Utilizing this type of structured financial document offers several advantages. It allows for accurate tax reporting by clearly separating business and personal income and expenses. It empowers individuals to monitor profitability trends, identify areas for improvement, and secure financing when needed. Moreover, a well-maintained record of income and expenses provides valuable insights into business health, enabling strategic planning and growth.

This foundational understanding of a structured financial summary for independent workers sets the stage for a more detailed exploration of its components, creation, and practical applications. The following sections will delve into specific aspects, offering guidance and resources for effective financial management.

1. Revenue

Accurate revenue tracking forms the cornerstone of a comprehensive profit and loss statement for independent contractors. A clear understanding of income streams is essential for assessing profitability, managing taxes, and making informed business decisions. This section explores key facets of revenue management within the context of an independent contractor’s financial records.

- Client Invoicing and PaymentsThis facet encompasses all income generated from client projects. It includes tracking invoices sent, payments received, and outstanding balances. Detailed records of client transactions are crucial for accurate revenue reporting and provide a basis for analyzing income patterns and forecasting future earnings. For example, a web developer might track payments for website design, maintenance, and hosting services separately.

- Project-Based RevenueOrganizing revenue by project allows for granular analysis of profitability. By associating income with specific projects, contractors can identify high-performing areas and those requiring adjustments in pricing or resource allocation. A consultant, for instance, can track revenue generated from individual consulting engagements to assess their relative success.

- Recurring Revenue StreamsFor contractors with recurring income sources, such as retainers or subscription services, tracking these payments separately provides valuable insights into predictable cash flow. Understanding the stability of recurring revenue allows for better financial planning and investment decisions. A graphic designer with a monthly retainer contract would categorize this income separately.

- Revenue Recognition PrinciplesAdhering to appropriate revenue recognition principles ensures accurate financial reporting. This involves recognizing income when it is earned, not necessarily when payment is received. For example, a contractor completing a project in phases should recognize revenue for each completed phase, even if the full payment is received upon final delivery.

By meticulously tracking and categorizing revenue streams, independent contractors gain a comprehensive understanding of their financial performance. This detailed information, when integrated into a profit and loss statement, provides a powerful tool for strategic decision-making, growth planning, and overall business success.

2. Expenses

Accurate expense tracking is fundamental to a comprehensive profit and loss statement for independent contractors. A thorough understanding of expenses provides insights into profitability, informs tax strategies, and supports informed business decisions. This section explores the crucial role of expense management within a profit and loss framework for independent contractors.

Categorizing expenses provides a structured view of where funds are allocated. Common categories include:

- Business-Related Expenses: These encompass costs directly related to service delivery or product creation. A software developer, for example, might include software licenses, cloud hosting fees, and online course subscriptions related to professional development. A freelance writer might list research materials, editing software, and professional association memberships.

- Marketing and Advertising: Expenses related to promoting services are essential for attracting clients. These might include website maintenance, online advertising campaigns, or networking event fees.

- Office Supplies and Equipment: Costs associated with necessary tools and resources, such as computers, printers, or office furniture, are categorized here. These can be depreciated over time, impacting the profit and loss statement across multiple periods.

- Travel and Transportation: For contractors who travel for client meetings or project-related activities, these expenses encompass airfare, mileage, and accommodation costs.

- Professional Fees: This category includes fees paid to other professionals, such as legal counsel, accountants, or virtual assistants.

Meticulous expense tracking offers several practical benefits. It allows for accurate deductions on tax returns, potentially minimizing tax liabilities. By analyzing expense trends, contractors can identify areas for cost optimization and improve overall profitability. Furthermore, detailed expense records are often required when seeking financing or demonstrating business viability to potential clients.

Understanding and effectively managing expenses are critical components of financial success for independent contractors. The accurate and organized recording of all business-related expenses provides a solid foundation for data-driven decision-making, contributing directly to long-term sustainability and growth. This meticulous tracking, reflected in a well-maintained profit and loss statement, enables informed adjustments to pricing strategies, resource allocation, and business development efforts.

