation, and growth planning. For example, a software company might identify separate revenue streams from software licenses, maintenance contracts, and consulting services. Observing the performance of each stream within the three-month period allows for targeted interventions. A decline in license sales might prompt a review of pricing strategies or marketing efforts, while growth in consulting revenue could suggest opportunities for expansion in that area.

Furthermore, analyzing revenue streams within a short-term financial statement allows for a more granular understanding of revenue trends and potential vulnerabilities. Suppose a business reliant on seasonal sales experiences a significant dip in one revenue stream during a particular quarter. This focused analysis provides a clear signal to investigate the cause and implement corrective actions. This might involve adjusting inventory levels, implementing promotional campaigns, or diversifying revenue sources to mitigate future risks. Conversely, identifying consistent growth within a specific revenue stream can highlight areas of strength and inform investment decisions to capitalize on successful strategies. This granular approach enables proactive management and optimization of revenue generation.

In conclusion, meticulous examination of revenue streams within a concise financial report is vital for assessing short-term financial performance and informing strategic planning. By understanding the contributions of individual revenue channels, businesses can identify trends, assess risks, and make informed decisions to drive sustainable growth and profitability. This practice fosters financial stability and allows organizations to adapt effectively to changing market conditions.

2. Operating Expenses

Operating expenses represent the costs incurred in the normal course of business operations. Within a three-month income statement, these expenses provide critical insights into cost management and operational efficiency. A detailed breakdown of operating expenses facilitates analysis of cost drivers and their impact on profitability. This understanding is essential for informed decision-making, cost control measures, and ultimately, improved financial performance. For example, a retail business might categorize operating expenses into rent, utilities, salaries, marketing, and cost of goods sold. Tracking these expenses over a three-month period reveals potential areas for cost optimization. Consistently high utility costs could prompt an energy efficiency audit, while escalating marketing expenses with stagnant sales might necessitate a campaign review.

Analyzing operating expenses within a shorter timeframe allows for more agile responses to changing business conditions. Suppose a manufacturing company experiences a sudden increase in raw material costs. Reviewing operating expenses within a three-month statement quickly reveals the impact on profit margins, allowing for timely adjustments such as sourcing alternative suppliers or implementing price adjustments. This rapid response can mitigate potential losses and maintain profitability. Conversely, a consistent decline in certain operating expenses, such as administrative costs, might indicate improved efficiency resulting from process improvements or automation. Recognizing these trends allows for reinforcement of successful strategies and further optimization efforts.

Careful monitoring and analysis of operating expenses within a three-month income statement are fundamental to sound financial management. This practice enables proactive identification of cost control opportunities, informed resource allocation, and ultimately, enhanced profitability. By understanding the relationship between operating expenses and overall financial performance within a short-term timeframe, organizations can adapt effectively to dynamic market conditions and achieve sustainable financial health. This detailed analysis provides the foundation for data-driven decisions, enabling businesses to navigate challenges and capitalize on opportunities for growth and efficiency.

3. Profit/loss calculation

Profit/loss calculation forms the core of a three-month income statement, providing a concise measure of financial performance over a short reporting period. This calculation, derived by subtracting total operating expenses from total revenues, offers a crucial snapshot of an organization’s financial health. A positive result signifies profitability, while a negative result indicates a loss. This key metric informs critical business decisions, allowing for timely adjustments to strategies and operations. For instance, a consistent loss over three consecutive months might necessitate a comprehensive review of pricing models, cost structures, or market positioning. Conversely, sustained profitability could indicate successful strategies and provide justification for further investment or expansion. The profit/loss calculation serves as a fundamental indicator of financial viability and sustainability within a defined timeframe.

The practical significance of understanding profit/loss within a three-month income statement lies in its ability to facilitate proactive financial management. This short-term perspective enables businesses to identify emerging trends and address potential issues before they escalate. For example, a declining profit margin over three months, even if still positive, could signal emerging challenges such as increasing competition or shifting market dynamics. This early warning allows for proactive interventions, such as targeted marketing campaigns or cost optimization measures. Furthermore, analyzing profit/loss in conjunction with other key metrics within the income statement, such as revenue growth and expense ratios, provides a more comprehensive understanding of the factors driving financial performance. This holistic view empowers informed decision-making, fostering agility and resilience in response to market fluctuations.

In conclusion, accurate and timely profit/loss calculation within a three-month income statement is essential for effective financial management. This crucial metric serves as a barometer of financial health, providing insights into operational efficiency, strategic effectiveness, and overall sustainability. By understanding the factors influencing profit/loss within a short reporting period, organizations can proactively address challenges, capitalize on opportunities, and navigate the complexities of the business landscape. This focused analysis fosters financial stability and positions organizations for long-term success.

4. Trend Identification

Trend identification within a three-month income statement provides crucial insights into the direction and momentum of financial performance. Analyzing short-term trends allows for proactive adjustments to strategies and operations, enabling organizations to capitalize on positive momentum or address emerging challenges before they escalate. This process involves examining key financial metrics over the three-month period to identify patterns and deviations from expected performance. The following facets illustrate the components and implications of trend identification in this context.

