This structured approach facilitates transparent financial reporting, enabling stakeholders to readily understand the sources and uses of cash. This enhanced transparency can strengthen stakeholder trust and inform better decision-making. Additionally, the granular detail inherent in this presentation method aids in identifying trends and anomalies in cash flow, allowing for more proactive financial management and potentially improved liquidity management.

The following sections will delve deeper into the specific components of this reporting structure, offering practical guidance on its preparation and interpretation. Topics covered include detailed examples for each activity category, common challenges encountered during preparation, and best practices for maximizing its utility for analysis and planning.

1. Cash Inflows

Cash inflows represent the lifeblood of any organization, reflecting its ability to generate funds through various activities. Within a direct cash flow statement template, these inflows are meticulously categorized to provide a transparent view of the sources fueling the entity’s operations and growth. Accurately representing cash inflows is essential for assessing financial health and making informed strategic decisions.

- Cash from Customers:This represents the primary source of operating cash inflows for most businesses. It encompasses payments received for goods sold or services rendered. Robust cash flow from customers indicates strong sales performance and efficient collection processes. Within the direct method, this figure is directly derived from sales records, rather than being adjusted from net income as in the indirect method.

- Cash from Interest and Dividends:This inflow stems from investments in interest-bearing instruments or dividend-paying securities. While often a smaller component compared to operating cash inflows, it reflects an organization’s investment strategy and its returns. This category highlights the benefits of sound investment decisions.

- Cash from the Sale of Assets:This inflow arises from divesting long-term assets, such as property, plant, and equipment, or investments. While potentially substantial, these inflows are typically non-recurring and should be analyzed separately from operating cash inflows. Understanding the reasons for asset sales is crucial for interpreting their impact on long-term financial stability.

- Cash from Refunds and Reimbursements:This category captures cash received from tax refunds, insurance claims, or other reimbursements. While often less predictable, these inflows can impact short-term liquidity. Their inclusion provides a complete picture of all cash sources during the reporting period.

By meticulously categorizing these inflows, a direct cash flow statement template offers valuable insights into the financial health and sustainability of an organization. Comparing these inflows over time can reveal trends and highlight potential areas for improvement in revenue generation, investment strategies, and overall financial management.

2. Cash Outflows

Cash outflows represent the disbursement of funds for various business activities. Within a direct cash flow statement template, these outflows are categorized to provide a transparent view of how an organization utilizes its financial resources. Accurate representation of cash outflows is crucial for assessing financial health and making informed strategic decisions. Understanding the dynamics of cash outflows within this structure is fundamental to financial statement analysis.

Several key categories of cash outflows exist within this framework. Payments to suppliers for goods and services constitute a significant portion of operating outflows. Salaries and wages paid to employees represent another substantial outflow directly tied to operations. Interest payments on debt obligations and income tax payments are also categorized within operating activities. Capital expenditures, such as purchasing equipment or property, are categorized as investing outflows. Repurchasing company stock or distributing dividends to shareholders falls under financing outflows. Analyzing these outflows reveals critical information about cost management, investment strategies, and financial stability.

For example, a consistent increase in payments to suppliers without a corresponding increase in sales might indicate rising input costs or inefficiencies in inventory management. A large capital expenditure outflow might signal expansion efforts or replacement of aging assets. Significant financing outflows for debt repayment could indicate a focus on deleveraging. By comparing these outflows over time and across different categories, analysts can gain a deeper understanding of an organization’s financial performance and strategic direction. Effectively managing cash outflows is essential for maintaining liquidity and achieving long-term financial goals. Mismanagement of outflows can lead to financial distress, highlighting the practical significance of understanding this component of the direct cash flow statement template.

3. Operating Activities

Operating activities represent the core business functions that generate revenue and expenses. Within a direct cash flow statement template, these activities are meticulously detailed to provide a transparent view of the cash inflows and outflows directly resulting from the business’s central operations. This granular approach distinguishes the direct method from the indirect method, which starts with net income and adjusts for non-cash items. Understanding operating activities is paramount for assessing a company’s ability to generate cash from its core business.

