Forecasting financial performance over multiple years offers several advantages. This structured approach allows for better strategic planning, informed decision-making regarding investments and resource allocation, and improved communication with stakeholders like investors and lenders. A multi-year projection can reveal potential financial challenges or opportunities, enabling proactive adjustments to business strategies and operational plans. It also provides a benchmark against which actual performance can be measured and analyzed.

This document provides a foundation for understanding key aspects of financial forecasting. Topics explored include the key components, methodologies for developing accurate projections, and best practices for utilizing these insights to drive business growth and stability.

1. Revenue Projections

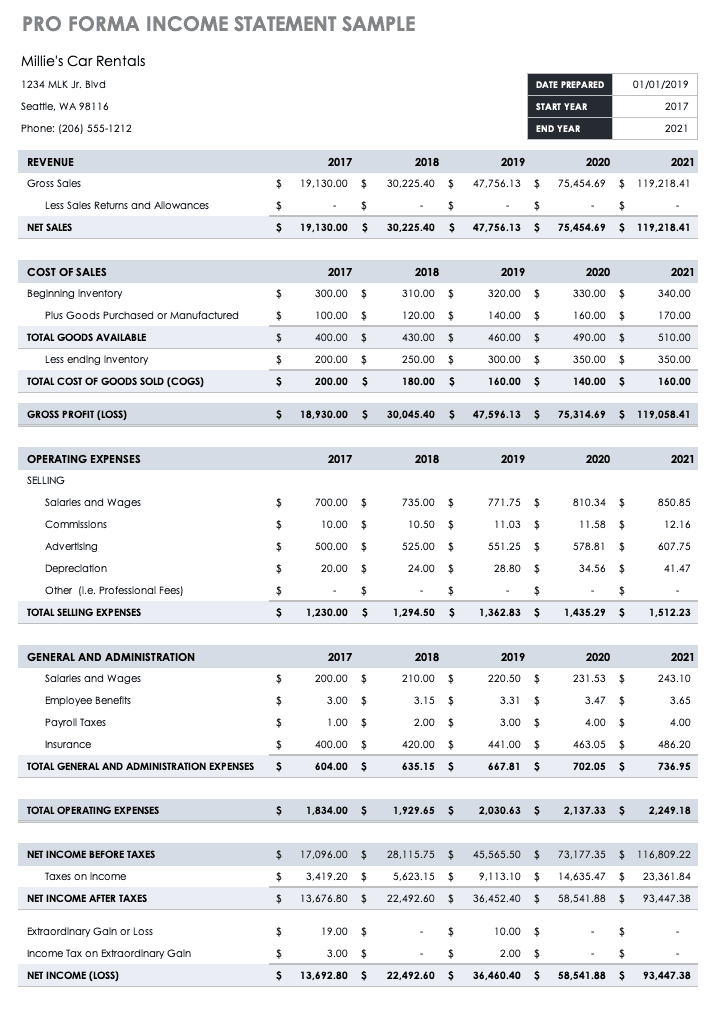

Revenue projections form the cornerstone of a three-year pro forma income statement. Accuracy in these projections directly impacts the reliability and usefulness of the entire financial model. Projected revenue figures represent the anticipated income generated from sales or services over the forecast period. These projections are based on a variety of factors, including historical sales data, market analysis, anticipated pricing strategies, and overall economic conditions. For example, a software company projecting revenue might consider factors like the growth of the software market, the expected adoption rate of their product, and anticipated pricing tiers.

The relationship between revenue projections and the pro forma income statement is causal. Revenue projections serve as the primary input for calculating subsequent figures within the statement, including gross profit, operating income, and net income. Overly optimistic revenue projections can lead to an inflated profit outlook, potentially misguiding investment decisions or business strategy. Conversely, underestimating revenue can result in missed opportunities for growth and investment. For instance, if a retail business underestimates its holiday season sales, it might understock inventory, leading to lost sales and disappointed customers.

Developing accurate revenue projections requires a rigorous and methodical approach. Historical data analysis, market research, competitor analysis, and consideration of internal factors, such as planned marketing campaigns and product launches, all contribute to more reliable projections. Understanding the interplay between these factors and revenue generation is crucial for developing a robust pro forma income statement, informing strategic decision-making, and ultimately, driving business success. Furthermore, regularly reviewing and adjusting revenue projections based on actual performance and changing market conditions enhances the accuracy and effectiveness of the financial forecast.

