Utilizing this type of financial projection provides several key advantages. It allows businesses to track projected progress towards financial goals, secure funding from investors or lenders, and identify potential financial issues before they arise. By comparing projected figures year-over-year, organizations can gain valuable insights into anticipated growth trends and make necessary adjustments to their business strategies to optimize financial outcomes. This proactive approach strengthens financial planning and contributes to long-term financial stability.

This structured financial overview is vital for informed decision-making and proactive financial management. The following sections will delve deeper into the key components, practical applications, and strategic advantages of incorporating this type of forward-looking financial analysis.

1. Revenue Projections

Revenue projections form the cornerstone of a three-year income statement template, providing the foundation for subsequent financial analyses and strategic decision-making. Accurate revenue forecasting is essential for evaluating potential profitability, securing investments, and guiding overall business strategy. Understanding the various facets of revenue projection within this multi-year framework is crucial for developing a robust and reliable financial outlook.

- Sales Forecasting MethodsVarious methods exist for projecting revenue, including historical data analysis, market research, and industry trend analysis. For example, a company might analyze past sales data to identify seasonal trends and project future sales based on anticipated market growth. Selecting the appropriate method depends on factors such as industry dynamics, data availability, and company-specific circumstances. The chosen method directly influences the accuracy and reliability of the entire income statement projection.

- Market Analysis & Growth PotentialUnderstanding the target market and its growth potential is crucial for realistic revenue projections. Market research helps identify potential market share, competitive pressures, and pricing strategies, influencing revenue expectations. For instance, a company entering a new market might project lower initial revenue due to market entry barriers, gradually increasing as market share expands. Integrating market dynamics into revenue projections strengthens the overall financial forecast.

- Pricing Strategies & Sales VolumeProjected revenue is a function of both pricing strategies and anticipated sales volume. A company considering a price increase must carefully analyze potential impacts on sales volume and overall revenue. For example, a premium pricing strategy might result in lower sales volume but higher per-unit revenue. Balancing these factors is critical for accurate revenue projections and informed pricing decisions.

- Impact on Profitability & Financial PlanningRevenue projections directly influence projected profitability and subsequent financial planning. Accurate revenue forecasting allows businesses to project potential profit margins, informing decisions related to cost management, investment strategies, and resource allocation. Overly optimistic revenue projections can lead to unrealistic profit expectations and potentially unsustainable financial planning. Conversely, conservative projections may limit growth opportunities. A balanced and well-informed revenue projection is essential for sound financial planning.

These interconnected facets of revenue projection underscore the importance of a well-informed and data-driven approach within the three-year income statement template. Accurate and realistic revenue projections provide the foundation for a comprehensive financial outlook, informing strategic decision-making and promoting long-term financial stability. By carefully considering these factors, businesses can develop a robust financial roadmap for sustained growth and success.

2. Cost of Goods Sold

Cost of goods sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a three-year income statement template, COGS plays a crucial role in determining gross profit and overall profitability. Accurately projecting COGS over a three-year horizon is essential for informed financial planning, pricing strategies, and investment decisions. A clear understanding of the relationship between COGS and revenue projections is fundamental to developing a comprehensive financial outlook. For example, if a company anticipates increased sales volume, a corresponding increase in COGS is expected, impacting projected gross profit margins. Accurately forecasting these interconnected elements allows businesses to proactively manage costs and optimize pricing strategies.

Several factors influence COGS projections within a three-year timeframe. Raw material prices, manufacturing costs, labor costs, and supply chain dynamics all contribute to the overall cost of producing goods. Fluctuations in any of these areas can significantly impact projected COGS and subsequently, profitability. For instance, a manufacturer relying on imported raw materials might experience increased COGS due to fluctuating exchange rates or supply chain disruptions. Incorporating these potential cost fluctuations into the three-year income statement template provides a more realistic financial projection, allowing businesses to anticipate and mitigate potential challenges. Analyzing historical COGS data, combined with industry trends and anticipated market conditions, strengthens the accuracy and reliability of these projections.

