Utilizing a no-cost, pre-designed structure for creating such a document offers significant advantages. It allows individuals to readily organize their financial information, saving time and effort. Accessibility to these resources empowers individuals to take control of their finances, promoting better financial planning and informed decision-making. This readily available resource facilitates regular financial reviews, enabling proactive adjustments to financial strategies and contributing to long-term financial stability.

This understanding of the documents purpose and benefits will allow us to explore related topics, such as how to accurately complete one, where to locate suitable options, and how to interpret the information it provides to make sound financial decisions.

1. Accessibility

Accessibility plays a crucial role in the effective utilization of personal financial statement templates. Removing barriers to access empowers individuals to take control of their financial well-being and make informed decisions. The following facets of accessibility are key considerations:

- Format AvailabilityTemplates should be available in various formats (e.g., spreadsheet, PDF, word processor document) to cater to different user preferences and software capabilities. This ensures compatibility with commonly used programs and devices, broadening the reach and usability of the template. For instance, offering a spreadsheet format allows for automatic calculations and dynamic adjustments, while a PDF version offers a printable, static view.

- Device CompatibilityTemplates should be accessible across various devices (desktops, laptops, tablets, smartphones). This allows users to access and update their financial information anytime, anywhere, promoting consistent financial monitoring and management, regardless of location or preferred device. This adaptability is essential in today’s mobile-first world.

- Language AccessibilityOffering templates in multiple languages caters to diverse populations, ensuring inclusivity and understanding. This is particularly important in multicultural societies where financial literacy resources may not be readily available in all languages. Providing translated versions breaks down language barriers and promotes financial empowerment for a wider audience.

- CostFree availability is a critical aspect of accessibility, ensuring that financial management tools are within reach for everyone, regardless of economic status. Removing cost barriers encourages wider adoption and promotes responsible financial planning across all income levels. This allows individuals to allocate resources towards their financial goals rather than the tools required to achieve them.

These facets of accessibility collectively contribute to the overall usability and effectiveness of personal financial statement templates. Ensuring broad access to these resources empowers individuals to actively engage in financial planning and make informed decisions that contribute to long-term financial health. The combination of accessible formats, device compatibility, language options, and cost-effectiveness maximizes the potential impact of these valuable tools.

