Utilizing a consistent format offers several advantages. It simplifies record-keeping for the association, enabling efficient tracking of dues and other charges. For homeowners, it provides a readily understandable summary of their account status, promoting financial awareness and facilitating timely payments. This clarity can minimize disputes and foster a positive relationship between the association and its members.

The following sections will delve into the specific components of these documents, exploring best practices for their creation and utilization, and highlighting the legal and financial implications for both homeowners’ associations and their members.

1. Account Identification

Accurate account identification is paramount for effective financial management within a homeowner’s association. Properly identifying each account on statements ensures that financial information reaches the intended recipient, preventing confusion and potential disputes. This accuracy forms the foundation for transparent and reliable financial reporting.

- Unique Account Numbers:Assigning a unique identifier to each homeowner account eliminates ambiguity, especially in communities with common names or similar addresses. This numerical identifier ensures that transactions are posted to the correct account, preventing errors and facilitating efficient record-keeping. For instance, an account number like “12345” distinguishes John Smith at 123 Main Street from another John Smith potentially residing at 124 Main Street.

- Property Address Verification:Including the full property address on the statement serves as an additional verification layer. This confirms that the statement corresponds to the correct property, even if minor discrepancies exist in the homeowner’s registered name. This is particularly crucial for properties owned by entities or held in trust where the account name might differ from the property address.

- Owner Name Clarity:While the account number serves as the primary identifier, including the homeowner’s name on the statement offers another level of confirmation. Listing the legal owner’s name, as registered with the association, ensures clarity and minimizes the risk of misinterpretation. This practice is essential for tracking ownership changes and maintaining accurate records.

- Sub-Account Differentiation (if applicable):Some associations might manage multiple accounts for a single property, such as separate accounts for regular assessments and special assessments. Clearly differentiating these sub-accounts on the statement ensures transparency and allows homeowners to understand the purpose of each charge. This segregation facilitates accurate tracking and prevents confusion between different payment obligations.

Accurate account identification ensures that each statement reflects the correct financial activity for the intended homeowner. This precision contributes to transparent financial management, fostering trust and promoting a positive relationship between the association and its members. In the context of a comprehensive statement template, accurate account identification is fundamental to ensuring the reliability and integrity of the financial information presented.

2. Date Range

A clearly defined date range is a critical component of any homeowner’s association statement of account template. This element provides context for the transactions listed, allowing homeowners to understand the period covered by the statement and reconcile it with their own records. A precise date range is essential for accurate financial reporting and promotes transparency between the association and its members.

- Statement Period Definition:The date range establishes the specific billing cycle covered by the statement. This period typically aligns with the association’s fiscal calendar, whether monthly, quarterly, or annually. A clearly stated period, for example, “January 1, 2024 – January 31, 2024,” prevents ambiguity and ensures that both the association and the homeowner understand the timeframe for the reported activity.

- Transaction Contextualization:The date range provides crucial context for the individual transactions listed within the statement. By associating each transaction with a specific date within the defined period, the statement allows homeowners to track their payments and charges chronologically. This chronological presentation facilitates reconciliation with personal records and helps identify any discrepancies.

- Accuracy and Dispute Resolution:A well-defined date range aids in resolving potential disputes regarding charges or payments. Having a clear timeframe for the transactions allows both the homeowner and the association to readily access supporting documentation and verify the accuracy of the information presented. This clarity minimizes misunderstandings and facilitates a more efficient resolution process.

- Financial Planning and Budgeting:The consistent use of specific date ranges on statements allows homeowners to anticipate upcoming charges and plan their finances accordingly. Predictable billing cycles, reflected in consistent date ranges, enable homeowners to budget effectively for their association dues and other related expenses. This predictability contributes to financial stability and reduces the likelihood of late payments.

The inclusion of a precise date range on a homeowner’s association statement of account is essential for both practical and legal reasons. It provides clarity, facilitates reconciliation, and supports accurate financial management for both the association and its members. This seemingly simple element plays a significant role in maintaining transparency and fostering a positive financial relationship within the community.

3. Transaction Details

Comprehensive transaction details are crucial for a transparent and informative homeowner’s association statement of account. These details provide clarity regarding the financial activity within the specified period, allowing homeowners to understand the basis for each charge and payment recorded on their account. A lack of sufficient detail can lead to confusion, disputes, and erode trust between the association and its members. Detailed transaction descriptions form the core of accountable financial reporting.

Each transaction entry should include a concise yet descriptive explanation of the charge or payment. Generic descriptions such as “assessment” or “fee” offer little insight. Instead, specifying “Annual Assessment Q1 2024” or “Late Payment Fee – March 2024” provides clarity and context. Further detail, such as invoice numbers or reference codes linked to specific services or violations, strengthens the record’s auditability. For example, a line item reading “Landscaping Services – Invoice #12345” provides a clear and verifiable record of a specific service rendered. This level of detail facilitates reconciliation and allows homeowners to track expenditures effectively.

