A profit and loss statement specifically designed for individuals operating their own businesses provides a structured overview of financial performance over a specific period. It systematically tracks all revenue generated from business activities and subtracts associated expenses to arrive at a net profit or loss figure. This organized financial record serves as a snapshot of business health, enabling informed decision-making and accurate tax reporting.

Utilizing such a structured financial document offers numerous advantages. It facilitates the identification of areas of profitability and potential cost savings. This detailed record is essential for securing loans or attracting investors, demonstrating financial stability and growth potential. Furthermore, it simplifies tax preparation by providing a clear and comprehensive record of income and expenditures, minimizing the risk of errors and maximizing deductible expenses.

This foundational understanding of a profit and loss statement for the self-employed serves as a springboard for exploring specific components, construction methods, and practical applications. Further topics will delve into categorizing income and expenses, calculating net profit, interpreting the results, and utilizing this information for strategic business management.

1. Revenue

Revenue forms the cornerstone of a self-employment income statement. It represents the total income generated from business activities before any expenses are deducted. Accurately capturing all revenue streams is crucial for determining profitability and for tax reporting compliance. A clear understanding of revenue sources enables informed business decisions, such as pricing strategies, marketing efforts, and expansion plans. The relationship between revenue and the income statement is one of direct impact: higher revenue contributes to increased profit, assuming expenses remain constant or decrease. For example, an independent consultant might list revenue from completed projects, retainers, and workshops separately to understand which services contribute most significantly to their overall income.

Further analysis of revenue often involves categorizing it based on different service offerings or product lines. This detailed breakdown provides insights into the performance of individual components of the business. Identifying top-performing revenue streams allows for strategic focus and resource allocation. Conversely, understanding underperforming areas facilitates course correction or discontinuation of less profitable activities. Tracking revenue trends over time reveals growth patterns, seasonal fluctuations, or potential issues requiring attention. For instance, an e-commerce business owner might categorize revenue by product category, identifying bestsellers and slow-moving items to optimize inventory management and marketing campaigns.

Accurate revenue recognition is paramount for maintaining a reliable financial picture. Understanding when to recognize revenue, especially for long-term projects or subscription-based services, can be complex. Misrepresenting revenue, either intentionally or unintentionally, can lead to inaccurate financial reporting and potential legal issues. Therefore, adhering to accounting principles and seeking professional advice when necessary ensures the integrity of the income statement and supports informed financial decision-making. The connection between revenue and the self-employment income statement is fundamental to understanding business performance, making it an essential element for long-term success.

2. Expenses

A comprehensive understanding of expenses is crucial for accurate and insightful self-employment income statements. Expenses represent the costs incurred in the process of generating revenue. They encompass a wide range of outlays, from raw materials and office supplies to marketing campaigns and professional fees. A clear and detailed record of all business-related expenses is fundamental for determining profitability, managing cash flow, and fulfilling tax obligations. The relationship between expenses and the income statement is inversely proportional: higher expenses lead to reduced profit, assuming revenue remains constant. For example, a freelance graphic designer would track expenses such as software subscriptions, hardware maintenance, and advertising costs.

Categorizing expenses provides a structured view of where funds are allocated. Common expense categories include cost of goods sold (COGS), marketing and advertising, rent and utilities, and professional services. This categorization facilitates analysis of spending patterns, identification of potential cost-saving opportunities, and informed budgeting for future periods. For instance, a consultant might categorize expenses into travel, client entertainment, and professional development, allowing for targeted budget adjustments in subsequent quarters.

Accurate expense tracking is not merely a bookkeeping exercise; it directly impacts profitability and tax liabilities. Meticulous record-keeping ensures that all deductible expenses are claimed, minimizing tax burdens. Furthermore, a detailed understanding of expense trends enables proactive cost management and informed business decisions. Failing to accurately track and categorize expenses can lead to an incomplete financial picture, hindering effective business management and potentially leading to compliance issues. Therefore, diligent expense management is an essential component of sound financial practices for the self-employed, directly influencing the accuracy and value of the income statement as a tool for business growth and financial health.

3. Net Profit/Loss

The net profit or loss, derived from a self-employment income statement, represents the bottom line of a business’s financial performance over a given period. This crucial figure indicates the financial health and sustainability of the self-employment venture. Understanding its calculation and implications is essential for informed decision-making, financial planning, and assessing business viability.

-

Calculation

Net profit or loss is calculated by subtracting total expenses from total revenues. A positive result signifies a net profit, indicating that the business generated more income than it spent. Conversely, a negative result signifies a net loss, indicating that expenses exceeded revenues. Accurate calculation depends on meticulous record-keeping of both income and expenditures.

