Utilizing such a document offers several advantages. It enables informed decision-making regarding property investments by providing a clear picture of current financial performance. This structured approach allows for accurate profit projections and facilitates the identification of areas for potential cost savings or revenue growth. Furthermore, it serves as a valuable tool for securing financing, as lenders often require this documentation to assess investment viability.

This understanding of the documents structure and benefits lays the groundwork for a deeper exploration of its individual components and their practical application in real estate investment analysis. Key topics to be covered include detailed breakdowns of income and expense categories, methods for calculating key performance indicators, and strategies for optimizing cash flow based on the insights provided by this essential financial tool.

1. Income

Accurate income reporting forms the foundation of a reliable rental property cash flow statement. This section captures all revenue streams generated by the property, providing crucial data for assessing profitability and making informed investment decisions. The primary income source is typically monthly rent collected from tenants. Additional income may include late fees, pet fees, parking fees, or income from on-site laundry facilities. Precisely recording all income sources, including the frequency and amount, ensures a comprehensive view of the property’s revenue generation capacity. For instance, a property with consistent rental income and additional revenue streams from amenities will exhibit a higher overall income, positively impacting the cash flow statement and potentially attracting investors.

A detailed breakdown of income sources within the statement allows for a granular analysis of revenue streams. This detailed approach facilitates the identification of potential areas for revenue growth. For example, if parking fees represent a significant income portion, exploring options for increasing parking capacity could enhance overall profitability. Conversely, consistently low occupancy rates signify the need to investigate market conditions and potentially adjust rental pricing strategies. Understanding the relationship between individual income components and overall cash flow empowers investors to make data-driven decisions regarding property management and investment strategies. Accurately projecting future income based on current trends and market analysis further enhances the statement’s predictive value.

In summary, the income section of a rental property cash flow statement is not merely a record of revenue; it’s a critical tool for evaluating investment performance and guiding future strategies. Meticulous income tracking, combined with insightful analysis, enables investors to optimize revenue streams, mitigate potential risks, and maximize the return on their investment. Challenges such as fluctuating occupancy rates or unexpected maintenance expenses can impact income projections and should be carefully considered when analyzing the statement. Ultimately, a thorough understanding of income dynamics is essential for successful real estate investment.

2. Expenses

Accurate and comprehensive expense tracking is crucial for a realistic assessment of rental property profitability. Within a cash flow statement template, the expenses section provides a structured overview of all costs associated with property ownership and operation. This detailed record enables informed decision-making regarding property management and investment strategies. Expenses are broadly categorized into operating expenses and capital expenditures. Operating expenses recur regularly and include essential costs like property taxes, insurance, property management fees, maintenance, repairs, utilities, and advertising. Capital expenditures, on the other hand, represent larger, less frequent investments in property improvements, such as roof replacements, HVAC system upgrades, or major renovations. For example, replacing a leaky roof would be classified as a capital expenditure, while routine gutter cleaning would fall under operating expenses. Understanding this distinction is vital for accurate financial forecasting and tax planning.

The relationship between expenses and overall cash flow is directly inverse: higher expenses reduce net income, while lower expenses contribute to higher profitability. This dynamic underscores the importance of diligent expense management. For instance, consistently high maintenance costs could indicate deferred maintenance issues that require immediate attention to prevent more significant expenses in the future. Analyzing expenses relative to rental income reveals critical performance indicators. A high expense ratio, where operating expenses consume a large portion of rental income, may signal inefficient management practices or underlying property issues. Conversely, a lower expense ratio suggests effective cost control and potentially higher profitability. Monitoring expense trends over time allows investors to identify potential cost-saving opportunities, such as renegotiating service contracts or implementing energy-efficient upgrades. Furthermore, accurate expense records are essential for tax reporting and compliance, allowing for legitimate deductions and minimizing tax liabilities.

In conclusion, the expenses section of a rental property cash flow statement provides critical insights into the financial health of an investment. Meticulous expense tracking, coupled with insightful analysis, empowers investors to identify areas for cost optimization, improve operational efficiency, and ultimately maximize profitability. Challenges like unexpected repairs or rising property taxes can impact cash flow projections and require proactive management strategies. A thorough understanding of expense dynamics is fundamental for successful real estate investment and long-term financial stability.

