Utilizing such a structured approach offers numerous advantages. It facilitates better informed decision-making by providing a clear picture of how operational changes might impact profitability, liquidity, and overall financial stability. Furthermore, it enables stakeholders to understand the relationships between different financial metrics and enhances the credibility of financial projections for potential investors and lenders.

This foundation allows for deeper exploration into crucial topics such as forecasting revenue and expenses, projecting balance sheet items, understanding cash flow dynamics, and performing sensitivity analysis to assess the impact of various scenarios. These insights are critical for strategic planning, performance evaluation, and securing financial resources for growth.

1. Integrated Financial Statements

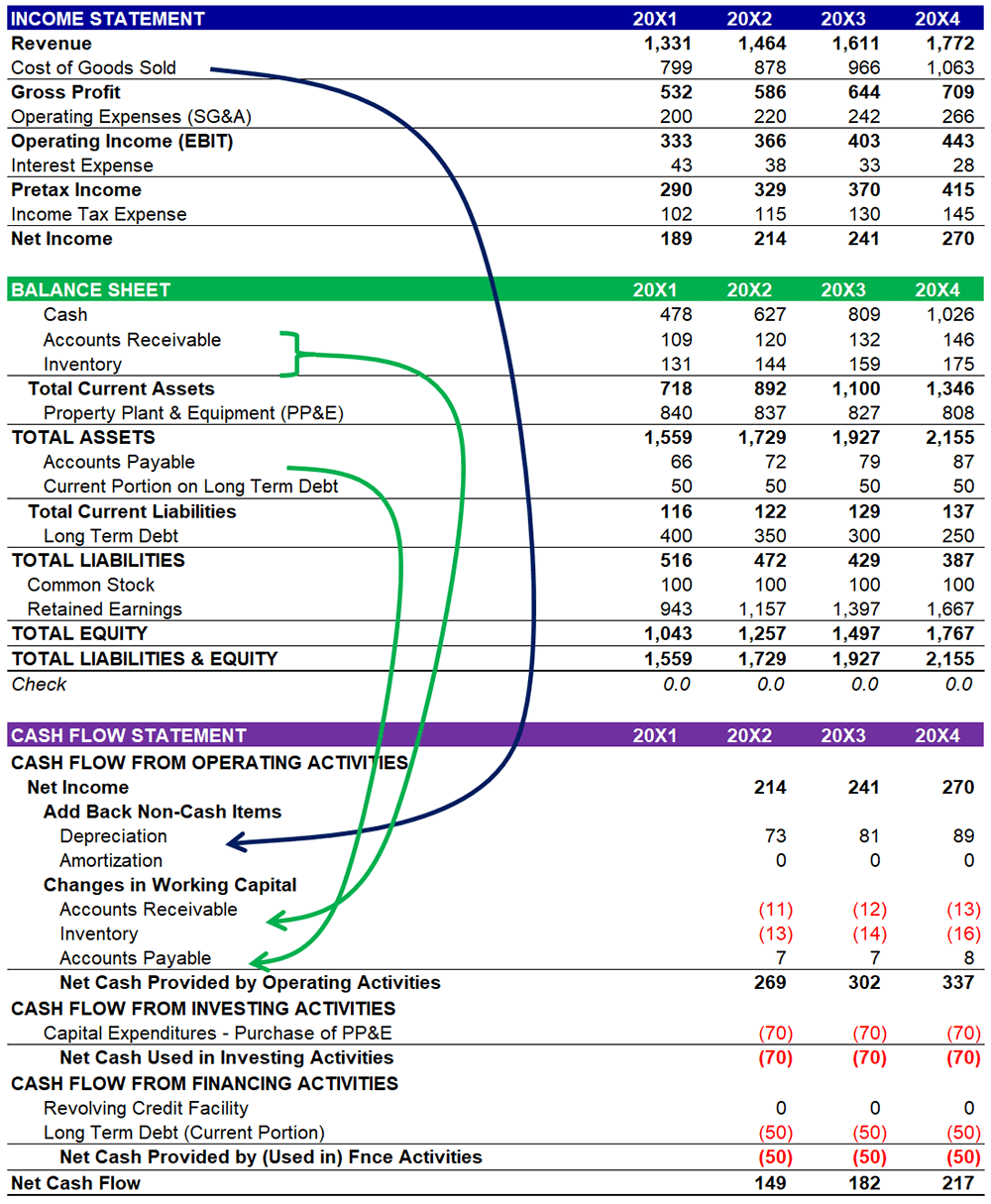

The power of a three-statement model lies in the integration of the income statement, balance sheet, and cash flow statement. This interconnectedness allows for a comprehensive and dynamic view of a company’s financial health, ensuring consistency and accuracy in forecasting and analysis. Understanding the relationships between these statements is crucial for leveraging the full potential of the model.