2. Cost Estimations

Accurate cost estimations are essential for a realistic three-year pro forma income statement. A comprehensive understanding of anticipated expenses allows for informed decision-making regarding pricing, resource allocation, and overall financial strategy. Cost estimations directly impact profitability projections and provide insights into the financial viability of future operations.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods or services. For a manufacturer, this includes raw materials, direct labor, and manufacturing overhead. For a retailer, COGS represents the purchase price of merchandise. Accurate COGS estimations are crucial for determining gross profit margins and understanding the relationship between production costs and revenue. For example, a furniture manufacturer must accurately estimate the cost of lumber, hardware, and labor to determine the appropriate selling price for its products.

- Operating ExpensesOperating expenses encompass all costs incurred in running the business, excluding COGS. These include salaries, rent, marketing, research and development, and administrative expenses. Projecting operating expenses requires careful consideration of historical data, anticipated growth plans, and potential inflationary pressures. For instance, a growing technology company might anticipate increased operating expenses related to hiring additional personnel and expanding office space.

- Depreciation and AmortizationDepreciation and amortization reflect the allocation of the cost of tangible and intangible assets over their useful lives. Accurately estimating these non-cash expenses is crucial for determining net income and understanding the long-term financial impact of capital investments. A transportation company, for example, must account for the depreciation of its vehicle fleet over time.

- Interest ExpenseInterest expense reflects the cost of borrowing capital. Projecting interest expense requires considering existing debt obligations, anticipated future borrowing needs, and prevailing interest rates. For a real estate developer financing a new project, accurately estimating interest expense is essential for determining project feasibility and profitability.

Accurately estimating these cost components is essential for developing a reliable three-year pro forma income statement. A thorough understanding of cost drivers and their potential impact on profitability allows businesses to make informed decisions regarding pricing strategies, resource allocation, and overall financial planning. By carefully considering each cost element and its relationship to projected revenue, businesses can create a robust financial model that provides a clear and accurate picture of their anticipated financial performance over the forecast period. This detailed cost analysis informs strategic decision-making, facilitates proactive adjustments to operational plans, and ultimately contributes to long-term financial stability and growth.

3. Profitability analysis

Profitability analysis forms a crucial component of a three-year pro forma income statement template. This analysis provides insights into a company’s projected ability to generate profit over the forecast period. A well-structured profitability analysis examines key metrics such as gross profit margin, operating profit margin, and net profit margin. These metrics reveal the relationship between revenue, costs, and profit, offering a comprehensive understanding of a company’s projected financial performance. For instance, a manufacturing company might analyze its projected gross profit margin to assess the efficiency of its production processes and pricing strategies. A decline in projected gross profit margin could signal increasing production costs or competitive pressures, prompting strategic adjustments to maintain profitability.

The pro forma income statement serves as the foundation for profitability analysis. Projected revenue and cost figures are used to calculate key profitability metrics. Analyzing trends in these metrics over the three-year period provides valuable insights into the long-term financial trajectory of the business. For example, a software company projecting increasing operating profit margins over the forecast period might interpret this as a positive sign of improving operational efficiency and scalability. Conversely, declining net profit margins despite increasing revenue could indicate escalating expenses or ineffective cost control measures. Understanding these trends allows for proactive adjustments to business strategies and operational plans.

The practical significance of profitability analysis lies in its ability to inform strategic decision-making. By understanding projected profit margins and their underlying drivers, businesses can identify areas for improvement, optimize pricing strategies, and allocate resources effectively. Furthermore, profitability analysis is essential for communicating with investors and lenders, demonstrating the financial viability of the business and its potential for future growth. A comprehensive profitability analysis provides a clear and concise picture of a company’s projected financial health, enabling informed decision-making and fostering long-term financial success. Challenges in conducting profitability analysis often arise from the inherent uncertainty of future market conditions and the difficulty in accurately projecting costs. Regularly reviewing and updating the pro forma income statement based on actual performance and market changes enhances the accuracy and reliability of profitability analysis, providing a dynamic tool for managing and optimizing financial performance.

4. Underlying Assumptions

A three-year pro forma income statement relies heavily on underlying assumptions about future economic and operational conditions. These assumptions represent educated guesses about factors that can significantly influence financial outcomes. Accuracy in these assumptions is crucial for the reliability and usefulness of the projected financial statements. A transparent and well-defined set of assumptions allows stakeholders to understand the basis of the projections and assess the potential risks and opportunities.

- Sales Growth RateProjecting future sales often involves assuming a specific growth rate. This rate might be based on historical trends, market analysis, or industry benchmarks. For example, a company operating in a rapidly expanding market might assume a higher sales growth rate compared to a company in a mature market. The assumed sales growth rate directly impacts projected revenue and, consequently, all other figures within the income statement. An overly optimistic growth rate can lead to inflated profit projections, while an overly conservative rate might understate potential profitability.

