Utilizing such a report allows businesses to anticipate potential financial challenges and opportunities. It provides a framework for budgeting, resource allocation, and strategic planning. This foresight can be critical for securing funding, attracting investors, and managing cash flow effectively. Furthermore, regular review and updates enable proactive adjustments to business strategies based on projected outcomes.

Further discussion will cover specific elements typically included in these reports, along with practical guidance on their creation and utilization for optimal financial management. Topics to be addressed include forecasting techniques, variance analysis, and best practices for interpreting the data to inform decision-making.

1. Revenue Projections

Revenue projections form the cornerstone of a 12-month profit and loss statement template. Accurate forecasting of future sales directly impacts the projected profitability and overall financial health depicted within the statement. A well-informed revenue projection considers historical sales data, market trends, anticipated growth, seasonality, and external economic factors. For instance, a retail business might anticipate higher revenue during the holiday season, reflecting this predictable fluctuation in their projections. This initial estimation sets the stage for subsequent calculations within the statement.

The projected revenue figure influences several other line items within the statement. Cost of goods sold, for example, is often calculated as a percentage of revenue. Accurate revenue projections, therefore, lead to more reliable cost estimations. Similarly, sales commissions and other variable expenses are often tied to revenue. The accuracy of these dependent projections hinges on the reliability of the initial revenue forecast. Inaccurate revenue projections can lead to misinformed decisions regarding pricing, inventory management, and resource allocation. Overly optimistic projections can result in overspending and cash flow issues, while overly conservative projections can limit growth opportunities. Consider a manufacturing company that underestimates revenue growth; this could lead to inadequate raw material procurement, hindering production and potentially losing sales.

Developing robust revenue projections requires a thorough understanding of the business, its target market, and the competitive landscape. Leveraging historical data, conducting market research, and incorporating expert insights contribute to more reliable forecasts. Regularly reviewing and adjusting projections based on actual performance and changing market conditions is crucial for maintaining the accuracy and relevance of the 12-month profit and loss statement. This continuous refinement ensures the statement remains a valuable tool for informed decision-making and effective financial management.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Within a 12-month profit and loss statement template, COGS plays a crucial role in determining gross profit, a key indicator of operational efficiency. Accurately calculating COGS is essential for understanding profitability and making informed pricing and purchasing decisions. This figure encompasses direct material costs, direct labor, and manufacturing overhead. For a manufacturing company, COGS includes raw materials, labor involved in production, and factory overhead. For a retailer, COGS represents the purchase price of merchandise sold. An accurate COGS calculation ensures the profit and loss statement reflects the true cost of generating revenue.

The relationship between COGS and revenue directly influences gross profit. A higher COGS relative to revenue reduces gross profit, signaling potential pricing or production inefficiencies. For example, if a furniture manufacturer experiences rising lumber costs, impacting COGS, while maintaining the same sales price, gross profit margin will decrease. This scenario highlights the importance of monitoring COGS trends and adjusting pricing or sourcing strategies accordingly. Analyzing COGS within the context of a 12-month profit and loss statement enables businesses to identify seasonal variations, production bottlenecks, and the impact of pricing changes on profitability. This analysis informs strategic decisions related to inventory management, production processes, and pricing strategies.

Understanding COGS is fundamental for accurate financial reporting and informed decision-making. Misrepresenting or inaccurately calculating COGS can lead to distorted profitability metrics and misinformed business strategies. Challenges in calculating COGS can arise from complex inventory valuation methods, fluctuating material costs, and variations in production processes. Implementing robust inventory management systems and cost accounting practices ensures accurate COGS calculations, contributing to a reliable and insightful 12-month profit and loss statement. This, in turn, facilitates data-driven decisions related to pricing, resource allocation, and overall business strategy.

