Utilizing this type of financial projection allows businesses to secure funding from lenders and investors by demonstrating financial viability and growth potential. It also aids in budgeting and resource allocation, allowing management to anticipate and address potential financial challenges proactively. Furthermore, it serves as a valuable tool for strategic planning, enabling businesses to model the financial impact of various strategic initiatives and make data-driven decisions.

The following sections will delve deeper into the specific components, creation methods, and practical applications of projected cash flow analysis for various business scenarios.

1. Projected Future Cash Flows

Projected future cash flows form the core of a pro forma cash flow statement template. The template serves as a structured framework for organizing and presenting these projections. Without estimated future inflows and outflows, the template remains an empty shell, lacking analytical value. The accuracy and reliability of these projected figures directly impact the usefulness of the entire statement for financial planning and decision-making. For example, a company anticipating a large capital expenditure in the coming year would input this projected outflow into the template, allowing for assessment of its impact on overall liquidity.

Developing accurate projected future cash flows requires careful consideration of various factors, including historical data, market trends, sales forecasts, and anticipated expenses. Different forecasting methods, such as trend analysis, regression analysis, and expert opinions, can be employed. Consider a retail business projecting holiday sales. Historical sales data from previous holiday seasons, coupled with current market trends and planned marketing campaigns, informs the projected cash inflows for that period. The reliability of these projections influences the business’s decisions regarding inventory management and staffing levels.

A robust understanding of the relationship between projected future cash flows and the pro forma cash flow statement template is crucial for sound financial management. Challenges may arise in accurately forecasting future cash flows due to unforeseen market fluctuations or internal operational changes. However, the template provides a dynamic tool to adapt to such changes by allowing for revisions and adjustments to the projections as new information becomes available. This iterative process of forecasting, monitoring, and revising ensures that the pro forma statement remains a relevant and valuable tool for guiding strategic decision-making.

2. Structured Format

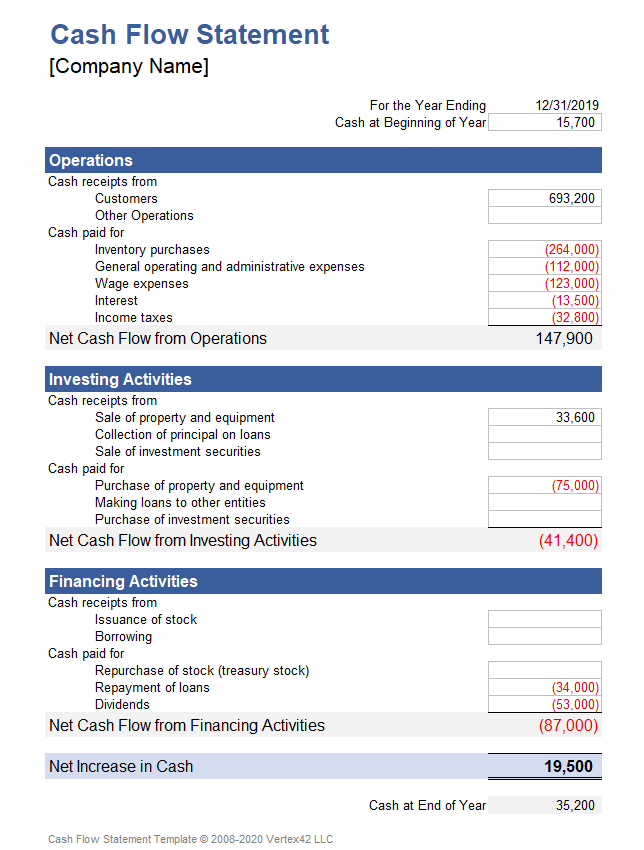

A structured format is essential to the efficacy of a pro forma cash flow statement template. Standardization ensures consistent organization of projected cash inflows and outflows, facilitating clear analysis and interpretation. This structure typically categorizes cash flows into operating activities, investing activities, and financing activities, providing a comprehensive view of the anticipated sources and uses of cash. Without a structured approach, the template loses its analytical power, becoming a collection of disjointed figures rather than a cohesive financial projection. For example, separating cash flows from core business operations from those related to asset acquisition or debt financing allows for targeted analysis of each area.

