Utilizing a standardized framework offers numerous advantages, including simplified tax preparation, accurate profit and loss assessment, and improved financial planning. It empowers investors to monitor cash flow, identify areas for potential cost reduction, and ultimately enhance profitability. This organized financial overview can also prove invaluable when seeking financing or attracting potential investors.

Understanding the components and practical application of this structured approach to financial reporting is critical for effective real estate investment management. The following sections will delve into the key elements of these documents, exploring best practices and offering practical guidance for their implementation.

1. Income

Accurate income tracking is fundamental to a reliable rental property financial statement. This involves meticulous recording of all revenue generated by the property. Primary income sources typically include monthly rent payments. Additional income may arise from late fees, pet fees, parking fees, laundry facilities, or other amenities. A comprehensive template facilitates detailed categorization of these diverse income streams, providing a granular view of revenue generation. For example, separating base rent from late fees allows for analysis of tenant payment patterns and potential adjustments to lease terms.

Precise income documentation is not only essential for understanding current financial performance but also for projecting future returns and making informed investment decisions. Consider a scenario where a property generates income from both residential units and on-site parking. A well-structured template allows for separate tracking of these income streams, revealing the contribution of each to overall profitability. This granular data empowers informed decisions regarding rent adjustments, amenity pricing, and potential property improvements. Furthermore, accurately documented income history strengthens credibility when seeking financing or presenting the investment to potential partners.

In summary, meticulous income tracking within a structured template is paramount for sound financial management. It provides the foundation for accurate profit and loss calculations, informed decision-making, and ultimately, successful real estate investment. Overlooking or underreporting income can lead to skewed financial analysis and potentially hinder long-term investment goals. Therefore, a comprehensive understanding of income sources and their proper documentation is crucial for maximizing the value of a rental property.

2. Expenses

A comprehensive understanding of expenses is crucial for accurate financial assessment of rental properties. A well-structured template facilitates detailed tracking and categorization of these expenditures, providing valuable insights into profitability and areas for potential cost optimization. This organized approach enables informed decision-making regarding property management and long-term investment strategies.

- Operating ExpensesThese recurring costs are essential for the day-to-day operation and maintenance of the property. Examples include property taxes, insurance premiums, property management fees, routine repairs, landscaping, and utilities. Accurately tracking these expenses within a template allows for analysis of operational efficiency and identification of potential cost-saving measures. For instance, comparing insurance premiums across different providers can lead to significant savings without compromising coverage.

- Capital ExpendituresThese are significant investments in property improvements or upgrades that extend the useful life of the asset or increase its value. Examples include roof replacements, HVAC system upgrades, major renovations, and additions. A template facilitates tracking these substantial investments, providing a clear record for depreciation calculations and demonstrating capital improvements to potential buyers or investors.

- Vacancy CostsThese represent the potential loss of income during periods when a property is unoccupied. Calculating vacancy rates and incorporating them into financial projections allows for a more realistic assessment of profitability. A template that accounts for vacancy costs provides a more accurate financial picture and assists in setting appropriate rental rates to mitigate potential losses.

- Financing CostsThese expenses are associated with securing and servicing loans used to acquire or improve the property. Mortgage interest payments, loan origination fees, and other financing charges are key components. Accurately tracking these expenses within a template is crucial for understanding the true cost of borrowing and its impact on overall profitability. This detailed tracking also aids in comparing different financing options and optimizing loan structures.

By meticulously tracking and categorizing these various expense types within a structured template, property owners gain a comprehensive overview of their financial obligations. This detailed analysis allows for informed decision-making regarding budgeting, expense control, and long-term investment strategies. Furthermore, a well-maintained record of expenses is essential for accurate tax reporting and demonstrating financial transparency to potential investors or lenders.

3. Cash Flow

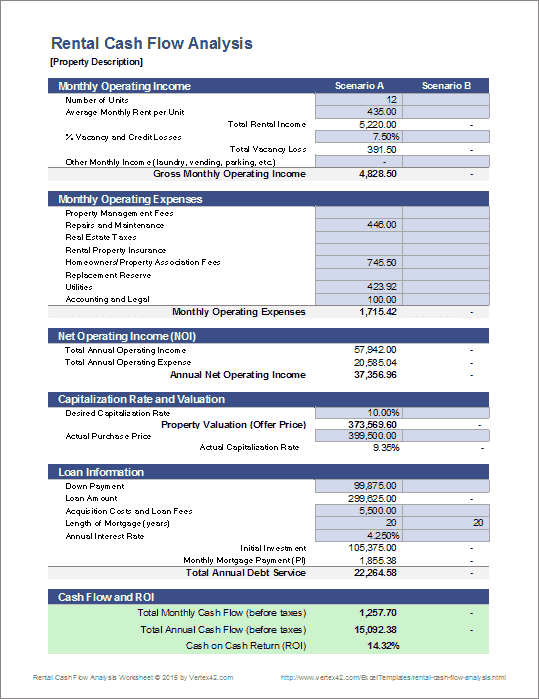

Cash flow, representing the net difference between income and expenses, is a critical metric within a rental property financial statement template. Accurately tracking cash flow provides insights into the property’s ability to generate funds for debt service, operating expenses, and reinvestment. A positive cash flow indicates that the property generates sufficient income to cover all expenses, while a negative cash flow suggests a shortfall requiring additional funding. Understanding cash flow dynamics is essential for evaluating investment performance and making informed financial decisions.

