Utilizing such a structure offers several advantages. It allows for consistent reporting and comparability across different periods or businesses. This consistency aids in identifying trends and potential problems, allowing for proactive financial management. Moreover, a well-defined structure simplifies the process, reducing the risk of errors and ensuring a reliable assessment of a company’s cash flow generating capabilities. This clear presentation of financial data can enhance transparency and build confidence among stakeholders.

This structured approach to cash flow analysis serves as a foundation for various critical business decisions. It informs investment strategies, helps determine dividend policies, and plays a crucial role in securing financing. Understanding the components and their interrelationships provides valuable insight into a company’s operational efficiency and financial stability.

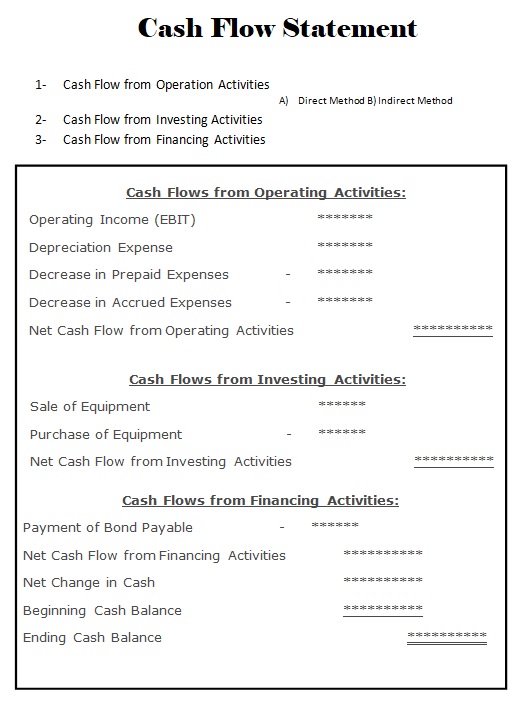

1. Standardized Structure

A standardized structure is fundamental to a free cash flow statement template. This structure ensures consistency and comparability across reporting periods and different companies. It provides a clear framework for organizing the various components of free cash flow, typically starting with net income and adjusting for non-cash items like depreciation and amortization. Changes in working capital, such as increases or decreases in accounts receivable and inventory, are then factored in. Finally, capital expenditures, representing investments in long-term assets, are deducted to arrive at the free cash flow figure. Without a standardized structure, analyzing and interpreting the cash generating ability of a business would be significantly more challenging. For instance, if one company includes interest expense in its calculation while another excludes it, direct comparison becomes misleading.

The standardized structure also facilitates trend analysis. By consistently applying the same format, analysts can track changes in free cash flow over time, identifying potential issues or improvements. For example, a consistent decline in free cash flow might indicate operational inefficiencies or declining market share. Conversely, a steady increase could suggest successful cost-cutting measures or growth in profitability. This ability to track performance over time is crucial for making informed investment decisions and assessing the long-term viability of a business. Imagine trying to compare the performance of two companies, one using a detailed, itemized format and the other using a highly summarized format; the lack of comparability would hinder meaningful analysis.

In conclusion, the standardized structure of a free cash flow statement template is essential for ensuring consistent reporting, facilitating comparability, and enabling meaningful analysis. It provides a framework for understanding a company’s cash generating ability and tracking its performance over time, supporting sound financial decision-making. Challenges can arise when companies deviate from standard practices, highlighting the importance of adhering to established guidelines for accurate and transparent financial reporting. This understanding is fundamental for anyone analyzing or interpreting financial statements.

2. Cash flow calculation

Accurate cash flow calculation is the core purpose of a free cash flow statement template. The template provides the structured framework for this calculation, guiding the user through the necessary steps to arrive at a meaningful free cash flow figure. Without a reliable calculation, the template’s value is significantly diminished. Understanding the components of this calculation is critical for interpreting the results and making informed financial decisions.

- Operating ActivitiesThis section focuses on cash generated from the core business operations. It starts with net income and adjusts for non-cash items like depreciation and amortization. Changes in working capital, such as fluctuations in accounts receivable, inventory, and accounts payable, are also incorporated. For example, an increase in accounts receivable, while representing revenue earned, doesn’t translate to immediate cash inflow and is therefore deducted. Accurately reflecting these operational cash flows is crucial for understanding a company’s core profitability.

- Investing ActivitiesThis section captures cash flows related to investments in long-term assets, primarily capital expenditures (CapEx). CapEx represents investments in property, plant, and equipment, essential for maintaining or expanding operational capacity. For example, purchasing new machinery or constructing a new factory would be reflected as cash outflows in this section. Analyzing investment activities provides insights into a company’s growth strategy and its commitment to long-term value creation. A consistently high level of CapEx might suggest a company is investing heavily in future growth.

