A multi-year income statement, projected or historical, provides a comprehensive overview of a company’s financial performance over an extended period. Covering four years allows for the analysis of trends, identification of recurring patterns, and assessment of long-term financial stability. This structured financial report details revenues, costs, and expenses, ultimately revealing net income or loss annually for the specified duration. It serves as a crucial tool for internal management decision-making, investor analysis, and lender evaluations.

Utilizing this type of financial document offers several advantages. It enables businesses to track progress towards financial goals, identify areas for improvement, and make informed decisions about future investments. The extended timeframe facilitates more accurate forecasting, allowing for better resource allocation and strategic planning. This comprehensive view also assists external stakeholders, such as investors and lenders, in evaluating the company’s financial health and growth potential.

The following sections will delve deeper into the specific components of this crucial financial tool, demonstrating its practical application and offering guidance on its creation and interpretation. Topics covered will include revenue analysis, cost management, profitability trends, and the impact of external factors on financial performance.

1. Revenue Streams

A multi-year profit and loss statement provides crucial insights into revenue streams, allowing businesses to understand the evolution of their income sources over an extended period. Analyzing these trends is essential for strategic planning, identifying growth opportunities, and assessing long-term financial stability.

-

Sales Revenue:

This represents income generated from core business operations, typically the sale of goods or services. Tracking sales revenue over four years reveals growth patterns, seasonality, and the impact of market fluctuations. Analyzing this data within the broader context of the income statement allows for a comprehensive understanding of profitability and operational efficiency. For example, consistently increasing sales revenue alongside controlled costs signals healthy growth.

-

Service Revenue:

For service-based businesses, this represents income earned from providing services. A four-year analysis reveals trends in service demand, pricing strategies, and client retention. Comparing service revenue growth with associated costs, such as labor and materials, provides insights into service profitability. For example, increasing service revenue with stagnant or declining costs indicates improved operational efficiency.

-

Investment Income:

This category encompasses income generated from investments, such as interest, dividends, and capital gains. Tracking investment income over time allows businesses to assess the performance of their investment portfolio and its contribution to overall profitability. Within a multi-year statement, this data can be analyzed alongside operational income to understand the balance between core business activities and investment strategies.

-

Other Revenue:

This category includes any revenue not derived from primary business operations or investments, such as rent from owned properties or gains from asset sales. Analyzing other revenue streams over a four-year period helps identify non-core income sources and assess their long-term viability. This information can be useful in identifying potential diversification opportunities or highlighting areas for cost optimization. For instance, consistently low rental income might prompt a business to consider divesting a property.

By analyzing these revenue streams within a four-year profit and loss statement, businesses gain a comprehensive understanding of their financial performance. This analysis enables informed decision-making regarding resource allocation, pricing strategies, and future investment opportunities. The long-term perspective offered by the statement facilitates the identification of sustainable growth patterns and potential risks, ultimately contributing to enhanced financial stability and strategic planning.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a four-year profit and loss statement, COGS analysis provides crucial insights into production efficiency, pricing strategies, and overall profitability trends. Understanding its components and trends over time is essential for informed financial decision-making.

-

Direct Materials:

This encompasses the raw materials used in production. Tracking direct material costs over four years reveals trends in raw material prices, supplier relationships, and potential supply chain vulnerabilities. For example, consistently rising direct material costs might indicate the need to explore alternative suppliers or adjust pricing strategies. Analyzing these trends within the context of revenue growth provides a clearer picture of margin pressure.

-

Direct Labor:

This includes the labor costs directly involved in producing goods. Analyzing direct labor costs over time reveals trends in labor efficiency, wage rates, and production capacity. For instance, rising direct labor costs coupled with stagnant production output could indicate declining labor productivity, prompting further investigation into process optimization or training needs. Comparing direct labor costs to revenue generated provides insights into labor cost as a percentage of sales.

-

Manufacturing Overhead:

This category includes all other costs directly associated with the production process, such as factory rent, utilities, and depreciation of manufacturing equipment. Monitoring manufacturing overhead over a four-year period reveals trends in production efficiency and cost control measures. For example, consistent increases in manufacturing overhead without corresponding increases in production volume may indicate inefficiencies requiring attention. Analyzing these trends alongside direct material and labor costs provides a comprehensive view of production costs and their impact on profitability.

