Utilizing a readily available, downloadable format offers several advantages. It facilitates quick and easy financial tracking, which is essential for informed decision-making. This accessibility can save businesses time and resources, allowing them to focus on core operations. Furthermore, a customizable version can be adapted to suit specific business needs, providing a tailored solution for various industries and organizational structures. The ability to readily print the statement facilitates sharing with stakeholders, such as investors or lenders, and provides physical documentation for record-keeping purposes.

This foundation of understanding the purpose and benefits of an easily accessible and adaptable profit and loss statement will serve as a basis for exploring topics such as how to choose the right template, how to use it effectively, and various examples demonstrating its application in different business contexts.

1. Accessibility

Accessibility, in the context of a no-cost, readily printable profit and loss statement template, refers to the ease with which businesses can obtain and utilize this crucial financial tool. This ease of access is a defining characteristic, removing significant barriers faced by smaller entities or startups often lacking the resources for expensive accounting software or professional services. A readily available template, downloadable from various online sources, democratizes access to structured financial reporting. For example, a small bakery can download a template and immediately begin tracking income and expenses, contributing to more informed decisions about pricing and ingredient sourcing. This contrasts sharply with the potential complexities and costs associated with proprietary software implementation or reliance on external accounting expertise.

The practical implications of this accessibility are significant. It fosters better financial management practices, even within organizations with limited resources. The ability to readily generate and analyze financial statements allows for timely identification of trends, potential issues, and opportunities for growth. Consider a freelance consultant: using a readily accessible template allows them to track project revenue against expenses, providing a clear picture of profitability and informing future pricing strategies. Furthermore, readily accessible templates often come in commonly used file formats like spreadsheets, further enhancing usability and integration with existing tools.

In summary, accessibility significantly impacts the utility of a readily printable profit and loss statement template. It empowers businesses of all sizes to engage in sound financial practices, contributing to improved decision-making, enhanced growth prospects, and overall financial health. While challenges such as data security and ensuring template accuracy remain important considerations, the inherent accessibility of these templates represents a significant step toward more inclusive and effective financial management practices.

2. Customizability

Customizability is a critical feature of a readily printable profit and loss statement template, enabling its adaptation to diverse business needs and industry-specific requirements. A template’s capacity for modification allows organizations to tailor financial reporting to reflect unique operational structures, cost categories, and revenue streams. This adaptability distinguishes a truly valuable template from a rigid, one-size-fits-all solution.

- Industry-Specific AdaptationsDifferent industries possess unique financial reporting needs. A restaurant, for instance, requires detailed tracking of food costs, labor, and occupancy expenses, while a consulting firm focuses on billable hours and project-related expenditures. Customizable templates allow adjustments to line items, calculations, and reporting categories to align precisely with these distinct requirements. This granular control facilitates more accurate financial analysis and informed decision-making within specific sectors.

- Scalability for GrowthAs businesses expand, their financial reporting requirements evolve. A customizable template accommodates growth by allowing the addition of new revenue streams, cost centers, and departments. This scalability ensures the template remains a relevant tool throughout a company’s lifecycle. A startup initially tracking basic revenue and expenses can later adapt the same template to reflect increased complexity as operations expand, avoiding the need for a complete system overhaul.

- Integration with Existing SystemsCustomizable templates often offer compatibility with existing software and accounting systems. The ability to export data in various formats or directly integrate with spreadsheet software streamlines financial reporting processes. This interoperability minimizes manual data entry, reducing errors and saving time. For example, a template designed to integrate with spreadsheet software can automate calculations and generate charts for visual representation of financial performance.

- Enhanced Clarity and CommunicationCustomizable templates allow businesses to tailor the presentation of financial information to specific audiences. Reports can be modified to highlight key performance indicators (KPIs) relevant to investors, lenders, or internal management. This focused communication improves transparency and facilitates better understanding of financial performance. Adding visual elements, like charts and graphs, further enhances communication and aids in identifying trends and potential issues.

