A specialized format for presenting financial data, this reporting tool separates variable costs from fixed costs to determine how much revenue is available to cover fixed expenses and contribute to profit. It provides a clearer picture of a company’s profitability at different sales volumes compared to a traditional income statement, which groups all expenses together. This distinct categorization of costs facilitates break-even analysis and pricing decisions.

Utilizing this structured approach offers several advantages. Managers can easily identify areas for cost control and assess the impact of changes in sales volume on profitability. This enhanced understanding supports informed decision-making regarding pricing strategies, product mix, and cost optimization initiatives. Ultimately, this leads to improved operational efficiency and better financial outcomes.

Understanding the structure and applications of this reporting method provides a foundation for exploring key concepts in managerial accounting, such as cost-volume-profit analysis, break-even point determination, and the impact of operating leverage.

1. Revenues

Revenue forms the foundation of the contribution margin income statement template. It represents the total income generated from sales of goods or services and serves as the starting point for calculating the contribution margin. Accurate revenue recognition is crucial for the integrity of this statement and subsequent analyses. For example, a software company selling subscriptions must accurately recognize revenue over the subscription period, impacting the reported revenue figures in each reporting period and influencing the depicted profitability.

The relationship between revenue and the contribution margin is direct and proportional. Increases in revenue, assuming constant variable costs, lead to a higher contribution margin, thus increasing the amount available to cover fixed costs and contribute to profit. Conversely, declining revenue can negatively impact profitability. Consider a retailer experiencing a sales slump. Lower revenues reduce the contribution margin, potentially leading to losses if fixed costs remain unchanged. This highlights the importance of revenue growth strategies and effective cost management.

Understanding the pivotal role of revenue within the contribution margin income statement template is essential for effective financial management. Accurate revenue reporting and analysis provide insights into a company’s sales performance, pricing effectiveness, and overall profitability. These insights inform strategic decisions regarding sales targets, pricing adjustments, and cost optimization initiatives. Challenges in revenue recognition, such as complex sales agreements or fluctuating market conditions, underscore the need for robust accounting practices and careful analysis of revenue trends.

2. Variable Costs

Variable costs hold a crucial position within the contribution margin income statement template. Directly tied to production or sales volume, these costs fluctuate proportionally with changes in output. Understanding their behavior is essential for accurate profit analysis and informed decision-making.

-

Direct Materials

Raw materials used in manufacturing represent a classic example of variable costs. For a furniture manufacturer, the cost of wood, fabric, and hardware directly correlates with the number of units produced. Higher production volumes necessitate greater material consumption, leading to increased variable costs. This direct relationship is clearly reflected within the contribution margin income statement, impacting the contribution margin and, consequently, profitability.

-

Direct Labor

Labor costs directly involved in production also fall under variable costs. In a garment factory, the wages paid to sewing machine operators depend on the number of garments produced. Increased production requires more labor hours, driving up variable labor costs. This dynamic relationship is captured in the contribution margin income statement, providing insights into the cost of labor per unit and its influence on profit margins.

-

Sales Commissions

Variable costs also extend to sales-related expenses. Commissions paid to sales representatives based on sales volume are a prime example. Higher sales generate larger commission payouts, illustrating the variable nature of this cost. Within the contribution margin income statement, sales commissions are deducted from revenue, affecting the contribution margin and ultimately impacting net income.

-

Shipping Costs

Expenses related to product delivery often behave as variable costs. For an e-commerce business, shipping fees increase with the number of orders shipped. Higher sales volumes translate to more shipments and therefore higher shipping costs. The contribution margin income statement reflects this relationship, demonstrating how shipping costs influence overall profitability, particularly for businesses with high shipping volumes.

The accurate categorization and analysis of variable costs are fundamental for interpreting the contribution margin income statement template effectively. By understanding how these costs respond to changes in production or sales, businesses can make informed decisions regarding pricing strategies, cost control measures, and production planning. This understanding allows for more accurate profit projections and facilitates informed strategic planning.

3. Contribution Margin

The contribution margin represents the financial buffer generated from sales after deducting variable costs. Calculated as revenue minus variable costs, it signifies the portion of income available to cover fixed expenses and subsequently contribute to net profit. Within the contribution margin income statement template, this figure serves as a critical indicator of operational efficiency and profitability. It provides insights into how effectively a business leverages its revenue to offset variable expenses and contribute to overall financial health. For instance, a high contribution margin suggests that a significant portion of each sale contributes towards fixed costs and profit, whereas a low margin may indicate potential pricing or cost management issues.