-

Implications for Business Health

The net profit or loss provides a clear indicator of a business’s financial health. Consistent profitability suggests sustainable business practices and potential for growth. Recurring losses, however, signal the need for adjustments, whether in pricing strategies, cost reduction measures, or revenue generation initiatives. Ignoring this figure can lead to financial instability and potential business failure.

-

Impact on Tax Liability

Net profit directly impacts tax liability for self-employed individuals. This figure forms the basis for calculating income tax owed. Understanding deductions and allowable expenses is crucial for minimizing tax burdens while remaining compliant with tax regulations. Accurate calculation of net profit is essential for accurate tax reporting.

-

Use in Financial Planning

Net profit data plays a crucial role in financial planning and decision-making. It informs pricing strategies, budgeting for future periods, and investment decisions. Tracking net profit over time allows for the identification of trends, seasonal fluctuations, and the effectiveness of implemented business strategies. This data-driven approach enables informed choices that contribute to long-term financial stability and growth.

In essence, net profit/loss serves as a key performance indicator for self-employed individuals. Its calculation, derived directly from the income statement, provides essential insights into financial health, informs tax obligations, and guides strategic planning. Regular monitoring and analysis of this figure are vital for sustainable business management and long-term success in self-employment.

4. Time Period

Defining a specific time period is essential for creating a meaningful self-employment income statement. This defined timeframe provides the boundaries for revenue and expense recognition, allowing for accurate assessment of financial performance. Without a clear time period, the income statement lacks context and becomes less useful for analysis, planning, and comparison. Selecting an appropriate reporting period depends on the nature of the business, its growth stage, and the specific information needed.

-

Fiscal Year

A fiscal year represents a 12-month period used for accounting purposes. It may align with the calendar year or follow a different schedule based on business cycles. Choosing a fiscal year consistent with industry norms or reflecting seasonal patterns allows for effective year-over-year performance comparisons. For established businesses, an annual income statement provides a comprehensive overview of financial performance and serves as a key document for tax reporting.

-

Quarterly Reporting

Breaking down the fiscal year into quarterly periods (three-month intervals) enables more frequent monitoring of financial performance. This shorter timeframe allows for quicker identification of trends, potential issues, and the effectiveness of implemented strategies. Quarterly income statements facilitate proactive adjustments and more agile financial management, especially beneficial for businesses in dynamic or rapidly changing markets. For example, a seasonal business might benefit from quarterly reporting to understand performance fluctuations throughout the year.

-

Monthly Reporting

Monthly income statements provide the most granular view of financial performance. This frequent reporting is particularly useful for startups, businesses experiencing rapid growth, or those requiring tight control over cash flow. Monthly tracking allows for immediate identification of deviations from budget, enabling swift corrective action. For instance, a freelancer might track monthly income and expenses to ensure consistent cash flow and identify potential client payment delays.

-

Year-to-Date Reporting

Year-to-date reporting reflects cumulative financial performance from the beginning of the fiscal year to a specific date. This perspective allows for tracking progress towards annual goals, assessing performance against projections, and making informed decisions about resource allocation throughout the year. It provides a valuable snapshot of overall financial health at any given point within the fiscal year.

The selected time period directly impacts the relevance and usefulness of a self-employment income statement. Choosing the appropriate timeframe, whether a fiscal year, quarter, month, or year-to-date, provides the necessary context for accurate analysis, informed decision-making, and effective financial management. The choice should align with business needs and provide the most meaningful insights into financial performance.

5. Accuracy

Accuracy in a self-employment income statement is paramount for sound financial management and compliance. Inaccurate data leads to flawed financial analysis, potentially impacting business decisions, tax liabilities, and opportunities for growth. Maintaining precise records is not merely a best practice; it’s a fundamental requirement for understanding true profitability, securing financing, and making informed business decisions.

-

Impact on Tax Liability

Accurate income and expense reporting directly affects tax obligations. Overstating income or understating expenses can lead to penalties and interest charges. Conversely, underreporting income or overstating expenses can result in missed opportunities for legitimate deductions. Precise record-keeping ensures compliance and minimizes the risk of audits and financial repercussions. For instance, accurately tracking mileage for business travel ensures proper deduction claims, impacting overall tax liability.

-

Financial Decision-Making

Reliable financial data is crucial for informed decision-making. Inaccurate figures can skew profitability assessments, leading to misguided investments, unsustainable pricing strategies, or improper cost management. Accurate statements provide the foundation for sound financial planning and strategic business decisions. For example, accurate profit margins inform pricing decisions and potential for expansion into new markets.

-

Securing Financing

Lenders and investors rely on accurate financial statements to assess creditworthiness and investment potential. Inaccurate or inconsistent data can undermine credibility and limit access to funding. A meticulously maintained income statement demonstrates financial stability and professionalism, increasing the likelihood of securing loans or attracting investment. A complete and accurate profit and loss history builds trust and strengthens loan applications.

