A projected financial statement showcasing anticipated revenue, expenses, and resulting profit or loss over a specific period is a crucial tool for business planning and financial forecasting. This forward-looking document allows organizations to estimate financial performance based on assumptions about future operations and market conditions. It differs from a historical profit and loss statement, which reflects actual past performance.

Using this type of financial projection offers several key advantages. It assists in securing funding from investors or lenders by demonstrating potential profitability. It facilitates informed decision-making regarding pricing strategies, cost management, and resource allocation. Furthermore, it serves as a benchmark against which actual financial results can be measured, enabling proactive adjustments and improved financial control. Regularly updating these projections allows businesses to adapt to changing market dynamics and refine their strategies.

This article will delve deeper into the practical applications and development of these crucial financial tools. Subsequent sections will explore the key components, construction methodologies, and interpretation of projected financial reports, empowering readers to leverage these insights for enhanced financial planning and business success.

1. Projected Revenue

Projected revenue forms the cornerstone of a pro forma profit and loss statement. Accuracy in revenue projections directly impacts the reliability and usefulness of the entire statement. Overly optimistic projections can lead to unrealistic expectations and flawed financial planning, while overly conservative estimates may hinder investment opportunities and business growth. The interconnectedness of projected revenue with other components, such as cost of goods sold and gross profit, underscores its critical role. A software company, for instance, might project revenue based on anticipated subscriptions and licensing fees, influenced by factors like market size, pricing strategy, and competitive landscape. This projection then informs resource allocation for marketing and product development.

Several methods exist for projecting revenue. Historical data analysis, market research, industry benchmarks, and sales pipeline forecasting offer valuable insights. Consider a retail business expanding into a new market. Historical sales data from existing locations, adjusted for market demographics and competitive pressures, can provide a foundation for revenue projections. Supplementing this with market research on consumer spending patterns strengthens the projection’s accuracy. Recognizing the inherent uncertainty in projections is crucial. Sensitivity analysis, exploring the impact of varying assumptions on revenue outcomes, provides a more robust understanding of potential scenarios.

Understanding the nuances of revenue projection within the context of a pro forma profit and loss statement is essential for sound financial planning. Realistic and well-supported revenue projections enable businesses to secure funding, make informed operational decisions, and navigate market uncertainties effectively. Challenges in accurately projecting revenue can stem from unpredictable market fluctuations, competitive pressures, and internal factors like production capacity. Addressing these challenges requires continuous monitoring, analysis, and adjustments to the projections, ensuring the pro forma statement remains a relevant and valuable tool for strategic decision-making.

2. Forecasted Expenses

Forecasted expenses represent a critical component of a pro forma profit and loss statement, providing an estimate of anticipated costs incurred in generating projected revenue. Accurate expense forecasting is crucial for determining profitability, securing funding, and making informed operational decisions. A comprehensive understanding of various expense categories and their potential impact on the bottom line is essential for developing a realistic and reliable financial projection.

-

Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing goods or services sold. For a manufacturing company, this includes raw materials, direct labor, and manufacturing overhead. A software company’s COGS might include software development costs and hosting fees. Accurately forecasting COGS is crucial for determining gross profit margins and overall profitability. For example, a furniture manufacturer must project lumber, hardware, and labor costs to accurately estimate COGS and set appropriate sales prices.

-

Operating Expenses

Operating expenses encompass costs incurred in running the business, excluding COGS. These include salaries, rent, marketing, utilities, and administrative expenses. Projecting operating expenses requires careful consideration of factors like staffing levels, marketing campaigns, and anticipated growth. A rapidly expanding tech startup, for example, might project significant increases in operating expenses related to hiring and marketing as it scales its operations.

-

Capital Expenditures (CAPEX)

CAPEX represents investments in long-term assets, such as equipment, property, and software. While not directly impacting the profit and loss statement in the same way as operating expenses, CAPEX influences depreciation expense, which does affect profitability. Accurately forecasting CAPEX is crucial for long-term financial planning and investment decisions. A transportation company, for instance, might project significant CAPEX for new vehicles, impacting depreciation expense and influencing overall profitability over time.