3. Operating Expenses

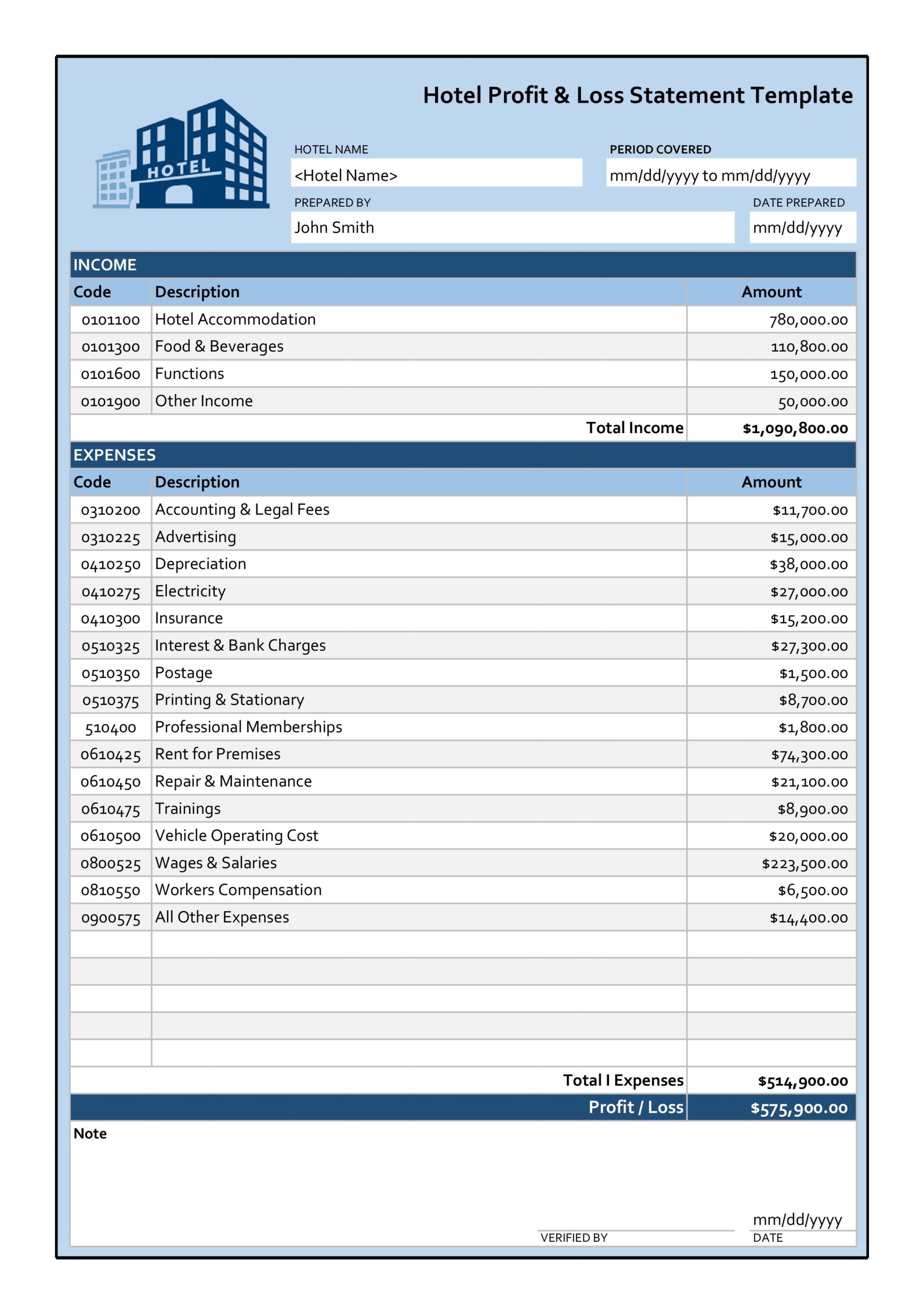

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). Within a 12-month profit and loss statement template, operating expenses are crucial for determining operating income, a key measure of profitability from ongoing operations. Accurate categorization and projection of operating expenses are essential for effective budgeting, resource allocation, and performance evaluation.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass a wide range of costs related to sales, marketing, administrative functions, and general business operations. Examples include salaries for sales and marketing staff, advertising costs, rent, utilities, and office supplies. Within the context of a 12-month profit and loss statement, careful projection of SG&A expenses is critical for accurate profitability forecasting. For example, a company anticipating an expansion into new markets might project increased marketing and sales expenses, impacting projected operating income.

- Research and Development (R&D) ExpensesR&D expenses represent investments in developing new products, services, or processes. These expenses are crucial for innovation and long-term growth. Accurate projection of R&D expenses within a 12-month profit and loss statement allows businesses to assess the financial impact of innovation initiatives. A technology company, for example, might project significant R&D expenses for developing new software, affecting its profitability forecast.

- Depreciation and AmortizationDepreciation and amortization represent the allocation of the cost of tangible and intangible assets over their useful lives. These non-cash expenses reflect the decline in value of assets over time. Including these expenses in a 12-month profit and loss statement provides a more accurate representation of the true cost of doing business. For instance, a manufacturing company depreciates its machinery over several years, reflecting this expense in its projected annual statements.

- Other Operating ExpensesThis category includes operating expenses that don’t fit into the other classifications. Examples include legal fees, professional fees, and insurance premiums. Accurate tracking and projection of these miscellaneous expenses contribute to a comprehensive understanding of overall operating costs and their impact on profitability.

Careful management and accurate projection of operating expenses are critical for achieving profitability and sustainable growth. Analyzing operating expenses within a 12-month profit and loss statement enables businesses to identify cost-saving opportunities, optimize resource allocation, and make informed decisions about pricing, expansion, and investment in future initiatives. This analysis allows businesses to proactively address potential financial challenges and improve overall operational efficiency.