The structured format also enhances comparability. Whether comparing projected performance against previous periods or benchmarking against industry averages, a consistent structure enables meaningful analysis. Consider a company evaluating the potential impact of a new product launch. By using a structured template, they can compare projected cash flows from the new product line against existing product lines, facilitating a data-driven assessment of the new venture’s potential contribution to overall financial performance. Furthermore, the structured format simplifies the process of consolidating financial projections from different departments or business units, promoting a unified and cohesive view of the organization’s future financial position.

Maintaining a structured format is paramount for effective financial planning and decision-making. While specific template designs may vary, the underlying principle of structured categorization remains crucial. Challenges can arise when dealing with complex financial transactions or unique business models, requiring careful consideration of how to categorize cash flows within the standard framework. However, adhering to a structured format, even in complex scenarios, ensures clarity, comparability, and ultimately, the reliability of the pro forma cash flow statement as a tool for strategic financial management.

3. Financial Planning Tool

A pro forma cash flow statement template functions as a crucial financial planning tool, enabling organizations to project future financial performance and make informed decisions. The template provides a structured framework for anticipating cash inflows and outflows, allowing businesses to assess their financial viability and plan for future investments, financing needs, and operational adjustments. Cause and effect relationships are central to this function. For instance, projected increases in sales revenue (a cause) will lead to higher cash inflows (an effect), impacting the overall cash position projected in the statement. Understanding these relationships allows businesses to model the financial consequences of various strategic initiatives. A company considering expansion into a new market, for example, can use the template to project the associated costs and anticipated revenues, assessing the potential impact on overall cash flow and profitability.

The importance of the pro forma cash flow statement as a financial planning tool is underscored by its practical applications. Consider a business seeking a loan for capital investment. A well-constructed pro forma statement, incorporating realistic projections, can demonstrate the business’s ability to repay the loan, increasing the likelihood of securing financing. Furthermore, the template facilitates proactive financial management. By projecting potential cash shortfalls, businesses can take preemptive measures, such as adjusting expenses or securing lines of credit, to mitigate financial risks. For example, a seasonal business anticipating lower sales during the off-season can use the template to forecast potential cash flow gaps and plan accordingly, ensuring sufficient liquidity to cover operational expenses during the slower period.

In summary, the pro forma cash flow statement template serves as a powerful financial planning tool, enabling organizations to anticipate future financial performance, evaluate strategic initiatives, secure financing, and manage financial risks. Challenges in accurately forecasting future cash flows and ensuring the reliability of underlying assumptions can impact the effectiveness of the template. However, its inherent flexibility allows for adjustments and revisions as new information becomes available, maintaining its relevance as a dynamic tool for strategic financial management. Integrating the template into regular financial planning processes allows organizations to make informed, data-driven decisions, fostering financial stability and supporting long-term growth.

4. Basis for Decision-Making

A pro forma cash flow statement template serves as a critical basis for informed financial decision-making. By projecting future cash inflows and outflows, the template provides a structured framework for evaluating potential investments, assessing financing needs, and guiding strategic operational adjustments. This forward-looking perspective allows organizations to anticipate potential financial challenges and opportunities, facilitating proactive and strategic responses.

- Investment DecisionsEvaluating potential investments requires careful consideration of their impact on future cash flows. A pro forma statement allows organizations to model the financial implications of various investment scenarios, comparing projected returns against anticipated costs. This analysis supports data-driven investment decisions, maximizing the potential for profitable capital allocation. For example, a company considering acquiring new equipment can use the template to project the increased revenue generated by the equipment against the associated purchase and maintenance costs, determining the investment’s overall financial viability.

