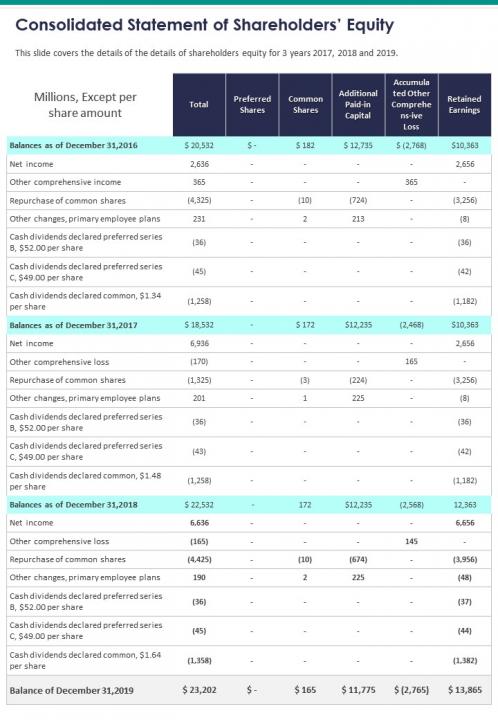

Using such a standardized structure offers several advantages. It promotes transparency by clearly presenting the factors influencing ownership changes, such as net income, dividends, stock issuances, and treasury stock transactions. This clarity facilitates informed decision-making by investors, creditors, and analysts. Furthermore, a standardized approach streamlines the reporting process, reducing the risk of errors and ensuring compliance with regulatory requirements. It also enables trend analysis over time, providing valuable insights into a company’s financial health and growth trajectory.

This foundational understanding of the structure and benefits of this type of reporting will serve as a basis for exploring its key components and practical applications in more detail.

1. Beginning Balance

The beginning balance within a statement of shareholders’ equity represents the equity position at the start of the reporting period. It serves as the foundation upon which all subsequent changes in equity are built. This figure is derived from the ending balance of the previous period’s statement, ensuring continuity and accurate tracking of equity over time. Without a correct beginning balance, the entire statement loses its integrity, as the changes reflected would be relative to an inaccurate starting point. For example, if a company’s retained earnings were misstated at the beginning of the year, the reported net income and ending retained earnings for the current year would also be incorrect.

Understanding the source and significance of the beginning balance is critical for proper interpretation. It provides context for analyzing the changes that occur during the reporting period. For instance, a large increase in retained earnings might appear impressive, but its significance diminishes if the company started with a substantially high retained earnings balance. Conversely, a modest increase could signify strong performance if the beginning balance was relatively low. A real-world example would be a company recovering from significant losses in a previous year; a small increase in retained earnings signifies positive progress. Therefore, comparing the beginning and ending balances offers valuable insights into the overall trend of equity growth or decline.

Accurate determination and presentation of the beginning balance are essential for transparency and accurate financial reporting. Any discrepancies or inconsistencies in the beginning balance should be investigated and rectified to ensure the reliability of the entire statement of shareholders’ equity. This careful attention to detail fosters trust among stakeholders and provides a solid basis for informed financial decision-making. Ignoring the importance of the beginning balance undermines the entire purpose of the statement and can lead to misinterpretations of a company’s financial health.

2. Net Income/Loss

Net income or loss represents the bottom line of a company’s income statement and plays a pivotal role in the statement of shareholders’ equity. It directly impacts retained earnings, one of the core components of equity. Profit increases retained earnings, while a net loss decreases them. This direct relationship makes net income/loss a key driver of changes in shareholders’ equity. For example, a company reporting a $1 million net income will see its retained earnings increase by the same amount, assuming no other factors affect retained earnings. Conversely, a $500,000 net loss would reduce retained earnings by that amount. This dynamic interplay illustrates the crucial link between profitability and equity.

The importance of net income/loss as a component of the statement of shareholders’ equity cannot be overstated. It provides critical insights into a company’s financial performance and its ability to generate value for shareholders. Consistently profitable companies tend to exhibit growing retained earnings, which strengthens their financial position and can lead to increased dividends or share buybacks. Conversely, sustained losses deplete retained earnings, potentially weakening the company’s financial stability and limiting its options for rewarding shareholders or reinvesting in growth. A real-world example would be a tech startup consistently reinvesting its profits (increasing retained earnings) to fuel research and development, aiming for long-term value creation.

