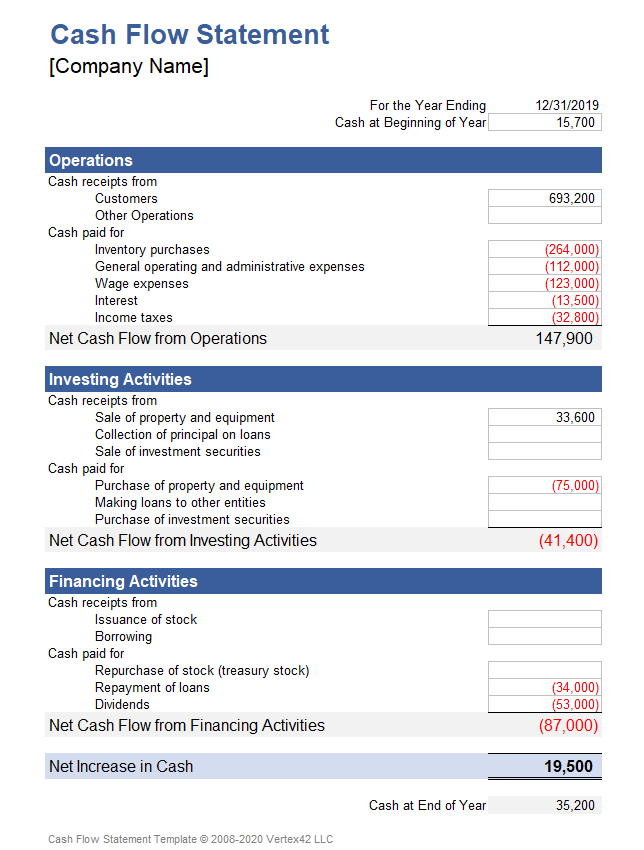

A structured format designed to present the movement of cash both into and out of an organization over a specific period, this tool categorizes cash flow into operating, investing, and financing activities. This provides a clear picture of how a company generates and uses its funds.

Utilizing such a pre-designed structure offers several advantages. It ensures consistency in reporting, simplifies the process of organizing financial data, and facilitates analysis by presenting information in a standardized manner. This can lead to better financial decisions and improved resource allocation.

The following sections will delve deeper into the specific components of each activity category within this structured format, offering practical examples and explaining how they contribute to a comprehensive understanding of an organization’s financial health.

1. Standardized Format

A standardized format is fundamental to the utility of a statement of cash flows template. Consistency in presentation allows for straightforward comparison across different reporting periods within the same organization and facilitates benchmarking against other entities. This comparability is crucial for identifying trends, evaluating performance, and making informed investment decisions. Without a standardized structure, analyzing cash flow information would be significantly more complex and prone to misinterpretation.

Consider a scenario where two companies operate within the same industry but present their cash flow information using different formats. Direct comparison becomes challenging, hindering potential investors from accurately assessing their relative financial strengths and weaknesses. A standardized template mitigates this issue by ensuring consistent categorization and reporting of cash flows from operating, investing, and financing activities. This allows stakeholders to focus on the underlying financial performance rather than deciphering varying presentation methods.

Adherence to a standardized format strengthens the reliability and interpretability of cash flow data. This promotes transparency and accountability, enabling stakeholders to gain a clear and consistent understanding of an organization’s financial health. The ability to readily compare and analyze cash flow information across different periods and entities underscores the importance of the standardized format as a cornerstone of effective financial reporting.

2. Categorized Activities

A core principle of a statement of cash flows template lies in the categorization of activities. This structured approach divides cash flows into three primary categories: operating, investing, and financing. Understanding these distinct categories is crucial for interpreting the overall financial picture presented by the statement.

-

Operating Activities

These activities represent the cash generated from a company’s core business operations. Examples include cash received from customers, cash paid to suppliers, and cash paid to employees. Analyzing operating cash flows provides insights into the profitability and sustainability of the core business. A healthy level of positive cash flow from operations is essential for long-term financial stability.

-

Investing Activities

Investing activities encompass cash flows related to the acquisition and disposal of long-term assets. This includes purchases of property, plant, and equipment (PP&E), investments in other companies, and the sale of existing assets. These cash flows provide insight into a company’s investment strategy and its potential for future growth. Significant cash outflows for investments may signal expansion plans, while substantial inflows could indicate divestment strategies.

-

Financing Activities

Financing activities involve transactions related to how a company obtains and manages its funding. Examples include issuing debt, raising equity capital, repurchasing shares, and paying dividends. Analyzing financing activities helps understand a company’s capital structure and its reliance on external funding. A high reliance on debt financing might increase financial risk, while substantial equity financing could suggest a focus on long-term growth.

-

Interrelation of Categories

While distinct, these categories are interconnected and offer a comprehensive view of a company’s financial activities. For example, strong cash flow from operations might fund investing activities, reducing the need for external financing. Conversely, weak operating cash flow might necessitate increased borrowing or equity issuance. Understanding the interplay between these categories is crucial for a complete financial assessment.

