A financial planning meeting agenda template is a framework that guides the structure and content of a meeting focused on financial planning. It ensures that the meeting remains organized, covers all necessary topics, and achieves its objectives.

An effective financial planning meeting agenda template offers several benefits. It helps participants stay on track, prioritize discussions, and make informed decisions. It promotes transparency, accountability, and efficient use of time. Moreover, it serves as a reference point for future meetings and a record of the discussions and outcomes.

To use a financial planning meeting agenda template, start by identifying the meeting’s goals and objectives. Then, allocate time slots for each agenda item, ensuring that critical topics receive adequate attention. Consider including sections for introductions, financial reviews, risk assessments, investment strategies, and action planning. Throughout the meeting, the agenda template helps keep the discussion focused and ensures that all perspectives are heard.

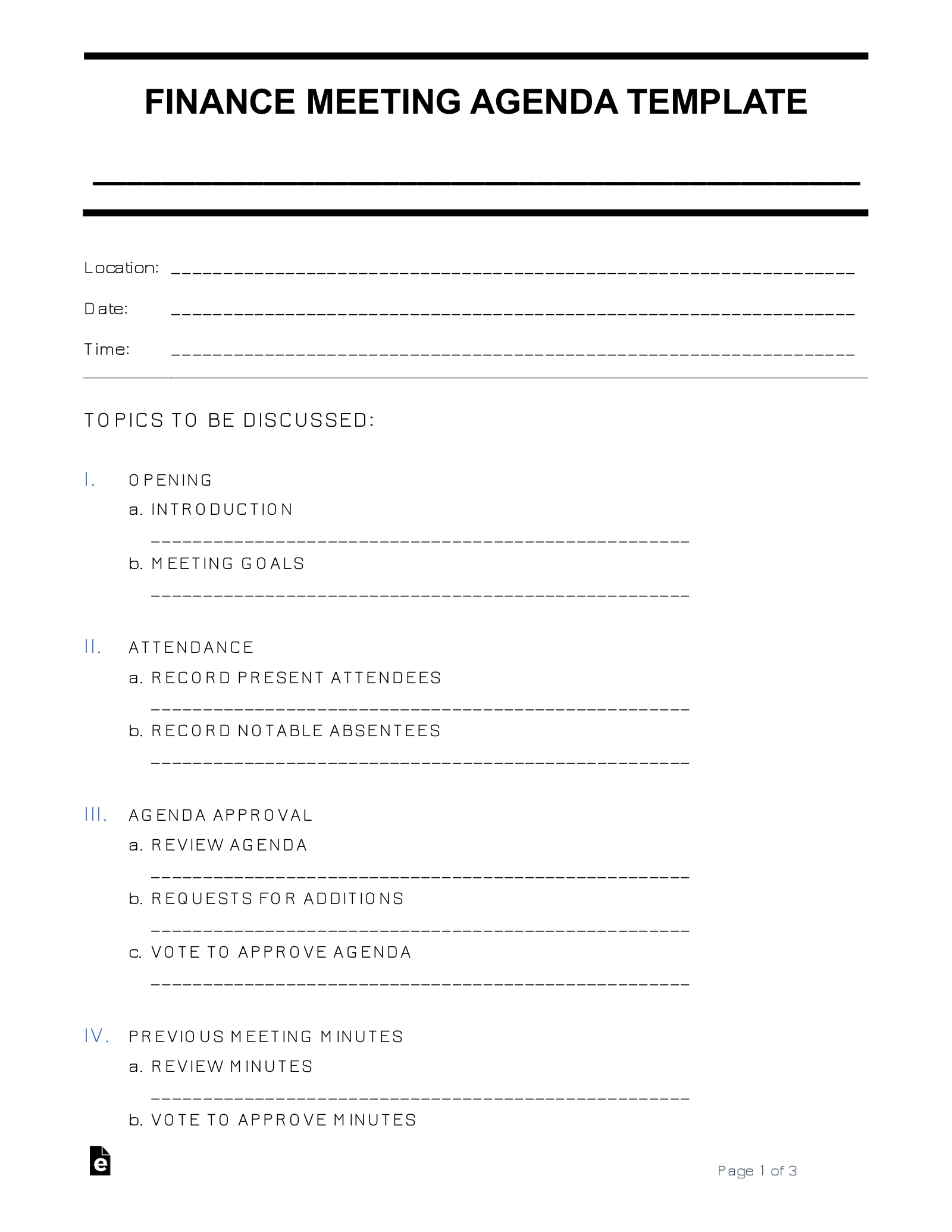

Key Components of a Financial Planning Meeting Agenda Template

A comprehensive financial planning meeting agenda template should include the following key components:

1: Introduction

The introduction should state the purpose of the meeting, welcome attendees, and review the agenda.

2: Financial Review

This section should include a review of the client’s financial situation, including income, expenses, assets, and liabilities.

3: Risk Assessment

The risk assessment should identify and evaluate potential financial risks that the client may face.

4: Investment Strategies

This section should discuss investment options and strategies that are aligned with the client’s financial goals and risk tolerance.

5: Action Planning

The action planning section should outline specific steps that the client and financial advisor will take to implement the financial plan.

6: Next Steps

This section should summarize the key decisions made during the meeting and outline the next steps in the financial planning process.

Summary

A well-structured financial planning meeting agenda template ensures that all important topics are covered and that the meeting remains focused and productive.

How to Create a Financial Planning Meeting Agenda Template

Creating a financial planning meeting agenda template involves the following steps:

1: Define the Purpose and Objectives

Start by clearly defining the purpose and objectives of the financial planning meeting. This will help you determine the key topics that need to be covered.

2: Allocate Time Slots

Allocate specific time slots for each agenda item, ensuring that critical topics receive adequate attention. Consider the complexity and importance of each topic when allocating time.

3: Include Key Sections

Include key sections in your agenda template, such as introductions, financial reviews, risk assessments, investment strategies, action planning, and next steps.

4: Consider Customization

While using a template provides a framework, consider customizing it to meet the specific needs of each financial planning meeting. Adjust the content and structure as necessary.

5: Review and Refine

Once you have created a draft agenda, review it carefully and make any necessary revisions. Seek feedback from colleagues or clients to ensure that the agenda is clear, comprehensive, and effective.

Summary

By following these steps, you can create a financial planning meeting agenda template that will help you conduct productive and successful meetings.

In conclusion, a financial planning meeting agenda template serves as a valuable tool for conducting organized and effective financial planning meetings. It provides a structured framework that ensures all critical topics are covered, discussions are focused, and decisions are made efficiently. By using a well-crafted agenda template, financial advisors and clients can maximize the productivity of their meetings and work towards achieving their financial goals.