Regularly generating these reports offers several advantages. The condensed timeframe facilitates quick identification of positive or negative financial shifts, enabling prompt corrective action. This frequency allows businesses to monitor their financial health closely, ensuring adherence to budgets and financial projections. The focused nature of the report simplifies the analysis process, enabling quicker insights into key performance areas and facilitating proactive adjustments to business strategies. Furthermore, these reports can be valuable tools for communicating with stakeholders, demonstrating financial transparency and accountability.

The following sections will delve into the specific components of a quarterly financial report, offering practical guidance on its creation and interpretation. This detailed exploration will cover various aspects, from revenue recognition and expense categorization to calculating key metrics and utilizing the report for informed decision-making.

1. Revenue

Revenue, the lifeblood of any business, forms the foundation of a 3-month profit and loss statement. Accurately capturing and analyzing revenue streams within this timeframe provides crucial insights into short-term financial performance and informs strategic decision-making.

- Sales RevenueThis represents income generated from core business operations, typically the sale of goods or services. For example, a retail store’s sales revenue reflects the total value of products sold within the three-month period. Accurately tracking sales revenue is fundamental to assessing overall financial health and growth trajectory within the quarter.

- Service RevenueApplicable to service-oriented businesses, this facet encompasses income derived from providing services. A consulting firm, for instance, would recognize revenue from client engagements completed during the quarter. Analyzing service revenue trends can illuminate areas of growth or decline within the service portfolio.

- Other RevenueThis category captures ancillary income streams not directly related to core operations. Examples include interest income, rental income, or gains from asset sales. While often smaller than primary revenue sources, these contributions can impact overall profitability and should be accurately recorded.

- Revenue RecognitionThe timing of revenue recognition is critical for accurate financial reporting. Generally Accepted Accounting Principles (GAAP) dictate specific criteria for recognizing revenue, often tied to the completion of a service or delivery of a product. Adhering to these principles ensures the integrity of the 3-month profit and loss statement and provides a consistent basis for comparison.

Understanding the composition and drivers of revenue within a quarterly context allows businesses to assess their short-term financial performance, identify potential areas for improvement, and make informed decisions regarding pricing, resource allocation, and future growth strategies. This granular analysis forms a cornerstone of effective financial management and provides valuable insights for stakeholders.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold during a given period. Within a 3-month profit and loss statement template, COGS plays a crucial role in determining gross profit and ultimately, net income. Accurately calculating COGS provides insights into production efficiency and profitability. A rising COGS relative to revenue can signal issues with supplier costs, manufacturing processes, or inventory management, warranting further investigation. Conversely, a declining COGS, assuming consistent quality and pricing, may indicate improved operational efficiency.

Several factors contribute to COGS. Direct material costs include raw materials, components, and packaging. Direct labor comprises wages and benefits for personnel directly involved in production. Manufacturing overhead encompasses factory rent, utilities, and depreciation of production equipment. For a furniture manufacturer, COGS would include the cost of lumber, hardware, labor for assembly, and factory overhead. For a software company selling subscriptions, COGS might include server costs, software licenses, and development labor directly tied to product maintenance and updates. Understanding the specific components of COGS within a particular industry provides deeper insights into financial performance.

Effective COGS management is essential for profitability. Strategies for optimizing COGS include negotiating better prices with suppliers, streamlining production processes, implementing efficient inventory control systems, and investing in automation. Analyzing COGS trends within the 3-month profit and loss statement template allows businesses to identify areas for cost reduction, enhance profitability, and make informed decisions regarding pricing and resource allocation. This detailed analysis is crucial for short-term financial planning and long-term business sustainability.

3. Gross Profit

Gross profit, a key metric within a 3-month profit and loss statement template, represents the profitability of a business after accounting for the direct costs associated with producing goods or services. Calculated as revenue less cost of goods sold (COGS), gross profit provides insights into a company’s production efficiency and pricing strategies within a specific timeframe. Analyzing gross profit trends over consecutive quarters can reveal shifts in market dynamics, production costs, or pricing strategies, enabling proactive adjustments to maintain or improve profitability.

- Relationship to Revenue and COGSGross profit directly reflects the relationship between revenue generated and the cost of producing those goods or services. A higher gross profit margin indicates greater efficiency in managing production costs relative to sales. For instance, if a company generates $500,000 in revenue and incurs $200,000 in COGS, the gross profit is $300,000. Monitoring this relationship within the 3-month timeframe allows businesses to quickly identify potential issues with rising costs or declining sales.

