Utilizing such a pre-designed structure offers several advantages. It ensures consistency and comparability across reporting periods, simplifying trend analysis and performance evaluation. The structured format also facilitates data entry, reduces errors, and saves time in report preparation. Furthermore, it promotes a clear understanding of the financial status for investors, creditors, and other interested parties, enhancing transparency and trust.

This foundational understanding allows for a deeper exploration of related topics, including financial ratio analysis, accounting principles, and the broader context of financial reporting. It serves as a gateway to comprehending a company’s financial strength and stability, informing strategic decisions and promoting sustainable growth.

1. Standardized Structure

A standardized structure is fundamental to the efficacy of a statement of financial position template. Consistency in presentation allows for efficient analysis, comparison, and interpretation of financial data. This structure ensures that information is presented systematically, facilitating understanding and reducing the risk of misinterpretation.

- Consistent FormattingConsistent formatting, including the use of predefined rows and columns for assets, liabilities, and equity, ensures uniformity across reporting periods. This allows for easy tracking of changes and trends over time. For example, consistent placement of “Cash and Cash Equivalents” as the first line item under current assets allows for immediate comparison across multiple balance sheets.

- Clearly Defined CategoriesClearly defined categories for different types of assets, liabilities, and equity provide a structured framework for organizing financial information. This categorization, adhering to established accounting principles, ensures that similar items are grouped together, facilitating accurate reporting. For instance, separating current liabilities from long-term liabilities provides a clear picture of short-term and long-term obligations.

- Predetermined CalculationsTemplates often include predetermined calculations, such as totaling assets, liabilities, and equity, ensuring accuracy and saving time. Automated calculations minimize the risk of manual errors and provide a readily available check on the balance sheets accuracy, ensuring the fundamental accounting equation is maintained. This automatic calculation of totals is a crucial control measure.

- Comparative Analysis EnabledThe standardized structure allows for seamless comparison of financial data across different periods or entities. This comparability is crucial for identifying trends, benchmarking performance, and making informed decisions. Analysts can readily compare key ratios, such as the current ratio, across different companies within the same industry using standardized balance sheets.

These facets of a standardized structure contribute significantly to the usability and value of the statement of financial position. By ensuring consistency, clarity, and accuracy, the standardized template enables informed decision-making based on a reliable and readily understandable representation of a company’s financial position.

2. Balance Sheet Snapshot

The term “balance sheet snapshot” encapsulates the core function of a statement of financial position template: to provide a concise view of a company’s financial standing at a specific point in time. This “snapshot” captures the cumulative effects of all financial transactions since the company’s inception, presenting a summarized overview of assets, liabilities, and equity. This static representation, while not reflecting the dynamic flow of transactions, offers crucial insights into the company’s resource allocation, obligations, and overall financial health. For instance, a balance sheet dated December 31, 2023, presents the company’s financial position on that specific date, reflecting the net result of all financial activities throughout 2023.

The template serves as the framework for constructing this snapshot. It dictates the organization and presentation of financial data, ensuring consistency and comparability. The template’s predefined structure ensures that essential elements, such as current assets, long-term liabilities, and shareholder’s equity, are clearly delineated and presented in a standardized manner. This structured presentation facilitates analysis and interpretation, enabling stakeholders to quickly grasp the company’s financial status. Imagine two companies using different formats for presenting their assets; comparison would be difficult. A standardized template addresses this challenge, allowing for straightforward comparisons between companies or across reporting periods for the same company. This promotes transparency and informed decision-making by investors, creditors, and management.

Understanding the connection between the balance sheet snapshot and the underlying template is essential for interpreting financial information effectively. The template ensures the snapshot’s reliability and comparability, allowing stakeholders to assess a company’s financial strength, liquidity, and solvency. However, the static nature of the snapshot must be acknowledged. It represents a single moment in time and does not reflect the continuous flow of transactions. Analyzing trends requires comparing snapshots across multiple reporting periods, providing a more dynamic view of the company’s financial performance and trajectory. This understanding is crucial for comprehensive financial analysis and informed decision-making regarding investment, lending, and internal management strategies.