- Revenue TrendsAnalyzing revenue trends reveals the trajectory of income generation. Consistent revenue growth suggests healthy demand and effective sales strategies, while declining revenue may signal market saturation, pricing issues, or competitive pressures. For example, a software company observing consistent growth in subscription revenue might validate their recurring revenue model, while declining sales of a specific product could prompt a review of its market positioning or features. Understanding revenue trends is essential for forecasting future performance and adjusting sales and marketing strategies.

- Expense TrendsMonitoring expense trends illuminates cost control effectiveness and operational efficiency. Rising expenses coupled with stagnant or declining revenue can indicate deteriorating profitability, prompting a review of cost structures and operational processes. Conversely, declining expenses alongside revenue growth suggest improving efficiency. For instance, a manufacturing company observing rising raw material costs might explore alternative suppliers or implement process improvements to reduce material usage. Analyzing expense trends informs cost optimization strategies and contributes to long-term financial sustainability.

- Profitability TrendsTracking profitability trends, such as gross profit margin and net profit margin, provides a crucial indicator of overall financial health. Improving profitability suggests effective cost management and pricing strategies, while declining profitability might indicate pricing pressure, rising costs, or operational inefficiencies. For example, a retail business experiencing declining profit margins might review pricing strategies, optimize inventory management, or implement cost-cutting measures. Analyzing profitability trends is essential for assessing the long-term viability and financial strength of an organization.

- Cash Flow TrendsWhile not directly reflected in the income statement, cash flow trends are closely related and can be inferred from changes in revenue, expenses, and working capital. A growing gap between reported profit and actual cash flow might indicate issues with collections, inventory management, or payment terms. For example, a construction company completing projects but experiencing delays in payment might show profitability on the income statement but struggle with cash flow. Monitoring these trends allows for proactive management of working capital and ensures sufficient liquidity to meet operational needs.

By analyzing these interconnected trends within a three-month income statement, businesses gain valuable insights into their short-term financial performance and can make informed decisions to navigate challenges and capitalize on opportunities. This focused analysis provides a foundation for proactive financial management, contributing to long-term stability and growth.

5. Performance Evaluation

Performance evaluation relies heavily on the insights derived from a three-month income statement. This condensed financial report provides a crucial snapshot of an organization’s recent performance, enabling stakeholders to assess progress towards short-term objectives and identify areas requiring attention. The statement’s concise timeframe allows for frequent performance checks, facilitating agile responses to changing market conditions and operational challenges. For instance, sales targets, cost management goals, and profitability benchmarks can be measured against actual results presented in the statement. A shortfall in sales might trigger a review of marketing strategies, while cost overruns could prompt an examination of operational efficiencies. This iterative process of evaluation and adjustment is crucial for achieving strategic objectives.

The practical significance of using a three-month income statement for performance evaluation lies in its ability to provide timely and actionable insights. Consider a retail business aiming to increase its profit margin. By analyzing the statement, management can identify whether the implemented strategies, such as price adjustments or inventory optimization, are yielding the desired results within the three-month timeframe. This rapid feedback loop allows for course correction and prevents deviations from strategic goals. Furthermore, the statement facilitates performance comparisons across different departments or product lines. If one product line consistently underperforms, resources can be reallocated or strategic adjustments made to improve its contribution to overall profitability. This granular analysis enables targeted interventions and optimizes resource allocation for maximum impact.

In conclusion, the three-month income statement serves as a critical tool for performance evaluation, offering a concise and timely overview of financial results. This focused timeframe enables frequent monitoring, agile decision-making, and targeted interventions to address performance gaps and capitalize on opportunities. By leveraging the insights derived from this statement, organizations can enhance operational efficiency, improve strategic execution, and achieve sustainable financial success. This regular evaluation process fosters a culture of accountability and continuous improvement, driving long-term value creation.