- Financing NeedsAccurately projecting future cash flows is essential for assessing financing needs. A pro forma statement allows organizations to anticipate potential shortfalls or surpluses, informing decisions regarding debt financing, equity financing, or internal funding strategies. For instance, a rapidly growing company anticipating significant cash outflows for expansion can use the template to determine the appropriate amount and type of financing required to support its growth trajectory. This proactive approach to financing ensures sufficient liquidity to meet operational needs and capitalize on growth opportunities.

- Operational AdjustmentsPro forma cash flow statements facilitate proactive operational adjustments. By projecting future cash flows under various operational scenarios, organizations can identify potential inefficiencies, optimize resource allocation, and implement cost-saving measures. For example, a business projecting a decline in sales can use the template to model the impact of various cost-cutting measures, such as reducing inventory levels or streamlining operational processes, mitigating the financial impact of the sales decline and preserving profitability.

- Strategic PlanningLong-term strategic planning relies heavily on accurate financial projections. A pro forma cash flow statement template provides a framework for aligning financial goals with strategic initiatives. By modeling the financial implications of different strategic options, organizations can make informed decisions that support sustainable growth and long-term financial health. For example, a company considering expanding into a new market can use the template to project the associated costs and anticipated revenues, enabling a data-driven assessment of the expansion’s strategic fit and potential contribution to overall financial performance.

By integrating the pro forma cash flow statement template into the decision-making process, organizations gain a powerful tool for navigating financial complexities, mitigating risks, and capitalizing on opportunities. The ability to project future financial performance provides a crucial foundation for strategic planning, resource allocation, and ultimately, the achievement of long-term financial objectives. While the accuracy of projections remains subject to external factors and internal assumptions, the template provides a dynamic framework for adapting to changing circumstances and making informed decisions based on the best available information.

5. Flexibility and Adaptability

Flexibility and adaptability are essential characteristics of an effective pro forma cash flow statement template. The dynamic nature of business environments necessitates a financial planning tool capable of accommodating changes in assumptions, market conditions, and internal strategies. This adaptability stems from the template’s structure, allowing for modification of inputs and recalculation of projections based on evolving circumstances. Cause and effect relationships are central to this dynamic. For example, a change in projected sales growth (a cause) will directly impact projected cash inflows (an effect), necessitating adjustments throughout the template. This inherent flexibility allows organizations to explore multiple scenarios, assess the financial impact of various strategic options, and make informed decisions based on the most current information.

The importance of flexibility is highlighted in real-world applications. Consider a startup developing a new product. Initial sales projections may be based on market research and competitive analysis. However, as the product enters the market and real-world data becomes available, initial assumptions may require revision. A flexible template allows the startup to incorporate this new information, adjusting sales projections, production costs, and marketing expenses accordingly. This iterative process of forecasting, monitoring, and revising ensures the pro forma statement remains a relevant tool for guiding decision-making throughout the product lifecycle. Another example is a company facing unexpected economic downturn. A flexible template allows for adjustments to projected sales, expenses, and capital expenditures, reflecting the changed economic reality and enabling the company to develop contingency plans to mitigate potential financial risks.

A deep understanding of the template’s flexibility and adaptability is crucial for sound financial management. Challenges arise when underlying assumptions prove inaccurate or unforeseen events disrupt projected cash flows. However, the ability to adapt the template to these changes ensures its continued relevance as a dynamic planning tool. By embracing the iterative nature of financial forecasting and utilizing a flexible template, organizations can navigate uncertainty, make informed decisions based on the best available data, and position themselves for long-term financial success. This adaptability reinforces the value of the pro forma cash flow statement as a cornerstone of strategic financial management.