3. Profit/Loss Calculation

The core purpose of an independent contractor profit and loss statement template is the calculation of net profit or loss. This calculation, derived from the fundamental equation of revenue minus expenses, provides a clear picture of financial performance over a specific period. A positive result indicates profitability, while a negative result signifies a loss. Accurate profit/loss calculation is essential for understanding business viability, informing tax obligations, and guiding strategic decision-making.

Consider a freelance graphic designer. Their revenue for a quarter might include $5,000 from client projects and $500 from selling stock photos. Their expenses for the same period might comprise $1,000 for software subscriptions, $500 for marketing, and $200 for office supplies. The profit/loss calculation would be ($5,000 + $500) – ($1,000 + $500 + $200) = $3,800 net profit. This positive result demonstrates profitable operations for the quarter. Conversely, if expenses exceeded revenue, the resulting negative number would indicate a loss, prompting analysis and potential adjustments to business practices.

Understanding the profit/loss calculation empowers informed decision-making. Consistent profitability allows for reinvestment, business expansion, or personal savings. A loss, however, necessitates analysis of contributing factors. Were marketing efforts ineffective? Were project bids too low? Analyzing expenses and revenue streams provides valuable insight, enabling adjustments to pricing strategies, client targeting, or expense management to steer the business toward profitability. This calculated metric within the template becomes a critical tool for evaluating business health and charting a course for sustainable growth.

4. Time Period

Defining a specific time period is crucial for utilizing an independent contractor profit and loss statement template effectively. This defined timeframe allows for analysis of financial performance over designated intervals, enabling trend identification and informed decision-making. Common time periods include monthly, quarterly, and annually. Selecting the appropriate time period depends on the nature of the business and the contractor’s specific needs. A contractor with consistent monthly clients might choose a monthly period for detailed tracking, while a contractor with fluctuating project timelines might prefer a quarterly view for broader trend analysis.

Consider a freelance writer who invoices clients monthly. Utilizing a monthly time period allows them to closely monitor income fluctuations, identify potential late payments, and quickly address any cash flow concerns. Conversely, a consultant engaged in long-term projects might find a quarterly time period more suitable for assessing overall project profitability and identifying areas for improvement in resource allocation or pricing. A yearly overview offers a high-level perspective on annual performance, useful for tax reporting and long-term strategic planning.

Selecting an appropriate time period provides a structured framework for evaluating financial performance. This structured approach enables meaningful comparisons across periods, facilitating trend identification, expense analysis, and informed adjustments to business practices. By analyzing profit and loss data within consistent timeframes, independent contractors gain valuable insights into business health, supporting proactive financial management and promoting long-term stability and growth. Consistent time periods in financial reporting offer critical insights for effective business management and informed decision-making.

5. Categorization

Categorization within an independent contractor profit and loss statement template provides a structured framework for organizing financial data. This systematic approach facilitates in-depth analysis of income and expenses, enabling informed financial management and strategic decision-making. Effective categorization offers insights into spending patterns, identifies areas for potential cost optimization, and supports accurate tax reporting.

- Revenue StreamsCategorizing revenue by source provides a granular understanding of income generation. A web developer, for instance, might categorize revenue into website design, maintenance contracts, and hosting services. This breakdown allows for analysis of each revenue stream’s performance and informs decisions regarding pricing adjustments or service diversification.

- Expense TypesCategorizing expenses, such as marketing, software subscriptions, or travel, provides a clear picture of where funds are allocated. This detailed breakdown enables identification of areas for potential cost reduction and facilitates informed budget allocation decisions. A freelance writer might categorize expenses into research materials, editing software, and professional memberships to understand their spending patterns.

- Project-Based CategorizationFor contractors working on multiple projects simultaneously, categorizing income and expenses by project provides valuable insights into project profitability. This granular view allows for assessment of project efficiency, informs pricing strategies for future projects, and supports data-driven decisions regarding resource allocation. A consultant, for instance, could track expenses and revenue for each client engagement separately.

- Tax-Relevant CategoriesCategorizing income and expenses according to tax regulations simplifies tax reporting and ensures accurate deduction claims. Maintaining separate categories for deductible business expenses, such as home office deductions or professional development courses, streamlines the tax preparation process and minimizes the risk of errors. This meticulous categorization ensures compliance and optimizes tax strategies.