- Cash Receipts from CustomersThis represents the primary source of operating cash inflows for most businesses. It encompasses all cash received from the sale of goods or services. For example, a retail store’s cash receipts from customers would include all payments received at point-of-sale, online transactions, and payments received on account. This direct measurement of cash received provides a clearer picture of revenue generation compared to the indirect method’s adjustments from accrual-based sales figures. Analyzing trends in cash receipts is crucial for evaluating sales performance and customer payment behavior.

- Cash Payments to SuppliersThis represents a major outflow within operating activities, encompassing payments made to vendors for goods and services necessary for business operations. For instance, a manufacturing company’s cash payments to suppliers would include raw materials, components, and manufacturing supplies. Tracking these payments provides insight into cost management and the efficiency of the supply chain. Comparing cash payments to suppliers with cash receipts from customers offers valuable insights into profitability and operating efficiency.

- Cash Payments for Operating ExpensesThis category includes cash outflows for expenses essential to daily operations, excluding cost of goods sold. Examples include rent, utilities, salaries, and marketing expenses. Directly tracking these cash payments provides a more accurate representation of operating expenses compared to the indirect method, which adjusts for non-cash items like depreciation and amortization. Analyzing these outflows helps identify areas for potential cost reduction and operational efficiency improvements.

- Cash Payments for Interest and TaxesThese outflows represent cash payments for interest expenses on debt obligations and income taxes. While classified as operating activities under the direct method, these payments can provide insight into the company’s financial structure and tax burden. For instance, high-interest payments might indicate a high level of debt, while fluctuating tax payments can reflect changes in profitability or tax regulations. Separating these cash flows facilitates a deeper understanding of their impact on overall cash flow.

By directly presenting these cash inflows and outflows, the direct cash flow statement offers a clearer and more comprehensive view of an organization’s core operating activities. This detailed breakdown enhances transparency and enables more effective analysis of a company’s ability to generate cash from its operations, ultimately contributing to more informed financial decision-making.

4. Investing Activities

Investing activities within a direct cash flow statement template encompass the acquisition and disposal of long-term assets. These activities offer crucial insights into an organization’s strategic capital allocation decisions and their impact on future growth potential. Unlike operating activities, which reflect day-to-day business functions, investing activities provide a perspective on long-term resource allocation and its implications for future financial performance. A thorough understanding of this section is essential for a comprehensive analysis of an entity’s financial health.

- Purchase of Property, Plant, and Equipment (PP&E)Acquiring tangible assets like land, buildings, machinery, and equipment represents a significant outflow in this category. These investments are crucial for expanding operational capacity, enhancing efficiency, or replacing obsolete assets. For example, a manufacturing company investing in new machinery signifies a commitment to increasing production capacity or improving product quality. Analyzing these outflows reveals an organization’s growth strategy and its willingness to invest in long-term productive assets.

- Sale of Property, Plant, and Equipment (PP&E)Divesting long-term tangible assets generates cash inflows within investing activities. These inflows can arise from selling obsolete equipment, downsizing operations, or strategic restructuring. For instance, a company selling a factory might indicate a shift in its manufacturing strategy or a decision to outsource production. Analyzing these inflows, alongside the reasons for divestiture, offers valuable context for understanding an organization’s strategic direction.

- Investments in SecuritiesAcquiring securities like stocks and bonds of other companies represents an investing outflow. These investments can be strategic, aiming for long-term growth or generating passive income. For example, a technology company investing in a startup might be seeking future technological synergies or market expansion. Conversely, selling these securities generates inflows. Analyzing these transactions provides insights into an entity’s investment portfolio and its risk tolerance.

- Loans Made to Other EntitiesProviding loans to other organizations represents an investing outflow. These loans can be part of a strategic partnership or an attempt to generate interest income. Receiving repayments of principal on these loans constitutes an inflow. For example, a financial institution lending to a business generates future interest income and expands its loan portfolio. Monitoring these flows is essential for assessing the quality of these investments and their potential risks.

By carefully analyzing investing activities within the direct cash flow statement template, stakeholders gain a deeper understanding of an organization’s long-term strategic decisions and their potential implications for future financial performance. The direct presentation of these cash flows facilitates a more transparent assessment of how an organization invests its resources and its potential for sustainable growth. This understanding is crucial for informed investment decisions and comprehensive financial analysis.

