Developing this type of long-term financial projection offers several advantages. It enables organizations to identify potential future challenges and opportunities, facilitating proactive adjustments to strategies and operations. Furthermore, it aids in securing funding from investors or lenders by demonstrating financial stability and growth potential. Finally, the process of creating such a document encourages internal analysis and alignment of financial goals across departments.

This foundation of financial foresight supports informed decisions regarding investments, expansion, and resource allocation. The following sections will delve into the specific components, creation methods, and practical applications of these crucial long-term financial projections.

1. Revenue Projections

Revenue projections form the cornerstone of a five-year income statement template. Accurate forecasting of future income is essential for informed financial planning, strategic decision-making, and attracting potential investors. Understanding the various facets contributing to revenue projections is crucial for constructing a realistic and robust financial outlook.

- Sales Growth AssumptionsPredicting future revenue relies heavily on assumptions about sales growth. These assumptions should be based on historical data, market analysis, industry trends, and anticipated economic conditions. For example, a company launching a new product might anticipate rapid initial growth followed by a gradual stabilization. Realistic sales growth assumptions are fundamental to credible long-term financial projections.

- Pricing StrategiesPricing strategies directly impact revenue generation. Factors such as production costs, competitor pricing, and perceived value influence pricing decisions. A premium pricing strategy might yield higher revenue per unit but potentially lower sales volume, while a competitive pricing strategy could lead to higher sales volume but lower profit margins. The chosen pricing strategy must align with overall business objectives and market dynamics.

- Market Share AnalysisUnderstanding market share and its potential evolution significantly influences revenue projections. A company aiming to increase market share might project higher revenue growth, while a company in a saturated market might anticipate slower growth. Analyzing market trends and competitor activities is crucial for realistic market share projections.

- External Economic FactorsExternal economic conditions, such as inflation, interest rates, and overall economic growth, can significantly impact revenue projections. A recessionary environment might necessitate conservative revenue estimates, while a period of economic expansion could justify more optimistic projections. Incorporating macroeconomic factors ensures that revenue projections remain grounded in realistic economic scenarios.

These interconnected facets provide a comprehensive framework for developing reliable revenue projections within a five-year income statement template. A thorough understanding of these elements enables organizations to create a robust financial roadmap, guiding strategic decisions and fostering sustainable growth.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Within a five-year income statement template, COGS plays a critical role in determining gross profit and overall profitability. Accurately projecting COGS over an extended period is essential for informed financial planning and strategic decision-making.

- Direct Material CostsThis encompasses the cost of raw materials, components, and other inputs directly used in production. For a furniture manufacturer, this includes wood, fabric, and hardware. Accurately forecasting these costs requires considering factors such as supplier contracts, commodity price fluctuations, and potential supply chain disruptions. In a five-year projection, anticipating changes in material costs is crucial for maintaining healthy profit margins.

- Direct Labor CostsDirect labor costs represent the wages and benefits paid to employees directly involved in production. For a manufacturing company, this includes assembly line workers and production supervisors. Projecting these costs requires considering factors such as labor market conditions, wage increases, and potential automation or outsourcing. A five-year projection allows businesses to assess the long-term impact of labor cost trends on profitability.

- Manufacturing OverheadManufacturing overhead includes all costs associated with the production process that are not directly tied to materials or labor. This includes factory rent, utilities, depreciation of manufacturing equipment, and quality control. Accurately projecting these costs requires an understanding of operational efficiency, potential facility expansions, and technological advancements. A five-year timeframe allows businesses to anticipate and plan for changes in manufacturing overhead.

- Inventory ManagementEffective inventory management directly impacts COGS. Holding excess inventory incurs storage costs and increases the risk of obsolescence, while insufficient inventory can lead to lost sales. Projecting inventory levels over a five-year period requires balancing the need for adequate stock with the costs of carrying inventory. Optimized inventory management contributes to a more accurate and reliable five-year income statement projection.

