Using a structured format ensures clarity and completeness, increasing the likelihood of efficient claims processing. This methodical approach simplifies the often complex process of documenting a loss, reducing the potential for errors or omissions that could delay settlement. It also provides a consistent framework for insurers to evaluate claims, promoting fairness and transparency. Furthermore, a readily available pre-formatted document saves time and reduces the burden on the policyholder during a potentially stressful period.

This resource will explore various aspects related to completing these important documents, offering guidance on best practices, common mistakes to avoid, and tips for maximizing a successful claim outcome. Further sections will address specific types of loss scenarios and provide examples of how to effectively document them.

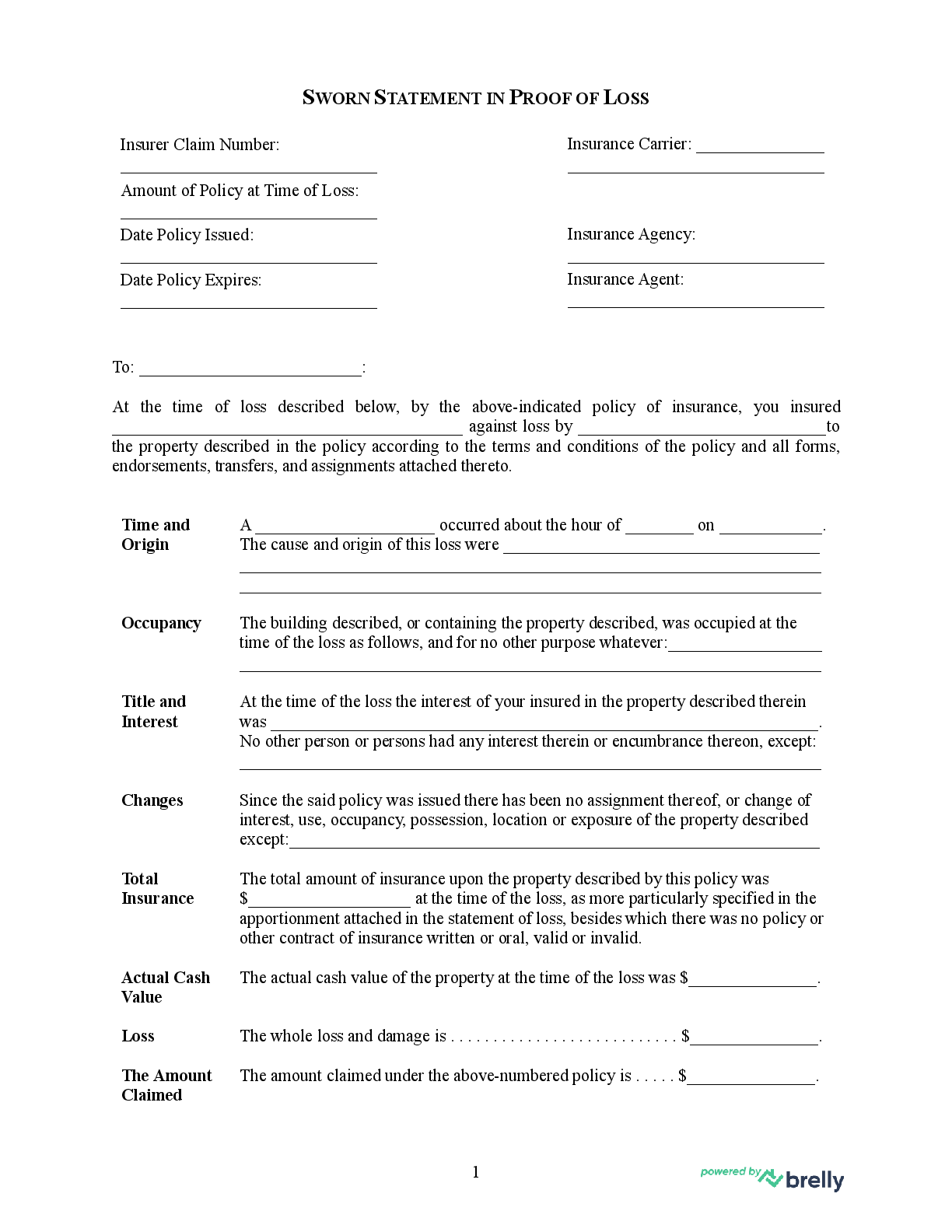

1. Standardized Form

Standardized forms are crucial for efficient and equitable insurance claim processing. A standardized insurance statement of loss template ensures consistent data collection, simplifies review, and promotes fair assessment across all claims. This structure benefits both the claimant, by providing clear guidance on required information, and the insurer, by streamlining the evaluation process.

