Utilizing such a tool allows for better budgeting, informed financial decision-making, and identification of areas for potential savings. It can also prove valuable for tax preparation, loan applications, and overall financial planning. A well-maintained record of income and expenses empowers individuals to gain control over their finances and work towards their financial goals.

This understanding of financial tracking lays the groundwork for exploring related topics such as budgeting methods, expense reduction strategies, and long-term financial planning.

1. Income Sources

Accurate representation of income sources forms the foundation of a reliable personal income and expense statement. Without a thorough accounting of all incoming funds, the resulting financial picture remains incomplete and potentially misleading. Understanding the relationship between income sources and the overall statement allows for informed financial decisions. For instance, differentiating between earned income (salary, wages) and unearned income (investments, dividends) provides valuable insights into financial stability and diversification.

Consider a scenario where an individual relies primarily on freelance work. Accurately documenting each project’s payment, including potential delays or fluctuations, becomes crucial for projecting future income and budgeting accordingly. Conversely, someone with a stable salary might focus on tracking additional income streams, such as rental income or investment returns, to assess their impact on overall financial health. This detailed tracking within the statement facilitates effective tax planning and informed investment strategies.

In conclusion, meticulous documentation of all income sources, regardless of size or regularity, ensures the integrity of the financial statement. This practice enables a comprehensive understanding of one’s financial position, empowering informed decision-making and promoting long-term financial well-being. Challenges may arise in tracking variable income streams, highlighting the need for consistent monitoring and accurate record-keeping systems. This detailed approach to income tracking provides a crucial foundation for broader financial planning and analysis.

2. Expense Categories

Effective financial management hinges on a clear understanding of expense allocation. Categorizing expenses within a personal income and expense statement template provides crucial insights into spending patterns and informs budget adjustments. This structured approach facilitates identifying areas of overspending and potential savings opportunities.

- Essential ExpensesThese encompass fundamental needs such as housing, utilities, food, and transportation. For example, rent or mortgage payments, electricity bills, grocery costs, and commuting expenses fall under this category. Accurate tracking of essential expenses allows for assessment of their proportion relative to income and identification of potential cost-saving measures. This might involve exploring more affordable housing options or optimizing commuting strategies.

- Discretionary ExpensesThese represent non-essential spending, including entertainment, dining out, hobbies, and travel. Regularly monitoring discretionary expenses illuminates areas where adjustments can be made to align with financial goals. For instance, reducing the frequency of restaurant meals or exploring more cost-effective leisure activities can free up resources for savings or debt reduction.

- Periodic ExpensesThese recurring expenses occur less frequently than monthly bills, such as annual insurance premiums, property taxes, or subscription renewals. Accounting for periodic expenses within the template ensures accurate budgeting and avoids unexpected financial strain. This may involve setting aside funds monthly to cover these larger, less frequent costs.

- Debt PaymentsThis category includes payments toward loans, credit cards, and other forms of debt. Tracking debt payments facilitates monitoring progress toward debt reduction and informs decisions regarding debt prioritization. Analyzing debt payments within the context of overall expenses can highlight opportunities for debt consolidation or refinancing.

By meticulously categorizing expenses within a personal income and expense statement template, individuals gain a comprehensive understanding of their financial outflows. This granular approach empowers informed decision-making regarding budgeting, saving, and debt management, ultimately contributing to improved financial well-being. Analyzing trends within each expense category over time provides further insights into spending habits and informs adjustments to achieve financial objectives.

3. Time Period

Defining a specific time period is crucial for utilizing a personal income and expense statement template effectively. The chosen timeframe provides the context for analyzing financial inflows and outflows, enabling meaningful comparisons and informed decision-making. Without a defined period, the data lacks structure and comparative value.

- Monthly TrackingMonthly tracking offers a granular view of income and expenses, facilitating timely adjustments to spending habits. Analyzing monthly data allows for quick identification of overspending trends and proactive budget adjustments. For example, unusually high utility bills in a particular month might prompt investigation into energy consumption patterns.

- Quarterly AnalysisQuarterly analysis provides a broader perspective on financial performance. This timeframe allows for assessing progress toward medium-term financial goals and identifying seasonal spending patterns. For instance, higher travel expenses in a specific quarter might reflect planned vacations, confirming adherence to a budgeted allocation.