For example, consider a property with a monthly rental income of $2,000 and total expenses of $1,500, resulting in a positive cash flow of $500. This positive cash flow provides financial flexibility for unforeseen repairs, property improvements, or debt reduction. Conversely, if expenses increase to $2,200 while income remains constant, the resulting negative cash flow of $200 necessitates drawing on reserves or seeking additional financing. This scenario underscores the importance of careful expense management and realistic income projections. A robust financial statement template facilitates this analysis by providing a clear structure for tracking both income and expenses, allowing for accurate cash flow calculations.

Monitoring cash flow trends over time allows investors to identify potential problems, assess the impact of rent adjustments or expense reductions, and make strategic decisions regarding property management. Consistently analyzing cash flow within a structured template helps ensure long-term financial stability and maximizes the return on investment. Neglecting cash flow analysis can lead to financial distress, even if the property appears profitable on paper based solely on income and expense figures. Therefore, incorporating cash flow analysis as a core component of the financial statement template is crucial for successful real estate investment management.

4. Profit/Loss

The profit/loss statement, a core component of a rental property financial statement template, provides a comprehensive overview of a property’s financial performance over a specific period. It summarizes all income generated and expenses incurred, resulting in a net profit or loss figure. This crucial financial statement allows investors to assess the profitability of their investment and make informed decisions regarding property management and future investments.

- Income AnalysisThis section details all revenue generated by the property, including rental income, late fees, parking fees, and other miscellaneous income sources. Accurately documenting all income streams is crucial for determining overall revenue and identifying potential areas for growth. For instance, if a property consistently generates significant income from laundry facilities, an investor might consider expanding or upgrading these facilities to further enhance revenue.

- Expense TrackingThis section itemizes all expenses associated with operating and maintaining the property, including mortgage payments, property taxes, insurance premiums, repairs, and property management fees. Precise expense tracking is essential for understanding the cost structure of the property and identifying potential areas for cost reduction. For example, if maintenance costs consistently exceed projections, an investor might investigate the causes and implement preventative maintenance measures to mitigate future expenses.

- Net Profit/Loss CalculationBy subtracting total expenses from total income, the profit/loss statement reveals the net profitability of the property. A positive net income indicates that the property is generating a profit, while a negative net income signifies a loss. This key metric is fundamental for evaluating investment performance and making strategic decisions. For instance, a consistently negative net income might prompt an investor to consider rent adjustments, expense reductions, or even divestment of the property.

- Trend AnalysisAnalyzing profit/loss statements over multiple periods reveals trends in income and expenses, offering valuable insights into the property’s financial trajectory. This trend analysis facilitates proactive management and informed decision-making. For example, if operating expenses consistently increase while income remains stagnant, an investor can identify the underlying causes and implement corrective measures to maintain profitability. This long-term perspective is crucial for sustainable real estate investment success.

By providing a structured framework for analyzing income, expenses, and net profitability, the profit/loss statement within a rental property financial statement template empowers investors to make data-driven decisions. This comprehensive overview of financial performance is essential for effective property management, long-term investment planning, and maximizing returns. Regularly reviewing and analyzing the profit/loss statement enables investors to monitor performance, identify potential challenges, and adapt their strategies to ensure sustainable profitability.

5. Balance Sheet

A balance sheet, an integral component of a rental property financial statement template, provides a snapshot of the property’s financial position at a specific point in time. It presents a concise summary of assets, liabilities, and equity, offering valuable insights into the property’s overall financial health. Understanding the balance sheet is crucial for assessing the long-term financial viability of the investment and making informed decisions regarding financing, property improvements, and overall investment strategy. The balance sheet illuminates the relationship between what the property owns (assets) and what it owes (liabilities), revealing the owner’s equity stake.

Assets represent what the property owns, including the property itself, cash held in reserve accounts, and any outstanding tenant security deposits. Liabilities represent financial obligations, such as outstanding mortgage balances, accrued property taxes, and any other debts secured by the property. Equity represents the owner’s stake in the property, calculated as the difference between assets and liabilities. For instance, if a property is valued at $300,000 (asset) and carries a mortgage balance of $200,000 (liability), the owner’s equity is $100,000. Monitoring changes in equity over time provides a clear indication of the property’s financial performance and the impact of investment decisions. Increasing equity suggests positive investment growth, while declining equity warrants further investigation into potential issues.

Analyzing the balance sheet in conjunction with other financial statements, such as the income statement and cash flow statement, provides a comprehensive understanding of the property’s financial performance. This integrated approach allows investors to assess the property’s overall financial health, identify potential risks and opportunities, and make informed decisions regarding property management and long-term investment strategies. Regularly reviewing the balance sheet within a structured template enables proactive management and contributes to the long-term success of the real estate investment. Neglecting this crucial component can lead to an incomplete understanding of the property’s financial standing and potentially hinder informed decision-making.

