Access to this organized record offers several advantages. It empowers employees to monitor their earnings and available leave, facilitating better financial planning and informed time-off requests. For employers, it streamlines payroll processes and ensures accurate record-keeping, reducing potential disputes and supporting compliance with labor regulations. A standardized format also promotes transparency and builds trust between employers and employees.

This foundation of understanding paves the way for a deeper exploration of related topics, such as payroll management best practices, legal requirements for wage and hour reporting, and strategies for optimizing employee leave policies.

1. Standardized Format

A standardized format is fundamental to a leave and earning statement template. Consistency ensures clarity, simplifies interpretation, and streamlines payroll processes. Standardization facilitates efficient data analysis, reduces errors, and supports compliance with regulatory requirements.

- Consistent LayoutA consistent layout ensures all essential information is presented in a predictable and organized manner. For example, sections for employee identification, pay period, earnings, deductions, and leave balances should always appear in the same order. This predictability simplifies review and reduces the likelihood of overlooking critical data. A standardized layout also facilitates automated data extraction and reporting.

- Uniform TerminologyUsing uniform terminology across all statements prevents confusion and ensures clear communication. Terms like “gross pay,” “net pay,” “year-to-date earnings,” and “accrued vacation time” should have consistent definitions. This clarity minimizes misunderstandings and supports accurate interpretation of the information presented.

- Defined Calculation MethodsClearly defined calculation methods for earnings, deductions, and leave accrual are essential for transparency and accuracy. Formulas for calculating overtime pay, tax withholdings, and leave accrual rates should be documented and consistently applied. This transparency builds trust and ensures fairness. Defined calculations also simplify audits and facilitate compliance with labor regulations.

- Accessibility ConsiderationsStandardization also extends to accessibility. The format should be easily readable and understandable, accommodating employees with diverse needs. For example, providing statements in multiple languages or formats (e.g., large print) ensures inclusivity and equal access to critical payroll information. This inclusivity fosters a supportive and equitable work environment.

These facets of a standardized format contribute significantly to the effectiveness of a leave and earning statement template. By promoting clarity, accuracy, and accessibility, a standardized format strengthens the value of these documents for both employers and employees, facilitating efficient payroll management and informed financial decision-making.

2. Accurate Calculations

Accuracy in calculations forms the bedrock of a reliable leave and earning statement template. Errors in calculating wages, deductions, or leave accrual can have significant consequences, impacting employee morale, financial stability, and organizational compliance. A robust template must prioritize precise calculations to ensure fairness, transparency, and legal adherence. For instance, an incorrect calculation of overtime pay could lead to underpayment, potentially resulting in legal disputes and reputational damage. Similarly, miscalculating tax withholdings can create liabilities for both the employer and the employee.

The practical significance of accurate calculations extends beyond individual paychecks. Precise record-keeping within the template facilitates accurate reporting for tax purposes, benefits administration, and financial audits. Errors can trigger costly corrections, penalties, and audits, consuming valuable time and resources. Moreover, inaccuracies erode employee trust, potentially leading to decreased morale and productivity. A well-designed template incorporates validation rules and automated checks to minimize the risk of errors. For example, formulas within the template can automatically calculate gross pay based on hours worked and pay rate, minimizing manual data entry and reducing the potential for human error.

In summary, accurate calculations are not merely a desirable feature but a non-negotiable requirement of a reliable leave and earning statement template. They underpin financial integrity, legal compliance, and positive employee relations. Prioritizing accuracy through automated calculations, validation rules, and regular audits strengthens the template’s role as a crucial tool for transparent and efficient payroll management.

3. Clear Presentation

Clear presentation within a leave and earning statement template is essential for ensuring comprehension and usability. A well-designed template prioritizes clarity to facilitate quick and accurate interpretation of the information presented. This clarity contributes to informed financial decision-making by employees and streamlines payroll management for employers. A poorly presented statement, regardless of its accuracy, can lead to confusion, errors, and wasted time.

- Logical StructureA logical structure guides the reader through the information in a natural, intuitive flow. Grouping related data, such as different types of earnings or deductions, enhances readability. For example, presenting all earnings together, followed by all deductions, creates a clear and organized structure. This logical flow minimizes cognitive effort and allows for efficient information retrieval.

- Visual HierarchyVisual hierarchy uses design elements like font size, weight, and spacing to emphasize key information and guide the reader’s eye. Clear headings and subheadings separate different sections, while bolding key figures like net pay makes them easily identifiable. For example, clearly distinguishing gross pay from net pay through visual cues prevents misinterpretations and ensures focus on essential data.