-

Inventory Costs:

These costs include expenses related to storing and managing inventory, such as warehousing, insurance, and obsolescence. Analyzing inventory costs over time reveals trends in inventory management efficiency and potential areas for improvement. For example, consistently high inventory costs may indicate overstocking or inefficient warehousing practices. Understanding inventory cost trends can inform decisions regarding inventory control measures, potentially leading to cost savings and improved cash flow. This data, analyzed within the four-year profit and loss statement, provides insights into working capital management and its impact on overall financial performance.

Analyzing COGS within a four-year profit and loss statement provides a comprehensive understanding of a company’s production efficiency and cost structure. By understanding these trends, businesses can make informed decisions regarding pricing, production processes, and supply chain management, ultimately enhancing profitability and long-term financial stability. This analysis further allows for benchmarking against industry averages, offering a comparative perspective on cost competitiveness and areas for potential improvement.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). Within a four-year profit and loss statement, analyzing operating expenses provides crucial insights into a company’s efficiency, cost control measures, and overall profitability. Understanding these expenses and their trends is essential for informed financial management and strategic decision-making.

-

Selling, General, and Administrative Expenses (SG&A):

SG&A encompasses a broad range of expenses, including salaries for non-production staff, marketing and advertising costs, rent, utilities, and office supplies. Tracking SG&A over four years reveals trends in overhead costs, marketing effectiveness, and administrative efficiency. For example, consistently rising SG&A expenses without a corresponding increase in revenue may signal inefficiencies or overspending requiring attention. Analyzing SG&A as a percentage of revenue provides valuable insights into cost control and scalability.

-

Research and Development (R&D):

R&D expenses represent investments in innovation and new product development. Analyzing R&D spending over a four-year period provides insights into a company’s commitment to innovation and its potential for future growth. Consistent investment in R&D can signal long-term growth prospects, while fluctuating or declining R&D spending may indicate a shift in strategic focus. Comparing R&D expenses to revenue or profitability metrics helps assess the effectiveness of these investments.

-

Depreciation and Amortization:

These are non-cash expenses that reflect the decline in value of assets over time. Depreciation applies to tangible assets like equipment and buildings, while amortization applies to intangible assets like patents and copyrights. Tracking these expenses within the four-year profit and loss statement provides insights into the age and useful life of a company’s assets. Significant changes in depreciation or amortization expenses may indicate major asset acquisitions or disposals. Understanding these trends helps assess the company’s long-term capital investment strategy.

-

Impairment Charges:

Impairment charges represent a reduction in the carrying value of an asset when its market value declines significantly. These are non-recurring expenses that can indicate challenges in specific areas of the business. Analyzing impairment charges within the four-year statement provides insights into potential financial difficulties and management’s response to declining asset values. While not necessarily indicative of ongoing operational issues, recurring impairment charges in specific areas warrant further investigation and may signal underlying problems.

Analyzing operating expenses within a four-year profit and loss statement offers a crucial perspective on a company’s efficiency, cost management strategies, and overall financial health. By examining these expenses and their trends, stakeholders gain a comprehensive understanding of how resources are utilized and the impact on profitability. This analysis allows for informed decision-making regarding cost control measures, investment strategies, and operational efficiency improvements, ultimately contributing to long-term financial stability and sustainable growth. Comparing operating expense trends to revenue growth provides insights into operational leverage and scalability.

4. Profitability Trends

A multi-year income statement, particularly one spanning four years, provides the necessary data to analyze profitability trends. These trends offer crucial insights into a company’s ability to generate sustainable profits over time. This analysis considers factors such as revenue growth, cost management, and changes in profit margins. Examining these trends helps stakeholders understand the company’s financial trajectory and make informed decisions about future investments and strategic direction. Cause and effect relationships can be observed; for instance, consistent increases in operating expenses without corresponding revenue growth can lead to declining profit margins. Conversely, successful cost-cutting initiatives combined with revenue growth can result in improved profitability.

Consider a company experiencing consistent revenue growth over the four-year period. However, if its cost of goods sold (COGS) is also rising proportionally, gross profit margin may remain stagnant. This scenario highlights the importance of analyzing both revenue and cost trends simultaneously. Another example might involve a company implementing cost-cutting measures that lead to a decrease in operating expenses. If this decrease is accompanied by a decline in revenue, overall profitability might not improve as expected. These examples demonstrate the importance of considering the interplay between various factors influencing profitability. A thorough analysis of profitability trends helps stakeholders identify potential risks and opportunities, allowing for more proactive financial management.