- Income Statement Linkages:The income statement, detailing revenues, expenses, and resulting profit or loss, feeds directly into the other two statements. Net income flows to the balance sheet, impacting retained earnings, and serves as the starting point for the cash flow statement. For example, a change in sales revenue directly affects both profitability and the cash available to the business.

- Balance Sheet Dynamics:The balance sheet reflects the company’s assets, liabilities, and equity at a specific point in time. Changes in working capital items, such as accounts receivable and inventory, derived from operational activities reflected in the income statement, influence the cash flow statement. Debt levels, impacting interest expense on the income statement, further illustrate the interconnected nature of the model.

- Cash Flow Statement Insights:The cash flow statement tracks the movement of cash both into and out of the company. It reconciles net income from the income statement with actual cash flows, accounting for non-cash items like depreciation. Changes in balance sheet accounts, such as increases in accounts payable or capital expenditures, are reflected here, demonstrating the cyclical flow of information within the model.

- Circular Flow of Information:The integrated nature of the model creates a circular flow of information. For example, increased sales (income statement) lead to higher cash balances (cash flow statement) which can be used to invest in new assets (balance sheet), potentially driving further sales growth. This dynamic interplay highlights the importance of a unified modeling approach.

Through this integration, a robust financial model provides a dynamic and comprehensive view of a companys financial position, enabling more accurate forecasting, informed decision-making, and a clearer understanding of the interplay between operational activities and financial outcomes. The interconnected nature of the statements ensures that changes in one area are reflected throughout the model, providing a holistic and accurate representation of a company’s financial performance.

2. Forecasting Assumptions

Forecasting assumptions are the bedrock of a three-statement financial model. These assumptions, based on historical data, market research, and management expectations, drive the model’s projections and influence key financial outcomes. Accurate and well-justified assumptions are critical for creating a reliable and insightful model. The following facets explore the key components and implications of these assumptions within the framework of a robust financial model.

- Revenue Growth:Projecting future revenue is a fundamental assumption. It considers factors such as market size, pricing strategies, and competitive landscape. For example, a software company might assume a certain percentage of market share growth based on historical performance and product development plans. This assumption directly impacts projected profitability and cash flow.

- Cost of Goods Sold (COGS):COGS assumptions reflect the direct costs associated with producing goods or services. These might include raw material costs, labor costs, and manufacturing overhead. For a retailer, accurate COGS projections, influenced by supplier contracts and inventory management strategies, are crucial for determining gross profit margins and subsequent profitability calculations.

- Operating Expenses:Operating expenses encompass selling, general, and administrative expenses necessary to run the business. Assumptions about these expenses often involve analyzing historical trends, considering future headcount needs, and anticipating changes in marketing or research and development spending. These projections directly impact projected operating income and overall financial performance.

- Capital Expenditures (CAPEX):CAPEX assumptions relate to investments in fixed assets like property, plant, and equipment. These assumptions are often linked to a company’s growth plans and strategic initiatives. For example, a manufacturing company might project significant CAPEX for new equipment to expand production capacity. This impacts both the balance sheet (through increased assets) and the cash flow statement (through cash outflows).

These interconnected assumptions form the basis for projecting future financial performance within the three-statement model. The accuracy and reliability of these assumptions directly impact the model’s output and its effectiveness as a decision-making tool. A rigorous and well-documented approach to developing forecasting assumptions is therefore essential for building a credible and insightful financial model. By carefully considering and justifying each assumption, stakeholders can gain a clearer understanding of the potential risks and opportunities facing the business and make more informed decisions about its future.

3. Scenario Analysis

Scenario analysis is a crucial component of financial modeling, providing a framework for evaluating the potential impact of various uncertain future events on a company’s financial performance. By exploring different possible outcomes, scenario analysis enhances decision-making by allowing stakeholders to understand the range of potential financial impacts and develop appropriate mitigation strategies. Within the context of a three-statement model, scenario analysis provides critical insights into the resilience and flexibility of a business under varying conditions.

- Base Case Scenario:The base case scenario represents the most likely outcome based on current conditions and reasonable expectations. It serves as a benchmark against which alternative scenarios are compared. This scenario incorporates the core assumptions driving the financial model and reflects the expected trajectory of the business under normal operating conditions. For example, a base case scenario might project steady revenue growth, stable margins, and consistent capital expenditures.

