Utilizing such a pre-designed structure offers numerous advantages. It enables proactive financial management by highlighting potential shortfalls or surpluses, facilitating informed decision-making. Regular tracking aids in budgeting, expense control, and identification of areas for potential savings. This insight can be crucial for achieving financial goals, whether for personal finances or business operations. Furthermore, a readily available format simplifies the process, saving time and effort.

This foundational understanding of financial tracking frameworks leads to a deeper exploration of specific components, effective implementation strategies, and practical applications for diverse financial situations. The following sections delve into these aspects, providing valuable insights and actionable advice.

1. Regular Tracking

Regular tracking forms the cornerstone of effective cash flow management, providing the foundation for accurate financial analysis and informed decision-making. A monthly cash flow statement template facilitates this crucial process by offering a structured framework for consistent data entry and review. This regular engagement with financial data unlocks valuable insights into spending patterns, income streams, and overall financial health.

- Frequency and ConsistencyConsistent, ideally monthly, engagement with the template establishes a clear picture of financial trends. This frequency allows for timely identification of potential issues, such as escalating expenses or declining revenues. For example, tracking monthly utility costs can reveal seasonal variations or inefficiencies, prompting corrective actions. This consistent approach contrasts sharply with sporadic reviews, which may obscure important trends and hinder proactive financial management.

- Early Problem DetectionRegular tracking enables early detection of financial imbalances. Consistent use of a template highlights deviations from expected patterns, such as a sudden increase in debt or a decrease in sales. Identifying these issues early provides an opportunity for timely intervention, preventing minor problems from escalating into major financial crises. For instance, noticing a consistent decline in operating income allows for prompt investigation and corrective action.

- Informed Decision-MakingData-driven insights derived from regular tracking empower informed financial decisions. A well-maintained cash flow statement provides a clear understanding of available resources, spending habits, and areas for potential improvement. This knowledge base supports strategic decisions related to budgeting, investments, and expense management. For example, identifying consistently high discretionary spending can inform budget adjustments and savings goals.

- Improved Financial ControlRegular tracking fosters a sense of control over financial resources. By consistently monitoring income and expenses, individuals and businesses gain a deeper understanding of their financial position. This awareness promotes proactive financial management, enabling more effective budgeting, expense control, and resource allocation. This control translates to greater financial stability and resilience in the face of economic fluctuations.

These facets of regular tracking, facilitated by a monthly cash flow statement template, contribute significantly to enhanced financial awareness and control. The consistent insights gained through this process empower proactive management, informed decision-making, and ultimately, greater financial stability and success.

2. Standardized Format

A standardized format is essential for maximizing the effectiveness of a monthly cash flow statement template. Consistency in structure ensures data integrity, simplifies analysis, and facilitates meaningful comparisons over time. This uniformity streamlines the tracking process and promotes accurate financial assessment.

- Uniformity and ComparabilityA standardized template ensures consistent categorization of income and expenses. This uniformity allows for accurate comparisons across different periods, revealing trends and patterns in financial behavior. For example, consistent categorization of “Marketing Expenses” allows for accurate tracking of spending trends in this area over several months, facilitating budget adjustments or strategy revisions.

- Simplified Data Entry and AnalysisA pre-defined structure simplifies data entry and reduces the likelihood of errors. The consistent layout allows for quick and efficient recording of financial transactions, freeing up time for analysis and interpretation. Using a standardized template with predefined fields for common expenses like “Rent” or “Utilities” streamlines the data entry process, reducing manual input and minimizing potential errors.

- Enhanced Data IntegrityStandardized formats contribute to data integrity by minimizing inconsistencies and errors. This accuracy is crucial for reliable financial analysis and informed decision-making. For instance, using a standardized template ensures consistent recording of dates and amounts, reducing the risk of discrepancies and ensuring accurate financial reporting.

- Integration with Other Financial ToolsA standardized format often facilitates seamless integration with other financial tools and software. This interoperability simplifies data transfer and allows for a more comprehensive view of financial health. A template designed for compatibility with common spreadsheet software or accounting programs allows for streamlined data transfer and integrated financial analysis.

The standardized format of a monthly cash flow statement template contributes significantly to its utility and effectiveness. By promoting data integrity, simplifying analysis, and enabling meaningful comparisons, a consistent structure empowers informed financial management and sound decision-making. This structured approach lays the groundwork for effective financial planning and long-term stability.

