Regular review of these condensed reports allows for proactive financial management. Potential problems, such as rising costs or declining sales, can be detected and addressed promptly. This frequency facilitates better cash flow management and provides valuable data for forecasting and budgeting for subsequent periods. The concise nature of a quarterly report can make it easier to communicate performance to stakeholders and fosters informed decision-making at all levels.

This overview highlights the core components and advantages of utilizing short-term financial reporting. The following sections will delve deeper into specific aspects of creating, interpreting, and utilizing these valuable tools for enhanced financial management.

1. Revenue

Revenue represents the lifeblood of any organization and forms the cornerstone of the 3-month profit and loss statement. Accurately capturing and analyzing revenue streams over this short timeframe provides critical insights into financial health and operational efficiency. A granular breakdown of revenue sources within the statement allows for the identification of top-performing products or services, as well as potential weaknesses in specific areas. For instance, a software company might categorize revenue by subscription type, highlighting growth areas like cloud-based offerings versus declining on-premise licenses. This level of detail enables data-driven decisions regarding resource allocation, marketing strategies, and product development.

The relationship between revenue and profitability is not always straightforward. A rise in revenue doesn’t necessarily translate to increased profit. Analyzing revenue in conjunction with the cost of goods sold (COGS) and operating expenses provides a more comprehensive understanding of profitability. For example, a retailer might experience increased sales during a promotional period, but associated discounts and increased marketing spend could negatively impact the bottom line. The 3-month statement allows businesses to assess the true impact of revenue generation on overall financial performance by presenting these factors in a concise, interconnected manner.

Understanding revenue trends within the quarterly reporting cycle allows for proactive financial management. Consistent monitoring enables businesses to identify seasonal fluctuations, anticipate potential shortfalls, and adjust strategies accordingly. This detailed insight into revenue performance, combined with an understanding of associated costs, empowers businesses to make informed decisions that drive sustainable growth and maximize profitability. Ignoring revenue trends within this short-term framework can lead to reactive, rather than proactive, decision-making, potentially hindering long-term success.

2. Expenses

A comprehensive understanding of expenses is crucial for interpreting a 3-month profit and loss statement. Expenses, categorized within the statement, provide insights into the cost structure of an organization and its operational efficiency over a short reporting period. These costs are typically categorized into distinct groups, such as cost of goods sold (COGS), operating expenses, and non-operating expenses. COGS represents the direct costs associated with producing goods sold, while operating expenses encompass costs like rent, salaries, and marketing. Non-operating expenses include items like interest payments or losses from asset sales. Accurately categorizing and tracking these expenses is essential for analyzing profitability and making informed financial decisions. For example, a manufacturing company might see an increase in raw material costs reflected in COGS, signaling potential supply chain issues or rising commodity prices. This detailed breakdown allows for targeted interventions, such as sourcing alternative suppliers or adjusting pricing strategies.

Analyzing expenses within the context of a 3-month reporting cycle facilitates proactive cost management. Tracking trends in expense categories can reveal areas of potential overspending or inefficiencies. For instance, a consistent rise in marketing expenses without a corresponding increase in sales might prompt a review of marketing campaign effectiveness. Regular monitoring also enables businesses to identify and address cost fluctuations stemming from external factors, such as seasonal variations or changes in economic conditions. A restaurant, for example, might anticipate higher utility costs during summer months and implement energy-saving measures to mitigate the impact. This proactive approach to expense management fosters financial stability and supports sustainable growth.

Effective expense management, facilitated by the 3-month profit and loss statement, is directly linked to profitability and overall financial health. By carefully tracking, analyzing, and controlling expenses, businesses can improve their bottom line and enhance their financial resilience. Failure to manage expenses effectively can lead to reduced profitability, cash flow constraints, and ultimately, jeopardize long-term sustainability. The 3-month statement provides a valuable tool for maintaining a close watch on expenses and ensuring they align with overall business objectives and revenue generation.

3. Profit/Loss

The “Profit/Loss” section represents the culmination of the data presented in a 3-month profit and loss statement. It provides a concise summary of an organization’s financial performance over the specified quarter, indicating whether operations resulted in a net profit (revenue exceeding expenses) or a net loss (expenses exceeding revenue). This bottom-line figure is a key indicator of financial health and sustainability, informing critical business decisions.

- Net Income CalculationNet income, or net loss, is derived by subtracting total expenses from total revenues. This figure represents the overall profitability of the business during the three-month period. A positive net income signifies profitability, while a negative net income indicates a loss. For example, if a company generates $150,000 in revenue and incurs $120,000 in expenses, the net income is $30,000. Conversely, if revenues are $100,000 and expenses are $130,000, the net loss is $30,000. Tracking net income over consecutive quarters reveals trends in profitability and informs strategic planning.