- Financing ActivitiesThis section deals with cash flows related to financing the business. It includes proceeds from debt or equity issuance, as well as payments of dividends and debt repayments. For example, issuing new shares of stock would represent a cash inflow, while repurchasing shares would be a cash outflow. Analyzing financing activities provides insights into a company’s capital structure and its financial stability. A company relying heavily on debt financing might be more vulnerable to economic downturns.

- Free Cash FlowThe culmination of these three sections yields the free cash flow figure, representing the cash available to the company after covering operational expenses and capital investments. This figure is a key indicator of financial health and is often used in valuation models and investment analysis. A positive and growing free cash flow is generally viewed as a positive sign, indicating the company’s ability to generate cash to reinvest in the business, pay dividends, or reduce debt.

Understanding each component of the cash flow calculation within the context of the free cash flow statement template is essential for a comprehensive analysis. By examining the interplay of operating, investing, and financing activities, analysts gain valuable insights into a company’s financial performance and its ability to generate cash sustainably. This understanding forms the basis for informed decision-making, whether it’s evaluating investment opportunities, assessing creditworthiness, or managing internal financial resources. Misinterpreting any component can lead to inaccurate conclusions about a company’s true financial position.

3. Financial Health Assessment

Assessing a company’s financial health is a crucial aspect of financial analysis, and a free cash flow statement template provides invaluable insights in this process. The template facilitates a deeper understanding of a company’s ability to generate cash, which is fundamental to its long-term sustainability and growth potential. By analyzing the components within the template, stakeholders can gain a clearer picture of a company’s financial strengths and weaknesses.

- Liquidity AnalysisLiquidity refers to a company’s ability to meet its short-term obligations. A free cash flow statement template, while not a direct measure of liquidity, offers insights into a company’s cash generating capacity. Strong free cash flow can indicate a greater ability to cover short-term debts and operating expenses, signifying healthy liquidity. Conversely, consistently negative free cash flow can raise concerns about a company’s ability to meet its immediate financial demands. For example, a retailer with robust free cash flow during the holiday season may be better positioned to manage increased inventory costs and supplier payments.

- Solvency AssessmentSolvency refers to a company’s long-term financial viability and its ability to meet its long-term obligations. Consistent positive free cash flow, as revealed by the template, strengthens a company’s solvency position. This cash can be used to repay long-term debt, invest in growth opportunities, or build a cash reserve, all of which enhance long-term financial stability. A company struggling to generate free cash flow may face difficulties servicing its debt and investing in future growth, potentially jeopardizing its long-term solvency. For instance, a manufacturing company with declining free cash flow might struggle to invest in new equipment, impacting its long-term competitiveness.

- Profitability EvaluationWhile profitability is typically assessed through the income statement, the free cash flow statement template provides a complementary perspective. Strong and growing free cash flow often indicates healthy underlying profitability. It suggests that a company is not only generating profits but also effectively converting those profits into cash. Analyzing the components of free cash flow within the template, such as changes in working capital, can offer insights into operational efficiency and its impact on profitability. A software company with high profitability but low free cash flow might be experiencing challenges with collecting payments from customers.

- Financial Planning and ForecastingA free cash flow statement template serves as a valuable tool for financial planning and forecasting. By analyzing historical free cash flow trends, businesses can project future cash flows, which informs budgeting decisions, investment strategies, and financing plans. Accurate free cash flow projections are crucial for making informed decisions about capital expenditures, dividend payments, and debt management. A company projecting strong free cash flow growth may be more inclined to pursue expansion opportunities or increase dividend payouts.

In conclusion, the free cash flow statement template plays a vital role in assessing a company’s financial health. By analyzing the components and trends revealed within the template, stakeholders can gain a comprehensive understanding of a company’s liquidity, solvency, profitability, and future prospects. This information is essential for making informed investment decisions, evaluating creditworthiness, and managing internal financial resources. For instance, comparing the free cash flow performance of companies within the same industry can provide valuable benchmarks for evaluating relative financial health.

4. Investment Decisions Support

Investment decisions, whether internal capital allocation or external investment analysis, require a thorough understanding of a company’s financial performance and prospects. A free cash flow statement template provides a crucial framework for analyzing a company’s cash generating ability, a key factor in evaluating investment opportunities. The template’s structured approach facilitates a comprehensive assessment of cash flows, enabling informed investment decisions.

- Valuation and Discounted Cash Flow AnalysisFree cash flow is a fundamental component of discounted cash flow (DCF) analysis, a widely used valuation method. The template provides the necessary inputs for projecting future free cash flows, which are then discounted back to their present value to estimate a company’s intrinsic worth. Accurate free cash flow projections, derived from a well-structured template, are essential for reliable valuation and informed investment decisions. For example, an investor considering acquiring a company would utilize a DCF model, relying heavily on free cash flow projections derived from the target company’s financials, organized within a standardized template, to determine a fair offer price.