Key Components of a Rental Property Financial Statement Template

Effective management of rental properties necessitates a clear and organized approach to financial reporting. A comprehensive financial statement template provides the structure for tracking key data points, enabling informed decision-making and maximizing returns. The following components are essential for a robust and insightful financial overview.

1. Income Statement: This statement details all revenue generated by the property, including rental income, late fees, and other miscellaneous income. Accurate income tracking is fundamental for assessing financial performance and projecting future returns. Detailed categorization of income streams provides granular insights into revenue generation and supports informed decision-making regarding rent adjustments and potential property improvements.

2. Expense Statement: This statement itemizes all expenses associated with operating and maintaining the property, encompassing mortgage payments, property taxes, insurance premiums, repairs, and property management fees. Meticulous expense tracking is crucial for understanding the cost structure of the property and identifying potential areas for cost optimization. This detailed record of expenses also facilitates accurate tax reporting and financial transparency.

3. Cash Flow Statement: This statement tracks the movement of cash both into and out of the property. It highlights the net difference between income and expenses, providing a clear picture of the property’s ability to generate funds for debt service, operating expenses, and reinvestment. Monitoring cash flow trends over time enables proactive management and informed financial decisions.

4. Profit/Loss Statement: This statement summarizes all income and expenses over a specific period, culminating in a net profit or loss figure. Analyzing profit/loss statements over multiple periods reveals trends in income and expenses, offering valuable insights into the property’s financial trajectory and supporting long-term investment planning. This statement is crucial for evaluating investment performance and making strategic decisions.

5. Balance Sheet: This statement provides a snapshot of the property’s financial position at a specific point in time. It outlines assets, liabilities, and equity, offering a concise overview of the property’s overall financial health. Understanding the balance sheet is essential for assessing long-term financial viability and making informed decisions regarding financing and investment strategy.

Utilizing a template that incorporates these components provides a holistic view of the property’s financial performance. This structured approach enables informed decision-making, improved financial planning, and enhanced profitability, ultimately contributing to the long-term success of the real estate investment.

How to Create a Rental Property Financial Statement Template

Developing a robust financial statement template requires a structured approach to ensure accurate tracking and analysis of key financial data. The following steps outline the process of creating a comprehensive template for effective rental property management.

1: Define Reporting Periods: Establish clear reporting periods, such as monthly, quarterly, or annually, to maintain consistency and facilitate accurate comparisons over time. Consistent reporting periods enable trend analysis and informed decision-making.

2: Structure the Income Section: Categorize all potential income sources, including base rent, late fees, pet fees, parking fees, and other miscellaneous income. This detailed categorization provides granular insights into revenue streams and facilitates accurate income tracking.

3: Detail Expense Categories: Outline all potential expense categories, including operating expenses (e.g., property taxes, insurance, repairs), capital expenditures (e.g., renovations, major repairs), and financing costs (e.g., mortgage interest). Comprehensive expense tracking is crucial for understanding the cost structure and identifying potential areas for cost optimization.

4: Incorporate Cash Flow Calculations: Include sections for calculating cash flow by subtracting total expenses from total income. Monitoring cash flow trends provides insights into the property’s ability to generate funds for debt service, operating expenses, and reinvestment. This analysis is essential for evaluating investment performance and making informed financial decisions.

5: Integrate Profit/Loss Calculation: Dedicate a section for calculating net profit or loss by subtracting total expenses from total income. Tracking profit/loss over different periods allows for trend analysis and assessment of the property’s overall financial performance. This information is crucial for long-term investment planning.

6: Include a Balance Sheet Section: Create a section for summarizing assets, liabilities, and equity. Regularly updating the balance sheet provides a snapshot of the property’s financial position at specific points in time, enabling assessment of long-term financial viability and supporting informed investment decisions.

7: Choose a Format: Select a format that suits individual needs and preferences, whether a spreadsheet, dedicated software, or a combination of tools. The chosen format should facilitate easy data entry, calculations, and report generation.

8: Regularly Update and Review: Maintain accurate and up-to-date records by regularly entering financial data into the template. Periodically review the generated reports to monitor performance, identify trends, and make informed decisions regarding property management and investment strategy. Regular review ensures data accuracy and supports proactive management.

A well-structured template provides a framework for organizing and analyzing financial data, enabling effective property management and informed decision-making. Consistent use of the template promotes financial transparency, facilitates accurate reporting, and contributes to the long-term success of the real estate investment.

Effective management of real estate investments relies on accurate and organized financial reporting. A structured approach, facilitated by a well-designed template, provides the framework for tracking income, expenses, cash flow, profitability, and overall financial health. This meticulous approach empowers informed decision-making, optimizing resource allocation, and enhancing long-term investment returns. Understanding the key components of these structured documents and their practical application is essential for maximizing the potential of rental properties.

Implementing a robust financial tracking system provides the foundation for sustainable growth and financial success in the competitive landscape of real estate investment. This proactive approach, grounded in accurate data analysis, mitigates potential risks and positions investors to capitalize on opportunities for long-term prosperity and portfolio growth. Consistent and diligent application of these financial management principles is paramount for achieving sustained success in real estate investment.