Utilizing such a structure empowers informed financial decision-making. By clearly presenting financial data, it enables users to identify areas for improvement, such as reducing debt or increasing savings. This organized overview can also be invaluable when planning for future financial goals, like retirement or large purchases, and can simplify tax preparation and loan applications.

This understanding of organized financial record-keeping provides a foundation for exploring topics such as budgeting, debt management, investment strategies, and long-term financial planning.

1. Track Net Worth

Tracking net worth forms the cornerstone of understanding one’s financial position. A personal balance sheet, a key component within a broader financial template, provides the structure for this crucial activity. Net worth, calculated as the difference between total assets and total liabilities, offers a concise snapshot of financial health at a specific point in time. A balance sheet systematically organizes assets (e.g., cash, investments, property) and liabilities (e.g., mortgages, loans, credit card balances), enabling precise net worth calculation. Regularly updating this information allows individuals to monitor progress toward financial goals and identify potential areas of concern.

For instance, an individual aiming to purchase a home can utilize a balance sheet to track the growth of their down payment savings against any outstanding debts. Observing a positive trend in net worth, driven by increasing assets and decreasing liabilities, signifies progress towards the homeownership goal. Conversely, a stagnant or declining net worth might necessitate adjustments to spending habits or debt management strategies. Understanding the dynamic relationship between assets, liabilities, and net worth, facilitated by a structured balance sheet, empowers proactive financial management.

Systematic net worth tracking, facilitated by a personal balance sheet within a comprehensive financial template, provides invaluable insights into financial health and progress. This understanding allows individuals to make informed decisions regarding spending, saving, and investing, ultimately enabling them to achieve their financial objectives effectively. Failing to track net worth can lead to a lack of awareness regarding financial vulnerabilities and missed opportunities for growth. Therefore, integrating net worth tracking into regular financial practice is essential for long-term financial well-being.

2. Analyze Income and Expenses

Analyzing income and expenses provides crucial insights into financial health and forms a cornerstone of effective financial planning. A structured approach, facilitated by the income statement component of a personal financial template, enables a comprehensive understanding of cash flow dynamics. This analysis reveals patterns of spending, identifies areas for potential savings, and informs budgeting decisions. The income statement systematically categorizes income sources (e.g., salary, investments, rental income) and expenses (e.g., housing, transportation, food). Quantifying these elements allows for the calculation of net income, a key indicator of financial well-being.

For example, an individual experiencing a consistent budget deficit, where expenses exceed income, can utilize an income statement to pinpoint specific expense categories contributing to the shortfall. This targeted analysis might reveal excessive spending on discretionary items, such as entertainment or dining out, prompting adjustments to spending habits. Conversely, a surplus of income over expenses presents opportunities for increased savings, debt reduction, or investments. Understanding the interplay between income, expenses, and net income empowers informed financial decision-making.

Systematic analysis of income and expenses, facilitated by a structured income statement, is essential for long-term financial stability. This practice allows individuals to identify and address financial imbalances, optimize spending patterns, and make informed choices regarding saving and investing. Without a clear understanding of cash flow dynamics, individuals risk accumulating debt, missing opportunities for growth, and jeopardizing their financial future. Integrating regular income and expense analysis into financial practice is crucial for achieving financial objectives and ensuring long-term financial well-being.

3. Inform Financial Decisions.

Informed financial decisions rely on a clear understanding of one’s financial position. A personal balance sheet and income statement template provides the necessary framework for organizing financial data, enabling effective analysis and informed decision-making. These structured templates empower individuals to assess their current financial standing, identify areas for improvement, and make strategic choices aligned with their financial goals.

- Debt ManagementAnalyzing liabilities on a balance sheet and expenses on an income statement reveals opportunities for debt reduction. For example, high credit card balances with high interest rates can be prioritized for payoff. The income statement can then be used to identify areas where expenses can be reduced to allocate more funds towards debt repayment. This informed approach accelerates debt reduction and minimizes interest payments.

- Investment StrategiesUnderstanding net worth and disposable income, derived from the balance sheet and income statement respectively, informs investment decisions. An individual with substantial savings and positive cash flow might consider higher-risk investments with potentially higher returns. Conversely, someone with limited savings and tight cash flow might opt for lower-risk, more conservative investments. This tailored approach aligns investment strategy with individual financial circumstances.