-

Financing Costs

Financing costs include interest expense on debt and other costs associated with raising capital. These costs are essential considerations, particularly for businesses relying on debt financing. Accurately projecting financing costs ensures a realistic assessment of profitability and informs financing decisions. A real estate developer relying on bank loans, for example, must carefully project interest expense to assess project viability and secure necessary funding.

A detailed understanding of these expense categories allows for a comprehensive and insightful analysis of a pro forma profit and loss statement. The interplay between projected revenue and forecasted expenses ultimately determines the projected profitability, providing a critical foundation for informed decision-making and strategic financial planning. Regularly reviewing and updating expense forecasts, considering potential variances and market fluctuations, enhances the accuracy and reliability of the pro forma statement as a strategic tool.

3. Estimated Profit/Loss

The estimated profit or loss, derived from projected revenue and expenses, represents a core output of a pro forma profit and loss statement template. This figure provides a critical financial outlook, informing strategic decision-making, resource allocation, and investor communication. Understanding the components and implications of the estimated profit/loss is essential for leveraging the full potential of pro forma financial statements.

-

Gross Profit

Gross profit, calculated as revenue minus the cost of goods sold (COGS), provides a preliminary indication of profitability before considering operating expenses. A high gross profit margin suggests efficient production or service delivery. A furniture manufacturer, for instance, might project a gross profit of 40%, indicating that 40 cents of every dollar earned covers production costs, leaving the remainder to cover operating expenses and contribute to net profit. Monitoring and analyzing gross profit within the pro forma statement allows businesses to assess pricing strategies and cost management effectiveness.

-

Operating Income

Operating income, calculated as gross profit minus operating expenses, reflects the profitability of core business operations. This metric provides a clearer picture of a company’s earning power before considering interest and taxes. A software company with a high operating income demonstrates efficient management of operating expenses relative to revenue. Analyzing projected operating income within the pro forma statement allows businesses to evaluate operational efficiency and identify potential areas for cost optimization.

-

Net Income

Net income, often referred to as the “bottom line,” represents the final profit or loss after all expenses, including interest and taxes, have been deducted. This crucial figure reflects the overall profitability of the business. A positive net income indicates profitability, while a negative net income indicates a loss. A retail business projecting a positive net income demonstrates the potential for sustainable growth and return on investment. Analyzing projected net income allows businesses to assess overall financial performance and inform strategic decisions regarding expansion, investment, and resource allocation.

-

Implications for Decision-Making

The estimated profit or loss figure significantly influences strategic decision-making. A projected loss might prompt adjustments to pricing strategies, cost reduction initiatives, or revisions to the business model. A projected profit, on the other hand, might support expansion plans, investment in research and development, or increased marketing efforts. For example, a startup projecting significant losses might revisit its market entry strategy or seek additional funding. Conversely, a company projecting substantial profit might consider acquiring competitors or expanding into new markets. The estimated profit/loss serves as a crucial input for strategic planning and resource allocation.

The estimated profit or loss, a culmination of projected revenue and expenses, provides a critical lens through which to assess the financial viability and potential of a business venture. By analyzing the components of the estimated profit/loss gross profit, operating income, and net income businesses gain valuable insights into their operational efficiency, cost structure, and overall financial health. This information, derived from the pro forma profit and loss statement template, empowers informed decision-making, enhances strategic planning, and facilitates effective communication with investors and stakeholders. Regularly reviewing and refining these projections, considering market dynamics and operational adjustments, ensures the pro forma statement remains a relevant and reliable tool for navigating the complexities of the business landscape.

4. Underlying Assumptions

A pro forma profit and loss statements integrity relies heavily on the validity of its underlying assumptions. These assumptions, representing educated guesses about future conditions, directly influence projected revenue, expenses, and ultimately, profitability. A clear understanding of these assumptions is crucial for interpreting the statement and making informed business decisions. Transparency regarding these assumptions is essential for stakeholders to assess the reliability and potential risks associated with the projected financial outcomes.

-

Sales Growth Assumptions

Sales growth assumptions project the rate at which revenue is expected to increase over the forecast period. These assumptions are typically based on market research, historical trends, competitive analysis, and anticipated market share. For example, a new restaurant might assume a 15% year-over-year sales growth based on market analysis and comparable restaurant performance in the area. Overly optimistic sales growth assumptions can lead to inflated profit projections and unrealistic expectations, while overly conservative assumptions can hinder investment and growth opportunities. Clearly stating and justifying these assumptions is crucial for stakeholder understanding and confidence.