- Indicator of Pricing Strategy EffectivenessGross profit margins can reveal the effectiveness of pricing strategies. A high gross profit margin might suggest successful premium pricing, while a low margin could indicate competitive pricing pressures or the need for cost optimization. Comparing gross profit margins to industry benchmarks offers valuable insights into competitive positioning and potential pricing adjustments.

- Impact on Overall ProfitabilityGross profit directly impacts a company’s overall profitability. A healthy gross profit provides the resources to cover operating expenses and ultimately generate net income. Tracking gross profit within the 3-month timeframe allows businesses to assess the financial sustainability of their operations and identify potential challenges in covering operational costs.

- Trend Analysis and ForecastingAnalyzing gross profit trends across multiple quarters provides valuable insights into a company’s financial trajectory. Consistent growth in gross profit, assuming stable revenue, suggests improving production efficiencies or successful pricing strategies. Conversely, declining gross profit might signal rising production costs, pricing pressures, or declining sales volume, requiring corrective action.

By analyzing gross profit within the context of a 3-month profit and loss statement template, businesses gain a crucial understanding of their short-term financial performance. This information is essential for making informed decisions related to pricing strategies, cost management, and resource allocation, ultimately contributing to long-term financial health and sustainability.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business outside of direct production. Within a 3-month profit and loss statement template, these expenses offer crucial insights into a company’s efficiency and resource allocation. Categorizing and analyzing operating expenses within this short timeframe allows for rapid identification of areas for potential cost savings and improved operational efficiency. This granular view of expenses facilitates timely adjustments to spending patterns, contributing to better financial control and improved profitability.

Several key categories comprise operating expenses. Selling, general, and administrative expenses (SG&A) include salaries for non-production staff, marketing and advertising costs, rent, and office supplies. Research and development (R&D) expenses encompass costs associated with developing new products or services. Depreciation and amortization reflect the allocation of the cost of long-term assets over their useful lives. For example, a software company’s operating expenses might include marketing campaign costs, salaries for sales and administrative personnel, office rent, and depreciation of computer equipment. A retail business might incur operating expenses related to store rent, employee salaries, advertising, and utilities. Understanding the specific operating expenses relevant to a particular industry provides a more nuanced understanding of financial performance.

Careful management of operating expenses is essential for profitability and long-term sustainability. Regular review of operating expenses within the 3-month profit and loss statement allows businesses to identify areas of potential overspending, implement cost control measures, and optimize resource allocation. This analysis facilitates informed decision-making regarding budgeting, staffing, and operational strategies. Furthermore, comparing operating expenses across multiple quarters can reveal trends and highlight potential inefficiencies. Addressing these issues promptly contributes to improved financial performance and enhanced competitiveness. By diligently tracking and analyzing operating expenses within this timeframe, organizations can proactively address cost challenges and improve their bottom line.

5. Net Income/Loss

Net income/loss, the bottom line of a 3-month profit and loss statement template, represents the overall profitability or loss incurred by a business within a single quarter. This crucial metric provides a concise summary of financial performance after accounting for all revenues and expenses. Understanding net income/loss is essential for evaluating short-term financial health, assessing the effectiveness of operational strategies, and making informed decisions regarding future resource allocation.

- Calculating Net Income/LossNet income is calculated by subtracting total expenses (including cost of goods sold and operating expenses) from total revenues. A positive result signifies net income, indicating profitability, while a negative result represents a net loss. For example, if a company generates $500,000 in revenue and incurs $400,000 in total expenses, the net income is $100,000. Conversely, if expenses exceed revenue, the result is a net loss.

- Interpreting Net Income/Loss within a QuarterAnalyzing net income/loss within a 3-month timeframe provides insights into short-term financial performance and trends. Consistent profitability across multiple quarters suggests sustainable business practices, while fluctuating or declining net income may signal underlying issues requiring further investigation. Comparing net income/loss to previous quarters or industry benchmarks provides valuable context for evaluating performance.

- Impact of Revenue and ExpensesNet income/loss is directly influenced by both revenue generation and cost management. Increases in revenue, assuming controlled expenses, will lead to higher net income. Conversely, rising expenses, without corresponding revenue growth, can erode profitability and potentially result in a net loss. Understanding this dynamic emphasizes the importance of balancing revenue generation with effective cost control.

- Implications for Decision-MakingNet income/loss within a 3-month profit and loss statement serves as a critical input for short-term and long-term decision-making. Consistent profitability allows for reinvestment, expansion, and other growth initiatives. Conversely, a net loss may necessitate cost-cutting measures, operational adjustments, or strategic shifts to restore profitability. This metric is crucial for evaluating the effectiveness of current strategies and informing future planning.