3. Facilitates Analysis

A key benefit of a standardized statement of financial position template lies in its ability to facilitate analysis. The structured presentation of financial data, categorized consistently across reporting periods and entities, provides a solid foundation for various analytical techniques. This allows stakeholders to derive meaningful insights into a company’s financial health, performance trends, and potential risks. Cause and effect relationships become clearer. For example, an increase in long-term debt coupled with a decrease in retained earnings might signal aggressive expansion financed through borrowing, prompting further investigation into the viability of such strategies. Without a standardized template, identifying these interconnected changes would be significantly more challenging.

Consider the calculation of key financial ratios. A consistent template ensures uniformity in the data used for these calculations, enabling accurate comparisons across different periods or companies. For instance, calculating the current ratio (current assets divided by current liabilities) requires readily identifiable and comparable figures for current assets and current liabilities. A standardized template ensures these figures are consistently located and presented, allowing for reliable ratio analysis and trend identification. This consistency enables meaningful comparisons between competitors or tracking a single company’s liquidity over time. Imagine trying to compare the liquidity of two companies, one reporting “cash and equivalents” and the other reporting “liquid assets” without clear definitions. A standardized template eliminates this ambiguity. The template’s facilitation of analysis becomes crucial for investment decisions, credit assessments, and internal performance evaluations.

The ability to facilitate analysis positions the statement of financial position template as a critical tool for informed decision-making. While the template itself does not perform the analysis, it provides the structured, comparable data essential for meaningful insights. Challenges arise when data is inconsistently presented or lacks standardization. Overcoming these challenges through standardized templates strengthens financial transparency, enhances comparability, and empowers stakeholders to make sound judgments based on a clear understanding of a company’s financial position. This understanding contributes significantly to the broader goal of assessing financial stability and making strategic decisions based on reliable data.

4. Enhances Comparability

Comparability, a cornerstone of financial analysis, relies heavily on the standardized structure provided by a statement of financial position template. This standardization allows for meaningful comparisons of financial data across different reporting periods within the same entity or between different entities within the same industry. Such comparisons are essential for identifying trends, benchmarking performance, and making informed decisions about resource allocation, investment strategies, and creditworthiness.

- Consistent PresentationConsistent presentation of financial information, facilitated by the template’s structured format, is fundamental for comparability. Using standardized line items for assets, liabilities, and equity ensures that similar elements are presented uniformly across different balance sheets. This consistency enables direct comparison of specific financial elements, such as the level of cash and cash equivalents or the amount of long-term debt, between different companies or across different reporting periods for the same company. Without this consistency, drawing meaningful comparisons would be significantly more challenging, potentially leading to inaccurate conclusions.

- Temporal AnalysisAnalyzing trends over time requires comparing financial data from multiple reporting periods. A consistent template facilitates this temporal analysis by ensuring that the same metrics are tracked and presented in the same manner across different periods. This allows analysts to identify changes in key financial ratios, such as profitability or solvency, over time, revealing insights into a company’s financial trajectory and performance. For example, tracking the debt-to-equity ratio over several years can reveal whether a company is becoming more or less leveraged, informing credit risk assessments.

- Benchmarking Against CompetitorsBenchmarking a company’s performance against its competitors provides valuable context for evaluating its financial health and competitiveness. A standardized statement of financial position template allows for direct comparison of key metrics, such as profitability margins or asset turnover ratios, between different companies within the same industry. This benchmarking enables identification of strengths and weaknesses relative to competitors, informing strategic decision-making and performance improvement initiatives. For instance, comparing inventory turnover rates can reveal differences in efficiency and inventory management practices.

- Industry AnalysisStandardized financial reporting facilitated by consistent templates allows for aggregated analysis of industry trends. By comparing key financial metrics across multiple companies within a specific industry, analysts can identify common characteristics, assess overall industry health, and understand the factors driving industry performance. This aggregated data provides valuable insights for investors, regulators, and industry participants, enabling more informed decision-making at both the company and industry levels.