- Capital Budgeting and Project EvaluationCompanies use free cash flow projections, often generated using a standardized template, to evaluate the viability of potential capital projects. By estimating the incremental free cash flows generated by a project, businesses can assess its profitability and make informed investment decisions. Comparing projected free cash flows against the project’s initial investment and ongoing costs determines whether the project is financially sound. For instance, a company deciding whether to invest in new manufacturing equipment would analyze the projected free cash flows generated by the increased production capacity, facilitated by the new equipment, to determine the project’s return on investment.

- Assessment of Financial Strength and StabilityA company’s ability to generate consistent and growing free cash flow, as revealed by the template, is a strong indicator of financial health and stability. Investors use this information to assess the long-term viability of a business and its ability to withstand economic downturns. Strong free cash flow provides a cushion against unforeseen challenges and offers greater flexibility in pursuing growth opportunities, making such companies more attractive investment prospects. A company with consistently positive free cash flow is generally perceived as less risky than a company with volatile or negative free cash flow.

- Comparison and BenchmarkingThe standardized format of a free cash flow statement template enables comparisons across different companies within the same industry. Investors can use this information to benchmark a company’s free cash flow performance against its competitors, identifying potential investment opportunities. A company generating significantly higher free cash flow than its peers, while exhibiting similar growth prospects, might be considered an undervalued investment. This comparative analysis allows for a more informed assessment of relative investment attractiveness.

In summary, a free cash flow statement template plays a critical role in supporting informed investment decisions. By providing a structured approach to analyzing a company’s cash generating ability, the template enables more accurate valuations, facilitates effective capital budgeting, and enhances the assessment of financial strength and stability. These insights are crucial for investors evaluating potential investment opportunities, companies making internal capital allocation decisions, and analysts assessing the financial health and prospects of businesses. The ability to interpret and analyze the information presented within the template is a fundamental skill for anyone involved in financial analysis and investment decision-making.

5. Enhanced Transparency

Enhanced transparency in financial reporting is a critical element of sound corporate governance and stakeholder trust. A free cash flow statement template plays a significant role in fostering this transparency by providing a standardized and structured format for presenting a company’s cash flow information. This standardized presentation allows stakeholders, including investors, creditors, and analysts, to readily understand and compare a company’s cash generating ability across different periods or against industry benchmarks. The clear articulation of cash inflows and outflows, facilitated by the template, illuminates the financial health and operational efficiency of a business. For example, a company consistently reporting strong free cash flow from operations, clearly delineated within the template, signals efficient management of working capital and effective cost control. Conversely, declining free cash flow from operations, especially when coupled with increasing capital expenditures, might raise concerns about a company’s ability to fund its growth organically. This transparent presentation of cash flow data allows stakeholders to make informed judgments about a company’s financial performance and future prospects.

The structured nature of a free cash flow statement template reduces the potential for manipulation or obfuscation of cash flow information. By adhering to a standardized format, companies are compelled to present their cash flows in a consistent and comparable manner, limiting opportunities for creative accounting practices. This enhanced transparency fosters greater trust among stakeholders, as they can rely on the consistency and comparability of the reported information. For instance, if a company consistently classifies certain expenses as investing activities rather than operating activities, deviating from standard practice within the template, it can distort the true picture of its operational cash flow performance. Such inconsistencies, easily identified within a standardized template, raise red flags for analysts and investors, prompting further scrutiny. Therefore, consistent application of a standardized template promotes greater accountability and reduces the risk of misleading financial reporting.

In conclusion, a free cash flow statement template serves as a cornerstone of enhanced transparency in financial reporting. Its standardized structure promotes clarity, comparability, and accountability, enabling stakeholders to gain a deeper understanding of a company’s cash generating ability and financial health. This transparency fosters trust, facilitates informed decision-making, and contributes to a more robust and efficient capital market. Challenges remain, however, in ensuring consistent application and interpretation of these templates across different industries and regulatory environments. Ongoing efforts to refine reporting standards and promote best practices in financial reporting are essential to maximizing the benefits of enhanced transparency afforded by the free cash flow statement template. The ability to critically analyze the information presented within these templates is a vital skill for all stakeholders in the financial ecosystem.

Key Components of a Free Cash Flow Statement Template

Understanding the key components of a free cash flow statement template is essential for accurate interpretation and analysis. These components provide a structured framework for calculating and presenting a company’s cash generating ability after accounting for operating expenses and capital investments.

