Utilizing a pre-designed structure offers several advantages. It ensures consistency in reporting, simplifies the process of compiling financial data, and facilitates comparison across different accounting periods. This standardized approach reduces the risk of errors and omissions, promotes transparency, and enables stakeholders to quickly grasp the financial health of an organization.

This foundational understanding of financial reporting structures is crucial for exploring the more nuanced aspects of business analysis. The following sections delve into specific elements, offering practical guidance and deeper insights into interpreting and utilizing these essential financial tools.

1. Standardized Format

A standardized format is fundamental to the efficacy of an income and loss statement template. Consistency ensures comparability across reporting periods and facilitates analysis, offering a clear, reliable view of financial performance. This structure provides a framework for organizing financial data in a predictable manner, enabling efficient interpretation and informed decision-making.

- Uniform Presentation:Uniformity in presenting financial data is essential for accurate trend analysis and performance evaluation. Consistent placement of revenue, cost of goods sold, operating expenses, and net income ensures stakeholders can readily locate and compare information. This allows for swift identification of significant changes or anomalies. For instance, consistent reporting of operating expenses enables tracking of cost increases or decreases over time, facilitating cost management strategies.

- Regulatory Compliance:Adhering to established accounting principles, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), ensures legal compliance and builds trust with investors and creditors. A standardized template aids in fulfilling these requirements by providing a structured format for reporting financial data according to these standards. Compliance reinforces transparency and credibility, enhancing stakeholder confidence.

- Simplified Analysis:Standardization simplifies the analytical process. Consistent categorization of revenues and expenses allows for streamlined ratio analysis, trend identification, and benchmarking against industry averages. This facilitated analysis enables stakeholders to quickly assess profitability, operational efficiency, and financial health. For example, consistent gross profit margin calculations across periods offer insights into pricing strategies and production costs.

- Efficient Auditing:A standardized format simplifies the audit process. Clear and organized financial data allows auditors to efficiently verify the accuracy and completeness of information, reducing the time and resources required for audits. This efficiency translates to cost savings and faster reporting cycles, benefiting both internal and external stakeholders. A clear audit trail also strengthens financial accountability.

By ensuring consistent data presentation, adherence to regulations, simplified analysis, and efficient auditing, a standardized income and loss statement template provides a robust foundation for sound financial management and informed decision-making. This structure enables businesses to effectively track performance, identify areas for improvement, and communicate financial health transparently to stakeholders.

2. Revenue Tracking

Accurate revenue tracking forms the cornerstone of a reliable income and loss statement. This process involves meticulously recording all income generated from a company’s operations. Effective revenue tracking provides the basis for calculating key profitability metrics, such as gross profit and net income. Without precise revenue figures, the resulting financial statement loses its integrity and ability to reflect the true financial health of the organization. For instance, a software company offering subscription-based services must meticulously track recurring revenue from existing clients as well as new sales, ensuring accurate depiction of growth and overall financial performance within the statement. Misrepresenting or omitting revenue streams can lead to distorted profitability calculations and misinformed business decisions.

A robust revenue tracking system, integrated with the income and loss statement template, enables detailed analysis of income streams. This allows businesses to identify top-performing products or services, assess sales trends, and make data-driven decisions regarding pricing, marketing, and resource allocation. For example, a retail business using a point-of-sale system integrated with its income statement template can track sales by product category, revealing which items contribute most significantly to revenue. This granular data informs inventory management, marketing campaigns, and potential expansion into new product lines. Furthermore, accurate revenue tracking simplifies tax reporting and ensures compliance with regulatory requirements.

In conclusion, meticulous revenue tracking within the structure of an income and loss statement template provides the foundation for accurate financial reporting and informed decision-making. The ability to analyze revenue streams, identify growth opportunities, and monitor performance hinges upon the precision and comprehensiveness of revenue data. Challenges may include integrating various revenue streams, managing complex pricing models, and ensuring data integrity across different systems. However, addressing these challenges through robust systems and processes is crucial for generating a reliable and informative income and loss statement, ultimately contributing to the overall financial health and sustainability of the organization.

