Utilizing a streamlined structure offers several advantages. It reduces the complexity often associated with financial reporting, making it easier for individuals and businesses to monitor their financial status. This accessibility promotes proactive financial management by highlighting potential cash shortfalls or surpluses, enabling timely adjustments and informed strategic planning. Furthermore, a simplified approach can save valuable time and resources, particularly for smaller businesses or individuals without dedicated financial expertise.

The following sections will delve into specific components, offer practical examples, and provide guidance on creating and interpreting these valuable financial tools.

1. Simplified Structure

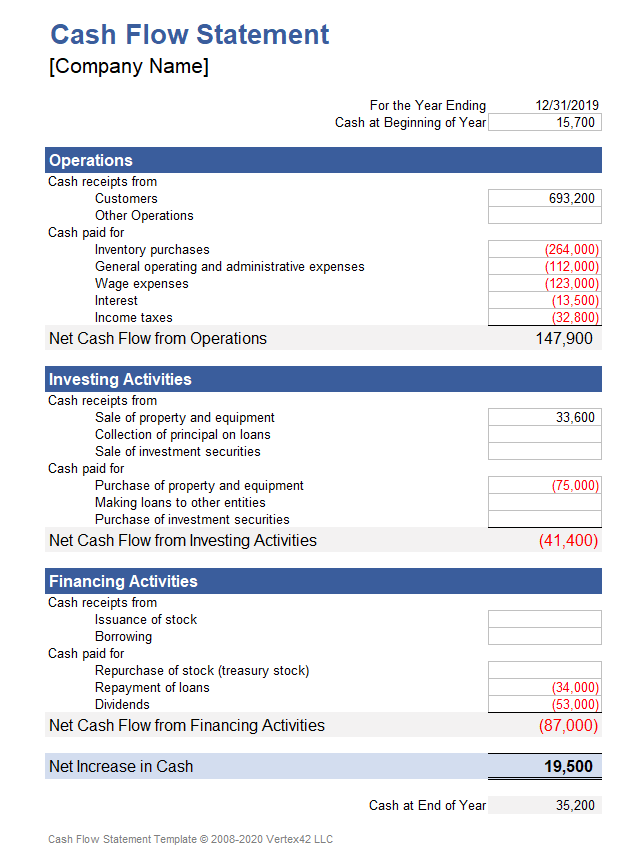

A simplified structure is fundamental to an effective cash flow statement template. It reduces complexity, making the document accessible to a wider audience, regardless of financial expertise. This streamlined approach focuses on essential elements, presenting information clearly and concisely. For example, instead of using complex accounting jargon, a simplified template might categorize cash flows as “Cash from Customers,” “Cash paid to Suppliers,” and “Cash from Investments.” This clarity allows business owners, managers, and even individuals to readily understand their financial position.

The simplified structure promotes efficient use of time and resources. It eliminates the need for extensive training or specialized knowledge to interpret the data. A small business owner, for instance, can quickly identify potential shortfalls in operating cash flow and take proactive measures, such as adjusting inventory levels or negotiating extended payment terms with suppliers. This ability to readily access and understand financial information empowers informed decision-making, contributing to better financial outcomes.

In conclusion, a simplified structure is a crucial element of an effective cash flow statement template. Its accessibility and clarity empower users to monitor financial health, identify potential issues, and make informed decisions, ultimately leading to improved financial management and stability. While comprehensive financial statements have their place, a simplified version provides a readily accessible tool for everyday financial management.

2. Accessible Format

An accessible format is crucial for an easy cash flow statement template. Accessibility translates to ease of understanding and use, regardless of financial expertise. This involves clear, concise language, logical organization, and a visually uncluttered presentation. A well-designed template avoids jargon and complex terminology, opting for straightforward labels like “Cash from Sales” or “Payments to Vendors.” Visual elements, such as clear headings, subheadings, and consistent formatting, further enhance readability and comprehension. For example, color-coding can differentiate cash inflows and outflows, offering an immediate visual cue. An accessible format empowers business owners, managers, and individuals to readily interpret the data and gain a clear understanding of their financial position. This understanding is fundamental for sound financial decision-making.

The practical significance of an accessible format lies in its ability to facilitate proactive financial management. When individuals and businesses can readily grasp their cash flow situation, they are better equipped to identify potential challenges and opportunities. For instance, a readily understandable cash flow statement can highlight an impending cash shortage, allowing sufficient time to secure a line of credit or adjust expenses. Conversely, it can reveal a surplus, presenting opportunities for investment or expansion. An accessible format empowers users to make informed, timely decisions that contribute to financial stability and growth. The ability to quickly and easily interpret financial data is particularly valuable for small businesses or startups, where resources and time are often limited.

