Utilizing a pre-designed format offers numerous advantages, including simplified reporting, improved accuracy, and consistent tracking across periods. This consistency allows for easy comparison of performance over time, enabling businesses to identify trends, anticipate potential problems, and make informed decisions. Moreover, a standardized structure ensures compliance with accounting principles and makes financial data readily accessible for stakeholders.

Understanding the structure and purpose of this financial tool is foundational for effective financial management. The following sections will delve into the specific components, offering practical examples and demonstrating how these documents can be implemented for optimal financial control and strategic decision-making.

1. Standardized Format

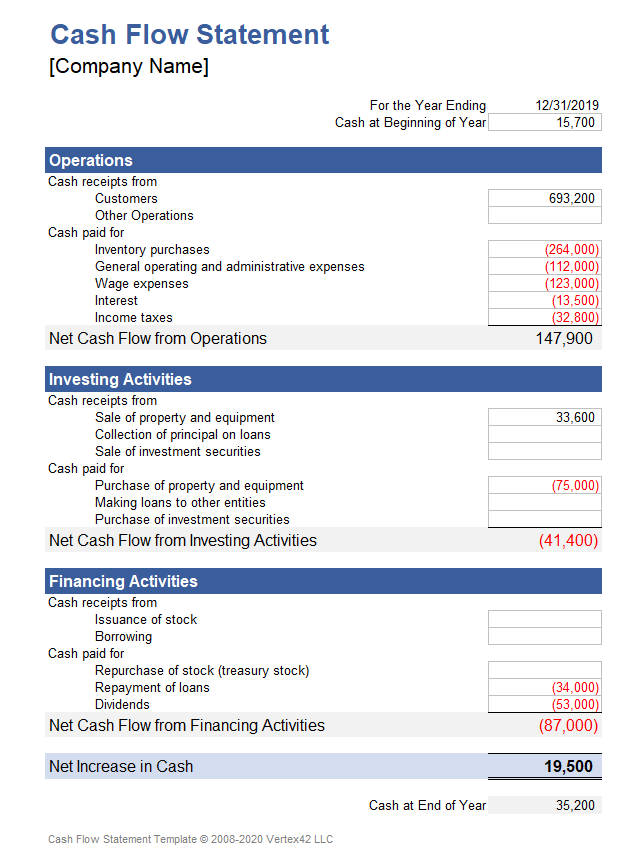

Standardized formatting is crucial for cash flow statements. A consistent structure ensures comparability across reporting periods, facilitating trend analysis and informed decision-making. This standardization allows stakeholders to readily understand the financial health of an organization, regardless of specific industry or size. For example, consistent categorization of operating activities, such as revenue and expenses, allows for clear performance evaluation across time. Without a standardized format, comparing financial performance over time or against competitors becomes significantly more challenging, potentially hindering strategic planning and investment decisions. A consistent structure also simplifies auditing processes, promoting transparency and accountability.

Consistent presentation of data within a standardized template allows for efficient analysis. Financial professionals can quickly identify key metrics and assess performance against benchmarks. This efficiency is amplified when comparing multiple periods or entities. Imagine analyzing cash flow statements from various subsidiaries with differing formatsthe process would be cumbersome and prone to errors. A standardized format streamlines this process, allowing for rapid identification of discrepancies and informed resource allocation. Furthermore, standardized templates often incorporate formulas and automated calculations, reducing manual data entry and minimizing the risk of errors.

Adhering to a standardized format strengthens financial reporting integrity and fosters trust among stakeholders. This consistency promotes transparency and allows for reliable comparisons, facilitating informed investment decisions and accurate performance evaluations. While specific elements within a template may require adjustments based on individual business needs, the underlying principle of standardization remains paramount for effective financial management. Failure to maintain a standardized format can lead to misinterpretations of financial data, hindering strategic planning and potentially impacting investor confidence. Therefore, prioritizing standardized formatting is essential for sound financial reporting and analysis.

2. Tracks Cash Inflows/Outflows

A core function of a business cash flow statement template is the meticulous tracking of cash inflows and outflows. This detailed record provides crucial insights into the financial health of an organization, informing strategic decisions and facilitating effective resource allocation. Without comprehensive tracking, understanding the dynamics of financial operations becomes significantly more challenging, potentially leading to uninformed decisions and financial instability.

- Operating ActivitiesThis section captures cash generated from the core business operations. Examples include sales revenue, payments to suppliers, and employee wages. Accurately tracking these flows is fundamental to understanding profitability and operational efficiency. Analyzing trends in operating cash flows can reveal areas for improvement, such as optimizing inventory management or refining pricing strategies. Consistent negative operating cash flow signals potential underlying issues requiring immediate attention.