1. Operating Activities: This section represents the cash generated from a company’s core business operations. It begins with net income and adjusts for non-cash items like depreciation and amortization. Changes in working capital, such as fluctuations in accounts receivable, inventory, and accounts payable, are also incorporated. This section provides insights into the efficiency of a company’s day-to-day operations and its ability to convert profits into cash.

2. Investing Activities: This section captures cash flows related to investments in long-term assets, primarily capital expenditures (CapEx). CapEx includes purchases of property, plant, and equipment necessary for maintaining or expanding operational capacity. Analyzing this section reveals a company’s investment strategy and its commitment to long-term growth.

3. Financing Activities: Cash flows related to financing the business are presented in this section. It includes proceeds from debt or equity issuance, dividend payments, and debt repayments. This section provides insights into a company’s capital structure and its reliance on external financing.

4. Net Increase/Decrease in Cash and Cash Equivalents: This element reflects the net change in a company’s cash and cash equivalents resulting from operating, investing, and financing activities. It represents the overall impact of these activities on the company’s cash position.

5. Beginning and Ending Cash and Cash Equivalents: The template presents the beginning cash balance, the net increase or decrease during the period, and the resulting ending cash balance. This provides a clear picture of the company’s cash position at the beginning and end of the reporting period.

6. Free Cash Flow: Although not always explicitly presented as a separate line item, free cash flow is a crucial metric derived from the template. It represents the cash available to the company after funding its operations and capital investments. Free cash flow is often used in valuation models, investment analysis, and assessing a companys financial flexibility.

Analyzing these interconnected components provides a comprehensive view of a company’s cash flow dynamics, enabling informed assessments of financial performance, stability, and growth potential. This understanding is essential for stakeholders making investment decisions, evaluating creditworthiness, and assessing a company’s long-term viability.

How to Create a Free Cash Flow Statement Template

Creating a free cash flow statement template involves structuring key financial data in a standardized format. This structure facilitates consistent calculation and clear presentation of a company’s cash generating ability after accounting for operating expenses and capital investments.

1: Operating Activities: Begin by calculating cash flow from operating activities. Start with net income and adjust for non-cash expenses like depreciation and amortization. Incorporate changes in working capital, including accounts receivable, inventory, and accounts payable. Increases in current assets should be subtracted, while decreases should be added. Conversely, increases in current liabilities should be added, and decreases subtracted.

2: Investing Activities: Calculate cash flow from investing activities. This primarily involves capital expenditures (CapEx), representing investments in long-term assets such as property, plant, and equipment. Cash outflows for CapEx should be subtracted. Proceeds from the sale of long-term assets should be added.

3: Financing Activities: Determine cash flow from financing activities. This includes proceeds from debt or equity issuance, which are added. Repayments of debt principal and dividend payments are subtracted. Repurchases of company stock are also subtracted.

4: Net Increase/Decrease in Cash and Cash Equivalents: Sum the cash flows from operating, investing, and financing activities to arrive at the net increase or decrease in cash and cash equivalents during the period.

5: Beginning and Ending Cash Balance: Present the beginning cash balance, add the net increase or decrease calculated in the previous step, and this results in the ending cash balance.

6: Free Cash Flow Calculation: While not a direct line item on the statement itself, free cash flow is a crucial metric derived from it. One common method is to subtract capital expenditures from cash flow from operations. Alternative methods may include adding net borrowing to this figure. Present this calculated free cash flow prominently for analysis and interpretation.

7: Template Design and Formatting: Organize these components within a clear and concise template, using consistent formatting for easy readability and comparability across reporting periods. Clear labels and headings enhance understanding. Consider including a separate section for supplemental disclosures or notes explaining significant cash flow items or accounting policies.

A well-structured template provides a consistent framework for analyzing a companys cash generating ability, facilitating informed decision-making by investors, creditors, and management. This structured approach enhances transparency and comparability, enabling stakeholders to gain valuable insights into a company’s financial performance and long-term prospects.

A free cash flow statement template provides a crucial framework for understanding a company’s financial health. Its standardized structure enables consistent calculation and presentation of cash generated from operations, investments, and financing activities. This structured approach facilitates analysis of key metrics, including operating cash flow, capital expenditures, and free cash flow, offering insights into a company’s ability to generate cash, meet its financial obligations, and invest in future growth. The template’s consistent format promotes comparability across different periods and companies, enabling informed investment decisions, credit assessments, and internal financial planning.

Accurate interpretation of free cash flow statements, facilitated by standardized templates, is essential for stakeholders navigating the complexities of financial markets. As businesses evolve and financial reporting standards adapt, the importance of rigorous cash flow analysis will continue to grow. Developing proficiency in utilizing and interpreting these templates is crucial for informed financial decision-making and fostering a transparent and efficient capital market.