Utilizing such a resource offers several advantages. It facilitates efficient tracking of financial data, simplifies the process of generating reports for internal analysis and external stakeholders, and can assist in identifying areas for potential cost savings or revenue growth. Accessibility to these resources at no cost lowers the barrier to entry for small businesses and startups, enabling them to implement sound financial practices from the outset.

This structured approach to financial reporting allows businesses to monitor their performance, identify trends, and make informed decisions to improve profitability and sustainability. The following sections delve deeper into specific aspects of financial statement analysis and practical application within various business contexts.

1. Accessibility

Accessibility is a critical factor driving the utility of free profit and loss statement templates. Eliminating cost barriers allows a broader range of users, including entrepreneurs, small business owners, and non-profit organizations, to implement essential financial tracking mechanisms. Without readily available, cost-free options, these users might resort to less structured methods, potentially hindering their ability to accurately assess financial health and make informed business decisions. For example, a startup operating on a limited budget can leverage a free template to monitor cash flow and secure funding, while a community organization can track donations and expenses to ensure transparency and accountability.

This democratization of financial management tools empowers individuals and organizations to engage in more robust financial planning and analysis. The availability of free templates fosters a greater understanding of financial performance, enabling proactive adjustments to budgets, pricing strategies, and operational efficiency. Consider a freelance consultant using a free template to analyze their income streams and expenses, leading to informed decisions about client acquisition and project pricing. This direct access to organized financial data facilitates sound financial management, contributing to long-term stability and growth.

In summary, widespread access to free profit and loss statement templates fosters financial literacy and strengthens economic foundations. While challenges may remain in terms of user education and template customization, the accessibility of these tools represents a significant step toward empowering individuals and organizations to take control of their financial well-being. This contributes to a more informed and robust economic landscape overall.

2. Standardized Format

Standardized formatting is a crucial element of free profit and loss statement templates. This consistent structure ensures data is presented uniformly, facilitating comparison across different periods within a single business and benchmarking against industry averages. A standardized template includes predefined categories for revenue, cost of goods sold, operating expenses, and other key financial elements, ensuring consistent data organization. This consistency allows for accurate trend analysis and performance evaluation. For example, a retailer can readily track changes in gross profit margins over several quarters, enabling timely adjustments to pricing or inventory management.

The use of a standardized format also simplifies communication with external stakeholders. Investors, lenders, and other parties can easily interpret the financial data presented in a familiar format, reducing the risk of misinterpretation and fostering trust. Consider a small business seeking a loan; providing a profit and loss statement in a standardized format streamlines the lender’s review process, enhancing the likelihood of approval. Furthermore, this consistency supports compliance with accounting standards and regulations, reducing the potential for errors and facilitating audits.

In summary, the standardized format inherent in free profit and loss statement templates provides significant advantages in terms of data analysis, communication, and compliance. While some customization may be necessary to accommodate specific industry requirements or business models, the underlying structure offers a valuable framework for effective financial management. This structured approach promotes transparency, accountability, and data-driven decision-making, contributing to the overall financial health and stability of organizations leveraging these readily available resources.

3. Financial Clarity

Financial clarity, a critical outcome of utilizing a free profit and loss statement template, emerges from the organized presentation of income and expenses. A well-structured template provides designated sections for various revenue streams, cost of goods sold, operating expenses, and other relevant financial data. This structured approach transforms raw financial data into a comprehensible narrative, enabling users to quickly grasp the overall financial performance of a business or project. For instance, a small business owner can readily identify the most significant expenses impacting profitability or track the growth of revenue from a new product line.

This enhanced understanding of financial performance facilitates more effective decision-making. By clearly visualizing profit margins, expense ratios, and other key metrics, businesses can identify areas for improvement, optimize resource allocation, and develop data-driven strategies for growth. Consider a non-profit organization using a template to track fundraising efforts and program expenses; this clarity enables them to demonstrate impact to donors and make informed decisions about program expansion or budget adjustments. The ability to analyze trends and patterns within the financial data further strengthens strategic planning and enhances financial forecasting accuracy.