Consistent and standardized formatting of transaction details ensures clarity and ease of interpretation. Utilizing a consistent date format, standardized description terminology, and clear indication of debits and credits eliminates ambiguity. A well-structured template ensures that information is presented uniformly across all statements, simplifying review and comparison. Consider a scenario where inconsistent date formats are used; this can lead to confusion and difficulty in reconciling transactions with personal records. Standardized formatting contributes to a more professional and trustworthy financial record, fostering confidence among homeowners in the association’s financial management practices. This meticulous approach to transaction details contributes significantly to transparent and accountable financial reporting within the association.

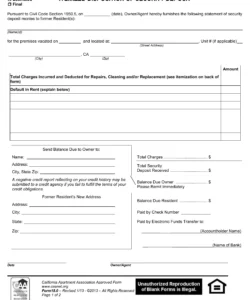

4. Balance Summary

A balance summary is a critical component of a comprehensive homeowner’s association (HOA) statement of account template. It provides a concise overview of the homeowner’s current financial standing with the association, summarizing key figures such as beginning balance, total charges, total payments, and ending balance. This consolidated view allows homeowners to quickly grasp their account status and identify any outstanding amounts owed. Without a clear balance summary, homeowners might struggle to understand their financial obligations, potentially leading to late payments and associated penalties. A well-structured balance summary contributes significantly to financial clarity and facilitates responsible financial management for both the homeowner and the association. For example, a homeowner can readily determine whether a payment made has been correctly applied and reflected in the current balance, preventing potential discrepancies and fostering trust in the HOA’s accounting practices.

The placement and format of the balance summary within the statement are crucial for its effectiveness. Ideally, it should be prominently displayed, often at the top or bottom of the statement, for easy access. The information should be presented in a clear and logical manner, using consistent terminology and formatting. A table format often proves effective for presenting the balance summary, allowing for easy visual comparison of key figures. For instance, clearly separating “Previous Balance,” “Current Charges,” “Payments Received,” and “Outstanding Balance” in a tabular format enhances readability and comprehension. Moreover, including the statement period alongside the balance summary further contextualizes the presented information, linking it to the specific timeframe covered by the statement. This precision strengthens the accuracy and reliability of the financial reporting.

An accurate and readily understandable balance summary empowers homeowners to manage their HOA-related finances effectively. It serves as a vital tool for reconciling payments, identifying outstanding dues, and budgeting for future assessments. Furthermore, it reinforces transparency and accountability within the association, fostering a positive financial relationship between the HOA and its members. Challenges can arise if the balance summary is unclear or inconsistent; this can lead to disputes and erode trust. Therefore, a well-designed balance summary is integral to a comprehensive and effective HOA statement of account template, promoting financial clarity and responsible community management. It serves as a cornerstone for effective financial communication within the association, facilitating a healthy and transparent financial ecosystem.

5. Contact Information

Inclusion of accurate and accessible contact information is a crucial element of any effective homeowner’s association (HOA) statement of account template. This information facilitates communication between the HOA and its members regarding account inquiries, discrepancies, or payment arrangements. Without clear contact information, homeowners face challenges in resolving issues promptly, potentially leading to escalated disputes and strained relationships. Providing multiple channels for communication, such as phone numbers, email addresses, and physical mailing addresses, ensures accessibility for diverse homeowner preferences and needs. For instance, a homeowner noticing a discrepancy in their listed payment can quickly contact the HOA’s accounting department through the provided contact details for clarification, preventing potential misunderstandings and promoting efficient resolution.

Strategic placement of contact information within the statement template enhances its visibility and usability. Ideally, contact details should be located prominently, perhaps in a dedicated section at the top or bottom of the statement, ensuring easy access for homeowners. Including specific contact details for different departments or individuals responsible for specific inquiries further streamlines communication. For example, providing a dedicated email address for payment inquiries or a separate phone number for architectural review requests can significantly reduce response times and improve the overall efficiency of communication. This targeted approach enhances the homeowner experience and fosters a more proactive and responsive HOA management approach.

Clear and accessible contact information contributes significantly to a transparent and responsive HOA management structure. It empowers homeowners to address financial concerns promptly and efficiently, minimizing potential conflicts and fostering a more positive relationship between the HOA and its members. Challenges arise when contact information is outdated or difficult to locate; this can erode trust and create unnecessary friction within the community. Therefore, including comprehensive and readily available contact information within the HOA statement of account template is a best practice that supports effective communication, efficient dispute resolution, and a stronger sense of community. This practice contributes to a more harmonious and well-managed community environment, ultimately benefiting all stakeholders.

Key Components of a Homeowner’s Association Statement of Account

A comprehensive statement of account template provides clarity and transparency in financial reporting for homeowner’s associations. Several key components ensure the document serves its purpose effectively.

