Utilizing a consistent format offers several advantages. It simplifies financial tracking, enabling property owners to monitor performance and identify potential issues. Regular reporting promotes better communication between owners and tenants, fostering trust and understanding. Furthermore, these structured records prove invaluable during tax season and can be essential for audits or legal matters. They also offer valuable insights for data analysis, enabling informed decision-making regarding property investments.

This foundation of organized financial reporting allows for a deeper exploration of related topics, including best practices for generating these documents, software solutions for streamlined reporting, and strategies for leveraging this information to optimize property investments.

1. Income

Accurate income reporting forms the cornerstone of a reliable property management monthly statement. A clear breakdown of all income sources provides property owners with essential financial insights, enabling informed decision-making and effective financial planning. This section explores key facets of income reporting within these statements.

- Rent PaymentsRent payments constitute the primary income source for most rental properties. A detailed record of each tenant’s payment, including the amount, due date, and payment date, provides a transparent overview of rental income. Tracking late payments and any associated fees is also crucial for comprehensive financial management. For example, if a tenant pays $1,500 in rent on the 5th of the month instead of the 1st, the statement should reflect both the full rent amount and any applicable late fee. This detailed record ensures accurate income reporting and facilitates efficient collection processes.

- Other IncomeBeyond standard rent payments, properties may generate income from other sources. These can include late fees, pet fees, parking fees, laundry facility income, or fees for other amenities. Accurately documenting these miscellaneous income streams ensures a complete financial picture. For instance, a property might generate $50 in late fees and $100 from laundry facilities. Including these amounts in the statement contributes to a more comprehensive understanding of overall property profitability.

- Vacancy LossPeriods of vacancy represent a direct reduction in potential income. Tracking vacancy periods and the associated lost income provides valuable insights into property performance and helps inform pricing strategies. For example, a vacant unit that typically rents for $1,000 per month represents a $1,000 loss in potential income for each vacant month. Documenting this loss allows property owners to assess the financial impact of vacancy and adjust strategies accordingly.

- Prepaid RentPrepaid rent, though received in advance, must be accurately allocated to the corresponding rental period. This prevents overstating income in the current reporting period and ensures accurate financial projections. If a tenant prepays $3,000 for three months of rent, the statement should only reflect $1,000 as income for the current month, with the remaining $2,000 allocated to subsequent months. This practice maintains accurate income reporting across all reporting periods.

By meticulously documenting these income components, a property management monthly statement template offers property owners a comprehensive understanding of their financial performance. This detailed income overview, combined with a clear presentation of expenses, empowers informed decision-making and contributes to effective long-term financial strategies. Analyzing income trends over time can further reveal valuable insights into property performance and market dynamics.

2. Expenses

Accurate and comprehensive expense tracking is crucial for effective property management. A detailed account of all property-related expenditures provides essential insights into profitability and informs strategic financial decisions. This section explores key expense categories within a property management monthly statement template.

- Operating ExpensesRegular operating expenses encompass the recurring costs associated with maintaining and running a property. These include routine maintenance, landscaping, pest control, utilities (water, gas, electricity), and property insurance. For example, a monthly statement might reflect $200 for landscaping, $150 for pest control, and $300 for water and electricity. Tracking these recurring costs allows property owners to monitor operational efficiency and budget effectively.

- Repairs and MaintenanceBeyond routine maintenance, properties often require repairs due to unforeseen issues or wear and tear. These expenses, while less predictable, are essential for preserving property value and tenant satisfaction. Examples include plumbing repairs, appliance replacements, and roof repairs. Accurately recording these costs, such as a $500 plumbing repair or a $1,000 appliance replacement, allows for accurate assessment of overall property expenses and aids in long-term financial planning.