3. Expense Categorization

Expense categorization is integral to a comprehensive income and loss statement template. Proper classification provides insights into cost structures, facilitates informed resource allocation, and enables accurate profitability analysis. A well-defined categorization system ensures consistent reporting and allows for meaningful comparisons across accounting periods, enhancing the analytical value of the financial statement.

- Cost of Goods Sold (COGS):COGS represents the direct costs associated with producing goods sold by a company. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS categorization is crucial for calculating gross profit, a key indicator of production efficiency. For a manufacturing company, accurately categorizing raw material costs, factory labor, and depreciation of manufacturing equipment within COGS is essential for determining the true cost of production and, consequently, the profitability of each product line.

- Operating Expenses:Operating expenses encompass the costs incurred in running the core business operations, excluding COGS. Examples include rent, salaries for administrative staff, marketing and advertising costs, and research and development expenses. Categorizing these expenses allows for analysis of overhead costs and their impact on overall profitability. For example, separating marketing expenses into online and offline campaigns allows for evaluation of their respective effectiveness and informs future budget allocation. Tracking these expenses over time enables businesses to identify trends, potential cost-saving opportunities, and areas requiring optimization.

- Interest Expense:Interest expense reflects the cost of borrowing money. This category is crucial for understanding the financial burden of debt and its impact on net income. Tracking interest expense separately allows businesses to assess the cost-effectiveness of financing strategies and make informed decisions regarding debt management. Comparing interest rates across different loan agreements highlights potential refinancing opportunities for cost savings.

- Tax Expense:Tax expense represents the amount owed in income taxes. Accurate categorization is crucial for legal compliance and for understanding the true net profit after all obligations have been met. Careful tracking of income tax liabilities and effective tax planning strategies can significantly impact a companys bottom line. This categorization also facilitates comparison of effective tax rates across different periods, providing insights into tax planning strategies.

Effective expense categorization within the income and loss statement template enables businesses to analyze cost structures, identify areas for potential cost savings, and make informed decisions regarding resource allocation. By providing a structured framework for classifying and tracking expenses, the template empowers organizations to understand the drivers of profitability and enhance overall financial performance. Furthermore, consistent expense categorization simplifies financial reporting and facilitates comparisons across different periods, supporting data-driven decision-making and contributing to long-term financial sustainability.

4. Profit Calculation

Profit calculation, a core function of the income and loss statement template, provides crucial insights into a company’s financial performance. This calculation represents the culmination of the information presented within the statement, summarizing the financial outcome of business operations over a specific period. Accurate profit determination is essential for assessing financial health, informing strategic decisions, and communicating performance to stakeholders.

- Gross Profit:Gross profit, calculated as revenue less cost of goods sold (COGS), reflects the profitability of production or core business operations before accounting for overhead expenses. This metric is essential for assessing the efficiency of production processes and pricing strategies. For a retailer, a declining gross profit margin could signal rising supplier costs or increased sales discounts. Within the income and loss statement template, gross profit provides a foundational understanding of profitability before considering operating expenses.

- Operating Profit:Operating profit, derived by subtracting operating expenses from gross profit, measures profitability from core business operations. This metric reveals the efficiency of managing overhead costs and generating profit from day-to-day activities. An increasing operating profit margin indicates improved cost control and operational efficiency. Within the template, operating profit offers insights into the profitability of core business functions before accounting for non-operating income and expenses.

- Net Profit:Net profit, the final profit calculation after all expenses, including interest and taxes, are deducted from revenues, represents the bottom line. This metric signifies the overall profitability of the company after all financial obligations have been met. Net profit is a key indicator of financial health and sustainability. Within the income and loss statement template, net profit provides a comprehensive measure of profitability, reflecting the combined impact of all business activities.

- Profit Margins:Profit margins, expressed as percentages, provide a standardized way to analyze profitability across different periods or compare performance against industry benchmarks. These metrics, including gross profit margin, operating profit margin, and net profit margin, facilitate deeper analysis of profitability trends and comparative performance. For instance, a consistently declining net profit margin could signal underlying issues requiring further investigation. Within the template, profit margins offer a valuable tool for assessing performance and identifying areas for improvement.

