Utilizing such a standardized structure offers several advantages. It allows property owners and managers to track financial health, identify areas for improvement, and benchmark performance against similar properties. This clear financial picture is crucial for securing financing, attracting investors, and making strategic decisions about property management and future investments. Moreover, a consistent reporting format simplifies tax preparation and provides valuable insights for long-term financial planning.

Understanding the components and applications of this financial tool is essential for effective real estate management. The following sections will delve deeper into specific aspects, including key metrics, practical examples, and best practices for implementation.

1. Revenue Streams

Revenue streams represent the lifeblood of any real estate investment, forming the foundation of a property’s financial performance. Within a real estate income statement template, revenue streams occupy a crucial position, providing the basis for profitability calculations. Accurately capturing all revenue sources is paramount for a comprehensive understanding of a property’s financial health. These sources typically extend beyond basic rental income to encompass various ancillary income streams, which can significantly impact overall profitability. For instance, a commercial property might generate revenue from parking fees, vending machines, or advertising space, while a residential property might include pet fees or laundry facilities income. Failing to account for these diverse revenue sources can lead to an incomplete financial picture and potentially misinformed investment decisions.

The relationship between revenue streams and the income statement template is one of direct influence. Increased revenue streams, assuming expenses remain constant or decrease, directly contribute to a higher net operating income, a key indicator of property performance. Conversely, declining revenue streams can signal underlying issues requiring attention, such as market fluctuations or ineffective property management practices. Consider a scenario where a multi-family property experiences a drop in occupancy rates. This directly impacts rental income, a primary revenue stream, and will be immediately reflected in the income statement. This visibility allows property owners to promptly address the issue, perhaps through targeted marketing efforts or rent adjustments, to mitigate further financial impact.

Understanding the composition and dynamics of revenue streams is essential for informed real estate investment and management. Careful analysis of these streams within the context of the income statement template provides critical insights into property performance, enabling data-driven decisions that optimize profitability and long-term financial success. Furthermore, accurate revenue reporting ensures compliance with regulatory requirements and facilitates effective communication with stakeholders. Challenges can arise in accurately classifying and tracking diverse revenue streams, particularly in complex properties. Implementing robust accounting systems and adhering to consistent reporting practices are vital to overcome these challenges and ensure the integrity of the financial data.

2. Operating Expenses

Operating expenses represent the costs associated with running and maintaining a real estate property. Within a real estate income statement template, these expenses are meticulously categorized and tracked to provide a clear picture of profitability and inform strategic decision-making. Accurate accounting for operating expenses is crucial for assessing the financial health of an investment and ensuring sustainable returns.

- Property Management FeesThese fees cover the services provided by a property management company, including tenant management, rent collection, and property maintenance oversight. For example, a property manager might charge a percentage of the collected rent or a flat fee. These fees directly impact the net operating income and must be carefully considered when evaluating investment performance.

- Maintenance and RepairsThis category encompasses routine maintenance, such as landscaping and cleaning, as well as unexpected repairs like plumbing or HVAC system replacements. A well-maintained property attracts and retains tenants, contributing to stable revenue streams. However, neglecting necessary repairs can lead to higher costs in the long run and negatively impact property value. These costs are variable and can fluctuate significantly based on property age and condition.

- Property Taxes and InsuranceProperty taxes are levied by local governments based on the assessed value of the property. Insurance policies protect against potential risks like fire or liability claims. These recurring expenses are essential for legal compliance and risk mitigation, impacting the overall profitability of the investment. These costs are relatively predictable and can be factored into long-term financial projections.

- UtilitiesDepending on the lease agreement, utilities such as water, electricity, and gas can be the responsibility of either the landlord or the tenant. Understanding the allocation of utility costs is crucial for accurate expense tracking and budgeting. For example, in a multi-unit building, common area utilities are typically covered by the landlord, while individual unit utilities might be paid by tenants.

Careful management of operating expenses is fundamental to maximizing the return on a real estate investment. By analyzing these expenses within the framework of a real estate income statement template, property owners can identify areas for potential cost savings and optimize their financial strategies. Comparing operating expenses across similar properties can also reveal inefficiencies and highlight opportunities for improvement. Ultimately, effective expense management contributes to a healthier bottom line and enhanced long-term value creation.