Systematic categorization within a profit and loss statement empowers independent contractors with a comprehensive understanding of their financial landscape. This structured approach facilitates informed decision-making, supports accurate tax reporting, and ultimately contributes to long-term financial stability and growth. By analyzing categorized data, contractors can identify trends, optimize resource allocation, and refine business strategies for sustained success. This detailed view of financial performance becomes a cornerstone of effective business management and strategic planning.

Key Components of an Independent Contractor Profit and Loss Statement

A well-structured profit and loss statement provides essential insights into the financial performance of an independent contractor’s business. Key components work together to offer a comprehensive overview of income, expenses, and resulting profitability.

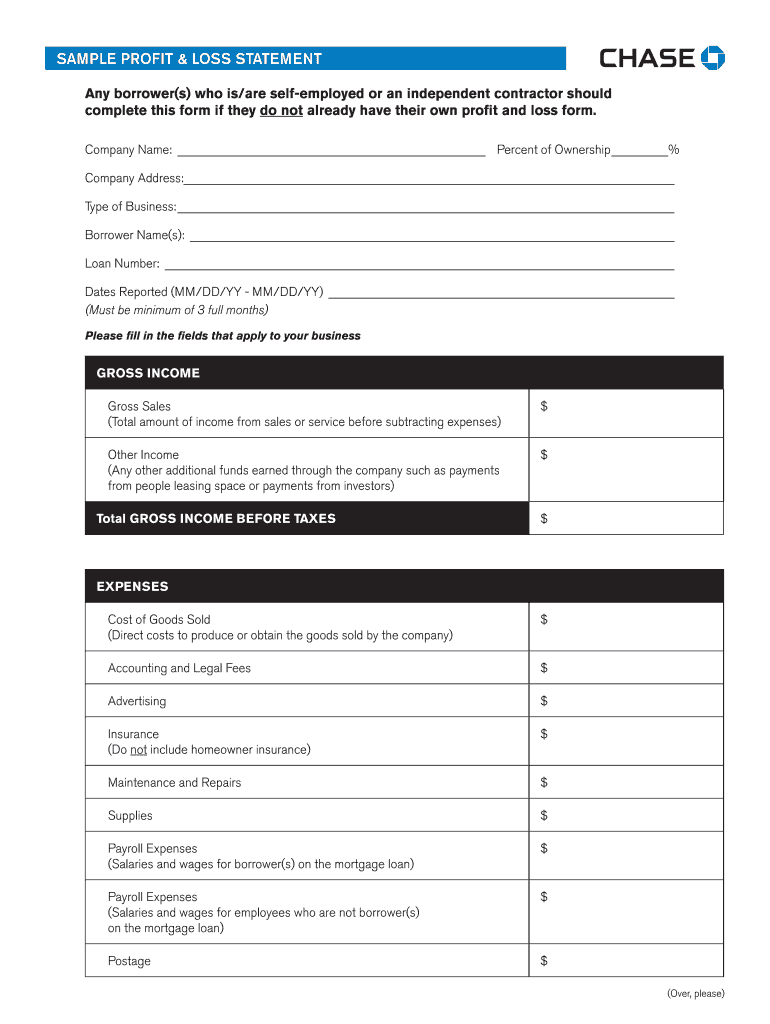

1. Revenue: This section details all income generated from client work or other business activities. Accurate revenue tracking is paramount, encompassing all payments received and outstanding invoices. Clear documentation of income sources is crucial for understanding revenue streams and forecasting future earnings.

2. Expenses: All business-related expenditures are documented in this section. Categorizing expenses, such as marketing, software subscriptions, and professional fees, allows for detailed analysis of spending patterns and identification of potential cost-saving opportunities. Accurate expense tracking is fundamental for tax reporting and profitability assessment.

3. Gross Profit: Calculated by subtracting the cost of goods sold (if applicable) from revenue, gross profit represents the income remaining after accounting for direct production costs. For service-based contractors, this is often equivalent to total revenue. This metric provides a preliminary view of profitability before considering operating expenses.

