Utilizing such a tool offers several advantages. It facilitates better financial management through organized tracking and analysis of expenditures. It can also serve as a valuable resource for creating budgets, identifying spending patterns, and detecting potential errors or fraudulent activities. Furthermore, these forms can be crucial for record-keeping when resolving discrepancies with financial institutions or for tax purposes.

Understanding the structure and benefits of these resources leads to more informed financial practices. This exploration will delve into the practical applications, potential customization options, and considerations for securely managing personal financial information.

1. Accessibility

Accessibility, in the context of complimentary credit card statement templates, refers to the ease with which individuals can obtain and utilize these resources. Ready availability is crucial for widespread adoption and effective utilization. Obstacles such as complicated download procedures, restrictive file formats, or platform compatibility issues limit practical application. For example, a template requiring specialized software restricts its use to those with access to such programs. Conversely, readily available templates in commonly used formats, such as spreadsheets or text documents, democratize access, empowering a wider range of individuals to manage their finances effectively.

The impact of accessibility extends beyond mere availability. Consider a scenario where a consumer disputes a transaction. Easy access to a readily customizable template allows quick organization of relevant information, facilitating a more efficient resolution process. Furthermore, accessible templates can play a vital role in financial education, providing practical tools for learning about budgeting and expense tracking. Templates optimized for various devices, including mobile phones and tablets, further enhance accessibility, accommodating diverse user preferences and technological capabilities.

Promoting accessibility requires careful consideration of format, distribution methods, and user experience. Addressing potential barriers, like language accessibility or technical proficiency requirements, ensures broader reach and impact. Ultimately, maximizing accessibility empowers individuals to take control of their financial well-being through informed decision-making and proactive financial management.

2. Customization

Customization represents a critical feature within complimentary credit card statement templates. The ability to adapt these templates to individual needs significantly enhances their utility. A generic template may not adequately capture the nuances of individual spending habits or budgeting strategies. Customization allows users to modify categories, add specific fields, and adjust the template structure to align precisely with personal financial management practices. This personalized approach facilitates more accurate tracking, analysis, and ultimately, more effective financial decision-making. For example, an individual focused on tracking business expenses can tailor a template to categorize deductible items meticulously, streamlining tax preparation.

The practical implications of customization extend to various financial scenarios. Consider an individual managing multiple credit cards. A customizable template allows consolidation of information from different sources into a single, unified format. This consolidated view simplifies tracking overall spending and identifying potential areas for improvement. Furthermore, customization can support specific financial goals, such as debt reduction or savings accumulation. By tailoring the template to highlight relevant information, users gain a clearer perspective on progress and identify opportunities for optimization. A user aiming to curb dining-out expenses could add a dedicated field for tracking such expenditures, promoting mindful spending.

Effective customization requires a balance between flexibility and structure. While templates should offer ample customization options, maintaining a basic framework ensures data consistency and facilitates meaningful analysis. Overly complex customization options can lead to confusion and diminish the template’s practical value. Striking this balance empowers users to create personalized tools that support their unique financial circumstances and goals, fostering informed financial management practices.

3. Accuracy

Accuracy within a complimentary credit card statement template is paramount for effective financial management. Inaccurate data renders financial analysis meaningless, potentially leading to flawed budgeting decisions and an incomplete understanding of spending habits. Maintaining accurate records within these templates ensures that subsequent financial decisions are based on reliable information. This exploration delves into key facets of accuracy, highlighting their significance.

- Data Entry ValidationPreventing errors during data entry is crucial. Implementing validation rules within the template, such as restricting input to numerical values in designated fields, minimizes human error. For instance, a date field should accept only valid date formats, preventing entries like “February 30th.” Such validation ensures data integrity from the outset.

- Regular ReconciliationPeriodically comparing template data with official bank statements is essential for identifying and rectifying discrepancies. This process, much like balancing a checkbook, verifies the accuracy of recorded transactions. Identifying a missed payment or an incorrectly recorded amount allows prompt correction, maintaining accurate financial records. This practice reinforces the reliability of the template as a financial management tool.

- Formula IntegrityTemplates often utilize formulas for calculations, such as totaling expenses or calculating balances. Ensuring the accuracy of these formulas is crucial for generating reliable insights. A flawed formula, such as an incorrect summation, can lead to inaccurate results and misinformed financial decisions. Regularly reviewing and validating formulas safeguards against such errors.

- Consistent CategorizationConsistent categorization of expenses is crucial for meaningful analysis. Using standardized categories throughout the template allows accurate tracking of spending within specific areas. For example, consistently classifying grocery purchases under “Groceries” rather than sometimes using “Food” or “Shopping” provides a more precise view of spending habits. This consistency enables targeted budgeting and informed financial choices.