Understanding the interplay between COGS and other components of the income statement is crucial for effective financial management. By accurately projecting COGS and its relationship to revenue, businesses can develop realistic profit margin expectations and make informed decisions regarding pricing, cost control measures, and investment strategies. Challenges in accurately projecting COGS can arise from unforeseen economic fluctuations, supply chain disruptions, or changes in production processes. Effectively managing these challenges requires ongoing monitoring, analysis, and adjustments to the three-year income statement template to ensure continued alignment with evolving business conditions. This proactive approach strengthens financial planning and contributes to long-term financial stability.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). Within a three-year income statement template, projecting operating expenses accurately is critical for determining operating income and overall profitability. A comprehensive understanding of operating expenses is crucial for informed financial planning, resource allocation, and strategic decision-making. Accurately forecasting these expenses over a three-year horizon enables businesses to anticipate financial challenges and opportunities, supporting data-driven decisions and promoting long-term financial health.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass a range of costs related to sales, marketing, administrative functions, and general overhead. Examples include salaries for sales and marketing staff, advertising costs, rent, utilities, and office supplies. Projecting SG&A within a three-year income statement template requires careful consideration of factors such as anticipated sales growth, marketing strategies, and administrative overhead requirements. For instance, a company expanding into new markets might project increased SG&A expenses to support marketing and sales efforts in those regions. Accurate SG&A projections contribute to realistic operating income forecasts and inform resource allocation decisions.

- Research and Development (R&D) ExpensesR&D expenses reflect investments in developing new products, services, or processes. These expenses can vary significantly depending on the industry and a company’s innovation strategy. Within a three-year timeframe, projecting R&D expenses requires careful consideration of planned innovation projects, technological advancements, and competitive pressures. A pharmaceutical company, for example, might project significant R&D expenses for drug development over several years. Accurate R&D projections are essential for assessing the financial viability of innovation initiatives and their potential impact on future profitability.

- Depreciation and AmortizationDepreciation and amortization represent the allocation of the cost of tangible and intangible assets over their useful lives. These non-cash expenses impact operating income and reflect the declining value of assets over time. Projecting depreciation and amortization within a three-year income statement template requires an understanding of asset lifespans, depreciation methods, and anticipated capital expenditures. For instance, a company investing in new equipment might project increased depreciation expenses over the subsequent years. Accurate projections of these expenses are crucial for assessing the long-term financial impact of capital investments.

- Operating Expense Ratios and TrendsAnalyzing operating expense ratios, such as the ratio of operating expenses to revenue, provides insights into a company’s cost structure and efficiency. Tracking these ratios over a three-year period helps identify trends and potential areas for cost optimization. For example, a consistent increase in operating expenses as a percentage of revenue might signal inefficiencies or escalating costs. Analyzing these trends within the three-year income statement template allows businesses to proactively address cost management issues and improve operational efficiency.

The accurate projection of operating expenses within a three-year income statement template is essential for developing a realistic and comprehensive financial outlook. By carefully considering the various components of operating expenses, their interrelationships, and potential future trends, businesses can gain valuable insights into their operational efficiency, profitability, and long-term financial health. This informed approach empowers organizations to make strategic decisions regarding resource allocation, cost management, and growth initiatives, ultimately contributing to sustained financial success.

4. Profitability Trends

Profitability trends, reflecting a company’s ability to generate profit over time, are central to the analysis of a three-year income statement template. Examining these trends provides crucial insights into a company’s financial health, operational efficiency, and potential for future growth. Understanding how profitability trends emerge and their implications within this multi-year framework is essential for informed decision-making, strategic planning, and long-term financial success. A consistent upward trend in profitability suggests a healthy and growing business, while declining profitability warrants further investigation and potential corrective actions.

- Gross Profit Margin AnalysisGross profit margin, calculated as revenue less cost of goods sold (COGS) divided by revenue, reveals the profitability of a company’s core production or service delivery. Analyzing gross profit margin trends within a three-year income statement template can illuminate shifts in production costs, pricing strategies, and overall product profitability. For example, a declining gross profit margin might indicate rising COGS, requiring an examination of raw material costs, production efficiencies, or pricing adjustments. Conversely, an increasing gross profit margin could suggest successful cost management or effective pricing strategies.

- Operating Profit Margin AnalysisOperating profit margin, calculated as operating income divided by revenue, reflects a company’s profitability after accounting for both COGS and operating expenses. Analyzing operating profit margin trends over three years provides a broader view of operational efficiency and cost management effectiveness. For example, a stable or increasing operating profit margin suggests effective control of operating expenses relative to revenue growth. A declining operating profit margin might signal escalating operating costs, requiring a review of expense management practices or pricing adjustments.