5. Financing Activities

Financing activities, a crucial component of the direct cash flow statement template, detail how an entity obtains and manages its capital funding. This section provides insights into an organization’s financial structure, its reliance on external financing, and its methods of distributing returns to investors. Understanding these cash flows is essential for assessing long-term solvency and financial stability. The direct method, unlike the indirect method, presents these cash flows as direct receipts and payments, offering greater transparency.

Key financing activities include proceeds from issuing debt or equity, representing cash inflows used to fund operations or investments. For instance, a company issuing bonds receives cash, increasing its available capital. Similarly, issuing common stock generates cash inflows from equity investors. Conversely, repaying debt principal represents a cash outflow, reducing the company’s financial obligations. Repurchasing company stock, often viewed as a return of capital to shareholders, also represents a cash outflow. Distributing dividends to shareholders is another significant cash outflow, reflecting the company’s profitability and dividend policy. These cash flows illustrate the interplay between raising capital and returning value to investors. For example, a rapidly growing company might rely heavily on debt or equity financing, resulting in large inflows. A mature, profitable company might prioritize dividend payments and debt reduction, leading to higher outflows in those categories. Analyzing these trends over time provides valuable insights into a company’s financial strategy and its implications for future growth.

Analyzing financing activities within the direct cash flow statement template provides a critical perspective on an entity’s long-term financial health. This section reveals how a company manages its capital structure, balances debt and equity financing, and distributes returns to investors. Understanding these dynamics is paramount for assessing financial risk, evaluating management decisions, and making informed investment judgments. Ignoring or misinterpreting financing activities can lead to an incomplete understanding of a company’s financial position and its potential for future success. Therefore, careful scrutiny of this section is indispensable for a comprehensive financial statement analysis.

Key Components of a Direct Cash Flow Statement Template

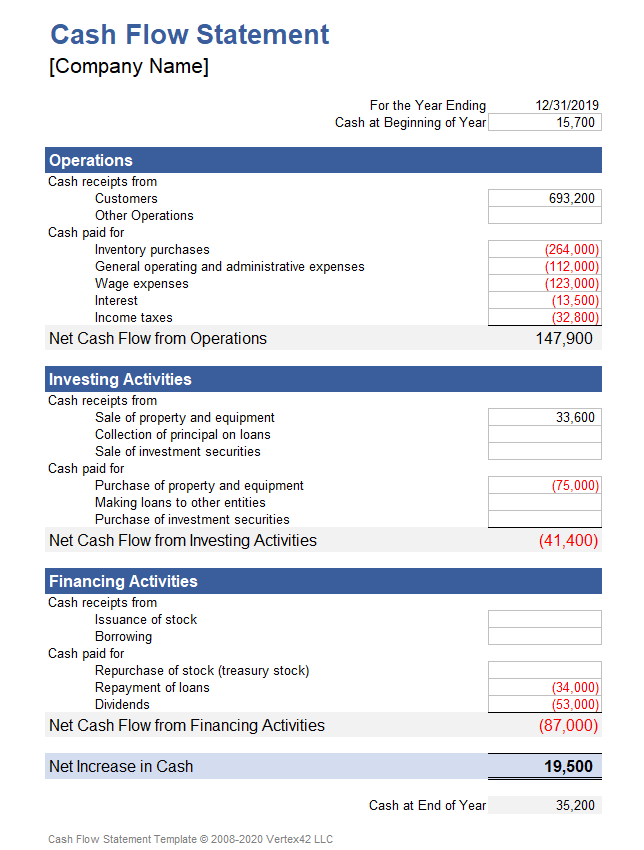

A direct cash flow statement template provides a structured approach to reporting cash inflows and outflows, categorized by operating, investing, and financing activities. Understanding these core components is fundamental to analyzing an entity’s financial health and performance.

1. Cash Inflows from Operating Activities: These represent cash generated from the core business operations. Primary examples include cash received from customers for goods sold or services rendered, interest received on investments, and dividends received from equity holdings. This direct representation of cash inflows provides a clear view of the revenue-generating capacity of the business.