Understanding profitability trends is crucial for assessing a company’s long-term financial health and sustainability. Identifying consistent patterns, whether positive or negative, enables stakeholders to make more accurate projections and develop informed strategies. Challenges in maintaining consistent profitability could arise from factors such as increased competition, changing market conditions, or internal operational inefficiencies. Addressing these challenges effectively requires a thorough understanding of the underlying trends and their contributing factors. The multi-year format provides the necessary historical context for informed decision-making and proactive adjustments to business strategies, contributing to long-term financial stability and sustainable growth. This analytical approach enhances the value of the income statement beyond a simple reporting tool, transforming it into a powerful instrument for strategic planning and financial management.

5. Financial Health Assessment

A four-year profit and loss statement provides a robust foundation for assessing a company’s financial health. This extended timeframe allows for a deeper understanding of performance trends, revealing underlying strengths and weaknesses that might be obscured by a shorter-term view. Analyzing revenue streams, cost structures, and profitability margins over multiple years offers a comprehensive perspective on financial stability and sustainability. Cause-and-effect relationships become clearer, for example, demonstrating how consistent cost control measures contribute to improved profit margins over time or how fluctuating revenues impact long-term financial stability. This information is critical for informed decision-making, enabling stakeholders to develop strategies that promote sustainable growth and mitigate potential risks.

Consider a company exhibiting steady revenue growth within a four-year statement. However, a simultaneous analysis of operating expenses might reveal escalating costs, ultimately eroding profit margins. This scenario, readily apparent within a multi-year framework, highlights a potential financial vulnerability despite top-line growth. Conversely, a company might demonstrate stable revenues but declining cost of goods sold (COGS) over the four-year period. This trend suggests improving production efficiencies, potentially indicating strengthening financial health. These examples underscore the importance of a multi-year perspective in accurately assessing financial health, providing insights beyond single-year snapshots.

A thorough financial health assessment, facilitated by a four-year profit and loss statement, is crucial for various stakeholders. Investors use this information to evaluate investment opportunities, lenders rely on it for creditworthiness assessments, and management leverages it for strategic planning and resource allocation. Understanding historical performance trends provides a foundation for projecting future performance, assessing risk, and developing informed strategies for sustainable growth. Challenges, such as consistently declining profitability or escalating operating expenses, can be identified and addressed proactively. By leveraging the insights gained from a multi-year analysis, stakeholders can make more informed decisions, contributing to improved financial outcomes and long-term stability.

6. Comparison Over Time

Analyzing financial performance over an extended period is crucial for understanding trends and making informed decisions. A four-year profit and loss statement template facilitates this analysis, enabling stakeholders to compare key financial metrics across multiple years. This comparative approach provides valuable insights into a company’s progress, challenges, and overall financial trajectory, enabling proactive adjustments to strategies and improved financial outcomes. This temporal analysis reveals the impact of various factors on financial performance, such as market fluctuations, economic downturns, or internal operational changes. It also highlights the effectiveness of strategic initiatives, cost-cutting measures, or investment decisions, providing a comprehensive view of the company’s financial journey.

-

Revenue Growth:

Comparing revenue year-over-year reveals growth patterns, stagnation, or decline. For instance, consistent revenue growth indicates increasing market share or successful product launches, while declining revenue may signal market saturation or competitive pressures. Within a four-year timeframe, this analysis can reveal cyclical patterns or long-term growth trajectories, informing revenue projections and strategic planning. Identifying periods of accelerated or decelerated growth can prompt further investigation into underlying factors, such as market changes or the impact of specific marketing campaigns.

-

Cost Management:

Analyzing cost trends, such as cost of goods sold (COGS) and operating expenses, over four years provides insights into cost control effectiveness and efficiency improvements. For example, a consistent decrease in COGS as a percentage of revenue suggests improved production efficiencies, while escalating operating expenses might indicate overspending or administrative inefficiencies. Comparing cost trends with revenue growth allows for analysis of operational leverage and profitability. Furthermore, this long-term view can reveal the impact of cost-cutting initiatives or investments in automation, providing valuable data for future cost management strategies.

-

Profitability Margins:

Tracking gross profit margin, operating profit margin, and net profit margin over multiple years reveals trends in profitability and the effectiveness of pricing strategies. For instance, increasing profit margins indicate improving profitability, while declining margins may signal pricing pressure or cost overruns. A four-year comparison can reveal the impact of external factors, such as economic downturns or changes in competitive landscapes, on profit margins. This analysis also highlights the long-term impact of strategic decisions, such as investments in research and development or expansion into new markets.

