A projected financial statement showcasing a company’s anticipated revenue and expenses over a specific period is a crucial planning tool. This forward-looking document allows businesses to estimate profitability, anticipate potential financial challenges, and make informed decisions about future operations. It is typically based on hypothetical scenarios or assumptions about future performance, enabling organizations to model the financial impact of various strategies or market conditions.

Utilizing this type of financial projection offers several advantages. It facilitates securing funding from investors or lenders by providing a clear picture of projected financial health. Furthermore, it aids in budgeting and resource allocation, allowing businesses to strategically plan expenditures and investments. The process of creating this projection also encourages careful consideration of potential risks and opportunities, promoting proactive management and informed decision-making.

This foundational understanding of projected financial reports paves the way for a deeper exploration of its components, creation methods, and practical applications in diverse business contexts.

1. Projected Revenue

Projected revenue forms the cornerstone of a pro forma income statement. Accuracy in revenue projections is paramount, as it directly influences the entire financial forecast. Overly optimistic projections can lead to unsustainable business plans, while overly conservative estimates may hinder growth opportunities. A robust projection considers market trends, historical data, sales pipeline strength, pricing strategies, and competitive landscape. For example, a software company launching a new product might project revenue based on anticipated subscription growth, considering factors like market penetration rate and average revenue per user. The cause-and-effect relationship is clear: a higher projected revenue, assuming expenses are managed effectively, translates to higher projected profitability.

Understanding the nuances of revenue projection within the context of a pro forma income statement is crucial for several reasons. It provides a basis for expense budgeting and resource allocation. Accurate revenue projections facilitate informed decisions regarding hiring, marketing campaigns, and capital expenditures. Furthermore, they play a vital role in attracting investors. A well-substantiated revenue projection demonstrates a companys growth potential and strengthens its credibility. A practical application can be seen in a retail business expanding into a new location. Projected revenue, based on market research and comparable store sales, informs decisions about inventory levels, staffing needs, and marketing spend.

In summary, projected revenue is not merely a number on a pro forma income statement; it represents a company’s growth trajectory and underpins its financial planning. A thorough understanding of revenue projection methodologies, coupled with a realistic assessment of market conditions, is crucial for creating a credible and actionable pro forma income statement. Challenges in revenue projection often stem from unpredictable market fluctuations and unforeseen external factors. Addressing these challenges requires continuous monitoring, analysis, and adjustments to the projections as new information becomes available.

2. Forecasted Expenses

Forecasted expenses represent a critical component of a pro forma income statement template. Accurate expense forecasting is essential for determining projected profitability and overall financial health. A comprehensive understanding of anticipated expenses allows businesses to make informed decisions regarding budgeting, resource allocation, and strategic planning. This section explores key facets of expense forecasting within the context of a pro forma income statement.

-

Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing goods sold by a company. Accurately forecasting COGS is crucial for determining gross profit margins. For a manufacturing company, COGS includes raw materials, direct labor, and manufacturing overhead. In a retail business, COGS represents the purchase price of merchandise sold. Accurate COGS projections depend on factors such as supplier pricing, production efficiency, and sales volume. Overestimating COGS can lead to unnecessarily low profit projections, while underestimating COGS can result in unrealistic financial expectations.

-

Operating Expenses

Operating expenses encompass the costs incurred in running a business’s day-to-day operations. These expenses are not directly tied to production but are essential for supporting core business functions. Examples include rent, utilities, salaries, marketing, and administrative costs. Projecting operating expenses requires careful consideration of factors like staffing levels, marketing campaigns, and anticipated growth in overhead costs. Accurate operating expense forecasts are vital for determining a company’s operating income and overall profitability.

