Utilizing such a model offers several advantages. It facilitates proactive identification of potential financial challenges and opportunities, enabling timely adjustments to business strategies. Furthermore, a clear financial outlook can enhance stakeholder confidence, attracting potential investors and strengthening relationships with lenders. The ability to model different scenarios allows businesses to assess the potential impact of various strategic initiatives and market conditions, fostering more informed and resilient decision-making.

This foundational understanding of financial forecasting sets the stage for a deeper exploration of specific components, best practices, and real-world applications. The following sections will delve into the key elements of constructing accurate projections, common pitfalls to avoid, and how these models can be leveraged to drive sustainable growth.

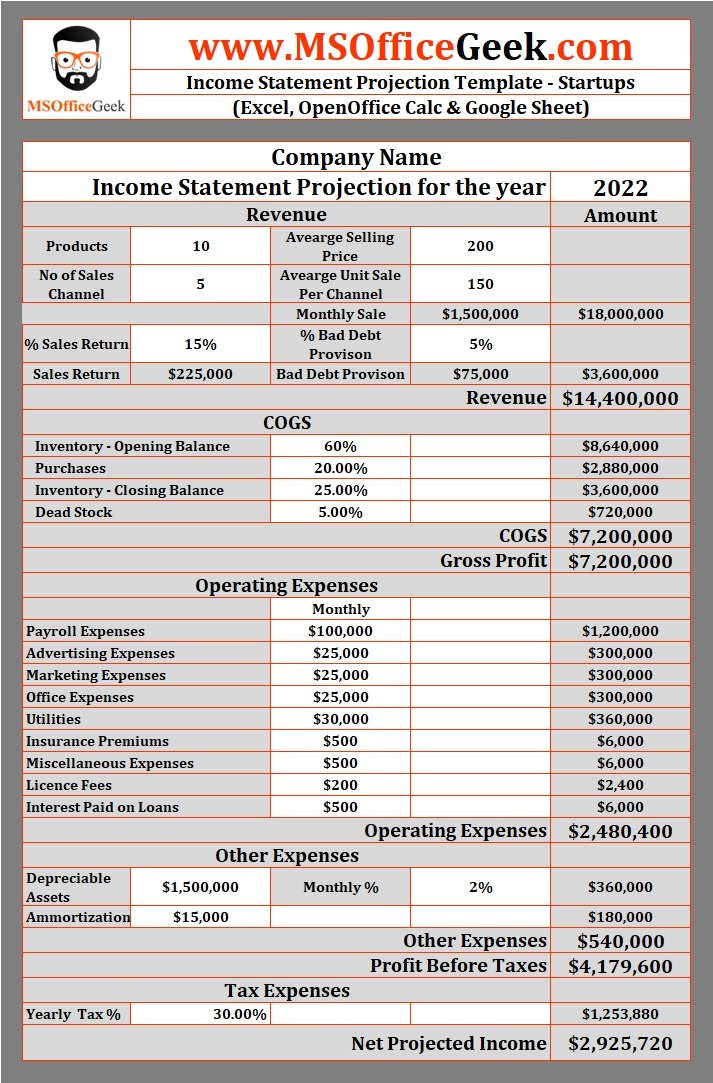

1. Revenue Projections

Revenue projections form the cornerstone of a three-year projected income statement. A well-constructed revenue forecast drives the entire financial model, influencing profitability calculations and shaping strategic decisions. The accuracy of these projections directly impacts the reliability and usefulness of the entire statement. Overly optimistic revenue projections can lead to unrealistic expectations and misallocation of resources, while overly conservative estimates can hinder growth opportunities. Cause-and-effect relationships are crucial here. For example, projected increases in marketing spend should ideally correlate with increased sales, impacting revenue projections and, consequently, the bottom line.

Several factors contribute to robust revenue projections within a three-year timeframe. Historical sales data provides a baseline, while market analysis informs growth expectations. Consideration of pricing strategies, competitive landscape, and economic conditions further refines these projections. For a subscription-based business, projected customer churn and acquisition costs significantly influence revenue. A retail business, on the other hand, might factor in seasonality and anticipated changes in consumer spending patterns. Understanding these industry-specific nuances is crucial for developing realistic and actionable revenue projections.