- Gross Profit vs. Net ProfitThe statement often distinguishes between gross profit and net profit. Gross profit represents revenue minus the cost of goods sold (COGS), reflecting the profitability of core business operations before considering other operating expenses. Net profit, as mentioned earlier, factors in all expenses, providing a more comprehensive view of overall profitability. Analyzing both figures offers insight into cost control and operational efficiency. A high gross profit but low net profit might suggest excessive overhead or administrative expenses. For instance, a retailer might have a strong gross profit margin on product sales but struggle with high rent costs, leading to a lower net profit.

- Impact on Decision-MakingThe profit or loss figure directly influences strategic decision-making within an organization. Consistently profitable quarters might allow for expansion, investment in research and development, or increased shareholder dividends. Conversely, sustained losses might necessitate cost-cutting measures, restructuring, or changes in business strategy. Understanding the factors contributing to profit or loss, as revealed in the statement, is crucial for making informed decisions to improve financial performance. For example, a consistent net loss might lead a company to reassess its pricing strategy, explore new markets, or streamline operations to reduce expenses.

- Trend Analysis and ForecastingReviewing profit and loss figures over multiple quarters enables trend analysis and informed forecasting. Consistent growth in profitability indicates a healthy trajectory, while declining profits signal potential challenges. These trends inform future projections and allow for proactive adjustments to business strategies. A company experiencing consistent profit growth might project future revenue based on historical data and allocate resources accordingly. Conversely, declining profitability might prompt adjustments to pricing, product offerings, or marketing strategies to reverse the trend.

The “Profit/Loss” section of the 3-month statement offers a crucial performance benchmark, allowing businesses to assess their short-term financial health, identify trends, and make informed decisions to drive future growth and profitability. This concise figure encapsulates the overall effectiveness of operational and strategic initiatives undertaken during the quarter and serves as a vital tool for ongoing financial management.

4. Time Period (Quarterly)

The quarterly timeframe inherent in a 3-month profit and loss statement provides a critical balance between detailed performance analysis and actionable financial management. Unlike annual statements, which offer a broader overview but may obscure short-term trends, quarterly reports provide a more granular view of financial performance, enabling timely interventions and adjustments to business strategy. This frequency allows organizations to track progress toward annual goals, identify emerging challenges, and adapt to changing market conditions more effectively.

- Short-Term Trend AnalysisQuarterly reporting facilitates the identification of short-term trends in revenue, expenses, and profitability. These trends, often obscured in annual reports, provide valuable insights into the effectiveness of operational strategies and market dynamics. For example, a seasonal business might observe predictable fluctuations in revenue across quarters, allowing for informed inventory management and staffing decisions. Similarly, unexpected dips in sales within a specific quarter can prompt immediate investigation and corrective action, preventing further losses.

- Performance Evaluation and Goal AdjustmentQuarterly statements serve as checkpoints for evaluating progress toward annual financial goals. By comparing actual results against projected targets, organizations can assess the effectiveness of their strategies and make necessary adjustments. If performance falls short of expectations, the quarterly timeframe allows for mid-course corrections, increasing the likelihood of achieving annual objectives. For instance, a company aiming for a specific annual revenue target can track quarterly progress and implement targeted marketing campaigns or sales initiatives if revenue generation lags behind projections.

- Cash Flow ManagementThe regular cadence of quarterly reporting supports effective cash flow management. By closely monitoring revenue and expenses over shorter periods, organizations gain a clearer understanding of cash inflows and outflows, enabling better forecasting and resource allocation. This enhanced visibility facilitates informed decisions regarding short-term financing needs, investment opportunities, and expense control measures. For example, a business anticipating a seasonal dip in revenue can proactively secure a line of credit or adjust spending patterns to maintain adequate cash reserves.

- Stakeholder CommunicationQuarterly reports serve as valuable communication tools for both internal and external stakeholders. They provide investors, lenders, and board members with regular updates on financial performance, fostering transparency and trust. Internally, these reports facilitate communication between departments and management, ensuring alignment on financial goals and operational strategies. Regular updates keep stakeholders informed of progress, challenges, and strategic adjustments, enabling informed decision-making at all levels.