In summary, an accessible format is not merely a desirable feature of an easy cash flow statement template; it is a cornerstone of its effectiveness. Accessibility promotes wider usage, facilitates timely decision-making, and empowers individuals and businesses to take control of their financial health. While adhering to accounting principles remains crucial, presenting this information in an accessible manner maximizes its practical value and contributes significantly to better financial outcomes. The absence of an accessible format can render even the most accurate data meaningless if it remains uninterpreted and unused.

3. Clear Categorization

Clear categorization is essential for an effective easy cash flow statement template. Categorization provides structure and meaning to raw financial data, transforming a list of transactions into a comprehensible overview of cash inflows and outflows. A well-categorized template distinguishes between operating activities (e.g., sales, expenses), investing activities (e.g., purchase or sale of assets), and financing activities (e.g., loans, equity). This separation allows for a deeper understanding of the sources and uses of cash, facilitating informed financial decisions. For example, a business might observe robust cash flow from operating activities but a significant outflow from investing activities, indicating expansion efforts. Without clear categorization, this insight would be obscured within a mass of undifferentiated data. The absence of clear categorization diminishes the practical value of the statement, hindering effective analysis and decision-making.

The practical significance of clear categorization lies in its ability to support proactive financial management. Distinct categories highlight trends and potential issues. For example, consistently negative cash flow from operating activities signals a need for operational adjustments, such as cost reduction or revenue enhancement strategies. Conversely, substantial positive cash flow from financing activities might indicate increasing reliance on debt, prompting a review of capital structure. Clear categorization empowers stakeholders to pinpoint areas requiring attention, enabling targeted interventions and informed strategic planning. A manufacturing company, for instance, might identify increasing raw material costs within its operating activities category, prompting negotiations with suppliers or exploration of alternative materials. This targeted approach to financial management relies heavily on the clarity provided by well-defined categories.

In conclusion, clear categorization is not merely a desirable feature of an easy cash flow statement template; it is a fundamental requirement for its effectiveness. It transforms raw data into actionable insights, facilitating informed decision-making and contributing significantly to financial health. The absence of clear categorization renders the statement less useful, hindering effective analysis and potentially obscuring critical trends or issues. Accurate categorization is a prerequisite for sound financial analysis and proactive management.

4. Time-saving tool

Efficiency in financial management is paramount, particularly for businesses and individuals operating within dynamic environments. An easy cash flow statement template functions as a time-saving tool, streamlining the process of tracking and analyzing cash flow data. This efficiency allows for more timely identification of financial trends and potential issues, enabling proactive interventions and informed decision-making. A readily accessible and user-friendly template reduces the administrative burden associated with manual calculations and complex spreadsheets, freeing up valuable time for strategic activities.

- Automated CalculationsTemplates often incorporate automated calculations, eliminating the need for manual data entry and reducing the risk of human error. Formulas automatically calculate net cash flow, facilitating rapid analysis and interpretation. For example, a template can automatically sum cash inflows from various sources and subtract total cash outflows, providing a clear picture of net cash flow for a given period. This automation saves significant time compared to manual calculations, especially for businesses with numerous transactions. This efficiency allows for more frequent and timely monitoring of cash flow, enhancing financial control.

- Pre-built StructureThe pre-built structure of a template eliminates the need to design a cash flow statement from scratch. Standard categories for operating, investing, and financing activities are typically included, ensuring consistent organization and facilitating comparison across periods. This standardized format simplifies data entry and analysis, reducing the time required to generate and interpret the statement. A startup, for instance, can utilize a pre-built template to quickly organize its financial information, allowing the management team to focus on core business activities rather than spreadsheet design.

- Report GenerationMany easy cash flow statement templates offer automated report generation features. Users can quickly generate reports for specific periods, facilitating trend analysis and performance evaluation. This automated reporting saves significant time compared to manually compiling data and creating reports. A retail business, for example, can readily generate monthly cash flow reports to monitor seasonal sales patterns and adjust inventory levels accordingly. This timely information empowers proactive decision-making and enhances operational efficiency.

- Integration with other toolsSome templates offer integration with accounting software or other financial tools, further streamlining data entry and analysis. Direct data imports eliminate manual data entry, reducing the risk of errors and saving considerable time. For instance, integration with point-of-sale systems can automatically populate sales data within the cash flow statement, providing real-time insights into cash inflows. This streamlined data flow enhances accuracy and reduces the administrative burden associated with data management.

The time-saving benefits of an easy cash flow statement template contribute significantly to effective financial management. By streamlining data entry, automating calculations, and facilitating report generation, these templates empower users to focus on analysis, interpretation, and strategic decision-making. The time saved translates into improved financial control, enhanced responsiveness to market dynamics, and increased opportunities for growth and stability. A readily available, easy-to-use template becomes a valuable asset, enabling informed financial management and contributing to overall business success.