- Cost InflationFuture costs are influenced by inflation. Assumptions about inflation rates for raw materials, labor, and operating expenses are crucial for accurately projecting future costs. For example, a manufacturing company might assume a specific inflation rate for raw material prices based on historical trends and anticipated market conditions. Inaccurate inflation assumptions can significantly affect projected profit margins and overall financial performance. Underestimating inflation can lead to understated costs and overstated profits, while overestimating it can have the opposite effect.

- Market ShareProjections often involve assumptions about a company’s future market share. This assumption reflects the company’s anticipated competitive position and its ability to capture a larger portion of the market. A company launching a new product might assume a gradual increase in market share over the forecast period. The assumed market share directly influences projected sales volume and revenue. Realistic market share assumptions are crucial for developing credible financial projections. Overly optimistic assumptions can lead to inflated revenue projections, while overly pessimistic assumptions can understate potential market penetration.

- Tax RateThe applicable tax rate significantly impacts projected net income. Changes in tax laws or regulations can necessitate adjustments to the assumed tax rate. For example, a company operating in multiple jurisdictions might need to consider different tax rates in each jurisdiction. Accurately projecting the tax rate is essential for determining the after-tax profitability of the business. Failing to incorporate potential changes in tax rates can lead to inaccurate net income projections and misinformed financial decisions.

These underlying assumptions form the foundation of a three-year pro forma income statement. Transparency in these assumptions is crucial for stakeholders to understand the basis of the projections and assess their reliability. Regularly reviewing and updating these assumptions based on actual performance, market changes, and evolving business strategies enhances the accuracy and relevance of the pro forma income statement, providing a dynamic tool for managing and optimizing financial performance. Sensitivity analysis, which explores the impact of varying these assumptions, further strengthens the analytical value of the pro forma statement, providing a range of potential outcomes and highlighting areas of vulnerability and opportunity.

5. Sensitivity Analysis

Sensitivity analysis plays a crucial role in evaluating the robustness of a three-year pro forma income statement template. Because pro forma statements rely on assumptions about future conditions, understanding the potential impact of variations in these assumptions is essential for informed decision-making. Sensitivity analysis systematically examines how changes in key input variables, such as sales growth rates or cost inflation, affect projected financial outcomes. This process provides a range of potential outcomes and highlights the variables that have the most significant impact on profitability and overall financial performance.

- Sales Volume FluctuationsChanges in projected sales volume directly impact revenue and, consequently, profitability. Sensitivity analysis might explore scenarios with higher or lower sales growth rates than initially assumed. For example, a retailer might analyze the impact of a 10% increase or decrease in projected sales volume on net income. This analysis reveals the potential upside and downside risks associated with sales volume fluctuations and informs decisions regarding inventory management, marketing strategies, and pricing.

- Cost VariabilityInput costs, such as raw materials or labor, can fluctuate significantly. Sensitivity analysis assesses the impact of cost changes on projected profit margins. A manufacturer, for instance, might analyze the effect of a 5% increase in raw material prices on gross profit margin. This analysis highlights the potential vulnerability of profitability to cost increases and informs decisions regarding supplier negotiations, cost control measures, and pricing adjustments.

- Market Share VolatilityChanges in market share can significantly impact projected revenue and market position. Sensitivity analysis can model different market share scenarios to assess their impact on financial performance. A telecommunications company, for example, might analyze the impact of a 2% increase or decrease in market share on overall revenue. This analysis informs decisions regarding competitive strategies, marketing investments, and product development efforts.

- Discount Rate ChangesThe discount rate used in discounted cash flow analysis impacts the present value of future cash flows. Sensitivity analysis can assess the impact of changes in the discount rate on valuation metrics and investment decisions. For example, a real estate developer might analyze the impact of a 1% change in the discount rate on the net present value of a project. This analysis informs decisions regarding project feasibility, financing options, and required rates of return.

By systematically exploring the impact of variations in key assumptions, sensitivity analysis provides a more nuanced and comprehensive view of potential financial outcomes. This information enhances the value of the three-year pro forma income statement, enabling more informed decision-making, more effective risk management, and more robust strategic planning. It allows businesses to identify key drivers of profitability and assess their potential impact under different scenarios, ultimately fostering greater financial stability and resilience. Sensitivity analysis provides valuable insights into the potential range of outcomes and highlights the areas of the pro forma statement that require the closest attention and monitoring.

Key Components of a Three-Year Pro Forma Income Statement Template

A comprehensive three-year pro forma income statement template requires several key components to provide a robust and insightful projection of future financial performance. These components work together to paint a detailed picture of a company’s anticipated financial health over the short to medium term.