Understanding the relationship between net income/loss and the statement of shareholders’ equity is essential for comprehensive financial analysis. It helps stakeholders assess a company’s profitability, its ability to generate and retain earnings, and its overall financial health. Furthermore, this understanding enables investors and analysts to make informed decisions about the company’s prospects and potential future returns. Challenges in accurately reporting net income, such as revenue recognition complexities or expense misclassification, can significantly impact the reliability of the entire statement of shareholders’ equity and should be carefully scrutinized. Accurate and transparent reporting of net income/loss is therefore crucial for maintaining investor confidence and promoting sound financial markets.

3. Dividends

Dividends represent a distribution of a company’s earnings to its shareholders. Within the context of the statement of shareholders’ equity, dividends represent a reduction in retained earnings. Understanding their impact is crucial for interpreting changes in equity over time.

- Cash DividendsCash dividends are the most common type of distribution, paid directly to shareholders in cash. They represent a direct outflow of cash from the company and decrease the retained earnings balance. A real-world example would be a mature company with stable earnings consistently paying quarterly cash dividends to its shareholders. Within the statement of shareholders’ equity, cash dividends are typically presented as a separate line item, clearly showing their impact on retained earnings. This transparency allows stakeholders to understand the portion of earnings returned to shareholders versus the portion reinvested in the business.

- Stock DividendsInstead of distributing cash, companies can issue additional shares to existing shareholders as stock dividends. While stock dividends do not directly reduce retained earnings in the same way cash dividends do, they dilute the ownership percentage of each share. This dilution is reflected in the statement of shareholders’ equity by increasing the number of outstanding shares and potentially impacting additional paid-in capital. For instance, a company issuing a 10% stock dividend would increase the number of outstanding shares by 10%, reducing the value of each individual share proportionally. This impact on ownership structure is crucial for investors to understand.

- Dividend Payout RatioThe dividend payout ratio, calculated as dividends paid divided by net income, reveals the proportion of earnings returned to shareholders. A high payout ratio suggests a mature company returning a significant portion of its profits, while a low ratio might indicate a growth-oriented company reinvesting most of its earnings. Analyzing this ratio in conjunction with the statement of shareholders’ equity offers deeper insights into a company’s dividend policy and its implications for future growth. For example, a consistent increase in the dividend payout ratio could signal management’s confidence in future earnings stability.

- Impact on Retained EarningsDividends, primarily cash dividends, directly impact retained earnings by reducing their balance. This reduction signifies a decrease in the accumulated profits available for reinvestment or future distributions. A substantial decrease in retained earnings due to high dividend payments could limit a company’s ability to fund growth initiatives or weather economic downturns. The statement of shareholders’ equity explicitly shows this impact, allowing stakeholders to assess the company’s financial flexibility and long-term sustainability. For instance, a company consistently paying out high dividends while facing declining profitability could be a warning sign of financial strain.

Understanding the different types of dividends, their impact on retained earnings, and their representation within the statement of shareholders’ equity is crucial for investors and analysts. By analyzing dividend-related information in conjunction with other components of the statement, stakeholders can gain a comprehensive understanding of a company’s financial performance, dividend policy, and overall financial health. This comprehensive view is essential for making informed investment decisions and assessing the long-term prospects of a company.

4. Stock Issuances

Stock issuances represent the creation and sale of new shares of stock by a company. Within the context of the statement of shareholders’ equity, stock issuances increase equity by increasing paid-in capital. Understanding the mechanics and implications of stock issuances is crucial for interpreting the statement and assessing a company’s financing activities.

- Initial Public Offerings (IPOs)An IPO represents the first time a company offers its shares to the public. This event typically generates significant capital for the company and marks a substantial increase in equity. The proceeds from an IPO are reflected in the statement of shareholders’ equity as an increase in paid-in capital. For example, a company issuing 10 million shares at $20 per share during an IPO would increase paid-in capital by $200 million. This influx of capital can be used for expansion, debt reduction, or other strategic initiatives.