Accurate revenue projections empower businesses to make informed decisions regarding investments, hiring, and expansion plans. They provide a benchmark for performance evaluation and allow for proactive adjustments to strategies. Challenges in accurately forecasting revenue can arise from unpredictable market fluctuations, changing consumer behavior, and internal operational shifts. Rigorous analysis, ongoing monitoring, and flexibility in adapting to evolving circumstances are essential for maintaining the integrity of the financial model and ensuring its continued relevance to long-term strategic planning.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Within a three-year projected income statement template, COGS plays a crucial role in determining gross profit and, subsequently, overall profitability. Accurately projecting COGS is essential for informed decision-making regarding pricing strategies, production efficiency, and resource allocation.

- Direct Material CostsThis encompasses the cost of raw materials, components, and packaging directly used in production. For a furniture manufacturer, this would include the cost of wood, fabric, and hardware. Accurate projection of direct material costs requires consideration of supplier contracts, potential price fluctuations, and anticipated production volume. In a three-year projection, this necessitates anticipating potential supply chain disruptions or changes in material costs.

- Direct Labor CostsDirect labor costs include wages, benefits, and payroll taxes for employees directly involved in production. For a clothing manufacturer, this includes salaries for sewing machine operators and pattern cutters. Projecting direct labor costs requires consideration of wage rates, anticipated staffing needs, and potential increases in labor costs over the three-year period.

- Manufacturing OverheadThis category includes indirect costs associated with the production process, such as rent for the manufacturing facility, utilities, and depreciation of manufacturing equipment. For a food processing company, this includes the cost of maintaining and operating production machinery. Accurate projection of manufacturing overhead requires consideration of facility costs, equipment maintenance schedules, and potential increases in utility rates.

- Inventory ChangesThe change in inventory levels between the beginning and end of each period impacts COGS. An increase in inventory suggests less cost is recognized in the current period’s COGS, while a decrease indicates more cost is recognized. Accurately projecting inventory levels is crucial for matching costs with revenue and providing a realistic view of profitability over the three-year horizon. This requires understanding sales forecasts, production capacity, and inventory management strategies.

Understanding and accurately projecting these components of COGS is fundamental to building a reliable three-year projected income statement. These projections directly impact gross profit margins and influence subsequent profitability calculations. Careful consideration of factors influencing each component, such as material price fluctuations, labor market conditions, and operational efficiency, is essential for developing a robust and informative financial model. Comparing projected COGS against industry benchmarks and historical data further enhances the analysis, allowing for identification of potential cost-saving opportunities and informed strategic adjustments.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business outside of direct production. Within a three-year projected income statement template, these expenses are crucial for determining operating income and ultimately, net profit. Accurate projection of operating expenses provides insights into the efficiency of business operations and facilitates informed resource allocation. Cause-and-effect relationships are central to understanding the impact of operating expenses. For example, an increase in sales and marketing expenses should ideally lead to higher revenue. Conversely, aggressive cost-cutting measures in research and development might hinder long-term innovation and competitiveness.

Several categories constitute operating expenses within a projected income statement. These include selling, general, and administrative expenses (SG&A), research and development (R&D), and marketing and advertising expenses. SG&A encompasses salaries for administrative staff, office rent, and utilities. R&D expenses cover costs associated with developing new products or services. Marketing and advertising expenses include costs related to promoting products or services. A technology company might invest heavily in R&D, impacting operating expenses significantly and influencing projected profitability, whereas a retail company might prioritize marketing and advertising spend to drive sales growth. Understanding the drivers of each expense category allows for more accurate projections and informed decision-making. For example, a growing company might anticipate increased office space requirements, impacting rent expense within SG&A. Similarly, a company launching a new product might project higher marketing and advertising costs during the initial launch phase.

Accurate projection of operating expenses is crucial for developing a realistic and comprehensive three-year financial model. These projections, combined with revenue and COGS projections, inform profitability forecasts and guide strategic planning. Challenges in projecting operating expenses can arise from unexpected economic conditions, changes in competitive landscape, and internal operational shifts. Regular review and adjustments to operating expense projections, based on actual performance and evolving market conditions, are essential for maintaining the accuracy and relevance of the financial model. Rigorous analysis of cost structures, identification of potential cost optimization opportunities, and alignment of operating expenses with strategic goals enhance the value and reliability of the projected income statement.