The categorization of activities within a statement of cash flows template provides a structured framework for analyzing a company’s financial performance. By examining the cash flows within each category, stakeholders can gain a deeper understanding of the sources and uses of cash, the sustainability of operations, and the overall financial health of the organization.

3. Operating Activities

Operating activities form a crucial component of the statement of cash flows template, providing insights into the cash generated from a company’s core business functions. This section explores the key facets of operating activities and their significance within the broader context of financial analysis.

-

Cash from Customers

This represents the primary source of operating cash inflow for most businesses. For example, a retail company receives cash payments from customers purchasing goods. Within the statement of cash flows, this inflow demonstrates the ability of the business to generate revenue and convert sales into cash, a critical indicator of operational efficiency.

-

Payments to Suppliers

Cash outflows to suppliers for inventory, raw materials, and other operating expenses are essential components of operating activities. Consider a manufacturing company paying for raw materials. This outflow, documented within the statement, reflects the cost of goods sold and its impact on cash flow. Analyzing this element helps assess the management of working capital.

-

Salary and Wage Payments

Employee compensation in the form of salaries and wages constitutes a significant operating cash outflow. For instance, a technology company disbursing payroll. This outflow, reported within the statement, demonstrates the cost of human capital required for operations. Monitoring this element aids in understanding the relationship between labor costs and overall profitability.

-

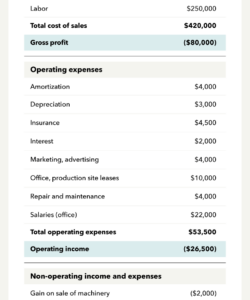

Operating Income Adjustments

Non-cash items like depreciation and amortization, while affecting net income, do not impact cash flow directly. These items require adjustments within the operating activities section to reconcile net income with actual cash generated from operations. For example, adding back depreciation expense in the statement provides a more accurate representation of cash flow generated by the business.

Analyzing operating activities within the statement of cash flows template offers crucial insights into a company’s ability to generate cash from its core business. Examining the interplay between cash inflows from customers and outflows to suppliers, employees, and other operating expenses provides a comprehensive understanding of operational efficiency and financial sustainability. This analysis contributes significantly to evaluating the overall financial health and stability of an organization.

4. Investing Activities

Investing activities within a statement of cash flows template provide crucial insights into an organization’s capital allocation strategies and its focus on long-term growth. These activities reflect cash flows related to the acquisition and disposal of long-term assets, offering a perspective on how management deploys resources to enhance future profitability.

-

Capital Expenditures (CAPEX)

CAPEX represents investments in fixed assets, such as property, plant, and equipment (PP&E). For example, a manufacturing company investing in new machinery or a technology company building a new data center. Within the statement of cash flows, significant CAPEX outflows often indicate a commitment to expansion and future growth, although they can also strain short-term liquidity.

-

Acquisitions and Divestitures

Acquisitions of other businesses represent significant investing activities, reflecting a strategic decision to expand market share or acquire new technologies. Conversely, divestitures, or the sale of business segments or assets, generate cash inflows. These transactions, documented within the statement, offer insights into an organization’s strategic direction and portfolio management.

-

Investments in Securities

Purchases and sales of securities, such as stocks and bonds of other companies, also fall under investing activities. For example, a company investing in the equity of another company for strategic purposes or generating returns. These investments, reflected within the statement, can indicate diversification strategies or efforts to generate returns from excess cash.

-

Loaning and Collecting Principal on Loans

Providing loans to other entities and collecting the principal repayments on those loans constitute investing activities. While interest income falls under operating activities, the principal amounts affect investing cash flows. These transactions, documented in the statement, can reflect a company’s involvement in lending activities and its management of financial assets.

Analyzing investing activities within the statement of cash flows provides valuable context for understanding an organization’s financial strategy. By examining the allocation of resources towards long-term assets and investments, stakeholders gain insights into growth prospects, risk appetite, and the potential for future returns. Understanding these activities is essential for a comprehensive assessment of an organization’s financial health and long-term viability.

5. Financing Activities

Financing activities within a statement of cash flows template offer crucial insights into how an organization obtains and manages its funding. This section examines the various components of financing activities, providing examples and explaining their implications for financial analysis.

-

Debt Financing

Debt financing involves borrowing money through loans or issuing bonds. Procuring a bank loan to finance equipment purchases or issuing corporate bonds to raise capital exemplifies debt financing. Within the statement of cash flows, proceeds from debt issuance represent cash inflows, while principal repayments constitute cash outflows. Increased debt levels, reflected in the statement, might indicate expansion plans but can also raise concerns about financial risk and debt servicing capacity.

-

Equity Financing

Equity financing involves raising capital by issuing shares of stock. A company conducting an initial public offering (IPO) or issuing additional shares to existing investors exemplifies equity financing. Within the statement of cash flows, proceeds from equity issuance represent cash inflows. Unlike debt, equity does not require periodic principal repayments, reducing the burden on future cash flows.

-

Share Repurchases

Companies may repurchase their own shares, reducing the number of outstanding shares. This action, reflected as a cash outflow in the statement, can signal management’s belief that the company’s stock is undervalued. Share repurchases can increase earnings per share and return value to shareholders.