- Annual ReviewAn annual review facilitates comprehensive assessment of financial health. This longer timeframe allows for evaluating overall income and expense trends, informing long-term financial planning and investment strategies. For example, comparing annual housing costs year over year provides insights into housing affordability and potential adjustments needed for future budgeting.

- Custom TimeframesUtilizing custom timeframes allows for targeted analysis of specific financial events or goals. This flexibility enables focused tracking for short-term projects, such as saving for a down payment or managing expenses related to a specific event. For instance, tracking expenses related to a home renovation project within a defined timeframe provides valuable insights into project costs and budget adherence.

Selecting an appropriate time period provides the framework for meaningful financial analysis within a personal income and expense statement template. Whether monthly tracking, quarterly analysis, or annual review, the chosen timeframe must align with individual financial goals and reporting needs. The flexibility to customize timeframes allows for focused tracking of specific financial events or objectives, enhancing the template’s utility as a comprehensive financial management tool.

4. Data Accuracy

Data accuracy within a personal income and expense statement template is paramount for deriving meaningful insights and making sound financial decisions. Inaccurate data renders the entire process ineffective, potentially leading to flawed budgeting, misguided investment strategies, and an incomplete understanding of one’s financial standing.

- Complete Recording of TransactionsEvery financial transaction, regardless of size, must be documented within the template. Omitting even small expenses can skew the overall picture of spending habits. For instance, failing to record regular small purchases like coffee or snacks can lead to an underestimation of discretionary spending, hindering accurate budget allocation.

- Correct Categorization of EntriesProper categorization ensures accurate analysis of spending patterns. Misclassifying expenses, such as assigning a grocery purchase to the “dining out” category, distorts the understanding of where funds are allocated. This can lead to misinformed decisions regarding budget adjustments in specific spending areas.

- Timely Entry of InformationRegular and prompt recording of transactions prevents omissions and ensures data integrity. Delaying entries increases the likelihood of forgetting transactions altogether, leading to an incomplete and inaccurate financial record. This can hinder timely identification of potential overspending and delay necessary budget adjustments.

- Verification and ReconciliationRegularly verifying entries against bank statements and receipts identifies discrepancies and ensures data reliability. This process helps detect errors, such as duplicate entries or incorrect amounts, maintaining the accuracy and integrity of the financial record. Reconciling the template with external financial statements provides further validation and strengthens the reliability of the data.

Maintaining accurate data within a personal income and expense statement template is foundational to effective financial management. The insights derived from accurate data inform budget creation, spending adjustments, and long-term financial planning. Compromised data accuracy undermines the template’s utility, potentially leading to flawed financial decisions and an incomplete understanding of one’s financial position. Diligence in recording, categorizing, and verifying data ensures the template serves as a reliable tool for achieving financial goals.

5. Regular Updates

Maintaining a regularly updated personal income and expense statement template is essential for accurate financial tracking and effective budget management. Consistent updates ensure the data reflects current financial realities, allowing for timely identification of spending trends and informed decision-making. Without regular updates, the template becomes a static snapshot of the past, failing to provide a relevant picture of current financial health. For instance, a sudden increase in transportation costs might go unnoticed without frequent updates, hindering timely budget adjustments or exploration of alternative commuting options.

The frequency of updates depends on individual financial circumstances and preferences. Some might find weekly updates beneficial for closely monitoring spending, while others might prefer bi-weekly or monthly updates. Irrespective of the chosen frequency, consistency is key. Automated tools and mobile applications can facilitate regular updates, minimizing manual effort and promoting data accuracy. For example, linking bank accounts to budgeting software allows for automatic transaction imports, simplifying the updating process and reducing the likelihood of errors. Regularly reconciling these automated updates with manual reviews of receipts and bank statements further enhances data reliability.

Regular updates to a personal income and expense statement template are crucial for maintaining an accurate and dynamic view of financial health. This practice enables proactive budget management, informed financial decisions, and timely identification of spending trends. Leveraging technology and establishing consistent update routines further strengthens the template’s effectiveness as a tool for achieving financial goals. Failure to maintain regular updates can lead to outdated information, hindering accurate financial assessment and potentially impacting long-term financial well-being.