- Net Profit Margin AnalysisNet profit margin, calculated as net income divided by revenue, represents the ultimate measure of a company’s profitability after all expenses, including taxes and interest, have been deducted. Analyzing net profit margin trends over a three-year period offers a comprehensive view of a company’s bottom-line performance and its ability to generate profit for its shareholders. A consistent upward trend in net profit margin indicates strong financial performance and effective management of all aspects of the business. A declining net profit margin warrants a detailed examination of revenue generation, cost control measures, and overall financial strategy.

- Impact of External Factors & Industry BenchmarksProfitability trends are not solely influenced by internal factors. External factors such as economic conditions, industry trends, and competitive pressures can significantly impact a company’s profitability. Comparing a company’s profitability trends to industry benchmarks provides valuable context and insights into its relative performance. For instance, a company with declining profitability in a growing industry might indicate internal operational challenges, while a company with stable profitability in a declining industry might suggest effective management in a challenging environment. Understanding these external influences and industry benchmarks is essential for accurately interpreting profitability trends within the three-year income statement template.

By analyzing these interconnected profitability trends within the framework of a three-year income statement template, businesses gain a comprehensive understanding of their financial performance and potential for future growth. This analysis informs strategic decision-making, resource allocation, and cost management strategies, ultimately contributing to sustained profitability and long-term financial success. Identifying consistent patterns, understanding underlying drivers, and comparing performance to industry benchmarks enables proactive adjustments and strengthens the overall financial outlook.

5. Financial Forecasting

Financial forecasting plays a crucial role in developing a three-year income statement template. It provides a structured framework for projecting future financial performance based on historical data, market analysis, and anticipated business activities. A well-defined forecasting process enables organizations to anticipate potential challenges and opportunities, supporting informed decision-making and strategic planning. This proactive approach strengthens financial stability and contributes to long-term success.

- Projected Financial StatementsCreating projected financial statements, including the income statement, balance sheet, and cash flow statement, forms the core of financial forecasting. These projections translate anticipated business activities into financial figures, providing a comprehensive view of future financial performance. For example, a company projecting increased sales volume would also forecast corresponding changes in cost of goods sold, operating expenses, and ultimately, net income. These interconnected projections within the three-year income statement template allow for a holistic assessment of anticipated financial outcomes.

- Key Performance Indicators (KPIs)Financial forecasting often involves projecting key performance indicators (KPIs) such as revenue growth rates, profit margins, and return on investment (ROI). These KPIs provide quantifiable metrics for evaluating projected financial performance and tracking progress toward strategic goals. For instance, a company aiming to improve profitability might project specific target profit margins within the three-year income statement template. Monitoring actual performance against these projected KPIs allows for timely adjustments and informed decision-making.

- Sensitivity Analysis & Scenario PlanningSensitivity analysis explores the potential impact of various assumptions and variables on projected financial outcomes. Scenario planning involves developing alternative financial projections based on different potential future scenarios, such as changes in market conditions or economic downturns. For example, a company might develop best-case, worst-case, and base-case scenarios within its three-year income statement template to assess the potential impact of varying revenue growth rates or cost fluctuations. This proactive approach enhances preparedness and supports informed responses to unforeseen circumstances.

- Strategic Decision-Making & Resource AllocationFinancial forecasting directly supports strategic decision-making and resource allocation. By projecting future financial performance, organizations can assess the financial viability of various strategic initiatives, prioritize investments, and allocate resources effectively. For instance, a company considering expanding into a new market would use financial forecasting to project potential revenue, costs, and profitability associated with the expansion. This analysis informs the decision-making process and ensures that resource allocation aligns with strategic goals and projected financial outcomes.

The insights gained from financial forecasting are integral to the development and utilization of a three-year income statement template. By projecting future financial performance and analyzing potential scenarios, organizations can make informed decisions, optimize resource allocation, and navigate the complexities of the business environment. This proactive and data-driven approach strengthens financial planning and positions organizations for sustained growth and success.

6. Strategic Planning

Strategic planning and a three-year income statement template are intrinsically linked. The template provides the financial framework upon which strategic decisions are made and evaluated. Strategic planning informs the assumptions and projections within the template, while the template, in turn, provides a financial roadmap for achieving strategic goals. This cyclical relationship is essential for organizations seeking sustained growth and long-term financial health.