-

Cost Assumptions

Cost assumptions project anticipated expenses related to production, operations, and other business activities. These assumptions often draw upon historical cost data, supplier contracts, and industry benchmarks. For instance, a manufacturing company might assume a 5% increase in raw material costs based on supplier projections and industry trends. Accurate cost assumptions are crucial for determining realistic profit margins. Underestimating costs can lead to inaccurate profit projections and potential financial difficulties. Transparency about cost assumptions allows stakeholders to assess the reliability of the projected financial outcomes.

-

Market Condition Assumptions

Market condition assumptions reflect anticipated economic and industry-specific factors that may influence business performance. These assumptions often consider factors like inflation, interest rates, unemployment, and regulatory changes. A real estate developer, for example, might assume a stable interest rate environment and moderate inflation when projecting project profitability. Changes in these market conditions can significantly impact projected financial performance. Clearly stating these assumptions allows stakeholders to understand the potential impact of external factors on the projected outcomes.

-

Operational Efficiency Assumptions

Operational efficiency assumptions project improvements in productivity, cost control, and resource utilization. These assumptions often relate to process improvements, technology adoption, and economies of scale. A logistics company might assume a 10% improvement in delivery efficiency through route optimization software. These assumptions directly influence projected cost savings and profitability. Realistic and well-supported operational efficiency assumptions are crucial for credible pro forma statements. Overly optimistic assumptions can lead to unrealistic profit projections and misinformed decision-making. Transparency regarding these assumptions allows stakeholders to assess the feasibility and potential impact of planned operational improvements.

A comprehensive understanding of these underlying assumptions is essential for interpreting a pro forma profit and loss statement effectively. These assumptions, representing the foundation upon which the financial projections are built, must be carefully considered, clearly articulated, and regularly reviewed. Transparency regarding these assumptions enables stakeholders to assess the reliability of the pro forma statement and understand the potential risks and opportunities associated with the projected financial outcomes. Sensitivity analysis, exploring the impact of varying assumptions on the projected profit/loss, further strengthens the analytical value of the pro forma statement, providing a more robust understanding of potential scenarios and enhancing informed decision-making.

5. Financial Planning

Financial planning and projected profit and loss statements are inextricably linked. The statement serves as a crucial tool within the broader financial planning process, providing a structured framework for projecting future financial performance. This forward-looking perspective enables informed decision-making regarding resource allocation, pricing strategies, and operational adjustments. The statement’s ability to model the financial impact of various strategic options enhances planning effectiveness. For example, a company considering expansion into a new market can use a projected profit and loss statement to assess the potential financial implications of different market entry strategies, informing decisions about investment levels and resource allocation. Furthermore, the statement facilitates proactive risk management by enabling businesses to anticipate potential financial challenges and develop mitigation strategies. A retailer anticipating increased competition can model the impact on sales and profitability, allowing for proactive adjustments to pricing or marketing strategies. Effective financial planning hinges on the insights derived from a well-constructed projected profit and loss statement.

Developing a robust financial plan requires integrating projected profit and loss statements with other financial planning tools, such as cash flow projections and balance sheet forecasts. This integrated approach provides a holistic view of the organization’s anticipated financial position, enabling more informed and strategic decision-making. For instance, a rapidly growing technology company might integrate its projected profit and loss statement with a cash flow projection to anticipate funding needs and ensure sufficient working capital to support growth. This integration also facilitates performance monitoring and control. By comparing actual financial results against the projections outlined in the statement, businesses can identify variances, analyze their causes, and implement corrective actions. This iterative process enhances financial control and improves the accuracy of future projections. A manufacturing company experiencing higher-than-projected material costs can analyze the variance, identify potential causes such as supply chain disruptions, and implement cost-saving measures or adjust pricing strategies.