Accurate COGS projections are fundamental to a robust five-year income statement template. By carefully considering these facets, businesses can gain a clearer understanding of future profitability, allowing for informed decisions regarding pricing, production, and resource allocation. This forward-looking perspective is invaluable for long-term financial planning and sustainable growth.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business outside of direct production. Within a five-year income statement template, accurately projecting these expenses is crucial for understanding profitability and making informed strategic decisions. A comprehensive understanding of the various categories of operating expenses is essential for developing a robust long-term financial plan.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass a broad range of costs related to sales, marketing, administration, and general business operations. Examples include salaries of sales and marketing staff, advertising costs, rent for office space, and legal and accounting fees. Projecting SG&A expenses over five years requires considering factors such as planned marketing campaigns, staffing levels, and anticipated office space needs. Accurate SG&A projections are crucial for assessing the long-term impact of operational costs on profitability.

- Research and Development (R&D) ExpensesR&D expenses represent investments in developing new products, services, or processes. For technology companies, R&D is often a significant operating expense. Projecting R&D spending over a five-year horizon requires aligning research goals with overall business strategy and considering factors such as technological advancements and competitive pressures. Accurately forecasting R&D expenses helps assess the long-term financial impact of innovation initiatives.

- Depreciation and AmortizationDepreciation represents the allocation of the cost of tangible assets, such as buildings and equipment, over their useful lives. Amortization represents the allocation of the cost of intangible assets, such as patents and trademarks. Projecting depreciation and amortization requires understanding the useful lives of assets and applicable accounting methods. These projections impact profitability calculations within the five-year income statement template.

- Impairment ChargesImpairment charges represent a reduction in the carrying value of an asset when its fair market value falls below its book value. This can occur due to factors such as technological obsolescence or changes in market conditions. While difficult to predict with certainty, considering potential impairment charges in a five-year projection provides a more conservative and realistic view of long-term financial performance.

Accurate projections of operating expenses are essential for a comprehensive five-year income statement template. By carefully considering these various expense categories, businesses can develop a more realistic understanding of future profitability. This long-term perspective informs strategic decision-making regarding pricing, resource allocation, and overall business strategy, facilitating sustainable growth and financial stability.

4. Profitability Trends

Analyzing profitability trends is a core purpose of a five-year income statement template. Tracking projected profitability over an extended period provides crucial insights into the long-term financial health and sustainability of an organization. This analysis allows for proactive identification of potential challenges and opportunities, enabling informed strategic decision-making and resource allocation.

- Gross Profit MarginGross profit margin, calculated as (Revenue – Cost of Goods Sold) / Revenue, indicates the profitability of core business operations after accounting for direct production costs. A rising gross profit margin over the five-year projection suggests improving efficiency in production or pricing strategies. Conversely, a declining trend may signal increasing production costs or competitive pressures, warranting further investigation and potential corrective actions.

- Operating Profit MarginOperating profit margin, calculated as Operating Income / Revenue, reflects profitability after accounting for both direct production costs and operating expenses. Analyzing trends in operating profit margin over five years provides insights into the overall efficiency of business operations. A consistently increasing operating margin indicates strong operational performance, while a declining margin may signal rising operating costs or declining sales, necessitating strategic adjustments.

- Net Profit MarginNet profit margin, calculated as Net Income / Revenue, represents the ultimate profitability after accounting for all expenses, including taxes and interest. Tracking net profit margin over five years offers a comprehensive view of the company’s bottom line. A healthy and growing net profit margin signifies sustainable financial performance, while a stagnant or declining trend indicates the need for strategic interventions to improve overall profitability.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)EBITDA, while not a direct measure of profitability, provides insights into a company’s operating performance before considering the impact of financing and accounting decisions. Analyzing EBITDA trends over five years can reveal underlying operational strengths and weaknesses, offering a clearer picture of core business performance independent of capital structure and accounting policies.

By analyzing these profitability trends within the context of a five-year income statement template, businesses gain valuable insights into their long-term financial trajectory. These insights inform strategic decisions related to pricing, cost management, investment priorities, and overall business strategy. Understanding these trends is essential for achieving sustainable growth and long-term financial success.

5. Key Performance Indicators (KPIs)

Key performance indicators (KPIs) provide quantifiable metrics for evaluating the financial health and progress of an organization. Within a five-year income statement template, KPIs offer critical insights into projected performance trends, enabling data-driven decision-making and strategic adjustments. Analyzing KPIs over an extended period allows for a deeper understanding of potential future challenges and opportunities, fostering proactive management and enhanced financial outcomes.