- Best Case Scenario:The best-case scenario explores the potential upside if key assumptions outperform expectations. This scenario helps identify the potential for exceeding financial targets and allows for strategic planning to capitalize on favorable market conditions. For instance, a best-case scenario might assume higher-than-expected market share gains, leading to accelerated revenue growth and increased profitability.

- Worst Case Scenario:The worst-case scenario examines the potential downside if key assumptions underperform. This analysis helps identify vulnerabilities and develop contingency plans to mitigate potential losses. A worst-case scenario might consider the impact of an economic downturn, resulting in lower sales volumes, reduced margins, and decreased cash flow.

- Sensitivity Analysis:While distinct from scenario analysis, sensitivity analysis often complements it. Sensitivity analysis isolates the impact of changes in individual variables, such as sales growth or interest rates, on key financial metrics. This analysis helps identify the key drivers of financial performance and assess the model’s responsiveness to changes in specific assumptions. For example, a sensitivity analysis might reveal the degree to which profitability is impacted by fluctuations in raw material prices.

By integrating scenario analysis into a three-statement model, businesses gain a more comprehensive understanding of their financial position and the potential range of future outcomes. This understanding allows for more informed decision-making, proactive risk management, and the development of flexible strategies that can adapt to changing market conditions. The insights gained from scenario analysis are crucial for strategic planning, resource allocation, and ensuring the long-term financial health of the organization.

4. Valuation Applications

Valuation applications leverage the outputs of a three-statement financial model to estimate the economic worth of a business. This connection between projected financial performance and valuation is crucial for various corporate finance activities, including mergers and acquisitions, fundraising, and investment analysis. Understanding how the three-statement model informs valuation methodologies provides essential insights for stakeholders seeking to assess a company’s intrinsic value.

- Discounted Cash Flow (DCF) Analysis:DCF analysis, a cornerstone of valuation, relies heavily on the projected free cash flows generated by a business, derived from the three-statement model. These projected cash flows are discounted back to their present value to estimate the company’s intrinsic value. The accuracy of the DCF valuation hinges on the reliability of the underlying financial projections, highlighting the importance of a robust three-statement model. For example, a company projecting rapid growth in free cash flow, supported by detailed revenue and expense projections, would likely result in a higher valuation than a company with stagnant projected cash flows.

- Precedent Transaction Analysis:Precedent transaction analysis involves comparing a company to similar businesses that have been recently acquired or merged. Key valuation multiples, such as enterprise value-to-revenue or enterprise value-to-EBITDA, derived from these transactions are applied to the subject company’s financial metrics, often projected from the three-statement model. For instance, if comparable companies were acquired at a multiple of 10x EBITDA, this multiple could be applied to the subject company’s projected EBITDA to estimate its value.

- Market Multiples Analysis:Market multiples analysis compares a company’s valuation metrics to those of its publicly traded peers. Multiples such as price-to-earnings (P/E) and price-to-sales (P/S) ratios, based on current market valuations, are applied to the subject company’s financial data, often projected from the three-statement model. This approach relies on the assumption that similar companies should trade at comparable multiples. For example, if the average P/E ratio of comparable companies is 20x, this multiple can be applied to the subject company’s projected earnings to estimate its value.

- Leveraged Buyout (LBO) Modeling:LBO modeling, used to evaluate the potential returns of an acquisition using debt financing, also relies on the three-statement model. The model projects the company’s financial performance under the leveraged capital structure and determines the feasibility and potential returns of the transaction. Key metrics such as the internal rate of return (IRR) and debt service coverage ratios are derived from these projections, informing investment decisions. For instance, an LBO model might project the impact of increased debt on interest expense, cash flow, and the ultimate return on investment for the acquiring firm.

These valuation applications demonstrate the integral role of the three-statement model in assessing a company’s value. The accuracy and reliability of the financial projections directly influence the valuation outcomes, emphasizing the importance of a well-constructed and thoroughly vetted model. By providing a comprehensive and consistent framework for projecting financial performance, the three-statement model enables informed decision-making in a wide range of corporate finance contexts.

5. Key Performance Indicators (KPIs)

Key performance indicators (KPIs) provide quantifiable metrics for evaluating a company’s performance against its strategic objectives. A three-statement financial model serves as a foundation for calculating and analyzing these KPIs, linking them directly to the company’s financial projections. This connection allows for a comprehensive assessment of financial health and operational efficiency, providing valuable insights for decision-making. KPIs derived from the model become critical tools for monitoring progress, identifying areas for improvement, and making informed adjustments to business strategies.

