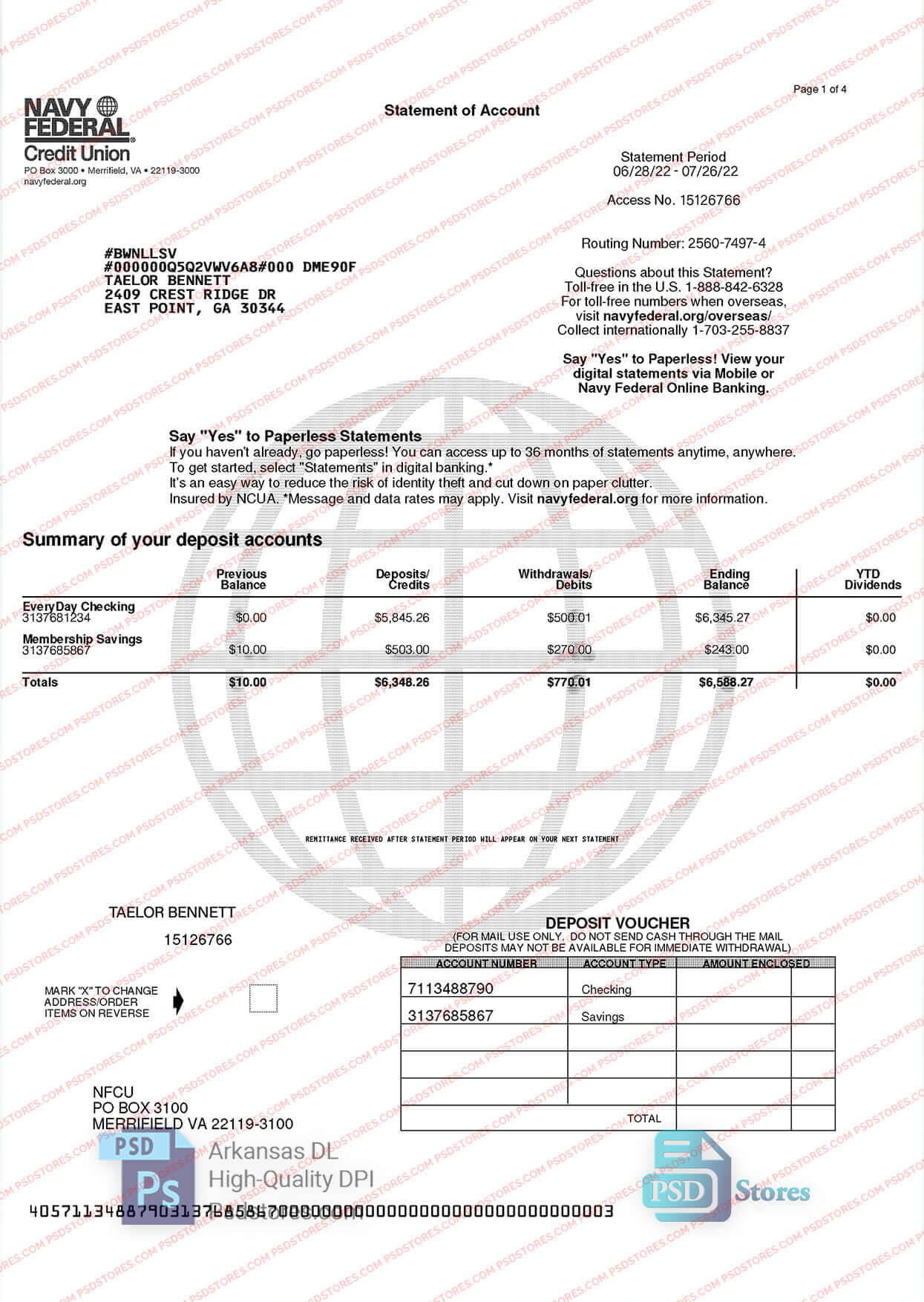

A document layout designed to mirror the official format of financial summaries issued by the specific financial institution provides a standardized framework for reviewing account activity. This structured representation typically includes details such as transaction dates, descriptions, amounts, and running balances, enabling users to track income and expenses effectively. Access to such a standardized structure can be valuable for budgeting, financial planning, and record-keeping purposes.