- Budgeting and SavingIncome statements provide a detailed view of spending patterns, highlighting areas of overspending. This information informs budget creation and identifies opportunities for increased savings. For instance, tracking spending on non-essential items can reveal potential areas for reduction, freeing up funds for savings or debt repayment. This data-driven approach promotes disciplined spending and effective savings strategies.

- Financial Goal SettingA clear understanding of one’s financial position, facilitated by these templates, enables realistic financial goal setting. Whether the goal is purchasing a home, retirement planning, or funding education, the templates provide the necessary data to assess feasibility and develop actionable plans. This informed approach increases the likelihood of achieving financial objectives.

By providing a structured overview of financial data, the personal balance sheet and income statement template empowers informed decision-making across various financial domains. This organized approach enables individuals to align their financial choices with their goals, promoting financial stability and long-term well-being. Without this structured framework, financial decisions may be based on assumptions rather than data, increasing the risk of financial missteps.

4. Facilitate Financial Planning.

Financial planning requires a clear understanding of one’s current financial standing and a structured approach to projecting future outcomes. A personal balance sheet and income statement template provides the necessary foundation for effective financial planning by organizing historical financial data and enabling informed projections.

- Goal SettingFinancial goals, such as retirement planning or homeownership, require a realistic assessment of current resources and projected growth. A balance sheet provides a snapshot of current net worth, while an income statement reveals income and expense patterns. These insights inform the feasibility of financial goals and guide the development of actionable plans. For example, planning for early retirement requires projecting future income needs and investment growth, based on current savings and projected investment returns, all derived from these financial statements.

- Budgeting and ForecastingEffective budgeting relies on understanding historical spending patterns and projecting future income and expenses. An income statement provides the necessary historical data, while the balance sheet informs the allocation of resources. Projecting future income and expenses, informed by historical trends, enables proactive adjustments to spending habits and savings strategies to achieve financial objectives. This forward-looking approach, grounded in historical data, ensures realistic budgeting and facilitates proactive financial management.

- Risk ManagementAssessing financial risks, such as unexpected job loss or medical expenses, requires an understanding of current financial resources and potential vulnerabilities. A balance sheet reveals the level of liquid assets available for emergencies, while an income statement informs the ability to absorb unexpected expenses. This analysis facilitates the development of contingency plans, such as emergency funds or insurance coverage, mitigating potential financial risks. Understanding one’s financial capacity to withstand unexpected events is crucial for long-term financial stability.

- Investment PlanningInformed investment decisions rely on an understanding of current assets, liabilities, and income streams. A balance sheet provides a clear picture of asset allocation, while an income statement reveals the capacity for investment contributions. This information informs investment strategy, asset allocation, and risk tolerance. For instance, an individual with substantial savings and consistent surplus income might consider higher-risk investments, while someone with limited savings and fluctuating income might opt for a more conservative approach.

By providing a structured framework for organizing and analyzing financial data, a personal balance sheet and income statement template facilitates informed financial planning. This organized approach enables individuals to set realistic goals, develop effective budgets, manage risks, and make strategic investment decisions, ultimately promoting long-term financial well-being. Without this foundation, financial planning becomes speculative and less likely to achieve desired outcomes.

5. Simplify Tax Preparation.

Organized financial records significantly simplify tax preparation. A personal balance sheet and income statement template provides the structure necessary for maintaining such records, streamlining the process of gathering and organizing information required for tax filing. This structured approach minimizes the time and effort spent searching for financial documents, reducing the likelihood of errors and omissions. The balance sheet aids in tracking deductible expenses related to assets, such as property taxes or investment expenses. The income statement provides a clear overview of income sources and deductible expenses, such as business expenses or charitable contributions. Having this information readily available simplifies the completion of tax forms and reduces the potential for errors that could lead to audits or penalties.

For example, an individual operating a small business can utilize the income statement template to track business income and expenses throughout the year. This organized record-keeping simplifies the calculation of business profits and deductions when filing taxes. Similarly, tracking deductible expenses, such as medical expenses or charitable donations, within the framework of the template ensures these deductions are not overlooked during tax preparation. This meticulous record-keeping, facilitated by the template, minimizes the stress associated with tax season and increases the accuracy of tax filings.