2. Comprehensiveness

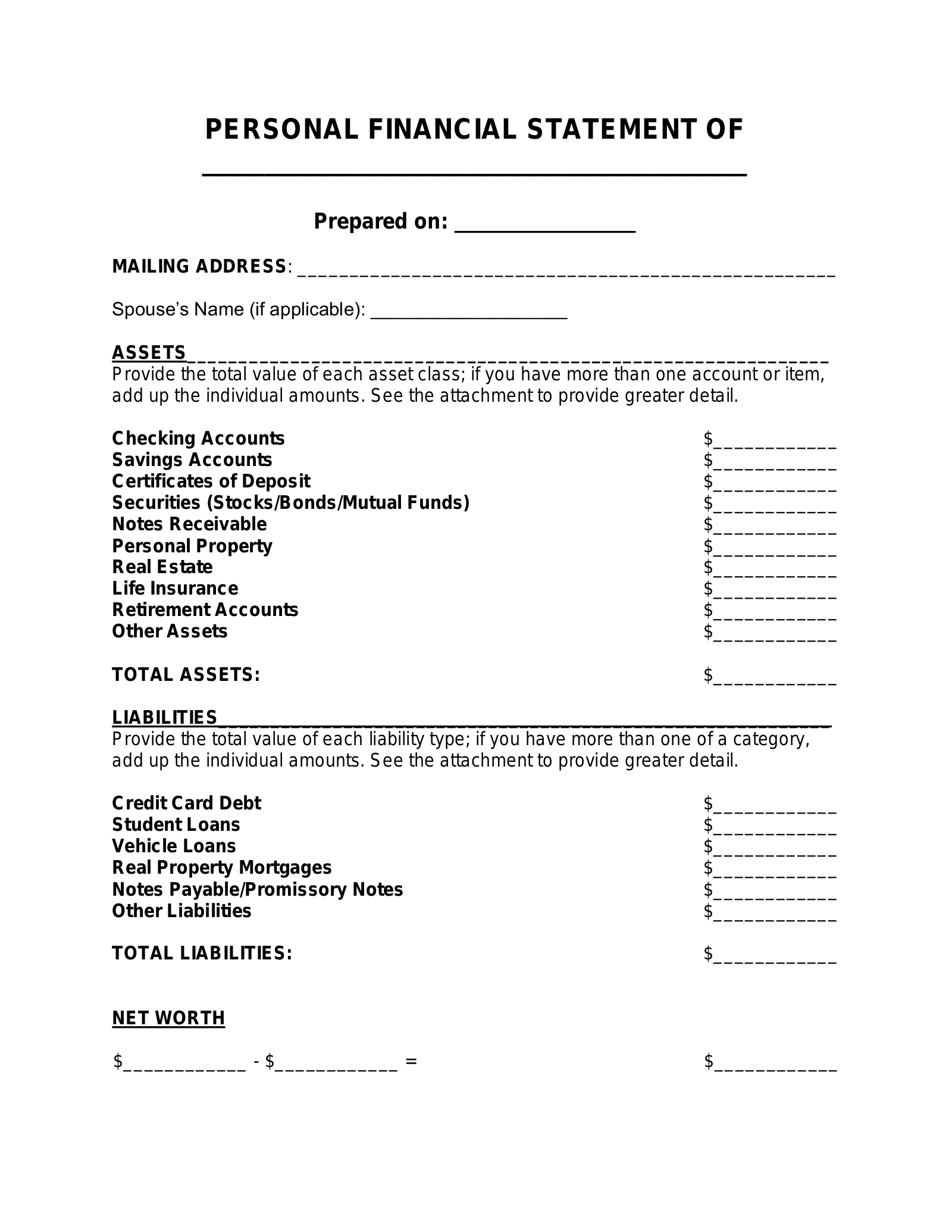

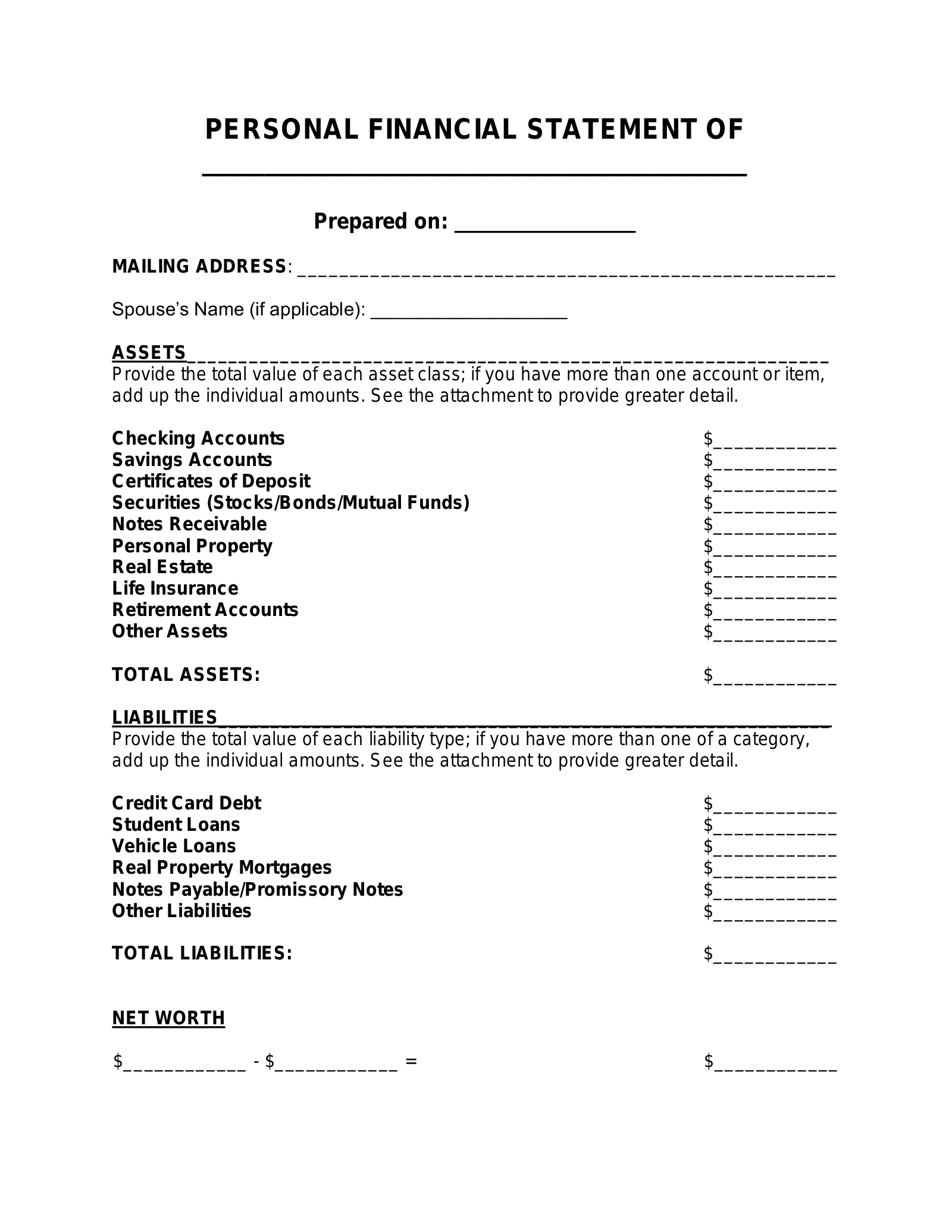

Comprehensiveness in a personal financial statement template is crucial for providing a holistic view of an individual’s financial position. A comprehensive template ensures all relevant aspects of financial health are captured, allowing for a thorough analysis and informed decision-making. This includes detailed sections for assets, encompassing everything from liquid holdings like checking and savings accounts to tangible assets like real estate and vehicles. Liabilities, such as mortgages, student loans, and credit card debt, must also be fully represented. Furthermore, sections for income sources (salary, investments, etc.) and recurring expenses (housing, transportation, utilities) are essential for understanding cash flow and budgeting. For example, omitting less frequent expenses like annual insurance premiums or property taxes could lead to an inaccurate assessment of one’s overall financial obligations.

The practical significance of a comprehensive template lies in its ability to provide a complete and accurate picture of one’s net worth. This comprehensive view is not only essential for personal financial management but also serves as a critical document when seeking financial services like loans or mortgages. Lenders rely on the information presented in a personal financial statement to assess creditworthiness and make informed lending decisions. A comprehensive statement provides a stronger basis for loan applications, increasing the likelihood of approval and potentially securing more favorable terms. Furthermore, detailed tracking of income and expenses within the template facilitates effective budgeting, allowing individuals to identify areas for potential savings and make informed adjustments to their spending habits.

In conclusion, the comprehensiveness of a personal financial statement template is directly linked to its effectiveness as a financial management tool. Templates lacking crucial categories can lead to an incomplete understanding of one’s financial standing, hindering effective planning and informed decision-making. A well-designed, comprehensive template empowers individuals to take control of their financial well-being, providing the necessary insights to achieve short-term and long-term financial goals. While locating and using a free template offers an accessible starting point, professional financial advice may be necessary for complex situations or personalized guidance.