Key Components of a Personal Income and Expense Statement

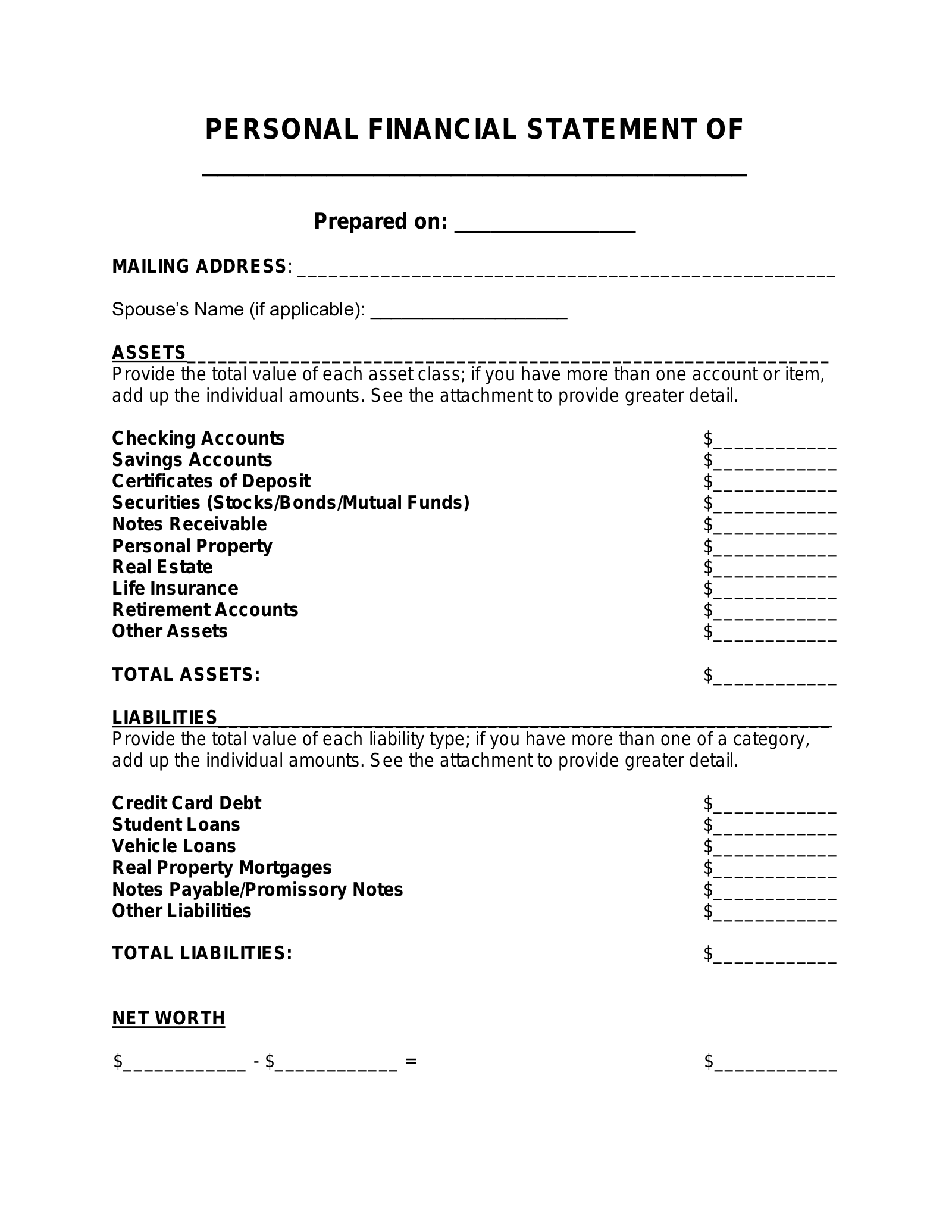

A well-structured statement requires several key components for accurate financial representation and analysis. These components provide the framework for organizing financial data and extracting meaningful insights.

1. Income Sources: Comprehensive documentation of all income streams, including salaries, wages, investments, and other sources, forms the basis of the statement. Accuracy in recording income is crucial for assessing overall financial health.