- Investing ActivitiesThis category encompasses cash flows related to long-term investments, such as the purchase or sale of property, plant, and equipment (PP&E), or investments in other companies. Monitoring these flows allows stakeholders to understand how the organization is allocating capital for future growth. For instance, significant investments in research and development might indicate a focus on innovation, while substantial divestitures could signal a shift in strategic direction.

- Financing ActivitiesFinancing activities involve cash flows related to debt, equity, and dividends. Tracking these flows illuminates how the organization is funding its operations and growth. Examples include proceeds from issuing debt or equity, loan repayments, and dividend distributions. Analyzing financing activities helps stakeholders understand the capital structure and the organization’s financial leverage.

- Net Change in CashThe net change in cash represents the overall difference between cash inflows and outflows during a specific period. This crucial metric provides a concise summary of the organization’s cash position changes. Analyzing the net change in cash over multiple periods can reveal trends in financial performance and inform future cash flow projections. Consistently negative net changes may indicate a need for external financing or operational adjustments.

By meticulously tracking these distinct categories of cash flows, a business cash flow statement template provides a comprehensive overview of an organization’s financial health. This information is invaluable for internal management, potential investors, and other stakeholders in assessing financial stability, evaluating performance, and making informed decisions. Understanding the interplay between these cash flow categories is essential for effective financial planning and strategic decision-making.

3. Categorizes Activities

A key strength of a business cash flow statement template lies in its ability to categorize activities. This structured approach provides a clear and organized view of how cash flows through an organization, facilitating analysis and informed decision-making. By segregating cash flows into distinct categories, the template allows stakeholders to understand the sources and uses of funds, enabling a comprehensive assessment of financial performance.

- Operating ActivitiesThis category encompasses the cash flows generated from the core business operations. Examples include cash received from customers, payments to suppliers for goods and services, salaries and wages paid to employees, and payment of income taxes. Analyzing operating cash flow provides insights into the profitability and efficiency of core business activities. Consistently positive operating cash flow indicates a healthy business model, while negative operating cash flow may signal underlying operational challenges.

- Investing ActivitiesInvesting activities involve cash flows related to the acquisition and disposal of long-term assets. This includes purchases and sales of property, plant, and equipment (PP&E), investments in other companies, and changes in other long-term assets. Analyzing investing activities reveals how an organization is allocating capital for future growth and expansion. Significant investments in PP&E might indicate expansion plans, while divestitures could signal a strategic shift or restructuring.

- Financing ActivitiesFinancing activities relate to the sources of funding for the organization. This category includes cash flows from issuing debt or equity, receiving loan proceeds, repaying debt principal, repurchasing company stock, and paying dividends to shareholders. Analyzing financing activities provides insights into the organization’s capital structure and financial leverage. A reliance on debt financing may indicate higher financial risk, while equity financing can dilute ownership.

- Non-Cash Investing and Financing ActivitiesWhile not directly impacting cash flow, certain significant investing and financing activities that do not involve cash are often disclosed as a supplementary schedule to the statement. These include acquiring assets through capital leases, converting debt to equity, or exchanging non-cash assets. This additional information provides a more complete picture of the organization’s financial activities and potential future impact on cash flows. For instance, a significant capital lease obligation might indicate future cash outflows for lease payments.

By categorizing activities in this manner, the business cash flow statement template transforms raw financial data into a powerful analytical tool. This categorization allows stakeholders to understand the interplay between different areas of the business and assess the overall financial health of the organization. This understanding is crucial for making informed decisions regarding resource allocation, strategic planning, and investment strategies.

4. Financial Planning Tool

A business cash flow statement template serves as a crucial financial planning tool. It provides a structured framework for projecting future cash flows, enabling organizations to anticipate potential shortfalls or surpluses and make informed decisions regarding resource allocation. By analyzing historical cash flow patterns and incorporating anticipated future changes, organizations can develop realistic budgets, secure necessary financing, and optimize investment strategies. For instance, a consistent pattern of negative cash flow during a specific quarter can inform inventory management decisions, helping businesses avoid overstocking and minimize cash tied up in unsold goods. Conversely, projected positive cash flow might create opportunities for strategic investments in expansion or research and development.

The template’s ability to categorize cash flows into operating, investing, and financing activities enhances its value as a financial planning tool. This categorization allows organizations to pinpoint specific areas of strength and weakness, facilitating targeted interventions. For example, consistently negative cash flow from operating activities might prompt a review of pricing strategies, cost-cutting measures, or efficiency improvements. Strong cash flow from investing activities, such as the sale of assets, can be strategically allocated to debt reduction or growth initiatives. Understanding the interplay between these categories is essential for developing comprehensive and effective financial plans. A manufacturing company anticipating increased demand can use the template to project the necessary investment in equipment and working capital, ensuring sufficient resources to meet production needs.

