Utilizing a standardized format for reporting financial performance offers several advantages. It promotes transparency and accountability by ensuring consistent reporting practices. This consistency simplifies the process of comparing financial data across different companies and timeframes, enabling informed decision-making. Furthermore, adherence to established accounting principles enhances the credibility and reliability of financial reports, fostering trust among stakeholders.

This consistent framework for presenting financial data allows for a more in-depth understanding of an organization’s financial health. The following sections will explore specific aspects of GAAP-compliant cash flow reporting, including detailed explanations of operating, investing, and financing activities, as well as practical examples and further resources.

1. Standardized Format

Standardization is a cornerstone of GAAP-based cash flow reporting. A standardized format ensures consistent presentation of financial data across different organizations and reporting periods. This consistency facilitates comparability, allowing stakeholders to analyze financial performance effectively. Without a standardized framework, comparing cash flow information from different entities would be significantly more challenging due to variations in presentation and classification. For example, one company might classify interest payments as an operating activity while another treats it as a financing activity. A standardized format eliminates this ambiguity, promoting transparency and enabling accurate benchmarking.

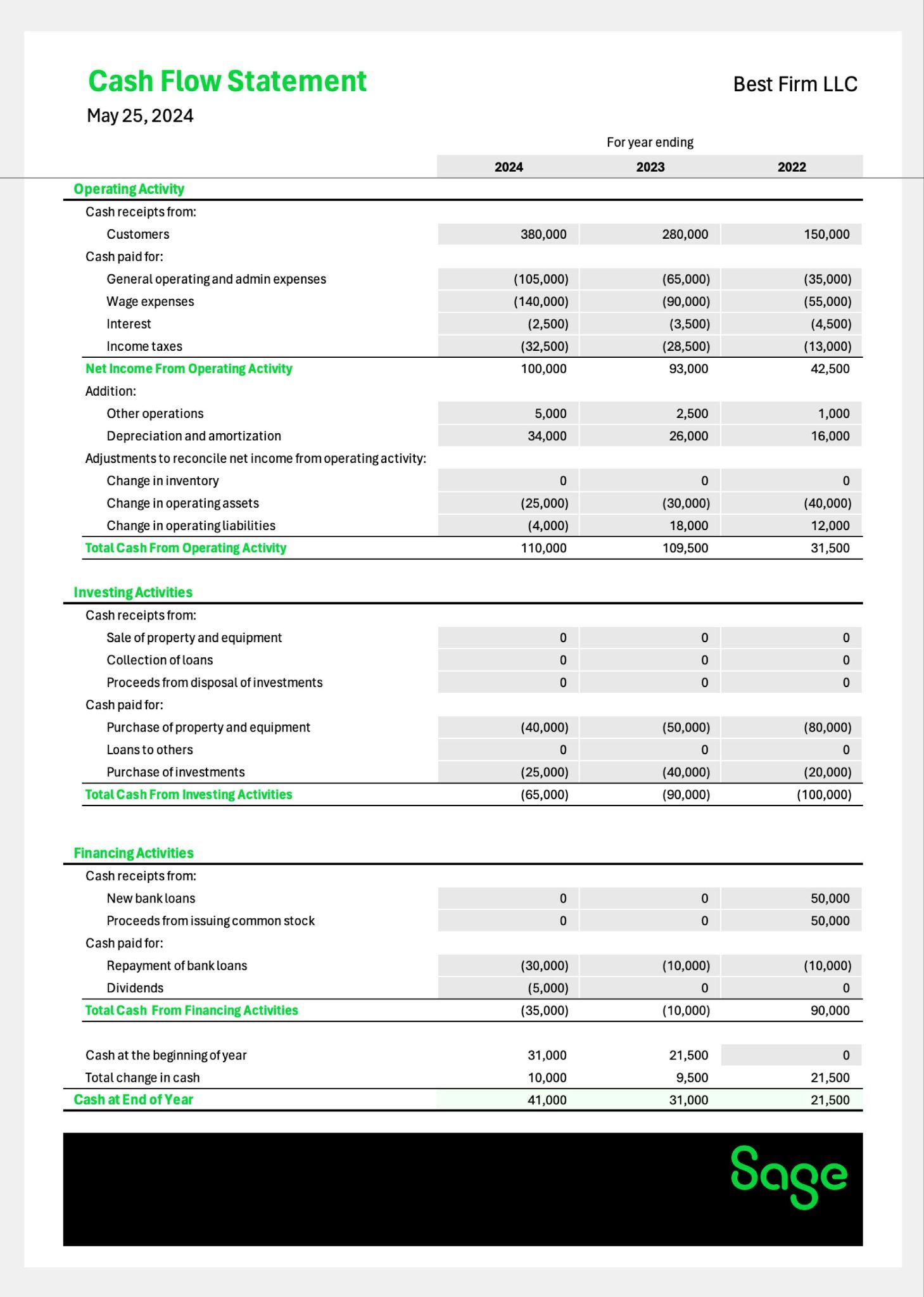

The standardized format mandates the classification of cash flows into three core categories: operating activities, investing activities, and financing activities. This structured approach provides a comprehensive view of how an entity generates and utilizes cash. Operating activities represent the cash flows generated from the core business operations. Investing activities encompass capital expenditures, acquisitions, and divestitures. Financing activities relate to debt, equity, and dividend transactions. This segregation of cash flows allows analysts to assess the financial health of an organization from multiple perspectives. For instance, strong cash flow from operations might indicate a sustainable business model, while substantial cash outflows for investing activities could signal expansion or modernization efforts.

Understanding the standardized format is crucial for interpreting and utilizing cash flow information effectively. This consistency fosters informed decision-making by investors, creditors, and other stakeholders. The ability to compare financial data across different organizations empowers users to identify trends, assess risks, and evaluate performance. While the specific details of cash flow statements might vary across industries and individual entities, adherence to a standardized format ensures a baseline level of comparability and transparency, critical for the efficient allocation of capital and resources.

2. Three Distinct Categories

A core principle of GAAP-based cash flow statements lies in the categorization of cash flows into three distinct activities: operating, investing, and financing. This structured approach provides a comprehensive overview of an entity’s cash sources and uses, enabling stakeholders to analyze financial performance and make informed decisions. Understanding these categories is fundamental to interpreting a cash flow statement effectively.

- Operating ActivitiesThese activities represent the cash flows generated from the core business operations of an entity. They reflect the day-to-day transactions involved in producing and selling goods or services. Examples include cash received from customers, cash paid to suppliers, and cash paid for salaries and wages. Analyzing operating cash flows offers insights into the profitability and sustainability of an entity’s core business. Strong operating cash flow often indicates a healthy and sustainable business model.