3. Comprehensive Data

The value of a monthly cash flow statement template hinges on the comprehensiveness of the data it contains. Accurate and complete information is crucial for generating meaningful insights into financial performance and making informed decisions. Incomplete or inaccurate data can lead to flawed analysis and potentially detrimental financial choices. This section explores the key facets of comprehensive data within the context of a monthly cash flow statement template.

- Inclusion of All Income SourcesAccurate representation of all income streams is fundamental. This includes salary, investment returns, rental income, and any other sources of revenue. Omitting even minor income sources can skew the overall picture of financial health. For example, failing to account for interest earned on savings accounts, while seemingly insignificant, can lead to an underestimation of total income and potentially impact budget planning.

- Detailed Expense TrackingMeticulous recording of all expenses, both fixed and variable, is critical. This includes essential expenditures like rent or mortgage payments, utilities, and groceries, as well as discretionary spending on entertainment or dining. Detailed expense tracking provides a granular view of spending patterns, highlighting areas for potential savings or budget adjustments. For instance, tracking daily coffee purchases can reveal a significant cumulative expense, prompting a reevaluation of spending habits.

- Categorization and ClassificationEffective data analysis relies on proper categorization and classification of income and expenses. Grouping similar transactions under specific headings, such as “Housing,” “Transportation,” or “Debt Repayment,” facilitates analysis and identification of spending trends. Consistent categorization also allows for meaningful comparisons across different time periods. For example, categorizing all transportation-related expenses, including fuel, public transport fares, and vehicle maintenance, allows for a comprehensive understanding of transportation costs and informed decision-making regarding commuting options.

- Timely and Accurate RecordingData accuracy depends on timely and consistent recording of transactions. Regularly updating the template, ideally soon after each transaction occurs, minimizes the risk of omissions or errors. Prompt recording also ensures that the cash flow statement accurately reflects the current financial situation. Delaying entries can lead to inaccuracies and make it difficult to reconstruct spending patterns accurately.

The comprehensiveness of data within a monthly cash flow statement template directly impacts the accuracy and reliability of financial analysis. By meticulously tracking all income and expenses, employing consistent categorization, and ensuring timely recording, individuals and businesses gain valuable insights into their financial health, empowering informed decision-making and effective financial planning.

4. Actionable Insights

A well-maintained monthly cash flow statement template provides more than just a record of transactions; it offers actionable insights crucial for informed financial management. These insights empower proactive decision-making, enabling individuals and businesses to optimize financial performance and achieve their goals. The following facets explore how a monthly cash flow statement template generates actionable insights.

- Identifying Spending PatternsRegularly updating the template reveals spending patterns and trends. Recurring expenses become readily apparent, highlighting areas of potential overspending. For example, consistent high expenditures on dining out may suggest an opportunity to reduce discretionary spending and allocate funds towards savings or debt reduction. Understanding these patterns empowers individuals to modify their financial behavior and make more informed choices.

- Uncovering Revenue StreamsTracking all income sources within the template provides a clear picture of revenue streams. This comprehensive view can highlight opportunities to diversify income or optimize existing channels. For instance, a consistent increase in income from freelance work may encourage exploration of further opportunities in that area, while a decline in sales from a particular product line might prompt a strategic review of business operations.

- Projecting Future Cash FlowHistorical data captured within the template allows for projections of future cash flow. By analyzing past trends and patterns, individuals and businesses can anticipate potential surpluses or shortfalls, facilitating proactive financial planning. For example, projecting increased expenses during holiday seasons enables proactive budgeting and prevents unexpected financial strain. This predictive capability is crucial for effective financial management.

- Evaluating Financial HealthThe comprehensive data within a monthly cash flow statement template provides a clear and concise overview of financial health. By analyzing income, expenses, and net cash flow, individuals and businesses can assess their current financial standing and identify areas for improvement. This regular evaluation facilitates informed decision-making regarding budgeting, investments, and debt management, leading to greater financial stability and long-term success.

These actionable insights, derived from a diligently maintained monthly cash flow statement template, empower informed financial decisions. By understanding spending patterns, optimizing revenue streams, projecting future cash flow, and regularly evaluating financial health, individuals and businesses can take control of their finances and achieve their financial goals. This proactive approach is crucial for long-term financial stability and success.