3. Structure

A well-defined structure is paramount in a personal financial statement template. A logical and organized format ensures clarity, simplifies data entry, and facilitates accurate analysis. A structured template guides users through the process of compiling their financial information, promoting completeness and minimizing potential errors. This structured approach facilitates a clear understanding of one’s financial standing, enabling informed decision-making and effective financial planning.

- CategorizationClear categorization of information is essential. Assets, liabilities, income, and expenses should be distinctly separated and further categorized into relevant subcategories. For example, assets might be divided into liquid assets (cash, checking accounts), investments (stocks, bonds), and fixed assets (real estate, vehicles). This systematic categorization enables users to quickly locate specific information and understand the composition of their financial portfolio.

- Logical FlowThe template should follow a logical flow, presenting information in a coherent order. Typically, this involves starting with assets, followed by liabilities, then income, and finally expenses. This sequential presentation mirrors the fundamental accounting equation (Assets = Liabilities + Equity) and provides a natural progression for understanding the relationship between these components. This structured flow simplifies the calculation of net worth and facilitates a comprehensive overview of financial health.

- Clear LabelingClear and concise labels for each section and subcategory are crucial for accurate data entry and interpretation. Ambiguous or unclear labeling can lead to confusion and errors, potentially misrepresenting the user’s financial situation. For instance, clearly distinguishing between “short-term liabilities” (due within one year) and “long-term liabilities” (due beyond one year) is essential for accurate debt assessment.

- Visual HierarchyEffective use of visual hierarchy, such as headings, subheadings, and bullet points, enhances readability and comprehension. A clear visual hierarchy guides the user’s eye through the template, making it easier to navigate and locate specific information. This visual organization contributes to a more user-friendly experience and reduces the cognitive load required to process the information.