The customizability of a readily printable profit and loss statement template directly contributes to its efficacy as a financial management tool. By offering adaptability across industries, scalability for growth, integration capabilities, and enhanced communication features, a customizable template empowers businesses to maintain accurate, relevant, and insightful financial records. This flexibility translates into better informed decision-making, improved resource allocation, and ultimately, greater financial success.

3. Accuracy

Accuracy in a readily printable profit and loss statement template is paramount for sound financial management. Inaccurate data renders financial analysis meaningless, leading to flawed decision-making and potentially jeopardizing business health. Ensuring data integrity within these templates requires careful consideration of several key facets.

- Data Entry ValidationTemplates should incorporate features that minimize data entry errors. Dropdown menus for expense categories or automated calculations can reduce manual input, mitigating the risk of typographical errors or incorrect formulas. A template that automatically calculates totals and subtotals based on entered values reduces the chance of mathematical mistakes, a common source of inaccuracy in manual spreadsheets. This ensures figures reflect actual financial performance accurately.

- Formula IntegrityPre-built formulas within the template must be accurate and reliable. Incorrect formulas can lead to significant discrepancies in calculated profits or losses. Regularly reviewing and verifying the underlying formulas is crucial, especially when adapting a template to specific business needs. For example, a template designed for a service-based business might require a different formula for calculating gross profit compared to one designed for a product-based business.

- Consistent Data InputMaintaining consistent data input practices is essential for accuracy. Using standardized formats for dates, currency, and numerical values avoids ambiguity and ensures data consistency across reporting periods. For instance, consistently using a specific date format prevents errors in calculations based on time periods. Similarly, consistent currency usage eliminates potential issues arising from exchange rate fluctuations.

- Regular ReconciliationRegularly reconciling the data within the template with bank statements, invoices, and other financial records is crucial for identifying and correcting discrepancies. This process validates the accuracy of the information within the template and provides an opportunity to catch errors early. Monthly reconciliation, for example, allows businesses to identify and rectify discrepancies promptly, ensuring the profit and loss statement reflects the actual financial position.

These facets of accuracy are essential considerations when utilizing readily printable profit and loss statement templates. Maintaining accurate financial records is the cornerstone of informed decision-making. Negligence in ensuring data accuracy can lead to misinterpretations of financial performance, potentially hindering growth and jeopardizing long-term sustainability. Choosing a well-designed template and adhering to rigorous data management practices ensures the reliability of financial analysis, enabling businesses to make sound decisions based on a clear and accurate understanding of their financial position.

4. Simplicity

Simplicity in a readily printable profit and loss statement template is crucial for its effectiveness. A straightforward, uncluttered design promotes ease of use, reduces the likelihood of errors, and ensures that the financial information presented is readily understandable, even for individuals without extensive accounting expertise. This clarity is especially valuable for smaller businesses or startups where financial management may be handled by individuals with diverse skill sets.

- Clear Layout and StructureA well-designed template presents information in a logical, organized manner, facilitating quick comprehension. Clear section headings, distinct line items, and a consistent visual hierarchy guide users through the statement, enabling efficient data entry and analysis. For example, a template with clearly labeled sections for revenue, cost of goods sold, and operating expenses simplifies the process of categorizing and recording financial transactions.

- User-Friendly TerminologyAvoiding complex accounting jargon in favor of straightforward language makes the template accessible to a broader audience. Replacing technical terms with more common equivalents improves understanding and reduces the risk of misinterpretation. For example, using “Sales” instead of “Revenue” or “Expenses” instead of “Expenditures” enhances clarity for users unfamiliar with accounting terminology. This straightforward approach ensures that the information conveyed is readily accessible and actionable.

- Minimalist DesignA clean, minimalist design avoids unnecessary visual clutter, improving focus and readability. Excessive formatting, complex charts, or unnecessary graphics can distract from the essential financial data. A template with a simple, uncluttered design allows users to quickly identify key figures and trends without being overwhelmed by extraneous visual elements. This streamlined presentation enhances the template’s practicality and facilitates efficient financial analysis.

- Intuitive NavigationTemplates should be easy to navigate, with clear instructions and intuitive functionality. Logical placement of data entry fields, automated calculations, and clear guidance on how to use the template improve user experience and minimize the learning curve. A template with built-in formulas for calculating totals and subtotals, for example, simplifies the data entry process and reduces the risk of errors. This intuitive design encourages consistent and accurate use of the template.

