A complimentary document providing a structured framework for organizing one’s assets, liabilities, and net worth is a valuable tool for financial planning. This framework allows individuals to gain a clear snapshot of their current financial standing, enabling informed decision-making regarding budgeting, investing, and overall financial management.

Utilizing such a document offers numerous advantages, including improved financial awareness, simplified tracking of financial progress, and facilitated preparation for loan applications or other financial endeavors. Access to these resources without cost removes a potential barrier to effective personal financial management, empowering individuals to take control of their financial well-being.

This understanding of one’s financial position forms the foundation for exploring broader topics such as budgeting strategies, investment planning, and debt management, all of which contribute to long-term financial health.

1. Accessibility

Accessibility is a critical factor when considering complimentary personal financial statement templates. It directly impacts how readily individuals can obtain and utilize these crucial tools for managing their finances. Easy access empowers individuals to take control of their financial well-being, regardless of technical expertise or resources.

-

Availability of Online Templates

Numerous websites offer free, downloadable templates in various formats (e.g., spreadsheets, PDFs). This widespread online availability removes geographical barriers and allows access from any internet-connected device. However, users should exercise caution and verify the credibility of the source to ensure data security.

-

User-Friendliness and Software Compatibility

Templates should be easy to navigate and compatible with commonly used software. An intuitive interface and clear instructions minimize the technical knowledge required for effective use. Compatibility with standard spreadsheet software ensures widespread usability.

-

Accessibility for Diverse Needs

Consideration should be given to individuals with diverse needs. This includes providing templates in alternative formats (e.g., large print, braille) and ensuring compatibility with assistive technologies. Such inclusivity broadens access to essential financial management tools.

-

Mobile Accessibility

In an increasingly mobile world, access via smartphones and tablets is essential. Templates optimized for mobile devices allow users to track and manage their finances conveniently, regardless of location. This enhances the practical application of these tools in daily life.

The accessibility of these free resources directly contributes to greater financial literacy and empowerment. By removing barriers to entry, these templates promote wider adoption of proactive financial management practices, leading to improved financial well-being for individuals.

2. Comprehensiveness

Comprehensiveness in a complimentary personal financial statement template is essential for providing a holistic view of one’s financial standing. A truly comprehensive template allows for informed decision-making regarding financial planning, budgeting, and goal setting by ensuring all relevant aspects of personal finances are captured.

-

Asset Inclusion

Accurate representation of all owned assets, including liquid assets (cash, checking accounts, savings accounts), investments (stocks, bonds, mutual funds), and fixed assets (real estate, vehicles), is crucial. Missing or underestimated assets can lead to an incomplete financial picture, hindering accurate assessment of net worth and potential investment opportunities. For example, omitting a retirement account significantly underrepresents one’s overall financial health.

-

Liability Coverage

Thorough documentation of all outstanding liabilities, including short-term debts (credit card balances, utility bills), long-term debts (mortgages, student loans), and other financial obligations is equally important. Ignoring or underestimating liabilities can lead to an overly optimistic view of financial health, potentially impacting credit scores and loan approvals. For instance, neglecting outstanding medical bills can create a misleading impression of available resources.

-

Net Worth Calculation

A comprehensive template automatically calculates net worth by subtracting total liabilities from total assets. This calculation provides a concise snapshot of current financial standing and serves as a benchmark for tracking progress toward financial goals. Regularly reviewing net worth facilitates informed adjustments to spending and saving habits.

-

Supporting Documentation Integration

While not always a direct feature of the template itself, a comprehensive approach to personal financial statements includes maintaining supporting documentation for all listed assets and liabilities. This might involve account statements, loan documents, or property appraisals. Ready access to supporting documentation streamlines financial reviews, tax preparation, and loan applications.

A comprehensive template provides the foundational structure for sound financial planning. It empowers individuals to gain a clear, accurate understanding of their financial situation, facilitating informed decisions and promoting long-term financial stability.