The projected profit and loss statement serves as a dynamic tool within the financial planning process, informing strategic decisions, facilitating proactive risk management, and enabling performance monitoring. Its integration with other financial planning tools enhances the comprehensiveness and effectiveness of the overall planning process. However, the inherent uncertainty of future conditions poses a challenge to the accuracy of projections. Regularly reviewing and updating the statement, incorporating new information and adjusting assumptions as needed, mitigates this challenge and ensures the statement remains a relevant and reliable tool for informed financial planning. Understanding this dynamic interplay between financial planning and projected profit and loss statements is essential for navigating the complexities of the business environment and achieving sustainable financial success.

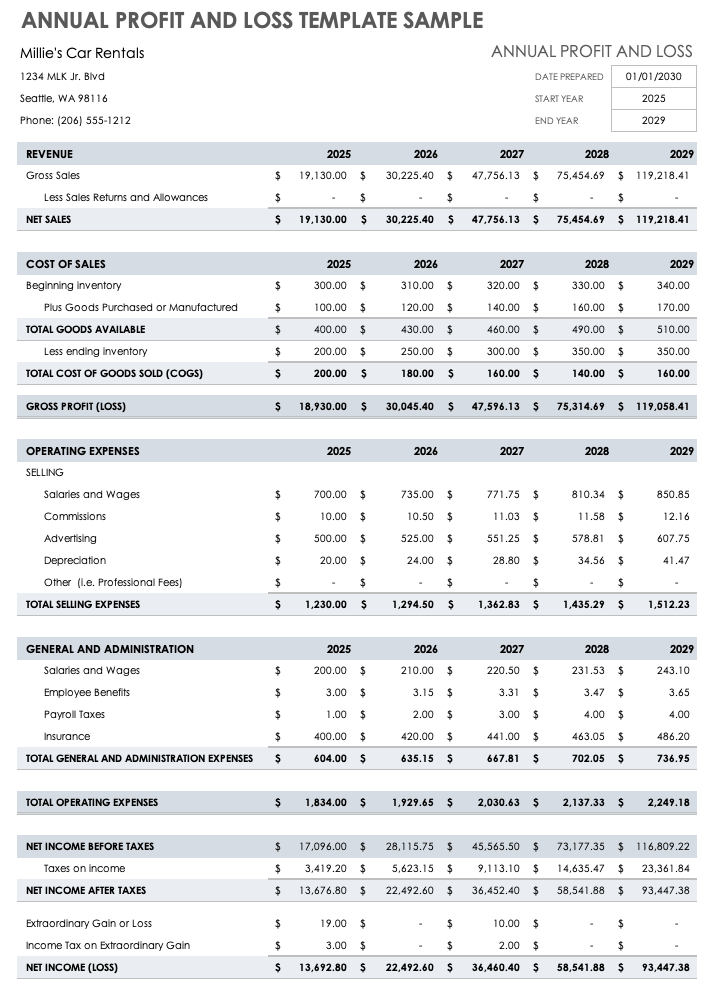

Key Components of a Pro Forma Profit and Loss Statement Template

A well-structured template requires a clear understanding of its core components. These elements, when combined, provide a comprehensive projection of future financial performance.

1. Revenue Projections: These represent the anticipated income from sales of goods or services. Accuracy in revenue projections is paramount, impacting all other aspects of the statement. Methodologies include historical data analysis, market research, and industry benchmarks. A software company, for example, might project revenue based on anticipated subscription growth and new product launches.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods or services. For a manufacturer, this includes raw materials and direct labor. A service provider’s COGS might include direct labor and project-related expenses. Accurate COGS projections are crucial for determining gross profit margins.

3. Operating Expenses: These expenses represent the costs of running the business, excluding COGS. Examples include salaries, rent, marketing, and administrative expenses. Projecting operating expenses requires careful consideration of staffing levels, marketing campaigns, and anticipated growth.

4. Gross Profit: Calculated as revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. This metric provides a key indicator of operational efficiency and pricing effectiveness.

5. Operating Income: This figure represents profit after deducting both COGS and operating expenses. Operating income reflects the profitability of the core business and provides insights into management’s ability to control costs.

6. Interest Expense: This component reflects the cost of borrowing money to finance operations or investments. Accurately projecting interest expense is crucial, especially for businesses with significant debt.

7. Income Tax Expense: This represents the estimated amount of income taxes owed based on projected profit. Tax rates and regulations play a significant role in this calculation.