Utilizing a pre-designed structure offers several advantages. It allows individuals to familiarize themselves with the presentation of official documents, simplifying the process of reconciling accounts and identifying potential discrepancies. This can save time and reduce the likelihood of errors. Additionally, having a standardized format readily available can streamline tasks like preparing tax documentation or applying for loans, where detailed financial records are often required.

This foundational understanding of structured financial summaries paves the way for a deeper exploration of related topics such as personal finance management, the importance of accurate record-keeping, and strategies for maximizing the utility of financial tools and resources.

1. Structure

The structure of a Navy Federal bank statement template is fundamental to its usability and the clarity of the financial information it presents. A well-defined structure ensures consistent placement of key data points, enabling efficient review and analysis. This organization typically follows a chronological order, presenting transactions from oldest to most recent, facilitating the tracking of account activity over a specific period. Consistent placement of account details, such as account number and holder information, further streamlines identification and record-keeping. Without a coherent structure, extracting meaningful information becomes significantly more challenging, potentially leading to oversight and difficulties in managing finances effectively.

Consider the impact of a disorganized statement. Locating specific transactions becomes a time-consuming task. Reconciling the statement with personal records grows complex, increasing the risk of errors. Furthermore, a poorly structured statement hinders effective analysis of spending patterns and budgeting efforts. In contrast, a clearly structured statement empowers informed financial decision-making. For example, readily identifiable date and amount fields allow for swift calculation of monthly expenditures on specific categories. Clear presentation of beginning and ending balances simplifies reconciliation and tracking of overall financial health. This structured approach transforms the statement from a simple record of transactions into a powerful tool for financial management.

In summary, the structure of a Navy Federal bank statement template is integral to its function as a tool for financial clarity. A logical, consistent structure promotes efficient review, accurate reconciliation, and insightful analysis. This, in turn, supports informed financial decisions and empowers individuals to maintain control over their financial well-being. Understanding this underlying structure allows for more effective utilization of the statement as a resource for both short-term and long-term financial planning.

2. Data Fields

Data fields within a Navy Federal bank statement template are the individual components that convey specific financial information. Accurate interpretation of these fields is crucial for understanding account activity and overall financial health. Each field serves a distinct purpose, contributing to a comprehensive overview of transactions and balances.

-

Transaction Date

The transaction date indicates when a specific activity occurred within the account. This allows for chronological tracking of debits and credits, facilitating reconciliation with personal records and identification of spending patterns over time. For instance, identifying all transactions occurring within a specific billing cycle allows for accurate budgeting and expense tracking. Accurate transaction dates are also essential for disputing unauthorized charges or resolving discrepancies.

-

Description

The description field provides a brief summary of the transaction, such as the merchant name, type of transaction, or check number. This information is essential for categorizing expenses and identifying the purpose of each transaction. For example, a description might indicate a purchase at a grocery store, an online bill payment, or an ATM withdrawal. Clear descriptions simplify the process of budgeting and analyzing spending habits.

-

Debit/Credit Amount

These fields represent the monetary value of each transaction. Debits represent funds leaving the account, while credits represent funds entering the account. The accurate recording of these amounts is crucial for maintaining an accurate account balance. Discrepancies in these fields can indicate errors or unauthorized activity. Understanding the distinction between debits and credits is fundamental to interpreting account activity.

-

Running Balance

The running balance displays the account balance after each transaction is applied. This provides a dynamic view of how funds fluctuate over time, allowing for immediate identification of low balance situations and facilitating proactive financial management. Tracking the running balance is essential for avoiding overdraft fees and maintaining sufficient funds for planned expenses.

Accurate comprehension of these data fields is paramount for leveraging the full utility of a Navy Federal bank statement template. Each field contributes to a complete picture of account activity, enabling informed financial management. By understanding the purpose and implications of each data point, individuals can effectively monitor their financial health, identify potential issues, and make sound financial decisions.