Consider a bakery producing artisanal bread. The revenue generated from selling each loaf contributes to the overall contribution margin after deducting the variable costs associated with ingredients like flour, yeast, and salt, along with the direct labor costs of baking. This remaining amount contributes toward covering fixed costs such as rent, utilities, and staff salaries not directly tied to production. The contribution margin, therefore, reveals the profitability of each loaf sold and collectively indicates the bakery’s ability to cover its fixed expenses and generate profit. Analyzing trends in the contribution margin can signal changes in cost structure, pricing strategies, or sales volume, prompting management to investigate and take corrective action if necessary.

Understanding the contribution margin is fundamental for interpreting the contribution margin income statement template and making informed business decisions. It offers valuable insights into a company’s cost structure, pricing effectiveness, and profitability at different sales volumes. This information empowers management to optimize pricing strategies, control variable costs, and make data-driven decisions regarding production levels and product mix. Furthermore, the contribution margin plays a crucial role in break-even analysis, helping businesses determine the sales volume required to cover all costs and achieve profitability. Accurately calculating and interpreting this metric is essential for effective financial management and long-term business success.

4. Fixed Costs

Fixed costs represent a critical component within the contribution margin income statement template. Unlike variable costs, which fluctuate with production or sales volume, fixed costs remain constant regardless of output. Understanding their impact on profitability is essential for effective financial analysis and decision-making. Properly classifying and analyzing fixed costs provides key insights into a company’s operational leverage and break-even point.

-

Rent and Lease Payments

Rental expenses for office space, manufacturing facilities, or equipment exemplify fixed costs. Whether a company produces 100 units or 1,000, the monthly rent remains the same. This consistency is reflected in the contribution margin income statement, where fixed costs like rent are deducted from the contribution margin to determine operating income. The unchanging nature of rent highlights its impact on profitability, particularly at lower sales volumes where a larger portion of the contribution margin is allocated to covering fixed expenses.

-

Salaries and Benefits for Administrative Staff

Salaries and benefits paid to administrative personnel not directly involved in production represent another category of fixed costs. These expenses remain relatively constant regardless of production levels. Within the contribution margin income statement, administrative salaries are deducted from the contribution margin, impacting operating income. This deduction underscores the importance of managing fixed costs effectively, as they represent a consistent expense that must be covered regardless of sales performance.

-

Insurance Premiums

Regular insurance premiums for property, liability, or health insurance represent predictable fixed costs. These payments remain consistent regardless of production or sales activity. On the contribution margin income statement, insurance premiums contribute to the overall fixed cost deduction from the contribution margin, influencing the final operating income. The consistent nature of insurance premiums underscores the importance of accurate budgeting and cost control measures.

-

Depreciation of Fixed Assets

The systematic allocation of a fixed asset’s cost over its useful life, known as depreciation, is considered a fixed cost. Regardless of production volume, the depreciation expense for equipment, machinery, or buildings remains consistent, reflecting the gradual reduction in asset value over time. This consistent expense, reported on the contribution margin income statement, impacts operating income. Understanding depreciations role as a fixed cost allows for accurate profit analysis and informed investment decisions.

Analyzing fixed costs within the context of the contribution margin income statement template is vital for effective financial management. By understanding the relationship between fixed costs, contribution margin, and operating income, businesses can make informed decisions regarding pricing strategies, cost control measures, and capacity planning. Furthermore, knowledge of fixed costs is essential for conducting break-even analysis and understanding the impact of operating leverage on profitability. Effectively managing fixed costs contributes to improved financial performance and sustainable business growth.

5. Operating Income

Operating income, a key metric within the contribution margin income statement template, represents the profitability of a business’s core operations after accounting for both variable and fixed costs. Calculated as the contribution margin minus fixed costs, it reveals the financial result of a company’s primary activities, excluding non-operating income and expenses such as interest or investments. Understanding operating income is crucial for assessing the efficiency and effectiveness of a company’s core business functions.

-

Profitability Measurement

Operating income serves as a direct measure of a company’s profitability from its core operations. A positive operating income indicates that the business generates sufficient revenue to cover both variable and fixed costs, while a negative figure signals potential issues with pricing, cost control, or sales volume. Analyzing trends in operating income over time provides valuable insights into the financial health and sustainability of the core business. For example, a consistent increase in operating income might suggest effective management and growth, while a decline could prompt further investigation into operational efficiency.

-

Impact of Cost Structure

The relationship between fixed costs, variable costs, and operating income is clearly depicted within the contribution margin income statement. A company with high fixed costs exhibits higher operating leverage, meaning changes in sales volume have a more significant impact on operating income. Conversely, businesses with lower fixed costs and higher variable costs experience less dramatic fluctuations in operating income with changes in sales. Understanding this relationship is crucial for making informed decisions about cost management, pricing strategies, and capacity planning.