- Revenue Growth RateRevenue growth rate measures the year-over-year percentage increase in revenue. Tracking this KPI within a five-year income statement template allows businesses to assess the effectiveness of sales and marketing strategies, identify potential growth stagnation, and make informed adjustments to revenue generation plans. For example, a consistently declining revenue growth rate might necessitate exploring new market segments or revising pricing strategies. Consistent growth, on the other hand, validates strategic direction and market positioning.

- Gross Profit Margin TrendAnalyzing the trend of gross profit margin over five years provides insights into the efficiency of production processes and pricing strategies. A steady or increasing gross profit margin suggests effective cost management and pricing decisions, while a declining margin might indicate rising production costs or increased competitive pressures, requiring operational adjustments or pricing revisions to maintain profitability.

- Customer Acquisition Cost (CAC)While not directly derived from the income statement, CAC, representing the cost of acquiring a new customer, is a crucial KPI to consider alongside projected revenue. Analyzing CAC in conjunction with revenue projections helps assess the efficiency of marketing efforts and the long-term sustainability of customer acquisition strategies. High CAC relative to customer lifetime value might signal the need for more targeted and cost-effective marketing approaches.

- Operating Expense RatioOperating expense ratio, calculated as operating expenses divided by revenue, measures the efficiency of managing operational costs. Tracking this KPI within a five-year projection allows businesses to identify potential areas for cost optimization and assess the impact of operational efficiency on overall profitability. A rising operating expense ratio might signal inefficiencies or escalating costs, requiring careful review and potential restructuring to maintain healthy profit margins.

Integrating these KPIs into a five-year income statement template provides a comprehensive and data-driven framework for evaluating projected financial performance. Analyzing KPI trends over an extended period empowers organizations to make informed decisions regarding resource allocation, strategic adjustments, and long-term growth initiatives, ultimately contributing to sustained financial health and success. Regularly reviewing and interpreting these KPIs within the context of evolving market conditions and business objectives ensures proactive management and enhances the likelihood of achieving financial goals.

Key Components of a Five-Year Income Statement Template

A robust five-year income statement template relies on several key components, each contributing to a comprehensive understanding of projected financial performance. Careful consideration of these elements is essential for accurate forecasting and informed decision-making.

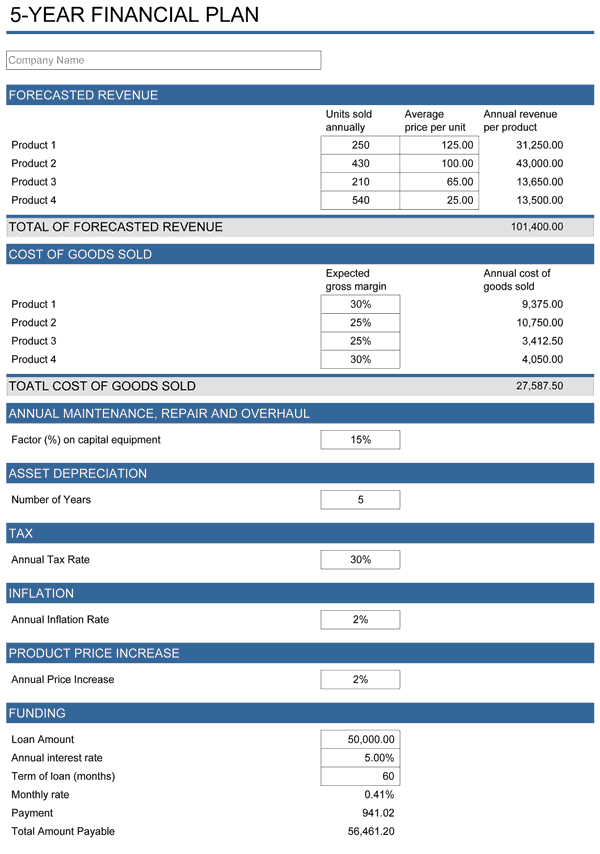

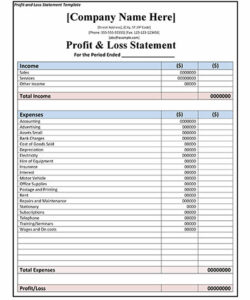

1. Revenue Projections: Forecasted revenue forms the foundation of the income statement. Projections should incorporate historical data, market analysis, anticipated growth rates, and pricing strategies. Realistic revenue projections are crucial for accurate profitability assessments.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services. Accurate COGS projections require detailed analysis of material costs, labor costs, manufacturing overhead, and inventory management. These projections directly impact gross profit calculations.

