Regular review of this type of condensed financial statement allows businesses to monitor progress towards goals, identify potential issues early on, and adjust strategies as needed. This frequency of reporting is particularly beneficial for seasonal businesses or those undergoing rapid growth or change. It offers a balance between the detailed insights of monthly reports and the broader perspective of annual statements.

The following sections will delve deeper into the specific components of this type of report, provide practical examples, and offer guidance on its creation and interpretation. This information will empower business owners and managers to leverage these reports effectively for improved financial management.

1. Revenue

Revenue, the lifeblood of any business, forms the foundation of the 6-month profit and loss statement. Accurate revenue reporting is essential for understanding financial performance and making informed decisions. This section explores key facets of revenue within the context of a semi-annual statement.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retail store, sales revenue would be the total value of goods sold. In a service-based business like a consulting firm, it would be the fees earned from providing services. Accurately tracking sales revenue is fundamental to assessing business growth and profitability over the six-month period.

- Other RevenueBeyond core operations, businesses may generate income from other sources. Examples include interest earned on investments, rental income from owned properties, or licensing fees. While often smaller than sales revenue, these sources contribute to the overall financial picture presented in the statement and should be categorized separately for clarity.

- Revenue RecognitionThe timing of revenue recognition is crucial for accurate reporting. Revenue should be recognized when it is earned, not necessarily when cash is received. For example, a subscription service recognizes revenue over the subscription period, even if the customer pays upfront for the entire year. Understanding revenue recognition principles ensures the statement accurately reflects the financial performance within the specific six-month window.

- Revenue TrendsAnalyzing revenue trends across multiple reporting periods provides valuable insights into business performance. Comparing revenue figures from one six-month period to the previous one, or to the same period in the prior year, can reveal growth patterns, seasonal fluctuations, or potential problems. This analysis is crucial for strategic planning and proactive adjustments to business operations.

By understanding these components of revenue, businesses can use the 6-month profit and loss statement effectively to assess financial health, identify areas for improvement, and make data-driven decisions to achieve sustainable growth. Accurate and detailed revenue reporting enables better forecasting, resource allocation, and overall financial management.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold during a given period. Within a six-month profit and loss statement, COGS plays a crucial role in determining gross profit and ultimately, net income. Accurate COGS calculations are essential for understanding profitability and making informed business decisions. A clear understanding of COGS within this timeframe allows businesses to assess the efficiency of production processes and identify potential areas for cost optimization. For example, a manufacturing company includes raw materials, direct labor, and manufacturing overhead within COGS. A retailer, on the other hand, includes the purchase price of goods sold. Understanding these distinctions is crucial for accurate reporting and analysis.

Several factors influence COGS, including inventory valuation methods (FIFO, LIFO, weighted average), production efficiency, and raw material costs. Fluctuations in these factors directly impact profitability. For instance, rising raw material prices can increase COGS, decreasing gross profit if sales prices remain constant. A company using the FIFO (First-In, First-Out) method will have a different COGS than one using LIFO (Last-In, First-Out), particularly during periods of price fluctuations. Analyzing COGS within the context of a six-month statement can reveal these impacts and inform pricing strategies, inventory management, and cost control measures.

Effective COGS management is fundamental to achieving sustainable profitability. Regularly reviewing COGS within a six-month timeframe provides valuable insights into cost trends and production efficiency. This allows businesses to identify potential cost-saving opportunities, optimize pricing strategies, and improve overall financial performance. Accurate COGS reporting also plays a crucial role in compliance with accounting standards and provides stakeholders with a transparent view of financial health. Ultimately, understanding COGS is indispensable for informed decision-making and long-term business success.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business, excluding the direct costs of producing goods or services (COGS). Within a six-month profit and loss statement, these expenses are crucial for determining operating income and ultimately, net income. Careful analysis of operating expenses within this timeframe provides valuable insights into cost management and operational efficiency. These expenses are broadly categorized into selling, general, and administrative expenses (SG&A), including items such as rent, salaries, marketing and advertising costs, utilities, and depreciation. For example, a software company might have significant operating expenses related to research and development, while a retail store might have higher expenses related to rent and store maintenance. Understanding the specific nature of operating expenses within different business models is crucial for accurate analysis.