The enhanced comparability afforded by a standardized statement of financial position template is crucial for robust financial analysis. By ensuring consistency and uniformity in data presentation, the template empowers stakeholders to draw meaningful comparisons, identify trends, benchmark performance, and ultimately, make informed decisions based on a clear and comprehensive understanding of a company’s financial position within its broader context.

5. Improved Transparency

Transparency in financial reporting is paramount for building trust and enabling informed decision-making. A well-structured statement of financial position template plays a crucial role in fostering this transparency by providing a clear, standardized framework for presenting financial information. This standardized presentation makes financial data more accessible and understandable to a wider range of stakeholders, including investors, creditors, regulators, and the public. Clarity and accessibility are key benefits. Obscured or inconsistent financial reporting can erode trust and hinder effective analysis. A robust template mitigates these risks, promoting confidence in the reliability and integrity of the reported information.

- Standardized DisclosureStandardized disclosure, facilitated by a consistent template, ensures that all material financial information is presented in a uniform and readily accessible manner. This reduces the risk of selective disclosure or manipulation of data, promoting a fair and accurate representation of a company’s financial position. For example, consistent reporting of contingent liabilities across all companies within a sector allows for more accurate comparisons and risk assessments. Without such standardization, some companies might obscure potential liabilities, hindering true transparency.

- Clarity and AccessibilityA well-designed template enhances the clarity and accessibility of financial information by presenting complex data in a structured and understandable format. This allows stakeholders with varying levels of financial expertise to grasp the key aspects of a company’s financial health. Imagine trying to decipher a balance sheet with inconsistent terminology and disorganized line items. A standardized template eliminates this confusion, making the information accessible to a broader audience, regardless of their financial acumen. This accessibility is crucial for empowering informed decision-making across all stakeholder groups.

- Enhanced ScrutinyImproved transparency through standardized reporting invites greater scrutiny from stakeholders. This increased scrutiny can act as a deterrent against financial misrepresentation and encourages greater accountability in financial reporting practices. Knowing that their financial statements will be analyzed against a standardized framework incentivizes companies to maintain accurate and transparent records. This heightened scrutiny contributes to greater market discipline and enhances the overall integrity of financial reporting. For example, consistent reporting of asset valuations allows analysts to easily compare valuation methods across companies, potentially revealing discrepancies or inconsistencies that warrant further investigation.

- Reduced Information AsymmetryInformation asymmetry, where one party has more information than another, can create an uneven playing field in financial markets. Standardized reporting helps reduce information asymmetry by ensuring that all stakeholders have access to the same fundamental financial information. This leveling of the information playing field promotes fairer valuations, reduces the potential for exploitation, and fosters greater trust among market participants. Consider a scenario where a company discloses key financial details only to a select group of investors. Standardized reporting mitigates such scenarios, promoting equal access to crucial information for all stakeholders.

These facets of improved transparency, enabled by a robust statement of financial position template, contribute significantly to the overall health and integrity of financial markets. By promoting clarity, accessibility, and accountability, standardized reporting fosters trust among stakeholders, empowers informed decision-making, and strengthens the foundations of a stable and efficient financial system. Moving forward, continued emphasis on standardized reporting practices will be crucial for maintaining market integrity and promoting sustainable economic growth. Furthermore, integrating technology for automated data extraction and analysis from standardized templates can further enhance transparency and efficiency in financial reporting.