By analyzing net income/loss within the context of the 3-month profit and loss statement template, stakeholders gain a clear understanding of a company’s financial performance within a specific timeframe. This information is vital for assessing operational efficiency, evaluating the effectiveness of business strategies, and making informed decisions regarding future resource allocation, contributing to long-term financial health and sustainability. Further analysis, comparing results against previous periods and industry benchmarks, provides a comprehensive understanding of financial trajectory and competitive positioning.

6. Quarterly Analysis

Quarterly analysis, facilitated by a 3-month profit and loss statement template, provides a crucial mechanism for evaluating short-term financial performance and identifying emerging trends. This regular assessment allows businesses to monitor progress toward objectives, identify potential challenges, and make informed decisions regarding resource allocation and strategic adjustments. The following facets highlight key components of this analytical process.

- Trend IdentificationAnalyzing financial data across multiple quarters reveals performance trends. For example, consistent growth in revenue suggests successful market penetration or effective sales strategies, while declining gross profit margins might signal rising production costs or pricing pressures. Identifying these trends enables proactive interventions to capitalize on positive momentum or address negative patterns before they escalate.

- Performance BenchmarkingQuarterly analysis allows for performance benchmarking against previous periods and industry averages. Comparing key metrics, such as net income or operating expenses, to historical data or industry benchmarks provides valuable context for evaluating performance and identifying areas for improvement. This comparative analysis helps assess competitive positioning and identify opportunities to enhance efficiency and profitability.

- Operational Efficiency EvaluationExamining trends in cost of goods sold (COGS) and operating expenses within a quarterly timeframe allows businesses to evaluate operational efficiency. Rising COGS relative to revenue may indicate inefficiencies in production or supply chain management, while escalating operating expenses could signal overspending in administrative or marketing functions. This analysis facilitates targeted interventions to optimize resource allocation and enhance operational effectiveness.

- Strategic Decision-MakingInsights derived from quarterly analysis inform strategic decision-making. Identifying positive trends allows businesses to double down on successful strategies, while recognizing negative trends prompts corrective actions. This data-driven approach to decision-making supports agile responses to changing market conditions and facilitates proactive adjustments to optimize performance and achieve business objectives. For instance, consistently strong performance in a particular product segment might justify increased investment in that area, while persistent losses in another segment could lead to a strategic shift in focus.

By leveraging the 3-month profit and loss statement template for quarterly analysis, businesses gain valuable insights into their financial health, operational efficiency, and strategic effectiveness. This regular assessment enables proactive adjustments, data-driven decision-making, and ultimately, enhanced financial performance and long-term sustainability. The insights gleaned from quarterly reviews empower organizations to navigate dynamic market conditions, capitalize on opportunities, and achieve their strategic goals.

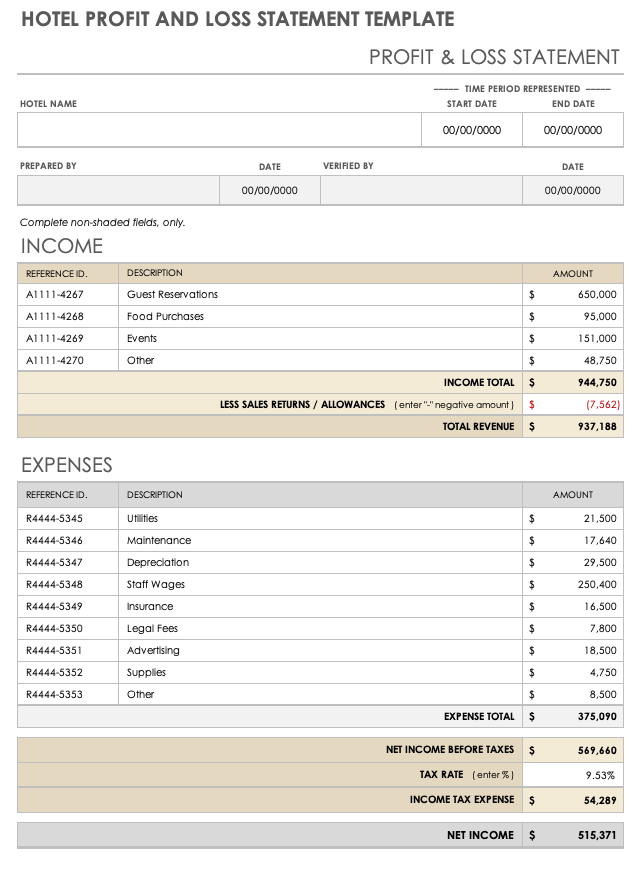

Key Components of a 3-Month Profit and Loss Statement

A 3-month profit and loss statement, also known as a quarterly income statement, provides a snapshot of a company’s financial performance over a three-month period. Understanding its key components is crucial for effective financial management and informed decision-making.