In summary, financial clarity achieved through the use of free profit and loss statement templates empowers informed decision-making and contributes to greater financial stability. While interpreting complex financial data can still present challenges, the organized structure of these templates provides a crucial foundation for understanding and managing financial performance. This understanding, in turn, supports sustainable growth, effective resource management, and enhanced stakeholder communication.

4. Informed Decisions

Informed decisions represent a crucial outcome facilitated by the utilization of free profit and loss statement templates. These templates provide the structured financial data necessary for evidence-based decision-making, replacing guesswork with concrete insights. By clearly presenting revenue, expenses, and profit margins, these tools empower businesses to identify trends, evaluate performance, and make strategic adjustments. For example, a restaurant owner analyzing a profit and loss statement might discover that food costs are disproportionately high, prompting a review of supplier contracts or menu pricing. Alternatively, a growing e-commerce business could identify its most profitable product lines, informing decisions about inventory management and marketing investments.

The ability to make informed decisions based on accurate financial data is essential for long-term sustainability and growth. Without a clear understanding of profitability and expense drivers, businesses risk misallocating resources, pursuing unsustainable strategies, and ultimately jeopardizing their financial health. Consider a non-profit organization relying on grant funding; a profit and loss statement can demonstrate responsible financial management to grantors, increasing the likelihood of continued support. Furthermore, data-driven insights gleaned from these statements can inform decisions about program effectiveness and resource allocation within the organization, maximizing impact and community benefit.

In summary, the accessibility of free profit and loss statement templates empowers organizations of all sizes to make informed, data-driven decisions. This capacity for strategic decision-making based on accurate financial analysis is crucial for navigating complex economic landscapes, ensuring long-term viability, and maximizing resource utilization. While interpreting financial data requires careful consideration and context-specific analysis, these readily available tools provide an essential foundation for informed financial management, contributing to sustainable growth and organizational success.

5. Cost-effective analysis

Cost-effective analysis finds a natural ally in the free profit and loss statement template. The template’s accessibility removes the financial barrier often associated with sophisticated analytical tools, enabling businesses, particularly startups and small enterprises, to conduct robust financial assessments without significant expense. This allows organizations to allocate limited resources more efficiently, focusing on core business activities rather than costly software or professional services. For example, a new online retailer can utilize a free template to track website traffic, sales conversions, and marketing campaign ROI, optimizing advertising spend and maximizing profitability without investing in expensive analytics platforms. This accessibility democratizes financial analysis, providing valuable insights to a wider range of users.

Furthermore, the standardized structure of these free templates facilitates consistent data collection and analysis. This consistency allows for accurate trend identification, performance benchmarking, and informed forecasting, leading to more cost-effective resource allocation. Consider a small manufacturing business using a template to track production costs, inventory levels, and sales volume. By analyzing these data points, the business can identify opportunities to streamline production processes, reduce waste, and optimize inventory management, directly impacting profitability. Moreover, readily available templates promote proactive financial management, enabling businesses to identify and address potential financial challenges before they escalate into costly problems. This proactive approach minimizes financial risk and contributes to long-term stability.

In conclusion, free profit and loss statement templates offer a powerful means of conducting cost-effective analysis. Accessibility and standardized formatting empower organizations to gain valuable financial insights, optimize resource allocation, and make data-driven decisions, contributing to increased efficiency and profitability. While the complexity of specific analytical needs may require further tools or expertise, these free resources provide a crucial foundation for cost-conscious financial management, particularly for businesses operating with limited budgets. This accessibility fosters a more informed and financially sound business environment overall.

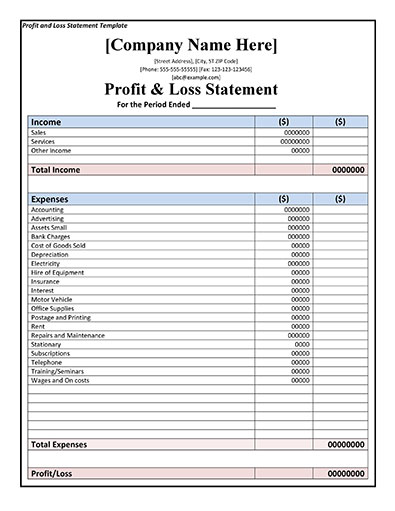

Key Components of a Profit and Loss Statement Template

Understanding the core components of a profit and loss statement template is essential for accurate financial reporting and analysis. These components provide a structured framework for organizing financial data, enabling businesses to assess performance, identify trends, and make informed decisions.