Maintaining accurate information within complimentary credit card statement templates forms the bedrock of sound financial practices. These facets of accuracy, working in concert, ensure the template serves as a reliable tool for managing personal finances. Neglecting accuracy undermines the template’s value, potentially leading to misinformed financial decisions. Prioritizing accurate record-keeping empowers informed decision-making and effective financial management.

4. Security

Security considerations are paramount when utilizing complimentary credit card statement templates. These templates often contain sensitive financial information, making robust security practices essential. Protecting this data from unauthorized access, misuse, or loss is crucial for maintaining financial well-being. The following facets highlight critical security aspects associated with using these templates.

- Password ProtectionProtecting template files with strong, unique passwords forms a fundamental security measure. Password protection prevents unauthorized access to sensitive financial data stored within the template. For example, utilizing a password manager to generate and store complex passwords enhances security. Without password protection, the data remains vulnerable to unauthorized access, potentially leading to identity theft or financial fraud.

- Secure StorageChoosing a secure storage location for template files is crucial. Storing templates on secure cloud services or encrypted local drives minimizes the risk of data breaches. Storing sensitive files on unencrypted, publicly accessible platforms increases vulnerability. For instance, storing a template containing financial details on a USB drive without encryption poses significant risks if the drive is lost or stolen. Secure storage practices protect against data loss and unauthorized access.

- Device SecurityMaintaining robust security measures on devices used to access templates is essential. Regularly updating operating systems and antivirus software safeguards against malware and other security threats. A compromised device provides a gateway for unauthorized access to sensitive financial information, even if the template itself is password-protected. Implementing strong device security measures complements file-level protection, creating a multi-layered security approach.

- Data Backup and RecoveryRegularly backing up template files ensures data recovery in case of device failure, accidental deletion, or other unforeseen events. Maintaining backups on separate storage devices or cloud services mitigates data loss risks. Without backups, critical financial information could be irretrievable. Implementing a robust backup and recovery strategy provides a safety net, preserving valuable financial data even in adverse circumstances.

Implementing these security measures reinforces the responsible use of complimentary credit card statement templates. Neglecting these considerations exposes sensitive financial information to significant risks, potentially compromising financial well-being. Prioritizing security ensures these templates remain valuable tools for financial management without jeopardizing the security of personal data. A comprehensive security approach safeguards against data breaches, unauthorized access, and data loss, promoting responsible and secure financial management practices.

5. Comprehensive Tracking

Comprehensive tracking within a complimentary credit card statement template forms the foundation for informed financial analysis and effective budgeting. Capturing a complete and detailed record of transactions provides valuable insights into spending patterns, facilitates accurate budgeting, and enhances financial control. This exploration delves into key facets of comprehensive tracking, illustrating their importance in maximizing the utility of these templates.

- Categorization GranularityDetailed categorization enables precise analysis of spending habits. Instead of broadly classifying purchases as “Entertainment,” a granular approach distinguishes between “Dining Out,” “Movies,” and “Concerts.” This detailed view reveals specific areas for potential budget adjustments. For example, if dining out constitutes a significant portion of entertainment expenses, targeted adjustments in this category can lead to substantial savings.

- Transaction Detail CaptureRecording comprehensive transaction details, including date, vendor, amount, and payment method, provides a richer context for analysis. Simply noting a $50 expense offers limited insight. However, documenting a $50 purchase at a specific grocery store on a particular date using a credit card allows tracking spending trends, identifying recurring purchases, and verifying transactions against official statements. This detailed information enhances accuracy and facilitates discrepancy resolution.

- Regular Recording FrequencyConsistent and frequent recording of transactions ensures a complete and accurate financial picture. Delaying entries or recording transactions in batches can lead to omissions and inaccuracies. Regular recording, ideally daily, minimizes the risk of overlooking transactions, ensuring a reliable dataset for analysis. This practice also reinforces mindful spending habits by promoting awareness of daily expenditures.

- Integration with Budgeting ToolsIntegrating tracking data with budgeting tools amplifies its value. Transferring categorized transaction data from the template to budgeting software or apps facilitates automated analysis, trend identification, and budget adherence monitoring. This integration streamlines the budgeting process and provides a dynamic view of financial progress. For example, automatically importing grocery expenses from the template into a budgeting app allows real-time monitoring of grocery spending against the allocated budget.

These interconnected facets of comprehensive tracking highlight the potential of complimentary credit card statement templates as powerful financial management tools. Leveraging these capabilities transforms the template from a simple record-keeping tool into a dynamic instrument for analyzing spending behavior, creating informed budgets, and ultimately, achieving financial goals. Comprehensive tracking empowers informed financial decisions, driving progress towards financial well-being.

