Utilizing such a structured financial report empowers informed financial management. It allows for accurate tracking of profitability, identification of areas for cost reduction, and informed investment strategies. This granular insight supports data-driven decisions regarding pricing, equipment upgrades, and business expansion, contributing to long-term financial stability and growth.

Understanding the components and applications of this financial tool is paramount for success in the transportation industry. The following sections will delve into creating and interpreting these statements, offering practical guidance for maximizing profitability and achieving financial objectives.

1. Revenue

Revenue represents the lifeblood of any business, and for owner-operators in the transportation sector, it signifies the income generated from hauling operations. Within the context of a profit and loss statement, revenue serves as the starting point for determining profitability. Accurately recording all income sources is critical; this includes linehaul revenue, accessorial charges (like detention or layover pay), and any other income directly related to transportation services. For example, an owner-operator might complete multiple hauls at varying rates, plus earn additional income from fuel surcharges. Each revenue stream must be meticulously documented within the statement to provide a complete financial picture.

The significance of accurate revenue tracking extends beyond simply knowing the gross income. It directly impacts the calculation of net profit by providing the baseline against which expenses are measured. Understanding revenue trends allows operators to identify seasonal fluctuations, assess the impact of rate changes, and make informed decisions about business strategies. For instance, consistently low revenue despite high mileage might indicate the need to renegotiate contracts or explore different freight lanes. Conversely, a period of high revenue can provide an opportunity for reinvestment in the business, such as equipment upgrades or expansion.

In summary, revenue forms the foundation of a comprehensive profit and loss statement. Meticulous tracking and analysis of revenue streams offer crucial insights into business performance, enabling owner-operators to make data-driven decisions, optimize profitability, and navigate the complexities of the transportation industry. Failing to accurately capture and analyze revenue can lead to an incomplete understanding of financial health, potentially hindering long-term growth and stability.

2. Operating Expenses

Operating expenses represent the costs necessary to run a business. Within the context of an owner-operator profit and loss statement template, these expenses encompass all costs directly associated with the operation of the trucking business, excluding the cost of goods sold (which is not typically applicable in this context). Categorizing and tracking these expenses is crucial for accurate profit calculation and informed financial management. Operating expenses can be broadly categorized into fixed costs, like insurance premiums and truck payments, and variable costs, such as fuel and maintenance, which fluctuate with usage.

The relationship between operating expenses and the profit and loss statement is fundamental. Accurate recording of all operating expenses provides a clear picture of the costs incurred to generate revenue. For example, consider an owner-operator with high fuel consumption due to an inefficient route or poorly maintained equipment. This will directly impact profitability, and this information, clearly presented within the statement, allows for targeted interventions. Similarly, understanding the proportion of fixed versus variable costs allows operators to make informed decisions about pricing and operational efficiency. Perhaps securing a fuel card with discounted rates could significantly reduce variable costs. Alternatively, negotiating better insurance premiums could lower fixed costs.

Effective management of operating expenses is crucial for maximizing profitability. The profit and loss statement serves as a tool to identify areas where cost optimization is possible. Consistent monitoring and analysis of operating expenses empower owner-operators to make data-driven decisions, improve efficiency, and ensure the long-term financial health and sustainability of their businesses. Ignoring or underestimating operating expenses can lead to an inaccurate profit calculation, potentially resulting in poor financial decisions and jeopardizing the viability of the operation.

3. Fuel Costs

Fuel costs represent a significant operating expense for owner-operators in the transportation industry. Accurate tracking and analysis of fuel consumption within a profit and loss statement template are essential for understanding profitability and making informed business decisions. Fuel costs directly impact an owner-operator’s bottom line, and effective management of this expense is crucial for long-term financial success.

- Fuel Efficiency TrackingMonitoring miles per gallon (MPG) is fundamental. Variations in MPG can indicate mechanical problems, inefficient driving habits, or the impact of different load types. Consistently tracking fuel efficiency provides valuable data for identifying areas for improvement within the profit and loss statement. For example, a drop in MPG could reveal the need for preventative maintenance, directly impacting profitability.

- Fuel Price FluctuationsFuel prices are subject to market volatility. A profit and loss statement should reflect these fluctuations to provide an accurate picture of profitability over time. Analyzing fuel expenses against market trends allows operators to understand the impact of price changes on their business and explore strategies like fuel hedging or route optimization to mitigate rising costs. For instance, comparing fuel expenses during periods of high and low prices can reveal opportunities for cost savings.

- Fuel SurchargesFuel surcharges are designed to offset the impact of fluctuating fuel prices. Accurate accounting for fuel surcharges within the profit and loss statement is essential. This ensures that revenue generated from surcharges is properly reflected and allows operators to assess whether the surcharges adequately compensate for fuel cost increases. This analysis can be crucial during periods of significant price volatility.

- Fuel Card Programs and DiscountsUtilizing fuel card programs or negotiating discounts can significantly impact fuel costs. A profit and loss statement should reflect the savings achieved through these programs. This allows operators to quantify the benefits of participating in such programs and make informed decisions about which programs offer the greatest advantage. Comparing fuel costs before and after implementing a fuel card program can demonstrate its effectiveness.