- Property Taxes and InsuranceProperty taxes and insurance represent significant recurring expenses. These costs, while often paid annually or semi-annually, should be reflected in the monthly statement on a prorated basis to provide a complete financial picture. For instance, if annual property taxes are $2,400, the monthly statement would reflect $200 ($2,400 / 12 months). Similarly, insurance premiums should be reflected monthly. This practice facilitates accurate budgeting and expense forecasting.

- Management FeesFor properties managed by a third-party company, management fees represent a regular expense. These fees typically represent a percentage of the collected rent or a fixed monthly amount. Clearly outlining these fees in the monthly statement ensures transparency and allows owners to monitor management costs. For example, a 5% management fee on $10,000 collected rent would be $500. This clear representation helps property owners understand the cost of professional management services.

Detailed expense tracking, encompassing both regular operating costs and less predictable expenses, is fundamental to sound financial management. A comprehensive understanding of these expenditures, as presented in a well-structured monthly statement, allows property owners to assess profitability, identify potential cost-saving opportunities, and make informed decisions regarding property investments.

3. Balance

The “Balance” section within a property management monthly statement template represents the financial outcome of a property’s performance during a specific reporting period. It reflects the net result of income generated and expenses incurred. A clear understanding of this balance is fundamental for assessing property profitability and making informed financial decisions.

- Net IncomeNet income, calculated by subtracting total expenses from total income, represents the profit generated by the property during the reporting period. A positive net income indicates profitability, while a negative net income signifies a loss. For instance, if total income is $12,000 and total expenses are $8,000, the net income is $4,000. This figure provides a clear measure of financial performance and informs investment decisions.

- Opening and Closing BalancesThe opening balance represents the available funds at the beginning of the reporting period, while the closing balance represents the funds available at the end. Tracking these balances provides insights into cash flow and facilitates financial planning. For example, an opening balance of $5,000 combined with a net income of $4,000 results in a closing balance of $9,000. This information is crucial for managing cash reserves and projecting future financial outcomes.

- Impact of Vacancy and Major RepairsVacancy periods and significant repair costs directly impact the balance. Periods of vacancy reduce income, while major repairs increase expenses. Reflecting these factors accurately in the statement provides a realistic view of financial performance. For example, a $2,000 roof repair would significantly reduce the net income and closing balance. Understanding the impact of such events is essential for effective financial management.

- Basis for Future Financial DecisionsThe calculated balance serves as a critical data point for future financial decisions related to the property. It informs decisions regarding rent adjustments, property improvements, and overall investment strategy. A consistently positive balance might justify property upgrades, while a negative balance may necessitate cost-cutting measures or rent adjustments. The balance, therefore, plays a pivotal role in long-term financial planning and investment analysis.

The “Balance” section provides a concise summary of a property’s financial performance. This clear representation of net income, opening and closing balances, and the impact of various factors offers property owners and managers essential insights for informed decision-making, contributing to effective financial management and long-term investment success.

4. Property Details

Accurate property details are essential components of a comprehensive property management monthly statement template. Clear identification and consistent referencing of the property ensure accurate financial reporting and facilitate effective property management. These details provide context for the financial data presented, enabling informed decision-making and efficient record-keeping.

- Property AddressThe full property address, including street number, street name, city, state, and zip code, is a fundamental identifier. It distinguishes the specific property to which the financial data pertains. For example, including “123 Main Street, Anytown, CA 91234” ensures clarity and avoids confusion with other properties in a portfolio. Accurate address information is crucial for legal and tax purposes.

- Property Type and SizeSpecifying the property type (e.g., single-family home, apartment building, commercial space) and size (e.g., square footage, number of units) provides further context for the financial data. This information helps in comparing performance across different property types and assessing the financial viability of each unit. For a multi-unit property, specifying the number of units and their respective sizes is essential for accurate income and expense allocation.

- Property Identification Number (PIN)Including the property identification number (PIN) or other relevant identification codes used by local authorities provides a unique and official reference for the property. This number is often required for tax assessments and other official documentation. Including this identifier ensures consistency and facilitates accurate record-keeping across different platforms and systems.