2. Expense Categories: Categorizing expenses provides a granular view of spending patterns. Standard categories include housing, transportation, food, utilities, healthcare, and debt payments. Detailed categorization enables identification of areas for potential savings.

3. Time Period: Defining a specific time period, such as monthly, quarterly, or annually, provides the context for analyzing financial trends. This allows for comparisons over time and informed adjustments to budgeting strategies.

4. Data Accuracy: Accurate data entry is paramount. Errors in recording transactions or miscategorizing expenses can lead to misleading conclusions. Regular verification and reconciliation with bank statements are essential.

5. Regular Updates: Consistent updates ensure the statement reflects current financial realities. Regularly recording transactions and updating the statement prevents data from becoming outdated and irrelevant.

6. Template Format: Choosing an appropriate template format, whether digital or paper-based, influences usability and data organization. A well-designed template simplifies data entry and facilitates analysis. Considerations include accessibility, ease of use, and compatibility with other financial tools.

7. Supporting Documentation: Retaining supporting documentation, such as receipts and bank statements, provides verification for recorded transactions. This documentation is crucial for auditing purposes and resolving discrepancies.

These components work together to create a comprehensive and reliable record of financial activity, enabling informed financial decisions and effective budget management. A well-maintained statement serves as a valuable tool for achieving financial goals and ensuring long-term financial well-being.

How to Create a Personal Income and Expense Statement Template

Creating a personalized template facilitates organized financial tracking. The following steps outline the process of developing a template tailored to individual needs.

1. Choose a Format: Select a format spreadsheet software, budgeting apps, or a simple notebook based on individual preferences and technological comfort. Spreadsheet software offers flexibility and formula integration for automated calculations. Budgeting apps provide convenient mobile access and often integrate with bank accounts. A notebook offers a tangible, low-tech option.

2. Define the Time Period: Establish a consistent tracking period, such as monthly, quarterly, or annually. This timeframe provides structure for analysis and comparison. Monthly tracking allows for detailed monitoring of spending habits, while annual tracking provides a broader overview of financial performance.

3. List Income Sources: Enumerate all sources of income, including salaries, wages, investment returns, rental income, and other sources. Detailed income tracking ensures a comprehensive view of financial inflows.

4. Categorize Expenses: Establish expense categories aligned with individual spending habits. Common categories include housing, transportation, food, utilities, healthcare, entertainment, and debt payments. Detailed categorization facilitates analysis of spending patterns.

5. Design the Template: Structure the template with clear headings for income sources, expense categories, and the chosen time period. Ensure adequate space for recording transactions and calculating totals. If using spreadsheet software, incorporate formulas for automated calculations.

6. Input Data Regularly: Consistently record income and expenses within the chosen time period. Timely data entry ensures accuracy and prevents omissions. Leverage features like automatic transaction imports from bank accounts if using budgeting apps or software.

7. Review and Analyze: Regularly review the completed template to identify spending trends, areas for potential savings, and progress toward financial goals. This analysis informs budget adjustments and future financial decisions.

8. Maintain Supporting Documentation: Retain supporting documentation, such as receipts, bank statements, and invoices, for verification purposes. This documentation supports the accuracy of the recorded data and can be valuable for tax preparation or auditing.

A well-designed and consistently maintained template enables effective financial tracking, promotes informed decision-making, and contributes to long-term financial well-being. Regular review and analysis of the data empowers individuals to understand their financial position and work toward their financial goals.

Careful management of personal finances requires a structured approach to tracking income and expenses. A dedicated template provides the necessary framework for organizing financial data, enabling informed decision-making and effective budgeting. Key aspects include accurate categorization of income and expenses, consistent data entry, and regular review of spending patterns. Leveraging available tools, whether digital spreadsheets or traditional notebooks, facilitates this process. Accurate data within such a template empowers informed choices regarding spending, saving, and overall financial management.

Financial well-being hinges on understanding one’s financial position. A well-maintained record of income and expenses serves as a roadmap for achieving financial goals. This practice empowers individuals to navigate financial complexities, make informed decisions, and build a secure financial future. The consistent application of these principles fosters financial stability and promotes long-term prosperity.