6. Underlying Assumptions

Underlying assumptions form the foundation of a pro forma cash flow statement template. These assumptions, representing educated guesses about future performance, directly influence the projected cash inflows and outflows. A clear understanding of these assumptions, their rationale, and their potential impact is crucial for interpreting the statement and making sound financial decisions. Without clearly defined and justifiable assumptions, the pro forma statement loses its predictive power and becomes a less reliable tool for financial planning.

- Revenue Growth AssumptionsRevenue projections are typically based on assumptions about future market conditions, sales growth rates, and pricing strategies. These assumptions can be derived from historical data, market research, industry trends, and management’s assessment of competitive landscapes. For example, a company projecting a 10% annual revenue growth rate should articulate the basis for this assumption, considering factors such as market share, anticipated product demand, and pricing strategies. Overly optimistic or pessimistic revenue assumptions can significantly impact the projected cash inflows and distort the overall financial picture.

- Expense AssumptionsProjecting future expenses requires assumptions about cost of goods sold, operating expenses, and capital expenditures. These assumptions should be linked to revenue projections and reflect anticipated changes in input costs, operating efficiencies, and investment plans. For instance, a manufacturing company projecting increased production should also account for associated increases in raw material costs, labor costs, and overhead expenses. Failure to accurately reflect these cost dynamics can lead to unrealistic profit margins and misrepresent the company’s true financial position.

- Financing AssumptionsAssumptions regarding financing activities play a crucial role in projecting future cash flows. These assumptions include anticipated debt levels, interest rates, equity contributions, and dividend payments. For example, a company planning to secure a new loan should factor in the associated interest expense and principal repayments in its cash flow projections. Similarly, assumptions about equity financing should reflect anticipated dilution and the potential impact on earnings per share. A clear understanding of these financing assumptions is essential for assessing the company’s long-term financial viability and capital structure.

- Working Capital AssumptionsWorking capital assumptions, relating to the management of current assets and liabilities, are essential for accurate cash flow projections. These assumptions include projected changes in accounts receivable, inventory levels, and accounts payable. For example, a company implementing a new inventory management system might assume a reduction in inventory holding costs, impacting projected cash outflows. Similarly, changes in credit policies can influence projected accounts receivable and accounts payable balances. Accurately reflecting these working capital dynamics is crucial for projecting short-term liquidity and ensuring the company’s ability to meet its ongoing financial obligations.

The reliability of a pro forma cash flow statement hinges on the validity of its underlying assumptions. Regularly reviewing and revising these assumptions, as new information becomes available, is crucial for maintaining the statement’s relevance and accuracy. Sensitivity analysis, examining the impact of changes in key assumptions on projected cash flows, can further enhance the decision-making process. By explicitly stating and justifying underlying assumptions, organizations can foster transparency, enhance the credibility of their financial projections, and make more informed strategic decisions.

Key Components of a Pro Forma Cash Flow Statement Template

A well-structured template ensures consistent and accurate financial projections. Understanding its key components is crucial for effective financial planning and analysis. These components work interdependently to provide a comprehensive view of a company’s projected financial position.

1. Operating Activities: This section projects cash flows generated from core business operations. Key elements include revenue from sales, payments to suppliers, salaries and wages, and other operating expenses. Accurate projections of these items are crucial for assessing the profitability and sustainability of core business activities.

2. Investing Activities: This section focuses on cash flows related to investments in long-term assets. Key elements include capital expenditures for property, plant, and equipment, acquisitions and divestitures of businesses, and investments in securities. Projecting these cash flows provides insights into a company’s growth strategy and its commitment to long-term value creation.

3. Financing Activities: This section details cash flows related to financing the business. Key elements include proceeds from debt or equity financing, loan repayments, dividend payments, and share repurchases. Analyzing these cash flows provides insights into a company’s capital structure and its financial stability.

4. Beginning Cash Balance: This represents the cash available at the start of the projected period. It serves as the foundation for calculating the net change in cash during the period and provides context for interpreting the ending cash balance.

