A financial report designed specifically for real estate investments provides a structured overview of income and expenses over a specific period. This report summarizes all cash inflows, such as rents collected and late fees, alongside all cash outflows, including mortgage payments, property taxes, insurance, maintenance, and repairs. It offers a clear picture of an investment’s financial performance.

Utilizing this type of structured financial reporting offers numerous advantages. It allows investors to accurately assess the profitability of their rental properties, identify areas for potential cost savings, and make informed decisions about future investments. This documented financial performance is also crucial for securing financing, attracting potential investors, and fulfilling tax obligations.

Understanding the components and benefits of organized financial reporting for real estate is essential for effective property management. The following sections will delve into the specific elements of income and expenses typically included in these reports, providing practical guidance for their creation and interpretation.

1. Income

Accurate income reporting forms the foundation of a reliable profit and loss statement for rental properties. This encompasses all revenue generated by the property, including standard monthly rents, late fees, pet fees, parking fees, and any other miscellaneous income streams. Clearly distinguishing between different income types allows for a granular understanding of revenue sources and their respective contributions to overall profitability. For instance, tracking late fees separately can highlight potential issues with tenant payment practices. Consistent and detailed income documentation is essential for accurate financial analysis and informed decision-making.

Consider a property with multiple units. Accurately recording the rent collected from each unit, along with any additional income specific to that unit, provides a precise income profile for each rental space. This detailed breakdown allows for a more nuanced understanding of the property’s performance, enabling owners to identify high-performing units and address potential issues with underperforming ones. Moreover, accurate income tracking facilitates comparisons across different properties within a portfolio, enabling strategic adjustments to rental pricing and other income-generating strategies.

Thorough income documentation is not only essential for understanding current financial performance but also for future projections and investment analysis. Understanding historical income trends allows for more accurate forecasting of future revenue streams, which is critical for making informed decisions about property improvements, rent adjustments, and overall investment strategy. Furthermore, consistent and accurate income records are crucial for tax reporting and compliance, minimizing potential liabilities and ensuring accurate representation of financial performance.

2. Expenses

A comprehensive understanding of expenses is crucial for accurate profit and loss analysis in rental property management. Accurately categorizing and tracking expenses allows for precise profitability calculations and informed decision-making regarding property investments. The following facets provide a structured approach to expense management within the context of a rental property profit and loss statement template.

-

Operating Expenses

These recurring costs are essential for the day-to-day operation and maintenance of the property. Examples include property taxes, insurance premiums, property management fees, landscaping, pest control, and routine repairs. Accurately tracking these expenses allows for effective budgeting and identification of potential cost-saving opportunities. Regular review of operating expenses can reveal areas where adjustments can be made to improve overall profitability. For instance, comparing insurance premiums across different providers can lead to significant savings.

-

Capital Expenditures (CAPEX)

These are significant investments in improvements or upgrades that extend the life of the property or increase its value. Examples include roof replacements, HVAC system upgrades, major renovations, and additions. While not recurring like operating expenses, CAPEX significantly impacts long-term profitability and should be carefully planned and accounted for within the profit and loss statement. Understanding the timing and magnitude of CAPEX allows for better financial forecasting and strategic allocation of resources.

-

Financing Costs

For properties financed through mortgages or other loans, financing costs represent a significant expense category. This includes mortgage interest payments, loan origination fees, and other associated costs. Accurately tracking financing costs is essential for determining the true cost of property ownership and its impact on overall profitability. Understanding the structure and terms of financing agreements allows for strategic refinancing decisions to optimize financing costs and maximize returns.

-

Vacancy Costs

Periods of vacancy represent a loss of potential income and should be accounted for within the expense structure. Vacancy costs can include lost rent, advertising expenses for finding new tenants, and cleaning and preparation costs for new occupancy. Minimizing vacancy periods through effective marketing and tenant screening processes is crucial for maximizing profitability. Analyzing vacancy trends can also inform pricing strategies and identify potential issues that may be contributing to extended vacancy periods.