These facets of simplicity contribute significantly to the utility of a readily printable profit and loss statement template. A straightforward design empowers individuals with varying levels of financial expertise to effectively track, analyze, and understand their business’s financial performance. This enhanced accessibility promotes sound financial management practices, contributing to better decision-making and ultimately, improved business outcomes.

5. Comprehensiveness

Comprehensiveness in a readily printable profit and loss statement template refers to its capacity to capture all essential elements of a business’s financial performance within a specific period. A comprehensive template provides a holistic view of financial health, enabling informed decision-making and strategic planning. This comprehensive overview is crucial for understanding profitability, identifying areas for improvement, and tracking progress towards financial goals.

- Inclusion of Key Financial ElementsA comprehensive template incorporates all fundamental components of a profit and loss statement, including revenue streams, cost of goods sold (COGS), operating expenses, and net income. Omitting any of these core elements undermines the accuracy and utility of the statement. For example, a template that excludes operating expenses like rent or utilities provides an incomplete picture of profitability, potentially misleading users about the true financial status of the business. Accurate representation of all revenue and expense categories is essential for a complete financial overview.

- Detailed Breakdown of CategoriesComprehensiveness extends beyond simply listing top-level categories. Detailed subcategories within each section provide a granular view of financial activity, enabling more precise analysis. Breaking down operating expenses into individual line items like rent, utilities, marketing, and salaries provides a more insightful view of where money is being spent compared to a single, aggregated “operating expenses” figure. This granular detail allows for identification of specific areas for cost optimization or investment.

- Flexibility for Diverse Business ModelsA truly comprehensive template accommodates various business models and industry-specific requirements. Whether a business is product-based, service-oriented, or a hybrid, the template should offer the flexibility to capture relevant revenue and expense categories. A template designed for a retail business might include sections for inventory and cost of goods sold, while one for a consulting firm might prioritize billable hours and project-related expenses. This adaptability ensures the template remains relevant and useful across diverse operational structures.

- Integration with Other Financial StatementsWhile the profit and loss statement provides a snapshot of financial performance over a specific period, its value is amplified when viewed in conjunction with other financial statements like the balance sheet and cash flow statement. A comprehensive template facilitates this integrated analysis by aligning data structures and terminology with these related reports. This interconnectedness allows for a more holistic understanding of financial health, revealing the interplay between profitability, assets, liabilities, and cash flow.

The comprehensiveness of a readily printable profit and loss statement template directly impacts its ability to provide meaningful insights into a business’s financial performance. By including all key financial elements, offering detailed breakdowns, accommodating diverse business models, and facilitating integration with other financial statements, a comprehensive template equips businesses with the information necessary for informed decision-making, strategic planning, and long-term financial success. A lack of comprehensiveness can lead to incomplete or misleading analysis, hindering a business’s ability to identify areas for improvement and capitalize on growth opportunities. Therefore, prioritizing comprehensiveness when selecting a template is crucial for effective financial management.

6. Compatibility

Compatibility, regarding readily printable profit and loss statement templates, signifies the ability to seamlessly integrate with existing software, operating systems, and other business tools. This interoperability is a critical factor influencing a template’s practical utility. A compatible template streamlines workflows, reduces manual data entry, and facilitates efficient financial reporting.

- Software CompatibilityCompatibility with commonly used spreadsheet software (e.g., Microsoft Excel, Google Sheets, LibreOffice Calc) is essential. Templates should open and function correctly within these programs, enabling users to leverage existing software functionalities like formulas, charting, and data analysis tools. A template compatible with spreadsheet software allows for automated calculations of totals, subtotals, and key financial ratios, minimizing manual effort and reducing the risk of errors. Conversely, incompatibility can lead to formatting issues, corrupted data, and the inability to utilize essential software features.