3. Cash Flow

Cash flow, the net balance of incoming and outgoing money, represents the lifeblood of a rental property investment. A rental property cash flow statement template provides the framework for analyzing this vital metric, enabling informed decision-making and long-term financial planning. Understanding cash flow dynamics is essential for assessing investment performance and ensuring sustainable profitability.

- Operating Cash FlowOperating cash flow reflects the day-to-day financial performance of the property. It is calculated by subtracting operating expenses from rental income. For example, if monthly rental income is $2,000 and operating expenses total $1,500, the operating cash flow is $500. Positive operating cash flow indicates that the property generates sufficient income to cover its operating costs, a fundamental requirement for a viable investment. Within a cash flow statement template, operating cash flow provides a clear picture of the property’s core profitability.

- Net Cash FlowNet cash flow encompasses all cash inflows and outflows associated with the property, including financing costs such as mortgage payments and capital expenditures like property improvements. It represents the overall profitability of the investment after all expenses are considered. For instance, if operating cash flow is $500, and the monthly mortgage payment is $300, the net cash flow is $200. A positive net cash flow is crucial for long-term financial sustainability and demonstrates the investment’s capacity to generate returns after all obligations are met. The cash flow statement template facilitates the calculation and analysis of net cash flow by providing a structured overview of all income and expense components.

- Cash Flow ProjectionsProjecting future cash flow is essential for evaluating investment potential and making informed decisions regarding property acquisitions or improvements. These projections involve estimating future income and expenses based on market trends, historical data, and anticipated changes in operating costs. For example, projecting an increase in rental income due to rising market rents or anticipating higher maintenance expenses due to aging infrastructure informs decisions regarding rent adjustments or capital improvements. A well-structured cash flow statement template serves as a valuable tool for creating and analyzing cash flow projections, allowing investors to assess potential returns and mitigate risks.

- Cash Flow ManagementEffective cash flow management is crucial for maintaining financial stability and maximizing returns. Strategies for optimizing cash flow include minimizing expenses, increasing rental income, and strategically timing capital expenditures. For example, negotiating lower insurance premiums, implementing energy-efficient upgrades, or increasing occupancy rates can positively impact cash flow. The cash flow statement template provides the necessary data for identifying areas for improvement and implementing effective cash flow management strategies. By closely monitoring cash flow, investors can ensure sufficient funds for operating expenses, debt service, and future investments.

By providing a structured framework for analyzing income and expenses, the rental property cash flow statement template allows investors to understand the nuances of cash flow dynamics. This understanding is essential for evaluating investment performance, making informed decisions regarding property management, and achieving long-term financial success in the competitive real estate market. Analyzing cash flow trends over time provides valuable insights into property performance and helps investors adapt to changing market conditions and optimize their investment strategies.