These profit calculations, derived from the structured data within the income and loss statement template, are fundamental to understanding financial performance. They offer a concise summary of profitability at various levels, enabling businesses to assess operational efficiency, evaluate the impact of expenses, and make informed decisions to enhance financial health. By analyzing these metrics within the context of the overall financial statement, stakeholders gain valuable insights into the company’s ability to generate profit and sustain long-term growth.

5. Performance Analysis

Performance analysis relies heavily on the data provided by an income and loss statement template. This structured financial report offers a framework for evaluating profitability, operational efficiency, and overall financial health. Analyzing the data within the template enables stakeholders to identify trends, assess performance against benchmarks, and make informed decisions to improve financial outcomes. This process provides a critical link between historical financial data and future strategic planning.

- Trend Analysis:Examining trends in revenue, expenses, and profit over multiple reporting periods within the income and loss statement template reveals patterns and provides insights into the company’s trajectory. For example, consistently increasing revenue alongside stable or decreasing expenses indicates positive growth and improved operational efficiency. Conversely, declining revenue coupled with rising expenses warrants further investigation into potential underlying issues. Trend analysis allows stakeholders to anticipate future performance based on historical data and adjust strategies accordingly.

- Ratio Analysis:Ratio analysis utilizes key financial metrics derived from the income and loss statement template, such as profitability ratios (e.g., gross profit margin, net profit margin) and efficiency ratios (e.g., inventory turnover ratio). Calculating these ratios allows for standardized comparisons against industry averages and competitors. For instance, a company with a lower gross profit margin than its competitors may need to reassess its pricing strategies or cost of goods sold. Ratio analysis provides a quantitative framework for evaluating performance and identifying areas for potential improvement.

- Benchmarking:Benchmarking involves comparing a company’s financial performance, as reflected in the income and loss statement template, against that of industry leaders or competitors. This process helps identify best practices, areas of competitive advantage, and areas requiring improvement. For example, a company with a significantly lower operating profit margin compared to its competitors might explore strategies to reduce overhead costs or improve operational efficiency. Benchmarking provides a valuable external perspective for evaluating performance and setting realistic targets.

- Forecasting:The income and loss statement template provides historical data that informs financial forecasting. By analyzing past trends and incorporating anticipated market conditions, businesses can project future financial performance. This process assists in budgeting, resource allocation, and strategic planning. For example, projecting future revenue growth based on historical trends informs sales targets and marketing budgets. Accurate forecasting based on the income statement template contributes to informed decision-making and proactive financial management.

By leveraging the structured data within the income and loss statement template, performance analysis becomes a powerful tool for understanding financial trends, identifying strengths and weaknesses, and making informed decisions to improve profitability and overall financial health. This analytical process provides a bridge between past performance and future strategic planning, enabling businesses to adapt to changing market conditions and achieve sustainable growth.

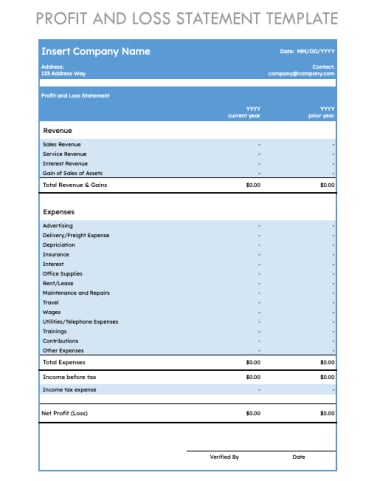

Key Components of an Income and Loss Statement Template

A comprehensive understanding of the key components within a standardized income and loss statement template is essential for accurate financial reporting and analysis. These components provide a structured framework for organizing and interpreting financial data, enabling informed decision-making.

1. Revenue: Revenue represents income generated from a company’s primary business activities. This typically includes sales of goods or services. Accurate revenue recognition is crucial for reflecting true financial performance. Different revenue streams should be clearly identified and categorized within the template.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit and assessing production efficiency.