-

Operational Efficiency Evaluation

Operating income serves as a valuable indicator of operational efficiency. By comparing operating income figures across different periods or against industry benchmarks, companies can assess their ability to control costs and generate profit from core operations. A higher operating income margin relative to competitors often suggests superior operational efficiency and cost control measures. This analysis facilitates identifying areas for improvement and implementing strategies to optimize operational performance.

-

Predictive Analysis for Future Performance

Analyzing historical operating income trends can provide valuable insights for predicting future performance and making informed business decisions. By understanding how operating income has responded to past changes in sales volume, costs, and pricing, companies can develop more accurate forecasts and projections. This predictive analysis allows for better resource allocation, investment planning, and strategic decision-making aligned with projected future performance. Consistent monitoring of operating income empowers businesses to proactively adapt to changing market conditions and maintain financial stability.

Operating income, as presented within the contribution margin income statement template, provides a fundamental understanding of a company’s core profitability and operational efficiency. By analyzing this metric in conjunction with other financial data, stakeholders can gain a comprehensive view of a company’s financial health, make informed decisions regarding resource allocation, and develop strategies to improve long-term profitability and sustainability. The clear presentation of operating income on the contribution margin income statement facilitates effective performance evaluation and informed decision-making.

6. Cost-Volume-Profit Analysis

Cost-volume-profit (CVP) analysis relies heavily on the data presented within the contribution margin income statement template. The clear segregation of fixed and variable costs facilitates the exploration of how changes in sales volume, costs, and selling price affect profitability. This analysis empowers businesses to understand the interplay between these factors and make informed decisions regarding pricing strategies, cost control, and production planning. The contribution margin, readily derived from the template, serves as a cornerstone of CVP calculations, including break-even point determination and target profit analysis. For example, a manufacturer can use CVP analysis, informed by the contribution margin income statement, to determine the sales volume necessary to cover both fixed and variable costs and achieve a desired profit level. This understanding is crucial for setting realistic sales targets and evaluating the financial viability of various production scenarios.

A practical application of CVP analysis using the contribution margin income statement template can be illustrated with a hypothetical scenario. Consider a coffee shop seeking to determine its break-even point. The contribution margin income statement provides the necessary data points: fixed costs (rent, utilities, salaries), variable costs (coffee beans, milk, cups), and selling price per cup. By dividing fixed costs by the contribution margin per cup (selling price minus variable cost per cup), the coffee shop can calculate the number of cups it needs to sell to break even. Further analysis can explore how changes in coffee bean prices or rent might affect the break-even point and inform pricing or cost-saving strategies. This example highlights the practical value of combining CVP analysis with the contribution margin income statement for informed decision-making.

The contribution margin income statement template provides the foundational structure for conducting meaningful CVP analysis. This analytical approach offers critical insights into the relationships between sales volume, costs, and profitability, enabling data-driven decision-making across various business functions. Understanding the interplay of these factors empowers businesses to optimize pricing strategies, manage costs effectively, and make informed choices regarding production volume and product mix. While CVP analysis offers valuable insights, its accuracy depends on the reliability of the underlying data and the validity of assumptions regarding cost behavior and sales projections. Recognizing these limitations and continually refining the data within the contribution margin income statement enhances the effectiveness of CVP analysis as a strategic planning tool.

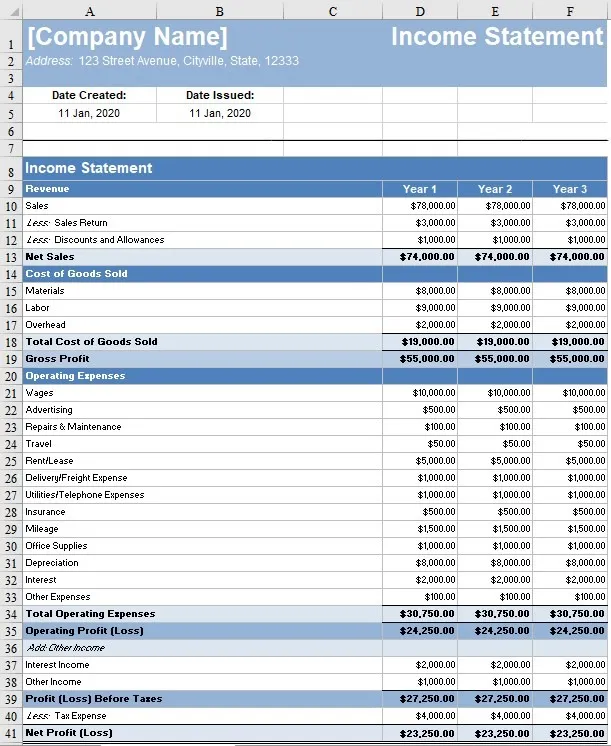

Key Components of a Contribution Margin Income Statement Template

Effective financial analysis requires a thorough understanding of the key components within a contribution margin income statement template. This specialized report provides crucial insights into profitability and cost behavior.