3. Net Operating Income

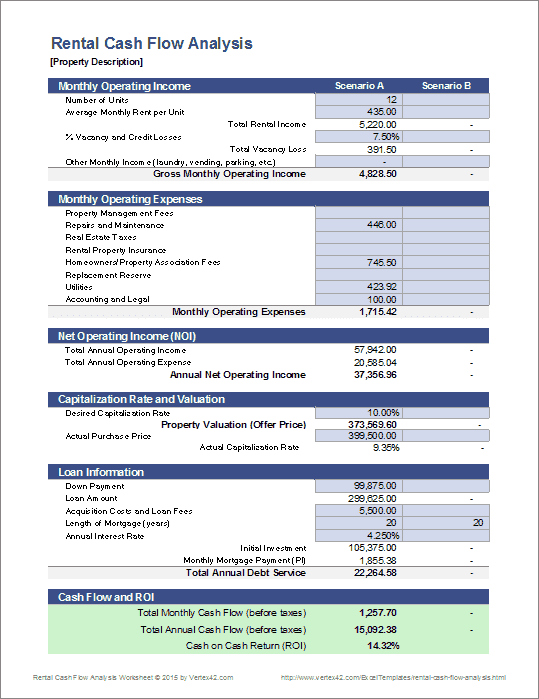

Net operating income (NOI) serves as a crucial performance indicator within a real estate income statement template. It represents the profitability of a property after accounting for operating expenses but before considering financing costs and income taxes. Understanding NOI is essential for evaluating investment performance, making informed decisions, and comparing properties on an apples-to-apples basis. This section explores key facets of NOI within the context of a real estate income statement template.

- Calculation and ComponentsNOI is calculated by subtracting operating expenses from total revenues. Revenues encompass all income generated by the property, including rents, parking fees, and other ancillary income streams. Operating expenses include costs such as property management fees, maintenance and repairs, property taxes, and insurance. For example, if a property generates $200,000 in annual revenue and incurs $100,000 in operating expenses, the NOI would be $100,000. Accurately capturing all revenue and expense components is crucial for a reliable NOI calculation.

- Significance in Investment AnalysisNOI plays a pivotal role in real estate investment analysis. It provides a standardized metric for comparing the profitability of different properties, regardless of their financing structures or tax implications. Investors use NOI to calculate key performance indicators such as capitalization rate (cap rate) and cash-on-cash return, which are essential for evaluating investment opportunities and making informed acquisition decisions. A higher NOI generally indicates a more profitable investment, all other factors being equal.

- Impact of Operating EfficiencyOperating efficiency directly influences NOI. Effective cost control measures, such as optimizing utility consumption or negotiating favorable contracts with vendors, can reduce operating expenses and increase NOI. Similarly, implementing strategies to maximize revenue generation, such as increasing occupancy rates or raising rents, can also boost NOI. For instance, implementing energy-efficient upgrades might reduce utility expenses, directly contributing to a higher NOI.

- Relationship with Property ValueNOI is a key determinant of property value. Investors often use the income approach to valuation, which relies on NOI to estimate market value. A higher NOI typically translates to a higher property value, assuming a stable capitalization rate. Understanding this relationship is essential for both buyers and sellers in real estate transactions. For example, if market cap rates for similar properties are 5%, a property with an NOI of $50,000 would be valued at $1,000,000.

By understanding the nuances of NOI within the structure of a real estate income statement template, stakeholders gain valuable insights into property performance and make data-driven decisions. Regularly monitoring and analyzing NOI trends can reveal opportunities for improvement, enhance profitability, and contribute to long-term financial success in real estate investments. Further analysis often involves comparing NOI against historical data, market benchmarks, and projected future performance to gain a comprehensive understanding of the investment landscape.