- Clarity and CompletenessStandardized fields prompt claimants to provide all necessary details, minimizing omissions that can lead to processing delays. Clear instructions reduce ambiguity, ensuring the submitted information aligns with the insurer’s requirements. For example, dedicated sections for describing the incident, listing damaged items, and providing contact information ensure a comprehensive record. This clarity minimizes back-and-forth communication, expediting the process.

- Efficiency and ConsistencyConsistent data structure facilitates automated processing and analysis. This streamlined approach allows insurers to handle a higher volume of claims efficiently while maintaining consistent evaluation criteria. Consistent forms also simplify data aggregation and analysis for identifying trends and improving risk management. This efficiency translates into quicker claim settlements for policyholders.

- Fairness and TransparencyStandardized criteria ensure all claims are evaluated objectively based on the same parameters. This transparency builds trust and reduces the potential for disputes arising from inconsistent application of evaluation criteria. For example, using a standardized form to document vehicle damage in a collision ensures that all relevant factors, like the vehicle’s age and pre-existing conditions, are considered fairly.

- Accessibility and Ease of UsePre-formatted templates simplify the often daunting task of documenting a loss. Clear instructions and readily available forms reduce the burden on the claimant, particularly during stressful circumstances following a loss. Online accessibility further simplifies submission and tracking, enhancing convenience. This streamlined approach allows claimants to focus on recovery rather than navigating complex paperwork.

The standardized structure of an insurance statement of loss template is fundamental to a streamlined and equitable claims process. It ensures all necessary information is captured consistently, facilitating efficient processing, objective evaluation, and ultimately, timely and fair claim resolutions. By adhering to this standardized approach, the insurance industry fosters trust and transparency throughout the claims process.

2. Required Information

Accuracy and completeness of required information directly impact the efficiency of insurance claim processing. A properly completed insurance statement of loss template necessitates specific details to initiate and substantiate the claim. Omissions or inaccuracies can lead to delays, requests for further information, and potentially, claim denial. This underscores the importance of understanding precisely what information is required and providing it accurately.

Essential information typically includes policyholder details (name, address, policy number), date and time of the incident, location of the incident, a detailed description of the event leading to the loss, and a comprehensive list of damaged or lost items. For example, in a theft claim, the required information would encompass the date and time of discovery, details about the stolen items (make, model, serial numbers), and any police report filed. In a fire damage claim, details of the fire’s origin, extinguishing methods, and a list of damaged property with associated values are crucial. The specificity of required information varies based on the nature of the loss. For property damage, providing photographs and repair estimates supports the claim, while medical claims necessitate medical reports and bills. Without this precise information, accurate assessment and timely processing are significantly challenged.

Understanding the required information and its impact on claim processing is crucial for both policyholders and insurers. Policyholders benefit from streamlined processing and prompt settlements, while insurers can efficiently manage claims and mitigate potential fraud. Clear communication regarding required information reduces processing times, minimizes disputes, and ensures equitable outcomes. Therefore, providing complete and accurate information within the structured framework of the insurance statement of loss template is essential for a successful and efficient claim resolution process.

3. Supporting Documentation

Supporting documentation plays a vital role in substantiating claims filed through an insurance statement of loss template. It provides tangible evidence of the loss, enabling insurers to accurately assess the extent of damages and determine appropriate compensation. This documentation bridges the gap between the reported loss and its verifiable reality, facilitating a more efficient and objective claims process. Without supporting documentation, claims become difficult to validate, potentially leading to delays, disputes, and underpayment.

The connection between supporting documentation and the insurance statement of loss template is integral. The template provides the structured framework for reporting the loss, while supporting documentation provides the evidentiary basis for the claim. For instance, in a household burglary claim, the template would detail the incident and list stolen items. Supporting documentation, such as photographs of the break-in, police reports, and receipts for the stolen items, would then corroborate the reported loss and substantiate the value of the stolen goods. Similarly, in an auto accident claim, the template would document the incident details, while photographs of the vehicle damage, repair estimates, and medical records would serve as essential supporting documentation. The type of supporting documentation required varies depending on the nature of the claim. Fire damage claims often require fire marshal reports and property inventories, while medical claims necessitate medical bills and diagnostic reports. This specificity underscores the importance of understanding the relevant documentation for each unique claim scenario.

Effective use of supporting documentation ensures efficient claim processing and equitable outcomes. It provides clarity, reduces ambiguity, and minimizes the potential for disputes. Insurers rely on this documentation to validate the reported loss and determine the appropriate settlement amount. Challenges can arise when documentation is missing, incomplete, or inconsistent with the information provided in the statement of loss template. Such discrepancies can trigger investigations, delay processing, and potentially lead to claim denial. Therefore, meticulous compilation and submission of supporting documentation are crucial for a smooth and successful claim resolution process. This meticulous approach benefits both the claimant and the insurer by ensuring transparency, accuracy, and efficiency in the claim settlement process.