-

Capital Expenditures (CAPEX)

CAPEX refers to investments in fixed assets, such as property, plant, and equipment. While not directly reflected in the income statement as an expense, CAPEX influences depreciation, which is an operating expense. Accurately forecasting CAPEX allows for better planning of long-term investments and their impact on future profitability. For example, a company investing in new machinery needs to consider the depreciation expense associated with that asset over its useful life. Understanding the relationship between CAPEX and depreciation ensures a more comprehensive and accurate pro forma income statement.

-

Financing Costs

Financing costs represent the expenses associated with borrowing money, such as interest payments on loans or debt. Accurately forecasting financing costs is essential for determining the net income available to shareholders. These costs can significantly impact profitability, especially for companies with substantial debt. Projecting financing costs requires understanding existing debt obligations, interest rates, and potential future borrowing needs. This facet is crucial for presenting a complete picture of a company’s projected financial performance.

By carefully considering and accurately forecasting each of these expense categories, businesses can create a robust and reliable pro forma income statement. This comprehensive approach to expense forecasting provides a clear understanding of projected profitability, facilitates informed decision-making, and strengthens financial planning. The interplay between these expense categories and projected revenue ultimately determines the projected financial success of a business venture as depicted in the pro forma income statement.

3. Estimated Profitability

Estimated profitability represents a core output derived from a pro forma income statement template. It signifies the projected financial gain after deducting anticipated expenses from projected revenues. Understanding estimated profitability is crucial for assessing the viability of business ventures, securing funding, and making informed strategic decisions. This section explores key facets contributing to a comprehensive understanding of estimated profitability within the context of a pro forma income statement.

-

Gross Profit

Gross profit, calculated as revenue minus the cost of goods sold (COGS), provides a fundamental measure of a company’s profitability in producing and selling its goods or services. A higher gross profit margin indicates greater efficiency in managing production costs. For example, a software company with high gross profit demonstrates efficient development and deployment processes. Within a pro forma income statement, gross profit serves as a foundation for assessing the overall profitability potential of a business venture.

-

Operating Income

Operating income, derived by subtracting operating expenses from gross profit, reflects a company’s profitability from its core business operations. This metric reveals how effectively a company manages its operating costs relative to its revenue generation. A growing operating income suggests operational efficiency and strong financial performance. In the context of a pro forma income statement, operating income offers insights into the sustainability and scalability of projected profitability.

-

Net Income

Net income, the bottom line of the income statement, represents the profit remaining after all expenses, including taxes and interest, have been deducted from revenue. This figure provides the most comprehensive measure of a company’s profitability. A positive net income signifies a profitable venture, while a negative net income indicates losses. Within a pro forma income statement, net income projection serves as a key indicator of a venture’s financial viability and potential for investor returns.

-

Profit Margins

Profit margins, calculated as various profit metrics (gross profit, operating income, net income) divided by revenue, express profitability as a percentage. These ratios provide a standardized way to compare profitability across different companies or periods, irrespective of revenue scale. Strong profit margins signify efficient cost management and pricing strategies. Within a pro forma income statement, projected profit margins offer a crucial benchmark for evaluating the financial health and potential of a business venture.

By analyzing these facets of estimated profitability within a pro forma income statement template, businesses gain a comprehensive understanding of their projected financial performance. These insights inform strategic decision-making, resource allocation, and investor communication. Accurately projecting and interpreting estimated profitability is essential for navigating the financial landscape and maximizing the potential for success.

4. Financial Planning Tool

A pro forma income statement template functions as a crucial financial planning tool. Its forward-looking nature allows businesses to anticipate potential financial outcomes based on various scenarios and assumptions. This predictive capability empowers informed decision-making across critical areas such as resource allocation, pricing strategies, and expansion plans. The cause-and-effect relationship is evident: a well-constructed pro forma income statement, reflecting realistic projections, directly influences the effectiveness of financial planning. For example, a rapidly growing e-commerce business can utilize a pro forma income statement to model the financial impact of expanding its warehousing capacity, informing decisions regarding investment timing and scale.

