Standardized reporting documents for charitable entities provide a structured overview of their financial health and activities. These reports typically include a balance sheet, income statement, and statement of cash flows, offering a transparent view of assets, liabilities, revenue, expenses, and cash movements. This structured approach facilitates accountability and informed decision-making.

Utilizing such structured documentation offers several advantages. It simplifies regulatory compliance, fosters trust with donors and stakeholders, enables efficient internal financial management, and supports data-driven strategic planning. Clear financial records also streamline the auditing process and demonstrate responsible resource allocation.

A deeper understanding of these documents is essential for effective nonprofit management. The following sections will explore the core components of these reports, including detailed explanations and practical examples.

1. Standardized Format

A standardized format is fundamental to the utility of financial statement templates for nonprofits. Consistency in presentation allows for straightforward comparison across reporting periods, enabling trend analysis and performance evaluation. This structured approach simplifies the auditing process and ensures compliance with regulatory requirements. A standardized template also facilitates benchmarking against similar organizations, offering valuable insights for strategic planning and operational improvements. For example, consistent categorization of expenses allows for accurate assessment of program effectiveness and administrative overhead.

The adoption of a standardized format promotes transparency and accountability. Donors and stakeholders can readily understand the financial health and activities of the organization, fostering trust and confidence. Internally, a standardized format streamlines financial management processes, reducing the risk of errors and improving efficiency. This allows financial professionals to focus on analysis and strategic planning rather than deciphering inconsistent data. For instance, consistent reporting of restricted funds ensures compliance with donor stipulations and demonstrates responsible resource management.

Standardization in financial reporting provides a solid foundation for effective nonprofit management. It empowers organizations to make data-driven decisions, demonstrate their impact, and maintain financial stability. While specific reporting requirements may vary based on jurisdiction and organization size, adherence to a consistent format remains crucial for transparency, accountability, and informed decision-making. Overcoming challenges in implementing standardized formats can be achieved through staff training and the utilization of readily available resources and software solutions. The long-term benefits of standardized financial reporting significantly outweigh the initial investment in implementation.

2. Transparency

Transparency is paramount for non-profit organizations, serving as a cornerstone of public trust and accountability. Standardized financial statement templates play a crucial role in achieving this transparency by providing a clear, consistent, and accessible view of an organization’s financial activities. This open access to financial information allows stakeholders, including donors, grant providers, and the public, to understand how resources are acquired and utilized. For instance, a clearly presented statement of functional expenses demonstrates the proportion of funds allocated to program activities versus administrative overhead, allowing potential donors to assess the organization’s efficiency. The cause-and-effect relationship is direct: structured financial reporting, facilitated by standardized templates, leads to enhanced transparency, fostering trust and encouraging continued support.

A lack of transparency can erode public confidence and hinder an organization’s ability to secure funding. Conversely, organizations that embrace transparency through meticulous financial reporting often experience increased donor engagement and stronger community relationships. Consider the case of a non-profit educational institution. By using a standardized template to clearly report its allocation of funds to scholarships, teacher training, and classroom resources, the institution demonstrates its commitment to its mission and builds trust with potential donors who are passionate about education. This example illustrates the practical significance of transparency in attracting and retaining financial support. Furthermore, transparent financial reporting strengthens internal governance by holding management accountable for responsible resource allocation.

In conclusion, transparency, enabled by standardized financial statement templates, is not merely a best practice for non-profit organizations but an essential component of their long-term sustainability and effectiveness. While implementing standardized reporting may present initial challenges in terms of staff training and data management, the resulting increase in transparency fosters trust, attracts resources, and ultimately strengthens the organization’s ability to fulfill its mission. This underscores the importance of viewing transparency not as an added burden but as a strategic investment in the organization’s future.

3. Compliance

Compliance with regulatory requirements is a non-negotiable aspect of non-profit financial management. Standardized financial statement templates serve as crucial tools in achieving and demonstrating this compliance. These templates ensure adherence to generally accepted accounting principles (GAAP) and regulatory mandates specific to the non-profit sector. Consistent application of these standards allows for accurate and comparable financial reporting, simplifying audits and minimizing the risk of legal and financial repercussions. For instance, proper reporting of restricted donations, in accordance with relevant regulations, demonstrates responsible stewardship of funds and safeguards the organization’s reputation.

The connection between compliance and standardized financial statement templates is demonstrably causal. Utilizing a structured template promotes consistent reporting practices, reducing the likelihood of errors and omissions that could lead to non-compliance. Furthermore, a standardized template facilitates the preparation of required reports for regulatory bodies, streamlining the compliance process. Consider the case of a non-profit hospital. Using a standardized template ensures accurate reporting of revenues, expenses, and assets, essential for compliance with healthcare-specific regulations and for maintaining eligibility for public funding. This proactive approach to compliance mitigates risks and strengthens the organization’s standing within the community.