4. Profitability Margins

Profitability margins, including gross profit margin, operating profit margin, and net profit margin, represent key performance indicators within a three-year projected income statement template. These metrics provide insights into a company’s ability to generate profit at various stages of its operations, from the sale of goods to the bottom line after all expenses are considered. Accurately projecting profitability margins is essential for assessing the financial health and sustainability of a business over the long term. Cause-and-effect relationships are crucial in understanding how changes in revenue, cost of goods sold (COGS), and operating expenses impact profitability margins. For instance, an increase in COGS without a corresponding increase in revenue will directly reduce the gross profit margin. Similarly, effective cost control measures in operating expenses can improve operating profit margin and ultimately impact net profit margin.

Gross profit margin, calculated as (Revenue – COGS) / Revenue, reflects the profitability of core business operations after accounting for direct production costs. A manufacturer might aim for a higher gross profit margin by optimizing production processes and negotiating favorable raw material prices. Operating profit margin, calculated as Operating Income / Revenue, indicates the profitability after accounting for both COGS and operating expenses. A software company investing heavily in research and development might accept a lower operating profit margin in the short term, anticipating higher profitability in the future as new products gain market share. Net profit margin, calculated as Net Income / Revenue, represents the overall profitability after considering all expenses, including taxes and interest. A retail business might focus on increasing net profit margin by improving inventory management to reduce storage costs and minimize losses from obsolete inventory.

Understanding and projecting profitability margins within a three-year timeframe provides valuable insights into the financial trajectory of a business. These projections facilitate informed decision-making regarding pricing strategies, cost control measures, and investment decisions. Challenges in accurately projecting profitability margins can stem from unpredictable market fluctuations, evolving competitive landscapes, and unforeseen economic conditions. Regular monitoring of actual performance against projected margins and incorporating adjustments based on evolving circumstances are crucial for maintaining the accuracy and relevance of the financial model. Furthermore, benchmarking profitability margins against industry averages provides context for evaluating performance and identifying areas for potential improvement. By effectively analyzing profitability margins, businesses can make strategic adjustments to optimize financial performance and ensure long-term sustainability.

5. Key Assumptions

Key assumptions underpin the integrity and reliability of a three-year projected income statement template. These assumptions represent educated estimates about future trends and conditions that influence revenue, expenses, and profitability. They provide context for the projections and allow stakeholders to understand the basis upon which the financial model is built. Cause-and-effect relationships are central to the role of key assumptions. For instance, assuming a specific inflation rate directly impacts projected costs, influencing both cost of goods sold and operating expenses. Similarly, assumptions regarding market growth rates directly affect revenue projections. A clear articulation of these assumptions allows for sensitivity analysis, demonstrating the potential impact of variations in these assumptions on the overall financial outlook.

Several key assumptions commonly influence a three-year projected income statement. Sales growth rates, based on historical data, market analysis, and competitive landscape assessments, drive revenue projections. Inflation rates impact projections for both COGS and operating expenses. Interest rates influence the cost of borrowing and subsequent interest expenses. Tax rates affect the calculation of net profit. Industry-specific assumptions, such as customer churn rate for a subscription-based business or occupancy rates for a real estate company, further refine the financial model. For a manufacturing company, assumptions about raw material prices significantly impact COGS projections. A technology company might base its revenue projections on assumptions regarding market adoption rates for new products. These examples illustrate the practical significance of carefully considered key assumptions.

Transparency and justification of key assumptions are essential for building a credible financial model. Clearly documented assumptions enable stakeholders to understand the rationale behind the projections and assess the potential risks associated with deviations from these assumptions. Challenges in formulating accurate assumptions can arise from unpredictable market fluctuations, evolving economic conditions, and unforeseen technological disruptions. Regular review and refinement of key assumptions, based on updated information and market analysis, are crucial for maintaining the accuracy and relevance of the projected income statement. Sensitivity analysis, exploring the impact of varying key assumptions on the projected financial outcomes, enhances the robustness and informativeness of the model, enabling businesses to make more informed decisions and adapt to changing circumstances.

Key Components of a Three-Year Projected Income Statement Template

A robust three-year projected income statement requires careful consideration of several key components. These components, when combined, provide a comprehensive view of a company’s projected financial performance over the specified period.

1. Revenue Projections: Forecasted revenue, often based on historical data, market trends, and anticipated sales performance, forms the foundation of the projected income statement. Realistic revenue projections are crucial for accurate profitability calculations.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services. Accurate COGS projections are essential for determining gross profit and understanding the relationship between production costs and revenue.