- Investing ActivitiesInvesting activities relate to the acquisition and disposal of long-term assets. These activities provide information about an entity’s capital expenditures, investments in other companies, and proceeds from the sale of assets. Examples include purchasing property, plant, and equipment (PP&E), acquiring other businesses, or selling investments. Cash flows from investing activities offer insights into an entity’s long-term strategic direction and growth prospects. Significant cash outflows for investments might suggest expansion plans, while substantial inflows could indicate divestment strategies.

- Financing ActivitiesFinancing activities concern an entity’s capital structure, including debt, equity, and dividends. These activities reflect how an entity raises capital and returns it to investors. Examples include issuing debt, repurchasing stock, and paying dividends. Analyzing financing activities reveals how an entity funds its operations and growth. Large debt issuances might signal aggressive expansion plans, while substantial dividend payments could indicate a mature and stable business.

By segregating cash flows into these three distinct categories, the GAAP cash flow statement template provides a detailed and nuanced understanding of an entity’s financial health. Analyzing each category independently, as well as their interplay, allows stakeholders to assess an organization’s financial performance, identify trends, and make informed decisions about resource allocation and investment strategies. This structured approach is crucial for evaluating an entity’s ability to generate cash, meet its financial obligations, and fund future growth.

3. Operating Activities

Operating activities form a crucial component of the GAAP cash flow statement template, providing insights into the cash flows generated from an entity’s core business operations. This section of the statement focuses on the cash inflows and outflows directly related to the production and delivery of goods or services. Accurately representing operating activities is essential for assessing an organization’s financial health and sustainability. The GAAP framework mandates specific classifications and treatments for various cash flows within this category, ensuring consistency and comparability across different entities. This standardized approach facilitates analysis by investors, creditors, and other stakeholders interested in evaluating the core profitability and operational efficiency of a business.

The relationship between operating activities and the overall GAAP cash flow statement template is one of integral connection. Operating activities serve as a key indicator of a company’s ability to generate cash from its core business functions. For instance, cash received from customers represents a primary inflow, while payments to suppliers and employees constitute significant outflows. Other examples include cash paid for interest expense or received from interest income. The net cash flow from operating activities, derived after considering all these inflows and outflows, provides a crucial measure of an organization’s ability to fund its operations internally. This metric is often considered a more reliable indicator of financial strength than net income, as it is less susceptible to accounting manipulations. A consistently positive cash flow from operating activities suggests a sustainable business model capable of generating sufficient cash to cover operating expenses, invest in growth opportunities, and meet financial obligations.