-

Dividend Payments

Distributions of profits to shareholders in the form of dividends represent a cash outflow within financing activities. A company declaring and paying quarterly dividends to its shareholders exemplifies this activity. Consistent dividend payments, as reflected in the statement, can signal financial stability and attract income-seeking investors. However, substantial dividend payouts can also limit a company’s ability to reinvest profits for future growth.

Analyzing financing activities provides a comprehensive understanding of an organization’s capital structure and its approach to funding operations and growth initiatives. The interplay between debt and equity financing, share repurchases, and dividend payments, as documented within the statement of cash flows, offers valuable insights into long-term financial strategies and their implications for overall financial health.

Key Components of a Statement of Cash Flows Template

A comprehensive understanding of a statement of cash flows requires familiarity with its core structural elements. The following components provide a foundation for analyzing this crucial financial statement.

1. Operating Activities: This section details cash flows generated from the core business operations. Key elements include cash received from customers, payments to suppliers for goods and services, salaries and wages paid to employees, and adjustments for non-cash items like depreciation and amortization.

2. Investing Activities: This section encompasses cash flows related to the acquisition and disposal of long-term assets. Key elements include capital expenditures for property, plant, and equipment (PP&E), investments in other companies, proceeds from the sale of assets, and loan transactions.

3. Financing Activities: This section details cash flows related to how the company obtains and manages its funding. Key elements include proceeds from debt issuance, equity financing, share repurchases, and dividend payments.

4. Beginning Cash Balance: The statement begins with the cash balance at the start of the reporting period. This provides a starting point for tracking cash flow changes.

5. Ending Cash Balance: The statement concludes with the cash balance at the end of the reporting period. This represents the net result of all cash inflows and outflows during the period.

6. Net Increase/Decrease in Cash: This figure represents the overall change in cash during the reporting period, calculated as the difference between the ending and beginning cash balances. It summarizes the net impact of operating, investing, and financing activities on cash.

7. Non-Cash Transactions: While not directly affecting cash flow, significant non-cash transactions are often disclosed in a separate note. Examples include stock-based compensation, debt-for-equity swaps, and asset exchanges.

Analyzing these interconnected components provides a robust understanding of an organization’s financial performance, its ability to generate and manage cash, and its prospects for future growth and stability. Each section offers unique insights into the financial health and strategic direction of the entity.

How to Create a Statement of Cash Flows Template

Creating a statement of cash flows template requires a structured approach to organize and categorize cash inflows and outflows. The following steps outline the process of developing a comprehensive template.

1. Define the Reporting Period: Specify the timeframe covered by the statement, such as a quarter or a fiscal year. A clearly defined period ensures consistency and allows for accurate comparisons across different periods.

2. Establish the Structure: Organize the template into three distinct sections: Operating Activities, Investing Activities, and Financing Activities. This categorization provides a standardized framework for presenting cash flow information.

3. Detail Operating Activities: Within this section, include line items for cash received from customers, payments to suppliers, salaries and wages, interest received and paid, and income tax payments. Adjust for non-cash items like depreciation and amortization.

4. Detail Investing Activities: Include line items for capital expenditures (purchases of PP&E), proceeds from the sale of assets, investments in other companies, and loans made or repaid. This section captures cash flows related to long-term assets.

5. Detail Financing Activities: Include line items for proceeds from debt issuance, equity financing, principal repayments on debt, share repurchases, and dividend payments. This section reflects how the organization sources and manages its capital.

6. Include Beginning and Ending Cash Balances: The template should capture the cash balance at the beginning of the reporting period and provide a space to calculate the ending cash balance. This allows for tracking the net change in cash.

7. Calculate Net Cash Flow: Include a formula to calculate the net increase or decrease in cash during the period. This represents the difference between the ending and beginning cash balances and summarizes the overall impact of cash flows from all activities.

8. Consider Supplemental Disclosures: Include a section for supplemental disclosures of significant non-cash transactions, such as stock-based compensation or debt-for-equity swaps. This enhances transparency and provides a more complete picture of financial activities.

A well-structured template ensures consistency in reporting, facilitates analysis, and promotes transparency by presenting cash flow information in a standardized and easily interpretable manner. This structured approach enables stakeholders to gain a clear understanding of an organization’s financial performance and its ability to generate and manage cash effectively.

A statement of cash flows template provides a structured framework for analyzing an organization’s financial health by categorizing cash flows into operating, investing, and financing activities. Understanding the components within each category, such as cash from customers, capital expenditures, and debt financing, allows stakeholders to assess an organization’s ability to generate cash from operations, invest in future growth, and manage its capital structure. The standardized format facilitates comparison across different reporting periods and enhances transparency, enabling informed decision-making based on a clear understanding of cash flow dynamics.

Effective utilization of this template provides a crucial tool for evaluating financial performance and strategic decision-making. Careful analysis of cash flow trends can reveal underlying strengths and weaknesses, enabling proactive management of financial resources and contributing to long-term sustainability. The insights gained from a thorough review of the statement of cash flows are essential for informed assessments of financial health and future prospects.