5. Net Change in Cash: This represents the overall increase or decrease in cash during the projected period, calculated by summing the net cash flows from operating, investing, and financing activities. This figure provides a concise overview of the company’s projected cash position.

6. Ending Cash Balance: This represents the projected cash available at the end of the period, calculated by adding the net change in cash to the beginning cash balance. This is a key indicator of a company’s projected liquidity and its ability to meet future financial obligations.

7. Underlying Assumptions: While not explicitly presented within the statement itself, the underlying assumptions driving the projections are crucial. These assumptions, concerning revenue growth, expenses, financing, and other key factors, should be clearly documented and justified to ensure transparency and facilitate informed interpretation of the projected cash flows.

Analyzing these interconnected components provides a comprehensive view of a company’s projected financial health, enabling informed decision-making regarding resource allocation, investment strategies, and overall financial planning. The accuracy and reliability of these projections depend on the validity of underlying assumptions and the rigor of the forecasting process.

How to Create a Pro Forma Cash Flow Statement Template

Creating a robust pro forma cash flow statement requires a structured approach and careful consideration of key financial drivers. The following steps outline the process:

1: Determine the Projection Period: Define the timeframe for the projection, whether it’s a quarter, a year, or multiple years. The period should align with the specific planning needs and strategic objectives.

2: Gather Historical Data: Collect relevant financial data from previous periods, including income statements, balance sheets, and cash flow statements. This historical data serves as a baseline for projecting future performance.

3: Develop Assumptions: Formulate realistic assumptions about key financial drivers, such as revenue growth, expenses, capital expenditures, and financing activities. These assumptions should be based on market research, industry trends, internal plans, and expert opinions.

4: Project Operating Activities: Forecast cash flows from core business operations, starting with revenue projections and subtracting projected operating expenses. This includes items like sales revenue, cost of goods sold, salaries, rent, and utilities.

5: Project Investing Activities: Estimate cash flows related to investments in long-term assets. This includes capital expenditures for property, plant, and equipment, acquisitions and divestitures of businesses, and investments in securities.

6: Project Financing Activities: Project cash flows related to financing the business, such as proceeds from debt or equity financing, loan repayments, interest payments, dividend payments, and share repurchases.

7: Calculate Net Change in Cash: Determine the overall change in cash for each period by summing the net cash flows from operating, investing, and financing activities.

8: Determine Ending Cash Balance: Calculate the ending cash balance for each period by adding the net change in cash to the beginning cash balance of that period. The ending balance of one period becomes the beginning balance for the next.

9: Review and Refine: Regularly review and refine the pro forma statement as new information becomes available or as business conditions change. This iterative process ensures the statement remains a relevant and reliable tool for financial planning and decision-making.

10. Document Assumptions: Clearly document all underlying assumptions. This enhances transparency and facilitates informed interpretation and analysis of projected cash flows. This documentation also enables easier adjustments as assumptions change.

A well-constructed pro forma cash flow statement template provides a dynamic framework for anticipating future financial performance, supporting strategic planning, and making informed financial decisions. Its value lies in its ability to model the financial impact of various strategic initiatives, assess financing needs, and guide operational adjustments. Maintaining accuracy and relevance requires rigorous analysis, realistic assumptions, and regular review.

Projected financial statements provide a crucial framework for anticipating future financial performance. Understanding their structure, components, and underlying assumptions is essential for sound financial planning and decision-making. From projecting operating activities and investment decisions to assessing financing needs and operational adjustments, these structured forecasts offer valuable insights for navigating financial complexities and achieving strategic objectives. Accuracy relies heavily on well-defined assumptions and continuous refinement based on evolving business conditions and market dynamics.

Effective utilization of these financial tools empowers organizations to make informed decisions, mitigate risks, and capitalize on opportunities for sustainable growth and long-term financial health. Integrating these projections into regular financial planning processes fosters a proactive approach to financial management, enabling organizations to anticipate challenges, adapt to change, and navigate the complexities of the business landscape with greater confidence.