Understanding operating activities within the context of the GAAP cash flow statement template is essential for informed financial analysis. By examining the components of operating cash flow, stakeholders can gain valuable insights into the efficiency of a company’s core business processes, its ability to manage working capital, and its overall financial health. Challenges can arise in classifying certain cash flows, such as interest payments or income from investments. GAAP guidelines provide specific criteria for proper classification, ensuring consistency and transparency. Accurate representation of operating activities is crucial for evaluating a company’s financial performance and making informed investment decisions. Analyzing this section alongside investing and financing activities provides a comprehensive understanding of an organization’s cash flow dynamics and its ability to create long-term value.

4. Investing Activities

Investing activities within a GAAP cash flow statement template detail the acquisition and disposal of long-term assets. This section provides crucial insights into an organization’s capital allocation strategies, growth prospects, and overall financial health. The accurate representation of investing activities is essential for stakeholders to assess the long-term viability and potential return on investment of a business. GAAP principles mandate specific classifications for these cash flows, ensuring consistency and comparability across different entities and reporting periods. This standardization facilitates informed decision-making by investors, creditors, and analysts seeking to understand how an organization invests its resources.

The importance of investing activities as a component of the GAAP cash flow statement template stems from their direct impact on an organization’s future earning potential. Capital expenditures, such as investments in property, plant, and equipment (PP&E), or acquisitions of other businesses, represent significant outflows of cash. Conversely, the sale of long-term assets generates cash inflows. Analyzing these flows offers valuable insights into an organization’s strategic direction. For example, substantial investments in research and development might indicate a focus on innovation and future growth, while significant divestitures could signal a restructuring or shift in strategic priorities. A real-life example might involve a technology company investing heavily in new data centers to support its expanding cloud computing business. This would be reflected as a significant cash outflow under investing activities, signaling a commitment to growth and potentially higher future revenues. Conversely, if the same company sold a non-core business segment, the proceeds would be recorded as a cash inflow under investing activities.

A thorough understanding of investing activities within the GAAP framework is essential for comprehensive financial analysis. By examining the types and magnitudes of investments, stakeholders can gain insights into an organization’s growth strategy, risk appetite, and potential for future returns. One challenge lies in differentiating between capital expenditures and operating expenses. GAAP provides specific criteria for this distinction, ensuring that investments with long-term benefits are properly classified under investing activities. This distinction is critical for accurately assessing an organization’s capital allocation decisions and their potential impact on future performance. Linking investing activities to the broader context of the cash flow statement provides a holistic view of an organizations financial health, highlighting the interplay between core operations, investment strategies, and financing decisions.

5. Financing Activities

Financing activities within a GAAP cash flow statement template depict the inflows and outflows of cash related to an entity’s capital structure. This encompasses transactions involving debt, equity, and dividends, providing crucial insights into how an organization raises capital and distributes returns to investors. Accurate reporting of financing activities is essential for stakeholders to assess an organization’s financial leverage, risk profile, and long-term sustainability. GAAP principles provide specific guidelines for classifying these cash flows, ensuring consistency and comparability across different entities and reporting periods. This standardized approach facilitates informed decision-making by investors, creditors, and analysts seeking to understand an organization’s financial strategy.

The significance of financing activities as a component of the GAAP cash flow statement template stems from their direct impact on an organization’s capital structure and financial risk. Issuing debt or equity securities generates cash inflows, providing resources for operations, investments, or debt repayment. Conversely, repaying debt, repurchasing stock, or paying dividends represent cash outflows. Analyzing these flows reveals how an organization finances its activities and manages its capital structure. For instance, a company issuing bonds to raise capital for a new factory would reflect this as a cash inflow under financing activities. Repurchasing company stock to increase shareholder value, on the other hand, would appear as a cash outflow. A real-world example could involve a mature company consistently paying dividends to its shareholders, reflecting a stable financial position and a commitment to returning capital to investors. Conversely, a rapidly growing company might rely heavily on debt financing to fuel expansion, resulting in significant cash inflows from debt issuance but also increased financial risk.

A comprehensive understanding of financing activities within the GAAP framework is essential for evaluating an organization’s financial health and long-term prospects. By examining the mix of debt and equity financing, dividend policies, and debt repayment schedules, stakeholders can assess the organization’s financial leverage, risk tolerance, and ability to meet its financial obligations. One key challenge lies in understanding the complex interplay between financing activities and the other sections of the cash flow statement. For instance, increased debt financing might lead to higher interest payments, impacting cash flow from operating activities. Similarly, significant capital expenditures funded by debt can impact both investing and financing activities. Connecting these interrelationships provides a holistic understanding of an organization’s financial strategy and its potential impact on long-term value creation.