3. Standard Format

The standard format of a Navy Federal bank statement template ensures consistency and facilitates efficient interpretation of financial information. Adherence to a standardized structure allows for straightforward comparison across statements, simplifies analysis of trends, and streamlines integration with financial management tools. This consistency is crucial for both individual users and financial professionals who rely on standardized data for accurate record-keeping and analysis.

-

Consistent Layout

A consistent layout ensures that key information, such as account details, transaction dates, and balances, appears in predictable locations. This predictability reduces cognitive load and allows users to quickly locate specific data points. For example, the account number consistently appearing in the top right corner allows for rapid identification and organization of records. Consistent placement of transaction details facilitates efficient reconciliation and analysis of spending patterns.

-

Standardized Terminology

The use of standardized terminology ensures clarity and reduces ambiguity in the interpretation of financial data. Consistent terms for debits, credits, and fees prevent confusion and ensure accurate understanding of account activity. For example, the consistent use of “Withdrawal” to denote a debit transaction eliminates potential misinterpretations and facilitates accurate categorization of expenses.

-

Date Formatting

Standardized date formatting ensures consistent representation of time periods, facilitating accurate tracking of transactions and account activity. A consistent format, such as MM/DD/YYYY, prevents ambiguity and simplifies the process of sorting and filtering transactions within a specific timeframe. This consistency is essential for accurate reporting and analysis of financial trends.

-

Numerical Representation

Standardized numerical representation, including consistent use of decimal places and currency symbols, ensures accuracy and prevents misinterpretation of financial figures. For instance, consistent use of two decimal places for monetary values ensures precision in calculations and prevents rounding errors. This precision is crucial for accurate budgeting, reconciliation, and financial planning.

The standard format of a Navy Federal bank statement template is integral to its utility as a tool for financial management. By adhering to established conventions for layout, terminology, date formatting, and numerical representation, the statement provides a clear, consistent, and reliable representation of financial information. This standardization empowers users to efficiently interpret their account activity, make informed financial decisions, and seamlessly integrate their financial data with other tools and resources.

4. Account Summary

The account summary within a Navy Federal bank statement template provides a concise overview of key account information, serving as a starting point for a detailed review of financial activity. This summarized view allows for quick assessment of account status and facilitates efficient identification of potential issues or areas requiring further investigation. Understanding the components of the account summary is crucial for effective interpretation and utilization of the full statement.

-

Account Holder Information

This section typically displays the name and address associated with the account, confirming the account ownership and providing necessary information for record-keeping. Accurate account holder information is crucial for verifying the legitimacy of the statement and ensuring that financial records are properly attributed.

-

Account Number

The account number uniquely identifies the specific account within the financial institution’s system. This number is essential for referencing the account in communications with the institution and for linking the statement to other financial records. Accurate recording and secure storage of the account number are crucial for preventing unauthorized access and maintaining account security.

-

Statement Period

The statement period specifies the timeframe covered by the statement, typically one month. This information is essential for contextualizing the transaction details and understanding the timeframe for which the account activity is being reported. Accurate identification of the statement period facilitates reconciliation with personal records and allows for comparison across multiple statements.

-

Opening and Closing Balances

These figures represent the account balance at the beginning and end of the statement period, respectively. Comparing these balances provides a quick overview of net account activity during the period. Significant changes in balance warrant further investigation into the underlying transactions. These balances are also crucial for reconciliation and tracking overall financial progress.

The account summary within a Navy Federal bank statement template provides a crucial overview of account details and activity, enabling efficient assessment of financial health and facilitating more detailed analysis of individual transactions. Understanding these components empowers individuals to effectively leverage the statement as a tool for informed financial management and decision-making. By providing a concise snapshot of key information, the account summary serves as a valuable entry point for comprehensive financial review and planning.

5. Transaction Details

Transaction details within a Navy Federal bank statement template provide a granular record of all account activity during a given statement period. This detailed account of individual transactions forms the core of the statement, enabling comprehensive analysis of spending patterns, identification of potential discrepancies, and verification of account accuracy. Understanding the components and implications of transaction details is fundamental to leveraging the full utility of the statement for informed financial management.