4. Metrics (e.g., NOI, Cap Rate)

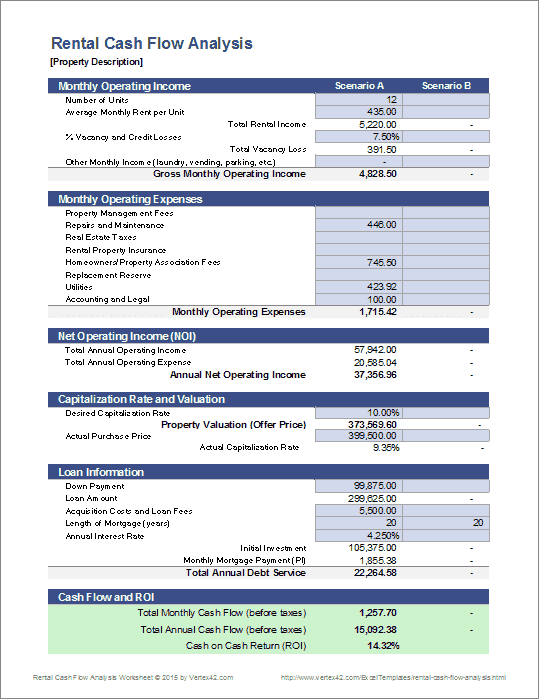

Key performance indicators (KPIs), derived from the data within a rental property cash flow statement template, provide crucial insights into investment profitability and potential. Two prominent metrics, Net Operating Income (NOI) and Capitalization Rate (Cap Rate), are particularly valuable for evaluating investment performance and making informed decisions. NOI, calculated by subtracting operating expenses from revenue, represents the property’s profitability before considering financing costs. A higher NOI generally indicates stronger financial performance. For example, a property with an annual revenue of $30,000 and operating expenses of $10,000 has an NOI of $20,000. This metric is essential for understanding the property’s core profitability and its ability to generate income independent of financing structure.

Cap Rate, calculated by dividing NOI by the property’s market value, expresses the potential rate of return on the investment. A higher Cap Rate suggests a higher potential return. For instance, a property with an NOI of $20,000 and a market value of $200,000 has a Cap Rate of 10%. This metric facilitates comparisons between different investment properties and aids in assessing potential risks and rewards. A lower Cap Rate might indicate a lower risk investment with stable income, while a higher Cap Rate could signal higher potential returns but with potentially greater risk. Understanding the relationship between NOI and Cap Rate provides a comprehensive view of investment performance and potential for appreciation.

Accurate calculation and analysis of these metrics are essential for effective investment management. Data within the cash flow statement directly informs these calculations. Inaccurate or incomplete data within the template will lead to misleading metric calculations and potentially flawed investment decisions. Regularly updating the cash flow statement ensures that the derived metrics accurately reflect the property’s current financial status. Furthermore, analyzing trends in NOI and Cap Rate over time provides valuable insights into property performance and market dynamics. For instance, a declining NOI might indicate increasing operating costs or decreasing rental income, signaling the need for corrective action. Conversely, a rising Cap Rate could suggest increasing property value and potential for greater returns. Utilizing these metrics within a comprehensive investment strategy empowers investors to make data-driven decisions, optimize property performance, and achieve long-term financial goals.

5. Template Structure

A well-structured template is essential for organizing financial data and ensuring the accuracy and usability of a rental property cash flow statement. A standardized structure facilitates consistent data entry, simplifies analysis, and enhances comparability across different properties or time periods. A logical framework ensures all relevant information is captured and presented in a clear, concise manner, enabling informed decision-making.

- Income SectionThis section systematically captures all revenue streams generated by the property. It typically includes detailed entries for monthly rent, late fees, pet fees, parking income, and any other miscellaneous income sources. Clear labeling and consistent formatting within this section ensure accurate income reporting and facilitate analysis of revenue trends. For example, separating rental income from other income sources allows for a granular understanding of revenue composition and potential areas for growth.

- Expense SectionThe expense section provides a structured breakdown of all costs associated with property ownership and operation. This includes operating expenses such as property taxes, insurance, maintenance, and utilities, as well as capital expenditures for major repairs or improvements. Categorizing expenses and providing space for detailed descriptions ensures comprehensive cost tracking and facilitates the identification of potential cost-saving opportunities. For instance, separating maintenance costs into routine and non-routine categories helps identify trends and predict future expenses.

- Cash Flow CalculationsThe template should incorporate formulas for automatically calculating key cash flow metrics, including gross operating income, net operating income, and cash flow after financing. Automated calculations minimize manual data entry, reduce the risk of errors, and ensure the accuracy of financial analysis. Furthermore, pre-built formulas for calculating metrics like debt service coverage ratio provide valuable insights into investment performance.

- Summary and Reporting FeaturesA comprehensive template includes summary sections and reporting features that consolidate key financial data and provide a high-level overview of property performance. Visualizations such as charts and graphs can enhance understanding of trends and facilitate comparisons across different properties or time periods. For example, a summary table displaying key metrics like NOI and Cap Rate over several years allows for quick assessment of investment performance and identification of potential issues. Furthermore, exportable reports simplify sharing information with stakeholders and facilitate collaboration with financial advisors.