4. Standardized Format

A standardized format is fundamental to the utility of a real estate income statement template. Consistency in presentation allows for straightforward comparison of financial performance across different properties, periods, or investment portfolios. This comparability is crucial for identifying trends, benchmarking against competitors, and making informed investment decisions. Without a standardized structure, analyzing data becomes cumbersome and the potential for misinterpretation increases. For example, comparing two properties where one reports revenue net of operating expenses and the other reports both revenue and expenses separately can lead to misleading conclusions about their relative profitability. A standardized template ensures consistent categorization and reporting of financial data, facilitating accurate and meaningful comparisons. Consider a real estate investment trust (REIT) managing a diverse portfolio of properties. A standardized income statement template allows the REIT to aggregate data efficiently and analyze performance across all holdings, regardless of individual property characteristics. This aggregated view facilitates portfolio-level decision-making, resource allocation, and performance reporting to investors.

Furthermore, a standardized format simplifies the process of financial analysis for stakeholders. Lenders, investors, and regulatory bodies can readily interpret the information presented, facilitating due diligence and investment evaluation. This clarity reduces the time and effort required to understand a property’s financial health, fostering trust and transparency. Imagine a scenario where a property owner seeks financing for a new acquisition. Providing a standardized income statement simplifies the lender’s underwriting process, potentially accelerating loan approval. This efficiency benefits both the borrower and the lender, streamlining the transaction process.

In conclusion, the standardized format of a real estate income statement template is integral to its effectiveness. It empowers stakeholders with the ability to compare performance, analyze trends, and make informed decisions based on reliable and readily interpretable financial data. This consistency is critical for effective communication, efficient analysis, and sound investment management in the real estate sector. Challenges can arise in adapting a standardized template to unique property types or complex ownership structures. However, the benefits of comparability and transparency outweigh the initial effort required for customization and implementation.

5. Performance Analysis

Performance analysis, leveraging data from a real estate income statement template, provides crucial insights into a property’s financial health and operational efficiency. This analysis goes beyond simply reviewing figures; it involves interpreting trends, identifying strengths and weaknesses, and ultimately informing strategic decision-making for optimized returns. This process is essential for effective asset management and achieving investment objectives.

- Trend IdentificationAnalyzing historical data from income statements reveals performance trends over time. This includes tracking revenue growth, expense fluctuations, and changes in net operating income. For example, consistently increasing operating expenses coupled with stagnant rental income could signal underlying management issues or market shifts. Identifying such trends allows for proactive adjustments to strategies, potentially mitigating negative impacts and capitalizing on positive developments.

- BenchmarkingPerformance analysis facilitates benchmarking against comparable properties in the market. This comparison provides a relative measure of a property’s performance, highlighting areas of strength and weakness. For instance, if a property’s operating expense ratio is significantly higher than the market average, it signals potential inefficiencies that warrant further investigation. Benchmarking provides valuable context for evaluating performance and identifying opportunities for improvement.

- Variance AnalysisComparing actual performance against budgeted figures reveals variances that provide insights into operational effectiveness. Significant deviations from the budget, whether positive or negative, warrant further scrutiny. For example, a substantial increase in maintenance expenses compared to the budget might indicate unexpected repairs or inefficient maintenance practices. Variance analysis helps pinpoint areas requiring corrective action or adjustments to future budget projections.

- Key Performance Indicator (KPI) EvaluationPerformance analysis involves tracking key performance indicators derived from the income statement, such as net operating income, capitalization rate, and cash-on-cash return. Monitoring these KPIs provides a concise overview of a property’s financial health and its ability to generate returns. For instance, a declining capitalization rate might indicate a decrease in property value or an increase in market risk. KPI evaluation facilitates informed decision-making regarding property management, acquisitions, and dispositions.

By integrating these facets of performance analysis with the data provided by a real estate income statement template, stakeholders gain a comprehensive understanding of a property’s financial trajectory. This understanding is crucial for optimizing operational strategies, mitigating risks, and maximizing the potential for long-term financial success in real estate investments. Furthermore, consistent performance analysis supports proactive management, enabling informed responses to market dynamics and enhancing the overall value of the investment.

Key Components of a Real Estate Income Statement Template

A comprehensive understanding of the key components within a real estate income statement template is crucial for effective property management and investment analysis. These components provide a structured overview of financial performance, enabling informed decision-making and optimized returns.

1. Potential Rental Income: This represents the maximum possible income if all units are fully occupied at market rent. It serves as a benchmark for evaluating occupancy rates and rental pricing strategies. Lost potential rental income due to vacancies or below-market rents can highlight areas for improvement in management practices.