Tracking operating expenses over a six-month period enables businesses to identify trends, assess cost control measures, and make informed decisions about resource allocation. For instance, a consistent increase in marketing expenses without a corresponding rise in sales might indicate a need to re-evaluate marketing strategies. Similarly, comparing operating expenses as a percentage of revenue across multiple six-month periods can reveal potential inefficiencies or areas for improvement. This analysis facilitates proactive adjustments to operational strategies and contributes to better financial planning. Monitoring operating expenses alongside revenue growth ensures sustainable profitability. For example, rapidly increasing sales might mask uncontrolled operating expenses, leading to a misleading impression of financial health. A comprehensive analysis within the six-month profit and loss statement provides a more nuanced understanding of the interplay between revenue generation and cost management.

Effective management of operating expenses is essential for long-term financial stability and growth. Regular review and analysis within the context of a six-month profit and loss statement empower businesses to optimize resource allocation, improve operational efficiency, and achieve profitability targets. Understanding the nuances of operating expenses and their impact on overall financial performance allows for data-driven decision-making and enhances the ability to adapt to changing market conditions. Neglecting careful analysis of these expenses can lead to unsustainable cost structures and hinder long-term success.

4. Gross Profit

Gross profit, a key performance indicator, occupies a central position within a six-month profit and loss statement. Calculated as revenue less the cost of goods sold (COGS), it represents the profitability of a company’s core business operations before accounting for operating expenses. Analyzing gross profit within this timeframe offers crucial insights into pricing strategies, production efficiency, and the overall financial health of a business. A healthy gross profit margin indicates the effectiveness of cost management and pricing decisions related directly to product or service delivery. For example, a retailer selling goods for $100 with a COGS of $60 achieves a gross profit of $40 and a gross profit margin of 40%. Monitoring this metric over six-month intervals allows businesses to identify trends and assess the impact of pricing adjustments, changes in raw material costs, or improvements in production processes.

The relationship between gross profit and other elements within the six-month profit and loss statement is crucial for comprehensive financial analysis. A consistent decline in gross profit, even with increasing revenue, could indicate rising production costs or ineffective pricing strategies, warranting further investigation. Conversely, a stable or increasing gross profit margin suggests efficient cost management and potentially allows for greater investment in other areas of the business, such as marketing or research and development. Understanding this dynamic is essential for making informed decisions regarding resource allocation and strategic planning. For instance, a manufacturing company experiencing increasing raw material costs might analyze gross profit trends to determine whether price increases are necessary to maintain profitability or if cost-saving measures within the production process are more effective.

Effective gross profit management is fundamental to achieving sustainable profitability. Within the context of a six-month profit and loss statement, gross profit serves as a critical barometer of financial health, providing insights into the efficiency of core business operations. Regularly analyzing gross profit trends empowers businesses to identify potential challenges, optimize pricing strategies, and improve cost control measures, contributing to long-term financial success. Ignoring fluctuations in gross profit can lead to missed opportunities for improvement and hinder the ability to adapt to changing market conditions. Therefore, careful attention to this key metric is essential for informed decision-making and sustainable growth.

5. Operating Income

Operating income, a crucial measure of profitability, represents the profit generated from a company’s core business operations after deducting operating expenses from gross profit. Within a six-month profit and loss statement, operating income provides valuable insights into the efficiency and sustainability of a company’s operational model. Analyzing operating income trends within this timeframe allows businesses to assess the effectiveness of cost management strategies, identify areas for potential improvement, and make informed decisions regarding resource allocation.

- Relationship to Gross ProfitOperating income is directly derived from gross profit. While gross profit reflects the profitability of core business activities (sales less cost of goods sold), operating income takes into account the additional costs associated with running the business (operating expenses). This relationship highlights the importance of managing both direct costs (COGS) and indirect costs (operating expenses) for achieving optimal profitability. A declining operating income despite steady or increasing gross profit might signal escalating operating expenses, warranting closer examination and potential cost-cutting measures.

- Impact of Operating ExpensesThe magnitude of operating expenses directly influences operating income. Effectively controlling these expenses, which include items like rent, salaries, marketing, and administrative costs, is essential for maximizing operating income and overall profitability. Comparing operating expenses as a percentage of revenue across multiple six-month reporting periods can reveal trends and potential inefficiencies. For instance, a consistent increase in operating expenses without a corresponding rise in revenue may indicate a need for cost optimization strategies.

- Indicator of Operational EfficiencyOperating income serves as a key indicator of a company’s operational efficiency. A healthy and growing operating income suggests effective management of both production costs and operating expenses. This signifies the ability to generate profit sustainably through core business operations. Conversely, a declining or negative operating income indicates operational challenges and the need for strategic adjustments. Analyzing operating income trends within a six-month timeframe allows for timely identification of such issues and facilitates proactive interventions.