1. Revenue Projections: These projections estimate future income based on factors such as historical sales data, market analysis, anticipated pricing strategies, and overall economic conditions. Accurate revenue projections are fundamental to the entire pro forma statement.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services. Accurate COGS estimations are crucial for determining gross profit margins.

3. Operating Expenses: This category encompasses all other costs incurred in running the business, excluding COGS. Projecting operating expenses requires careful consideration of historical data, anticipated growth plans, and potential inflationary pressures.

4. Gross Profit: Calculated as Revenue – COGS, gross profit represents the profit generated from core business operations before considering operating expenses.

5. Operating Income: This metric, calculated as Gross Profit – Operating Expenses, reflects the profitability of the core business operations after accounting for all operating costs.

6. Interest Expense: This represents the cost of borrowing capital and is essential for businesses carrying debt obligations.

7. Income Tax Expense: This component reflects the estimated income tax liability based on projected pre-tax income and applicable tax rates.

8. Net Income: This bottom-line figure represents the company’s projected profit after all expenses, including taxes and interest, have been deducted. Net income is a key indicator of overall financial performance and is closely scrutinized by investors and stakeholders.

These components interact dynamically, with changes in one area potentially impacting others. A thorough understanding of each element and their interrelationships is essential for developing a reliable and insightful pro forma income statement, informing strategic decision-making, and ultimately driving sustainable business growth.

How to Create a Three-Year Pro Forma Income Statement

Developing a robust three-year pro forma income statement involves a structured approach and careful consideration of key financial drivers. The following steps outline the process for creating this essential financial planning tool.

1: Gather Historical Financial Data: Begin by collecting historical financial statements, including income statements, balance sheets, and cash flow statements, for at least the past three years. This data provides a baseline for projecting future performance.

2: Make Revenue Projections: Project future revenue based on historical trends, market analysis, anticipated pricing strategies, and overall economic conditions. Consider factors specific to the industry and business model.

3: Estimate Cost of Goods Sold (COGS): Project COGS based on historical cost data, anticipated production volumes, and potential changes in input prices. Consider factors such as raw material costs, direct labor, and manufacturing overhead.

4: Project Operating Expenses: Estimate future operating expenses, including salaries, rent, marketing, research and development, and administrative costs. Consider factors like anticipated growth plans, inflation, and planned investments.

5: Calculate Gross Profit and Operating Income: Calculate projected gross profit by subtracting projected COGS from projected revenue. Then, calculate projected operating income by subtracting projected operating expenses from gross profit.

6: Account for Non-Operating Income and Expenses: Include any anticipated non-operating income or expenses, such as interest income, interest expense, gains or losses from investments, and other non-recurring items.

7: Determine Income Tax Expense: Estimate income tax expense based on projected pre-tax income and applicable tax rates. Consider potential changes in tax laws or regulations.

8: Calculate Projected Net Income: Arrive at projected net income by subtracting income tax expense from pre-tax income. This figure represents the bottom line and is a key indicator of overall profitability.

9: Conduct Sensitivity Analysis: Vary key assumptions, such as sales growth rates or cost inflation, to assess their impact on projected financial outcomes. This provides a range of potential scenarios and highlights areas of vulnerability or opportunity.

10: Regularly Review and Update: Regularly review and update the pro forma income statement based on actual performance and changes in market conditions or business strategy. This ensures the ongoing accuracy and relevance of the financial projections.

A well-constructed three-year pro forma income statement provides valuable insights into future financial performance, facilitating informed decision-making, effective resource allocation, and proactive adjustments to business strategies. This structured approach to financial forecasting enhances communication with stakeholders and strengthens the foundation for long-term financial stability and growth.

Developing a robust financial forecast over a three-year horizon provides invaluable insights for strategic planning and informed decision-making. A structured template incorporating revenue projections, cost estimations, and profitability analysis, underpinned by clearly defined assumptions, offers a comprehensive view of anticipated financial performance. Sensitivity analysis further enhances the model’s robustness by exploring the potential impact of varying key assumptions. This methodical approach empowers organizations to proactively identify potential challenges and capitalize on emerging opportunities, fostering financial stability and sustainable growth.

The ability to accurately project financial performance is paramount in today’s dynamic business environment. A well-constructed multi-year projection serves not only as a roadmap for future growth but also as a critical communication tool for stakeholders. By embracing a disciplined and analytical approach to financial forecasting, organizations enhance their ability to navigate uncertainty, adapt to changing market conditions, and ultimately achieve long-term financial success. Continuous monitoring, analysis, and refinement of the forecasting process are essential for maintaining its relevance and maximizing its strategic value.