4. Facilitates Processing

Streamlined claims processing is a critical aspect of the insurance industry, impacting both operational efficiency and customer satisfaction. The insurance statement of loss template serves as a crucial tool in facilitating this process, providing a standardized framework for information submission that simplifies review, assessment, and ultimately, resolution. Its structured format reduces ambiguity, minimizes back-and-forth communication, and accelerates the overall claims lifecycle.

- Standardized Data CollectionStandardized fields within the template ensure consistent data collection across all claims. This uniformity simplifies data entry, automated processing, and analysis. For instance, dedicated fields for policy information, incident details, and loss descriptions ensure consistent data capture regardless of the specific circumstances. This uniformity eliminates guesswork and promotes efficient data management.

- Reduced Processing TimeBy providing a clear framework for required information, the template minimizes the need for follow-up inquiries and supplemental documentation requests. Complete submissions expedite the review process, allowing claims adjusters to focus on assessment and resolution rather than information gathering. This efficiency translates to quicker turnaround times and faster claim settlements.

- Improved Accuracy and CompletenessClear instructions and designated fields within the template prompt claimants to provide all necessary details, reducing the likelihood of errors and omissions. Complete and accurate information upfront minimizes the potential for delays caused by incomplete submissions. For example, dedicated sections for itemizing damaged property and providing supporting documentation ensure comprehensive claims submissions, reducing the need for supplemental information.

- Enhanced Transparency and CommunicationThe standardized format promotes transparency by providing a clear and consistent communication channel between the claimant and the insurer. All parties involved have access to the same structured information, reducing ambiguity and fostering a shared understanding of the claim. This transparency builds trust and facilitates smoother communication throughout the claims process.

The insurance statement of loss template’s role in facilitating processing is integral to the efficiency and effectiveness of the entire claims system. By providing a standardized framework for information submission, it streamlines workflows, reduces processing time, and improves accuracy. This, in turn, benefits both the claimant, through quicker settlements, and the insurer, through optimized operational efficiency and enhanced customer satisfaction. The structure provided by the template lays the foundation for a more efficient and transparent claims experience for all stakeholders.

5. Aids Claim Evaluation

Objective and efficient claim evaluation hinges on the quality of information provided. A well-structured insurance statement of loss template directly aids this evaluation by providing adjusters with a comprehensive and organized overview of the loss. This structured approach facilitates a thorough understanding of the incident, enabling accurate assessment of damages and determination of appropriate compensation. Without a standardized template, the evaluation process becomes susceptible to inconsistencies, potentially leading to delays, disputes, and inaccurate settlements.

The template’s structured format ensures all essential information is readily available to the adjuster. Clear sections for incident details, damaged items, supporting documentation, and witness information streamline the evaluation process. For example, in a vehicle damage claim, the template would guide the claimant to provide details of the accident, photographs of the damage, and repair estimates. This organized presentation enables the adjuster to quickly grasp the scope of the damage and assess the claim’s validity. Conversely, disorganized or incomplete information hinders evaluation, requiring additional inquiries and potentially delaying the settlement process. A comprehensive template also aids in fraud detection by providing a clear framework for comparing reported information against supporting evidence. Discrepancies between the narrative, documentation, and claimed damages can raise red flags, prompting further investigation. This systematic approach safeguards against fraudulent claims and ensures fair allocation of resources.

Effective claim evaluation relies on the synergy between a comprehensive insurance statement of loss template and the supporting documentation. The template provides the structure, while the documentation provides the evidence. This combination empowers adjusters to make informed decisions, ensuring fair and timely claim resolutions. Challenges arise when information is missing, inaccurate, or inconsistent across the template and supporting documents. These discrepancies necessitate further investigation, prolonging the evaluation process and potentially leading to disputes. Therefore, a complete and accurate statement of loss, supported by relevant documentation, is essential for efficient and equitable claim evaluation, ultimately benefiting both the claimant and the insurer.

Key Components of an Insurance Statement of Loss Template

Accurate and efficient claims processing relies on a comprehensive understanding of the key components within a standardized insurance statement of loss template. These components ensure that all necessary information is captured systematically, facilitating a smooth and transparent claims process for both the policyholder and the insurer. Omissions or inaccuracies within these key components can lead to processing delays and potentially impact the claim outcome.

1. Policyholder Information: This section captures essential identifying information about the insured, including full name, address, contact information, and policy number. Accurate policyholder information is crucial for verifying coverage and ensuring proper communication throughout the claims process.

2. Loss Details: This component documents the specifics of the loss event, including the date, time, and location of the incident. A clear and concise description of the circumstances surrounding the loss is essential for accurate assessment. This may include details such as the cause of a fire, the location of a burglary, or the specifics of an accident.