4. Operating Expenses: These expenses are not directly tied to service delivery but are necessary for business operations. Examples include rent, utilities, marketing costs, and administrative expenses. Tracking operating expenses is crucial for understanding overhead costs and their impact on overall profitability.

5. Net Profit/Loss: This crucial figure represents the bottom line the actual profit or loss generated by the business after deducting all expenses from revenue. Net profit indicates financial health and sustainability, informing key business decisions and strategic planning.

6. Time Period: The profit and loss statement covers a specific period, such as a month, quarter, or year. This defined timeframe allows for performance analysis over designated intervals, facilitating trend identification and informed decision-making. Consistent reporting periods enable meaningful comparisons and support accurate performance evaluation.

7. Categorization: Organizing income and expenses into relevant categories provides a structured view of financial data. This systematic approach facilitates in-depth analysis of spending patterns, identification of potential cost optimizations, and supports accurate tax reporting. Detailed categorization enhances understanding of financial performance and informs strategic planning.

These interconnected components provide a comprehensive overview of financial performance, enabling informed decision-making, effective financial management, and ultimately, business success for independent contractors. Accurate and detailed tracking of each element contributes to a clear understanding of profitability, supports strategic planning, and promotes long-term financial stability.

How to Create an Independent Contractor Profit and Loss Statement

Creating a profit and loss statement provides essential insights into financial performance. The following steps outline the process of developing this crucial financial tool for independent contractors.

1. Choose a Time Period: Select a specific timeframe for the statement, such as a month, quarter, or year. Consistent time periods allow for accurate performance comparisons over time. The chosen timeframe should align with business needs and reporting requirements.

2. Determine Revenue: Compile all income generated during the chosen period. This includes client payments, project fees, and any other business-related income. Accurate revenue tracking is paramount for assessing overall financial performance. Maintain meticulous records of all income sources.

3. Categorize Revenue: Organize income into relevant categories. This might include categorizing by client, project, or service type. Categorization provides a granular view of income streams and facilitates analysis of performance trends.

4. Itemize Expenses: List all business-related expenses incurred during the chosen period. This includes expenses like software subscriptions, marketing costs, office supplies, and professional fees. Thorough expense tracking is crucial for understanding cost structures and identifying potential areas for savings.

5. Categorize Expenses: Organize expenses into relevant categories, such as marketing, software, travel, and office supplies. Categorization provides a structured view of spending and facilitates analysis of expense trends. Consistent categorization supports accurate financial reporting.

6. Calculate Gross Profit: Subtract the cost of goods sold (if applicable) from total revenue. For service-based businesses, this is generally equivalent to total revenue. Gross profit represents earnings before accounting for operating expenses.

7. Calculate Net Profit/Loss: Subtract total expenses from gross profit. This crucial figure represents the overall profit or loss generated during the specified period. Net profit/loss provides a clear picture of financial performance and informs strategic decision-making.

8. Review and Analyze: Regularly review the completed statement to identify trends in revenue and expenses. This analysis informs strategic decisions related to pricing, resource allocation, and business development. Consistent review supports proactive financial management and promotes long-term stability.

A well-structured statement offers valuable insights into financial health, enabling informed decisions, strategic planning, and long-term business success. This structured approach to financial reporting provides a clear understanding of profitability and supports effective resource management.

Effective financial management is paramount for independent contractors, and a properly utilized profit and loss statement template provides a critical tool for achieving this. From meticulous revenue tracking and categorized expense recording to accurate profit/loss calculation, each component contributes to a comprehensive understanding of financial performance. Utilizing this structured approach empowers informed decision-making, supports strategic planning, and fosters long-term financial stability. A well-maintained record provides a clear picture of business health, enabling proactive adjustments and informed navigation of the financial landscape.

Careful attention to financial details empowers independent contractors to not just survive but thrive. Regularly generating and analyzing these statements provides valuable insights, enabling informed decisions that drive profitability and long-term success. This proactive approach to financial management is an investment in business sustainability and future growth potential. Embracing this structured approach to financial reporting is not merely a best practice but a fundamental requirement for navigating the complexities of independent contracting and building a secure financial future.