- Owner InformationWhile the statement primarily focuses on the property’s financial performance, including the owner’s name and contact information can be valuable for administrative purposes. This information allows for easy communication and ensures that relevant parties can access the financial data. It also provides a point of contact for any inquiries regarding the property or the statement itself.

Accurate property details within the monthly statement template contribute significantly to its overall value and usability. They provide context for the financial information, ensure clear identification of the subject property, and facilitate efficient communication and record-keeping. This attention to detail enhances the value of the statement as a tool for informed financial management and decision-making.

5. Tenant Information

Comprehensive tenant information is a crucial component of a robust property management monthly statement template. This information not only identifies the occupants responsible for generating rental income but also provides essential context for understanding payment patterns and potential discrepancies. Accurate and up-to-date tenant information facilitates effective communication and strengthens the landlord-tenant relationship.

- Tenant Full Name and Contact InformationRecording the full legal name and current contact information for each tenant is fundamental. This information enables clear communication regarding rent payments, lease renewals, maintenance requests, and other property-related matters. For instance, having accurate phone numbers and email addresses allows property managers to quickly address late rent payments or inform tenants of upcoming maintenance. This clear communication channel contributes to a more efficient and transparent management process.

- Lease Terms and DatesDocumenting the lease start and end dates, along with key lease terms such as monthly rent amount and any specific clauses, provides essential context for interpreting the financial data. Knowing the lease terms allows for accurate tracking of rent payments and facilitates timely lease renewal notifications. For example, if a tenant’s lease expires next month, the property manager can initiate the renewal process well in advance, ensuring continuous occupancy and stable income flow.

- Payment HistoryMaintaining a record of each tenant’s payment history, including dates and amounts paid, provides valuable insights into payment patterns and helps identify potential issues. This record can reveal consistent late payments, partial payments, or missed payments, enabling proactive intervention and minimizing financial risks. A history of consistent on-time payments, conversely, builds trust and strengthens the landlord-tenant relationship.

- Unit Number or Property DesignationIn multi-unit properties, clearly identifying the specific unit occupied by each tenant is crucial for accurate rent allocation and expense tracking. This designation ensures that rent payments are correctly attributed to the appropriate unit and simplifies financial reporting. In a large apartment complex, for example, this detailed information is vital for distinguishing between individual tenants and their respective financial obligations. It also aids in identifying the source of any payment discrepancies or maintenance requests.

By incorporating comprehensive tenant information, a property management monthly statement template becomes a more powerful tool for effective property management. This data enhances financial transparency, facilitates proactive communication, and contributes to a more organized and efficient management process. The inclusion of tenant details directly supports accurate financial record-keeping and promotes a stronger landlord-tenant relationship, which are foundational to successful property management.

6. Reporting Period

The reporting period defines the timeframe covered by the financial data within a property management monthly statement template. Accurate specification of this period is crucial for ensuring the relevance and comparability of financial information. A clearly defined reporting period provides context for the income and expenses reported, enabling meaningful analysis and informed decision-making.

- Date Range SpecificityPrecise start and end dates delineate the reporting period. This specificity ensures that all transactions within that timeframe are included and accurately reflected in the statement. For example, a reporting period of “July 1, 2024 to July 31, 2024” clearly defines the timeframe for the included financial data. This precise delineation prevents ambiguity and ensures accurate financial reporting.

- Consistency in ReportingConsistent reporting periods, typically monthly, facilitate trend analysis and performance comparisons over time. Regular monthly statements allow for tracking changes in income and expenses, enabling property owners to identify potential issues or opportunities. Consistent reporting also simplifies year-end financial reporting and tax preparation.

- Alignment with Financial ObjectivesThe reporting period should align with the property owner’s financial objectives. Monthly reporting provides a granular view of financial performance, while quarterly or annual reporting offers a broader perspective. The chosen reporting period should reflect the level of detail required for effective financial management and decision-making. A property owner focused on short-term performance might prefer monthly statements, while a long-term investor might find quarterly statements sufficient.