4. Profitability Analysis

Profitability analysis, a critical component of financial assessment, relies heavily on data presented within a 12-month profit and loss statement template. This analysis provides insights into a business’s ability to generate profit from its operations, crucial for evaluating financial health and informing strategic decision-making. The statement serves as a foundation for calculating key profitability metrics, enabling informed assessments of operational efficiency and long-term sustainability.

- Gross Profit MarginGross profit margin, calculated as (Revenue – COGS) / Revenue, reflects the profitability of core operations after accounting for direct production costs. Analyzing gross profit margin within a 12-month projected statement allows businesses to assess the efficiency of production processes and pricing strategies. For instance, a declining gross profit margin might indicate increasing raw material costs or ineffective pricing. Monitoring this metric within the projected timeframe allows for proactive adjustments to mitigate potential profit erosion.

- Operating Profit MarginOperating profit margin, calculated as Operating Income / Revenue, measures profitability after accounting for both COGS and operating expenses. This metric, derived from the 12-month profit and loss statement, provides insights into the efficiency of overall business operations. A consistent operating profit margin indicates sustainable profitability, while fluctuations may signal operational inefficiencies or changing market conditions. Tracking projected operating profit margin enables businesses to anticipate potential challenges and adjust operational strategies accordingly.

- Net Profit MarginNet profit margin, calculated as Net Income / Revenue, represents the overall profitability after considering all expenses, including taxes and interest. This metric, derived from the bottom line of the 12-month profit and loss statement, offers a comprehensive view of a business’s financial performance. Analyzing projected net profit margin provides valuable insights into the long-term financial sustainability and the effectiveness of overall financial management.

- Trend AnalysisAnalyzing profitability trends over the 12-month period provides valuable insights into the long-term financial trajectory. Comparing projected profitability metrics across different months can reveal seasonal patterns, the impact of marketing campaigns, and the effectiveness of cost-saving initiatives. This analysis allows businesses to identify potential risks and opportunities, facilitating proactive adjustments to business strategies to maximize profitability over the projected timeframe.

Utilizing the 12-month profit and loss statement template for profitability analysis empowers businesses to make informed decisions regarding pricing, cost management, resource allocation, and growth strategies. Regularly reviewing and analyzing these profitability metrics allows for proactive adaptation to changing market dynamics and ensures alignment with long-term financial objectives. This process contributes to improved financial performance and enhanced long-term sustainability.

5. Cash Flow Insights

While a 12-month profit and loss statement template projects profitability, it doesn’t directly reflect cash flow, the actual movement of money in and out of a business. Understanding projected cash flow is crucial for managing liquidity, ensuring sufficient funds for operations, and making informed investment decisions. Analyzing cash flow implications within the context of a projected profit and loss statement provides a comprehensive view of financial health and facilitates proactive financial management.

- Operating Cash Flow ProjectionsProjecting operating cash flow involves estimating cash inflows from sales and outflows from operating expenses. This projection, while linked to the profit and loss statement, considers the timing of cash transactions. For example, a business might recognize revenue in the profit and loss statement when a sale is made, but the actual cash inflow might occur later if payment terms extend credit to customers. Accurately projecting operating cash flow ensures sufficient liquidity for day-to-day operations.

- Investing Cash Flow ProjectionsInvesting cash flow relates to the purchase and sale of long-term assets. While the profit and loss statement reflects depreciation, a non-cash expense, the actual cash outflow for asset acquisition occurs at the time of purchase. Analyzing projected investing cash flow within the context of the profit and loss statement provides a comprehensive view of capital expenditures and their impact on overall liquidity. For instance, a manufacturing company investing in new equipment would project a significant cash outflow, impacting overall cash flow despite potential profitability gains from increased production capacity.

- Financing Cash Flow ProjectionsFinancing cash flow involves cash inflows from borrowing and equity financing and cash outflows for debt repayment and dividend payments. Integrating financing cash flow projections with the profit and loss statement provides a complete picture of how a business plans to fund its operations and growth. For example, a business securing a loan would project a cash inflow, impacting overall cash flow and enabling investments reflected in the profit and loss projections.

- Cash Flow Forecasting and ManagementDeveloping a comprehensive cash flow forecast based on the 12-month profit and loss statement allows businesses to anticipate potential cash flow gaps or surpluses. This foresight enables proactive management of working capital, optimizing inventory levels, negotiating favorable payment terms with suppliers, and securing necessary financing. Proactive cash flow management ensures sufficient liquidity to meet operational needs, fund growth initiatives, and navigate unforeseen financial challenges.