2. Other Income: This encompasses any income generated beyond rental income, such as parking fees, laundry services, or late fees. Accurately tracking other income streams is essential for a complete financial picture and understanding the overall profitability of a property.

3. Gross Potential Income: Calculated by summing potential rental income and other income, this figure represents the total possible income before accounting for any operating expenses. It provides a baseline for assessing overall revenue generation potential.

4. Vacancy and Credit Loss: This accounts for lost income due to vacant units or unpaid rent. Analyzing vacancy rates and credit losses helps assess the effectiveness of tenant screening processes and marketing efforts. High vacancy or credit loss percentages can indicate underlying market challenges or management inefficiencies.

5. Effective Gross Income: This reflects the actual income collected after deducting vacancy and credit loss from gross potential income. Effective gross income is a more realistic representation of achievable revenue and serves as a starting point for calculating net operating income.

6. Operating Expenses: These encompass all costs associated with operating and maintaining the property, including property taxes, insurance, maintenance, utilities, and management fees. Careful management of operating expenses is crucial for maximizing profitability.

7. Net Operating Income (NOI): Derived by subtracting operating expenses from effective gross income, NOI represents the property’s profitability before considering financing costs and income taxes. NOI is a key metric used in investment analysis and valuation.

Accurate and consistent reporting of these components within a standardized template provides a clear and comparable view of financial performance. This facilitates effective property management, informed investment decisions, and optimized returns in the real estate sector.

How to Create a Real Estate Income Statement Template

Creating a robust income statement template provides a structured approach to analyzing real estate investments. This structured approach ensures consistency, facilitates comparisons, and allows for informed decision-making. The following steps outline the process of developing a comprehensive template.

1. Define the Reporting Period: Specify the timeframe for the income statement, whether it’s monthly, quarterly, or annually. A consistent reporting period allows for accurate trend analysis and performance comparisons over time.

2. Structure Income Categories: Establish clear categories for all revenue streams. This typically includes potential rental income, other income (e.g., parking fees, laundry income), and adjustments for vacancy and credit losses. Clear categorization ensures accurate revenue tracking and analysis.

3. Categorize Operating Expenses: Create a detailed breakdown of operating expenses, including property taxes, insurance, maintenance, utilities, management fees, and marketing costs. Comprehensive expense tracking is essential for identifying areas for potential cost savings.

4. Calculate Net Operating Income (NOI): Subtract total operating expenses from effective gross income (gross potential income less vacancy and credit loss) to arrive at NOI. NOI serves as a key indicator of property profitability.

5. Implement Formulas and Automation: Utilize spreadsheet software to automate calculations within the template. This reduces manual data entry, minimizes errors, and ensures accuracy in financial reporting.

6. Regularly Update and Review: Maintain the template with accurate and up-to-date data. Regularly review the income statement to identify trends, analyze performance, and inform strategic decision-making.

7. Consider Software Solutions: Explore dedicated property management software that often includes built-in income statement templates and reporting functionalities. Such software can streamline data collection and analysis processes.

A well-structured template offers a clear and organized view of financial performance, enabling effective property management and informed investment decisions. This structured approach supports proactive adjustments, optimizes resource allocation, and enhances long-term financial success in real estate.

Effective real estate management hinges on a clear understanding of financial performance. A real estate income statement template provides the necessary framework for organizing revenue streams, tracking operating expenses, and calculating net operating income. Utilizing a standardized template facilitates consistent reporting, enabling meaningful comparisons across properties and periods. This structured approach empowers stakeholders to analyze trends, benchmark performance, and make data-driven decisions that optimize returns and contribute to long-term financial success. From evaluating potential acquisitions to managing existing portfolios, the insights derived from a well-structured income statement are invaluable for navigating the complexities of the real estate market.

The consistent application and analysis of data within a real estate income statement template are not merely best practices but essential components of successful real estate investment. This structured approach to financial management provides the foundation for informed decision-making, optimized resource allocation, and sustainable growth in the dynamic real estate landscape. As market conditions evolve and investment strategies adapt, the importance of accurate and insightful financial reporting remains paramount for achieving long-term prosperity in the real estate sector.