3. Operating Expenses: Operating expenses encompass all costs incurred in running the business outside of direct production. This includes selling, general, and administrative expenses (SG&A), research and development (R&D), depreciation, amortization, and potential impairment charges. Accurate operating expense projections are crucial for understanding overall profitability.

4. Gross Profit: Calculated as Revenue – COGS, gross profit reflects the profitability of core business operations. Analyzing gross profit trends over five years provides insights into production efficiency and pricing strategies.

5. Operating Income: Calculated as Gross Profit – Operating Expenses, operating income reflects profitability after accounting for all operating costs. Analyzing operating income trends helps assess overall operational efficiency.

6. Net Income: Net income represents the bottom line after accounting for all expenses, including taxes and interest. Projecting net income over five years provides a crucial measure of overall profitability and financial health.

These interconnected components provide a comprehensive framework for understanding projected financial performance. Accurate and detailed projections of each element are essential for informed decision-making, strategic planning, and long-term financial success.

How to Create a Five-Year Income Statement Template

Developing a five-year income statement template requires a systematic approach, combining historical data, market analysis, and strategic forecasting. The following steps outline a structured process for creating a comprehensive and insightful financial projection.

1: Gather Historical Financial Data: Compile income statements from the previous three to five years. This data serves as a foundation for identifying trends and establishing a baseline for future projections. Complete data sets facilitate more accurate and reliable forecasts.

2: Conduct Market Research: Analyze industry trends, competitor performance, and anticipated economic conditions. Understanding market dynamics provides context for projecting revenue growth and anticipating potential challenges. Thorough market research informs realistic assumptions for future performance.

3: Project Revenue Growth: Based on historical data, market research, and strategic initiatives, project revenue growth for each of the next five years. Consider factors such as pricing strategies, anticipated market share, and product development plans. Realistic revenue projections form the basis of the entire income statement.

4: Forecast Cost of Goods Sold (COGS): Project COGS based on anticipated production volumes, material costs, labor costs, and manufacturing overhead. Consider factors such as supplier contracts, potential supply chain disruptions, and anticipated technological advancements. Accurate COGS projections are crucial for determining gross profit.

5: Project Operating Expenses: Forecast operating expenses, including SG&A, R&D, depreciation, and amortization. Consider factors such as planned marketing campaigns, staffing levels, and anticipated office space needs. Accurate operating expense projections are essential for understanding overall profitability.

6: Calculate Projected Profitability: Using the projected revenue, COGS, and operating expenses, calculate projected gross profit, operating income, and net income for each year. These profitability metrics provide key insights into the long-term financial health of the organization.

7: Analyze Key Performance Indicators (KPIs): Calculate and analyze KPIs such as revenue growth rate, gross profit margin trend, and operating expense ratio. These KPIs provide valuable insights into projected performance trends and inform strategic decision-making.

8: Review and Refine: Regularly review and refine the five-year income statement template based on actual performance, evolving market conditions, and strategic adjustments. This iterative process ensures that the projection remains relevant and provides a valuable tool for ongoing financial planning and decision-making.

Creating a robust five-year income statement template requires a thorough understanding of historical performance, current market dynamics, and future strategic goals. This structured approach, coupled with regular review and refinement, equips organizations with valuable insights for long-term financial planning and sustainable growth.

Developing a comprehensive projection of financial performance over an extended period provides organizations with a crucial tool for strategic planning and informed decision-making. From revenue projections and cost analysis to profitability trends and key performance indicators, a robust template offers valuable insights into the long-term financial trajectory of a business. Understanding the components, creation process, and analytical insights derived from such a projection empowers organizations to navigate future challenges, capitalize on emerging opportunities, and make data-driven decisions that contribute to sustainable growth.

Effective financial management hinges on the ability to anticipate and adapt to evolving market conditions. A well-constructed long-term financial projection serves as a roadmap, guiding strategic decisions and fostering financial stability. Regular review and refinement of these projections, informed by actual performance and market dynamics, ensure that organizations remain agile and well-positioned for long-term success in a dynamic economic landscape. This proactive approach to financial planning is essential for navigating uncertainty and achieving sustained growth and profitability.