- Concise LanguageConcise language avoids jargon and technical terms, using plain language that is easily understood by all employees. Instead of using complex abbreviations, the template should use clear, descriptive terms. For example, “YTD” might be replaced with “Year-to-Date Earnings” to ensure universal understanding. This clarity reduces the potential for misinterpretation and fosters transparency.

- Uncluttered DesignAn uncluttered design avoids excessive visual elements that can distract from the essential information. Whitespace, consistent font usage, and a balanced layout contribute to a clean, professional appearance. Avoiding unnecessary lines, boxes, or shading prevents visual overload and ensures the data remains the focal point. This streamlined presentation enhances readability and professionalism.

These facets of clear presentation contribute significantly to the effectiveness of a leave and earning statement template. By prioritizing logical structure, visual hierarchy, concise language, and uncluttered design, the template becomes a valuable tool for transparent communication and efficient payroll management, empowering both employers and employees.

4. Comprehensive Data

Comprehensive data is a cornerstone of an effective leave and earning statement template. A complete and detailed record of earnings, deductions, and leave accrual is crucial for both employer and employee. This data transparency fosters trust, facilitates informed decision-making, and supports compliance with regulatory requirements. The absence of comprehensive data can lead to confusion, disputes, and potential legal challenges. For example, an incomplete record of overtime hours could lead to underpayment and subsequent legal action. Similarly, missing details regarding deductions for benefits or retirement contributions can create discrepancies and erode employee trust.

The practical implications of comprehensive data extend beyond individual payroll records. Aggregated data from leave and earning statements provides valuable insights for organizational planning and decision-making. Accurate data on total payroll costs, employee benefits utilization, and leave trends informs strategic decisions related to budgeting, staffing, and benefits administration. This data-driven approach optimizes resource allocation and supports long-term organizational success. Furthermore, comprehensive data plays a critical role in ensuring compliance with labor laws and tax regulations. Accurate record-keeping facilitates accurate reporting, minimizing the risk of penalties and audits.

In conclusion, the inclusion of comprehensive data within a leave and earning statement template is not merely a best practice but a fundamental requirement. It supports accurate payroll processing, informed decision-making, and regulatory compliance. This data transparency strengthens the employer-employee relationship, fosters trust, and contributes to a more stable and efficient work environment. Challenges related to data privacy and security must be addressed through robust data protection measures and adherence to relevant regulations. Integrating comprehensive data within the framework of a well-designed template empowers organizations to leverage the full potential of payroll data for strategic advantage.

5. Accessibility for Employees

Effortless access to leave and earning statements is crucial for employee empowerment and financial well-being. Accessibility ensures that individuals can readily review their compensation, deductions, and leave balances, promoting transparency and informed financial planning. Restricted access can create barriers to understanding one’s financial situation, potentially leading to confusion, errors, and financial instability. A well-designed template prioritizes accessibility, considering diverse employee needs and technological limitations.

- Multiple FormatsOffering statements in various formats caters to diverse preferences and technological capabilities. Providing options such as PDF, online portals, and printed copies ensures access regardless of individual circumstances. For example, employees without reliable internet access benefit from printed statements, while tech-savvy individuals might prefer accessing information through a secure online portal. This flexibility ensures inclusivity and equitable access to critical payroll information.

- Mobile CompatibilityIn today’s mobile-centric world, ensuring mobile compatibility is paramount. Statements should be easily viewable and navigable on smartphones and tablets, allowing employees to access their information anytime, anywhere. Mobile compatibility empowers individuals to conveniently track their earnings and leave balances, facilitating proactive financial management and informed decision-making on the go.

- User-Friendly InterfaceRegardless of the chosen format, a user-friendly interface is essential. A clear, intuitive layout, concise language, and logical organization simplify navigation and comprehension. For example, using clear headings, visual cues, and consistent terminology facilitates quick access to desired information. This user-centric design minimizes cognitive effort and ensures a positive user experience.

- Assistive Technology CompatibilityTemplates should be compatible with assistive technologies, such as screen readers and text-to-speech software, to ensure accessibility for employees with disabilities. This inclusivity reflects a commitment to equal access to information and supports a diverse and inclusive workforce. Adhering to accessibility guidelines demonstrates a commitment to inclusivity and ensures all employees can access their payroll information regardless of individual needs.

These accessibility considerations directly impact the effectiveness of a leave and earning statement template. By prioritizing multiple formats, mobile compatibility, user-friendly interfaces, and assistive technology compatibility, organizations empower their employees with convenient and equitable access to critical financial information. This transparency strengthens the employer-employee relationship and promotes a culture of trust and open communication. Furthermore, accessible templates contribute to a more inclusive and equitable workplace, ensuring all individuals have the tools they need to manage their finances effectively.

