Utilizing a structured financial statement offers several advantages. It facilitates tracking revenue streams and identifying areas of high expenditure. This information is crucial for informed decision-making, strategic planning, and securing funding from investors or lenders. Furthermore, readily available formats ensure consistency and accuracy, reducing the likelihood of errors and simplifying tax preparation.

Understanding the structure and benefits of this financial tool is the first step toward effective financial management. The following sections will delve into the specific components of this type of report, provide practical examples of its application, and offer guidance on selecting the most appropriate format for specific business needs.

1. Revenue

Revenue represents the lifeblood of any business, forming the foundation of the income statement. Accurately capturing and categorizing revenue streams is crucial for understanding financial performance and making informed decisions. Within the structured format of a profit and loss statement designed for small businesses, revenue provides the starting point for calculating profitability.

- Sales RevenueThis constitutes the primary income source for most businesses, generated from the sale of goods or services. For a retail store, this would be the income from selling products; for a consulting firm, it would be the fees earned from providing services. Accurately recording sales revenue, including returns and allowances, is essential for a realistic assessment of business health on the income statement.

- Other Operating RevenueThis encompasses income generated from activities related to core business operations but not directly from primary sales. Examples include late fees, delivery charges, or rental income from equipment. While often smaller than sales revenue, these streams contribute to overall profitability and should be accurately tracked within the predefined categories of the income statement.

- Non-Operating RevenueThis represents income generated from activities outside the core business operations. Examples include interest income, proceeds from asset sales, or one-time gains from investments. While important to track, these are typically separated from operating revenue on the income statement to provide a clearer picture of core business profitability.

- Revenue RecognitionThis principle governs when revenue is recorded on the income statement. Generally, revenue is recognized when earned, meaning when goods are delivered or services are rendered, regardless of when payment is received. This standardized practice ensures consistency and comparability across different periods within the income statement and between businesses.

A thorough understanding of these different revenue streams and their proper categorization is essential for interpreting the income statement accurately. By correctly recording and classifying all sources of income, businesses can gain a comprehensive view of their financial performance, identify areas for growth, and make data-driven decisions to improve profitability. This meticulous approach is vital for using the income statement as an effective management tool.

2. Expenses

Accurate expense tracking is fundamental to a comprehensive understanding of profitability, making it a critical component of any income statement. Within the structured format of a profit and loss statement designed for small businesses, expenses are categorized systematically, allowing for detailed analysis and informed decision-making. This structured approach reveals the cost of doing business and its impact on net income. A clear picture of expense distribution enables targeted cost management strategies.

Several key expense categories provide insights into different aspects of business operations. Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. This includes raw materials, direct labor, and manufacturing overhead. For a retailer, COGS represents the cost of purchasing inventory. Accurately calculating COGS is crucial for determining gross profit. Operating expenses encompass the costs incurred in running the business outside of direct production or sales, including rent, utilities, marketing, and administrative salaries. Analyzing trends in operating expenses can reveal opportunities for cost optimization. Non-operating expenses are unrelated to core business operations and might include interest payments on debt or losses from asset sales. Separating these expenses provides a clearer view of profitability derived from core business activities. For example, a rising trend in operating expenses, such as marketing costs, might prompt a review of marketing campaign effectiveness or exploration of alternative, lower-cost strategies. Similarly, understanding COGS can inform pricing decisions and inventory management.

Understanding the relationship between expenses and overall profitability is essential for sustainable business management. Through meticulous tracking and categorization within the predefined structure of a small business income statement template, opportunities for cost reduction and improved efficiency can be identified. This detailed analysis facilitates data-driven decisions that contribute to long-term financial health. Challenges in expense management can arise from inaccurate data entry, inconsistent categorization, or a failure to analyze trends over time. Addressing these challenges through diligent record-keeping and regular review ensures the income statement remains a reliable tool for financial planning and growth.

3. Profitability

Profitability, a key metric of financial health, represents the business’s ability to generate earnings relative to expenses. Within the framework of a small business income statement template, profitability assessments provide essential insights for evaluating performance and making strategic decisions. This structured financial statement facilitates the calculation and analysis of profitability metrics, enabling businesses to monitor progress towards financial goals.

- Gross ProfitGross profit, calculated as revenue less the cost of goods sold (COGS), reflects the profitability of core business operations. For example, a furniture maker’s gross profit indicates the profitability of producing and selling furniture before accounting for overhead. Analyzing gross profit trends on the income statement can reveal the effectiveness of pricing strategies, production efficiency, and inventory management. A declining gross profit margin might signal rising production costs or overly competitive pricing.