In conclusion, compliance is not merely a procedural hurdle but an integral element of responsible non-profit governance. Standardized financial statement templates offer a practical and effective means of achieving and demonstrating compliance, safeguarding the organization’s reputation, and ensuring its long-term sustainability. While adapting to evolving regulatory landscapes can pose challenges, the consistent application of standardized templates provides a stable framework for navigating these changes and maintaining compliance. This reinforces the vital role of compliance in upholding public trust and ensuring the continued effectiveness of non-profit organizations.

4. Accountability

Accountability forms the bedrock of public trust in non-profit organizations. Standardized financial statement templates are instrumental in fostering this accountability by providing a transparent and verifiable record of financial activities. This structured reporting enables stakeholders to assess how resources are managed and whether they are being used effectively to achieve the organization’s stated mission. A clear link exists between the use of standardized templates and demonstrable accountability. For instance, a non-profit dedicated to environmental conservation can use a standardized template to demonstrate precisely how donations are allocated to specific projects, such as habitat restoration or public awareness campaigns. This level of detail allows donors to see the tangible impact of their contributions, strengthening their trust and encouraging continued support. The cause-and-effect relationship is evident: standardized reporting leads to greater transparency, which in turn fosters accountability.

Failing to prioritize accountability can severely damage an organization’s reputation and jeopardize its ability to secure future funding. Conversely, organizations that embrace accountability through rigorous financial reporting build stronger relationships with donors and the wider community. Consider a non-profit providing disaster relief services. By using a standardized template to track and report all expenditures related to disaster response, the organization demonstrates responsible stewardship of funds and assures donors that their contributions are being used efficiently and effectively. This example highlights the practical significance of accountability in maintaining donor confidence and maximizing the impact of charitable giving. Moreover, consistent and transparent financial reporting strengthens internal governance by holding management accountable for responsible resource allocation.

In summary, accountability is not merely a desirable attribute but a fundamental requirement for non-profit organizations. Standardized financial statement templates provide a practical and effective mechanism for achieving and demonstrating accountability, strengthening public trust, and ensuring the long-term sustainability of the organization. While implementing standardized reporting may require initial investments in training and systems, the resulting increase in accountability fosters confidence, attracts resources, and ultimately empowers the organization to fulfill its mission more effectively. The potential challenges of adapting to standardized formats are far outweighed by the long-term benefits of enhanced accountability.

5. Informed Decisions

Sound financial decisions are essential for the long-term sustainability and effectiveness of any non-profit organization. Standardized financial statement templates play a pivotal role in facilitating informed decision-making by providing a clear, accurate, and readily accessible overview of an organization’s financial position. These templates enable stakeholders to analyze trends, assess performance, and identify areas for improvement. A direct correlation exists between the use of standardized templates and the ability to make data-driven decisions. For example, a non-profit providing affordable housing can use financial statement data to analyze occupancy rates, operating costs, and funding sources, enabling informed decisions about future development projects or rent adjustments. This demonstrates the practical application of financial data in guiding strategic planning and resource allocation. The cause-and-effect relationship is clear: standardized financial reporting empowers informed decision-making, leading to more effective programs and greater organizational impact.

Without access to accurate and readily interpretable financial information, organizations risk making decisions based on assumptions rather than data, potentially jeopardizing their financial stability and mission fulfillment. Conversely, organizations that prioritize data-driven decision-making, facilitated by standardized financial reporting, are better equipped to adapt to changing circumstances and optimize resource allocation. Consider a non-profit arts organization. By analyzing revenue trends from ticket sales, memberships, and grants, using data from standardized financial statements, the organization can make informed decisions about programming, marketing strategies, and fundraising efforts. This example illustrates the practical significance of data analysis in enhancing organizational effectiveness and achieving strategic goals. Furthermore, readily available financial data strengthens internal governance by enabling boards and management teams to monitor performance and hold themselves accountable for achieving desired outcomes.

In conclusion, informed decision-making is not merely a desirable practice but a critical requirement for responsible non-profit management. Standardized financial statement templates provide the essential foundation for data-driven decisions, enabling organizations to allocate resources effectively, adapt to changing circumstances, and maximize their impact. While the initial implementation of standardized reporting may present challenges in terms of data collection and analysis, the resulting improvements in decision-making processes significantly outweigh these challenges. This underscores the importance of viewing standardized financial reporting not as an administrative burden but as a strategic investment in the organization’s future success. The ability to readily access and interpret financial data, facilitated by standardized templates, empowers non-profits to make informed decisions that advance their mission and ensure long-term sustainability.

Key Components of Non-Profit Financial Statements

Understanding the core components of non-profit financial statements is crucial for effective oversight and decision-making. These statements provide a comprehensive view of an organization’s financial health and activities, enabling stakeholders to assess its performance and sustainability.