- Goal Setting & Target DefinitionStrategic planning begins with defining clear, measurable, achievable, relevant, and time-bound (SMART) goals. These goals, whether related to market share, revenue growth, or profitability, are then translated into specific financial targets within the three-year income statement template. For example, a goal of achieving a 10% market share might translate into specific revenue targets for each of the next three years. These financial targets provide quantifiable benchmarks against which to measure progress and assess the effectiveness of strategic initiatives.

- Resource Allocation & Investment DecisionsStrategic planning guides resource allocation and investment decisions. The three-year income statement template provides the financial context for evaluating the potential return on investment (ROI) of various strategic initiatives. For instance, a company considering investing in new technology would use the template to project the potential impact on revenue, costs, and profitability over the next three years. This analysis informs the investment decision and ensures that resources are allocated strategically to maximize returns and support long-term growth.

- Performance Monitoring & Course CorrectionRegular monitoring of actual performance against the projections within the three-year income statement template is a crucial aspect of strategic planning. This ongoing assessment allows for timely identification of deviations from the plan and facilitates necessary course corrections. For example, if actual revenue falls short of projections, strategic adjustments might be required, such as revising marketing strategies, adjusting pricing, or streamlining operations. The template serves as a control mechanism, ensuring that strategic initiatives remain aligned with financial goals.

- Adaptability & Long-Term VisionStrategic planning requires adaptability and a long-term vision. The three-year income statement template provides a framework for anticipating future challenges and opportunities. However, the business environment is dynamic, and unexpected events can significantly impact financial performance. Therefore, the strategic plan and the associated financial projections within the template should be reviewed and adjusted periodically to reflect changing market conditions, emerging technologies, and evolving competitive landscapes. This adaptability ensures that the strategic plan remains relevant and effective in achieving long-term goals.

The interplay between strategic planning and the three-year income statement template is dynamic and iterative. The template informs strategic decisions, while the strategic plan provides the context for the financial projections within the template. This ongoing interaction is essential for organizations to navigate the complexities of the business environment, achieve sustainable growth, and maintain long-term financial health. By aligning financial projections with strategic goals and adapting to evolving circumstances, organizations can effectively manage resources, capitalize on opportunities, and achieve lasting success.

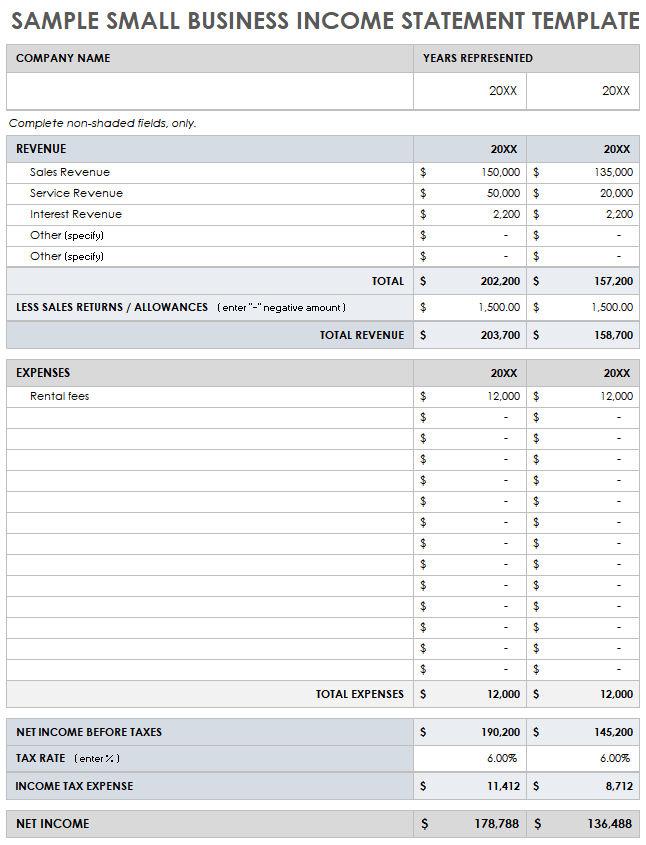

Key Components of a Three-Year Income Statement Template

A comprehensive three-year income statement template comprises several key components, each contributing to a thorough understanding of projected financial performance. These components, when analyzed collectively, provide valuable insights for informed decision-making and strategic planning.

1. Revenue Projections: Forecasted revenue figures, often broken down by product or service, form the foundation of the income statement. These projections consider historical data, market trends, and anticipated sales volume. Accuracy in revenue projections is crucial as it influences all subsequent calculations within the template.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services. Accurate COGS projections are essential for determining gross profit margins. These projections often consider factors like raw material costs, labor expenses, and manufacturing overhead.