- Operating ProfitOperating profit, derived by subtracting operating expenses from gross profit, reveals profitability after accounting for the costs of running the business. For a retail store, operating profit demonstrates profitability after factoring in rent, salaries, and marketing expenses. This metric, readily discernible within a small business income statement, is crucial for assessing the efficiency of day-to-day operations. A consistent decline in operating profit could indicate the need for cost-cutting measures or operational improvements.

- Net ProfitNet profit, often referred to as the “bottom line,” represents the final profitability figure after accounting for all revenue and expenses, including taxes and interest. This figure, easily identifiable on the income statement, provides a comprehensive view of a business’s overall financial performance. Consistent net profit growth demonstrates sustainable business practices and effective management, while losses signal the need for corrective action.

- Profitability RatiosProfitability ratios, calculated using figures from the income statement, provide deeper insights into financial performance. Examples include gross profit margin, operating profit margin, and net profit margin. These ratios, easily derived from a structured income statement template, facilitate comparisons with industry benchmarks and internal targets, revealing areas of strength and weakness. Consistently low-profit margins might necessitate a comprehensive review of pricing, cost structures, and operational efficiency.

These various aspects of profitability, easily analyzed within the structure of a small business income statement, provide a comprehensive view of financial performance. By regularly monitoring these metrics and understanding their interrelationships, businesses gain valuable insights for strategic planning, operational adjustments, and informed decision-making. This data-driven approach is crucial for achieving sustainable growth and long-term financial success. Utilizing a standardized income statement template facilitates this ongoing monitoring and analysis, enabling proactive responses to changes in the financial landscape.

4. Time Period

The time period covered by a profit and loss statement is fundamental to its interpretation and application. A small business income statement template provides a structured framework for analyzing financial performance over specific durations, enabling effective tracking of trends and informed decision-making. Selecting the appropriate reporting period is crucial for generating meaningful insights and facilitating accurate comparisons.

- Fiscal YearA fiscal year represents a 12-month period used for accounting purposes. While often aligned with the calendar year, a fiscal year can start on any date. Analyzing a full fiscal year’s performance, as captured within an income statement template, provides a comprehensive overview of annual profitability and allows for year-over-year comparisons. This longer timeframe helps smooth out seasonal fluctuations and provides a broader perspective on financial health.

- Quarterly ReportingQuarterly reports divide the fiscal year into four three-month periods. These shorter intervals, easily tracked within a standardized income statement template, allow businesses to monitor performance more frequently. This enables quicker identification of trends and facilitates more timely adjustments to strategies. Quarterly reports are also often required for publicly traded companies and may be requested by lenders or investors.

- Monthly StatementsGenerating monthly income statements provides the most granular view of financial performance. This frequency, facilitated by the use of a pre-designed template, is particularly valuable for businesses with volatile revenue streams or tight margins. Monthly tracking enables rapid responses to changing market conditions and facilitates close monitoring of cash flow. This granular approach can be especially beneficial for startups and small businesses in dynamic markets.

- Year-to-Date AnalysisYear-to-date (YTD) analysis examines financial performance from the beginning of the fiscal year to a specific date. This provides a cumulative perspective on profitability and other key metrics within the defined period. YTD analysis, easily performed using income statement templates, facilitates tracking progress towards annual goals and allows for comparisons against previous years’ performance. This cumulative perspective provides a broader understanding of long-term trends and their impact on financial health.

Understanding the nuances of each time period and its implications for interpreting financial data is essential for effective business management. Selecting the appropriate timeframe within a small business income statement template allows for meaningful analysis, accurate trend identification, and informed decision-making. The chosen timeframe should align with business objectives and the specific information needs of stakeholders, whether they are internal management, investors, or lenders. Consistent application of the chosen time period across financial reporting ensures comparability and facilitates accurate performance evaluation.