5. Financial Planning

Effective financial planning relies on a clear understanding of cash flow dynamics. A monthly cash flow statement template provides the necessary framework for capturing and analyzing this crucial information. This structured approach facilitates informed decision-making, enabling individuals and businesses to achieve short-term and long-term financial goals. The following facets explore the integral connection between financial planning and the utilization of a monthly cash flow statement template.

- Budgeting and ForecastingA monthly cash flow statement template serves as a cornerstone of effective budgeting. Historical data on income and expenses informs realistic budget creation. Furthermore, by analyzing past trends, future cash flow can be projected, enabling proactive allocation of resources and anticipation of potential shortfalls. For example, consistently high utility expenses during summer months, as revealed by the template, can be factored into future budgets, ensuring adequate financial preparation.

- Debt ManagementUnderstanding cash flow is critical for effective debt management. The template provides a clear picture of available funds, enabling strategic allocation towards debt repayment. Identifying periods of higher cash flow allows for accelerated debt reduction, minimizing interest payments and improving overall financial health. For instance, consistently positive cash flow during bonus payout periods can be strategically allocated towards high-interest debt, accelerating progress towards financial freedom.

- Investment StrategiesInformed investment decisions require accurate assessment of available resources. A monthly cash flow statement template provides this crucial insight, enabling alignment of investment strategies with actual cash flow realities. Understanding periods of positive cash flow allows for strategic investment allocations, maximizing returns and building long-term wealth. For example, consistently positive cash flow from a rental property, as tracked in the template, can be strategically reinvested in other income-generating assets.

- Goal Setting and AchievementFinancial goals, whether short-term or long-term, require a structured approach to planning and execution. A monthly cash flow statement template provides the framework for tracking progress towards these goals. By monitoring income, expenses, and net cash flow, individuals and businesses can assess their progress and make necessary adjustments to their financial strategies. For example, consistently tracking savings contributions within the template allows individuals to monitor progress towards a down payment goal, providing motivation and enabling adjustments to savings strategies as needed.

The consistent use of a monthly cash flow statement template empowers effective financial planning by providing the necessary data and insights for informed decision-making. By facilitating budgeting, debt management, strategic investment, and goal achievement, this structured approach enables individuals and businesses to take control of their financial future and build long-term stability and prosperity.

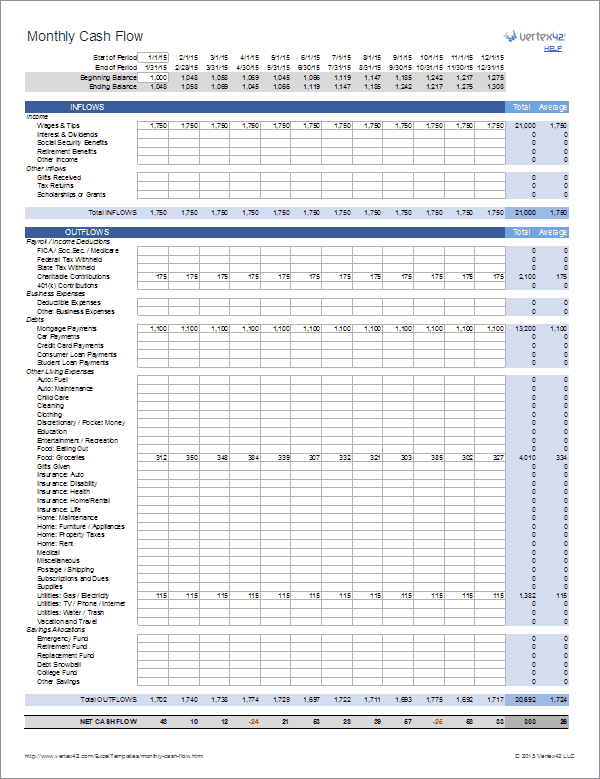

Key Components of a Cash Flow Statement Template

A well-structured cash flow statement template provides a comprehensive overview of financial activity. Key components ensure consistent tracking and accurate analysis, enabling informed financial decisions.

1. Beginning Cash Balance: The starting point for the period, representing the cash on hand at the beginning of the month. This figure is crucial for calculating net cash flow and understanding overall liquidity.

2. Cash Inflows (Receipts): A detailed record of all cash received during the month. This includes operating income from sales, investments, and any other sources of revenue. Accurate recording of inflows is essential for assessing overall financial performance.