1. Revenue: This represents income generated from sales of goods or services, and any other income streams earned during the quarter. Accurate revenue recognition is critical for a reliable financial statement.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold during the quarter. This includes raw materials, direct labor, and manufacturing overhead. Analyzing COGS helps assess production efficiency.

3. Gross Profit: Calculated as revenue minus COGS, gross profit indicates profitability before accounting for operating expenses. This metric provides insights into pricing strategies and production efficiency.

4. Operating Expenses: These expenses represent the costs incurred in running the business outside of direct production. Examples include salaries, rent, marketing, and administrative expenses. Managing operating expenses is crucial for overall profitability.

5. Operating Income: Calculated as gross profit less operating expenses, this reveals the profitability of core business operations.

6. Other Income/Expenses: This category includes income or expenses not directly related to core business operations, such as interest income or expense, gains or losses from investments, and other non-operating items.

7. Income Tax Expense: This represents the expense incurred for income taxes during the quarter.

8. Net Income/Loss: This is the bottom line, representing the overall profit or loss after all revenues and expenses have been accounted for. This key figure summarizes the financial outcome of the quarter’s operations.

Careful examination of these components provides a comprehensive understanding of a company’s financial performance during a specific quarter, enabling stakeholders to make informed decisions and strategic adjustments for future growth and stability. Regular review and analysis of these elements are essential for sound financial management.

How to Create a 3-Month Profit and Loss Statement

Creating a 3-month profit and loss statement involves organizing financial data to present a clear picture of performance over a quarter. A systematic approach ensures accuracy and facilitates meaningful analysis.

1. Establish Reporting Period: Clearly define the specific three-month period the statement will cover. This ensures consistency and allows for accurate comparisons across different periods.

2. Gather Revenue Data: Compile all revenue generated during the reporting period. This includes sales revenue, service revenue, and any other income streams. Ensure accuracy and proper revenue recognition principles are followed.

3. Calculate Cost of Goods Sold (COGS): Determine all direct costs associated with producing goods sold during the quarter. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

4. Determine Gross Profit: Calculate gross profit by subtracting COGS from total revenue. This metric reflects profitability before operating expenses are considered.

5. Itemize Operating Expenses: Categorize and list all operating expenses incurred during the quarter. This includes selling, general, and administrative expenses (SG&A), research and development (R&D), depreciation, and amortization.

6. Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income. This represents the profitability of core business operations.

7. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income/expense or gains/losses from investments. This provides a comprehensive view of all financial activity.

8. Calculate Income Tax Expense: Determine the income tax liability for the quarter. This expense reflects the applicable tax rate on pre-tax income.

9. Determine Net Income/Loss: Calculate net income/loss by subtracting income tax expense from pre-tax income. This crucial metric represents the overall profitability or loss after accounting for all revenues and expenses during the quarter.

10. Present the Statement: Organize the collected information into a clear and concise format. A standard profit and loss statement format presents revenue, COGS, gross profit, operating expenses, operating income, other income/expenses, income before taxes, income tax expense, and finally, net income/loss. Ensure the statement clearly identifies the reporting period and includes relevant details for each line item.

Accurate data collection and meticulous calculations are essential for generating a reliable and insightful 3-month profit and loss statement. This statement, when analyzed effectively, informs strategic decision-making, facilitates performance evaluation, and contributes to enhanced financial management.

Regularly preparing and analyzing quarterly profit and loss statements provides essential insights into short-term financial performance. Understanding revenue streams, managing the cost of goods sold, and controlling operating expenses are crucial for achieving profitability. Careful examination of these interconnected elements within a concise timeframe enables proactive adjustments to business strategies and informed resource allocation. This iterative process of review and analysis contributes to enhanced operational efficiency and supports sustainable growth.

Effective utilization of these statements allows businesses to navigate dynamic market conditions and make data-driven decisions. This consistent focus on short-term financial performance builds a foundation for long-term stability and success. Accurate and timely financial reporting is not merely a compliance requirement; it is a strategic imperative for organizations seeking to thrive in a competitive landscape. The insights gleaned from this process empower informed decision-making and contribute significantly to long-term financial health and sustainable growth.