-

Long-Term Business Health

Consistent accuracy in financial reporting contributes to long-term business health. Tracking trends and identifying areas for improvement requires reliable data. Inaccurate records obscure financial realities, hindering effective analysis and potentially leading to unsustainable business practices. Accurate data supports informed decisions that contribute to long-term growth and stability.

Accuracy in a self-employment income statement is not merely a procedural detail but a cornerstone of responsible financial management. It impacts every aspect of the business, from tax compliance and financial planning to securing funding and ensuring long-term viability. Maintaining meticulous and accurate records is an investment in the present and future success of the self-employed venture.

6. Organization

A well-organized self-employment income statement is crucial for clear financial analysis and efficient business management. Organization facilitates easy interpretation of financial data, simplifies tax preparation, and supports informed decision-making. A structured approach to income and expense categorization provides valuable insights into business performance and contributes to long-term financial health. Disorganized records, conversely, hinder analysis, increase the risk of errors, and obscure the true financial picture.

-

Consistent Categorization

Consistent categorization of income and expenses provides a structured framework for analysis. Establishing clear categories, such as “Sales Revenue,” “Marketing Expenses,” or “Office Supplies,” allows for tracking spending patterns, identifying areas for potential savings, and comparing performance across different periods. For example, consistently categorizing all marketing-related costs, whether online advertising or print materials, allows for a comprehensive view of marketing spend and its effectiveness. Inconsistency in categorization obscures meaningful analysis and hinders effective budget management.

-

Chronological Order

Maintaining records in chronological order simplifies tracking income and expenses over time. This ordered approach facilitates the identification of trends, seasonal fluctuations, and the impact of specific business activities on financial performance. For instance, arranging invoices and receipts by date enables clear tracking of payments, facilitates reconciliation with bank statements, and simplifies tax preparation. A chronological record also provides a historical overview of financial activity, valuable for long-term planning and analysis.

-

Supporting Documentation

Maintaining supporting documentation, such as invoices, receipts, and bank statements, is essential for verifying the accuracy of the income statement. These documents provide an audit trail, supporting claimed expenses and validating reported income. This meticulous approach ensures compliance with tax regulations and strengthens financial credibility. Organized supporting documentation simplifies tax preparation, facilitates loan applications, and provides a clear record of financial transactions. For example, retaining receipts for business-related meals allows for accurate expense tracking and substantiates deductions during tax season.

-

Digital Tools and Software

Utilizing digital tools and accounting software significantly enhances organization and efficiency. These tools automate data entry, categorize transactions, and generate reports, minimizing manual effort and reducing the risk of errors. Cloud-based solutions offer accessibility and data security, facilitating collaboration with accountants or financial advisors. From spreadsheet software to dedicated accounting platforms, these tools streamline financial management and contribute to a more organized and accurate income statement. For instance, using accounting software to track invoices and automatically categorize expenses simplifies record-keeping and generates reports for analysis.

A well-organized self-employment income statement is not merely a matter of neatness; it is a fundamental component of sound financial management. Consistent categorization, chronological order, supporting documentation, and the use of digital tools all contribute to an accurate, easily interpretable, and valuable tool for business analysis, planning, and long-term success. This organized approach provides the foundation for informed financial decisions, strengthens financial credibility, and contributes to the overall health and sustainability of the self-employed venture.

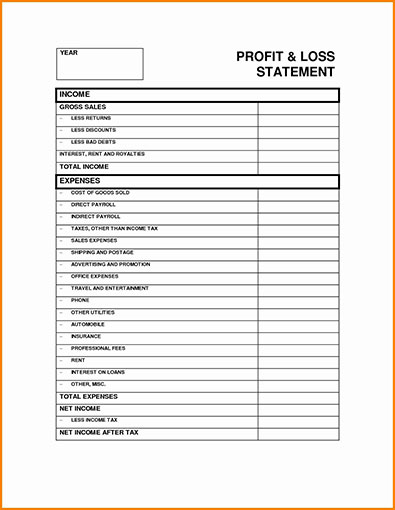

Key Components of a Self-Employment Income Statement

A comprehensive self-employment income statement requires several key components to accurately reflect financial performance. These components provide a structured overview of revenue, expenses, and resulting profitability, enabling informed business decisions and accurate tax reporting. Each element plays a vital role in understanding the financial health of a self-employed venture.

1. Revenue: This section details all income generated from business activities. It should include gross sales, fees earned, and any other income directly related to business operations. Accurate revenue reporting is crucial for assessing overall profitability and meeting tax obligations. Clear categorization of revenue streams, such as product-specific sales or services rendered, provides deeper insights into business performance.