3. Operating Expenses: These expenses encompass all costs associated with running the business outside of direct production, including selling, general, and administrative expenses, research and development, and marketing and advertising. Detailed operating expense projections offer insight into operational efficiency.

4. Gross Profit: Calculated as Revenue – COGS, gross profit represents the profitability of core business operations. Analyzing projected gross profit helps assess the efficiency of production and pricing strategies.

5. Operating Income: Calculated as Gross Profit – Operating Expenses, operating income reflects profitability after accounting for all operating costs. This metric is vital for evaluating the overall operational efficiency of the business.

6. Net Income: Representing the bottom line after all expenses, including taxes and interest, are deducted, net income provides a comprehensive measure of profitability. Projected net income is a key indicator of financial health and sustainability.

7. Key Assumptions: Underlying assumptions about factors like inflation rates, market growth, and interest rates provide context for the projections and allow for sensitivity analysis. Clearly stated assumptions enhance transparency and allow for informed interpretation of the financial model.

8. Depreciation and Amortization: These non-cash expenses reflect the decrease in value of assets over time and are essential for accurately representing the true cost of using these assets in generating revenue.

Accurate projections of these components are essential for informed decision-making, strategic planning, and performance evaluation. They provide a framework for understanding the financial implications of various business strategies and enable proactive adjustments to optimize financial outcomes.

How to Create a 3-Year Projected Income Statement

Developing a robust three-year projected income statement involves a systematic approach encompassing key financial data and informed assumptions. The following steps outline the process:

1. Gather Historical Financial Data: Compile historical income statements, balance sheets, and cash flow statements for at least the past three years. This data serves as a foundation for identifying trends and informing future projections.

2. Conduct Market Research: Analyze industry trends, competitor performance, and economic forecasts. Understanding the market landscape provides context for revenue projections and helps in anticipating potential challenges and opportunities.

3. Project Revenue: Forecast sales revenue for each of the next three years, considering historical data, market research, and anticipated pricing strategies. Break down revenue projections by product line or service category for greater granularity.

4. Project Cost of Goods Sold (COGS): Estimate COGS for each year, considering direct material costs, direct labor costs, manufacturing overhead, and anticipated changes in inventory levels. Factor in potential fluctuations in raw material prices and production efficiency.

5. Project Operating Expenses: Forecast operating expenses, including selling, general, and administrative (SG&A) expenses, research and development (R&D), and marketing and advertising. Consider factors such as anticipated headcount growth, office space requirements, and planned marketing campaigns.

6. Calculate Projected Profitability: Calculate gross profit, operating income, and net income for each year based on the projected revenue, COGS, and operating expenses. Analyze projected profit margins to assess the financial health and sustainability of the business.

7. Document Key Assumptions: Clearly document all key assumptions underlying the projections, such as inflation rates, market growth rates, interest rates, and tax rates. This enhances transparency and facilitates sensitivity analysis.

8. Conduct Sensitivity Analysis: Test the impact of variations in key assumptions on the projected financial outcomes. This helps assess the potential risks and opportunities associated with different scenarios and informs contingency planning.

A well-constructed three-year projected income statement provides a roadmap for strategic decision-making, resource allocation, and performance evaluation. Regular review and updates, incorporating actual results and revised assumptions, ensure the ongoing accuracy and relevance of the financial model.

A well-constructed three-year projected income statement template provides a crucial tool for businesses seeking to navigate the complexities of financial planning and strategic decision-making. By projecting key financial metrics such as revenue, cost of goods sold, operating expenses, and profitability margins, organizations gain valuable insights into their potential financial trajectory. The process of developing these projections requires a thorough understanding of historical performance, market dynamics, and key underlying assumptions. Careful consideration of these factors, combined with rigorous analysis and ongoing monitoring, empowers businesses to make informed decisions regarding resource allocation, investment strategies, and operational efficiency.

Effective utilization of a three-year projected income statement fosters proactive financial management, enabling businesses to anticipate potential challenges and capitalize on emerging opportunities. This forward-looking approach enhances stakeholder confidence, attracts potential investors, and strengthens relationships with lenders. Furthermore, the ability to model various scenarios and conduct sensitivity analysis allows organizations to assess the potential impact of different strategic initiatives and market conditions, fostering resilience and adaptability in the face of uncertainty. Ultimately, a robust and well-maintained three-year projected income statement serves as an invaluable roadmap for achieving sustainable growth and long-term financial success.