Integrating cash flow insights with the 12-month profit and loss statement provides a holistic view of financial performance, enabling informed decision-making and proactive financial management. Understanding the interplay between projected profitability and cash flow is essential for long-term financial sustainability and achieving strategic business objectives. This integrated approach facilitates effective resource allocation, optimized capital structure, and enhanced resilience in the face of economic fluctuations.

Key Components of a 12-Month Profit and Loss Statement Template

A comprehensive 12-month profit and loss statement template provides a structured framework for projecting financial performance over a one-year period. Understanding the key components within this framework is essential for accurate forecasting, informed decision-making, and effective financial management.

1. Revenue Projections: Forecasted revenue forms the foundation of the statement, influencing subsequent calculations and overall profitability projections. Accurate revenue projections rely on historical data, market analysis, and anticipated growth factors.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold. Accurate COGS calculations are crucial for determining gross profit and assessing operational efficiency.

3. Operating Expenses: These expenses encompass costs related to sales, marketing, administration, and general business operations. Categorizing and projecting operating expenses accurately are vital for budgeting and performance evaluation.

4. Gross Profit: Calculated as Revenue – COGS, gross profit reflects the profitability of core operations. Analyzing gross profit trends helps assess pricing strategies and production efficiency.

5. Operating Income: Calculated as Gross Profit – Operating Expenses, operating income reflects profitability from ongoing operations. Monitoring operating income aids in evaluating operational effectiveness and overall financial health.

6. Net Income: Represents the overall profitability after accounting for all expenses, including taxes and interest. Net income provides a comprehensive view of a business’s financial performance and sustainability.

7. Depreciation and Amortization: These non-cash expenses represent the allocation of the cost of tangible and intangible assets over their useful lives. Including these expenses provides a more accurate depiction of the true cost of doing business.

8. Taxes and Interest: These expenses represent financial obligations impacting overall profitability. Accurate projections of tax liabilities and interest payments are essential for comprehensive financial planning.

Effective financial planning requires a thorough understanding and accurate projection of these key components. This detailed approach facilitates informed decision-making, optimized resource allocation, and proactive management of financial performance throughout the projected period.

How to Create a 12-Month Profit and Loss Statement Template

Creating a robust 12-month profit and loss statement requires a systematic approach and careful consideration of various factors. The following steps outline the process of developing a comprehensive template for projecting financial performance.

1. Establish a Timeframe: Clearly define the 12-month period for the projection. Specify the start and end dates to ensure consistency and relevance of the data.

2. Gather Historical Data: Collect financial data from previous periods. This historical information serves as a baseline for projecting future performance. Analyze past trends in revenue, expenses, and profitability.

3. Project Revenue: Forecast sales revenue for each month of the projected period. Consider market trends, seasonality, historical sales data, and anticipated growth factors.

4. Estimate Cost of Goods Sold (COGS): Project COGS based on projected revenue and historical COGS ratios. Account for potential fluctuations in material costs and production efficiency.

5. Project Operating Expenses: Forecast operating expenses, including sales and marketing costs, administrative expenses, research and development, and other operating costs. Consider anticipated changes in staffing, marketing campaigns, and other operational factors.

6. Calculate Gross Profit and Operating Income: Determine projected gross profit by subtracting projected COGS from projected revenue. Calculate projected operating income by subtracting projected operating expenses from projected gross profit.

7. Account for Other Income and Expenses: Include projections for other income and expenses, such as interest income, interest expense, and taxes. These items impact overall profitability and should be factored into the projection.

8. Calculate Net Income: Determine projected net income by subtracting all expenses, including taxes and interest, from total income (revenue plus other income). Net income provides a comprehensive view of projected profitability.

9. Review and Refine: Regularly review and refine the projections based on actual performance, changing market conditions, and updated business strategies. This iterative process ensures the statement remains a relevant and valuable tool for financial management.

A well-constructed 12-month profit and loss statement template offers a crucial tool for financial planning, resource allocation, and performance evaluation. Regularly reviewing and updating the projections ensures the statement remains a relevant and valuable tool for informed decision-making and achieving financial objectives.

A well-structured projected annual financial report offers invaluable insights into anticipated financial performance. From revenue projections and cost estimations to profitability analysis and cash flow management, understanding each component’s interplay is crucial. Accurate forecasting and regular review enable proactive adjustments to business strategies, optimized resource allocation, and informed decision-making. This structured approach to financial planning empowers organizations to navigate challenges, capitalize on opportunities, and achieve sustainable growth.

Effective utilization of these financial tools requires diligent data analysis, continuous refinement of projections, and a commitment to adapting to dynamic market conditions. The insights derived from this process are essential for navigating the complexities of the business landscape, fostering financial stability, and achieving long-term success. Organizations prioritizing robust financial planning position themselves for informed decision-making and sustainable growth in the face of evolving market dynamics.