The importance of the pro forma income statement as a financial planning tool is underscored by its ability to facilitate proactive financial management. By projecting potential challenges and opportunities, businesses can develop contingency plans and optimize resource allocation to maximize profitability. A practical application can be seen in a manufacturing company exploring new product development. A pro forma income statement allows the company to assess the potential financial impact of launching the new product, considering factors like research and development costs, marketing expenses, and projected sales revenue. This analysis informs decisions regarding resource commitment, pricing strategies, and market entry timing.

In summary, the pro forma income statement template serves as an indispensable financial planning tool. Its capacity to model future financial performance enables businesses to make data-driven decisions, mitigate risks, and capitalize on growth opportunities. The practical significance of this understanding lies in its contribution to sound financial management and enhanced prospects for long-term success. However, the inherent challenge lies in ensuring the accuracy of underlying assumptions. Overly optimistic or pessimistic projections can lead to flawed financial planning. Addressing this challenge necessitates meticulous data analysis, continuous monitoring of market conditions, and regular revisions to the pro forma income statement to reflect evolving circumstances.

5. Future Performance Basis

A pro forma income statement template, while projecting future financial performance, inherently relies on a foundation of assumptions about future conditions. This “future performance basis” comprises the underlying expectations about key factors influencing revenue, expenses, and ultimately, profitability. Understanding this basis is crucial for interpreting the pro forma statement and assessing its reliability. The accuracy and realism of these assumptions directly impact the credibility and usefulness of the projected financial outcomes.

-

Market Conditions

Projected market growth, anticipated demand shifts, and competitive landscape dynamics form core components of the future performance basis. For example, a company projecting rapid revenue growth must substantiate this projection with market research indicating expanding market size or increasing market share. Realistic assumptions about market conditions are essential for creating a credible pro forma income statement. Overly optimistic market assumptions can lead to inflated revenue projections and unrealistic profitability estimates.

-

Sales Projections

Assumptions regarding sales volume, pricing strategies, and customer acquisition costs directly influence revenue projections. For instance, a subscription-based software company must project subscriber growth rates, churn rates, and average revenue per user. These assumptions must be grounded in historical data, market analysis, and realistic sales forecasts. Unrealistic sales projections can undermine the entire pro forma income statement, leading to inaccurate profitability estimates and misinformed financial planning.

-

Cost Assumptions

Projected expenses, including cost of goods sold, operating expenses, and financing costs, depend on assumptions about input prices, labor costs, and overhead expenses. For example, a manufacturing company must project raw material prices, labor rates, and factory overhead costs. Accurate cost assumptions are critical for determining realistic profit margins. Underestimating future costs can lead to overly optimistic profitability projections, while overestimating costs can hinder investment decisions.

-

External Factors

Macroeconomic conditions, regulatory changes, and unforeseen events can significantly impact future performance. While difficult to predict with certainty, considering potential external factors adds a layer of realism to the pro forma income statement. For instance, a company operating in a regulated industry must consider potential regulatory changes that could impact its cost structure or revenue streams. Acknowledging potential external influences strengthens the pro forma income statement’s value as a planning tool, allowing businesses to prepare for potential challenges and opportunities.

The future performance basis provides the contextual foundation upon which the entire pro forma income statement rests. Understanding and critically evaluating these underlying assumptions is essential for interpreting the projected financial outcomes and assessing the reliability of the pro forma statement. The interplay between these assumptions ultimately determines the projected financial trajectory of the business, highlighting the importance of a well-informed and realistic future performance basis. Regularly reviewing and refining these assumptions, based on evolving market conditions and new information, ensures that the pro forma income statement remains a relevant and reliable tool for financial planning and decision-making.