By meticulously tracking and analyzing fuel costs within the framework of a profit and loss statement, owner-operators gain valuable insights into a major expense category. This information empowers informed decision-making regarding fuel efficiency strategies, cost management, and pricing, ultimately contributing to enhanced profitability and long-term financial stability.

4. Maintenance

Maintenance expenses represent a critical component of an owner-operator profit and loss statement template. These costs, encompassing both preventative and reactive maintenance, directly impact profitability and require diligent tracking. Preventative maintenance, including regular oil changes, tire rotations, and inspections, minimizes the risk of costly breakdowns and extends the operational life of equipment. Reactive maintenance, addressing unexpected repairs and component failures, can disrupt operations and incur significant expenses. A well-maintained truck operates more efficiently, consuming less fuel and reducing the likelihood of downtime due to mechanical issues. For example, neglecting regular brake maintenance could lead to more extensive and expensive repairs down the line, impacting the bottom line. Conversely, consistent preventative maintenance, while incurring upfront costs, can prevent more substantial expenses in the long run.

Accurately categorizing and recording maintenance expenses within the profit and loss statement provides valuable insights into the overall cost of equipment ownership. This data allows operators to anticipate future maintenance needs, budget accordingly, and make informed decisions about equipment replacement. Analyzing maintenance costs alongside operational data, such as mileage and load types, can reveal patterns and potential areas for improvement. For instance, an operator consistently hauling heavy loads might experience higher tire wear and tear, requiring more frequent tire replacements. This information, derived from the profit and loss statement, can inform decisions about tire selection, load management, and pricing strategies. Ignoring maintenance costs can lead to unexpected financial burdens, impacting profitability and long-term sustainability.

In summary, understanding and managing maintenance expenses is essential for owner-operators seeking to maximize profitability. Diligent tracking within the profit and loss statement framework allows for informed decision-making, improved operational efficiency, and proactive cost management. This approach ensures the long-term health and productivity of equipment, contributing to the overall financial success of the business. Failing to account for maintenance appropriately can lead to an inaccurate assessment of profitability and hinder the ability to make sound business decisions.

5. Insurance

Insurance premiums represent a significant fixed cost within an owner-operator profit and loss statement template. Various types of insurance coverage, including liability, cargo, physical damage, and bobtail insurance, are essential for protecting the business against financial risks associated with accidents, cargo loss, or damage to the truck. These premiums, while representing a substantial expense, safeguard the operator from potentially devastating financial consequences. For example, without adequate liability coverage, an accident could result in crippling legal fees and settlements, directly impacting the operator’s financial stability. Conversely, maintaining comprehensive insurance coverage, while increasing upfront costs, mitigates the risk of catastrophic financial losses.

Accurately recording insurance premiums within the profit and loss statement facilitates effective cost management and allows for an accurate assessment of profitability. This information enables operators to evaluate the cost-benefit of different insurance policies, explore options for optimizing coverage, and negotiate competitive premiums. For instance, an operator might discover that bundling different insurance policies with a single provider offers cost savings compared to purchasing individual policies. This analysis, facilitated by the profit and loss statement, can lead to significant reductions in operating expenses. Failing to account for insurance costs accurately can lead to an underestimation of operating expenses and an inaccurate profit calculation, hindering informed decision-making.

In conclusion, insurance plays a crucial role in protecting owner-operators from financial risks inherent in the transportation industry. Properly accounting for insurance premiums within the profit and loss statement framework promotes sound financial management and enables data-driven decisions regarding coverage and cost optimization. This proactive approach strengthens the financial resilience of the business, contributing to long-term stability and success. Ignoring or underestimating the importance of insurance can expose operators to significant financial vulnerabilities, potentially jeopardizing the viability of their operations.

6. Depreciation

Depreciation, representing the decrease in an asset’s value over time, plays a crucial role within an owner-operator profit and loss statement template. Specifically, it reflects the declining value of capital-intensive assets like trucks and trailers due to wear and tear, obsolescence, and age. Accurately accounting for depreciation provides a more realistic portrayal of profitability and allows for informed financial planning, particularly concerning future asset replacement. For example, a new truck loses a significant portion of its resale value within the first few years of operation. Recognizing this depreciation within the profit and loss statement provides a more accurate picture of the true cost of operating that asset over time. This understanding facilitates informed decisions about asset lifespan, replacement cycles, and potential resale value.

Several methods exist for calculating depreciation, each with its own implications for the profit and loss statement. The straight-line method, for example, evenly distributes the asset’s depreciable cost over its useful life, while accelerated depreciation methods allocate a larger portion of the depreciation expense to the earlier years of the asset’s life. The chosen method affects the timing of depreciation expense recognition, influencing profitability calculations within specific accounting periods. Understanding these different methods and their impact on the financial statement is crucial for accurate financial analysis and informed decision-making. For instance, using an accelerated depreciation method might result in lower reported profits in the early years of an asset’s life but offer tax advantages. Conversely, the straight-line method provides a more consistent reflection of depreciation expense over time.