Accurate and detailed expense tracking across these categories provides a comprehensive view of the costs associated with rental property ownership. This granular understanding of expenses allows for informed decision-making regarding property management, rent adjustments, and overall investment strategies. By analyzing expense trends within the context of the profit and loss statement, investors can identify areas for improvement, optimize resource allocation, and maximize the profitability of their rental investments.

3. Calculations

Accurate calculations are fundamental to a meaningful profit and loss statement for rental properties. These calculations transform raw income and expense data into actionable insights, driving informed financial decisions. Understanding the key calculations provides a basis for evaluating property performance and making strategic adjustments.

-

Net Operating Income (NOI)

NOI represents the property’s profitability before accounting for debt service and capital expenditures. It is calculated by subtracting total operating expenses from total revenue. NOI provides a clear picture of the property’s core operating performance and serves as a key metric for property valuation and comparison. For example, a property with higher NOI is generally considered more valuable than a comparable property with lower NOI, assuming similar risk profiles.

-

Cash Flow

Cash flow measures the actual cash generated by the property after accounting for all expenses, including debt service (mortgage payments). Positive cash flow indicates that the property generates sufficient income to cover all expenses, while negative cash flow indicates a shortfall. Analyzing cash flow is crucial for assessing the property’s ability to generate returns and cover financial obligations. Understanding cash flow trends can also inform decisions regarding rent adjustments and expense management.

-

Capitalization Rate (Cap Rate)

The cap rate is a crucial metric for evaluating the potential return on investment for a rental property. It is calculated by dividing the NOI by the property’s market value or purchase price. Cap rates provide a standardized way to compare the relative value of different investment properties, independent of financing. A higher cap rate generally suggests a higher potential return, but also potentially higher risk.

-

Return on Investment (ROI)

ROI measures the overall profitability of a rental property investment. It is calculated by dividing the net profit (after all expenses and debt service) by the total investment. ROI provides a comprehensive assessment of the return generated on the invested capital, considering both income and appreciation. Analyzing ROI over time allows investors to track the performance of their investments and make informed decisions regarding future acquisitions or dispositions.

These calculations, derived from the data within the profit and loss statement, provide critical insights into the financial performance of a rental property. Understanding these metrics is essential for effective property management, investment analysis, and strategic decision-making. By analyzing these calculated values over time, investors can identify trends, optimize performance, and maximize the return on their rental property investments. Comparing these metrics across different properties within a portfolio allows for informed resource allocation and strategic adjustments to maximize overall portfolio performance.

4. Reporting Period

The reporting period defines the timeframe covered by a rental property profit and loss statement. Selecting an appropriate reporting period is crucial for deriving meaningful insights into financial performance. Common reporting periods include monthly, quarterly, and annually, each serving distinct analytical purposes. The choice of reporting period directly influences the data presented and the conclusions drawn from the statement.

Monthly reporting provides a granular view of income and expenses, allowing for timely identification of trends and potential issues. For example, a sudden spike in repair costs in a particular month could indicate an unforeseen maintenance issue requiring immediate attention. Annual reporting, on the other hand, offers a broader perspective on overall profitability and facilitates year-over-year comparisons. This longer timeframe smooths out short-term fluctuations and provides a clearer picture of long-term performance trends. Quarterly reporting provides a balance between these two, offering a more frequent overview than annual reporting while still mitigating some of the volatility inherent in monthly data.

The strategic selection of a reporting period depends on the specific analytical objectives. For operational management and expense control, monthly reporting is often preferred. For evaluating long-term investment performance and making strategic decisions, annual reporting provides a more comprehensive view. Understanding the nuances of each reporting period and its impact on data interpretation is essential for leveraging the full potential of a rental property profit and loss statement template.