- Operating System CompatibilityTemplates should function seamlessly across various operating systems (e.g., Windows, macOS, Linux). This cross-platform compatibility ensures accessibility for users regardless of their preferred operating system. A template designed to work flawlessly across different operating systems eliminates the need for platform-specific versions, simplifying distribution and usage within diverse technological environments. Incompatibility can restrict access for certain users, hindering collaboration and efficient information sharing.

- File Format CompatibilityTemplates offered in commonly used file formats (e.g., .xls, .xlsx, .csv, .ods) maximize accessibility and interoperability. These formats are generally supported by a wide range of software applications, facilitating data exchange and integration with other business tools. A template available in a widely supported file format can be readily imported into various accounting software packages, databases, or reporting tools. Conversely, less common or proprietary file formats can limit usability and create integration challenges.

- Hardware CompatibilityWhile less critical than software compatibility, consideration should be given to hardware limitations, particularly for businesses operating in resource-constrained environments. Templates with large file sizes or complex formatting might pose challenges for older or less powerful hardware. A template designed with efficiency in mind minimizes processing requirements and ensures smooth performance even on less powerful devices. This consideration expands access and usability for businesses operating with limited technological resources.

Compatibility considerations significantly influence the usability and effectiveness of readily printable profit and loss statement templates. A compatible template seamlessly integrates into existing workflows, promoting efficiency and accuracy in financial reporting. Conversely, incompatibility issues can lead to frustration, data loss, and limitations in leveraging available tools and technologies. Therefore, careful assessment of compatibility factors is essential for selecting a template that optimizes functionality and supports streamlined financial management practices.

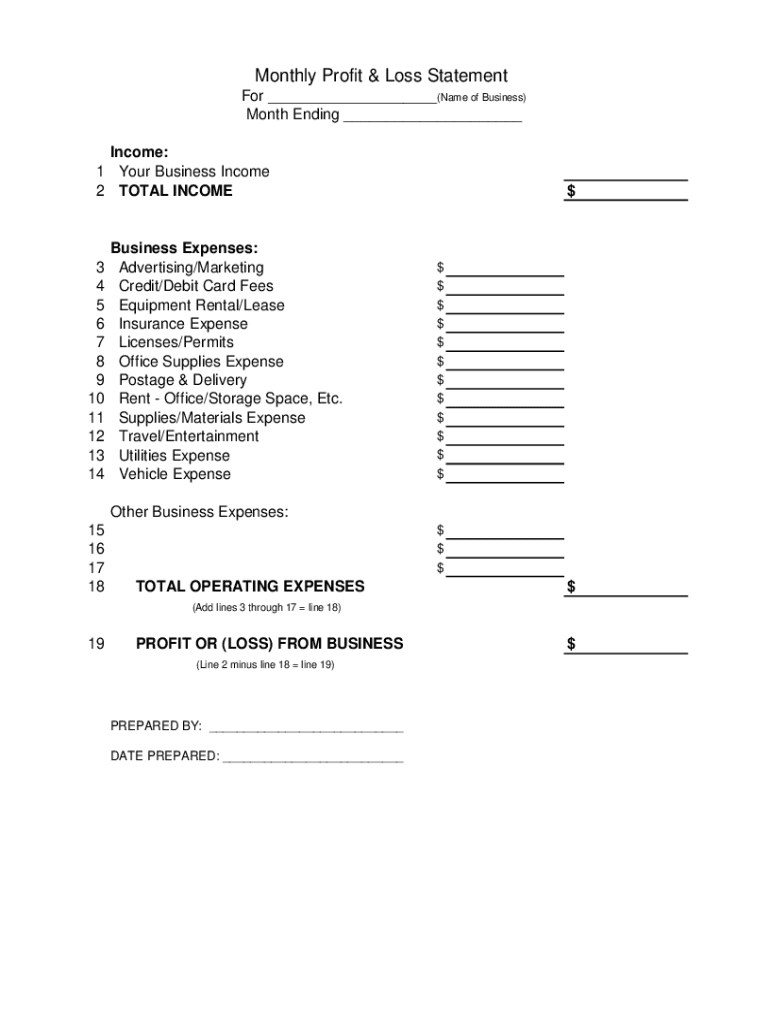

Key Components of a Profit and Loss Statement Template

Essential elements comprise a robust, readily available profit and loss statement template. Understanding these components is crucial for accurate financial reporting and analysis.