3. Operating Expenses: These expenses encompass the costs of running the business beyond direct production costs, including selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation/amortization. Accurately forecasting operating expenses is critical for understanding projected operating income.

4. Gross Profit: Calculated as revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. Analyzing gross profit trends helps assess the efficiency of production and pricing strategies.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of the core business operations. This figure is key for evaluating the overall operational efficiency and effectiveness of cost management.

6. Interest Expense and Income: This component accounts for the cost of borrowing money (interest expense) and any income generated from interest-bearing investments. These figures are crucial for understanding the impact of financing activities on overall profitability.

7. Income Before Taxes: This represents the income generated before accounting for income tax expenses. It provides a clear picture of profitability before the impact of tax obligations.

8. Net Income: Often referred to as the “bottom line,” net income represents the final profit after all expenses, including taxes, have been deducted. This figure is a key indicator of a company’s overall financial performance and profitability.

These interconnected components provide a comprehensive view of projected financial performance over a three-year horizon. By carefully analyzing each element and understanding their interrelationships, organizations can gain valuable insights into potential challenges and opportunities, facilitating informed decision-making and strategic planning for sustained growth and success.

How to Create a Three-Year Income Statement Template

Developing a three-year income statement template requires a structured approach, combining historical data analysis with forward-looking projections. A well-constructed template provides a robust framework for financial planning, strategic decision-making, and performance evaluation.

1: Gather Historical Financial Data: Compile income statement data from the past three years. This historical data serves as a baseline for future projections. Complete data sets offer a more accurate foundation for subsequent forecasting.

2: Project Revenue: Forecast revenue for each of the next three years, considering factors such as historical growth rates, market trends, pricing strategies, and anticipated sales volume. Realistic revenue projections are crucial for the accuracy of the entire template.

3: Project Cost of Goods Sold (COGS): Forecast COGS for each year, considering factors like raw material costs, labor expenses, production efficiency, and anticipated changes in production volume. Accurate COGS projections are essential for determining gross profit margins.

4: Project Operating Expenses: Project operating expenses, including SG&A, R&D, and depreciation/amortization, for each year. Consider factors like anticipated staffing levels, marketing expenditures, administrative costs, and planned investments in research and development.

5: Calculate Projected Profitability: Calculate projected gross profit, operating income, and net income for each year based on the revenue, COGS, and operating expense projections. These calculations offer insights into projected profitability trends and overall financial performance.

6: Conduct Sensitivity Analysis: Explore the potential impact of variations in key assumptions, such as revenue growth rates or cost fluctuations, on projected profitability. Sensitivity analysis enhances understanding of potential risks and opportunities.

7: Review and Refine: Regularly review and refine the template to reflect changes in business conditions, market dynamics, and strategic priorities. Maintaining an up-to-date template ensures its continued relevance and value for decision-making.

8: Format and Present: Organize the projected data clearly and concisely within the template, ensuring readability and ease of interpretation. A well-formatted template facilitates effective communication and supports informed decision-making.

A robust three-year income statement template, built upon accurate historical data and well-informed future projections, provides invaluable insights into projected financial performance. This structured approach supports effective financial planning, resource allocation, and strategic decision-making, contributing to long-term financial health and sustainable growth. Ongoing review and refinement ensure the template remains a relevant and powerful tool for navigating the dynamic business landscape.

Developing a robust financial outlook is crucial for navigating the complexities of the business environment and achieving sustained growth. A three-year income statement template provides a structured framework for projecting future financial performance, enabling organizations to anticipate challenges, capitalize on opportunities, and make informed strategic decisions. From revenue projections and cost management to profitability analysis and strategic planning, this comprehensive financial tool empowers organizations to take a proactive approach to financial management. Understanding the key components, development process, and strategic implications of this template is essential for effective financial planning and long-term success.

Effective financial management requires a forward-looking perspective. Leveraging the insights gained from a well-constructed three-year income statement template allows organizations to make data-driven decisions, optimize resource allocation, and navigate the dynamic business landscape with greater confidence. This proactive approach to financial planning is not merely a best practice; it is a fundamental requirement for achieving sustained growth, maintaining financial stability, and realizing long-term strategic objectives. The ability to anticipate, adapt, and innovate rests firmly on a foundation of sound financial projections and informed decision-making.