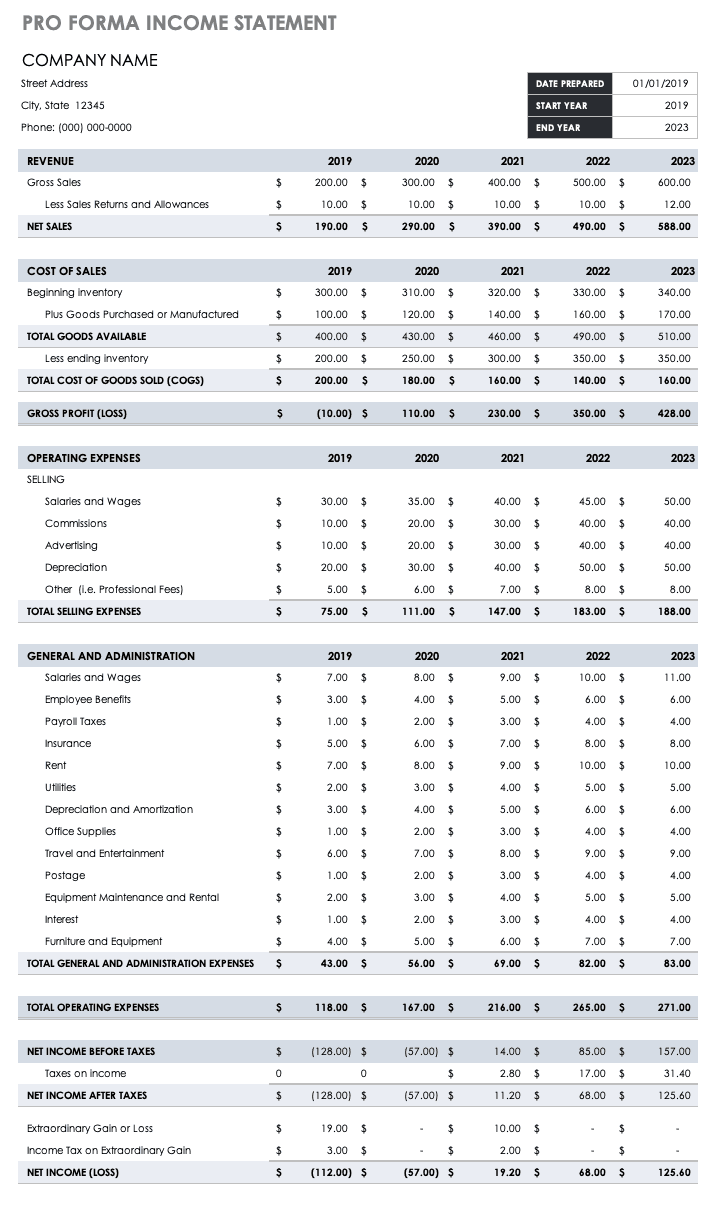

Key Components of a Pro Forma Income Statement Template

A pro forma income statement template comprises several key components, each contributing to a comprehensive projection of future financial performance. Understanding these components is crucial for constructing a robust and reliable financial forecast.

1. Revenue Projections: These projections estimate future sales revenue based on factors such as anticipated market demand, pricing strategies, and sales volume. Accurate revenue projections form the foundation of a credible pro forma income statement.

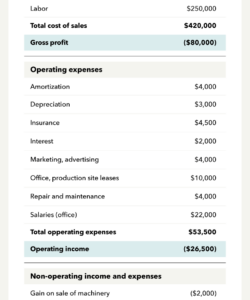

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services. Accurately forecasting COGS is essential for determining gross profit margins and overall profitability.

3. Operating Expenses: Operating expenses encompass the costs incurred in running daily business operations, including salaries, rent, marketing, and administrative expenses. Forecasting these expenses accurately is crucial for projecting operating income.

4. Gross Profit: Calculated as revenue minus COGS, gross profit reflects the profitability of a company’s core business activity before considering operating expenses.

5. Operating Income: Operating income, derived by subtracting operating expenses from gross profit, reveals a company’s profitability from its primary operations.

6. Interest Expense: This component represents the cost of borrowing money and impacts the net income available to shareholders. Accurately forecasting interest expense is vital for businesses with debt obligations.