Key Components of a GAAP Cash Flow Statement Template

A GAAP cash flow statement template provides a structured framework for reporting cash inflows and outflows, categorized into three core activities: operating, investing, and financing. Understanding these key components is crucial for analyzing an organization’s financial performance and making informed decisions.

1. Operating Activities: This section details cash flows generated from the core business operations. It includes cash received from customers, cash paid to suppliers, and cash paid for salaries and wages. This component reflects the organization’s ability to generate cash from its primary business functions.

2. Investing Activities: This section captures cash flows related to the acquisition and disposal of long-term assets. Examples include purchases of property, plant, and equipment (PP&E), investments in other companies, and proceeds from the sale of assets. This component provides insights into the organization’s capital allocation strategies and growth plans.

3. Financing Activities: This section reports cash flows related to changes in an organization’s capital structure. It includes proceeds from issuing debt or equity, repayments of debt, repurchases of stock, and dividend payments. This component reveals how the organization raises capital and distributes returns to investors.

4. Standardized Format: Adherence to a standardized format, dictated by GAAP, ensures consistency and comparability across different organizations and reporting periods. This standardized structure facilitates analysis and benchmarking by investors and other stakeholders.

5. Beginning and Ending Cash Balances: The statement reconciles the beginning and ending cash balances for the reporting period. This reconciliation provides a clear picture of the net change in cash and cash equivalents.

6. Non-Cash Transactions: Significant non-cash transactions, such as the exchange of stock for assets or the conversion of debt to equity, are disclosed in a separate footnote or supplemental schedule. While not affecting cash flow directly, these transactions offer important context for understanding changes in the financial position.

Analyzing these components collectively provides a comprehensive understanding of an organization’s financial health, its ability to generate cash, and its strategies for investing and financing its operations. This structured approach facilitates informed decision-making by investors, creditors, and other stakeholders.

How to Create a GAAP Cash Flow Statement

Creating a GAAP-compliant cash flow statement requires a structured approach and adherence to specific accounting principles. The following steps outline the process of developing this crucial financial statement.

1: Gather Necessary Financial Information: Begin by collecting all relevant financial data, including the income statement, balance sheet, and general ledger details for the reporting period. This information provides the foundation for calculating cash flows from operating, investing, and financing activities.

2: Determine Net Income: Obtain the net income figure from the income statement. This serves as the starting point for calculating cash flow from operating activities using either the direct or indirect method.

3: Calculate Cash Flow from Operating Activities: Using the indirect method, adjust net income for non-cash items such as depreciation, amortization, and changes in working capital (accounts receivable, inventory, accounts payable). The direct method, while less common, involves directly calculating cash inflows and outflows from operating activities.

4: Analyze Investing Activities: Identify and record all cash flows related to investments in long-term assets. This includes purchases and sales of property, plant, and equipment (PP&E), acquisitions and divestitures of businesses, and investments in securities.

5: Analyze Financing Activities: Document all cash flows related to changes in the capital structure. This includes proceeds from issuing debt or equity, repayments of debt, repurchases of stock, and payments of dividends.

6: Reconcile Beginning and Ending Cash Balances: Ensure that the sum of cash flows from operating, investing, and financing activities reconciles with the change in cash and cash equivalents between the beginning and end of the reporting period. This reconciliation confirms the accuracy of the statement.

7: Disclose Non-Cash Transactions: Report any significant non-cash transactions, such as exchanges of assets or debt conversions, in a separate footnote or supplemental schedule. While not impacting cash flow directly, these transactions provide valuable context for understanding changes in financial position.

8: Review and Verify: Thoroughly review the completed statement for accuracy and completeness. Ensure compliance with all relevant GAAP standards and disclosure requirements. Professional review by an accountant is recommended.

A meticulously prepared GAAP cash flow statement provides a transparent and comprehensive overview of an organization’s cash flows, enabling stakeholders to assess its financial performance, liquidity, and long-term viability. This structured approach promotes informed decision-making and enhances financial transparency.

Careful adherence to a standardized structure for presenting financial data, based on Generally Accepted Accounting Principles (GAAP), ensures clarity, consistency, and comparability in reporting cash inflows and outflows. Categorizing these flows into operating, investing, and financing activities provides a comprehensive view of an entity’s financial operations, facilitating informed assessments of performance, liquidity, and long-term viability. Understanding the specific requirements for classifying and reporting each activity is crucial for accurate and transparent financial reporting.

Mastery of this structured approach empowers stakeholders with the insights necessary for sound financial analysis and decision-making. Accurate and consistent application of these principles fosters trust and transparency in financial reporting, contributing to the stability and efficiency of capital markets. Continued emphasis on rigorous financial reporting practices remains essential for promoting financial health and informed investment decisions.