1. Revenue: This section captures all income generated from business operations, including sales of goods or services. Accurate revenue reporting is fundamental to understanding overall financial performance.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold by a business. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit reflects the profitability of core business operations before accounting for operating expenses.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, such as rent, salaries, marketing, and administrative costs. Careful tracking of operating expenses is essential for managing profitability.

5. Operating Income: Operating income, derived by subtracting operating expenses from gross profit, indicates the profitability of the business after accounting for day-to-day operational costs.

6. Other Income/Expenses: This category includes income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses.

7. Income Before Taxes: This represents the total income generated by the business before accounting for income tax obligations.

8. Net Income: This bottom-line figure represents the final profit or loss after all expenses and taxes have been deducted. Net income provides a comprehensive measure of a business’s financial performance over a specific period.

Effective utilization of a profit and loss statement template requires a comprehensive understanding of these key components. Accurate data entry and analysis within this structured framework enables businesses to gain valuable insights into their financial performance, facilitating informed decision-making and contributing to long-term sustainability.

How to Create a Free Profit and Loss Statement Template

Creating a free profit and loss (P&L) statement template offers a cost-effective method for tracking financial performance. The following steps outline the process of developing a functional and readily adaptable template.

1. Choose a Software: Spreadsheet software (e.g., Google Sheets, Microsoft Excel, LibreOffice Calc) provides the necessary functionality for creating a P&L template. These platforms offer built-in formulas and formatting options, simplifying calculations and data organization.

2. Establish Reporting Period: Define the timeframe for the P&L statement (e.g., monthly, quarterly, annually). This ensures consistent tracking and allows for period-over-period comparisons.

3. Create Key Sections: Establish distinct sections for revenue, cost of goods sold (COGS), gross profit, operating expenses, operating income, other income/expenses, income before taxes, and net income. Clear sectioning enhances readability and data analysis.

4. Define Revenue Categories: List all sources of revenue relevant to the business. This might include product sales, service fees, or other income streams. Detailed categorization improves revenue tracking accuracy.

5. Itemize COGS: If applicable, list all direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit margins.

6. Categorize Operating Expenses: List all operational expenses, including rent, salaries, marketing, utilities, and administrative costs. Detailed categorization facilitates expense management and analysis.

7. Incorporate Formulas for Calculations: Utilize formulas within the spreadsheet to automate calculations for gross profit, operating income, income before taxes, and net income. Automated calculations reduce errors and save time.

8. Test and Refine: Enter sample data to test the functionality of the template. Ensure formulas calculate correctly and that the template provides a clear overview of financial performance. Refine the template as needed based on testing results.

A well-structured template, incorporating these elements, provides a powerful tool for monitoring financial performance, identifying trends, and making informed business decisions. Regular review and refinement ensure the template remains aligned with evolving business needs and provides ongoing value for financial analysis and planning.

Access to complimentary profit and loss statement templates represents a significant advantage for businesses seeking to enhance financial management practices. These resources offer a structured approach to organizing income and expenses, calculating key profitability metrics, and facilitating informed decision-making. Standardized formats promote consistency in reporting, enabling trend analysis, performance benchmarking, and effective communication with stakeholders. The ability to analyze financial data efficiently empowers organizations to identify areas for improvement, optimize resource allocation, and develop strategies for sustained growth. While customization may be necessary to address specific business requirements, the core components of these templates provide a valuable framework for sound financial practices.

Leveraging these accessible resources contributes to a more informed and financially sound business environment. Regular review and analysis of profit and loss statements, facilitated by these templates, enable proactive financial management, mitigating potential risks and promoting long-term stability. The widespread availability of these tools empowers organizations of all sizes to take control of their financial well-being, contributing to a more robust and sustainable economic landscape.