The consistent structure provided by a template ensures that all essential financial information is captured and presented in a standardized format. This consistency simplifies analysis, enhances data integrity, and improves the overall usability of the cash flow statement as a decision-making tool. A well-designed template enables investors to quickly assess property performance, identify areas for improvement, and make informed decisions regarding property management and investment strategies. Utilizing a standardized template promotes best practices in financial record-keeping and contributes to long-term success in real estate investment.

6. Regular Updates

Maintaining an accurate and up-to-date rental property cash flow statement template is crucial for informed decision-making and effective financial management. Regular updates ensure the statement reflects the current financial status of the property, enabling investors to monitor performance, identify trends, and make proactive adjustments to optimize returns. Neglecting regular updates can lead to inaccurate financial analysis, potentially resulting in missed opportunities or flawed investment strategies. The frequency of updates depends on the complexity and volatility of the property’s financials, but generally, monthly or quarterly updates are recommended.

- Reflecting Current Market ConditionsRental markets are dynamic, with fluctuating vacancy rates, rental prices, and operating expenses. Regular updates capture these changes, providing an accurate reflection of current market conditions. For example, increasing property taxes or a rise in vacancy rates directly impacts profitability and should be reflected in the statement promptly. This real-time insight enables investors to adjust rental pricing strategies, explore cost-saving measures, or make informed decisions regarding property improvements.

- Tracking Performance TrendsConsistent updates allow for the identification of performance trends over time. Analyzing historical data reveals patterns in income and expenses, providing valuable insights into property performance and potential areas for improvement. For example, consistently increasing maintenance costs could indicate underlying property issues requiring attention. Tracking trends also allows investors to evaluate the effectiveness of management strategies and make data-driven decisions regarding future investments.

- Informing Financial ProjectionsAccurate financial projections rely on up-to-date data. Regularly updated cash flow statements provide the foundation for reliable forecasting, enabling investors to anticipate future income and expenses, assess potential returns, and make informed decisions regarding property acquisitions or dispositions. For example, projecting future rental income requires accurate data on current market rents and occupancy rates. Regular updates ensure these projections remain aligned with market realities.

- Supporting Informed Decision-MakingTimely updates empower investors with the information necessary to make informed decisions regarding property management and investment strategies. Whether considering rent adjustments, property improvements, or refinancing options, accurate financial data is paramount. For example, deciding whether to invest in a major renovation requires a clear understanding of current cash flow and projected returns, which can only be derived from an up-to-date cash flow statement.

In conclusion, regular updates to a rental property cash flow statement template are essential for maintaining an accurate and relevant financial overview. This practice enables investors to monitor performance, identify trends, and make informed decisions that optimize returns and contribute to long-term financial success. The insights gained from a consistently updated statement are invaluable for navigating the complexities of the real estate market and maximizing the potential of rental property investments.

Key Components of a Rental Property Cash Flow Statement Template

A comprehensive understanding of key components is essential for effectively utilizing a rental property cash flow statement template. These components provide a structured framework for analyzing income, expenses, and cash flow, enabling informed investment decisions.

1. Rental Income: This represents the primary revenue stream, encompassing all rent collected from tenants. It includes recurring monthly rent payments as well as any additional income generated from late fees, pet fees, or other lease agreements. Accurate recording of rental income is fundamental for assessing property profitability.

2. Other Income: Beyond rental income, properties may generate revenue from various sources, such as laundry facilities, parking fees, or storage rentals. This section captures all ancillary income streams, providing a comprehensive view of revenue generation.

3. Operating Expenses: These recurring costs are essential for property maintenance and operation. Common operating expenses include property taxes, insurance premiums, property management fees, maintenance repairs, utilities, and advertising expenses. Accurate tracking of operating expenses is crucial for understanding profitability.

4. Capital Expenditures: These represent investments in property improvements or major repairs that extend the useful life of the asset. Examples include roof replacements, HVAC system upgrades, or major renovations. Capital expenditures are typically less frequent than operating expenses but can significantly impact cash flow.

5. Financing Costs: For properties financed with debt, this section accounts for mortgage payments, including principal and interest. Accurately tracking financing costs is essential for understanding the overall financial burden and assessing the true profitability of the investment.