6. Legal Compliance

Legal compliance forms a non-negotiable foundation for any leave and earning statement template. Templates must adhere to relevant employment laws and regulations, encompassing accurate wage calculations, lawful deductions, and transparent reporting. Failure to comply can result in substantial penalties, legal action, and reputational damage. For instance, incorrect calculation or reporting of overtime pay can violate the Fair Labor Standards Act (FLSA) in the United States, leading to significant fines and back pay obligations. Similarly, non-compliance with data privacy regulations, such as GDPR in Europe, can result in substantial penalties. A compliant template mitigates these risks, safeguarding both the organization and its employees.

Several legal requirements directly impact template design and content. Wage and hour laws mandate accurate tracking and reporting of hours worked, regular pay rates, and overtime calculations. Tax laws dictate accurate withholding and reporting of federal, state, and local taxes. Additionally, data privacy regulations necessitate secure handling and storage of sensitive employee information. A robust template incorporates these requirements seamlessly, ensuring accurate calculations, transparent reporting, and secure data management. Templates must also adapt to evolving legal landscapes. Changes in minimum wage laws, tax rates, or data privacy regulations necessitate template updates to maintain compliance. Regular review and updates are essential to mitigate legal risks and ensure ongoing adherence to current legislation.

In conclusion, legal compliance is not merely a desirable feature but a critical requirement for any leave and earning statement template. A compliant template protects organizations from legal challenges, fosters trust with employees, and contributes to a fair and transparent work environment. Neglecting legal compliance exposes organizations to significant risks, potentially jeopardizing financial stability and reputation. A proactive approach to compliance, incorporating regular reviews and updates, safeguards organizations and their employees, ensuring adherence to evolving legal standards. This commitment to legal compliance strengthens the template’s role as a crucial tool for ethical and sustainable payroll management.

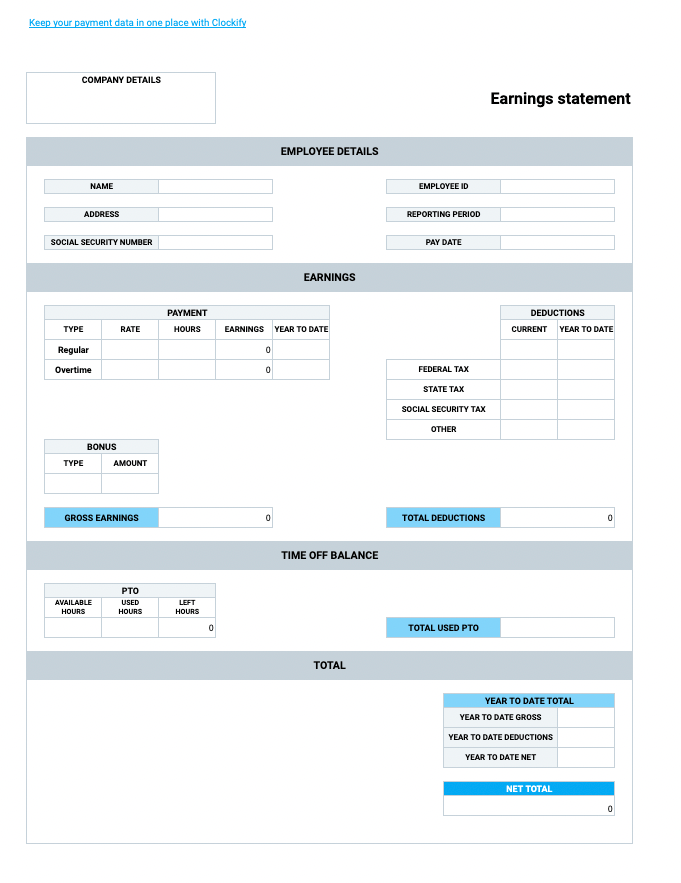

Key Components of a Leave and Earning Statement Template

A comprehensive leave and earning statement template requires specific components to ensure clarity, accuracy, and legal compliance. These components contribute to transparent communication between employers and employees, facilitating informed financial decisions and efficient payroll management.

1. Employee Information: This section accurately identifies the employee and includes details such as full name, employee ID, department, and job title. Accurate employee identification is crucial for proper record-keeping and payroll processing.

2. Pay Period: The pay period covered by the statement must be clearly defined, specifying the start and end dates. A defined pay period ensures accurate calculation of earnings and deductions for the specific timeframe.

3. Earnings: This section details all forms of compensation earned during the pay period, including regular wages, overtime pay, bonuses, and commissions. A clear breakdown of earnings promotes transparency and allows employees to verify the accuracy of their compensation.