5. Template Format

A consistent template format is essential for effective utilization of rental property profit and loss statements. Standardized formatting ensures comparability across different reporting periods, facilitates efficient data entry, and reduces the risk of errors. A well-structured template should clearly delineate income categories, expense categories, and calculated metrics, enabling straightforward analysis and interpretation of financial data. This structured approach allows for easy identification of trends, anomalies, and areas requiring attention. For example, a consistent format for reporting operating expenses allows for immediate comparison of current expenses against previous periods or budgeted amounts, facilitating proactive cost management.

Practical applications of a standardized template include tracking performance over time, comparing performance across multiple properties, and generating reports for tax purposes or investor presentations. A consistent structure allows for the creation of automated reports and dashboards, streamlining financial analysis and decision-making. Furthermore, a well-defined template facilitates integration with accounting software, enabling seamless data transfer and reducing manual data entry. This integration not only saves time but also improves accuracy and reduces the risk of human error. Utilizing a template specifically designed for rental properties ensures inclusion of all relevant income and expense categories, enhancing the comprehensiveness and accuracy of the financial analysis.

Consistent template formatting contributes significantly to the accuracy, efficiency, and usability of rental property profit and loss statements. A well-structured template enables clear and concise communication of financial information, supporting informed decision-making and effective property management. Adopting a standardized approach to reporting enhances comparability, facilitates trend analysis, and promotes informed financial strategies for maximizing returns on rental property investments.

Key Components of a Rental Property Profit and Loss Statement Template

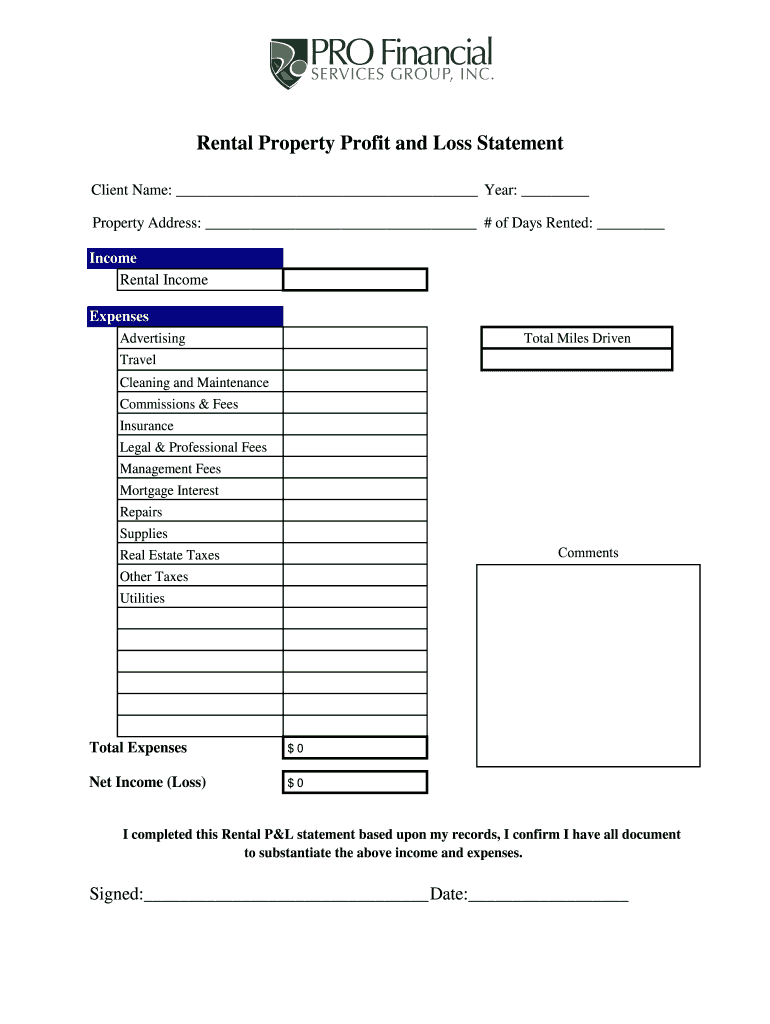

A comprehensive profit and loss statement template for rental properties requires specific components for accurate financial analysis. These components provide a structured framework for capturing all relevant income and expenses, enabling informed decision-making.