In summary, depreciation is a vital component of a comprehensive owner-operator profit and loss statement. Accurate depreciation accounting, using appropriate calculation methods, provides crucial insights into the true cost of asset ownership, facilitates realistic profitability assessments, and supports informed long-term financial planning, including asset replacement strategies. Failing to account for depreciation can lead to an overstated perception of profitability, potentially hindering long-term financial stability and preparedness for future capital expenditures.

Key Components of an Owner-Operator Profit and Loss Statement

Essential elements within a profit and loss statement template provide a comprehensive overview of financial performance for owner-operators in the transportation sector. Understanding these components is fundamental for informed financial management and data-driven decision-making.

1. Revenue: Encompasses all income generated from transportation services, including linehaul revenue, accessorial charges (e.g., detention, layover), and fuel surcharges. Accurate revenue tracking is paramount for determining profitability and identifying growth opportunities.

2. Operating Expenses: Represents the costs associated with running the business. This includes fixed costs (e.g., insurance premiums, truck payments) and variable costs (e.g., fuel, maintenance). Effective management of operating expenses is crucial for maximizing profitability.

3. Fuel Costs: A significant expense category requiring meticulous tracking. Monitoring fuel efficiency (MPG), accounting for fuel price fluctuations, and managing fuel surcharges are essential for cost control.

4. Maintenance Expenses: Includes preventative maintenance (e.g., oil changes, inspections) and reactive maintenance (e.g., repairs). Effective maintenance management minimizes downtime and extends the useful life of assets.

5. Insurance Premiums: Covers essential insurance coverage like liability, cargo, and physical damage. Adequate insurance safeguards the business from financial risks associated with accidents or cargo loss.

6. Depreciation: Reflects the declining value of assets (e.g., trucks, trailers) over time. Accurate depreciation accounting provides a realistic portrayal of profitability and informs asset replacement decisions.

These components, when analyzed collectively, provide a detailed overview of financial performance. This data empowers owner-operators to identify areas for improvement, optimize resource allocation, and make strategic decisions to enhance profitability and achieve long-term financial stability.

How to Create an Owner-Operator Profit and Loss Statement

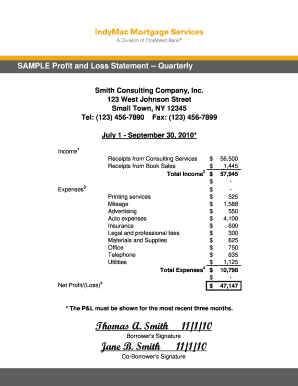

Creating a profit and loss statement provides essential insights into the financial health of an owner-operator trucking business. The following steps outline the process of developing this crucial financial document.

1. Choose a Reporting Period: Select a specific timeframe for the statement, such as a month, quarter, or year. Consistent reporting periods facilitate trend analysis and performance comparisons.

2. Calculate Total Revenue: Sum all income generated from trucking operations during the chosen period. This includes linehaul revenue, accessorial charges (e.g., detention, layover), and fuel surcharges. Ensure accurate recording of all revenue sources.

3. Itemize Operating Expenses: Categorize and record all expenses directly associated with business operations. This includes fuel costs, maintenance (preventative and reactive), insurance premiums, truck and trailer payments, permits, and licenses.

4. Calculate Gross Profit: Subtract total operating expenses from total revenue. This figure represents the profit generated before accounting for depreciation.

5. Calculate Depreciation Expense: Determine the depreciation expense for the reporting period based on the chosen depreciation method (e.g., straight-line, accelerated). This reflects the decrease in asset value over time.

6. Calculate Net Profit/Loss: Subtract depreciation expense from the gross profit. This final figure represents the net profit or loss for the reporting period.

7. Review and Analyze: Carefully examine the completed statement, comparing it to previous periods and industry benchmarks. Identify trends, areas for improvement, and potential cost-saving opportunities. This analysis informs data-driven decision-making for enhanced profitability and financial stability.

A well-constructed profit and loss statement offers a clear and concise snapshot of financial performance. Regularly generating and analyzing this statement empowers informed business decisions, contributing to long-term success in the transportation industry.

Financial viability in the transportation sector relies heavily on informed financial management. A properly utilized profit and loss statement template provides owner-operators with the essential tool for tracking revenue, managing expenses, and calculating profitability. By meticulously documenting income and expenditures, including often-overlooked costs like depreciation, operators gain a comprehensive understanding of their financial standing. This data-driven approach empowers informed decision-making regarding pricing strategies, equipment maintenance, and operational efficiency, ultimately contributing to long-term sustainability and growth.

The complexities of the transportation industry demand a commitment to financial awareness. Regularly generating and analyzing a profit and loss statement provides the necessary insights to navigate challenges, capitalize on opportunities, and achieve financial success. This proactive approach to financial management is not merely a best practice; it is a fundamental requirement for thriving in the competitive landscape of the transportation sector.