- Secondary OfferingsAfter the initial IPO, a company may issue additional shares through a secondary offering. This can be done to raise further capital or to allow existing shareholders to sell some of their holdings. Similar to IPOs, secondary offerings increase paid-in capital and are reflected in the statement of shareholders’ equity. For instance, a company issuing 5 million additional shares at $25 per share in a secondary offering would increase paid-in capital by $125 million. This additional capital can be crucial for funding growth or managing financial obligations.

- Employee Stock Options (ESOs)Companies often grant ESOs to employees as a form of compensation. When employees exercise these options, new shares are issued, increasing the number of outstanding shares and impacting paid-in capital. The statement of shareholders’ equity reflects these changes, providing transparency about the dilutionary effect of stock options. For example, if employees exercise options for 1 million shares, the number of outstanding shares increases, potentially impacting earnings per share and other key metrics.

- Impact on Paid-in CapitalStock issuances directly increase paid-in capital, the portion of equity representing the amount shareholders have invested in the company. This increase reflects the inflow of cash or other assets from the sale of shares. The statement of shareholders’ equity clearly presents this impact, allowing stakeholders to understand the sources of equity growth and the changing ownership structure. For example, if paid-in capital increases significantly over several reporting periods due to multiple stock issuances, it indicates the company has been actively raising capital through equity financing. This information is essential for evaluating the company’s financial strategy and its potential impact on shareholder returns.

By analyzing stock issuances within the framework of the statement of shareholders’ equity, investors can gain valuable insights into a company’s financing activities, its growth strategy, and the evolution of its ownership structure. This understanding is critical for assessing the long-term prospects of the company and making informed investment decisions.

5. Treasury Stock

Treasury stock represents shares of a company’s own stock that it has repurchased from the open market. Within the context of the statement of shareholders’ equity template, treasury stock reduces shareholders’ equity. This reduction occurs because the repurchased shares are no longer outstanding and therefore do not represent ownership interests. Essentially, treasury stock transactions reverse the effects of stock issuances. When a company repurchases its own shares, it decreases the number of outstanding shares and reduces the amount of equity held by external shareholders. For example, if a company repurchases 1 million shares at $50 per share, the total shareholders’ equity will decrease by $50 million, reflecting the cash outflow and the reduction in outstanding shares.

The inclusion of treasury stock transactions in the statement of shareholders’ equity template provides valuable insights into a company’s capital management strategies. Companies repurchase their own shares for various reasons, including increasing earnings per share, returning capital to shareholders, or signaling undervaluation. The impact of treasury stock transactions on equity can be significant. A large repurchase program can substantially reduce shareholders’ equity, potentially affecting key financial ratios and metrics. For instance, a consistent decline in shareholders’ equity due to aggressive share repurchases might raise concerns about a company’s long-term financial stability if not accompanied by strong earnings growth. Conversely, a moderate repurchase program can be viewed as a positive signal, indicating management’s confidence in the company’s future prospects. Analyzing treasury stock activity alongside other equity changes helps stakeholders understand the company’s capital allocation priorities and their potential impact on shareholder value. A real-world example would be a mature company with consistent cash flow using share repurchases as a way to distribute profits to shareholders and increase the value of remaining shares.

Understanding the relationship between treasury stock and the statement of shareholders’ equity is essential for comprehensive financial analysis. By carefully examining treasury stock activity, investors can gain a deeper understanding of a company’s capital allocation decisions, its financial health, and its long-term strategy. This knowledge is crucial for making informed investment decisions and evaluating the potential risks and rewards associated with investing in a particular company. The failure to properly account for treasury stock can lead to misinterpretations of a company’s financial position and obscure the true impact of share repurchases on shareholder equity. Therefore, accurate and transparent reporting of treasury stock transactions is critical for maintaining market integrity and protecting investor interests.

Key Components of a Statement of Shareholders’ Equity Template

A comprehensive understanding of the statement of shareholders’ equity requires a thorough examination of its key components. These components provide a detailed view of the changes in a company’s ownership structure over a specific period.