-

Posting Date

The posting date indicates when a transaction was officially applied to the account. While similar to the transaction date, discrepancies can arise due to processing times. For example, a purchase made on a Saturday may post to the account on the following Monday. Understanding this distinction is crucial for reconciling transactions and accurately tracking account balances.

-

Transaction Type

The transaction type categorizes the nature of the transaction, such as a debit card purchase, ATM withdrawal, direct deposit, or check payment. This categorization facilitates analysis of spending habits and identification of recurring transactions. For instance, frequent ATM withdrawals might suggest opportunities for optimizing cash management strategies. Recognizing patterns in transaction types allows for more informed budgeting and financial planning.

-

Description/Merchant Name

This field provides specific details about the transaction, such as the merchant name, location, or check number. This information is crucial for identifying and categorizing expenses. For example, a transaction description might include the name of a grocery store, a utility company, or an online retailer. These details enable detailed tracking of spending across different categories and provide insights into spending habits.

-

Amount

The amount field represents the monetary value of the transaction, indicating the amount of funds added to or subtracted from the account. Accuracy of these amounts is critical for maintaining accurate account balances. Discrepancies in transaction amounts should be investigated promptly to identify potential errors or unauthorized activity. Accurate recording and verification of transaction amounts are essential for effective financial management.

Comprehensive analysis of transaction details within a Navy Federal bank statement template is paramount for informed financial management. By understanding the components and implications of each transaction record, individuals can effectively track spending, identify potential issues, and make sound financial decisions. This granular level of detail empowers proactive financial management and provides the foundation for effective budgeting, planning, and overall financial well-being.

6. Financial Analysis

Financial analysis relies heavily on the data provided within a Navy Federal bank statement template. The statement serves as a primary source document, providing the raw data necessary for assessing financial health, identifying trends, and informing financial decisions. Effective analysis of this data is crucial for sound financial planning and management.

-

Spending Pattern Identification

Transaction details within the statement allow for identification of spending patterns across various categories, such as groceries, dining, entertainment, and transportation. Analyzing these patterns provides insights into spending habits and can reveal areas for potential budget adjustments. For example, consistently high expenditures on dining out may suggest opportunities for reducing expenses by preparing meals at home. Recognizing these patterns empowers informed decision-making regarding resource allocation.

-

Budgetary Control

The statement facilitates budgetary control by providing a clear record of income and expenses. Comparing actual spending against budgeted amounts allows for identification of variances and adjustments to spending habits. For instance, exceeding a budgeted amount for entertainment may necessitate reductions in other discretionary spending categories. The statement serves as a tool for monitoring financial progress and maintaining adherence to budgetary goals.

-

Fraud Detection

Careful review of transaction details enables detection of potentially fraudulent activity. Unauthorized transactions, unfamiliar merchant names, or discrepancies in amounts should be investigated promptly. For example, a series of small, unauthorized transactions might indicate compromised account security. Regular review of the statement is crucial for safeguarding financial assets and mitigating potential losses due to fraud.

-

Financial Goal Tracking

The statement plays a crucial role in tracking progress towards financial goals, such as saving for a down payment or paying off debt. By monitoring account balances and transaction activity, individuals can assess their progress and make necessary adjustments to their financial strategies. For instance, consistently increasing account balances indicate positive progress towards savings goals. The statement provides tangible evidence of financial progress and motivates continued adherence to financial plans.

In conclusion, the Navy Federal bank statement template is an indispensable tool for financial analysis. By leveraging the detailed transaction data and summary information provided within the statement, individuals can gain valuable insights into their financial health, identify areas for improvement, and make informed decisions to achieve their financial goals. Effective analysis of this data is essential for sound financial planning and empowers individuals to take control of their financial well-being.

Key Components of a Navy Federal Bank Statement Template

Understanding the core components of a Navy Federal bank statement template is essential for effective financial management. The following points highlight key elements for comprehension and utilization.

1. Account Holder Information: This section identifies the account owner and typically includes the name and address associated with the account. Accurate account holder information is crucial for verifying the legitimacy of the statement and ensuring proper record attribution.