These structural elements contribute significantly to the usability and effectiveness of a personal financial statement template. A well-structured template empowers individuals to efficiently organize their financial data, gain a clear understanding of their financial position, and make informed decisions. The clarity and organization provided by a structured template ultimately contribute to better financial management and informed decision-making.

4. Accuracy

Accuracy within a personal financial statement template is paramount for its efficacy as a financial management tool. Inaccurate data renders the statement unreliable, potentially leading to flawed financial decisions. Cause and effect relationships are directly at play; inaccurate inputs will inevitably produce inaccurate outputs, misrepresenting net worth, cash flow, and overall financial health. For example, an overstated asset value or an understated liability balance can create a falsely optimistic picture of one’s financial situation. Conversely, underestimating income or overestimating expenses can lead to unnecessary budget restrictions or inadequate financial planning. The ripple effect of inaccurate data can impact everything from loan applications and investment strategies to retirement planning and day-to-day spending habits.

The importance of accuracy as a core component of a personal financial statement cannot be overstated. It serves as the foundation upon which sound financial decisions are made. Consider a scenario where an individual is applying for a mortgage. If the personal financial statement submitted to the lender contains inflated asset values or omits significant liabilities, the lender may approve a loan amount the individual cannot realistically afford. This can lead to financial strain, potential foreclosure, and long-term damage to creditworthiness. Conversely, accurate and complete information allows lenders to assess risk appropriately and offer loan terms that align with the individual’s true financial capacity. Beyond lending, accurate data within the statement provides a clear picture of spending patterns, facilitating the identification of areas for potential savings and enabling the creation of a realistic budget. This, in turn, promotes better financial control and facilitates progress toward financial goals.

In summary, accuracy is not merely a desirable attribute but a non-negotiable requirement for a functional personal financial statement. It underpins the entire process of financial planning and decision-making. While a free template provides a valuable framework, the onus of accurate data entry rests solely with the individual. Diligence in accurately recording financial data is crucial for realizing the full benefits of a personal financial statement, ensuring that it serves as a reliable tool for achieving financial well-being. Acknowledging the potential consequences of inaccurate information underscores the critical need for meticulous data entry and regular review to maintain an accurate and up-to-date financial picture.

5. Regular Updates

Maintaining an up-to-date personal financial statement is crucial for its continued relevance as a financial management tool. A static, outdated document provides a limited snapshot of the past, offering little insight into current financial health. Regular updates ensure the statement accurately reflects the dynamic nature of personal finances, enabling informed decisions based on current data. This dynamic approach to financial management allows for timely adjustments to spending, saving, and investment strategies as financial circumstances evolve.

- FrequencyThe appropriate update frequency depends on individual circumstances and financial activity levels. While monthly updates provide a granular view of financial changes, quarterly updates may suffice for individuals with more stable finances. More frequent updates may be necessary during periods of significant financial change, such as job transitions or major investments. For example, tracking expenses monthly can help identify spending trends and areas for potential savings, while less frequent updates might be suitable for monitoring long-term investment growth. The chosen frequency should balance the need for current data with the practicalities of data entry and review.

- ConsistencyConsistent updates, regardless of the chosen frequency, are key to establishing a reliable financial tracking system. Sporadic or irregular updates diminish the value of the statement, potentially overlooking important changes in financial status. Regular updates cultivate a habit of financial awareness, allowing for proactive adjustments to financial strategies. Just as regular health checkups are essential for physical well-being, regular financial reviews contribute to long-term financial health.

- Triggers for UpdatesCertain financial events warrant prompt updates to the personal financial statement. These triggers include significant changes in income, new debt obligations, major asset acquisitions or disposals, and changes in recurring expenses. For instance, securing a new job with a higher salary necessitates updating the income section, while taking out a mortgage requires adding the corresponding liability. Timely updates triggered by these events ensure the statement remains an accurate reflection of current financial reality. Promptly recording these changes allows for a more accurate assessment of net worth and informs future financial decisions.

- Utilizing TechnologyLeveraging technology simplifies the process of regular updates. Spreadsheet software with automated calculations streamlines data entry and reduces the risk of manual errors. Personal finance apps offer convenient mobile access, facilitating real-time tracking of income and expenses. These technological tools enhance efficiency and accuracy, making regular updates more manageable and less time-consuming. This integration of technology promotes consistent engagement with personal finances and supports informed financial decision-making.