3. Structure

A well-defined structure is paramount in a free personal financial statement template. A logical and organized framework ensures clarity, facilitates accurate data entry, and promotes efficient analysis. Structure dictates how information is presented and categorized, directly impacting the template’s usability and effectiveness. A poorly structured template can lead to confusion, omissions, and ultimately, an inaccurate representation of one’s financial status. Conversely, a well-structured template simplifies the process, making it easier to track financial progress and identify areas for improvement.

Consider a template that separates assets into distinct categories such as liquid assets, investments, and fixed assets. This categorization allows for a granular view of holdings, facilitating analysis of asset allocation and diversification. Similarly, clear delineation of liabilities, categorized by type and repayment terms, promotes a comprehensive understanding of debt obligations. This structured approach allows for easy comparison of assets and liabilities, leading to a more accurate net worth calculation. For example, separating short-term debt like credit card balances from long-term debt like mortgages provides a clearer picture of overall debt burden and its potential impact on long-term financial goals.

A structured template serves as a robust foundation for informed financial management. It facilitates consistent tracking of financial progress over time, allowing for identification of trends and adjustments to financial strategies as needed. The structure enables users to quickly locate specific information, simplifying the process of updating the statement and generating reports for various purposes, such as loan applications or financial reviews. Challenges may arise if the chosen template’s structure doesn’t align with individual needs or preferences. Therefore, selecting a template with a clear, logical structure that accommodates specific financial circumstances is crucial for maximizing its utility and achieving financial clarity.

4. Customization

Customization options within a free personal financial statement template significantly enhance its utility. Adapting the template to individual circumstances ensures accurate reflection of one’s financial reality. While a generic template provides a basic framework, customization allows for personalized tracking and analysis, leading to more effective financial management.

-

Categorization of Assets and Liabilities

Standard templates may offer broad categories. Customization allows for finer categorization, such as differentiating between various types of investments (e.g., retirement accounts, taxable brokerage accounts) or debts (e.g., secured vs. unsecured loans). This granular approach provides a more nuanced understanding of financial holdings and obligations. For example, separating investment properties from primary residences provides a clearer view of real estate holdings.

-

Inclusion of Specific Financial Goals

Templates can be customized to incorporate specific financial goals, such as saving for a down payment, retirement planning, or debt reduction. Integrating these goals into the statement provides a direct link between current financial status and future aspirations, motivating adherence to financial plans. Tracking progress against these goals within the statement offers a tangible measure of success.

-

Currency and Language Options

For individuals managing finances across borders or preferring a language other than English, customization options for currency and language are beneficial. This ensures the template remains relevant and accessible regardless of geographical location or linguistic preference. Accurate representation of finances in the appropriate currency avoids potential misinterpretations due to exchange rate fluctuations.

-

Integration with Budgeting Tools

Some free templates offer integration with budgeting software or apps. This connection streamlines financial management by automatically updating the financial statement with data from budgeting activities, creating a dynamic and interconnected system for tracking income, expenses, and net worth. This integration fosters a more holistic and efficient approach to personal finance management.

Effective customization transforms a generic free personal financial statement template into a powerful, personalized tool. This tailored approach empowers individuals to gain deeper insights into their financial situation, make informed decisions aligned with their goals, and ultimately achieve greater financial well-being.

5. Regular Updates

Maintaining current information within a free personal financial statement template is crucial for accurate financial assessment. Regular updates ensure the documented financial status aligns with reality, allowing for informed decision-making and effective financial planning. Neglecting updates leads to a distorted view of one’s financial health, hindering the ability to identify potential risks or opportunities. For instance, a significant increase in market value of investments held within a brokerage account would not be reflected in an outdated statement, potentially leading to misinformed investment decisions.