Efficient tax preparation relies on organized financial records. Utilizing a personal balance sheet and income statement template establishes a framework for maintaining such records, streamlining the tax filing process and reducing the likelihood of errors. This proactive approach not only saves time and effort but also contributes to accurate and compliant tax filings, minimizing the potential for future complications. Failing to maintain organized financial records can lead to a stressful and error-prone tax preparation process, potentially resulting in missed deductions, inaccurate filings, and increased scrutiny from tax authorities. Therefore, incorporating these templates into regular financial practice contributes significantly to simplified and accurate tax preparation.

Key Components of Personal Financial Statements

Effective financial management necessitates a structured approach to organizing financial data. Key components within personal financial statement templates provide the framework for this organization, enabling comprehensive analysis and informed decision-making.

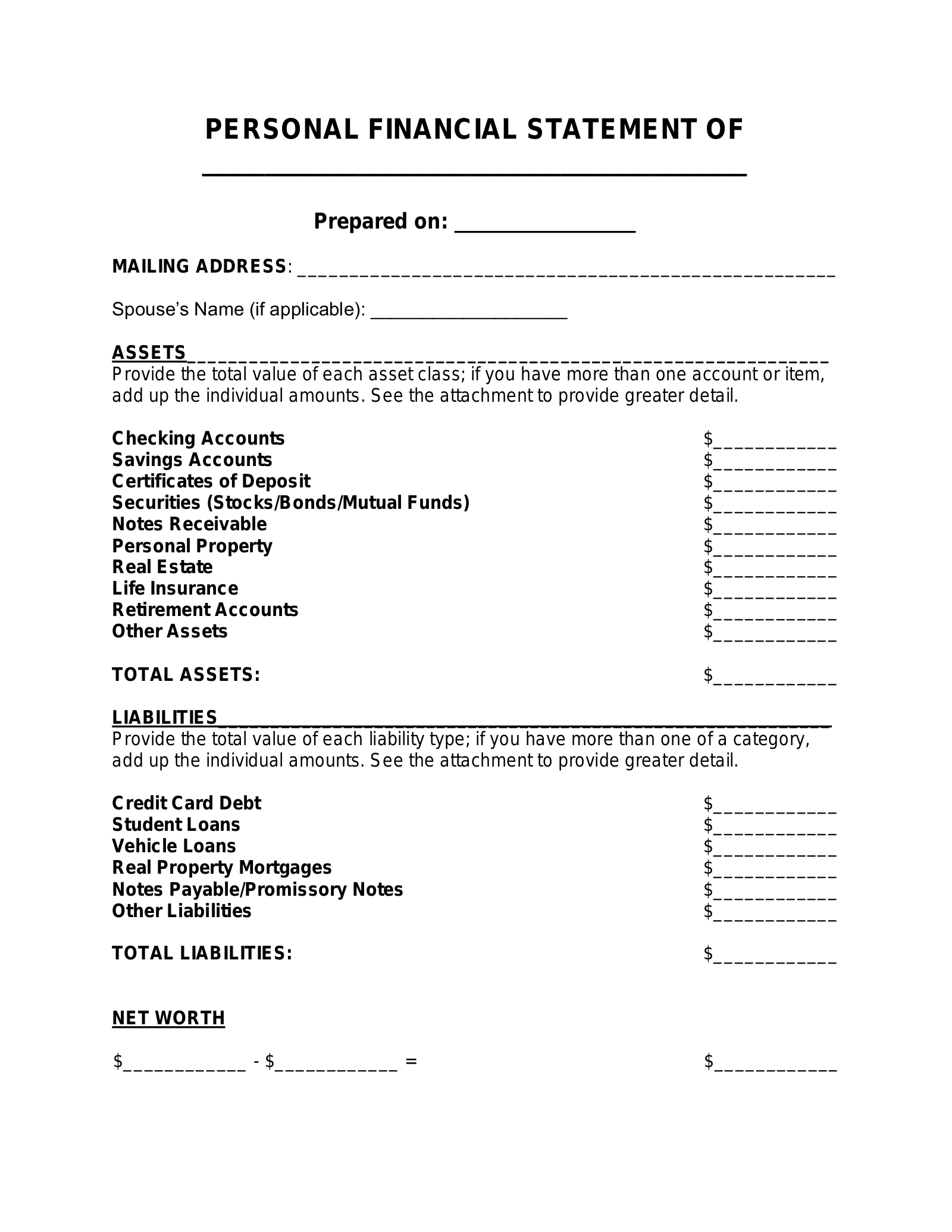

1. Assets: A comprehensive record of all items owned with monetary value. This includes liquid assets like cash and checking accounts, investment assets such as stocks and bonds, and tangible assets like real estate and personal property. Accurate valuation of assets is crucial for determining net worth.