Key Components of a Statement of Financial Position Template

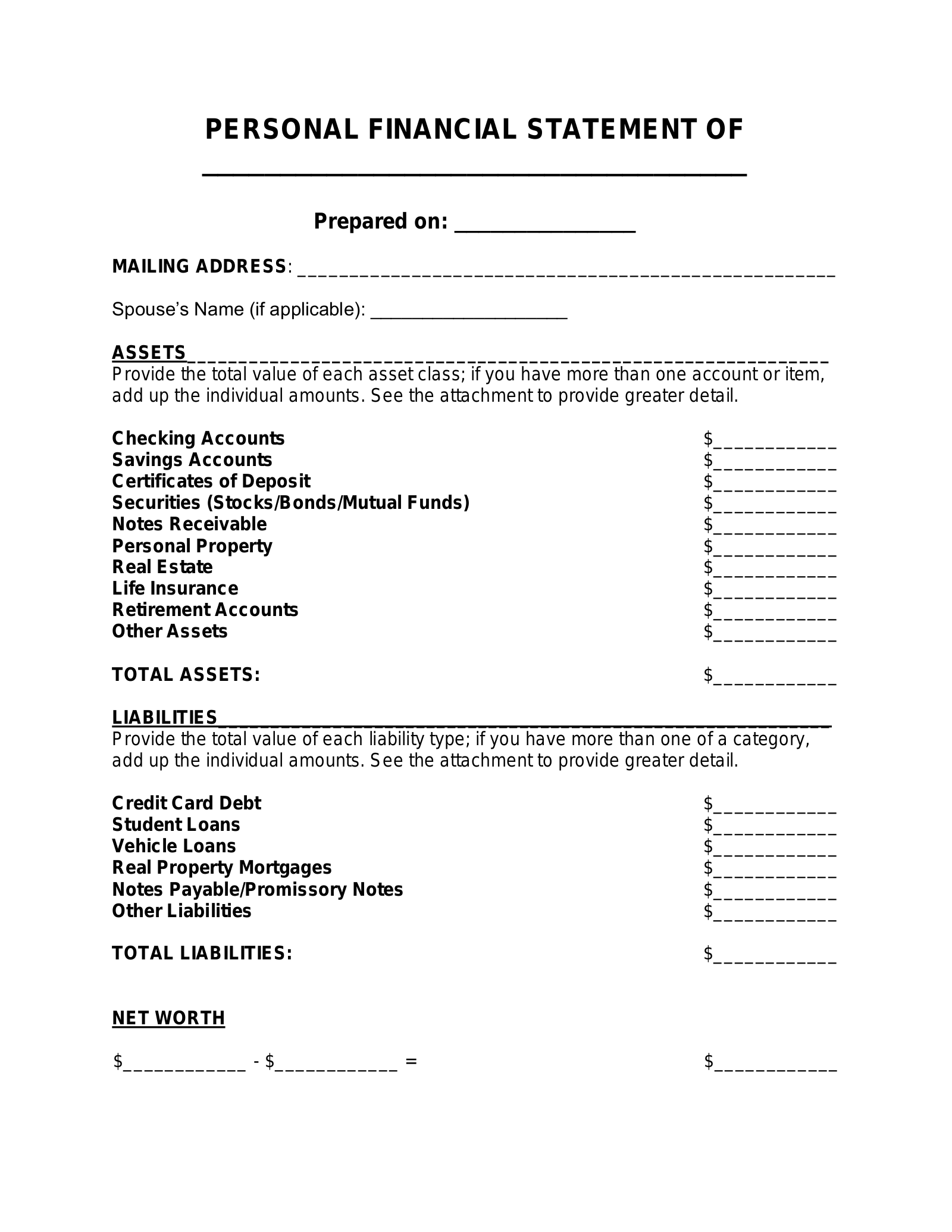

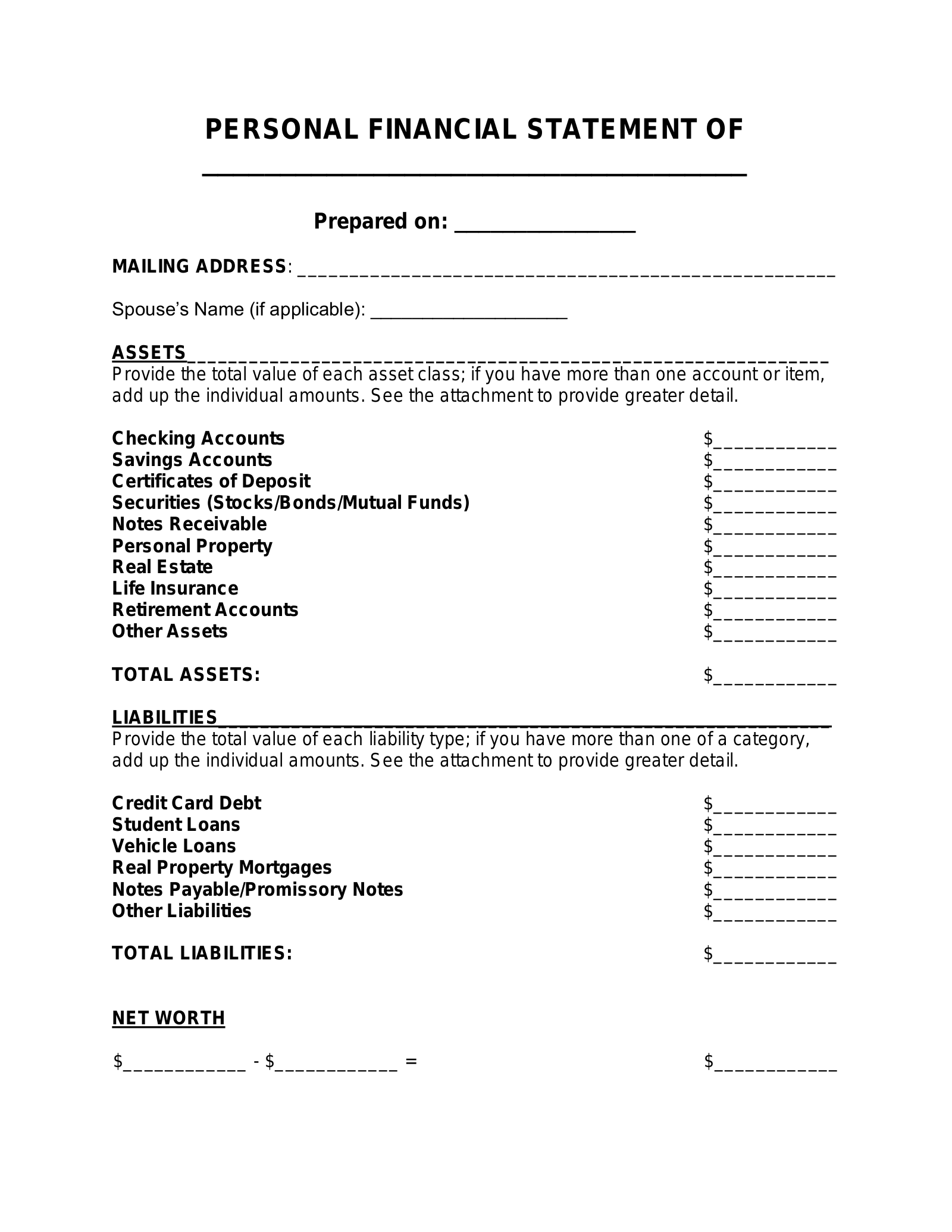

A comprehensive understanding of a company’s financial position requires familiarity with the key components constituting a statement of financial position template. These components, structured according to established accounting principles, provide a standardized framework for presenting a concise and accurate overview of a company’s assets, liabilities, and equity.

1. Assets: Represent resources controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity. These are categorized as current (expected to be realized within one year) and non-current (held for longer than one year). Examples include cash, accounts receivable, inventory, property, plant, and equipment.

2. Liabilities: Represent present obligations of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits. These are also categorized as current (due within one year) and non-current (due beyond one year). Examples include accounts payable, short-term loans, and long-term debt.

3. Equity: Represents the residual interest in the assets of the entity after deducting all its liabilities. This reflects the owners’ stake in the company. Components of equity can include common stock, retained earnings, and additional paid-in capital.

4. Heading: Clearly identifies the entity, the statement type (“Statement of Financial Position”), and the reporting date. This provides crucial context for interpreting the information presented.

5. Units of Measurement: Specifies the monetary unit (e.g., USD, EUR) used in the statement, ensuring consistent interpretation of the financial figures.