5. Informed Decisions

Sound financial decisions rely on accurate and readily available data. An easy cash flow statement template provides this crucial foundation, empowering stakeholders to make informed choices regarding resource allocation, investment strategies, and overall financial management. A clear understanding of cash inflows and outflows allows businesses to anticipate potential shortfalls, identify opportunities for growth, and optimize financial performance. For example, a consistent surplus in operating cash flow might justify investments in new equipment or expansion into new markets. Conversely, a persistent deficit could necessitate cost-cutting measures or a reassessment of pricing strategies. The template’s accessibility ensures that this vital information is readily available to decision-makers, facilitating timely and effective responses to changing market conditions. Without a clear picture of cash flow, decisions become reactive rather than proactive, increasing the risk of financial instability.

The practical significance of informed decision-making enabled by an easy cash flow statement template extends beyond short-term financial management. Strategic planning, long-term growth initiatives, and even exit strategies benefit from a deep understanding of cash flow dynamics. For instance, a company considering an acquisition can use a cash flow statement template to assess the target company’s financial health and project the impact of the acquisition on its own cash flow. Similarly, a business preparing for an initial public offering (IPO) can leverage the template to demonstrate its financial stability and growth potential to potential investors. In these contexts, the template becomes a critical tool for communicating financial performance and supporting informed decision-making by internal and external stakeholders. Accurate and accessible cash flow information enhances credibility and builds confidence among investors, lenders, and other key partners.

In conclusion, an easy cash flow statement template serves as a cornerstone of informed financial decision-making. By providing a clear and accessible overview of cash inflows and outflows, the template empowers stakeholders to make proactive, data-driven choices that contribute to financial stability and long-term success. The ability to anticipate challenges, identify opportunities, and communicate financial performance effectively is crucial in today’s dynamic business environment. Failure to leverage the insights provided by a cash flow statement can lead to missed opportunities, reactive decision-making, and ultimately, financial instability. The template’s simplicity and accessibility democratize financial understanding, placing crucial data in the hands of those who need it most.

6. Financial Clarity

Financial clarity, a critical aspect of sound financial management, is significantly enhanced by utilizing an easy cash flow statement template. Understanding the nuances of cash flow is essential for businesses and individuals seeking to navigate financial complexities and make informed decisions. A simplified template provides an accessible pathway to achieving this clarity, empowering users to gain a comprehensive overview of their financial health and make data-driven decisions.

- Real-Time Financial AwarenessAn easy cash flow statement template provides real-time insights into financial status. By tracking inflows and outflows, users gain a clear understanding of their current financial position. This awareness is crucial for identifying potential shortfalls, seizing opportunities, and adapting to changing financial circumstances. For example, a small business owner can use a template to monitor daily sales and expenses, enabling prompt adjustments to inventory or pricing strategies. This real-time awareness facilitates proactive financial management, reducing the risk of unexpected financial distress.

- Simplified ComplexitiesTraditional financial statements can be complex and difficult to interpret for those without specialized accounting knowledge. An easy cash flow statement template simplifies these complexities, presenting information in a clear and concise manner. This accessibility empowers a wider range of users, from business owners to individual investors, to understand their financial standing. For instance, a startup founder can utilize a simplified template to track cash burn rate and runway, facilitating informed decisions regarding fundraising and resource allocation. This simplification of complex financial data democratizes access to crucial financial insights.

- Enhanced Decision-MakingClear financial data empowers informed decision-making. An easy cash flow statement template provides the necessary information to make strategic choices regarding investments, budgeting, and overall financial management. By understanding cash flow patterns, businesses can anticipate future needs, optimize resource allocation, and make data-driven decisions that contribute to financial stability and growth. For example, a restaurant owner can analyze historical cash flow data from the template to project future revenue during peak seasons, enabling informed staffing and inventory decisions. This enhanced decision-making capability translates into improved operational efficiency and financial performance.

- Improved Communication with StakeholdersClear and concise financial reporting facilitates effective communication with stakeholders. An easy cash flow statement template provides a standardized format for presenting financial information to investors, lenders, and other key partners. This transparency builds trust and credibility, enhancing relationships and facilitating access to capital. For example, a non-profit organization can utilize a template to clearly demonstrate its responsible use of donor funds, fostering continued support and attracting new donors. This improved communication strengthens stakeholder relationships and contributes to long-term organizational sustainability.