7. Income Tax Expense: Projected income tax expense is based on estimated pre-tax income and applicable tax rates. This component is crucial for determining net income.

8. Net Income: Net income represents the final profit after all expenses, including taxes and interest, have been deducted from revenue. This bottom-line figure serves as a key indicator of a company’s overall profitability.

A thorough understanding and accurate projection of each component contributes to a robust pro forma income statement, facilitating informed financial planning and decision-making.

How to Create a Pro Forma Income Statement

Creating a pro forma income statement involves a systematic process of projecting future financial performance based on reasoned assumptions and historical data. A well-structured approach ensures a robust and reliable financial forecast.

1. Establish a Time Frame: Define the period the pro forma statement will cover, whether it’s a quarter, a year, or multiple years. The time frame should align with the planning horizon and business objectives.

2. Project Revenue: Forecast future sales revenue based on market analysis, historical trends, pricing strategies, and anticipated sales volume. Consider factors like market growth, market share, and customer acquisition costs.

3. Forecast Cost of Goods Sold (COGS): Estimate the direct costs associated with producing goods or services. Consider factors such as raw material prices, manufacturing overhead, and direct labor costs. For service businesses, COGS might include direct labor and service-related expenses.

4. Project Operating Expenses: Estimate all operating expenses necessary to run the business. This includes salaries, rent, utilities, marketing and advertising expenses, research and development, and administrative costs. Consider historical data and anticipated changes in operating activities.

5. Calculate Gross Profit: Subtract projected COGS from projected revenue to arrive at the gross profit. This metric provides insight into the profitability of core business operations before considering operating expenses.

6. Calculate Operating Income: Subtract projected operating expenses from gross profit to arrive at operating income. This metric reveals the profitability of the business’s core operations.

7. Project Other Income and Expenses: Include any non-operating income or expenses, such as interest income, interest expense, gains or losses from investments, and one-time charges.

8. Calculate Pre-Tax Income: Determine pre-tax income by adding or subtracting other income and expenses to the operating income.

9. Project Income Tax Expense: Estimate the income tax expense based on the projected pre-tax income and applicable tax rates.

10. Calculate Net Income: Subtract projected income tax expense from pre-tax income to arrive at net income. This bottom-line figure represents the overall profitability after all expenses and taxes.

11. Sensitivity Analysis: Conduct sensitivity analysis by adjusting key assumptions to assess the impact of potential variations on projected financial performance. This provides insight into the robustness of the pro forma statement under different scenarios.

12. Regularly Review and Revise: Periodically review and revise the pro forma income statement as new information becomes available or business conditions change. This ensures the pro forma statement remains a relevant and reliable tool for financial planning and decision-making.

By following these steps and incorporating realistic assumptions, a robust pro forma income statement provides valuable insights into future financial performance, enabling informed decision-making and proactive financial management. The accuracy of the pro forma statement depends critically on the validity of the underlying assumptions.

In conclusion, a pro forma income statement template provides a crucial framework for projecting future financial performance. Its value lies in its ability to model various scenarios, enabling businesses to anticipate potential challenges and opportunities. From revenue projections and expense forecasts to estimated profitability, each component contributes to a comprehensive understanding of a venture’s financial trajectory. The reliance on reasoned assumptions underscores the importance of careful planning, thorough analysis, and continuous monitoring of market conditions. Constructing a robust pro forma income statement empowers businesses to make data-driven decisions, secure funding, and navigate the complexities of the financial landscape.

The dynamic nature of business necessitates regular review and revision of the pro forma income statement to reflect evolving circumstances. This iterative process ensures its continued relevance as a strategic planning tool. Ultimately, a well-constructed pro forma income statement provides not merely a snapshot of projected financials, but a roadmap for achieving financial goals and ensuring long-term sustainability. Its utility extends beyond financial forecasting, serving as a testament to a company’s foresight, preparedness, and commitment to sound financial management.