1. Revenue: This section details all income generated from business operations, including sales of goods or services. Accurate revenue reporting is fundamental to understanding overall financial performance. Different revenue streams should be itemized for a clear breakdown.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is critical for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profitability of core business operations before accounting for operating expenses.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Examples include rent, salaries, marketing, and administrative costs. Categorizing operating expenses provides insights into cost structures.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects profitability after accounting for day-to-day business operations.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income or expense, gains or losses from investments, and one-time events.

7. Net Income: Representing the bottom line, net income is calculated as Operating Income plus Other Income/Expenses. This figure reflects the overall profitability of the business after all income and expenses are considered.

Accurate and detailed reporting within each of these components provides a clear and comprehensive picture of financial performance, enabling informed decision-making and effective strategic planning. This structured approach allows for identification of areas for improvement, optimization of resource allocation, and ultimately contributes to sustainable business growth.

How to Create a Free Printable Profit and Loss Statement Template

Creating a profit and loss statement template requires careful planning and structuring to ensure accuracy and usability. The following steps outline the process of developing a template suitable for various business needs.

1. Choose a Software Application: Spreadsheet software (e.g., Microsoft Excel, Google Sheets, LibreOffice Calc) is generally recommended due to its formula capabilities and formatting flexibility. Selecting the appropriate software ensures wide accessibility and compatibility.

2. Establish Reporting Periods: Define the timeframe for the statement (e.g., monthly, quarterly, annually). Consistent reporting periods facilitate accurate performance tracking and trend analysis over time. This establishes a standardized timeframe for financial review.

3. Structure the Template: Create distinct sections for key components: Revenue, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, Operating Income, Other Income/Expenses, and Net Income. A logical structure ensures clear and organized financial reporting. This organized structure aids in clear data presentation.

4. Define Revenue Categories: Itemize specific revenue streams (e.g., product sales, service fees, subscriptions). Detailed categorization allows for analysis of individual revenue sources and their contribution to overall performance. This detailed view allows for strategic revenue analysis.

5. Detail Cost of Goods Sold: For product-based businesses, specify direct costs associated with production (e.g., raw materials, direct labor). Accurate COGS calculation is crucial for determining profitability. This allows for accurate gross profit calculations.

6. Categorize Operating Expenses: List all operational costs (e.g., rent, salaries, marketing, utilities). Categorizing expenses facilitates cost management and analysis. This categorization allows for identification of potential cost-saving measures.

7. Incorporate Formulas: Utilize formulas for automated calculations (e.g., Gross Profit = Revenue – COGS; Net Income = Operating Income + Other Income/Expenses). Automated calculations minimize manual data entry and reduce the risk of errors. Automated calculations enhance accuracy and efficiency.

8. Format for Clarity: Use clear labels, consistent formatting, and appropriate font sizes. A well-formatted template enhances readability and comprehension. Clear formatting improves usability and professional presentation.

A well-structured template facilitates accurate data entry, automated calculations, and clear presentation of financial performance, contributing to informed decision-making and effective financial management. Regular review and refinement of the template ensure its continued relevance and utility as business needs evolve.

Readily available, no-cost profit and loss statement templates offer valuable tools for businesses seeking to monitor and analyze financial performance. Understanding key aspects like customizability, accuracy, simplicity, and compatibility is crucial for selecting and effectively utilizing these templates. From accessibility for resource-constrained businesses to detailed categorization of income and expenses, these templates provide a structured framework for informed financial decision-making. Careful consideration of each component, from revenue streams to operating expenses, ensures a comprehensive understanding of profitability and overall financial health.

Effective financial management hinges on accurate and accessible data. Leveraging readily available, printable templates represents a practical step toward informed financial practices. Regularly reviewing and analyzing financial data through these templates empowers businesses to identify trends, address challenges, and make strategic decisions that contribute to long-term growth and sustainability. The ability to adapt and refine these templates to evolving business needs ensures their continued value as essential tools for financial success.