2. Liabilities: A detailed account of all outstanding debts and financial obligations. This encompasses short-term liabilities like credit card balances and upcoming bill payments, and long-term liabilities such as mortgages and student loans. Accurate accounting for liabilities is essential for calculating net worth and assessing debt levels.

3. Income: A systematic record of all sources of income. This includes earned income from salaries and wages, investment income from dividends and interest, and any other income streams such as rental income or business profits. Precise income tracking is fundamental for budgeting and financial planning.

4. Expenses: A categorized breakdown of all expenditures. This encompasses essential expenses like housing, food, and transportation, as well as discretionary expenses like entertainment and dining. Detailed expense tracking reveals spending patterns and informs budgeting decisions.

5. Net Worth Calculation (Balance Sheet): Derived by subtracting total liabilities from total assets. This key metric provides a snapshot of overall financial health at a specific point in time. Regularly monitoring net worth allows for assessment of financial progress and identification of potential areas of concern.

6. Net Income Calculation (Income Statement): Calculated by subtracting total expenses from total income. This metric reveals the overall profitability of financial activities over a specific period. Tracking net income informs budgeting decisions, identifies opportunities for increased savings, and assesses financial stability.

These components, working in concert, provide a structured framework for understanding and managing personal finances. This organized approach facilitates informed decision-making regarding budgeting, saving, investing, and debt management, ultimately promoting long-term financial well-being. Accurate and consistent data entry within these components ensures the reliability of financial analysis and the effectiveness of financial planning.

How to Create Personal Financial Statements

Creating personal financial statements, comprising a balance sheet and an income statement, provides a comprehensive overview of one’s financial health. These statements offer valuable insights for informed financial decision-making and planning.

1. Choose a Template or Software: Numerous spreadsheet templates or personal finance software applications offer pre-built formats for creating balance sheets and income statements. Selecting a suitable template simplifies the process and ensures consistent organization.

2. Gather Financial Documents: Collect all relevant financial documents, including bank statements, investment account statements, loan documents, credit card statements, and pay stubs. These documents provide the necessary data for populating the templates accurately.

3. Populate the Balance Sheet: Begin by listing all assets, including cash, investments, and property, along with their current market values. Then, list all liabilities, including loans and credit card balances, noting outstanding amounts. Calculate net worth by subtracting total liabilities from total assets.

4. Populate the Income Statement: List all sources of income, including salaries, wages, investment income, and any other income streams. Then, categorize and list all expenses, including housing, transportation, food, and entertainment. Calculate net income by subtracting total expenses from total income.

5. Review and Update Regularly: Regularly review and update both statements, preferably monthly or quarterly. This consistent monitoring provides a dynamic view of financial health, enabling timely adjustments to financial strategies.

6. Analyze the Results: Scrutinize the completed statements to identify trends, strengths, and weaknesses. A growing net worth and positive net income generally indicate sound financial health. Conversely, declining net worth or negative net income necessitates adjustments to financial habits.

7. Utilize for Financial Planning: Employ these statements to inform financial decisions, such as budgeting, debt management, and investment planning. A clear understanding of ones financial position empowers informed choices and facilitates achievement of financial goals.

Systematic creation and analysis of personal financial statements provide invaluable insights into one’s financial well-being. This organized approach facilitates proactive financial management, enabling informed decisions and promoting long-term financial stability.

A structured approach to personal finance, facilitated by frameworks for organizing assets, liabilities, income, and expenses, empowers informed financial decision-making. These frameworks provide a clear snapshot of net worth and cash flow, enabling individuals to track progress, identify areas for improvement, and make strategic choices aligned with financial goals. From budgeting and debt management to investment planning and tax preparation, these organized records serve as invaluable tools for achieving financial stability and long-term well-being.

Financial well-being requires proactive management and informed decision-making. Utilizing structured frameworks for organizing financial information provides the necessary foundation for achieving financial goals and securing long-term financial health. Consistent application of these principles empowers individuals to navigate the complexities of personal finance with confidence and clarity.