An investment committee meeting agenda template is a structured plan or outline used to guide discussions and decision-making during investment committee meetings. It ensures that all essential topics are covered, discussions are focused, and decisions are made efficiently.

Using an investment committee meeting agenda template offers several benefits:

- Improved meeting efficiency: An agenda keeps the meeting on track, ensuring that all important topics are discussed and decisions are made within the allocated time.

- Enhanced focus and clarity: A well-structured agenda provides a clear roadmap for the meeting, helping participants stay focused and engaged.

- Increased transparency: An agenda shared with participants in advance fosters transparency and allows them to prepare for the meeting.

- Facilitated decision-making: An agenda ensures that all relevant information and perspectives are presented, enabling informed decision-making.

- Improved accountability: An agenda serves as a record of the meeting, documenting the topics discussed, decisions made, and action items assigned.

An investment committee meeting agenda template should typically include the following elements:

- Meeting title and date

- Attendees

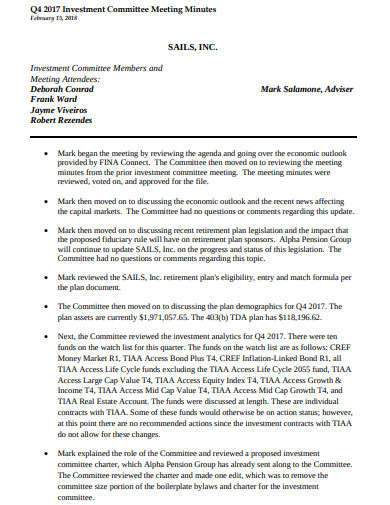

- Approval of previous meeting minutes

- Review of investment performance

- Discussion of new investment opportunities

- Review of existing investments

- Discussion of investment strategy

- Action items

- Next meeting date

Customizing the agenda template to fit the specific needs and objectives of the investment committee is essential. This may involve adding or removing items, adjusting the order of topics, or incorporating additional sections. By utilizing an investment committee meeting agenda template, committees can conduct effective and productive meetings, leading to well-informed investment decisions.

Key Components of Investment Committee Meeting Agenda Template

Investment committee meeting agenda templates comprise several essential components that contribute to their effectiveness and ensure comprehensive coverage of important topics during meetings.

1: Meeting Identification

This section includes the meeting title, date, time, and location. It helps identify the specific meeting and provides necessary details for participants.

2: Attendees

This section lists the names of individuals expected to attend the meeting, including committee members, guests, and any other relevant parties. It ensures that all necessary perspectives are represented.

3: Approval of Previous Meeting Minutes

This component allows the committee to review and approve the minutes from the previous meeting, ensuring accuracy and continuity in the decision-making process.

4: Review of Investment Performance

This section involves examining the performance of existing investments, assessing returns, risks, and adherence to investment objectives. It helps the committee make informed decisions about future investment strategies.

5: Discussion of New Investment Opportunities

This component provides a platform to explore and evaluate potential new investment opportunities. It includes presentations, discussions, and analysis to identify promising investment options.

6: Action Items

This section outlines specific actions that need to be taken following the meeting. It assigns responsibilities, deadlines, and follow-up mechanisms to ensure timely execution of decisions.

7: Next Meeting Date

This component indicates the date and time of the next scheduled investment committee meeting, ensuring continuity and advance planning.

How to Create an Investment Committee Meeting Agenda Template

An investment committee meeting agenda template serves as a roadmap for effective and productive meetings. Here’s a step-by-step guide to create one:

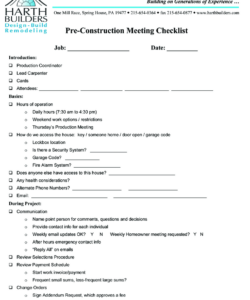

1: Define Meeting Objectives

Start by clearly outlining the purpose and goals of the meeting. This will help you determine the essential topics to include in the agenda.

2: Identify Attendees

Determine who should attend the meeting based on their roles and expertise. This includes committee members, investment professionals, and any other relevant parties.

3: Structure the Agenda

Use a logical flow to organize the agenda. Common sections include:

- Meeting identification (title, date, location)

- Attendees

- Approval of previous meeting minutes

- Review of investment performance

- Discussion of new investment opportunities

- Review of existing investments

- Discussion of investment strategy

- Action items

- Next meeting date

4: Allocate Time Wisely

Estimate the appropriate amount of time for each agenda item, considering its importance and complexity.

5: Incorporate Supporting Materials

Include references to relevant documents, presentations, or reports that support agenda items, ensuring participants have the necessary information.

6: Review and Refine

Regularly review and update the agenda template based on feedback and changing circumstances to ensure its effectiveness.

Summary

Creating an investment committee meeting agenda template requires careful planning and attention to detail. By following these steps, you can develop a structured and comprehensive agenda that facilitates efficient and informed decision-making.

In conclusion, an investment committee meeting agenda template serves as a vital tool for organizing and guiding productive investment committee meetings. By providing a structured framework, it ensures that all critical topics are addressed, discussions are focused, and decisions are made efficiently. An effective agenda template enhances meeting efficiency, improves focus and clarity, fosters transparency, facilitates informed decision-making, and promotes accountability.

Adopting an investment committee meeting agenda template empowers committees to conduct well-organized and productive meetings, leading to sound investment decisions and successful investment outcomes. It is a valuable tool that supports committees in fulfilling their fiduciary responsibilities and achieving their investment objectives.