The frequency of updates depends on individual circumstances and the volatility of financial holdings. More frequent updates are advisable for individuals actively engaged in investments or experiencing significant changes in income or expenses. Someone purchasing a new property or experiencing a job change should update their statement promptly to reflect these substantial shifts in financial status. Less frequent updates might suffice for individuals with relatively stable finances. However, a minimum quarterly review is recommended even in stable financial situations to capture potential fluctuations and ensure accuracy. This consistent practice reinforces financial awareness and allows for timely adjustments to financial strategies as needed.

Regular updates provide a dynamic view of financial health, enabling proactive adjustments to spending, saving, and investment strategies. They empower informed decisions regarding debt management, retirement planning, and other crucial financial goals. Challenges may arise in maintaining consistent updates due to time constraints or perceived complexity. However, utilizing technological tools like automated data feeds from financial institutions can streamline the process. Ultimately, the benefits of maintaining an up-to-date personal financial statement far outweigh the effort required, fostering financial awareness, informed decision-making, and greater control over one’s financial well-being.

6. Privacy

Data privacy is paramount when utilizing free personal financial statement templates. These documents contain highly sensitive information, making safeguarding against unauthorized access and misuse critical. Consequences of compromised financial data can range from identity theft and financial fraud to reputational damage and emotional distress. Consider the potential impact of a leaked template containing bank account details, investment holdings, and liability information. Such a breach could expose individuals to targeted phishing attacks, unauthorized fund transfers, or even fraudulent loan applications.

Several factors influence privacy considerations. The chosen storage method, whether digital or physical, dictates the necessary security measures. Password-protected files, encrypted storage devices, and secure physical locations mitigate risks associated with digital and physical storage, respectively. Sharing practices also warrant careful consideration. Sharing templates via unsecured email or messaging platforms increases vulnerability to data breaches. Furthermore, the source of the template plays a crucial role. Templates downloaded from reputable financial institutions or established financial planning websites generally offer greater security assurances compared to those obtained from less credible sources. Verifying the source’s security protocols and data handling practices is essential. For example, opting for a template from a website with robust security measures, like HTTPS encryption and a clear privacy policy, minimizes risks associated with data transmission and storage.

Protecting financial information requires a multi-faceted approach. Strong passwords, two-factor authentication, and regular software updates safeguard digital files. Physical documents necessitate secure storage locations, such as locked filing cabinets or safe deposit boxes. Limiting access to these documents further minimizes risks. Implementing robust security practices is crucial not only for immediate protection but also for long-term financial well-being. Failure to prioritize data privacy can have lasting repercussions, impacting credit scores, loan approvals, and overall financial stability. Understanding and addressing these privacy concerns is fundamental to responsible financial management.

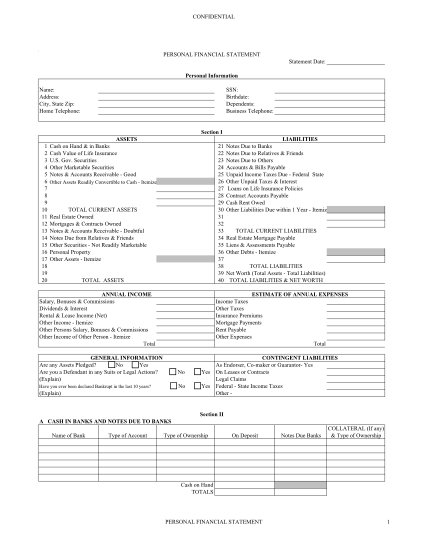

Key Components of a Personal Financial Statement Template

A well-structured personal financial statement template provides a comprehensive snapshot of an individual’s financial health. Understanding its core components is essential for accurate assessment and effective financial planning.

1. Assets: This section details everything an individual owns with monetary value. Categorization typically includes liquid assets (readily convertible to cash), investments (stocks, bonds, real estate), and fixed assets (personal property like vehicles or jewelry). Accurate valuation is crucial for a realistic net worth calculation.