Effective financial planning requires more than simply projecting future cash flows. It also necessitates scenario analysis and contingency planning. The template provides a framework for evaluating the potential impact of various economic conditions, market fluctuations, or internal operational changes. By modeling different scenarios, organizations can assess their resilience to unforeseen events and develop contingency plans to mitigate potential risks. For example, a retailer might model the impact of a potential economic downturn on consumer spending and adjust inventory levels or marketing strategies accordingly. This proactive approach to financial planning allows organizations to navigate uncertainty and maintain financial stability. The template, therefore, empowers organizations to move beyond reactive financial management to proactive strategic planning, enhancing their ability to achieve long-term financial goals.

5. Improved Accuracy

Improved accuracy in financial reporting is a direct consequence of utilizing a well-designed business cash flow statement template. The structured format minimizes the risk of errors associated with manual data entry and calculations. Pre-built formulas and automated calculations within the template further enhance accuracy, ensuring consistent application of accounting principles and reducing the likelihood of human error. This improved accuracy is crucial for informed decision-making, reliable performance evaluation, and maintaining stakeholder trust. For example, a template with automated calculations for depreciation expense ensures consistent application of depreciation methods across reporting periods, eliminating potential discrepancies that might arise from manual calculations. This accuracy is particularly important when comparing financial performance over time or against industry benchmarks.

Furthermore, a standardized template promotes consistency in data collection and categorization. Clearly defined fields for operating, investing, and financing activities minimize ambiguity and ensure that cash flows are classified correctly. This consistency reduces the risk of misclassifications that can distort the overall picture of financial health. Consider a scenario where a loan repayment is incorrectly categorized as an operating activity instead of a financing activity. This error would misrepresent both operating cash flow and financing cash flow, potentially leading to inaccurate assessments of profitability and debt management. A template with clear guidelines for categorization minimizes such risks, promoting greater accuracy in financial reporting.

The benefits of improved accuracy extend beyond internal decision-making. Accurate cash flow statements are essential for building trust and credibility with external stakeholders, including investors, lenders, and regulatory bodies. Reliable financial information facilitates informed investment decisions, strengthens loan applications, and ensures compliance with reporting requirements. Inaccuracies in financial reporting can damage an organization’s reputation and jeopardize its access to capital. A well-structured template, therefore, serves as a cornerstone of transparent and trustworthy financial reporting, contributing to the long-term financial health and stability of the organization. The consistent application of accounting principles through a standardized template ensures that financial statements are comparable across periods and with other entities, facilitating meaningful analysis and benchmarking.

6. Stakeholder Transparency

Stakeholder transparency is paramount for organizational success. A business cash flow statement template plays a vital role in fostering this transparency by providing stakeholders with a clear and comprehensive view of an organization’s financial health. This open access to financial information empowers stakeholders to make informed decisions, builds trust, and strengthens accountability. The template’s structured format and consistent application of accounting principles ensure that the information presented is reliable, comparable, and easily understood.

- Enhanced CommunicationClear and accessible financial information, facilitated by a standardized template, enhances communication between organizations and their stakeholders. Investors can assess the organization’s ability to generate returns, lenders can evaluate creditworthiness, and suppliers can gauge financial stability. This transparency fosters open dialogue and strengthens relationships with key stakeholders. For example, a consistently positive cash flow from operating activities can reassure investors about the sustainability of the business model, while a declining trend might prompt further inquiries and discussions about operational challenges.

- Informed Decision-MakingStakeholders rely on accurate and accessible financial information to make informed decisions. A well-structured cash flow statement provides insights into an organization’s financial performance, its ability to generate cash, and its management of financial resources. This information empowers investors to make investment decisions, lenders to assess credit risk, and suppliers to evaluate the long-term viability of the organization as a business partner. A company demonstrating strong cash flow from operations is more likely to attract investors and secure favorable financing terms.

- Building Trust and CredibilityTransparency in financial reporting builds trust and credibility with stakeholders. Openly sharing financial information demonstrates accountability and fosters confidence in the organization’s management. This trust is essential for attracting investment, securing financing, and maintaining strong relationships with suppliers and customers. Conversely, a lack of transparency can erode trust and raise concerns about the organization’s financial health and integrity. Consistently providing accurate and accessible cash flow statements through a standardized template demonstrates a commitment to transparency and strengthens stakeholder confidence.

- Accountability and GovernanceA business cash flow statement template promotes accountability by providing a clear record of cash inflows and outflows. This detailed tracking of financial transactions strengthens internal controls and reduces the risk of financial mismanagement. The template’s structured format also facilitates audits and ensures compliance with regulatory requirements, further enhancing accountability. Clear documentation of cash flows allows stakeholders to hold management accountable for financial performance and ensures responsible stewardship of resources.