-

Financial Ratios:

Analyzing key financial ratios, such as liquidity ratios, profitability ratios, and solvency ratios, across four years provides a comprehensive assessment of financial health and stability. For example, consistently improving current and quick ratios indicate strengthening liquidity, while declining debt-to-equity ratios suggest improving financial leverage. Comparing these ratios over time reveals trends in financial risk and stability, informing investment decisions and creditworthiness assessments. This analysis allows stakeholders to identify potential financial vulnerabilities or strengths, facilitating proactive risk management and strategic planning.

By comparing these key metrics over time, using a four-year profit and loss statement template, stakeholders gain valuable insights into a company’s financial performance and underlying trends. This comparative analysis enables informed decision-making, proactive adjustments to business strategies, and enhanced financial outcomes. The extended timeframe offers a more nuanced understanding of the company’s financial trajectory, revealing both challenges and opportunities, and contributing to long-term financial stability and sustainable growth.

Key Components of a Multi-Year Income Statement

A comprehensive multi-year income statement, particularly one spanning four years, provides crucial insights into a company’s financial performance and trends. Understanding its key components is essential for informed financial analysis and strategic decision-making.

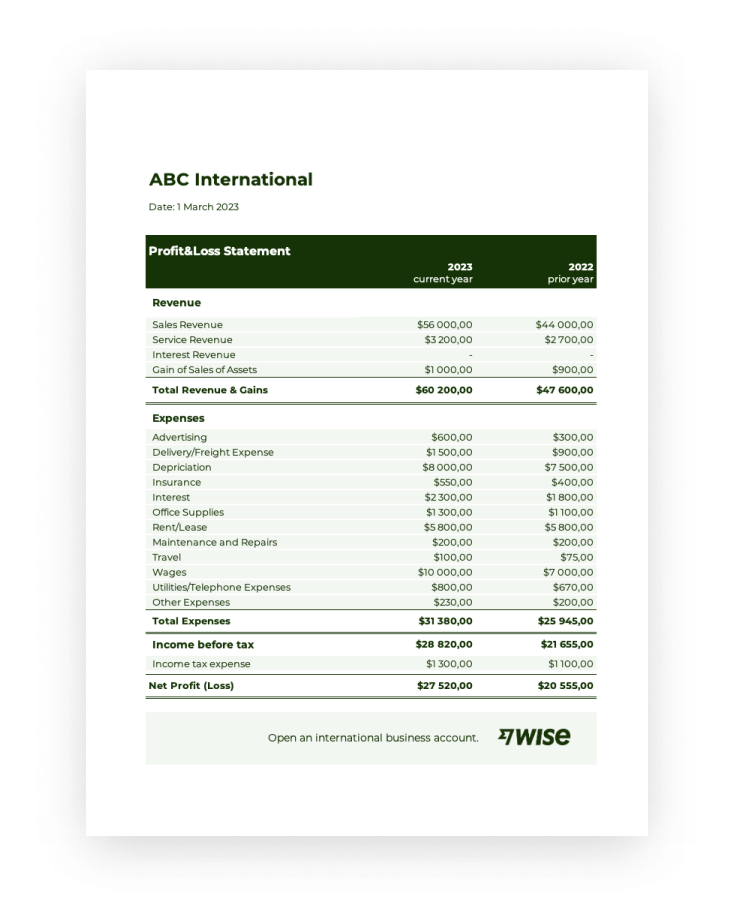

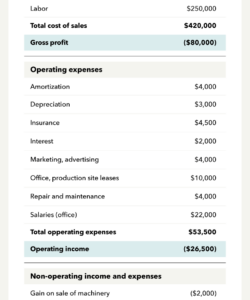

1. Revenue: This section details all revenue streams generated over the four-year period. It includes sales revenue, service revenue, investment income, and any other income sources. Analyzing revenue trends reveals growth patterns, market fluctuations, and the effectiveness of sales and marketing strategies. Disaggregating revenue into different streams offers a granular understanding of income sources and their respective contributions.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold. This section details direct materials, direct labor, manufacturing overhead, and inventory costs. Analyzing COGS trends reveals insights into production efficiency, cost control measures, and the impact of raw material price fluctuations. Understanding COGS is crucial for assessing gross profit margins and overall profitability.