The quarterly timeframe of a 3-month profit and loss statement provides a crucial lens for understanding short-term financial performance, enabling organizations to react quickly to changing market conditions, manage cash flow effectively, and make informed decisions to achieve long-term financial objectives. This balance between detail and timeliness makes quarterly reporting a powerful tool for proactive financial management and sustainable growth.

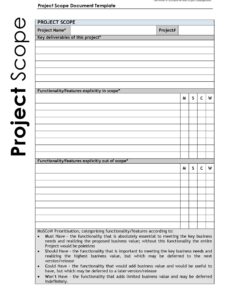

5. Template Structure

A standardized template ensures consistency and comparability in financial reporting. A well-designed template for a 3-month profit and loss statement provides a structured framework for organizing financial data, facilitating analysis, and enabling meaningful comparisons across reporting periods. This structure ensures key information is presented clearly and logically, promoting informed decision-making.

- Standard SectionsStandard sections within the template categorize financial data into key areas. These typically include revenue, cost of goods sold (COGS), operating expenses, and non-operating expenses. This consistent categorization allows for easy comparison of performance across different periods and facilitates the identification of trends within specific areas. For example, consistent placement of the operating expenses section allows for quick identification of cost fluctuations over multiple quarters.

- Clear Line ItemsClearly defined line items within each section provide further granularity. Within revenue, for instance, line items might include sales from different product lines or geographic regions. Similarly, operating expenses could be broken down into salaries, rent, marketing, and utilities. This detailed breakdown enables a deeper understanding of cost drivers and revenue streams. For example, separate line items for different marketing campaigns allow for evaluation of individual campaign effectiveness.

- Consistent FormattingConsistent formatting, such as date formats, currency conventions, and calculation methods, ensures data integrity and comparability. Using consistent formulas for calculating key metrics like gross profit margin or net income ensures accuracy and allows for meaningful trend analysis over time. For example, consistently applying the same depreciation method across reporting periods provides a more accurate picture of asset values and profitability.

- Comparative Data PresentationMany templates incorporate comparative data, presenting figures from previous periods alongside current data. This side-by-side comparison facilitates trend analysis and performance evaluation. Presenting data from the same quarter of the previous year, for example, allows for year-over-year performance comparisons, revealing growth patterns or areas requiring attention. This comparative view enhances the analytical value of the statement.

A well-structured template is essential for maximizing the value of a 3-month profit and loss statement. It promotes clarity, consistency, and comparability, enabling efficient analysis, informed decision-making, and effective communication of financial performance to stakeholders. Utilizing a standardized structure transforms raw financial data into a powerful tool for understanding and managing short-term financial health.

6. Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) derived from a 3-month profit and loss statement provide quantifiable metrics for evaluating short-term financial performance against established objectives. These KPIs offer valuable insights into operational efficiency, profitability, and overall financial health, enabling data-driven decision-making and strategic adjustments. Analyzing KPIs within this condensed timeframe allows for proactive management and facilitates more effective responses to changing market conditions.

- Gross Profit MarginGross profit margin, calculated as (Revenue – COGS) / Revenue, reflects the profitability of core business operations before accounting for other expenses. Tracking this KPI over consecutive quarters reveals trends in production efficiency and pricing strategies. For example, a declining gross profit margin might indicate rising raw material costs or increased competition, prompting a review of pricing or sourcing strategies. Consistent monitoring allows for timely interventions to maintain healthy profit margins.

- Operating Income MarginOperating income margin, calculated as Operating Income / Revenue, measures profitability after accounting for both COGS and operating expenses. This KPI provides a broader view of operational efficiency and cost control effectiveness. A declining operating margin, even with a stable gross margin, could indicate rising overhead costs or inefficient resource allocation, prompting a review of operational processes. Tracking this KPI helps ensure sustainable profitability.

- Net Profit MarginNet profit margin, calculated as Net Income / Revenue, represents the overall profitability of the business after all expenses are considered. This bottom-line KPI reflects the combined impact of operational efficiency, cost management, and pricing strategies. Analyzing net profit margin trends helps assess the overall financial health of the organization and informs strategic decisions regarding growth, investment, and resource allocation. Consistent monitoring of net profit margin is crucial for long-term financial sustainability.

- Operating Expense RatioThe operating expense ratio (OER), calculated as Operating Expenses / Revenue, indicates the proportion of revenue consumed by operating costs. Tracking OER over time helps identify areas of potential cost inefficiency and assess the impact of cost-cutting measures. A rising OER, for instance, might signal increasing administrative overhead or inefficient marketing spend, prompting a review of operational processes and resource allocation. Monitoring OER contributes to improved cost control and enhanced profitability.