1. Property Information: Clear identification of the property, including address and unit numbers (if applicable), is essential for accurate record-keeping and reporting. This information allows for easy differentiation between multiple properties within a portfolio.

2. Reporting Period: The specified timeframe, whether monthly, quarterly, or annually, dictates the scope of the financial data presented. A consistent reporting period allows for meaningful comparisons over time.

3. Income Section: This section details all revenue generated by the property, including rents, late fees, and other miscellaneous income. Clear categorization of income streams provides insights into revenue drivers.

4. Expense Section: This section comprehensively outlines all costs associated with property ownership and operation, including operating expenses, capital expenditures, financing costs, and vacancy costs. Categorization aids in expense management and budgeting.

5. Calculations: Key metrics derived from the income and expense data, such as Net Operating Income (NOI), cash flow, capitalization rate, and return on investment (ROI), provide essential insights into property performance and profitability.

6. Depreciation: An allowance for the wear and tear of the property over time. This non-cash expense impacts taxable income and should be accurately reflected in the statement.

7. Net Income: This bottom-line figure represents the property’s profit after deducting all expenses, including depreciation, from total income. Net income serves as a crucial indicator of overall financial performance.

Accurate and detailed documentation across these components allows for a comprehensive understanding of a rental property’s financial health, facilitating strategic decision-making for optimized profitability and long-term growth.

How to Create a Rental Property Profit and Loss Statement Template

Creating a robust template ensures consistent tracking and analysis of rental property financials. A well-structured template facilitates informed decision-making and effective property management.

1. Define the Reporting Period: Establish the timeframe for the statement (monthly, quarterly, or annually). Consistent reporting periods enable accurate comparisons over time.

2. Property Identification: Clearly identify the property, including the full address and individual unit numbers if applicable. This ensures accurate record-keeping for specific properties.

3. Structure the Income Section: Categorize all income sources, such as rents, late fees, parking fees, and other miscellaneous income. Detailed categorization provides insights into revenue streams.

4. Detail the Expense Section: Categorize all expenses, including operating expenses (e.g., property taxes, insurance, maintenance), capital expenditures (e.g., renovations, major repairs), financing costs (e.g., mortgage interest), and vacancy costs. Comprehensive expense tracking is crucial for accurate profitability analysis.

5. Include Calculation Fields: Incorporate formulas to automatically calculate key metrics like Net Operating Income (NOI), cash flow, capitalization rate, and return on investment (ROI). Automated calculations improve accuracy and efficiency.

6. Account for Depreciation: Include a section for depreciation expense, which reflects the decrease in property value over time. Accurate depreciation tracking is crucial for tax purposes.

7. Calculate Net Income: Deduct total expenses, including depreciation, from total income to arrive at the net income. This figure represents the overall profitability of the property.

8. Choose a Format: Select a format spreadsheet software, dedicated property management software, or even a well-structured document that facilitates data entry, calculations, and report generation. A user-friendly format promotes consistent use and accurate record-keeping.

A comprehensive template incorporating these elements provides a structured framework for analyzing rental property financials, supporting informed decisions regarding property management, investment strategies, and long-term financial planning.

Effective management of rental properties requires a thorough understanding of financial performance. A properly structured profit and loss statement template provides the framework for capturing, categorizing, and analyzing income and expenses. This structured approach enables calculation of key performance indicators such as Net Operating Income, cash flow, and return on investment, facilitating informed decision-making regarding pricing strategies, expense management, and overall investment strategy. Consistent use of a comprehensive template ensures accurate financial reporting, supports compliance requirements, and promotes long-term financial health.

Accurate financial analysis is paramount to success in the rental property market. Implementing a robust profit and loss statement template provides the necessary tools for informed financial management, enabling investors to maximize returns, mitigate risks, and achieve long-term financial objectives. Regular review and analysis of these statements are crucial for adapting to market changes, optimizing property performance, and building a sustainable and profitable real estate portfolio.