1. Beginning Balance: The beginning balance represents the equity position at the start of the reporting period. This figure is crucial as it serves as the foundation for calculating subsequent changes in equity. It is derived from the ending balance of the previous period’s statement, ensuring continuity and accurate tracking of equity over time.

2. Net Income/Loss: Net income, derived from the income statement, increases retained earnings, a key component of equity. Conversely, a net loss decreases retained earnings. This direct relationship highlights the impact of a company’s profitability on its equity position.

3. Dividends: Dividends represent distributions of earnings to shareholders. Cash dividends directly reduce retained earnings. Stock dividends, while not impacting retained earnings directly, dilute ownership by increasing outstanding shares.

4. Stock Issuances: Issuing new shares increases equity by increasing paid-in capital. This can occur through initial public offerings (IPOs), secondary offerings, or the exercise of employee stock options. Stock issuances reflect a company’s capital-raising activities.

5. Treasury Stock: Treasury stock represents shares repurchased by the company. These repurchases decrease shareholders’ equity as they reduce the number of outstanding shares. Treasury stock transactions reflect a company’s capital management strategies.

Careful consideration of these components provides a holistic view of the factors influencing a company’s equity, facilitating informed analysis and decision-making.

How to Create a Statement of Shareholders’ Equity

Creating a statement of shareholders’ equity requires a systematic approach and a clear understanding of its components. The following steps outline the process:

1. Establish Reporting Period: Define the specific time frame covered by the statement, typically a quarter or a fiscal year. This ensures consistency and allows for comparison across periods. Accurate date ranges are crucial for regulatory compliance and internal analysis.

2. Determine Beginning Balances: Obtain the ending balances of each equity account from the previous reporting period’s statement. These figures serve as the starting point for the current period’s calculations. Accuracy is paramount, as any errors in beginning balances will cascade through the entire statement.

3. Account for Net Income/Loss: Record the net income or loss from the income statement. Net income increases retained earnings, while a net loss decreases them. This direct relationship highlights the impact of profitability on shareholders’ equity.

4. Incorporate Dividend Activity: Account for all dividend distributions during the reporting period. Cash dividends directly reduce retained earnings. Stock dividends increase the number of outstanding shares, potentially impacting paid-in capital.

5. Reflect Stock Transactions: Record all stock issuances and repurchases. Issuances increase paid-in capital, while treasury stock transactions decrease shareholders’ equity. Proper documentation of these transactions is essential for transparency.

6. Calculate Ending Balances: Calculate the ending balance for each equity account by adding or subtracting the relevant changes during the period from the beginning balance. This provides a snapshot of the company’s equity position at the end of the reporting period.

7. Prepare the Statement: Organize the information into a clear and concise format. The statement should clearly present the beginning balance, each change during the period, and the ending balance for each equity account. A well-structured statement facilitates understanding and analysis.

8. Review and Verify: Thoroughly review the statement for accuracy and completeness. Ensure all transactions are properly recorded and that calculations are correct. This final step is critical for maintaining the integrity and reliability of the financial reporting process. Any discrepancies or inconsistencies should be investigated and rectified immediately.

By following these steps, one can create a statement of shareholders’ equity that accurately reflects the changes in a company’s ownership structure, providing valuable insights for stakeholders.

Careful examination of the provided structure reveals its function as a crucial tool for communicating changes in a company’s ownership framework. From the initial setup with beginning balances to incorporating net income, dividends, stock activities, and treasury stock, each component contributes to a comprehensive understanding of equity fluctuations. This structured approach ensures transparency and facilitates informed decision-making for investors, creditors, and other stakeholders. Accuracy in preparing this statement is paramount, as it directly reflects a company’s financial health and stability.

Accurate and transparent reporting within this framework provides crucial insights into a company’s financial health, strategic decisions, and potential for future growth. Stakeholders rely on this information to make informed decisions, highlighting the importance of meticulous record-keeping and adherence to established accounting principles. Continued scrutiny and analysis of these statements remain essential for navigating the complexities of financial markets and ensuring sound investment strategies.