Regular updates are essential for maximizing the value of a personal financial statement free template. They transform a static document into a dynamic tool for ongoing financial management. By incorporating regular updates into financial practices, individuals gain a clearer understanding of their financial trajectory, empowering them to make informed adjustments and work towards their financial goals. The ability to track progress, identify potential issues, and adapt to changing circumstances underscores the crucial role of regular updates in effective personal financial management.

Key Components of a Personal Financial Statement Template

A well-structured template ensures clarity and facilitates accurate financial analysis. Key components contribute to a comprehensive and reliable overview of one’s financial health.

1. Assets: A detailed account of everything owned with monetary value. This includes liquid assets (cash, checking/savings accounts), investments (stocks, bonds, retirement accounts), and fixed assets (real estate, vehicles). Accurate valuation is crucial for determining net worth.

2. Liabilities: A comprehensive list of all outstanding debts and financial obligations. This encompasses short-term debts like credit card balances and long-term debts like mortgages, student loans, and auto loans. Accurate reporting is essential for understanding debt burden and overall financial health.

3. Income: A record of all sources of income, including salaries, wages, investment returns, rental income, and any other form of regular financial inflow. Accurate income reporting is fundamental for budgeting and financial planning.

4. Expenses: A detailed categorization of all spending, encompassing fixed expenses (rent, mortgage payments, insurance) and variable expenses (groceries, entertainment, transportation). Tracking expenses is crucial for identifying areas for potential savings and maintaining a balanced budget.

5. Net Worth Calculation: A clear calculation derived by subtracting total liabilities from total assets. This figure represents the overall value of one’s financial holdings. Accurate calculation hinges on the accuracy of the underlying asset and liability data.

6. Date and Personal Information: The statement should clearly display the date it was created and include relevant personal information, such as name and contact details. This ensures the document is readily identifiable and attributable to the correct individual.

These interconnected elements provide a holistic representation of financial standing. Accurate and up-to-date information within each component is essential for generating a reliable and informative financial overview that facilitates informed decision-making.

How to Create a Personal Financial Statement

Creating a personal financial statement involves compiling relevant financial data into an organized format. This process facilitates a clear understanding of one’s current financial standing and provides a basis for informed financial planning.

1: Gather Necessary Documents: Collect all relevant financial documents, including bank statements, investment account statements, loan documents, and recent pay stubs. These documents provide the source data for accurate reporting.

2: Choose a Template or Software: Select a pre-designed template (spreadsheet software, online resources) or personal finance software. These tools provide a structured framework for organizing financial information. A template offers a basic structure while software often includes automated calculations and additional features.

3: List Assets: Thoroughly document all assets, including liquid assets (cash, checking/savings accounts), investment holdings (stocks, bonds, retirement funds), and fixed assets (real estate, vehicles). Determine current market values for accurate representation.

4: Document Liabilities: Compile a complete list of all outstanding debts, including credit card balances, student loans, mortgages, and auto loans. Ensure accurate reporting of outstanding balances.

5: Calculate Net Worth: Subtract total liabilities from total assets to determine net worth. This key figure provides a snapshot of overall financial health.

6: Record Income and Expenses: Document all sources of income (salary, investments, etc.) and categorize expenses (housing, transportation, food, etc.). This data provides insights into cash flow and spending patterns.

7: Review and Update Regularly: Regularly review and update the statement (monthly or quarterly) to reflect changes in financial circumstances. Consistent updates maintain the accuracy and relevance of the statement as a financial management tool.

8: Seek Professional Advice (Optional): Consider consulting with a financial advisor for personalized guidance and assistance with complex financial matters. Professional advice can provide valuable insights and tailored strategies for achieving financial goals.

By following these steps, individuals can create a comprehensive personal financial statement. This document serves as a valuable tool for tracking financial progress, informing financial decisions, and achieving long-term financial well-being.

Access to a personal financial statement free template empowers individuals to take control of their financial lives. Understanding its components, structure, and the importance of accurate and regular updates are crucial for maximizing its effectiveness. From assessing net worth and tracking cash flow to securing loans and making informed investment decisions, a well-maintained personal financial statement serves as an invaluable tool for achieving financial well-being. The availability of free resources eliminates cost barriers, making sound financial management accessible to all.

Financial well-being is an ongoing journey, not a destination. Regularly engaging with a personal financial statement, even a free template, fosters financial awareness and promotes proactive financial management. This empowers individuals to navigate financial complexities, make informed decisions, and build a secure financial future. Leveraging these readily available resources is a crucial step toward achieving long-term financial stability and realizing financial aspirations.