4. Deductions: All deductions from gross pay are itemized in this section, including taxes (federal, state, local), retirement contributions, health insurance premiums, and other voluntary deductions. Transparent reporting of deductions fosters trust and ensures accurate calculation of net pay.

5. Leave Accrual and Balances: This section provides a summary of accrued leave time, including vacation time, sick leave, and other types of leave. Clear presentation of leave balances empowers employees to manage their time off effectively and make informed decisions regarding leave requests.

6. Net Pay: This crucial component displays the total amount of compensation after all deductions, representing the actual take-home pay for the employee. Accurate calculation and clear presentation of net pay are fundamental to ensuring employee satisfaction and financial stability.

7. Year-to-Date (YTD) Totals: YTD totals provide a cumulative overview of earnings, deductions, and leave balances for the current year. These totals facilitate long-term financial planning and provide valuable context for understanding overall compensation and leave usage.

8. Employer Information: This section includes essential information about the employer, such as company name, address, and contact information. This information is crucial for addressing inquiries or resolving any discrepancies related to the statement.

Accurate data presentation, clear categorization, and adherence to legal requirements ensure the template’s efficacy as a valuable tool for both employers and employees. These components working in concert contribute to a transparent and efficient payroll process, supporting informed financial decisions and promoting a positive employer-employee relationship.

How to Create a Leave and Earning Statement Template

Creating a robust and compliant leave and earning statement template requires careful planning and consideration of various factors. A well-designed template ensures accurate record-keeping, promotes transparency, and facilitates compliance with legal requirements. The following steps outline the process:

1. Define Template Objectives: Clearly outline the purpose and scope of the template. Determine the specific information to be included and the target audience. Consider legal requirements, internal policies, and reporting needs. This foundational step ensures the template aligns with organizational objectives and regulatory frameworks.

2. Select Software or Method: Choose an appropriate method for creating the template. Options include spreadsheet software, dedicated payroll software, or custom-developed solutions. Consider factors such as scalability, data security, and integration with existing systems. The chosen method must support accurate calculations, secure data storage, and efficient report generation.

3. Design Template Layout: Structure the template logically, grouping related information and using clear headings. Prioritize readability and visual clarity. Consider accessibility requirements for users with disabilities. A well-designed layout facilitates efficient data entry, review, and interpretation.

4. Incorporate Key Components: Include essential elements such as employee information, pay period, earnings, deductions, leave accrual and balances, net pay, year-to-date totals, and employer information. Ensure accurate data mapping and validation rules to minimize errors. Comprehensive data inclusion promotes transparency and supports informed decision-making.

5. Implement Calculations and Formulas: Integrate accurate formulas for calculating gross pay, deductions, net pay, and leave accrual. Automate calculations where possible to minimize manual data entry and reduce errors. Implement validation rules to ensure data integrity and prevent inconsistencies.

6. Ensure Legal Compliance: Adhere to all relevant employment laws and regulations, including wage and hour laws, tax regulations, and data privacy requirements. Consult legal counsel to ensure compliance and mitigate potential risks. Regularly review and update the template to reflect changes in legislation.

7. Test and Refine: Thoroughly test the template with sample data to identify and correct any errors or inconsistencies. Solicit feedback from users to improve usability and address any practical challenges. Ongoing refinement ensures the template remains accurate, efficient, and user-friendly.

8. Implement Security Measures: Protect sensitive employee data through robust security measures, such as access controls, encryption, and secure storage. Regularly review and update security protocols to mitigate data breaches and ensure compliance with data privacy regulations. Data security is paramount for maintaining employee trust and protecting confidential information.

A meticulously crafted template, incorporating these essential elements, promotes transparency, accuracy, and legal compliance, facilitating efficient payroll management and supporting informed financial decisions by employees. Regular review and adaptation to evolving needs and regulations ensure the template remains a valuable tool for both the organization and its workforce.

Accurate and accessible leave and earning statement templates are indispensable for transparent and compliant payroll management. Standardized formatting, accurate calculations, comprehensive data, and clear presentation empower employees to understand their compensation and manage their leave effectively. Adherence to legal requirements safeguards both organizations and employees, mitigating potential risks and fostering a culture of trust. Accessibility considerations ensure equitable access to critical information for all employees, regardless of individual needs or technological limitations. A robust template serves as a cornerstone of efficient payroll processes, supporting informed financial decisions and contributing to a positive employer-employee relationship.

Effective implementation and ongoing refinement of these templates are crucial for optimizing payroll processes, promoting financial well-being, and maintaining legal compliance. Regular review and adaptation to evolving regulations and organizational needs ensure the template remains a valuable tool for both employers and employees. Prioritizing accuracy, transparency, and accessibility within these documents strengthens the foundation of fair and ethical employment practices, contributing to a more equitable and sustainable work environment.