3. Gross Profit: Gross profit, calculated as revenue less COGS, represents the profitability of core business operations before accounting for operating expenses. This metric is a key indicator of a company’s ability to generate profit from its products or services.

4. Operating Expenses: Operating expenses comprise the costs incurred in running the day-to-day business operations, excluding COGS. These expenses typically include salaries, rent, marketing expenses, and administrative costs. Categorizing operating expenses facilitates analysis of overhead costs and their impact on profitability.

5. Operating Income: Operating income, calculated as gross profit less operating expenses, reflects the profitability of core business operations. This metric provides insights into the efficiency of managing overhead costs and generating profit from ongoing activities.

6. Other Income and Expenses: This category encompasses income and expenses not directly related to core business operations, such as interest income, interest expense, gains or losses from investments, and other non-operating items. These items are typically listed separately to provide a clearer picture of core business profitability.

7. Income Before Taxes: Income before taxes represents the company’s profit after accounting for all operating and non-operating income and expenses but before deducting income tax expense. This metric provides a clear view of profitability before considering tax obligations.

8. Income Tax Expense: Income tax expense reflects the amount owed in income taxes based on taxable income. Accurate calculation of this expense is crucial for legal compliance and determining net income.

9. Net Income: Net income, the final profit calculation after all expenses have been deducted from revenues, represents the bottom line. This metric signifies the overall profitability of the company after all financial obligations have been met, serving as a key indicator of financial health.

These interconnected components provide a structured view of a company’s financial performance. Analyzing these elements within the template facilitates informed decision-making, enabling stakeholders to assess profitability, identify trends, and develop strategies for financial growth and sustainability.

How to Create an Income and Loss Statement Template

Creating a standardized template ensures consistent and accurate financial reporting. The following steps outline the process of developing an effective income and loss statement template.

1. Define the Reporting Period: Specify the timeframe covered by the statement, whether it’s a month, quarter, or year. A clearly defined reporting period is essential for accurate comparison and analysis.

2. Establish Revenue Categories: Categorize revenue streams to provide a detailed view of income sources. This may include sales of goods, service fees, or other revenue-generating activities. Clear categorization facilitates analysis of revenue trends and performance.

3. Outline Expense Categories: Establish clear categories for various expenses, such as cost of goods sold (COGS), operating expenses (e.g., rent, salaries, marketing), and non-operating expenses (e.g., interest expense). Detailed expense categorization enables in-depth cost analysis and informs cost management strategies.

4. Incorporate Profit Calculations: Include formulas to calculate key profit metrics: gross profit (revenue – COGS), operating profit (gross profit – operating expenses), and net profit (operating profit – other expenses + other income – taxes). These calculations provide insights into profitability at different levels.

5. Design the Template Structure: Structure the template in a clear and organized manner, ensuring logical flow from revenue to net income. Consistent formatting facilitates readability and interpretation. Consider using a table format for clear data presentation.

6. Implement Formulas and Formatting: Utilize spreadsheet software to automate calculations and apply consistent formatting. Automated calculations minimize errors and ensure accuracy. Consistent formatting enhances readability and professionalism.

7. Test and Refine: Populate the template with sample data to verify calculations and identify potential errors. Thorough testing ensures accuracy and reliability. Refine the template based on testing results to optimize its functionality.

A well-designed income and loss statement template provides a structured framework for tracking financial performance. Consistent application of these steps ensures accurate reporting, facilitates analysis, and supports informed decision-making. Regular review and refinement of the template ensures its ongoing effectiveness and relevance.

Standardized financial reporting offers invaluable insights into operational efficiency and profitability. Understanding its core componentsrevenue tracking, expense categorization, and profit calculationis fundamental to sound financial management. Utilizing a structured template ensures data consistency, facilitates analysis, and enables informed decision-making, contributing significantly to long-term financial health and sustainability.

Effective utilization of these tools empowers organizations to navigate the complexities of financial reporting, optimize resource allocation, and achieve sustainable growth. A proactive approach to financial management, driven by accurate data and insightful analysis, positions organizations for long-term success in the dynamic business landscape.