2. Account Number: This unique identifier distinguishes the specific account within the financial institution’s system. It’s essential for referencing the account in communications and linking the statement to other financial records.

3. Statement Period: This specifies the timeframe covered by the statement, typically one month. This information contextualizes the transaction details and allows for comparison across multiple statements.

4. Opening/Closing Balances: These figures represent the account balance at the beginning and end of the statement period, respectively. They provide a quick overview of net account activity and serve as crucial data points for reconciliation and financial tracking.

5. Transaction Details: This section forms the core of the statement, providing a detailed record of each transaction. Key data fields within transaction details include posting date, transaction type, description/merchant name, and amount.

6. Transaction Date: This indicates when a specific transaction occurred. Accurate transaction dates are essential for reconciliation with personal records and for identifying spending patterns over time.

7. Running Balance: Displayed after each transaction, the running balance provides a dynamic view of how funds fluctuate over time. Tracking this balance aids in avoiding overdrafts and maintaining sufficient funds for planned expenses.

Comprehensive understanding of these components empowers effective interpretation and utilization of the statement for informed financial management, analysis, and planning. This structured information facilitates accurate record-keeping, insightful trend analysis, and proactive financial decision-making.

How to Create a Navy Federal Bank Statement Template

Creating a document that mirrors the structure and data fields of an official Navy Federal bank statement requires careful attention to detail and adherence to specific formatting conventions. This process allows for the creation of mock statements for various purposes, such as budgeting exercises or software testing.

1. Software Selection: Choose spreadsheet software (e.g., Microsoft Excel, Google Sheets, or similar applications) or a word processing document that allows for table creation. The chosen software must allow for precise formatting and data entry.

2. Header Creation: Replicate the header section of an official statement. This typically includes the Navy Federal Credit Union logo, the words “Bank Statement,” and the statement period. Accuracy in replicating the header format is crucial for visual authenticity.

3. Account Information Section: Include fields for the account holder’s name, address, and account number. Ensure proper alignment and formatting consistency with official statements. Accurate placement of these details is crucial for clarity and record-keeping.

4. Opening and Closing Balances: Designate clearly labeled fields for the opening and closing balances of the statement period. These fields should be positioned prominently for easy access and review. Accuracy in these fields is essential for financial calculations and reconciliation.

5. Transaction Details Table: Create a table with columns for the date, description, debit amount, credit amount, and running balance. Ensure sufficient space within each cell for detailed entries and consistent formatting across rows. The transaction details table forms the core of the statement and requires meticulous attention to detail.

6. Data Entry and Formatting: Populate the template with sample transaction data. Use consistent date formats, currency symbols, and numerical representation. Maintain clear distinctions between debits and credits. Accurate and consistent data entry ensures the usability and reliability of the template.

7. Review and Refinement: Carefully review the completed template for accuracy, consistency, and adherence to the official statement format. Refine formatting and adjust column widths as needed to ensure clarity and readability. Thorough review is essential for creating a reliable and functional template.

Precise replication of the structure, data fields, and formatting conventions of official Navy Federal bank statements is crucial for creating a useful template. This meticulous approach ensures the template’s effectiveness for budgeting exercises, software testing, and other applications requiring realistic mock statements. The template’s utility directly correlates with the accuracy and fidelity of its design.

Careful examination of the structure, data fields, and inherent value of a document modeled after official financial summaries from this specific financial institution reveals its significance in personal finance management. Understanding the layout, the specific information conveyed within each section, and the potential applications of such a template empowers informed financial decision-making. From facilitating accurate budgeting and expense tracking to aiding in fraud detection and financial goal monitoring, the utility of such a resource extends beyond simple record-keeping.

Effective financial management hinges on access to clear, concise, and readily interpretable financial data. Leveraging standardized templates provides a framework for organizing and understanding this data, promoting financial awareness and informed decision-making. This structured approach to financial management ultimately contributes to greater financial stability and the achievement of long-term financial objectives. Continued exploration of resources and tools for financial management is encouraged.