In summary, an easy cash flow statement template serves as a powerful tool for achieving financial clarity. By simplifying complex data, providing real-time insights, and enhancing communication, these templates empower individuals and businesses to make informed decisions, manage resources effectively, and achieve financial stability and growth. This clarity is not merely a desirable outcome; it is a fundamental requirement for sound financial management and long-term success in todays dynamic economic landscape.

Key Components of an Easy Cash Flow Statement Template

Effective cash flow management requires a clear understanding of the core components within a simplified statement template. These elements provide a structured framework for analyzing financial health.

1. Operating Activities: This section captures cash flow generated from the core business operations. Key elements include cash received from customers, cash paid to suppliers, and cash paid for operating expenses (e.g., salaries, rent, utilities). This component provides insights into the profitability and sustainability of core business functions.

2. Investing Activities: This section reflects cash flows related to investments in long-term assets. Key elements include purchases and sales of property, plant, and equipment (PP&E), as well as investments in other companies. This component provides a view into capital expenditures and investment strategies.

3. Financing Activities: This section details cash flows related to financing the business. Key elements include proceeds from debt or equity financing, loan repayments, and dividend payments. This component reveals the capital structure and financing strategies employed.

4. Beginning Cash Balance: This crucial starting point represents the cash available at the beginning of the reporting period. It provides context for subsequent changes in cash flow and is essential for accurate tracking.

5. Ending Cash Balance: This figure represents the cash available at the end of the reporting period. It is a key indicator of financial health and liquidity, reflecting the net impact of all cash inflows and outflows.

6. Net Cash Flow: This represents the overall change in cash during the reporting period. It is calculated by summing the net cash flows from operating, investing, and financing activities. This crucial metric provides a concise overview of financial performance.

A structured template incorporating these components facilitates a comprehensive understanding of cash flow dynamics, enabling informed decision-making and proactive financial management. Analyzing these elements provides valuable insights into a business’s financial health, sustainability, and growth potential.

How to Create an Easy Cash Flow Statement Template

Creating a streamlined cash flow statement template involves a structured approach focusing on essential components. This process enables clear tracking of cash inflows and outflows, facilitating informed financial decisions.

1. Define the Reporting Period: Specify the timeframe covered by the statement (e.g., monthly, quarterly, annually). A consistent reporting period allows for accurate tracking and comparison of cash flow trends over time.

2. Determine Key Categories: Establish clear categories for cash inflows and outflows. Standard categories include operating activities, investing activities, and financing activities. Further categorization within these broad areas (e.g., sales, expenses, investments) enhances clarity and analysis.

3. Establish a Starting Point: Record the beginning cash balance. This figure represents the cash on hand at the start of the reporting period and serves as the foundation for calculating subsequent changes in cash flow.

4. Track Cash Inflows: Systematically record all cash inflows within the defined categories. This includes cash from sales, investments, financing, and other sources. Accurate and timely recording ensures a comprehensive view of incoming cash.

5. Track Cash Outflows: Systematically record all cash outflows within the defined categories. This encompasses expenses, investments, loan repayments, and other disbursements. Accurate tracking provides insights into spending patterns and areas for potential cost optimization.

6. Calculate Net Cash Flow: Determine the net cash flow for each category by subtracting total outflows from total inflows. This calculation provides a clear picture of the net change in cash within each area of operation.

7. Calculate Ending Cash Balance: Calculate the ending cash balance by adding the net cash flow to the beginning cash balance. This figure represents the cash on hand at the end of the reporting period and is a key indicator of financial health.

8. Review and Analyze: Regularly review the completed cash flow statement to identify trends, potential issues, and opportunities for improvement. This analysis informs strategic financial decisions and contributes to long-term financial stability.

A well-structured template, consistently applied, empowers stakeholders to monitor financial health, anticipate potential challenges, and make informed decisions that contribute to long-term success. Regular review and analysis of the statement enhance financial awareness and contribute to proactive financial management.

Simplified cash flow statement templates provide accessible and efficient tools for understanding financial health. Streamlined structures, clear categorization, and automated calculations empower stakeholders to monitor cash inflows and outflows, enabling informed decision-making. From small businesses to large corporations, these templates facilitate proactive financial management, contributing to stability and growth. Understanding key components, such as operating activities, investing activities, and financing activities, allows for a comprehensive analysis of financial performance. Creating and consistently utilizing a template fosters financial clarity and control.

Effective financial management hinges on readily available and easily interpretable data. Leveraging the power of simplified cash flow statement templates enables organizations and individuals to navigate complex financial landscapes with confidence. Consistent application and thoughtful analysis of these statements contribute significantly to long-term financial stability and informed strategic planning. Embracing these tools empowers stakeholders to take control of their financial future, mitigating risks and maximizing opportunities for growth and prosperity.