8. Net Income: Often referred to as the “bottom line,” net income represents the final profit or loss after all expenses and taxes have been deducted. This figure provides a comprehensive view of a company’s projected profitability.

These components, when combined and analyzed, provide a comprehensive financial outlook, informing strategic decisions and facilitating informed resource allocation. The accuracy and reliability of these projections, however, depend heavily on the validity of underlying assumptions regarding market conditions, operational efficiency, and other key factors.

How to Create a Pro Forma Profit and Loss Statement

Creating a pro forma profit and loss statement involves a structured approach to projecting future financial performance. A methodical process ensures a comprehensive and reliable financial forecast.

1. Establish a Timeframe: Define the period the statement will cover, whether it’s a quarter, a year, or multiple years. The timeframe should align with the planning horizon and business objectives.

2. Project Revenue: Forecast sales revenue based on market analysis, historical data, sales pipeline projections, and anticipated growth rates. Consider factors like market size, pricing strategies, and competitive pressures.

3. Forecast Cost of Goods Sold (COGS): Estimate direct costs associated with producing goods or services. This involves projecting raw material costs, direct labor, manufacturing overhead, or service delivery expenses. Consider factors like supplier contracts, production efficiency, and economies of scale.

4. Project Operating Expenses: Estimate expenses related to running the business, excluding COGS. This includes projecting salaries, rent, marketing and advertising costs, utilities, and administrative expenses. Consider factors like staffing levels, marketing campaigns, and anticipated growth.

5. Calculate Gross Profit: Subtract projected COGS from projected revenue to arrive at gross profit. Analyze the gross profit margin to assess pricing strategies and cost management effectiveness.

6. Calculate Operating Income: Subtract projected operating expenses from gross profit to arrive at operating income. Analyze operating income to assess operational efficiency and profitability before considering interest and taxes.

7. Project Other Income and Expenses: Include any anticipated income or expenses not directly related to core operations, such as interest income, interest expense, and gains or losses from asset sales. Account for anticipated income tax expenses based on projected profit and applicable tax rates.

8. Calculate Net Income: Subtract projected other expenses, including taxes, from operating income to arrive at net income, or the “bottom line.” This figure represents the overall projected profit or loss for the specified period.

9. Document Assumptions: Clearly articulate the underlying assumptions driving the projections. This includes assumptions about market growth, cost trends, competitive landscape, and operational efficiency. Transparent documentation of assumptions enhances the statement’s credibility and allows for informed interpretation by stakeholders.

10. Review and Refine: Regularly review and update the pro forma statement to reflect changes in market conditions, operational performance, and strategic direction. This iterative process ensures the statement remains a relevant and reliable tool for financial planning and decision-making.

A well-constructed pro forma profit and loss statement provides a crucial framework for financial planning, enabling businesses to anticipate future performance, allocate resources effectively, and make informed decisions to drive growth and profitability. Regular review and refinement, incorporating updated information and revised assumptions, ensure the statement remains a valuable tool for navigating the complexities of the business environment.

Projected financial reports serve as crucial tools for business planning, enabling informed decision-making and strategic resource allocation. Understanding the core componentsrevenue projections, cost of goods sold, operating expenses, and the resulting profit or lossprovides a foundation for analyzing financial performance. The underlying assumptions driving these projections require careful consideration and transparent documentation, as they directly influence the reliability and interpretability of the statement. Creating these projected statements involves a structured approach, encompassing timeframe establishment, detailed expense and revenue forecasting, and rigorous assumption documentation. Regular review and refinement of these statements, incorporating updated market data and operational adjustments, are essential for maintaining their relevance and accuracy.

Effective utilization of these projected reports requires a comprehensive understanding of their components, development process, and underlying assumptions. These tools offer valuable insights for navigating the complexities of the business landscape, enabling proactive financial management and informed strategic decision-making. Organizations leveraging the power of these projected reports gain a competitive advantage by anticipating future financial performance, identifying potential challenges, and adapting strategies to achieve sustainable growth and profitability. The ongoing refinement and thoughtful interpretation of these statements remain crucial for navigating an ever-evolving business environment and maximizing long-term financial success.