5. Standardized Format

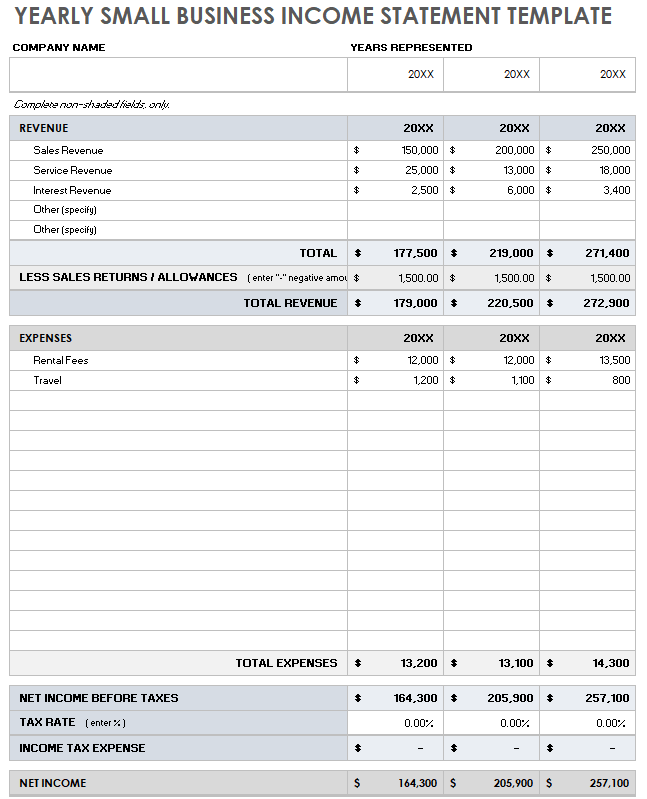

Standardized formatting is a defining characteristic of effective income statement templates designed for small businesses. This structured approach ensures consistency, comparability, and ease of interpretation. A standardized format typically includes predefined sections for revenue, cost of goods sold, operating expenses, and net income. This structured presentation allows business owners and stakeholders to quickly grasp key financial metrics and track performance over time. Without standardization, comparing financial data across different periods or against industry benchmarks becomes significantly more challenging. For instance, a template designed for a retail business would clearly separate sales revenue from other income sources like returns or interest, enabling accurate assessment of core sales performance. Similarly, standardized expense categorization allows for efficient tracking and analysis of operational costs.

Consistent use of a standardized income statement template offers several practical advantages. It simplifies tax preparation by ensuring all necessary information is readily available in an organized format. Furthermore, a clear and consistent presentation of financial data enhances credibility when seeking funding from investors or lenders. Imagine a small business applying for a loan. A standardized income statement provides the lender with a clear and readily understandable overview of the business’s financial health, increasing the likelihood of loan approval. Conversely, inconsistent or disorganized financial reporting can raise red flags and hinder access to capital. Standardized formatting also streamlines internal analysis, enabling business owners to quickly identify trends, spot potential problems, and make informed decisions. For example, consistent tracking of operating expenses within a standardized format can reveal inefficiencies or areas where cost-cutting measures may be necessary.

In conclusion, the standardized format inherent in a small business income statement template provides a crucial foundation for effective financial management. This structured approach ensures data consistency, facilitates meaningful comparisons, enhances credibility with external stakeholders, and streamlines internal analysis. Adopting a standardized format empowers small businesses to effectively monitor their financial health, make informed decisions, and achieve sustainable growth. While specific template structures may vary based on industry and business needs, the underlying principle of standardization remains crucial for accurate and efficient financial reporting.

6. Simplified Tracking

Simplified tracking, facilitated by a well-designed income statement template, is crucial for effective financial management in small businesses. Such templates offer a structured approach to recording and analyzing financial data, reducing complexity and improving accuracy. This streamlined process allows business owners to focus on interpreting the data rather than grappling with manual calculations and complex spreadsheets, enabling more informed decision-making and proactive financial management. The following facets demonstrate how these templates simplify the tracking process:

- Automated CalculationsTemplates often incorporate automated calculations for key metrics such as gross profit, operating profit, and net income. This eliminates manual calculations, reducing the risk of errors and saving valuable time. For example, a template might automatically calculate gross profit by subtracting the cost of goods sold from revenue, streamlining the process and ensuring accuracy. This automation allows business owners to focus on analyzing profitability trends rather than performing repetitive calculations.

- Pre-Categorized ExpensesTemplates typically pre-categorize common business expenses, such as rent, utilities, marketing, and salaries. This structured approach simplifies expense tracking and facilitates analysis of spending patterns. Imagine a business owner trying to analyze marketing expenses. A pre-categorized template automatically sorts these costs, enabling quick identification of areas where marketing spend is high or growing unexpectedly. This facilitates better budget allocation and cost control.

- Comparative AnalysisIncome statement templates facilitate comparative analysis by providing a consistent format for tracking financial performance over different periods. This allows business owners to easily compare current performance with previous periods or against industry benchmarks. For example, comparing monthly revenue figures within a template can reveal seasonal trends or identify periods of unexpected growth or decline. This insight allows for proactive adjustments to business strategies.

- Data VisualizationSome templates incorporate data visualization features, such as charts and graphs, to represent financial data in a more accessible format. Visual representations can make complex financial information easier to understand and interpret, allowing for quicker identification of key trends and insights. For example, a line graph depicting revenue trends over several quarters provides a clear visual representation of growth patterns, making it easier to identify potential issues or opportunities.