1. Statement of Financial Position (Balance Sheet): This statement provides a snapshot of an organization’s assets, liabilities, and net assets at a specific point in time. It reveals the resources available to the organization and the claims against those resources. Key elements include cash, investments, accounts receivable, property and equipment, accounts payable, loans, and net assets (unrestricted, temporarily restricted, and permanently restricted).

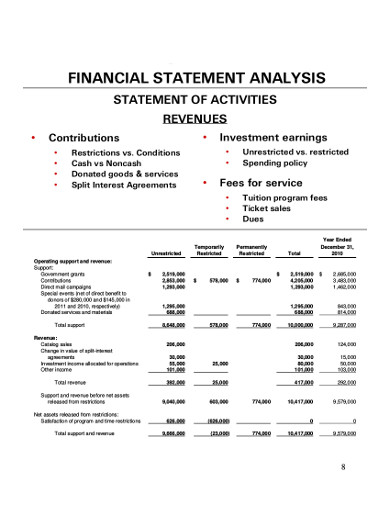

2. Statement of Activities (Income Statement): This statement reports an organization’s revenues and expenses over a specific period, typically a fiscal year. It shows the organization’s operating performance, indicating whether it generated a surplus or deficit. Key elements include program service revenue, contributions, grants, investment income, fundraising expenses, program service expenses, and administrative expenses.

3. Statement of Cash Flows: This statement tracks the flow of cash both into and out of an organization during a specific period. It categorizes cash flows into operating activities, investing activities, and financing activities. This information is crucial for assessing an organization’s liquidity and its ability to meet its financial obligations.

4. Statement of Functional Expenses: This statement provides a detailed breakdown of expenses by function, such as program services, administration, and fundraising. This breakdown allows stakeholders to understand how resources are allocated across different activities and assess the efficiency of resource utilization.

5. Notes to the Financial Statements: These notes provide additional details and context to the information presented in the core financial statements. They include accounting policies, descriptions of significant transactions, and other relevant disclosures necessary for a complete understanding of the organization’s financial position.

These interconnected statements offer a comprehensive and transparent view of a non-profit’s financial health, enabling informed decision-making and promoting accountability to stakeholders. Careful analysis of these components provides crucial insights into an organization’s financial performance, stability, and ability to fulfill its mission.

How to Create Non-Profit Financial Statement Templates

Creating effective financial statement templates requires careful planning and consideration of relevant accounting principles and regulatory requirements. A well-structured template ensures consistency, accuracy, and transparency in financial reporting.

1. Determine Reporting Requirements: Research applicable accounting standards (e.g., GAAP) and specific regulatory requirements for non-profit organizations in the relevant jurisdiction. This ensures compliance and facilitates comparability.

2. Select Key Financial Statements: Choose the essential financial statements to include in the template, such as the Statement of Financial Position, Statement of Activities, Statement of Cash Flows, and Statement of Functional Expenses. Consider the organization’s size and complexity when selecting the appropriate statements.

3. Design the Template Structure: Develop a clear and consistent format for each statement, including column headings, row labels, and calculation formulas. Ensure the template is user-friendly and facilitates data entry and analysis.

4. Incorporate Chart of Accounts: Integrate the organization’s chart of accounts into the template to ensure consistent categorization of financial transactions. This promotes accuracy and simplifies the reporting process.

5. Include Notes to the Financial Statements: Allocate space for essential notes and disclosures, providing additional context and explanations for the figures presented in the financial statements. This enhances transparency and understanding.

6. Implement Internal Controls: Establish internal controls to ensure data accuracy and prevent errors. This may include data validation rules, review procedures, and segregation of duties.

7. Test and Refine: Thoroughly test the template with sample data to identify and correct any errors or inconsistencies. Solicit feedback from relevant stakeholders and refine the template as needed.

8. Regularly Review and Update: Periodically review and update the template to reflect changes in accounting standards, regulatory requirements, or organizational structure. This ensures ongoing compliance and accuracy.

A well-designed template, incorporating these steps, provides a robust framework for accurate, consistent, and transparent financial reporting, enabling informed decision-making and strengthening accountability.

Standardized reporting structures, exemplified through thoughtfully designed templates, are indispensable for effective non-profit financial management. These templates provide a framework for consistent, accurate, and transparent reporting, enabling organizations to meet regulatory requirements, build trust with stakeholders, and make informed decisions. From facilitating compliance to empowering data-driven strategies, the utilization of robust financial statement templates strengthens accountability and promotes organizational sustainability.

Rigorous financial management, supported by clear and accessible reporting, is not merely a procedural necessity but a strategic imperative for non-profit organizations. Embracing best practices in financial reporting, including the adoption of standardized templates, empowers organizations to demonstrate their impact, secure resources, and fulfill their missions effectively. The ongoing commitment to transparent and accountable financial practices strengthens the entire non-profit sector, fostering public trust and enabling these vital organizations to achieve their important social objectives.