Several critical KPIs are directly derived from the interconnected data within the three-statement model. For example, gross profit margin, calculated from the income statement, reflects the efficiency of production and pricing strategies. Return on equity (ROE), calculated using net income from the income statement and equity from the balance sheet, measures the profitability generated from shareholder investments. Operating cash flow, derived from the cash flow statement, indicates the company’s ability to generate cash from its core operations. Debt-to-equity ratio, calculated from the balance sheet, assesses the company’s financial leverage and risk profile. Analyzing these KPIs in conjunction with the underlying financial statements provides a holistic view of a company’s financial and operational performance. For example, a declining gross profit margin might indicate increasing production costs or competitive pricing pressures, prompting management to investigate and implement corrective actions. Similarly, a strong operating cash flow could signal opportunities for reinvestment or debt reduction.

Understanding the relationship between KPIs and the three-statement model is crucial for effective performance management. The model not only provides the data for calculating KPIs but also allows for scenario analysis to assess the potential impact of different business strategies on these metrics. This forward-looking perspective enables proactive adjustments and informed decision-making. Moreover, consistent monitoring of KPIs derived from the model allows for timely identification of trends and potential issues, facilitating proactive interventions to maintain financial health and achieve strategic goals. For instance, by modeling the impact of a price increase on sales volume, gross profit margin, and ultimately ROE, management can make informed decisions about pricing strategies and their potential impact on shareholder returns. The ability to analyze these interconnected relationships strengthens the practical application of the three-statement model as a dynamic management tool.

6. Dynamic Financial Planning

Dynamic financial planning represents an iterative and adaptive approach to managing a company’s finances, leveraging the interconnectedness of the three-statement model. It moves beyond static budgets and forecasts, allowing for continuous adjustments based on real-time data, changing market conditions, and evolving business strategies. This dynamic approach is crucial for navigating uncertainty and ensuring financial stability in today’s complex business environment. The three-statement model serves as the engine for this dynamic process, providing a structured framework for incorporating changes and analyzing their impact across all aspects of a company’s financial position.

- Real-time Monitoring and Analysis:Dynamic financial planning incorporates real-time monitoring of actual financial performance. Variances between actual results and projected figures within the three-statement model trigger analysis to understand underlying causes and inform corrective actions. For example, if sales lag behind projections, the model can be used to assess the impact on profitability and cash flow, prompting adjustments to marketing strategies or pricing models. This real-time feedback loop allows for proactive adjustments to maintain financial health.

- Scenario Planning and Risk Management:The three-statement model facilitates scenario planning by allowing businesses to assess the financial impact of various potential events, such as changes in interest rates, economic downturns, or shifts in competitive landscapes. This analysis informs risk management strategies and allows for proactive adjustments to mitigate potential negative impacts. For instance, a company can model the impact of rising interest rates on its debt service obligations and adjust its capital structure accordingly.

- Flexible Budgeting and Forecasting:Dynamic financial planning moves beyond static annual budgets, embracing flexible budgets that adjust to changes in business activity and market conditions. The three-statement model provides a framework for updating forecasts based on real-time data and revised assumptions, ensuring that financial projections remain relevant and accurate. For example, a company experiencing rapid growth can use the model to adjust its revenue projections, expense budgets, and capital expenditure plans to align with its evolving needs.

- Strategic Decision-Making and Resource Allocation:The dynamic nature of the three-statement model enhances strategic decision-making. By analyzing the interconnected impact of various strategic initiatives on financial performance, businesses can make informed choices about resource allocation, investment priorities, and growth strategies. For example, a company considering a new product launch can use the model to evaluate the potential impact on revenue, costs, and profitability, informing the decision about whether to proceed with the investment. This dynamic approach to strategic planning ensures that decisions align with overall financial objectives.

By integrating these dynamic elements, the three-statement model becomes a powerful tool for managing financial performance in a rapidly changing environment. It empowers businesses to move beyond static planning processes and embrace a more agile and adaptive approach to financial management. The ability to incorporate real-time data, analyze various scenarios, and adjust plans dynamically allows organizations to navigate uncertainty, optimize resource allocation, and achieve sustainable financial growth.

Key Components of a Three-Statement Financial Model

A robust three-statement model hinges on several interconnected components. Understanding these elements is crucial for developing accurate projections and leveraging the model’s full potential for informed decision-making.

1. Income Statement: The income statement projects a company’s revenues, expenses, and resulting profit or loss over a defined period. Accuracy in forecasting these elements is paramount, as they form the basis for subsequent projections in the balance sheet and cash flow statement.

2. Balance Sheet: The balance sheet projects a company’s assets, liabilities, and equity at specific points in time. It reflects the cumulative impact of operational activities and financing decisions, providing insights into a company’s financial position and stability.