2. Liabilities: This section outlines all outstanding debts and financial obligations. Categorization includes short-term liabilities (credit card balances, utility bills) and long-term liabilities (mortgages, student loans). Accurate reporting of liabilities is critical for a clear understanding of debt burden.

3. Net Worth: This crucial calculation, derived by subtracting total liabilities from total assets, provides a concise summary of one’s financial standing. Regular monitoring of net worth allows for tracking progress toward financial goals and identification of potential areas for improvement.

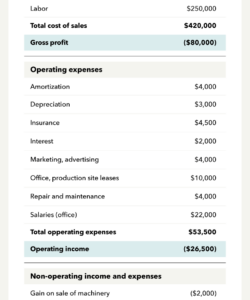

4. Income Statement (Optional): While not always included in basic templates, an income statement section tracks income and expenses over a specific period. This component offers insights into spending habits and identifies potential areas for budgeting adjustments.

5. Financial Goals (Optional): Some templates include a section for outlining short-term and long-term financial goals. Integrating goals within the statement provides motivation and facilitates tracking progress toward achieving financial aspirations.

Accurate completion of each section, coupled with regular updates, ensures the personal financial statement serves as a powerful tool for informed financial management and decision-making.

How to Create a Free Personal Financial Statement Template

Creating a personal financial statement template provides a structured approach to organizing financial data. This process facilitates a clear understanding of assets, liabilities, and net worth, enabling informed financial decision-making.

1: Choose a Format: Selecting an appropriate format is the initial step. Spreadsheet software offers flexibility and automated calculations. Alternatively, a simple document or even a handwritten format can suffice. The chosen format should align with individual preferences and technical capabilities.

2: Create the Assets Section: This section lists all items owned with monetary value. Categorizing assets into liquid assets (cash, checking accounts), investments (stocks, bonds), and fixed assets (real estate, vehicles) provides a structured overview. Accurate valuation of each asset is crucial.

3: Create the Liabilities Section: This section details all outstanding debts and financial obligations. Categorizing liabilities into short-term (credit card balances) and long-term (mortgages) provides a clear picture of debt burden. Accurate reporting of outstanding balances is essential.

4: Calculate Net Worth: Subtracting total liabilities from total assets yields net worth. This key figure provides a concise snapshot of current financial standing. Including a dedicated space for this calculation within the template ensures easy tracking over time.

5: Consider Optional Sections: An income statement, tracking income and expenses, provides insights into spending patterns. A section for outlining financial goals can further enhance the template’s utility. Inclusion of these optional sections depends on individual needs and preferences.

6: Regularly Update Information: Maintaining an up-to-date statement is crucial for accurate financial assessment. Regularly reviewing and updating asset values, liabilities, and income/expenses ensures the template reflects current financial reality.

7: Protect Privacy: Given the sensitive nature of financial information, safeguarding the completed template is crucial. Secure storage, whether digital or physical, protects against unauthorized access and potential misuse. Strong passwords, encryption, and discreet physical storage are recommended.

A well-structured template, regularly updated and securely stored, empowers informed financial decisions and facilitates progress toward financial goals. This organized approach promotes financial awareness and enables proactive management of personal finances.

Access to complimentary structured frameworks for organizing financial data empowers informed decision-making. Understanding the components, benefits, and best practices associated with these tools is crucial for effective financial management. From accessibility and comprehensiveness to structure, customization, regular updates, and privacy considerations, each aspect plays a vital role in maximizing the utility of these resources. A well-maintained document provides a clear snapshot of one’s financial health, enabling proactive management of assets, liabilities, and net worth.

Leveraging these freely available resources represents a proactive step toward financial well-being. Regular engagement with these tools fosters financial literacy, promotes informed financial decisions, and ultimately contributes to greater financial stability and long-term success. Embracing these practices equips individuals with the knowledge and resources necessary to navigate the complexities of personal finance and achieve financial goals.