- Impact on Financial AnalysisThe reporting period directly impacts financial analysis. Shorter reporting periods, such as monthly, allow for quicker identification of trends and anomalies. Longer reporting periods, while providing a broader overview, may obscure short-term fluctuations. The appropriate reporting period depends on the specific analytical needs and the nature of the property investment. Analyzing data from consistent reporting periods provides a clearer picture of performance trends and facilitates data-driven decision-making.

Accurate definition of the reporting period is essential for the integrity and usability of a property management monthly statement template. A clearly defined and consistently applied reporting period ensures that the financial data presented is relevant, comparable, and provides a meaningful basis for financial analysis and decision-making. This clarity contributes significantly to the template’s effectiveness as a tool for property management and financial oversight.

Key Components of a Property Management Monthly Statement Template

A well-structured monthly statement template provides a clear and comprehensive overview of a property’s financial performance. Key components ensure consistent reporting and facilitate informed financial management.

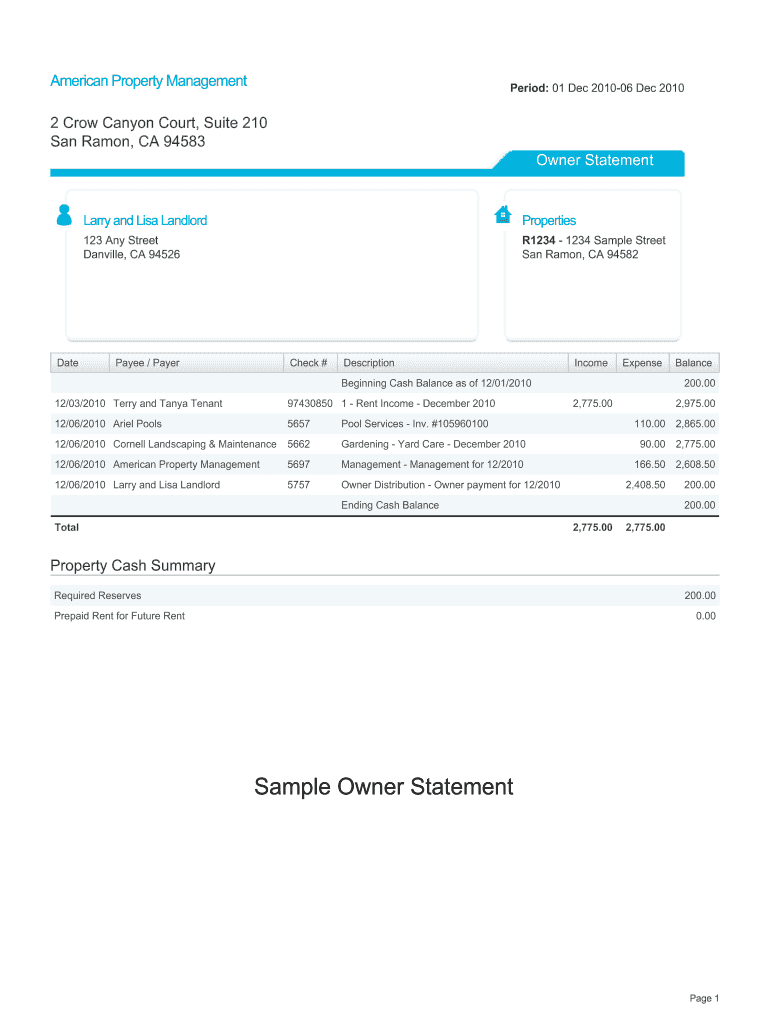

1. Property Identification: Clear identification of the property, including the full address, property type, and any relevant identification numbers, provides essential context for the financial data. This ensures accurate record-keeping and facilitates property comparisons within a portfolio.