6. Budgeting Assistance

Effective budgeting relies on a clear understanding of spending patterns. Complimentary credit card statement templates provide a valuable tool for gathering and organizing the necessary financial data to create and maintain realistic budgets. Utilizing these templates facilitates informed financial decisions, promotes responsible spending habits, and contributes to achieving financial goals. The following facets illustrate the connection between budgeting assistance and the utilization of these templates.

- Spending Pattern AnalysisCategorized transaction data within the template allows for detailed analysis of spending habits. Identifying trends, such as recurring monthly subscriptions or frequent dining-out expenses, provides valuable insights for budget allocation. For example, recognizing a consistent pattern of high spending on take-out coffee can inform a decision to reduce this expense and allocate the savings towards a financial goal, such as debt reduction.

- Budget Creation and AdjustmentAccurate spending data extracted from the template informs realistic budget creation. By understanding historical spending patterns, individuals can allocate appropriate funds to different categories, ensuring a balanced and achievable budget. Furthermore, tracking actual spending against the budget allows for adjustments throughout the budgeting period. If actual grocery expenses consistently exceed the allocated budget, adjustments can be made in other categories or to the overall grocery allocation.

- Goal Setting and TrackingIntegrating template data with financial goals enhances budget effectiveness. Allocating funds within the budget specifically towards goals like saving for a down payment or paying off debt provides a tangible framework for achieving financial aspirations. Tracking progress towards these goals by monitoring relevant expenses within the template reinforces positive financial behavior and motivates continued adherence to the budget.

- Variance Analysis and RefinementRegularly comparing actual spending recorded in the template against the budgeted amounts allows for variance analysis. Identifying discrepancies between planned and actual spending provides opportunities for budget refinement. If spending consistently exceeds the budget in a particular category, this analysis can prompt investigation into the underlying causes and inform strategies for better budget adherence in subsequent periods.

Complimentary credit card statement templates, through these facets, become integral tools for budgeting assistance. They empower individuals to analyze spending patterns, create realistic budgets, track progress towards financial goals, and refine budgeting strategies based on actual spending data. This informed approach to budgeting promotes responsible financial behavior, contributing to long-term financial well-being.

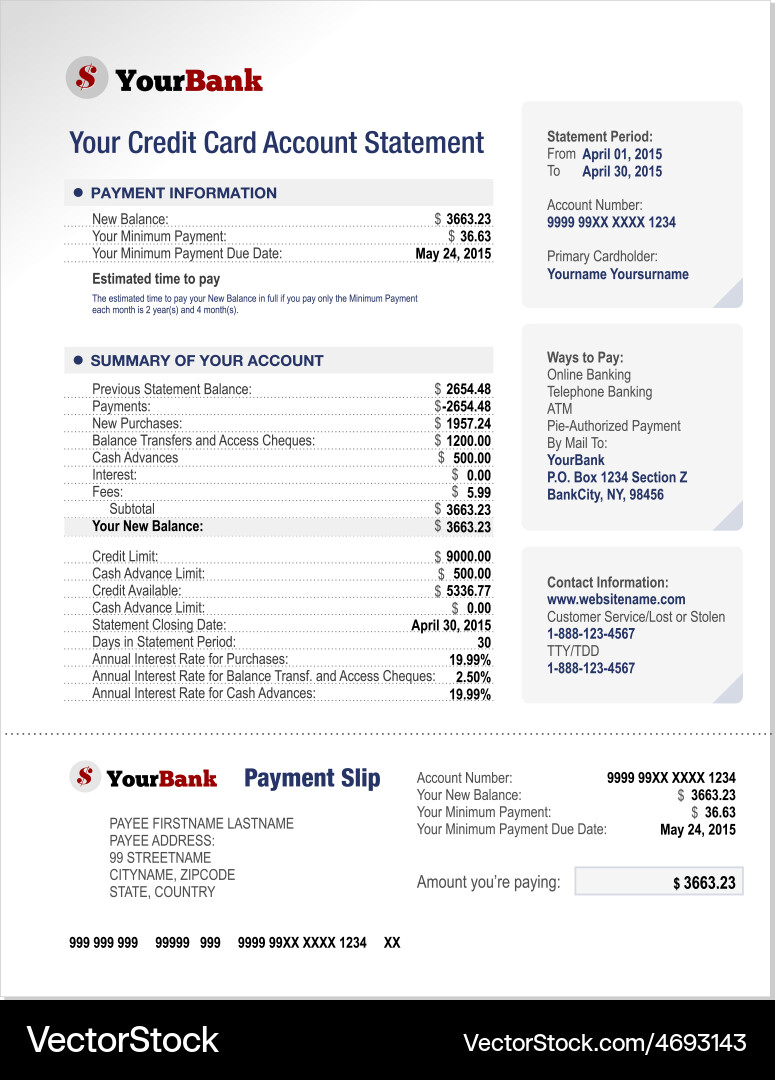

Key Components of a Complimentary Credit Card Statement Template

Essential elements comprise a well-structured complimentary credit card statement template. Understanding these components allows users to leverage these tools effectively for improved financial management.