6. Subtotals and Totals: Strategic use of subtotals within asset, liability, and equity sections provides a clearer picture of the composition of each category. Total assets, total liabilities, and total equity are clearly presented, adhering to the fundamental accounting equation (Assets = Liabilities + Equity).

7. Notes to the Financial Statements: While not directly part of the statement itself, these accompanying notes provide essential details and explanations regarding the figures presented. They offer further context and clarification on accounting policies, significant accounting estimates, and other relevant information necessary for a comprehensive understanding of the companys financial position.

These elements form the core structure of a statement of financial position, enabling a standardized and transparent presentation of a company’s financial status. This standardized framework ensures comparability across reporting periods and between different entities, facilitating informed decision-making by stakeholders reliant on accurate and accessible financial information.

How to Create a Statement of Financial Position Template

Creating a standardized statement of financial position template ensures consistency, accuracy, and comparability in financial reporting. This structured approach facilitates analysis and enhances transparency for stakeholders. The following steps outline the process of developing a robust and effective template.

1. Define the Reporting Entity: Clearly identify the entity for which the template will be used. This ensures that the template captures the specific financial activities and structure of the intended organization. Specifying the legal entity name avoids ambiguity and ensures proper attribution of financial data.

2. Establish Reporting Period and Currency: Specify the reporting period (e.g., fiscal year, quarter) and the currency (e.g., USD, EUR) for the template. This provides essential context for the financial data presented. Consistent reporting periods and currency facilitate trend analysis and cross-entity comparisons.

3. Structure the Asset Section: Categorize assets into current and non-current classifications. Common line items within current assets include cash and cash equivalents, accounts receivable, and inventory. Non-current assets typically include property, plant, and equipment, intangible assets, and long-term investments.

4. Structure the Liabilities Section: Categorize liabilities into current and non-current classifications. Current liabilities encompass obligations due within one year, such as accounts payable, short-term loans, and accrued expenses. Non-current liabilities include long-term debt, deferred revenue, and lease obligations.

5. Structure the Equity Section: Outline the components of equity, which represent the residual interest in the assets after deducting liabilities. Common equity components include common stock, preferred stock, additional paid-in capital, retained earnings, and treasury stock.

6. Incorporate Formulas and Calculations: Embed formulas to automate calculations within the template, such as totaling assets, liabilities, and equity. Automated calculations minimize the risk of manual errors and ensure that the fundamental accounting equation (Assets = Liabilities + Equity) is always maintained. This also streamlines the process of preparing financial statements.

7. Design for Clarity and Readability: Employ clear and concise labels for each line item. Use consistent formatting, including font styles and cell borders, to enhance readability. A visually appealing and well-organized template facilitates efficient data entry and interpretation.

8. Provide Space for Notes and Disclosures: Allocate space within or alongside the template for accompanying notes and disclosures. These supplementary details offer crucial context and clarification regarding the figures presented in the statement of financial position, enhancing transparency and understanding.

A well-designed template provides a robust framework for presenting a clear, accurate, and consistent snapshot of a company’s financial position. This structure facilitates analysis, comparison, and informed decision-making by stakeholders, enhancing transparency and fostering trust in financial reporting.

Standardized structures for presenting financial position are essential for clear communication and informed decision-making. These structured templates provide a consistent framework for organizing and disclosing assets, liabilities, and equity, facilitating analysis, comparison, and enhanced transparency. Understanding the key components, benefits, and creation process of these templates allows stakeholders to effectively interpret financial information and assess an entity’s financial health. This structured approach to financial reporting is crucial for maintaining accountability and promoting trust within the financial ecosystem.

Effective utilization of statement of financial position templates promotes greater financial transparency and strengthens the overall integrity of financial reporting. As financial landscapes become increasingly complex, the importance of standardized reporting practices will only continue to grow. Embracing these standardized templates contributes to a more informed and efficient marketplace, fostering stability and sustainable economic growth. Continued focus on refining and adapting these templates to evolving reporting needs will remain a critical aspect of maintaining trust and promoting sound financial practices.