3. Itemized Loss Inventory: A detailed inventory of damaged or lost items is crucial for substantiating the claim. This section typically requires descriptions of each item, including make, model, age, purchase date, and estimated value. Providing accurate valuations and supporting documentation, such as receipts or appraisals, strengthens the claim.

4. Supporting Documentation: This section specifies the required documentation to support the claim. Examples include photographs of damage, police reports, medical records, repair estimates, and receipts for lost or damaged items. Supporting documentation validates the reported losses and aids in accurate assessment.

5. Witness Information: If applicable, this section gathers information about any witnesses to the loss event. Witness names, contact information, and statements can provide valuable corroborating evidence to support the claim’s validity.

6. Claim Summary: This section provides a concise overview of the entire claim, summarizing the key details of the loss, the claimed damages, and the requested compensation. A clear and concise summary ensures all parties involved have a shared understanding of the claim’s scope.

7. Signature and Declaration: The policyholder’s signature affirms the accuracy and truthfulness of the information provided within the statement of loss. This declaration is a crucial component for legal and processing purposes.

Accurate completion of each component within the insurance statement of loss template is critical for efficient claims processing and equitable outcomes. This structured approach facilitates clear communication, reduces ambiguity, and ensures timely and accurate claim assessment, ultimately benefiting both the policyholder and the insurer. A comprehensive and well-organized submission strengthens the claim and contributes to a smoother resolution process.

How to Create an Insurance Statement of Loss

Creating a comprehensive and accurate insurance statement of loss is crucial for efficient claim processing. A methodical approach ensures all necessary information is presented clearly and logically, facilitating a smooth and timely resolution. Following established best practices maximizes the likelihood of a successful claim outcome.

1. Obtain the Correct Form: Contact the insurance provider directly or access their website to obtain the correct insurance statement of loss template. Using the insurer’s specific form ensures compliance with their requirements and streamlines processing. Generic forms may lack necessary fields or information.

2. Provide Accurate Policy Information: Carefully complete the policyholder information section with accurate details, including the policy number, insured’s name, address, and contact information. Accurate policy details are essential for verifying coverage and ensuring effective communication.

3. Document the Loss Details: Provide a clear and concise narrative of the loss event, including the date, time, location, and a detailed description of the circumstances. Supporting evidence, such as photographs and police reports, should be referenced and attached.

4. Create an Itemized Loss Inventory: Prepare a comprehensive list of all damaged or lost items. Include detailed descriptions, including make, model, serial numbers (where applicable), date of purchase, and estimated value. Receipts, appraisals, or other supporting documentation should be provided for each item to substantiate the claimed value.

5. Include Supporting Documentation: Gather all relevant supporting documentation, such as photographs, police reports, repair estimates, medical records, and receipts. Organize these documents logically and label them clearly for easy reference by the claims adjuster. This documentation substantiates the claim and facilitates efficient processing.

6. Review and Sign: Carefully review the completed statement of loss template and all supporting documentation to ensure accuracy and completeness. Sign and date the form to attest to the truthfulness of the information provided. An unsigned form may delay processing.

7. Submit the Claim Promptly: Submit the completed statement of loss and supporting documentation to the insurance provider promptly and according to their instructions. Timely submission ensures adherence to policy deadlines and initiates the claim evaluation process without delay. Retain copies of all submitted documents for your records.

A meticulously completed insurance statement of loss, accompanied by comprehensive supporting documentation, is fundamental to a successful claim. This organized approach facilitates efficient processing, accurate assessment, and ultimately, a timely and equitable resolution. Adhering to these best practices benefits both the claimant and the insurer by promoting transparency, accuracy, and efficiency throughout the claim settlement process.

Accurate and efficient claims processing hinges on the effective use of standardized forms for reporting losses. These structured templates provide a crucial framework for documenting essential information, including policy details, incident specifics, itemized loss inventories, and supporting documentation. Understanding the key components within these templates and adhering to best practices for completion ensures clarity, reduces processing times, and promotes equitable claim outcomes. Supporting documentation, such as photographs, receipts, and official reports, plays a vital role in substantiating the reported losses and facilitating accurate assessment by insurance adjusters.

Effective utilization of these templates benefits both policyholders and insurers. Policyholders experience smoother claims processes and quicker resolutions, while insurers benefit from streamlined workflows and reduced administrative burden. The standardized approach promotes transparency and consistency, minimizing disputes and fostering trust throughout the claims process. Ultimately, a well-crafted and thoroughly documented statement of loss, submitted through the appropriate template, is essential for navigating the complexities of insurance claims and securing fair and timely compensation for covered losses. Diligence in accurate completion and timely submission contributes significantly to a positive claims experience.