- Basis for Future ProjectionsOperating income data from a six-month profit and loss statement forms a valuable basis for projecting future performance. By analyzing historical trends and considering anticipated market conditions, businesses can develop more accurate financial forecasts. These projections play a crucial role in strategic planning, budgeting, and investment decisions. For example, consistent growth in operating income might support expansion plans, while declining operating income might necessitate cost-cutting measures or revisions to business strategies.

In conclusion, operating income within a six-month profit and loss statement offers a crucial lens through which to assess the financial health and operational efficiency of a business. By understanding the factors that influence operating income and analyzing trends over time, businesses gain valuable insights that inform strategic decision-making and contribute to long-term sustainable growth. Careful attention to this key metric empowers businesses to optimize resource allocation, enhance profitability, and adapt effectively to evolving market dynamics.

6. Net Income/Loss

Net income/loss, the ultimate bottom line in financial performance, represents the total earnings or losses of a company over a specific period, in this context, six months. Positioned at the culmination of the six-month profit and loss statement, this figure encapsulates the cumulative impact of all revenue streams and expenses. Understanding net income/loss is fundamental for assessing financial health, evaluating profitability, and making informed business decisions.

- Cumulative Result of OperationsNet income/loss reflects the aggregated result of all operational activities, encompassing revenue generation, cost of goods sold, operating expenses, and other income and expenses. It provides a concise overview of financial performance over the six-month period, summarizing the combined effect of all financial transactions. A positive net income indicates profitability, while a negative net income (net loss) signifies financial losses incurred during the period. For example, a company with $1 million in revenue, $600,000 in COGS, $300,000 in operating expenses, and $20,000 in other income would report a net income of $120,000.

- Impact of Non-Operating ItemsWhile operating income reflects profitability from core business operations, net income/loss also considers non-operating items, such as interest income, interest expense, taxes, and one-time gains or losses. These items, though often outside the scope of regular business activities, can significantly influence the final net income/loss figure. For instance, a large one-time gain from the sale of an asset could significantly boost net income in a particular six-month period, while a substantial interest expense could reduce it. Understanding the contribution of these non-operating factors provides a more comprehensive view of overall financial performance.

- Basis for Financial RatiosNet income/loss serves as the foundation for calculating key financial ratios, such as profit margin, return on assets (ROA), and return on equity (ROE). These ratios provide valuable insights into profitability, efficiency, and financial health, facilitating comparisons across different periods or with industry benchmarks. For example, a consistently increasing net income margin over consecutive six-month periods suggests improving profitability, while a declining ROA might indicate decreasing efficiency in asset utilization. Analyzing these ratios based on the six-month net income/loss figure provides a more granular understanding of financial performance.

- Indicator of Financial SustainabilityNet income/loss provides a crucial indicator of a company’s financial sustainability. Consistently generating positive net income demonstrates the ability to generate profit and cover all expenses, including taxes and interest. Sustained net losses, however, raise concerns about long-term viability and the need for corrective measures. Analyzing net income/loss trends within the six-month profit and loss statement allows for timely assessment of financial health and facilitates proactive interventions to address potential issues. For example, persistent net losses might necessitate cost reduction strategies, revenue enhancement initiatives, or restructuring efforts to ensure long-term sustainability.

In conclusion, net income/loss, the final outcome presented in the six-month profit and loss statement, provides a crucial overview of financial performance, encompassing both operational results and non-operating factors. By analyzing net income/loss trends, understanding its underlying components, and utilizing it to calculate key financial ratios, stakeholders gain valuable insights into financial health, profitability, and the long-term sustainability of a business. Careful attention to this key metric enables informed decision-making, facilitates proactive adjustments to business strategies, and contributes to enhanced financial performance.

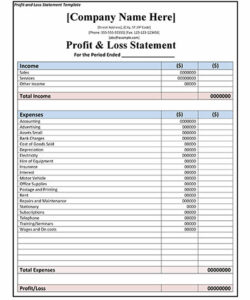

Key Components of a Six-Month Profit and Loss Statement

A six-month profit and loss statement provides a snapshot of a company’s financial performance over half a year. Understanding its key components is crucial for informed financial analysis and decision-making. The following elements constitute the core structure of this essential financial document.