3. Cash Flow Statement: The cash flow statement projects the movement of cash into and out of a company. It reconciles net income with actual cash flows, accounting for non-cash items and changes in working capital, providing a crucial view of a company’s liquidity and ability to meet its financial obligations.

4. Assumptions and Drivers: Underlying the three core statements are key assumptions about revenue growth, cost structures, capital expenditures, and other factors. These assumptions, based on historical data, market research, and management expectations, drive the model’s outputs and influence projected financial performance.

5. Inter-statement Linkages: The power of the three-statement model lies in the dynamic relationships between the statements. Changes in one statement ripple through the others, ensuring consistency and providing a holistic view of a company’s financial health. For example, changes in sales revenue impact profitability (income statement), asset levels (balance sheet), and cash flow (cash flow statement).

6. Scenario Analysis: Building multiple scenarios, such as base case, best case, and worst case, allows stakeholders to assess the potential impact of various future events on financial performance. This analysis enhances decision-making by providing insights into potential risks and opportunities.

These interconnected elements work together to provide a comprehensive and dynamic representation of a company’s financial position. The accuracy of the model’s projections and its effectiveness as a decision-making tool depend critically on the careful development and integration of each component.

How to Create a Three-Statement Financial Model

Building a robust three-statement model requires a structured approach and careful consideration of key components. The following steps outline a practical process for developing such a model.

1: Historical Data Gathering and Analysis: Begin by collecting historical financial data, including income statements, balance sheets, and cash flow statements for at least three to five years. Analyze historical trends in revenue growth, cost structures, and key financial ratios to inform future projections.

2: Develop Key Assumptions: Based on historical analysis, industry research, and management expectations, develop key assumptions about future revenue growth, cost of goods sold, operating expenses, capital expenditures, and other relevant drivers. Document these assumptions clearly and justify their rationale.

3: Build the Income Statement: Project future revenues, expenses, and resulting profit or loss based on the established assumptions. Consider various forecasting techniques, such as time series analysis or regression analysis, where appropriate. Ensure accurate formulas and cell referencing for dynamic calculations.

4: Construct the Balance Sheet: Project balance sheet items, including assets, liabilities, and equity, based on the projected income statement and assumptions about working capital management, capital expenditures, and financing activities. Maintain balance sheet integrity by ensuring that the accounting equation (Assets = Liabilities + Equity) always holds true.

5: Develop the Cash Flow Statement: Project cash flows from operating, investing, and financing activities, linking them to the income statement and balance sheet projections. Reconcile net income with actual cash flows, accounting for non-cash items and changes in working capital. Pay close attention to the timing of cash flows.

6: Implement Inter-Statement Linkages: Establish dynamic links between the three statements to ensure consistency and accuracy. For example, net income from the income statement flows to retained earnings on the balance sheet and serves as the starting point for the cash flow statement. Changes in working capital on the balance sheet impact cash flows from operations.

7: Perform Scenario Analysis: Develop multiple scenarios, including a base case, best case, and worst case, to assess the potential impact of various future events on financial performance. Adjust key assumptions within each scenario to reflect different potential outcomes and analyze their impact on key financial metrics.

8: Validation and Refinement: Thoroughly review and validate the model’s outputs, ensuring that projections are reasonable and consistent with historical trends and industry benchmarks. Refine assumptions and recalibrate the model as needed based on feedback from stakeholders and ongoing analysis. Regularly update the model with actual results and revised assumptions to maintain its accuracy and relevance for ongoing financial planning and decision-making.

A meticulously constructed three-statement model offers valuable insights into a company’s financial health and future prospects. Through rigorous analysis, dynamic linkages, and thoughtful scenario planning, the model provides a powerful framework for informed decision-making and strategic planning. Maintaining the model’s integrity and relevance through ongoing validation and refinement is crucial for its continued effectiveness as a management tool.

Building a robust, integrated financial projection requires a thorough understanding of the interplay between the income statement, balance sheet, and statement of cash flows. Accurate forecasting hinges on well-defined assumptions, rigorous analysis, and dynamic linkages between these core financial statements. Scenario planning and sensitivity analysis further enhance the model’s utility, allowing stakeholders to explore various potential outcomes and assess the impact of changing conditions on a company’s financial health. Through this integrated approach, a clear and comprehensive view of a company’s financial position emerges, empowering informed decision-making and strategic planning.

Mastering this interconnected framework provides a powerful tool for navigating the complexities of the financial landscape. It allows organizations to move beyond static budgets and embrace a more dynamic and adaptive approach to financial management. By diligently crafting, analyzing, and refining these models, businesses gain a deeper understanding of their financial drivers, enabling more effective resource allocation, proactive risk management, and ultimately, sustainable growth and value creation.