3. Operating Expenses: This section encompasses all expenses incurred in running the core business operations, excluding COGS. It includes selling, general, and administrative expenses (SG&A), research and development (R&D), depreciation and amortization, and impairment charges. Analyzing operating expenses reveals trends in overhead costs, marketing effectiveness, and administrative efficiency, providing valuable insights into cost management practices.

4. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. Analyzing gross profit trends helps assess the efficiency of production and pricing strategies.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of core business operations. Analyzing operating income trends reveals the impact of cost management and operational efficiency on overall profitability.

6. Net Income: This represents the bottom line the company’s profit after all expenses, including taxes and interest, have been deducted. Analyzing net income trends provides a comprehensive assessment of the company’s overall profitability and financial performance.

Through careful examination of these components within a multi-year framework, stakeholders gain a comprehensive understanding of a company’s financial performance, its ability to generate sustainable profits, and its overall financial health. This information is critical for informed decision-making, strategic planning, and effective financial management.

How to Create a Four-Year Profit and Loss Statement

Creating a comprehensive four-year profit and loss statement involves a systematic approach to gathering, organizing, and presenting financial data. This process facilitates informed analysis of performance trends, supports strategic decision-making, and enhances stakeholder understanding of a company’s financial health. The following steps outline the process:

1. Gather Financial Data: Compile all relevant financial records, including income statements, balance sheets, and cash flow statements for the past four years. Ensure data accuracy and completeness for reliable analysis. This includes detailed records of revenue streams, cost of goods sold, operating expenses, and other relevant financial information.

2. Choose a Template or Software: Select a suitable template, either a pre-designed spreadsheet or specialized accounting software. Ensure the chosen tool allows for clear presentation of data across multiple years. Templates often provide pre-built formulas and formatting for streamlined calculations and consistent presentation.

3. Input Data Year by Year: Enter financial data for each year into the template, ensuring accurate categorization and alignment across the four-year period. Maintain consistency in data entry to avoid errors and facilitate accurate comparisons across years. Clearly label each year’s data for easy identification and analysis.

4. Calculate Key Metrics: Calculate key financial metrics, including gross profit, operating income, and net income for each year. Use formulas within the template or software to automate these calculations and ensure accuracy. These calculations provide the foundation for analyzing profitability trends and assessing overall financial performance.

5. Format for Clarity: Format the statement for clear and concise presentation. Use consistent formatting for headings, subheadings, and numerical data. Ensure clear labeling of all figures and metrics for easy interpretation. Consider using visual aids, such as charts and graphs, to highlight key trends and comparisons.

6. Review and Verify: Thoroughly review the completed statement for accuracy and completeness. Verify all calculations and ensure data consistency across all four years. This final review is crucial for ensuring the reliability of the statement and the validity of any subsequent analysis.

7. Analyze and Interpret: Analyze the statement to identify key trends, patterns, and insights into financial performance. Compare key metrics year-over-year to assess progress, identify areas for improvement, and inform strategic decision-making. This analysis provides valuable information for stakeholders, enabling informed decisions and proactive financial management.

8. Document Assumptions and Context: Include a section outlining any significant assumptions made during the creation of the statement, such as projected growth rates or economic forecasts. Provide context surrounding major events impacting financial performance, like acquisitions, divestitures, or market shifts, to enhance understanding. This added context ensures transparency and allows for a more nuanced interpretation of the financial data.

A well-constructed four-year profit and loss statement offers valuable insights into a company’s financial trajectory. This structured approach to data gathering, organization, and presentation enhances understanding of past performance, informs future projections, and empowers stakeholders to make data-driven decisions.

A multi-year income statement provides a crucial tool for understanding long-term financial performance. Analysis of revenue streams, cost of goods sold, operating expenses, and profitability trends over an extended period offers valuable insights into a company’s financial health, stability, and potential for sustainable growth. Comparison across multiple years facilitates the identification of recurring patterns, the assessment of strategic initiatives’ effectiveness, and the development of informed projections. Careful examination of these elements allows stakeholders to gain a comprehensive understanding of the factors influencing financial outcomes and make data-driven decisions.

Leveraging the insights provided by this type of financial statement empowers businesses to proactively adapt to changing market conditions, optimize resource allocation, and enhance long-term financial stability. A thorough understanding of historical performance serves as a cornerstone for effective strategic planning and informed decision-making, ultimately contributing to sustained growth and financial success. This analytical approach transforms financial reporting from a retrospective summary into a proactive tool for future success.