These KPIs, derived from the 3-month profit and loss statement, provide crucial benchmarks for evaluating short-term financial performance. By analyzing trends in these metrics, organizations can identify areas of strength and weakness, adapt to changing market conditions, and make data-driven decisions to improve operational efficiency, profitability, and overall financial health. Regular monitoring and analysis of these KPIs are essential for proactive financial management and sustainable growth.

Key Components of a 3-Month Profit and Loss Statement

Essential components comprise a 3-month profit and loss statement, providing a structured overview of financial performance during a specific quarter. Understanding these components is crucial for accurate interpretation and effective financial management.

1. Revenue: This section details all income generated from sales, services, or other operational activities during the three-month period. A breakdown by product, service, or customer segment provides further insights into revenue streams.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold, including raw materials, direct labor, and manufacturing overhead. This component is crucial for calculating gross profit.

3. Gross Profit: Calculated as Revenue – COGS, gross profit reflects the profitability of core business operations before accounting for other expenses. This metric is essential for assessing pricing strategies and production efficiency.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, including salaries, rent, utilities, marketing, and administrative costs. Careful categorization and tracking of operating expenses are crucial for cost control and efficiency analysis.

5. Operating Income: Calculated as Gross Profit – Operating Expenses, operating income reflects the profitability of the business after accounting for all operating costs. This metric provides a broader view of operational efficiency.

6. Other Income/Expenses: This section includes income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time charges. Accurate reporting of these items provides a comprehensive financial picture.

7. Net Income/Loss: This bottom-line figure, calculated as Operating Income +/- Other Income/Expenses, represents the overall profit or loss generated by the business during the three-month period. It serves as a key indicator of financial health and sustainability.

These interconnected components provide a comprehensive view of financial performance during a given quarter, enabling informed decision-making, effective resource allocation, and proactive financial management. Regular review and analysis of these components are crucial for achieving short-term and long-term financial objectives.

How to Create a 3-Month Profit and Loss Statement

Creating a 3-month profit and loss statement involves organizing financial data into a structured format to provide a clear overview of performance. The following steps outline the process of creating this essential financial report.

1. Establish Reporting Period: Define the specific three-month period the statement will cover (e.g., January 1 to March 31). Consistent reporting periods facilitate accurate comparisons and trend analysis over time.

2. Gather Revenue Data: Compile all revenue generated during the reporting period. This includes sales of goods or services, interest income, and any other income streams. Categorize revenue by product line, service type, or customer segment for more detailed analysis.

3. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

4. Determine Gross Profit: Calculate gross profit by subtracting COGS from total revenue. This figure represents the profitability of core business operations before considering operating expenses.

5. Compile Operating Expenses: Gather all operating expenses incurred during the reporting period. Categorize expenses into relevant areas, such as salaries, rent, utilities, marketing, and administrative costs. Detailed categorization facilitates cost control and analysis.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to arrive at operating income. This figure reflects the profitability of the business after accounting for all operating costs.

7. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income, investment gains or losses, and one-time charges. These items provide a comprehensive picture of financial performance beyond core operations.

8. Calculate Net Income/Loss: Determine the net income or loss by adding or subtracting other income/expenses from operating income. This bottom-line figure represents the overall profit or loss generated during the three-month period.

9. Format and Review Organize the collected data into a clear and structured format using a spreadsheet or accounting software. Employ a standardized template to ensure consistency and comparability across reporting periods. Review the statement for accuracy and completeness before finalizing.

A completed 3-month profit and loss statement provides a concise snapshot of financial performance, enabling informed decision-making, effective resource allocation, and proactive financial management. Following these steps ensures a structured, accurate, and valuable report for assessing short-term financial health.

Short-term financial reports covering three months provide a crucial tool for monitoring business performance and enabling proactive financial management. Understanding the structure, components, and key performance indicators derived from these statements allows organizations to analyze revenue streams, manage expenses effectively, and assess overall profitability within a defined short period. The consistent application of standardized templates ensures comparability across reporting cycles, facilitating trend analysis and informed decision-making. By leveraging these condensed reports, businesses gain valuable insights into operational efficiency, identify potential challenges, and adapt strategies to achieve short-term and long-term financial objectives.

Effective utilization of these statements empowers organizations to move beyond reactive financial management and embrace a proactive approach to navigating the complexities of the business landscape. Regular review and analysis of these reports fosters a culture of data-driven decision-making, contributing to enhanced financial stability, sustainable growth, and long-term success. The insights gleaned from these statements provide a foundation for informed strategic planning, optimized resource allocation, and a more resilient financial future.