3. Cash Outflows (Disbursements): A comprehensive list of all cash expenditures during the month. This encompasses operating expenses, investments, debt repayments, and any other cash outflows. Detailed tracking of outflows is crucial for identifying areas of potential cost savings and managing budgets effectively.

4. Net Cash Flow: The difference between total cash inflows and total cash outflows during the month. This key metric reveals the overall change in cash position and provides insights into financial health. A positive net cash flow indicates an increase in cash reserves, while a negative net cash flow signals a decrease.

5. Ending Cash Balance: The cash on hand at the end of the month, calculated by adding the net cash flow to the beginning cash balance. This figure represents the available cash resources for the subsequent period and is a critical indicator of short-term liquidity.

6. Non-Cash Transactions: While not directly impacting cash flow, non-cash transactions such as depreciation or stock-based compensation are often included for informational purposes and reconciliation with other financial statements. These transactions provide a more complete picture of overall financial activity.

These components work together to provide a comprehensive and structured view of financial activity, enabling accurate analysis, informed decision-making, and effective financial planning.

How to Create a Monthly Cash Flow Statement Template

Creating a structured template for tracking monthly cash flow requires careful consideration of key components and consistent formatting. A well-designed template facilitates accurate data entry, simplifies analysis, and enables informed financial decisions.

1. Choose a Format: Select a format suitable for the intended use. Spreadsheet software offers flexibility and built-in calculation functions, while dedicated accounting software provides more advanced features. Simpler templates can be created using word processing software or even manually on paper. The chosen format should align with user proficiency and reporting requirements.

2. Define the Reporting Period: Clearly establish the reporting period, typically a calendar month. Consistent reporting periods facilitate accurate tracking and meaningful comparisons over time. This defined period ensures data integrity and allows for tracking progress against budget targets.

3. Establish Key Categories: Categorize income and expenses to facilitate detailed analysis. Standard categories include operating activities, investing activities, and financing activities. Within these broad categories, create subcategories for specific income and expense types, such as salaries, rent, utilities, loan repayments, and investments. Consistent categorization enables identification of spending patterns and trends.

4. Include Beginning and Ending Balances: Incorporate fields for beginning and ending cash balances. The beginning balance represents the cash on hand at the start of the period, while the ending balance reflects the cash position at the end of the period. These figures are crucial for calculating net cash flow and assessing overall liquidity.

5. Detail Income and Expense Sections: Create separate sections for cash inflows (receipts) and cash outflows (disbursements). Within each section, provide lines for individual income and expense items, allowing for detailed tracking and analysis. Detailed entries facilitate accurate assessment of financial performance.

6. Calculate Net Cash Flow: Include a formula to automatically calculate net cash flow, which is the difference between total cash inflows and total cash outflows. This key metric provides insights into overall financial health and trends. Automated calculation minimizes manual errors and saves time.

7. Consider Non-Cash Transactions: While not directly impacting cash flow, consider including a section for non-cash transactions such as depreciation or stock-based compensation. These entries provide a more complete picture of overall financial activity and facilitate reconciliation with other financial statements. This comprehensive view enhances overall financial understanding.

8. Test and Refine: After creating the template, test its functionality and refine as needed. Ensure formulas are accurate and categories are appropriately defined. Regular review and refinement ensure the template remains relevant and effective for ongoing financial management. Continuous improvement optimizes the template’s utility.

A well-structured template, incorporating these elements, provides a powerful tool for tracking, analyzing, and ultimately managing cash flow effectively. This structured approach enables proactive financial management and informed decision-making, leading to improved financial outcomes.

A structured approach to financial management, facilitated by a monthly cash flow statement template, provides essential insights into income, expenses, and overall financial health. Regular tracking, standardized formatting, comprehensive data inclusion, and analysis of actionable insights contribute significantly to informed financial decision-making. This organized approach empowers proactive management of resources, enabling strategic planning for both short-term and long-term financial goals. Understanding the key components of such a template and implementing a well-designed structure are crucial steps toward achieving financial stability and success.

Effective financial management requires consistent diligence and a commitment to informed decision-making. A monthly cash flow statement template serves as an invaluable tool in this process, providing the framework for achieving financial clarity and control. Consistent application of these principles positions individuals and businesses for sustained financial well-being and long-term prosperity. Embracing this structured approach to financial management is an investment in future success.