2. Reporting Period: Precise specification of the start and end dates of the reporting period ensures that the financial information is relevant and comparable. Consistent reporting periods enable trend analysis and performance evaluation over time.

3. Tenant Information: Detailed tenant information, including names, contact details, lease terms, and payment history, offers valuable insights into rental income streams. This information supports effective communication and facilitates proactive management of tenant-related matters.

4. Income Details: A comprehensive breakdown of all income sources, including rent payments, late fees, and other miscellaneous income, provides a transparent view of revenue generation. Accurate income reporting is crucial for assessing property profitability.

5. Expense Breakdown: Detailed categorization of all property-related expenses, such as operating costs, repairs, taxes, and management fees, allows for thorough expense tracking and analysis. This information is essential for identifying cost-saving opportunities and managing budgets effectively.

6. Balance Summary: Calculation of the net income, representing the difference between total income and total expenses, provides a clear picture of the property’s financial performance during the reporting period. Tracking opening and closing balances further enhances financial oversight.

These components work together to create a comprehensive financial picture of a property’s performance, providing property owners and managers with the information needed for informed decision-making and effective financial management. This structured approach promotes transparency, accountability, and ultimately contributes to successful property investment.

How to Create a Property Management Monthly Statement Template

Creating a standardized template ensures consistent and accurate financial reporting for rental properties. A well-designed template simplifies data entry, analysis, and facilitates informed decision-making. The following steps outline the process of creating a comprehensive template.

1. Define the Reporting Period: Establish a consistent reporting timeframe, typically monthly. Clearly specify the start and end dates for the reporting period. This ensures data consistency and facilitates comparisons over time.

2. Property Identification: Include fields for essential property details: full address, property type, and any relevant identification numbers (e.g., Property Identification Number – PIN). This ensures clear identification of the property associated with the financial data.

3. Tenant Details Section: Incorporate sections for tenant information: full name, contact information, lease start and end dates, unit number (for multi-unit properties), and current payment status. This information facilitates communication and rent tracking.

4. Income Section: Create a detailed section for recording all income sources: rent payments, late fees, pet fees, parking fees, and any other miscellaneous income. Itemized income tracking provides a clear picture of revenue generation.

5. Expense Section: Develop a comprehensive expense section, categorized for accurate tracking. Include fields for operating expenses (e.g., utilities, maintenance, landscaping), repairs, property taxes, insurance, and management fees. Detailed expense tracking facilitates budget management and analysis.

6. Balance Calculation: Include a section to calculate the net income by subtracting total expenses from total income. Display both the opening and closing balances for the reporting period to provide a comprehensive view of cash flow.

7. Software Solutions: Consider utilizing property management software or spreadsheet programs to create and manage the template. These tools often offer automated calculations, reporting features, and data storage capabilities.

8. Regular Review and Updates: Periodically review and update the template to ensure its continued accuracy and relevance. Adapt the template to accommodate changes in regulations, property details, or management practices. Regular review maintains the template’s effectiveness as a financial management tool.

A well-designed template incorporating these components promotes financial transparency, facilitates efficient data management, and supports informed decision-making regarding property investments. Consistent use of a standardized template contributes to effective property management and financial success.

Accurate and consistent financial reporting is paramount to successful property management. Standardized documentation provides a crucial framework for organizing income, expenses, and balance details, offering valuable insights into property performance. A well-designed template facilitates transparency between property owners and tenants, simplifies tax reporting, and supports informed financial decision-making. Key elements such as detailed property and tenant information, comprehensive income and expense tracking, and clear balance summaries contribute to the template’s overall effectiveness as a management tool.

Effective utilization of these templates empowers informed decision-making, promotes financial stability, and contributes to long-term success in property investment. Consistent and meticulous financial reporting, facilitated by well-structured templates, is not merely a best practice but a cornerstone of successful property management. Leveraging these tools allows stakeholders to navigate the complexities of property finances with clarity and confidence, fostering sustainable growth and profitability.