Key Components of a Three-Month Income Statement Template

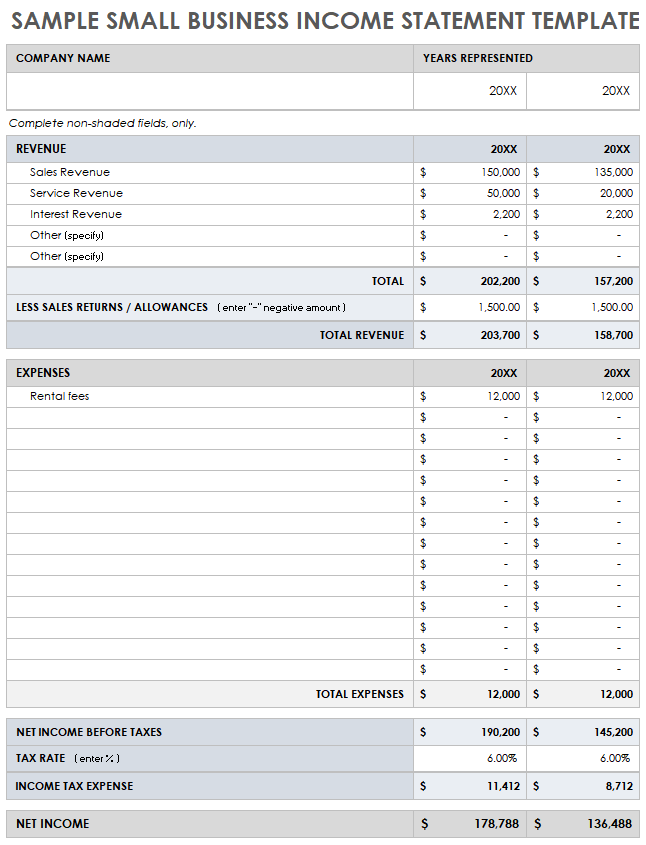

A concise financial statement covering three months provides a snapshot of an organization’s performance during a specific quarter. Understanding the key components is crucial for accurate interpretation and informed decision-making. The following elements constitute a typical three-month income statement.

1. Reporting Period: Clearly indicates the specific three-month period covered by the statement. This ensures accurate temporal context for the financial data presented.

2. Revenue: Details all income generated from sales, services, or other operational activities during the reporting period. This section may include subcategories for different revenue streams, offering a more granular view of income sources.

3. Cost of Goods Sold (COGS): Represents the direct costs associated with producing goods or services sold, including raw materials, direct labor, and manufacturing overhead. This component is relevant primarily for businesses involved in production or manufacturing.

4. Gross Profit: Calculated as Revenue minus COGS, reflecting the profitability of core business operations before accounting for other expenses. This metric provides insight into pricing strategies and production efficiency.

5. Operating Expenses: Encompasses all costs incurred in running the business, excluding COGS. This category typically includes expenses such as rent, utilities, salaries, marketing, and administrative costs. Provides insights into cost management and operational efficiency.

6. Operating Income: Calculated as Gross Profit minus Operating Expenses, representing the profitability of the business after accounting for all operating costs. This metric reflects the efficiency of core business operations.

7. Other Income/Expenses: Includes income or expenses not directly related to core business operations, such as interest income, investment gains/losses, or one-time charges. Provides a comprehensive view of financial performance beyond core operations.

8. Net Income: Represents the final profit or loss after accounting for all revenues and expenses, including taxes. Serves as the bottom-line measure of financial performance during the reporting period.

These components offer a structured framework for understanding financial performance within a specific quarter. Analysis of these elements allows for informed decision-making, identification of trends, and evaluation of operational efficiency. This information is critical for both internal management and external stakeholders.

How to Create a Three-Month Income Statement

Creating a three-month income statement involves organizing financial data into a structured format to assess short-term performance. The following steps outline the process.

1. Define the Reporting Period: Specify the precise three-month period the statement covers. This ensures accurate temporal context for the data.

2. Gather Revenue Data: Compile all income generated from sales, services, and other operational activities during the specified period. Categorize revenue streams for a more granular analysis.

3. Calculate Cost of Goods Sold (COGS): For businesses involved in production or manufacturing, determine the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead.

4. Compute Gross Profit: Subtract COGS from Revenue to determine Gross Profit. This metric reflects the profitability of core operations before accounting for other expenses.

5. Itemize Operating Expenses: List all costs incurred in running the business, excluding COGS. This includes rent, utilities, salaries, marketing, and administrative expenses. Categorize expenses for detailed analysis.

6. Calculate Operating Income: Subtract Operating Expenses from Gross Profit to arrive at Operating Income. This represents profitability after accounting for all operating costs.

7. Account for Other Income/Expenses: Include any income or expenses not directly related to core operations, such as interest income, investment gains/losses, or one-time charges. This provides a comprehensive view of financial performance.

8. Determine Net Income: Subtract all expenses, including taxes and other income/expenses, from total revenue to arrive at Net Income. This represents the final profit or loss for the reporting period.

9. Present the Data: Organize the calculated figures into a clear and structured format. Using a spreadsheet software or dedicated accounting software can streamline this process and enhance accuracy. Ensure clear labeling of each component and consistent formatting for easy interpretation.

Accurate data collection and meticulous calculation are crucial for generating a reliable three-month income statement. This statement provides a valuable tool for assessing short-term financial performance and making informed decisions.

Concise financial reports covering three-month periods offer valuable insights into an organization’s short-term financial performance. These reports provide a structured overview of revenue, expenses, and profitability, enabling stakeholders to identify trends, evaluate operational efficiency, and make informed decisions. Understanding the key components, creation process, and analytical implications of these statements is essential for effective financial management. From revenue stream analysis and expense tracking to profit/loss calculation and performance evaluation, these reports facilitate proactive interventions and strategic adjustments. This granular approach empowers organizations to navigate short-term challenges, capitalize on opportunities, and ensure financial stability.

Leveraging these focused financial tools empowers organizations to navigate the complexities of the business landscape with agility and foresight. Regularly generating and analyzing these reports fosters a culture of data-driven decision-making, contributing to sustainable growth and long-term financial health. This practice enables organizations to not only react effectively to current market conditions but also anticipate future trends and position themselves for continued success. The insights derived from these reports provide a crucial foundation for strategic planning, resource allocation, and ultimately, achieving financial objectives.