2. Cash Outflows from Operating Activities: These represent cash disbursed for expenses directly related to running the business. Key examples include payments to suppliers for inventory, salaries and wages paid to employees, rent and utilities, and payments for interest and taxes. Analyzing these outflows provides insights into cost management and operational efficiency.

3. Cash Flows from Investing Activities: These represent cash flows related to the acquisition and disposal of long-term assets. Acquiring property, plant, and equipment (PP&E) represents a significant outflow, while selling these assets generates inflows. Investing in or selling securities and making or receiving loans also fall under this category. These cash flows reflect an organization’s strategic investment decisions.

4. Cash Flows from Financing Activities: These represent cash flows related to raising and repaying capital. Issuing debt (e.g., bonds) or equity (e.g., stock) generates cash inflows, while repaying debt principal represents an outflow. Repurchasing company stock and paying dividends to shareholders are also categorized as financing outflows. These flows provide insights into the capital structure and distribution of returns to investors.

Careful analysis of each of these components provides a comprehensive understanding of how cash is generated and utilized within an organization. This detailed perspective allows for a thorough assessment of financial performance, liquidity, and long-term sustainability.

How to Create a Direct Cash Flow Statement Template

Creating a direct cash flow statement template requires a structured approach to organize cash inflows and outflows according to operating, investing, and financing activities. This process facilitates a clear and comprehensive understanding of an entity’s cash flow dynamics.

1. Establish Reporting Period: Define the specific time frame for the statement, such as a month, quarter, or year. This ensures consistency and comparability across reporting periods.

2. Categorize Cash Flows: Group all cash transactions into one of the three primary categories: operating, investing, or financing activities. This categorization forms the foundation of the direct method.

3. Operating Activities: Begin with cash received from customers. Subtract cash paid to suppliers for goods and services. Subtract cash paid for operating expenses, including salaries, rent, and utilities. Subtract cash paid for interest and taxes.

4. Investing Activities: List cash inflows from selling long-term assets, such as property, plant, and equipment (PP&E), or investments. Subtract cash outflows for acquiring PP&E or investments. Include cash flows from lending activities and collecting loan principal.

5. Financing Activities: List cash inflows from issuing debt or equity. Subtract cash outflows for repaying debt principal, repurchasing company stock, and paying dividends.

6. Calculate Net Cash Flow: For each category (operating, investing, and financing), subtract total cash outflows from total cash inflows to determine the net cash flow for each activity. This provides insight into the primary sources and uses of cash.

7. Determine Ending Cash Balance: Add the net cash flows from all three activities to the beginning cash balance to arrive at the ending cash balance. This figure represents the cash available at the end of the reporting period.

8. Review and Verify: Thoroughly review all entries for accuracy and completeness. Ensure proper categorization and mathematical accuracy to maintain the integrity of the statement.

A well-constructed template offers a transparent view of an entity’s cash flow dynamics, facilitating informed financial analysis and decision-making. This structured approach provides stakeholders with a detailed understanding of cash generation and utilization, crucial for assessing financial health and long-term sustainability.

A direct cash flow statement template provides a structured and transparent method for analyzing an organization’s cash inflows and outflows. By categorizing cash flows into operating, investing, and financing activities, this format offers a granular view of how cash is generated and utilized within a specific period. This detailed presentation enhances the understanding of core business operations, investment decisions, and financing strategies, enabling stakeholders to make more informed assessments of financial performance and long-term sustainability. Unlike the indirect method, which starts with net income and applies adjustments, the direct method directly presents cash receipts and payments, offering a clearer picture of the actual cash movement within the business. This approach facilitates the identification of trends, anomalies, and potential areas for improvement in cash management. Moreover, it fosters greater transparency and accountability in financial reporting.

The ability to interpret and utilize this financial statement effectively is crucial for sound financial management and informed decision-making. Effective cash flow management is essential for navigating economic fluctuations, capitalizing on growth opportunities, and ensuring long-term financial stability. The insights gained from a direct cash flow statement empower stakeholders to evaluate an entity’s financial health, anticipate potential challenges, and make strategic decisions that contribute to sustainable growth and success. Further exploration and application of this reporting method are encouraged to fully leverage its potential for enhanced financial analysis and improved organizational performance.