1. Account Identification: Clear identification of the homeowner’s account is paramount. This typically includes the account number, property address, and homeowner name. Accurate account identification prevents misapplied payments and ensures accurate record-keeping.

2. Date Range: The statement must clearly define the period covered by the reported transactions. A specific date range, such as “January 1, 2024 – January 31, 2024,” contextualizes the financial activity and facilitates reconciliation with homeowner records.

3. Transaction Details: Detailed descriptions of each transaction are essential. Vague descriptions like “fee” are insufficient. Specific details, such as “Annual Assessment Q1 2024” or “Late Payment Fee – March 2024,” provide clarity and enable accurate tracking of charges and payments.

4. Balance Summary: A concise summary of the account balance, including the beginning balance, total charges, total payments, and ending balance, provides a snapshot of the homeowner’s current financial standing. This summary facilitates budgeting and prompt payment of dues.

5. Contact Information: Accessible contact information for the HOA’s accounting department empowers homeowners to address inquiries and resolve discrepancies efficiently. Providing multiple contact channels, such as phone numbers, email addresses, and physical addresses, ensures accessibility.

These elements ensure that statements of account serve as effective communication tools, fostering financial transparency and accountability within the homeowner’s association. Accurate and comprehensive statements contribute to a positive financial relationship between the association and its members, promoting a well-managed and financially stable community.

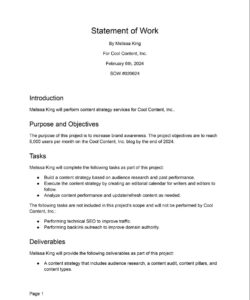

How to Create a Homeowner’s Association Statement of Account Template

Creating a standardized template ensures clarity and consistency in financial reporting for homeowner’s associations. A well-structured template benefits both the association and its members by facilitating accurate record-keeping, timely payments, and transparent communication.

1. Software Selection: Choose appropriate software. Spreadsheet software or dedicated HOA management software offers the necessary functionality for creating and managing statements. Consider factors such as scalability, reporting capabilities, and integration with other association management tools. Selecting software tailored to HOA financial management often streamlines processes and improves efficiency.

2. Header Information: Include essential header information. The association’s name, contact information, and the statement period should be clearly displayed at the top of the template. This ensures clear identification and contextualizes the information presented within the statement.

3. Account Identification Section: Designate a section for clear account identification. This section should include fields for the homeowner’s account number, property address, and legal name as registered with the association. Accurate account identification is crucial for preventing misapplied payments and maintaining accurate records.

4. Transaction Detail Area: Create a structured area for listing transaction details. This area should include columns for the transaction date, description, debit amount, credit amount, and running balance. Detailed descriptions, such as “Annual Assessment Q1 2024” or “Late Payment Fee – March 2024”, provide clarity and facilitate accurate tracking.

5. Balance Summary Section: Incorporate a dedicated balance summary section. This section should clearly display the beginning balance, total charges, total payments, and ending balance for the statement period. A well-structured balance summary allows homeowners to quickly grasp their current financial standing.

6. Contact Information Section: Include a section for HOA contact information. This section should list relevant phone numbers, email addresses, and physical mailing addresses for inquiries related to account balances, payments, or other financial matters. Accessible contact information promotes efficient communication and facilitates prompt resolution of inquiries.

7. Legal Disclosures (if applicable): Include any necessary legal disclaimers or disclosures required by state or local regulations. This ensures compliance and provides homeowners with important legal information related to their account and payment obligations.

8. Testing and Refinement: Before widespread implementation, test the template with a small group of homeowners to gather feedback and identify any necessary revisions. This iterative process ensures the template’s usability and effectiveness in conveying essential financial information.

A well-designed template, incorporating these elements, promotes financial transparency and accountability, fostering a positive financial relationship between the association and its members. Consistent use of a standardized template streamlines communication, simplifies record-keeping, and contributes to a well-managed community.

Accurate and comprehensive financial reporting is essential for the effective management of any homeowner’s association. Standardized documents, utilizing a well-designed template, provide clarity and transparency for both the association and its members. Key elements such as clear account identification, precise date ranges, detailed transaction descriptions, concise balance summaries, and accessible contact information ensure that these documents serve as valuable communication tools, facilitating timely payments, efficient dispute resolution, and a positive financial relationship within the community. Consistent implementation of these best practices promotes financial stability and contributes to a well-managed and harmonious community environment.

Effective financial management within a homeowner’s association requires ongoing attention to detail and a commitment to transparent communication. Regular review and refinement of accounting practices, including the utilization of robust and adaptable templates, are crucial for maintaining financial health and fostering a positive relationship between the association and its members. By prioritizing clear and accurate financial reporting, homeowner’s associations can build trust, promote financial stability, and contribute to a thriving community environment. A commitment to these principles strengthens the foundation of the association and ensures its long-term success.