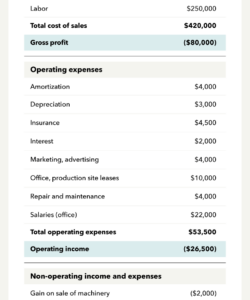

2. Cost of Goods Sold (COGS): Applicable to businesses selling physical products or reselling goods, COGS represents the direct costs associated with producing or acquiring the items sold. This includes raw materials, manufacturing costs, and wholesale purchase prices. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated by subtracting COGS from revenue, gross profit represents the income remaining after accounting for the direct costs of goods sold. This figure is a key indicator of production efficiency and pricing effectiveness.

4. Operating Expenses: This section encompasses all costs incurred in running the business, excluding COGS. These expenses include rent, utilities, marketing and advertising, insurance, professional fees, and office supplies. Categorizing operating expenses provides insights into spending patterns and potential areas for cost optimization.

5. Operating Income: Calculated by subtracting operating expenses from gross profit, operating income reflects the profitability of core business operations before considering non-operating income and expenses.

6. Other Income/Expenses: This section includes income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses. These items are factored in to arrive at the final net profit or loss figure.

7. Net Profit/Loss: This bottom-line figure represents the overall profitability of the business after all income and expenses have been accounted for. A positive net profit indicates profitability, while a negative net profit signifies a loss. This crucial metric informs financial health and influences future business strategies.

8. Time Period: The income statement must clearly specify the reporting period, whether it’s a month, quarter, or fiscal year. This defined timeframe provides context for the financial data and allows for accurate comparison across different periods. Consistent reporting periods enable trend analysis and informed financial planning.

Accurate and comprehensive reporting of these components provides a clear picture of financial performance. This structured overview is essential for informed decision-making, effective financial planning, accurate tax reporting, and the long-term success of any self-employed venture.

How to Create a Self-Employment Income Statement

Creating a self-employment income statement involves organizing financial data into a structured format. This process facilitates clear analysis of business performance and simplifies tax reporting. The following steps outline the creation of a comprehensive and accurate income statement.

1. Define the Reporting Period: Specify the timeframe covered by the income statement (e.g., month, quarter, fiscal year). A clearly defined period ensures accurate tracking and analysis of financial activity within specific time boundaries.

2. Calculate Total Revenue: Sum all income generated from business activities during the defined period. This includes sales, services rendered, and any other business-related income. Maintain supporting documentation, such as invoices and payment records, to ensure accuracy and facilitate verification.

3. Determine Cost of Goods Sold (COGS): If applicable, calculate the direct costs associated with producing or acquiring goods sold. This includes raw materials, manufacturing expenses, and wholesale purchase prices. Accurate COGS calculation is crucial for determining gross profit.

4. Calculate Gross Profit: Subtract COGS from total revenue to arrive at gross profit. This figure represents income after accounting for direct product costs and reflects the profitability of core sales or service activities.

5. Itemize Operating Expenses: List all business-related expenses incurred during the reporting period, excluding COGS. Categorize these expenses for better analysis (e.g., rent, utilities, marketing, insurance, professional fees). Maintain supporting documentation for each expense, such as receipts and invoices.

6. Calculate Operating Income: Subtract total operating expenses from gross profit. This figure represents income generated from core business operations after accounting for both direct and indirect costs.

7. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income, investment gains or losses, or one-time expenses. These items are factored in to arrive at the final net profit or loss.

8. Calculate Net Profit/Loss: Subtract total expenses (including COGS and operating expenses) and other expenses from total revenue (including other income). This final figure represents the overall profitability or loss for the defined period.

A well-structured income statement provides a clear and comprehensive overview of financial performance. This organized data facilitates informed business decisions, accurate tax reporting, and effective financial planning. Regularly generating and reviewing this statement enables proactive financial management and contributes to long-term business success.

Profit and loss statements tailored for the self-employed provide a crucial framework for understanding financial performance. From revenue and expense categorization to net profit calculation, each element contributes to a comprehensive financial overview. Accuracy, organization, and a clearly defined reporting period are essential for meaningful analysis and informed decision-making. This structured approach empowers self-employed individuals to track profitability, manage expenses effectively, and meet tax obligations efficiently. Understanding the components and creation process of these statements equips individuals with the tools necessary for sound financial management.

Effective utilization of these financial statements is paramount for long-term success in self-employment. Regular review and analysis of financial data enable proactive adjustments, informed strategic planning, and sustainable growth. This commitment to financial awareness empowers self-employed individuals to navigate the complexities of business ownership, maximize profitability, and achieve financial goals. The insights derived from these statements form the bedrock of informed financial management, paving the way for continued success and financial stability in the dynamic landscape of self-employment.