1. Transaction Date: Accurate recording of transaction dates provides context for spending analysis and reconciliation with official bank statements. This allows identification of spending patterns and potential discrepancies.

2. Transaction Description/Merchant: Clear descriptions or merchant names provide specific details about each transaction, facilitating categorization and budget analysis. This component enables granular insights into spending habits.

3. Transaction Amount: Precise recording of transaction amounts ensures accurate balance calculations and facilitates reconciliation. This fundamental element supports accurate financial tracking.

4. Payment Type: Noting the payment method (e.g., credit, debit, cash) allows for more nuanced tracking and analysis of spending behavior. This categorization aids in understanding payment preferences and managing various accounts.

5. Category/Budget Allocation: Assigning transactions to specific budget categories (e.g., groceries, utilities, entertainment) facilitates organized tracking and analysis of spending within designated budget areas. This promotes effective budget management and identification of areas for potential adjustments.

6. Running Balance: Maintaining a running balance after each transaction provides a real-time overview of available funds and spending trends. This dynamic view enables proactive financial management.

7. Statement Period: Clearly defining the statement period ensures accurate record-keeping and facilitates comparison with official bank statements. This element promotes organized financial management and simplifies reconciliation processes.

8. Account Information: Including account details, such as account number and cardholder name, ensures accurate record association and supports efficient management of multiple accounts. This organizational feature enhances clarity and facilitates record-keeping.

These components work together to create a comprehensive and informative record of financial activity, enabling effective tracking, analysis, and budget management. Leveraging these elements facilitates informed financial decision-making and promotes responsible financial practices.

How to Create a Complimentary Credit Card Statement Template

Creating a personalized template provides a flexible, adaptable tool for managing financial records. The following steps outline the process for generating a complimentary credit card statement template.

1. Choose a Software Application: Spreadsheet software (e.g., Google Sheets, Microsoft Excel, LibreOffice Calc) offers robust functionality for creating templates. Their inherent calculation capabilities and formatting flexibility support accurate financial tracking and analysis.

2. Define the Statement Period: Establish a clear timeframe for the statement, such as a month or a billing cycle. This ensures consistency and facilitates reconciliation with official bank statements.

3. Create Column Headers: Establish columns for essential data points. These typically include “Transaction Date,” “Description/Merchant,” “Amount,” “Payment Type,” “Category,” and “Running Balance.”

4. Incorporate Formulas for Calculations: Utilize formulas to automate calculations, particularly for the “Running Balance” column. This ensures accuracy and minimizes manual effort.

5. Customize Categories: Tailor spending categories to reflect individual spending habits and budgeting priorities. This personalized approach facilitates more targeted analysis and budget management.

6. Implement Data Validation: Where applicable, use data validation features to ensure data integrity. Restricting input to specific formats (e.g., dates, numbers) minimizes errors and ensures consistency.

7. Add Account Information (Optional): Include account details, such as account number and cardholder name, for enhanced organization, especially when managing multiple accounts.

8. Test and Refine: Enter sample transactions to test the template’s functionality and identify potential areas for improvement. Refine formulas, formatting, and categories as needed.

A well-structured template provides a framework for organizing financial transactions and gaining valuable insights into spending patterns. Regular use, accurate data entry, and periodic review contribute to effective financial management.

Effective personal financial management necessitates meticulous record-keeping and analysis. Leveraging complimentary credit card statement templates provides a readily available, customizable resource for tracking expenditures, understanding spending patterns, and informing budget decisions. Accessibility, customization options, and the ability to maintain accurate, secure records contribute significantly to the template’s utility. Comprehensive tracking, coupled with integration into budgeting practices, further empowers informed financial decision-making. Understanding the key components and creation process maximizes the benefits derived from these valuable tools.

Informed financial decisions contribute significantly to long-term financial well-being. Adopting proactive financial management practices, facilitated by tools such as complimentary credit card statement templates, empowers individuals to take control of their financial health and work towards achieving financial goals. Regular review and analysis of financial records contribute to a more secure and stable financial future.