Through these facets, simplified tracking, inherent in a well-designed income statement template, empowers small businesses to effectively monitor financial health, identify areas for improvement, and make data-driven decisions. This structured approach frees up valuable time and resources, enabling business owners to focus on strategic planning and achieving long-term financial goals. The ease of use and improved accuracy fostered by simplified tracking contribute significantly to the overall effectiveness of financial management within a small business context.

Key Components of a Small Business Income Statement

A well-structured income statement provides a clear snapshot of a business’s financial performance. Understanding the key components is crucial for interpreting the information and making informed business decisions. The following elements are fundamental to a comprehensive small business income statement:

1. Revenue: Revenue represents all income generated from business operations. This includes sales of goods or services, as well as other income streams such as interest or rental income. Accurate revenue recording is fundamental to assessing overall profitability.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit margins.

3. Gross Profit: Gross profit is calculated by subtracting COGS from revenue. This metric reflects the profitability of core business operations before accounting for other operating expenses. Analyzing gross profit trends provides insight into pricing strategies and production efficiency.

4. Operating Expenses: Operating expenses encompass the costs incurred in running the business outside of direct production. This includes rent, utilities, salaries, marketing, and administrative expenses. Careful management of operating expenses is crucial for maintaining profitability.

5. Operating Income: Operating income, calculated by subtracting operating expenses from gross profit, reflects the profitability of the business’s core operations. This metric provides insight into the efficiency and effectiveness of day-to-day business activities.

6. Other Income and Expenses: This category includes income and expenses not directly related to core business operations, such as interest income, investment gains, or losses from asset sales. These items are listed separately to provide a clearer picture of core business profitability.

7. Income Tax Expense: This represents the income tax liability incurred by the business during the reporting period. Accurate calculation of income tax expense is essential for legal compliance and financial planning.

8. Net Income: Net income, also known as the “bottom line,” represents the final profitability figure after accounting for all revenues and expenses, including taxes. This key metric indicates the overall financial success of the business during the reporting period.

Careful analysis of these interconnected components provides a comprehensive understanding of a business’s financial health, allowing for data-driven decisions and effective long-term strategic planning.

How to Create an Income Statement for a Small Business

Creating a profit and loss statement involves organizing financial data into a structured format. This process facilitates clear insights into revenue streams, expenses, and overall profitability. A systematic approach ensures accuracy and consistency, providing valuable information for business decision-making.

1. Choose a Reporting Period: Select a specific time frame for the income statement, such as a month, quarter, or fiscal year. Consistent reporting periods allow for accurate tracking of performance trends over time.

2. Calculate Revenue: Determine total revenue generated during the chosen period. This includes all income from sales of goods or services, as well as any other income streams like interest or rental income.

3. Determine Cost of Goods Sold (COGS): Calculate all direct costs associated with producing goods sold. This typically includes raw materials, direct labor, and manufacturing overhead. For service-based businesses, this section might not be applicable.

4. Calculate Gross Profit: Subtract COGS from total revenue to determine gross profit. This figure represents the profit generated from core business activities before accounting for operating expenses.

5. Itemize Operating Expenses: List all operating expenses incurred during the reporting period. This includes costs like rent, utilities, salaries, marketing, and administrative expenses. Categorizing expenses facilitates analysis and cost management.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to arrive at operating income. This metric reflects the profitability of core business operations after accounting for all operating costs.

7. Account for Other Income and Expenses: Include any income or expenses not directly related to core business operations, such as interest income, investment gains, or losses. These items provide a comprehensive picture of overall financial performance.

8. Calculate Net Income: Subtract all expenses, including taxes and other income/expenses, from total revenue to arrive at net income. This “bottom line” figure represents the overall profit or loss for the reporting period.

Following these steps provides a structured and informative financial statement, enabling insightful analysis and informed decision-making. Regular creation and review of this document promotes proactive financial management and contributes to long-term business success. Utilizing a template or software can further streamline this process.

Profit and loss reporting, facilitated by structured templates designed for smaller enterprises, provides crucial insights into financial performance. Understanding revenue streams, expense categories, and profitability metrics, such as gross profit, operating profit, and net income, is essential for informed decision-making. Standardized formatting and simplified tracking contribute to efficient data analysis, enabling timely adjustments to business strategies and promoting long-term financial stability. Careful consideration of the reporting period, whether monthly, quarterly, or annually, ensures the generated information aligns with specific business needs and objectives.

Effective utilization of these financial tools empowers small businesses to navigate the complexities of financial management, optimize resource allocation, and pursue sustainable growth. Regular review and analysis of these statements, coupled with a proactive approach to expense management and revenue generation, are vital for long-term success in a competitive business landscape. The insights derived from these reports provide a foundation for informed decision-making, enabling businesses to adapt to market changes and achieve financial objectives.