6. Net Operating Income (NOI): This key metric represents the property’s profitability before considering financing costs. It is calculated by subtracting operating expenses from total revenue (rental income + other income). NOI provides a clear picture of the property’s core operating performance.

7. Cash Flow: This crucial metric represents the net balance of cash inflows and outflows. It can be calculated pre- and post-financing, offering insights into both operating performance and overall investment profitability. Positive cash flow is essential for long-term financial sustainability.

8. Capitalization Rate (Cap Rate): This metric, calculated by dividing NOI by the property’s market value, provides a measure of the potential rate of return on the investment. Cap rate is valuable for comparing investment properties and assessing potential risks and rewards.

Effective utilization of a rental property cash flow statement template requires a thorough understanding of these interconnected components. Accurate data entry and analysis of these elements enable informed decision-making regarding property management, investment strategies, and long-term financial planning.

How to Create a Rental Property Cash Flow Statement Template

Creating a robust template ensures consistent tracking and analysis of property financials. A structured approach facilitates informed decision-making and contributes to successful real estate investment.

1: Define the Reporting Period: Specify the timeframe for the statement, typically monthly, quarterly, or annually. A consistent reporting period allows for accurate performance tracking and trend analysis over time. For example, a monthly statement provides granular insights into short-term fluctuations, while an annual statement offers a broader overview of yearly performance.

2: Structure the Income Section: Create distinct categories for various income sources. Include recurring rental income, late fees, pet fees, parking fees, and any other miscellaneous income generated by the property. Clear categorization ensures accurate revenue tracking and facilitates analysis of individual income streams.

3: Detail the Expense Section: Categorize operating expenses meticulously, including property taxes, insurance, property management fees, maintenance, repairs, utilities, and advertising. Separately list capital expenditures for significant improvements or repairs. Detailed expense tracking enables precise profitability analysis and identifies areas for potential cost savings.

4: Incorporate Cash Flow Calculations: Include formulas for calculating key metrics such as gross operating income (total revenue – operating expenses), net operating income (gross operating income – capital expenditures), and cash flow after financing (net operating income – financing costs). Automated calculations ensure accuracy and efficiency.

5: Add Key Performance Indicators (KPIs): Include sections for calculating essential metrics like Net Operating Income (NOI) and Capitalization Rate (Cap Rate). These KPIs provide valuable insights into property performance and investment potential. Regularly tracking these metrics allows for performance benchmarking and informed decision-making.

6: Design for Regular Updates: Structure the template to facilitate easy data entry and updates. Consider using a spreadsheet program or specialized software for efficient data management. Regular updates, typically monthly or quarterly, ensure the statement accurately reflects the property’s current financial status.

7: Review and Refine: Periodically review the template’s structure and content to ensure it remains relevant and effective. Adapt the template as needed to accommodate changes in property operations, market conditions, or reporting requirements. Ongoing review ensures the template remains a valuable tool for financial analysis.

A well-designed template provides a structured framework for capturing, analyzing, and interpreting financial data, empowering investors to make informed decisions and maximize returns.

Effective management of rental properties requires a thorough understanding of financial performance. A rental property cash flow statement template provides the necessary framework for organizing and analyzing critical financial data, including income from various sources, operating and capital expenses, and financing costs. Calculating key metrics such as Net Operating Income (NOI) and Capitalization Rate (Cap Rate) provides valuable insights into profitability and investment potential. A well-structured template facilitates accurate data entry, simplifies calculations, and enables efficient reporting. Regular updates ensure the statement reflects current market conditions and property performance, enabling informed decision-making.

Diligent use of a rental property cash flow statement template empowers investors to make data-driven decisions, optimize property performance, and achieve long-term financial success. Accurate financial analysis is essential for navigating the complexities of the real estate market, mitigating risks, and maximizing the potential of rental property investments. The insights derived from a comprehensive cash flow statement are crucial for long-term financial planning and building a sustainable real estate portfolio. Continued learning and adaptation to evolving market dynamics are essential for sustained success in real estate investment.