1. Revenue: This represents income generated from sales of goods or services, along with other income sources like interest or royalties. Accurate revenue recognition is vital for reflecting true financial performance within the six-month period.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit and assessing production efficiency.

3. Gross Profit: Calculated as revenue minus COGS, gross profit reflects the profitability of core business operations before considering operating expenses. Analyzing gross profit helps assess pricing strategies and production cost management.

4. Operating Expenses: These expenses encompass the costs incurred in running the business, excluding COGS. They include selling, general, and administrative expenses (SG&A) like rent, salaries, marketing, and utilities. Monitoring operating expenses is vital for cost control and operational efficiency.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reveals the profitability of core business operations after accounting for all operating costs. This metric offers insights into operational efficiency and cost management effectiveness.

6. Other Income/Expenses: This category includes income and expenses not directly related to core business operations, such as interest income, interest expense, gains or losses from investments, and taxes. These items can significantly impact overall profitability.

7. Net Income/Loss: Representing the final bottom line, net income/loss is calculated by adding other income and subtracting other expenses from operating income. This figure reflects the overall profitability or loss of the company over the six-month period and is crucial for evaluating financial health and sustainability.

Careful analysis of these interconnected components offers valuable insights into financial performance trends, cost structures, and overall profitability. Regular review and interpretation of these elements enable informed decision-making, proactive adjustments to business strategies, and improved financial outcomes.

How to Create a Six-Month Profit and Loss Statement

Creating a six-month profit and loss statement involves systematically organizing financial data to present a clear picture of performance. The following steps outline the process:

1. Choose a Reporting Period: Define the specific six-month period for the statement. This ensures consistency and allows for accurate comparisons across different periods. For example, January 1st to June 30th or July 1st to December 31st.

2. Gather Financial Data: Collect all relevant financial records, including sales invoices, purchase orders, expense receipts, bank statements, and payroll records. Accurate data collection is fundamental for a reliable statement.

3. Calculate Revenue: Determine total revenue generated during the six-month period. This includes sales revenue from core business operations and any other income streams. Ensure consistent revenue recognition principles are applied.

4. Determine Cost of Goods Sold (COGS): Calculate the direct costs associated with producing goods sold. This typically includes raw materials, direct labor, and manufacturing overhead for manufacturers or the purchase price of goods for retailers.

5. Calculate Gross Profit: Subtract COGS from revenue to arrive at gross profit. This figure represents the profitability of core business operations before accounting for operating expenses.

6. Itemize Operating Expenses: Categorize and list all operating expenses incurred during the period. This includes selling, general, and administrative expenses (SG&A) like rent, salaries, marketing, utilities, and depreciation.

7. Calculate Operating Income: Subtract total operating expenses from gross profit to determine operating income. This metric reflects the profitability of core operations after accounting for operating costs.

8. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income/expense, gains/losses from investments, and taxes. These items impact the final net income/loss figure.

9. Calculate Net Income/Loss: Add other income and subtract other expenses from operating income to determine the final net income or net loss for the six-month period. This bottom-line figure reflects the overall profitability or loss.

10. Prepare the Statement: Organize the calculated figures into a structured format, typically using a spreadsheet or accounting software. The statement should clearly present all key components, including revenue, COGS, gross profit, operating expenses, operating income, other income/expenses, and net income/loss. Ensure clear labels and consistent formatting for easy readability.

A well-constructed statement provides a concise overview of financial performance, facilitating analysis, informed decision-making, and strategic planning. Regularly preparing and reviewing this statement enables businesses to monitor progress, identify trends, and adapt to changing market conditions effectively.

Regularly generating and analyzing semi-annual profit and loss statements offers invaluable insights into financial performance trends, enabling proactive adjustments to business strategies. Understanding key components like revenue streams, cost of goods sold, operating expenses, and the resulting net income or loss empowers informed decision-making. Careful examination of these figures, combined with trend analysis and comparison against industry benchmarks, facilitates effective cost management, optimized pricing strategies, and improved operational efficiency. This structured approach to financial reporting provides a critical foundation for long-term financial health and sustainable growth.

Leveraging the insights derived from these statements allows businesses to navigate dynamic market conditions, identify potential challenges early on, and capitalize on opportunities for growth. This proactive approach to financial management is essential for not only achieving short-term objectives but also building a resilient and prosperous future. Consistent and meticulous attention to these financial details empowers businesses to thrive in competitive landscapes and achieve sustained success.