1. Revenues: The top line of the statement represents the total income generated from sales. Accurate revenue recognition is paramount for the integrity of subsequent calculations and analyses.

2. Variable Costs: These costs fluctuate directly with sales or production volume. Examples include direct materials, direct labor, and sales commissions. Accurate categorization is essential for understanding cost behavior and its impact on profitability.

3. Contribution Margin: Calculated as revenues minus variable costs, this key figure represents the amount available to cover fixed costs and contribute to profit. It is a critical indicator of operational efficiency.

4. Fixed Costs: These costs remain constant regardless of sales or production volume. Examples include rent, salaries of administrative staff, and insurance premiums. Understanding fixed costs is essential for break-even analysis and assessing operational leverage.

5. Operating Income: Derived by subtracting fixed costs from the contribution margin, operating income reflects the profitability of core business operations. This metric is crucial for evaluating operational efficiency and overall financial performance.

These interconnected elements provide a comprehensive view of a company’s financial performance. The statement’s structure facilitates cost-volume-profit analysis, enabling informed decision-making regarding pricing, production, and resource allocation. Accurate data and a clear understanding of these components are crucial for effective financial management and strategic planning.

How to Create a Contribution Margin Income Statement

Creating a contribution margin income statement requires a structured approach and accurate data. The following steps outline the process of developing this valuable financial report.

1. Gather Sales Data: Compile accurate sales figures for the given period. This data forms the foundation of the income statement and must reflect actual revenue generated from goods or services sold. Ensure data integrity by verifying sales records and accounting for any returns or discounts.

2. Calculate Variable Costs: Determine all variable costs directly associated with production or sales. This includes direct materials, direct labor, sales commissions, and other expenses that fluctuate proportionally with sales volume. Accurate cost allocation is crucial for a meaningful contribution margin calculation.

3. Compute the Contribution Margin: Subtract total variable costs from revenues to arrive at the contribution margin. This key figure represents the portion of revenue available to cover fixed costs and contribute to profit. Expressing the contribution margin as a percentage of revenue (contribution margin ratio) provides valuable insights into cost structure and profitability.

4. Determine Fixed Costs: Identify and total all fixed costs, which remain constant regardless of sales volume. These typically include rent, salaries of administrative staff, insurance premiums, and depreciation expenses. Accurate fixed cost allocation is crucial for determining operating income and conducting break-even analysis.

5. Calculate Operating Income: Subtract total fixed costs from the contribution margin to determine operating income. This figure reflects the profitability of core business operations after considering both variable and fixed costs. Analyzing operating income trends reveals insights into operational efficiency and overall financial health.

6. Format the Statement: Organize the calculated figures into a clear and concise report. The statement should clearly present revenues, variable costs, contribution margin, fixed costs, and operating income. A well-formatted statement enhances readability and facilitates analysis.

7. Analyze the Results: Review the completed contribution margin income statement to gain insights into cost behavior, profitability, and operational efficiency. Compare figures against prior periods or industry benchmarks to identify trends and areas for improvement. This analysis informs strategic decision-making regarding pricing, cost control, and production planning.

A properly constructed contribution margin income statement provides a powerful tool for financial analysis and management decision-making. The insights derived from this statement inform strategic planning, cost optimization initiatives, and pricing strategies. Regular review and analysis of this statement are essential for maintaining financial health and achieving sustainable business growth.

This exploration of the contribution margin income statement template has highlighted its significance as a managerial accounting tool. From dissecting its core componentsrevenues, variable costs, contribution margin, fixed costs, and operating incometo illustrating its application in cost-volume-profit analysis, the versatility of this statement becomes evident. Its ability to illuminate the relationship between cost behavior, sales volume, and profitability empowers informed decision-making related to pricing strategies, cost control measures, and operational efficiency improvements.

Effective utilization of the contribution margin income statement template provides a crucial foundation for data-driven decision-making and sustainable financial performance. Continuous analysis and interpretation of this statement, combined with a thorough understanding of its underlying principles, remain essential for navigating the complexities of the modern business landscape and achieving long-term financial success.