By facilitating clear and consistent reporting, a business cash flow statement template strengthens stakeholder transparency. This transparency, in turn, fosters trust, empowers informed decision-making, promotes accountability, and contributes to the long-term sustainability and success of the organization. The template, therefore, serves as a crucial tool for effective communication and strengthens relationships between organizations and their stakeholders. This enhanced transparency creates a foundation for sustainable growth and long-term value creation.

Key Components of a Cash Flow Statement

A structured cash flow statement provides a comprehensive overview of an organization’s financial activities. Understanding its key components is crucial for accurate interpretation and effective financial management.

1. Operating Activities: This section details cash flows generated from core business operations. Key elements include cash received from customers, payments to suppliers, salaries and wages, and income tax payments. Analyzing this section reveals the profitability and efficiency of core business functions.

2. Investing Activities: This section tracks cash flows related to long-term investments. Key elements include purchases and sales of property, plant, and equipment (PP&E), investments in other entities, and proceeds from the sale of investments. This section provides insights into capital allocation strategies and future growth prospects.

3. Financing Activities: This section details cash flows related to debt, equity, and dividends. Key elements include proceeds from issuing debt or equity, loan repayments, and dividend distributions. Analyzing this section illuminates the capital structure and financial leverage of the organization.

4. Beginning Cash Balance: This crucial starting point represents the cash available at the beginning of the reporting period. It provides context for understanding the net change in cash during the period.

5. Ending Cash Balance: This figure represents the cash on hand at the end of the reporting period. It is the result of the combined cash flows from operating, investing, and financing activities, added to the beginning cash balance.

6. Non-Cash Transactions: While not directly impacting cash flow, significant non-cash transactions are often disclosed as a supplementary schedule. Examples include converting debt to equity or acquiring assets through capital leases. These disclosures provide a more complete picture of financial activities and potential future impacts on cash flow.

Analyzing these interconnected components provides a holistic understanding of an organization’s financial performance, its sources and uses of cash, and its overall financial health. This information is essential for effective financial planning, strategic decision-making, and stakeholder communication.

How to Create a Business Cash Flow Statement Template

Developing a robust template ensures consistent and accurate tracking of cash flow, facilitating informed financial decisions. The following steps outline the creation process:

1. Define the Reporting Period: Specify the timeframe covered by the statement, whether monthly, quarterly, or annually. A consistent reporting period allows for accurate comparisons and trend analysis over time.

2. Structure the Template: Organize the template into three distinct sections: Operating Activities, Investing Activities, and Financing Activities. This structure adheres to standard accounting practices and facilitates clear categorization of cash flows.

3. Operating Activities Section: Begin with net income and adjust for non-cash items like depreciation and amortization. Include changes in working capital accounts such as accounts receivable, inventory, and accounts payable. This section reflects cash generated from core business operations.

4. Investing Activities Section: Detail cash flows related to capital expenditures, asset sales, and investments. This section provides insights into how resources are allocated for long-term growth.

5. Financing Activities Section: Include details on debt, equity, and dividends. Track proceeds from issuing debt or equity, loan repayments, and dividend payments. This section reveals the organization’s capital structure and financing strategies.

6. Calculate Net Change in Cash: Sum the net cash flows from operating, investing, and financing activities. This figure represents the overall change in cash during the reporting period.

7. Include Beginning and Ending Cash Balances: The beginning cash balance is the cash on hand at the start of the reporting period. Adding the net change in cash to the beginning balance yields the ending cash balance.

8. Incorporate Non-Cash Transactions (Supplementary Schedule): While not directly impacting cash flow, significant non-cash transactions, like converting debt to equity, should be disclosed in a supplementary schedule for comprehensive reporting.

A well-structured template provides a clear, organized view of cash flow, facilitating analysis, planning, and informed financial decisions. Regularly updating and reviewing the template ensures its continued effectiveness as a financial management tool.

A well-designed business cash flow statement template provides a crucial framework for understanding financial health. From tracking inflows and outflows across core operational, investing, and financing activities, to facilitating accurate financial planning and promoting stakeholder transparency, a standardized template offers numerous benefits. Its structured approach enables efficient analysis, enhances accuracy, and fosters informed decision-making, contributing significantly to an organization’s long-term financial stability and success. Regular review and diligent maintenance of this essential tool empowers organizations to proactively manage financial resources, navigate economic uncertainties, and achieve strategic objectives.

Effective financial management requires more than just recording transactions; it demands a deep understanding of cash flow dynamics. Leveraging the insights offered by a robust cash flow statement template equips organizations with the knowledge needed to optimize resource allocation, secure necessary funding, and navigate the complexities of the financial landscape. Ultimately, prioritizing cash flow management through structured analysis fosters financial resilience, supports sustainable growth, and contributes to long-term organizational success.